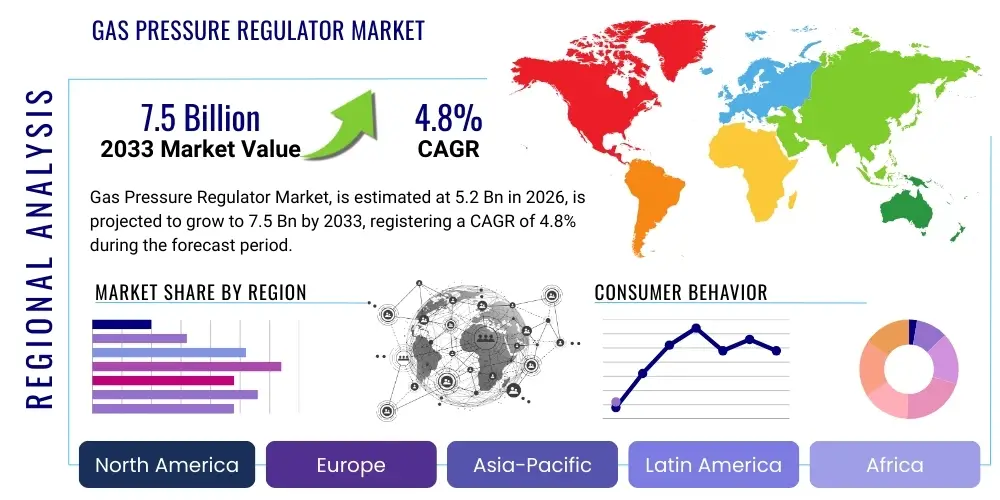

Gas Pressure Regulator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442988 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Gas Pressure Regulator Market Size

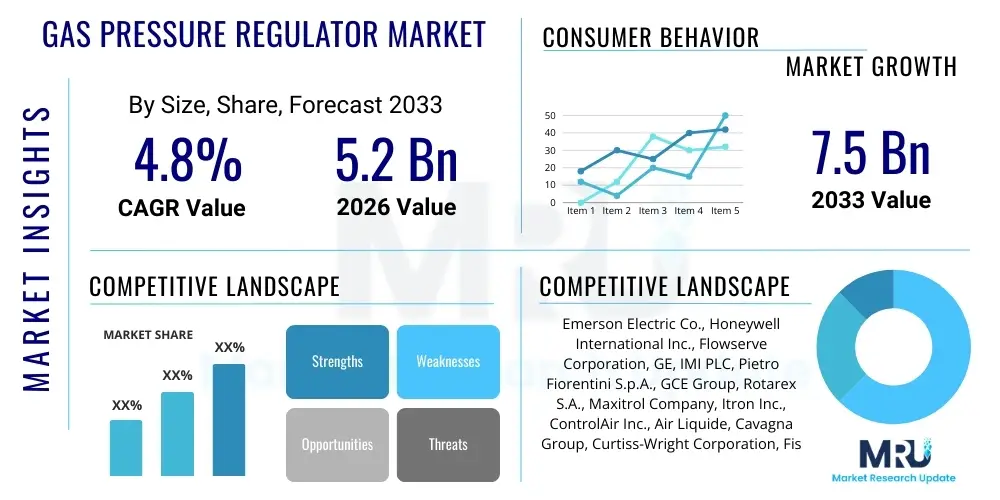

The Gas Pressure Regulator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Gas Pressure Regulator Market introduction

The Gas Pressure Regulator Market encompasses devices essential for controlling and stabilizing the pressure of various gases, ensuring safe and efficient operation across industrial, commercial, and residential applications. These devices are critical components in fluid control systems, designed to reduce a high-pressure input source down to a usable and constant lower pressure output, irrespective of fluctuations in the upstream pressure or changes in flow rate. The robust demand is underpinned by the increasing global reliance on natural gas and specialized industrial gases, alongside stringent safety regulations mandating precise pressure control in high-stakes environments such as chemical processing, oil and gas exploration, and medical oxygen delivery. The intrinsic need for safety, efficiency, and system longevity drives continuous innovation and market growth.

Gas pressure regulators are fundamentally classified based on their functional mechanism (direct-acting vs. pilot-operated) and their application environment (high-purity, cryogenic, or standard industrial use). Key applications span the entire energy value chain, from pipeline transmission systems where vast volumes of gas must be managed, to localized residential installations requiring meticulous control for appliances. Furthermore, the burgeoning requirement for high-purity gases in the semiconductor and pharmaceutical industries necessitates highly specialized, ultra-clean regulators capable of maintaining precision and preventing contamination. The technological evolution focuses on enhancing reliability, incorporating advanced materials for corrosive resistance, and integrating digital connectivity for remote monitoring and diagnostics.

Major benefits derived from the deployment of high-quality gas pressure regulators include significant energy savings due to optimized flow, enhanced process control leading to consistent product quality, and perhaps most importantly, substantial risk mitigation related to over-pressurization and system failure. Driving factors for this market expansion include rapid industrialization in emerging economies, particularly in the Asia-Pacific region, coupled with substantial investments in natural gas infrastructure globally. Furthermore, the necessity to retrofit aging distribution systems in mature markets with modern, high-precision regulators contributes significantly to market volume. These foundational elements ensure the gas pressure regulator market remains strategically vital to global energy and industrial infrastructure.

Gas Pressure Regulator Market Executive Summary

The global Gas Pressure Regulator Market is characterized by steady growth, primarily fueled by infrastructural development across the utility sector and escalating safety mandates in the industrial domain. Business trends indicate a strong shift toward digitalization, with leading manufacturers focusing on developing 'smart regulators' equipped with IoT capabilities for real-time monitoring, predictive maintenance, and operational optimization. Merger and acquisition activities remain prevalent, often driven by larger conglomerates seeking to consolidate expertise in specific high-growth niche segments, such as ultra-high-purity or hydrogen-ready regulators. Supply chain resilience, particularly concerning critical materials like specialized steels and advanced elastomers, is a crucial competitive differentiator, driving localized manufacturing initiatives in certain regions to mitigate geopolitical risks and logistical delays.

Regionally, the Asia Pacific (APAC) market is projected to exhibit the fastest growth, underpinned by massive urbanization, substantial investments in liquefied natural gas (LNG) infrastructure, and the expansion of manufacturing capabilities in China and India. North America and Europe, while being mature markets, maintain high revenue share due to stringent regulatory frameworks and consistent demand for replacement and upgrade of existing pipeline and distribution networks. The energy transition globally is also reshaping regional dynamics, with regions actively developing hydrogen hubs and carbon capture infrastructure beginning to show increased demand for specialized high-pressure and high-accuracy regulating equipment. Policy shifts promoting cleaner energy sources directly correlate with regulator demand in these pivotal geographical areas.

Segment trends reveal that the oil and gas sector remains the largest application segment, although the pharmaceutical and medical sectors are demonstrating accelerated growth, driven by the expansion of healthcare infrastructure and heightened demand for medical oxygen and sterile gas delivery systems, particularly post-2020. By product type, pilot-operated regulators are gaining traction in large-scale industrial applications due to their superior flow capacity and precision under varying load conditions, while direct-acting regulators continue to dominate the commercial and residential segments where simplicity and cost-effectiveness are paramount. Material segment evolution is centered on enhanced corrosion resistance, with specialized stainless steel and advanced polymer seals becoming standard requirements for aggressive media or harsh environmental conditions, ensuring extended service life and reduced operational downtime.

AI Impact Analysis on Gas Pressure Regulator Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Gas Pressure Regulator Market predominantly center on predictive maintenance capabilities, optimization of gas distribution networks, and enhancement of regulator manufacturing processes. Users are keenly interested in how machine learning algorithms can analyze data streams from smart sensors embedded in modern regulators to predict potential failures before they occur, thereby minimizing catastrophic safety incidents and unplanned downtime. A secondary but significant theme is the role of AI in optimizing pipeline pressure settings dynamically across vast, complex networks, leading to reduced energy consumption and improved overall system efficiency. Key concerns revolve around data security, the high initial cost of sensor integration, and the complexity of training robust AI models tailored to varied gas media and environmental stressors. This adoption is transforming the regulator from a passive mechanical component into an intelligent, actively managed network node.

- AI enables predictive failure analysis by processing vibration, temperature, and pressure deviation data from smart regulators.

- Machine Learning optimizes large-scale gas distribution networks, dynamically adjusting set points for energy efficiency and flow stability.

- Generative AI supports the design phase, simulating regulator performance under extreme or novel operating conditions, accelerating R&D cycles.

- Automated quality control systems utilize computer vision and AI in manufacturing, ensuring higher product uniformity and compliance standards.

- AI integration necessitates the development of cyber-secure communication protocols for field-deployed smart regulators communicating critical telemetry data.

DRO & Impact Forces Of Gas Pressure Regulator Market

The Gas Pressure Regulator Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities that shape investment decisions and technological trajectory. A dominant driver is the accelerating global transition towards cleaner energy sources, particularly natural gas, which necessitates extensive investments in new pipeline infrastructure, storage facilities, and distribution networks—all requiring high volumes of specialized regulators. Furthermore, the strict global regulatory landscape, exemplified by organizations like the American Petroleum Institute (API) and various regional safety commissions, continually mandates the replacement of older, less accurate equipment with certified, modern regulators, thereby sustaining a robust replacement market. The inherent safety criticality of pressure regulation means compliance drives demand even during periods of broader economic slowdown. These factors establish a strong, non-discretionary demand base for precision regulation technology.

However, the market faces significant restraints that dampen growth potential. Chief among these is the inherent volatility in the prices of critical raw materials, such as brass, stainless steel, and specialized alloys, which directly impacts manufacturing costs and profit margins, particularly for standardized, high-volume regulators. Moreover, the development and certification of highly specialized regulators for extreme environments, such as high-temperature or cryogenic applications, requires substantial upfront capital investment in R&D and sophisticated testing facilities, creating barriers to entry for smaller manufacturers. The slow adoption rate of advanced smart regulators in less developed regions due to high initial integration costs and lack of necessary digital infrastructure also acts as a constraint on the market’s technological ceiling.

Despite these challenges, substantial opportunities are emerging, principally driven by the global energy transformation. The rise of the hydrogen economy, requiring specialized regulators capable of handling the unique properties and high pressures of hydrogen gas, represents a significant untapped market segment. Similarly, advancements in Carbon Capture, Utilization, and Storage (CCUS) projects necessitate high-integrity, corrosive-resistant regulators for managing CO2 streams. Furthermore, the continuing trend toward smart manufacturing (Industry 4.0) offers opportunities for manufacturers to differentiate products through connectivity, offering value-added services like predictive maintenance contracts and remote diagnostics, thus shifting revenue streams towards service provision rather than just component sales. These opportunities offer high-margin growth areas distinct from traditional oil and gas applications.

Segmentation Analysis

The Gas Pressure Regulator Market is segmented across multiple dimensions, providing a granular view of specific market dynamics based on product characteristics, material composition, and ultimate end-user application. Understanding these segmentations is vital for manufacturers to tailor product development and market strategies effectively. Key segmentation categories include Type (differentiating based on design complexity and pressure management stages), Material (reflecting corrosion resistance and pressure tolerance), and critical Application sectors (defining the usage environment and regulatory requirements). This structural breakdown assists in evaluating competitive advantages and identifying high-growth niches, such as high-purity regulators versus bulk industrial gas regulators. The application segmentation, in particular, reveals that while the oil and gas industry maintains volume dominance, other high-tech sectors are demanding regulators with superior precision and material quality.

- By Type:

- Single Stage Regulators

- Dual Stage Regulators

- High Pressure Regulators

- Low Pressure Regulators

- Pilot-Operated Regulators

- By Material:

- Brass Regulators

- Stainless Steel Regulators

- Carbon Steel Regulators

- Specialty Alloy Regulators

- By Application:

- Oil & Gas Industry (Upstream, Midstream, Downstream)

- Chemical and Petrochemical Industry

- Power Generation (Thermal and Nuclear)

- Medical and Healthcare

- Residential and Commercial Usage

- Semiconductor and Electronics

- Aerospace and Defense

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Gas Pressure Regulator Market

The value chain for the Gas Pressure Regulator Market initiates with the upstream supply of specialized raw materials, primarily high-grade metals such as stainless steel, brass, and carbon steel, alongside specialty polymers and elastomers used for diaphragms and seals. Efficiency and cost optimization at this stage are crucial, as material costs represent a significant component of the final product price, and quality dictates regulator performance and lifespan, especially concerning corrosion resistance and pressure integrity. Strategic sourcing and long-term contracts with specialized metal processing houses are critical competitive factors. Manufacturers engage in precision machining, assembly, and rigorous testing/calibration phases. The complexity of manufacturing, coupled with mandatory compliance with international safety standards (e.g., ISO, ASME, PED), necessitates high vertical integration or strong partnerships with specialized component suppliers.

Midstream activities primarily focus on logistics, warehousing, and, most importantly, distribution channels. The distribution model is complex, utilizing a mix of direct sales channels for large-scale, customized industrial projects (e.g., major pipeline projects or power plants) and indirect distribution through specialized industrial distributors, technical resellers, and local plumbing/gas supply wholesalers for standard commercial and residential products. Technical expertise within the distribution network is paramount, as regulators often require detailed selection advice and after-sales support based on specific gas type, flow requirements, and environment. Effective inventory management across various geographical nodes is essential to satisfy immediate maintenance and repair needs from end-users, especially in critical infrastructure applications.

Downstream analysis involves the direct installation, commissioning, maintenance, and eventual decommissioning or replacement of regulators at the end-user site. Direct channels are favored by Original Equipment Manufacturers (OEMs) who integrate regulators into larger systems (e.g., chemical processing skids, medical gas panels). Indirect channels cater heavily to the Maintenance, Repair, and Overhaul (MRO) segment, providing replacement parts and standard regulators for existing infrastructure. The long-term service agreements for smart regulators, focusing on remote diagnostics and predictive maintenance, are rapidly growing, shifting the downstream value proposition from transactional sales to continuous service provision. This service component is becoming a significant profit center, requiring manufacturers to invest in field service technicians and digital support infrastructure.

Gas Pressure Regulator Market Potential Customers

The potential customer base for gas pressure regulators is extremely broad, spanning critical infrastructure and specialized industrial processing across diverse global economies. The largest and most consistent demand originates from utility companies and midstream operators involved in the transmission and distribution of natural gas, requiring thousands of robust regulators for pipeline stations, city gate stations, and local service lines. These buyers prioritize reliability, high flow capacity, and long-term durability in harsh outdoor environments. Additionally, major petrochemical and chemical processing plants represent significant buyers, demanding specialized regulators capable of handling aggressive, corrosive, or high-temperature process gases with exceptional precision and compliance with strict environmental discharge regulations.

A rapidly expanding customer segment is the medical and pharmaceutical industry, which requires ultra-high-purity regulators for dispensing medical oxygen, nitrogen, and other specialty gases used in hospitals, laboratories, and manufacturing clean rooms. These customers emphasize material cleanliness, traceability, and extreme accuracy to ensure patient safety and product integrity. The ongoing global expansion of healthcare facilities, particularly in emerging markets, consistently drives demand for this specialized segment. Furthermore, the semiconductor fabrication industry, requiring highly precise control over inert and reactive process gases, represents a premium customer segment where cost is secondary to performance and purity.

Beyond large-scale industrial buyers, the residential and commercial sectors constitute a massive volume market, characterized by smaller, standardized regulators used for connecting utility lines to homes, restaurants, and small businesses for heating and cooking purposes. While these regulators are lower in individual unit cost, the aggregate demand is immense and stable, tied directly to construction rates and utility service expansion. Finally, specialized buyers in the aerospace and defense sectors procure customized, high-reliability regulators designed for extreme pressures and temperatures, often involving rigorous qualification standards for use in propulsion systems or life support equipment, representing a crucial segment valuing bespoke engineering solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., Honeywell International Inc., Flowserve Corporation, GE, IMI PLC, Pietro Fiorentini S.p.A., GCE Group, Rotarex S.A., Maxitrol Company, Itron Inc., ControlAir Inc., Air Liquide, Cavagna Group, Curtiss-Wright Corporation, Fisher Regulators, Go Regulator, Sensus, Swagelok Company, Parker Hannifin, Technifab |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas Pressure Regulator Market Key Technology Landscape

The technology landscape for gas pressure regulators is currently defined by a dual focus on material science advancements and digital integration. Material innovation is crucial, driven by the need to handle increasingly aggressive media (such as sour gas or highly purified specialty gases) and extreme conditions (cryogenic temperatures or very high pressures). This involves the use of specialized alloys, such as Hastelloy or Monel, alongside advanced polymer and elastomer formulations for diaphragm and seal materials to ensure superior chemical resistance, thermal stability, and prolonged cycle life. Furthermore, research into additive manufacturing (3D printing) is beginning to impact complex internal geometries, potentially leading to lighter, more customized, and faster-produced regulator bodies with enhanced flow characteristics and reduced material waste during fabrication.

Digitalization represents the most transformative technological shift. The emergence of 'smart regulators' incorporates microprocessors, sensors (pressure, temperature, flow), and low-power wireless communication modules (e.g., LoRaWAN, 5G). These components enable the regulator to function as a data node within a larger supervisory control and data acquisition (SCADA) system. Key functionalities include continuous self-diagnostics, tamper detection, and remote adjustment of pressure set points, which significantly improves operational flexibility and reduces the need for manual field checks. This integration is paramount for optimizing gas distribution networks, allowing utilities to achieve dynamic load balancing and faster response to unexpected network events or leakages.

In terms of mechanism refinement, there is ongoing technological development in pilot-operated regulators to enhance stability and response time, particularly in high-flow, rapidly changing industrial environments. Innovations are focused on minimizing 'droop' (pressure deviation as flow increases) and improving shut-off reliability. Additionally, the development of regulators specifically engineered for hydrogen service is a critical area, requiring new sealing techniques and metallic compositions to mitigate hydrogen embrittlement and leakage concerns. These hydrogen-ready technologies must meet future energy transition mandates, pushing the boundaries of current regulator design principles to handle the unique molecular structure and pressure requirements of hydrogen gas distribution systems.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand patterns and technological requirements within the Gas Pressure Regulator Market, heavily influenced by local infrastructure investment, regulatory stringency, and prevailing energy mix. North America and Europe currently hold significant market shares, characterized by mature, yet continuously upgrading, gas distribution infrastructure. In these regions, demand is driven less by new infrastructure expansion and more by mandated upgrades, the replacement of aging assets for safety compliance, and the early adoption of high-tech smart regulators aimed at network efficiency and reduction of methane emissions. Furthermore, Europe is rapidly investing in hydrogen pipeline conversions, necessitating highly specialized regulators compliant with European Pressure Equipment Directive (PED) standards.

The Asia Pacific (APAC) region stands out as the primary engine of future market growth, fueled by unprecedented levels of industrialization, urbanization, and a rapid shift towards natural gas as a transitional fuel source. Countries like China, India, and Southeast Asian nations are massively expanding their city gas distribution (CGD) networks, pipeline infrastructure, and industrial capacity (chemical, manufacturing), generating substantial volume demand for standard and specialized regulators. While price sensitivity remains a factor in this region, the increasing focus on industrial safety, particularly in newly constructed facilities, is raising the quality threshold and driving adoption of more sophisticated pressure control equipment.

The Middle East and Africa (MEA) region is dominated by oil and gas upstream and midstream activities. Demand here centers on robust, high-pressure regulators designed to withstand the severe operational conditions associated with oil and gas extraction and processing, often requiring specialized materials due to the presence of highly corrosive sour gas (H2S). Latin America experiences moderate, project-based growth, linked to specific energy sector investments in Brazil, Mexico, and Argentina. Both MEA and LATAM are increasingly adopting regulators with enhanced durability and remote monitoring capabilities to manage assets distributed over vast, often remote, territories effectively.

- Asia Pacific (APAC): Highest projected CAGR due to pipeline network expansion, rapid urbanization, and massive industrial sector growth, particularly in chemical and power generation industries.

- North America: Strong demand driven by regulatory mandates for leak reduction, modernization of aging pipeline assets, and early commercialization of smart regulator technologies.

- Europe: Focus shifting towards specialized hydrogen regulators and advanced technologies for methane emission reduction, coupled with strong established demand from process industries and utilities.

- Middle East & Africa (MEA): Consistent demand dominated by high-pressure, robust regulators required for corrosive upstream oil and gas production and processing facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas Pressure Regulator Market.- Emerson Electric Co.

- Honeywell International Inc.

- Flowserve Corporation

- GE (Baker Hughes)

- IMI PLC

- Pietro Fiorentini S.p.A.

- GCE Group

- Rotarex S.A.

- Maxitrol Company

- Itron Inc.

- ControlAir Inc.

- Air Liquide

- Cavagna Group

- Curtiss-Wright Corporation

- Fisher Regulators (Part of Emerson)

- Go Regulator

- Sensus (Part of Xylem)

- Swagelok Company

- Parker Hannifin Corporation

- Technifab Products, Inc.

Frequently Asked Questions

Analyze common user questions about the Gas Pressure Regulator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a gas pressure regulator in industrial applications?

The primary function of a gas pressure regulator is to reduce a high, often fluctuating, inlet gas pressure to a lower, constant, and stable outlet pressure regardless of changes in upstream pressure or downstream flow demand, ensuring safe system operation and consistent process quality.

How do smart regulators differ from traditional mechanical gas pressure regulators?

Smart regulators incorporate integrated sensors, microprocessors, and communication capabilities (IoT) to provide real-time data, enable remote monitoring, facilitate predictive maintenance, and allow for dynamic, automated adjustment of pressure set points, offering higher operational efficiency and safety than purely mechanical models.

Which application segment holds the largest share in the Gas Pressure Regulator Market?

The Oil & Gas industry, covering upstream extraction, midstream transmission, and downstream distribution sectors, currently accounts for the largest share of the market due to the essential need for rigorous pressure management across vast, high-volume pipeline and processing networks globally.

What is driving the demand for specialized regulators in the Asia Pacific region?

The demand in the APAC region is primarily driven by massive infrastructure expansion, including the establishment of new city gas distribution (CGD) networks, significant investments in chemical and petrochemical manufacturing facilities, and rapid urbanization demanding extended utility services.

What technological challenge is posed by hydrogen gas to regulator design?

Hydrogen gas poses a technological challenge because its small molecular size increases leak potential, and it can cause hydrogen embrittlement in certain standard metallic materials. This necessitates the use of specialized alloys, advanced sealing materials, and stringent leak-testing procedures for hydrogen-ready regulators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager