Gasoline Marine Fuel Filter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441199 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Gasoline Marine Fuel Filter Market Size

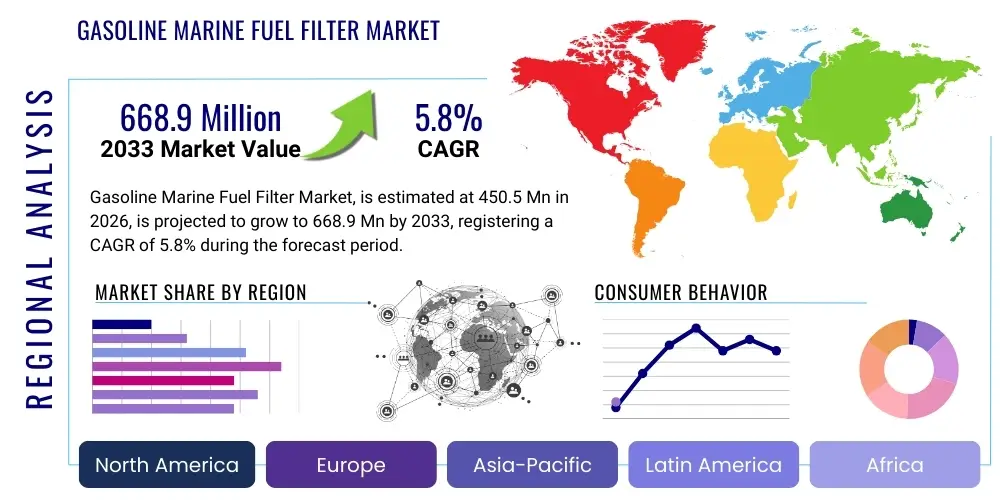

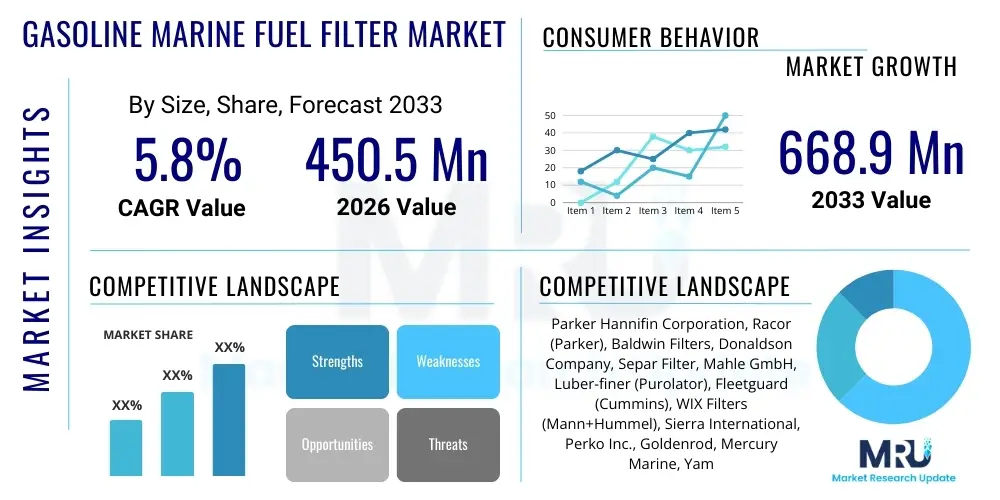

The Gasoline Marine Fuel Filter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 668.9 Million by the end of the forecast period in 2033.

Gasoline Marine Fuel Filter Market introduction

The Gasoline Marine Fuel Filter Market encompasses the manufacturing, distribution, and sale of specialized filtration systems designed to protect marine gasoline engines from contaminants such as dirt, rust, water, and microbial growth. These filters are crucial components in ensuring the longevity, performance efficiency, and reliability of marine propulsion systems, ranging from small recreational boat engines to larger commercial vessels utilizing gasoline powerplants. The product description highlights precision-engineered filtration media, often incorporating specialized materials capable of both particulate removal and phase separation of emulsified water, which is a common and highly damaging contaminant in marine fuel systems due to condensation and tank breathing.

Major applications of these fuel filters span across various marine sectors, including recreational boating (runabouts, pontoons, fishing boats), high-performance marine racing, and light commercial operations that rely on powerful and efficient gasoline stern drive or outboard engines. The necessity for high-quality filtration is amplified in the marine environment where engines operate under fluctuating loads and environmental conditions, demanding consistent delivery of clean fuel. Furthermore, the increasing use of ethanol-blended fuels (e.g., E10) necessitates filters that are compatible with these chemically aggressive blends, preventing degradation of filter materials and subsequent system failure.

Key driving factors propelling market growth include stringent environmental regulations mandating lower emissions, which indirectly require higher fuel quality and better filtration to maintain optimal engine combustion. Furthermore, the increasing global registration of recreational boats, coupled with the rising consumer awareness regarding preventative maintenance and the high cost of engine repairs due to fuel contamination, significantly boosts aftermarket demand. The continuous innovation in engine technology, requiring tighter fuel system tolerances, further reinforces the critical role of advanced gasoline marine fuel filters in safeguarding modern, highly sensitive direct injection systems.

Gasoline Marine Fuel Filter Market Executive Summary

The Gasoline Marine Fuel Filter Market is experiencing sustained growth, driven fundamentally by the expanding global fleet of recreational vessels and persistent regulatory pressure on emissions standards, demanding flawless engine performance achievable only through superior fuel hygiene. Business trends indicate a strong shift toward integrated fuel-water separating filtration systems, particularly in the aftermarket, where boat owners prioritize proactive maintenance solutions. Furthermore, Original Equipment Manufacturers (OEMs) are increasingly adopting premium, high-capacity filters as standard equipment to manage warranty claims related to ethanol-induced corrosion and particle damage, thereby establishing a baseline of quality that elevates market expectations and average product price points.

Regional trends demonstrate North America and Europe as primary revenue generators, characterized by mature boating cultures and high disposable incomes allocated to marine leisure activities, translating into robust demand for both replacement filters and new installations. The Asia Pacific region, specifically countries like Australia and certain emerging economies in Southeast Asia, is projected to register the fastest growth rate, fueled by rising middle-class affluence, increased investment in coastal tourism infrastructure, and subsequent growth in small-to-medium-sized marine craft fleets. These regional dynamics highlight the necessity for supply chain agility to meet varied regional standards, such as those related to specific ethanol content tolerances.

Segment trends reveal that the Cartridge Filters segment, particularly those designed for high efficiency and extended service intervals, is dominating based on technological advancements facilitating easier disposal and reduced environmental impact compared to traditional spin-on designs. Regarding application, the Outboard Engines segment holds a commanding market share, reflecting the global dominance of outboard technology in the recreational sector, which demands extremely reliable filtration due to high power-to-weight ratios and reliance on compact fuel systems. The Aftermarket distribution channel remains critical, driven by necessary periodic maintenance cycles, ensuring a steady, predictable stream of revenue for specialized filter manufacturers and distributors.

AI Impact Analysis on Gasoline Marine Fuel Filter Market

User queries regarding AI in the Gasoline Marine Fuel Filter Market predominantly revolve around predictive maintenance schedules, optimized supply chain logistics, and AI’s role in material science innovation for filter media. Common concerns include how AI algorithms can monitor engine operational parameters (vibration, fuel pressure drop, fuel composition) to accurately predict filter clogging before engine performance degrades, moving beyond simple pressure differential sensors. Users also express interest in how machine learning can be leveraged to analyze massive datasets of fuel contamination incidents across different geographies, helping manufacturers design filters better suited to local fuel quality variations. The core expectation is that AI integration will shift filtration management from reactive replacement to highly precise, condition-based servicing, drastically reducing unexpected downtime and maintenance costs for commercial operators and high-end recreational users.

- AI-driven predictive maintenance scheduling based on real-time sensor data analysis of fuel flow rate and differential pressure across the filter element.

- Optimization of manufacturing processes using AI for quality control, ensuring consistent pore size distribution and media integrity in high-performance filters.

- Enhanced inventory management and demand forecasting for aftermarket distribution by analyzing seasonal boating trends, regional fuel quality data, and historical maintenance cycles.

- Development of smart fuel systems incorporating machine learning to self-diagnose filtration efficiency and communicate required service intervals directly to the end-user or marina service center.

- AI simulation utilized in R&D for modeling fluid dynamics and particle capture effectiveness, leading to the rapid design of innovative, high-efficiency filter media resistant to ethanol and microbial degradation.

- Leveraging AI to analyze sensor inputs related to fuel contamination severity (e.g., water ingress frequency), allowing the marine ECU to adjust engine parameters dynamically to prevent damage until filter replacement can occur.

DRO & Impact Forces Of Gasoline Marine Fuel Filter Market

The Gasoline Marine Fuel Filter Market is significantly influenced by a confluence of driving factors, primarily the robust growth in recreational boating activities globally and the non-negotiable requirement for high engine performance and reliability in demanding marine environments. The continuous technological advancements in marine engines, particularly the proliferation of complex direct fuel injection systems, necessitate increasingly fine and robust filtration, as these systems are highly sensitive to microscopic particulates and water contamination. Regulatory mandates, such as those imposed by the EPA and IMO regarding emission reductions, further pressure manufacturers to adopt best-in-class filtration to ensure compliance throughout the engine's lifespan, thereby institutionalizing the demand for high-quality filters.

However, the market faces restraints, chiefly the potential for users, particularly in the private recreational sector, to neglect timely filter replacement or opt for cheaper, non-OEM filters of substandard quality, leading to long-term engine damage but suppressing current aftermarket revenue potential for high-end products. Another significant restraint is the volatility in crude oil prices, which impacts gasoline prices and can temporarily dampen overall recreational boating activity and subsequent maintenance expenditure. Furthermore, the market must contend with the complex challenge posed by ethanol-blended fuels, which demand specialized, costly materials to prevent filter component swelling and deterioration, increasing manufacturing costs and potentially discouraging adoption in price-sensitive segments.

Opportunities for growth are abundant, particularly in developing smart filtration systems that integrate sensor technology to provide real-time condition monitoring, offering a premium feature that justifies higher pricing. There is also a substantial opportunity in expanding the specialized filter segment catering specifically to high-performance engines and niche markets requiring maximum water separation efficiency. Impact forces, driven by the threat of substitution from alternative propulsion technologies (e.g., electric marine motors) and the bargaining power of major OEM engine manufacturers who dictate initial procurement standards, compel filter producers to maintain rigorous quality control and pursue continuous material innovation to secure long-term supply contracts and sustain competitive advantage in the aftermarket.

- Drivers:

- Global expansion of the recreational marine industry and subsequent increase in boat registrations.

- Strict global environmental regulations mandating clean engine operation and reduced emissions.

- Technological proliferation of complex, pressure-sensitive direct injection marine engine systems.

- Restraints:

- User complacency or non-adherence to recommended maintenance schedules, leading to delayed filter replacement.

- Price sensitivity in the aftermarket driving adoption of low-cost, low-quality generic filters.

- Material compatibility challenges and cost implications associated with high ethanol-content fuels.

- Opportunities:

- Development and integration of intelligent fuel monitoring and smart filter technology utilizing IoT sensors.

- Penetration into emerging markets with rapidly growing marine leisure and light commercial fleets.

- Focus on specialized filter media for advanced water separation and microbial contamination control.

- Impact Forces:

- Bargaining Power of Buyers (OEMs and large distributors) demanding high quality at optimized costs.

- Threat of New Entrants necessitating significant investment in regulatory compliance and specialized manufacturing techniques.

- Rivalry Intensity among established filter manufacturers focused on efficiency and material science innovation.

Segmentation Analysis

The Gasoline Marine Fuel Filter Market is meticulously segmented based on product type, material composition, application, and distribution channel, providing a granular view of market dynamics and specialized demand areas. Analyzing these segments helps stakeholders understand where technological differentiation is most impactful and where procurement volumes are concentrated. The diversity in marine engine types, ranging from small outboards to powerful inboard systems, necessitates a wide array of filtration solutions, each optimized for specific flow rates, pressure tolerances, and contaminant profiles. This segmentation structure is crucial for targeted product development and effective market penetration strategy, particularly differentiating between the high-volume replacement market and the high-specification OEM supply chain.

Segmentation by Type reveals distinct product categories, where Spin-on Filters offer convenience and ease of replacement, dominating the aftermarket due to their robust design and familiarity. Conversely, advanced Cartridge Filters and dedicated Separators/Elements often offer superior efficiency and are frequently favored by OEMs for permanent, high-performance systems requiring maximum water removal capabilities, reflecting a continuous trend toward higher filtration efficiency standards. Material segmentation is increasingly vital, moving beyond traditional aluminum housings to incorporate composite materials that offer superior corrosion resistance against saltwater and ethanol fuels, thus ensuring durability and compliance with marine safety standards.

Application-based segmentation clearly indicates the heavy influence of the Outboard Engines segment, reflecting the widespread adoption of these engines for recreational use globally, driving demand for compact yet highly efficient fuel filters. The distribution channel breakdown underscores the strategic importance of the Aftermarket, which accounts for the vast majority of ongoing revenue, driven by mandatory periodic maintenance intervals. Success in the Aftermarket relies heavily on brand recognition, robust distribution networks through marine dealers, and readily available stock, contrasting with the OEM channel, which requires long-term engineering partnerships and stringent quality control protocols.

- By Type:

- Spin-on Filters

- Cartridge Filters

- Separators/Elements

- By Material:

- Aluminum Housings

- Steel Housings

- Composite/Polymer Housings

- By Application:

- Inboard Engines (Cruisers, Yachts)

- Outboard Engines (Fishing Boats, Pontoons)

- Stern Drive Engines (Sport Boats, Runabouts)

- By Distribution Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Gasoline Marine Fuel Filter Market

The value chain for the Gasoline Marine Fuel Filter Market is complex, starting with the procurement of highly specialized raw materials, moving through precision manufacturing, and culminating in global distribution to diverse end-users. The upstream analysis focuses heavily on securing high-grade filtration media, such as synthetic cellulose, glass fibers, and advanced polymers, essential for achieving the required micron ratings and resistance to chemical degradation from gasoline and ethanol blends. Key upstream relationships involve material suppliers specializing in corrosion-resistant metals (aluminum alloys, treated steel) for housing construction and advanced sealing technology providers, ensuring the final product meets stringent marine durability and safety standards. The ability to source these specialized materials reliably and cost-effectively dictates manufacturing margins and product performance consistency.

Midstream activities involve sophisticated, high-precision assembly processes. Manufacturers must employ advanced techniques like automated pleating, ultrasonic welding, and rigorous testing protocols to ensure the integrity of the filter element and its housing. Quality control is paramount in this stage, as a single faulty seal or improperly bonded pleat can lead to catastrophic engine failure in a marine environment. Furthermore, compliance with international marine certifications (e.g., ISO standards, specific regional marine classification society requirements) necessitates significant capital investment in certified production facilities and traceability systems, forming a substantial barrier to entry for potential competitors.

Downstream analysis highlights the critical role of distribution channels, which are bifurcated into OEM and Aftermarket routes. The OEM channel involves direct supply to engine manufacturers (e.g., Mercury, Yamaha, Volvo Penta) under long-term contracts, demanding just-in-time delivery and adherence to engine-specific engineering specifications. The Aftermarket channel, which drives recurring revenue, relies on a vast network of distributors, marine parts retailers, repair shops, and online platforms. Effective penetration in the Aftermarket requires robust logistics (indirect sales) and strong brand recognition to influence end-user purchasing decisions, often facilitated by direct sales and technical support provided through authorized dealerships to ensure correct application and installation.

Gasoline Marine Fuel Filter Market Potential Customers

The primary end-users and buyers of Gasoline Marine Fuel Filters fall into three main categories: Original Equipment Manufacturers (OEMs), Marine Service and Repair Centers, and Direct Consumers (Boat Owners). OEMs, such as major manufacturers of outboard, inboard, and stern drive gasoline engines (e.g., Mercury Marine, Yamaha, Suzuki, Volvo Penta), represent the largest volume purchasers, integrating these filters into their assembly lines. Their demand is characterized by strict technical specifications, high volume consistency, and a requirement for filters that match or exceed engine warranty standards, often leading to exclusive supply arrangements that emphasize product performance over immediate cost savings.

Marine Service and Repair Centers, including professional marinas, independent boat mechanics, and authorized dealer service departments, form the core of the aftermarket demand. These entities purchase filters in bulk for routine maintenance, repair operations, and seasonal servicing. Their purchasing decisions are driven by factors such as accessibility, inventory breadth (covering multiple engine models and brands), and the reliability of the filtration brand, as they are responsible for guaranteeing the quality of the service provided. This segment relies heavily on robust distribution channels that can supply parts quickly and efficiently to minimize boat downtime, emphasizing strong relationships with local and national parts distributors.

The third major customer segment consists of Direct Consumers—individual boat owners, enthusiasts, and small-scale commercial fishermen operating gasoline-powered vessels. While many consumers rely on service centers for installation, a growing number of DIY boat owners purchase replacement filters directly through marine retail stores or e-commerce platforms. For this segment, ease of installation (e.g., spin-on designs), clear product documentation, and reputable brand names are critical purchasing factors. The increasing complexity of modern fuel systems, however, is subtly pushing more consumers towards professional service centers, reinforcing the importance of the professional repair segment in driving premium filter sales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 668.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Parker Hannifin Corporation, Racor (Parker), Baldwin Filters, Donaldson Company, Separ Filter, Mahle GmbH, Luber-finer (Purolator), Fleetguard (Cummins), WIX Filters (Mann+Hummel), Sierra International, Perko Inc., Goldenrod, Mercury Marine, Yamaha Motor Co., Ltd., Suzuki Marine, Volvo Penta, Crusader Engines, Fram/Sogefi, UFI Filters, Champion Laboratories |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gasoline Marine Fuel Filter Market Key Technology Landscape

The technology landscape for Gasoline Marine Fuel Filters is defined by continuous innovation focused on maximizing filtration efficiency, enhancing water separation capabilities, and improving material compatibility with modern, chemically complex fuels. A major technological focus is the development of multi-layered synthetic media, moving beyond traditional cellulose. Synthetic media, often utilizing micro-glass fibers or high-density polymer matrices, allows for significantly higher dirt holding capacity and superior particle capture efficiency (up to Beta 200 rating) without compromising flow rate, which is critical for the high-demand fuel systems found in modern marine gasoline engines. This technological shift ensures that even microscopic particulates, highly damaging to direct injection components, are consistently removed, thereby meeting the stringent performance requirements set by engine manufacturers.

Another pivotal technological advancement involves sophisticated fuel-water separation technology. Given the pervasive nature of water contamination in marine environments (due to condensation and exposure), filters are increasingly utilizing hydrophobic and oleophobic treatments applied to the filter media, promoting the coalescence of fine water droplets into larger, easily drainable entities. Technologies such as high-efficiency coalescing elements and advanced turbine-style separation chambers, often integrated into the filter housing, are becoming standard. Furthermore, materials science innovation is driving the adoption of specialized housing materials and seals, particularly composite polymers or proprietary coated aluminum, offering robust protection against the corrosive effects of salt spray and the hygroscopic nature of ethanol-blended fuels, which are prone to phase separation and subsequent system degradation.

The emerging technological frontier includes the integration of smart filtration monitoring systems, utilizing embedded Internet of Things (IoT) sensors. These sensors continuously track critical performance indicators, such as fuel temperature, flow resistance (differential pressure), and even the presence of free water at the filter's base. This data is wirelessly transmitted to the engine control unit (ECU) or a dedicated display, enabling condition-based monitoring rather than relying solely on time or engine hour intervals for replacement. This precision maintenance capability enhances safety, reduces operational uncertainty for commercial operators, and allows for optimal use of the filter's lifespan, representing a significant value-add that drives the premium segment of the market and facilitates AEO by providing timely, actionable insights.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most mature market for Gasoline Marine Fuel Filters, driven by the world's highest concentration of recreational boat ownership and a deeply ingrained culture of marine leisure activities. Demand here is characterized by high turnover in the aftermarket due to rigorous seasonal maintenance schedules and the prevalence of high-horsepower, gasoline-powered outboards and stern drives. Strict regulatory frameworks, especially concerning ethanol usage and environmental protection (e.g., EPA mandates), necessitate the use of premium, certified fuel-water separating filters that are resistant to corrosion and maintain high efficiency. The region is a key hub for OEM procurement, hosting major engine manufacturers and driving innovation in filter media technology.

- Europe: The European market demonstrates strong demand, particularly in coastal nations like Italy, France, and Scandinavia, focusing heavily on small to medium-sized recreational boats and chartered leisure fleets. Unlike North America, European demand is often characterized by a greater emphasis on efficiency in compact spaces and adherence to differing local fuel standards, though the trend towards high-efficiency, ethanol-compatible filtration remains universal. The European aftermarket is highly fragmented but sophisticated, relying heavily on national distributors and established marine service networks for filter replacement. Growth is stable, supported by rising consumer affluence and favorable regulatory environments promoting safe boating practices, which naturally includes fuel system reliability.

- Asia Pacific (APAC): The APAC region is the fastest-growing market segment, fueled by rapid urbanization, increasing disposable income, and governmental investments in coastal tourism infrastructure, particularly in countries like Australia, China, and Southeast Asian island nations. The market here is currently dominated by smaller, local fishing fleets moving towards modern outboard engines and an exploding middle class embracing recreational boating. This region presents unique challenges related to inconsistent fuel quality and extreme tropical humidity, amplifying the necessity for superior water separation capabilities in marine filters. Market expansion is driven by both direct imports of foreign engines (requiring OEM-specified filters) and the development of local manufacturing partnerships targeting price sensitivity.

- Latin America (LATAM): The Latin American market exhibits sporadic demand, heavily influenced by economic stability and localized infrastructure. Countries with extensive coastlines and inland waterways, such as Brazil and Mexico, are key consumers. The market structure is heavily biased toward the aftermarket, often utilizing imported engines and relying on localized distributors. A critical factor in this region is the requirement for robust filters capable of handling potentially lower-quality or inconsistently refined gasoline, placing a premium on durability and high contaminant holding capacity, often favoring robust spin-on and heavy-duty separator designs.

- Middle East and Africa (MEA): The MEA region represents a nascent but expanding market, primarily concentrated in the Gulf Cooperation Council (GCC) states due to luxury marine leisure activities and oil & gas related light commercial vessel operations. Demand in the Middle East is characterized by high-end, powerful marine craft requiring specialized, reliable filtration solutions to cope with extreme heat and high salinity environments. Africa's market is predominantly driven by essential fishing and transport fleets, where affordability and basic engine protection are paramount. Long supply chains and reliance on authorized dealer networks for high-quality replacements characterize the distribution in the more developed parts of the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gasoline Marine Fuel Filter Market.- Parker Hannifin Corporation

- Racor (Parker)

- Baldwin Filters

- Donaldson Company

- Separ Filter

- Mahle GmbH

- Luber-finer (Purolator)

- Fleetguard (Cummins)

- WIX Filters (Mann+Hummel)

- Sierra International

- Perko Inc.

- Goldenrod

- Mercury Marine

- Yamaha Motor Co., Ltd.

- Suzuki Marine

- Volvo Penta

- Crusader Engines

- Fram/Sogefi

- UFI Filters

- Champion Laboratories

Frequently Asked Questions

Analyze common user questions about the Gasoline Marine Fuel Filter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Gasoline Marine Fuel Filter and why is it crucial in the marine environment?

The primary function is to remove particulates (dirt, rust) and separate water from gasoline before it reaches the engine. This function is crucial in the marine environment because condensation and tank breathing lead to high levels of water contamination, which, if unfiltered, causes catastrophic rust and damage to precision fuel injectors and internal engine components, compromising reliability.

How do ethanol-blended fuels (E10, E15) impact the selection criteria for marine fuel filters?

Ethanol-blended fuels are hygroscopic, meaning they readily absorb water, and they can degrade traditional filter materials and seals. Selection criteria must prioritize filters featuring corrosion-resistant housings (e.g., polymer or coated aluminum) and specialized synthetic media that maintain structural integrity and efficient separation performance when exposed to these chemically aggressive blends, preventing material swelling or dissolution.

What is the difference between a standard fuel filter and a fuel water separator in marine applications?

A standard fuel filter primarily removes solid particulates. A fuel water separator, which is the preferred standard in marine applications, performs both particulate filtration and actively separates free and emulsified water using specialized hydrophobic media or turbine designs, collecting the water in a sump for safe manual draining.

Which technology segment is expected to drive the highest growth in the Gasoline Marine Fuel Filter Market through 2033?

The Cartridge Filters and Separators/Elements segment is expected to drive the highest growth. This growth is linked to OEM adoption of high-efficiency, multi-layered synthetic media required by modern direct injection engines, coupled with the rising implementation of integrated fuel-water separation units featuring advanced smart sensing capabilities for predictive maintenance.

What are the key drivers for the aftermarket segment versus the OEM segment?

The OEM segment is driven by new engine production volumes and strict engineering specifications, focusing on initial quality and long-term contracts. The aftermarket segment is driven by the steady, mandatory schedule of periodic maintenance and replacement cycles for the existing fleet, relying heavily on brand availability, distribution network efficiency, and consumer adherence to service intervals.

How do stringent environmental regulations influence the design requirements for gasoline marine fuel filters?

Environmental regulations, such as those from the EPA, require marine engines to maintain specific emission standards throughout their operational lifespan. Clean combustion necessitates exceptionally clean fuel; therefore, filters must achieve ultra-fine micron ratings (often 10 microns or finer) to protect injectors and catalytic converters, ensuring sustained engine performance that minimizes harmful exhaust emissions, thus demanding higher technological precision in manufacturing.

What role does material science play in enhancing the durability and lifespan of marine fuel filters?

Material science is crucial in developing filter components resistant to the harsh marine environment. This includes creating specialized synthetic filter media with high chemical resistance to ethanol and acidic fuel contaminants, designing corrosion-proof housing materials (like advanced polymers or coated alloys to resist saltwater oxidation), and engineering durable seals that maintain integrity under constant vibration and temperature fluctuations, significantly extending the filter's reliable operational lifespan.

What is the significance of the "Beta Ratio" in selecting high-performance gasoline marine fuel filters?

The Beta Ratio is a crucial metric indicating the filter's efficiency at capturing particles of a specific size. A higher Beta Ratio (e.g., Beta 200 at 10 microns) signifies that the filter is highly efficient, capturing 99.5% of particles at or above that micron size. For modern marine engines with highly sensitive components, a high Beta Ratio is essential to prevent costly wear and ensure system longevity.

Why is the Asia Pacific region projected to be the fastest-growing market for these filters?

The Asia Pacific region’s rapid growth is driven by increasing economic prosperity leading to higher recreational boating adoption, significant government investment in marine tourism infrastructure, and the subsequent modernization of regional fishing and transportation fleets, all requiring reliable, high-quality filtration solutions for newly acquired gasoline engines.

How is the integration of IoT technology revolutionizing the gasoline marine fuel filtration industry?

IoT integration, through embedded smart sensors, allows for real-time monitoring of differential pressure, water levels, and overall filter condition. This shift facilitates condition-based predictive maintenance, alerting operators precisely when a filter needs replacement, maximizing its useful life, minimizing engine downtime, and transforming reactive service into proactive system management.

What specific challenges does microbial contamination present, and how are modern filters addressing this?

Microbial contamination ("diesel bug," although less common in gasoline, can still occur) leads to sludge formation that rapidly clogs filters. Modern marine filters address this challenge by incorporating high-capacity media with dedicated coatings or designs to handle gelatinous contaminants, and ensuring superior water separation, which is key since microbes thrive at the fuel-water interface.

In the value chain, what is the most critical factor influencing manufacturing cost efficiency?

The most critical factor influencing manufacturing cost efficiency is the secure and optimized sourcing of specialized filtration media (synthetic fibers and composites). These materials, essential for achieving high efficiency and ethanol resistance, represent a high proportion of the production cost, making long-term procurement contracts and vertical integration key to maintaining competitive pricing and margins.

How does the presence of aluminum alloy housings address typical marine filtration challenges?

Aluminum alloy housings provide excellent strength-to-weight ratios and, when properly coated or treated, offer significant resistance to external corrosion from saltwater and internal corrosion from certain fuel contaminants. They ensure the filter system remains structurally sound and leak-free in high-vibration, high-humidity marine environments, adhering to essential safety standards.

What impact does the bargaining power of OEM buyers have on the filter market?

The bargaining power of major OEM buyers (engine manufacturers) is substantial. They demand extremely high-quality, customized products at optimal prices and often require manufacturers to meet stringent warranty and quality control standards, forcing filter suppliers to invest continuously in R&D and certified production facilities to secure and retain these lucrative, long-term supply agreements.

Why is it essential for filter distributors in the aftermarket to maintain a wide breadth of inventory?

Aftermarket distributors must maintain a wide breadth of inventory to service the immense variety of gasoline marine engines in use globally, covering different flow rates, thread patterns, and specification requirements mandated by numerous engine brands (e.g., Mercury, Yamaha, Honda). Quick availability prevents long boat downtime, which is a major factor driving customer satisfaction and sales volume in the service sector.

How is competition intensifying within the gasoline marine fuel filter market?

Competition is intensifying through technological differentiation, where established players invest heavily in proprietary synthetic media and smart filter designs. Price competition also remains fierce, particularly in the lower-end aftermarket segments, forcing manufacturers to balance superior performance requirements mandated by modern engines against cost pressures from both OEM and aftermarket procurement departments.

What specific regulations govern the disposal or recycling of used gasoline marine fuel filters?

Disposal regulations typically classify used fuel filters as hazardous waste due to retained fuel residues and collected contaminants. Regulations usually mandate proper draining and collection of waste fuel before disposal of the metal or composite housing, often requiring specialized waste management services to comply with local environmental protection agency guidelines to prevent soil and water contamination.

How does the shift towards stern drive and inboard gasoline engines compare in filtration demand to outboard engines?

Outboard engines drive higher volume demand due to their recreational popularity, requiring compact, high-efficiency filters. Stern drive and inboard engines, often found in larger performance boats and cruisers, typically demand higher flow rates and larger capacity filtration systems, sometimes necessitating dual-stage or redundant filtering systems for continuous, heavy-duty operation and enhanced reliability.

In what ways can advanced polymers and composite materials replace traditional metal filter housings?

Advanced polymers and composites are replacing metal in certain applications due to their inherent superior resistance to galvanic and chemical corrosion, particularly from saltwater and ethanol fuels. They also offer weight reduction, which is advantageous in marine applications, and can be engineered for specific pressure tolerances while often facilitating easier, tool-less element replacement in cartridge designs.

What is the concept of 'flow rate resistance' and why is minimizing it important for high-performance marine engines?

Flow rate resistance refers to the pressure drop across the filter media as fuel passes through. Minimizing this resistance is critical for high-performance engines because they require a consistent, high volume of fuel delivery to prevent fuel starvation at peak RPMs. Modern filter media must achieve maximum filtration efficiency with minimal restriction to ensure engine power output is never compromised.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager