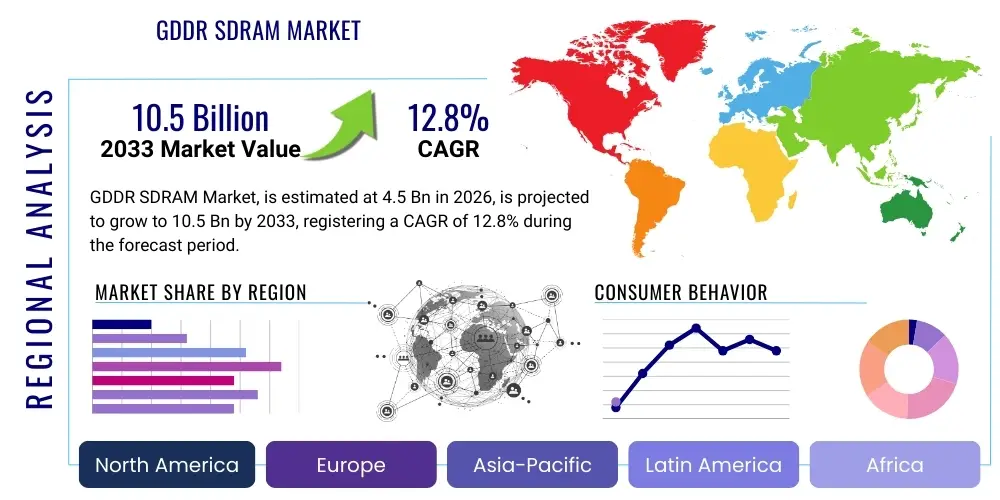

GDDR SDRAM Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443472 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

GDDR SDRAM Market Size

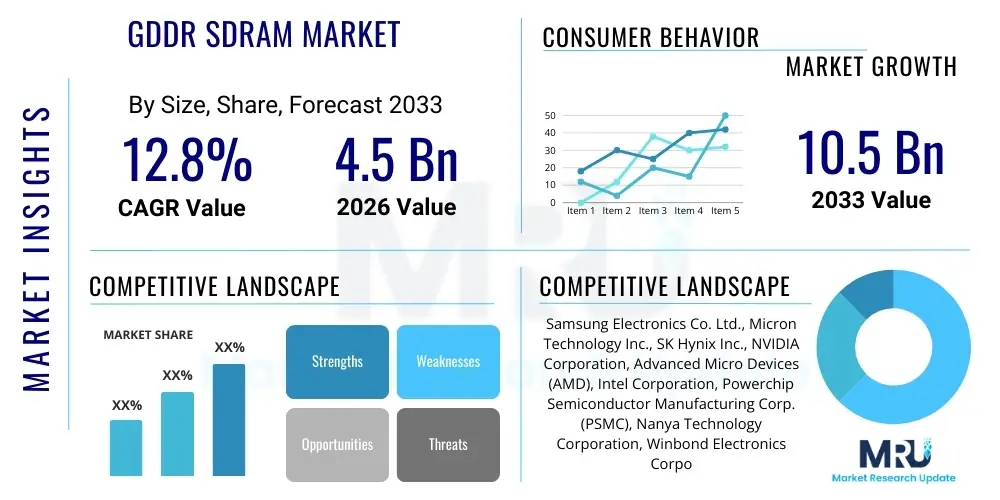

The GDDR SDRAM Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 10.5 Billion by the end of the forecast period in 2033.

GDDR SDRAM Market introduction

The Graphics Double Data Rate Synchronous Dynamic Random-Access Memory (GDDR SDRAM) market encompasses high-bandwidth memory solutions specifically designed to accelerate data throughput in graphics processing units (GPUs) and other high-performance accelerators. This specialized memory is critical for rendering complex visual data, executing parallel processing tasks, and managing vast datasets required by modern computational workloads. Key applications span across high-end gaming, professional visualization, data centers utilizing hardware acceleration, and emerging fields such as artificial intelligence (AI) and machine learning (ML), where ultra-fast memory access is paramount to performance efficiency.

GDDR SDRAM serves as the primary memory interface for dedicated graphics cards, offering significantly higher bandwidth and operating frequencies compared to conventional DDR SDRAM used for system memory (RAM). The product evolution, marked by advancements from GDDR5 through the latest GDDR6X and the upcoming GDDR7 standards, continuously pushes the boundaries of memory transfer rates, addressing the exponentially increasing demands for real-time processing and graphical fidelity. These generational leaps primarily focus on maximizing effective clock speeds, optimizing power consumption, and enhancing channel architectures to mitigate bottlenecks associated with data retrieval and storage within the GPU ecosystem.

Driving factors for the substantial market expansion include the global surge in high-resolution content creation, the robust proliferation of competitive esports and immersive gaming platforms, and the increasing reliance on hardware accelerators in enterprise data centers for computationally intensive tasks. Furthermore, the burgeoning demand for specialized AI training hardware, coupled with the integration of advanced graphics systems into autonomous vehicles and professional design workstations, solidifies the critical role of GDDR SDRAM technology in the future digital economy, positioning it as an indispensable component for high-performance computing infrastructure.

GDDR SDRAM Market Executive Summary

The GDDR SDRAM market exhibits significant momentum driven by fundamental shifts in consumer entertainment and enterprise computational needs. Business trends reveal a concentrated effort by leading memory manufacturers—Samsung, Micron, and SK Hynix—to accelerate the development and mass production of the latest memory standards, specifically GDDR6X and GDDR7, to maintain competitive differentiation in performance and power efficiency. Strategic alliances between semiconductor firms and major GPU designers (NVIDIA, AMD) are crucial for optimizing memory integration and ensuring rapid market adoption. The recurring semiconductor capacity constraints present a notable business challenge, yet the inherent demand stemming from AI inference engines and advanced graphics rendering ensures continued high average selling prices (ASPs) and robust investment in fabrication technologies capable of handling advanced lithography requirements.

Regionally, the Asia Pacific (APAC) stands as the dominant market, serving both as the primary global manufacturing hub for GDDR SDRAM components and the largest consumer base for gaming hardware and data center infrastructure, particularly in China, South Korea, and Taiwan. North America and Europe demonstrate robust growth in the application segment, driven by large-scale enterprise adoption of AI accelerators and the concentration of high-end research and development centers. Future growth will be significantly influenced by geopolitical stability concerning semiconductor supply chains, especially relating to manufacturing concentrated in Taiwan and South Korea, which dictates the overall global supply capacity.

Segmentation trends highlight the increasing dominance of GDDR6 and its enhanced variant, GDDR6X, which currently command the majority market share due to their superior bandwidth capabilities suitable for current-generation gaming consoles and mainstream graphics cards. However, the rapidly approaching commercialization of GDDR7, characterized by unprecedented data rates and improved energy efficiency, is expected to catalyze a massive transition across high-end computing applications and specialized AI hardware towards the end of the forecast period. The application segment growth is overwhelmingly skewed towards data center/HPC and gaming, reflecting the dual pressures of computational intensity and visual complexity driving memory bandwidth requirements.

AI Impact Analysis on GDDR SDRAM Market

Common user questions regarding AI’s impact on GDDR SDRAM center around whether High-Bandwidth Memory (HBM) will completely displace GDDR, how the demand for AI accelerators influences GDDR standards development, and what specific attributes (latency vs. bandwidth) AI workloads prioritize in GDDR memory. Users are frequently concerned with the longevity of GDDR technology given the high performance of HBM in specialized AI training hardware. Analysis confirms that while HBM dominates the ultra-high-end training market due to stacking density, GDDR SDRAM maintains critical relevance and growing demand in inference applications, edge AI, and high-volume data center accelerators that require a balance of high bandwidth, cost-effectiveness, and heat dissipation characteristics suitable for mass deployment. The key themes revolve around the continuous need for higher capacity and speed in GDDR to service the burgeoning intermediate AI application space, ensuring that GDDR standards are increasingly optimized for parallel data access crucial for neural network execution.

The integration of artificial intelligence and machine learning models across various sectors mandates specialized hardware capable of rapid data processing, thereby significantly elevating the requirement for high-speed memory like GDDR SDRAM. AI workloads, especially deep learning inference and certain training tasks, rely heavily on massive parallel computations. GDDR SDRAM provides the necessary memory bandwidth to keep the numerous processing cores within a GPU or AI accelerator fed with data efficiently, directly mitigating bottlenecks that otherwise degrade computational throughput. This demand ensures sustained investment in GDDR technology, pushing performance metrics further with each new generation.

Furthermore, the democratization of AI, moving computation from centralized clouds to the edge (e.g., smart vehicles, industrial IoT, consumer devices), strengthens the necessity for cost-effective, yet high-performance, memory solutions. GDDR, being less expensive and possessing a simpler integration profile than HBM, is ideally suited for these edge deployments. The optimization of GDDR standards to handle lower power states while maintaining high throughput is becoming a critical design parameter, influenced directly by the power constraints inherent in edge computing infrastructure and the need to maintain thermal efficiency in densely packed AI servers.

- AI drives demand for ultra-high memory bandwidth (GDDR6X, GDDR7) to feed massively parallel GPU cores.

- Increased deployment in AI inference accelerators where cost-performance ratio favors GDDR over HBM.

- AI training models necessitate larger memory buffers, increasing demand for higher density GDDR modules.

- Development cycles of new GDDR standards are now influenced by AI-specific workload characteristics, optimizing for random and parallel access patterns.

- Expansion of GDDR usage in edge computing and autonomous driving platforms requiring accelerated on-device AI processing.

DRO & Impact Forces Of GDDR SDRAM Market

The GDDR SDRAM market is primarily driven by the relentless pace of innovation in graphics processing and computational acceleration, counterbalanced by significant restraints concerning manufacturing complexity and supply chain stability, while abundant opportunities emerge from specialized industry applications. The fundamental driver is the exponentially increasing complexity of software—from realistic ray-traced graphics in gaming to vast parameter models in AI—which consistently demands higher memory bandwidth. Impact forces, such as the strategic maneuvering of core semiconductor companies and rapid technological obsolescence, shape the competitive landscape and investment cycles within the industry. The collective interaction of these forces dictates market pricing, technological roadmaps, and ultimately, the accessibility of high-performance computing capabilities across global sectors.

Key drivers include the global adoption of 4K and 8K resolution displays, necessitating robust frame buffer capabilities and fast texture loading supported by GDDR technology. The intense competition within the gaming industry, especially concerning console cycles (PlayStation and Xbox), locks in large volumes of demand for high-specification GDDR memory, acting as a crucial foundational demand vector. Additionally, the continued expansion of cryptocurrency mining, although volatile, historically surges demand for high-bandwidth graphics cards, subsequently increasing GDDR memory consumption when market conditions are favorable. These drivers ensure a baseline level of high-volume consumption, prompting continuous manufacturing ramp-ups.

Conversely, the market faces significant restraints, notably the increasing complexity and cost associated with advancing GDDR standards. Moving to GDDR6X and GDDR7 requires sophisticated manufacturing techniques and tighter tolerances, increasing R&D expenditure and per-unit production costs. Furthermore, the inherent volatility of the semiconductor supply chain, sensitive to geopolitical shifts and natural disasters, poses a persistent risk to delivery schedules and price stability. Opportunities lie prominently in emerging applications: the proliferation of autonomous vehicle technology necessitates specialized, high-reliability GDDR for real-time sensor fusion and decision-making systems, while the foundational architecture of the metaverse requires unprecedented graphical and computational power, securing GDDR’s long-term utility.

Segmentation Analysis

The GDDR SDRAM market is segmented comprehensively based on Memory Type, Application, and Data Rate, allowing for granular analysis of demand patterns and technological adoption across diverse end-user sectors. Segmentation by Memory Type distinguishes between mature standards (GDDR5) and cutting-edge technologies (GDDR6X, GDDR7), reflecting the continuous cycle of technological innovation and replacement. The Application segment is crucial, differentiating between high-volume consumer markets (Gaming Consoles, Graphics Cards) and high-value, performance-critical enterprise markets (HPC, AI Accelerators, Automotive). Data Rate segmentation, often measured in Gigabits per second (Gbps), provides insight into the performance tier targeted by various product offerings and is fundamental for determining competitive positioning within specialized markets.

The current market landscape shows GDDR6 as the volume leader, striking an optimal balance between performance, power efficiency, and cost, making it the preferred choice for mass-market graphics cards and current-generation gaming consoles. However, the premium segment is rapidly migrating towards GDDR6X and anticipated GDDR7, driven solely by the insatiable appetite for bandwidth in high-end data center acceleration and flagship consumer products. The application segmentation reveals that while gaming remains the largest consumer by sheer volume, the highest growth rate is forecast within the Data Center and AI/ML categories, where performance specifications are critical and procurement budgets are less sensitive to cost fluctuations.

Geographic segmentation underscores the regional disparities in manufacturing capabilities versus consumption patterns. APAC remains indispensable for production, hosting the major fabrication facilities. Consumption, however, is heavily distributed across APAC (due to massive gaming markets), North America (due to leading HPC and AI cloud providers), and Europe (due to advanced industrial and automotive sectors). This segmentation framework is vital for manufacturers and investors in identifying strategic areas for capacity expansion and product portfolio emphasis based on localized demand characteristics and regulatory requirements.

- Memory Type: GDDR5, GDDR5X, GDDR6, GDDR6X, GDDR7

- Application: Gaming Consoles, Discrete Graphics Cards (PCs), High-Performance Computing (HPC) & Data Centers, Automotive (Infotainment & ADAS), AI/ML Accelerators, Professional Visualization Workstations

- Data Rate: 12 Gbps and Below, 14 Gbps – 18 Gbps, 20 Gbps and Above (including GDDR6X/GDDR7 speeds)

- Regional Analysis: North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Value Chain Analysis For GDDR SDRAM Market

The value chain for the GDDR SDRAM market is highly integrated and complex, starting from sophisticated upstream raw material and equipment suppliers, progressing through highly specialized fabrication and testing, and concluding with diverse downstream distribution and integration channels. Upstream analysis involves highly specialized material providers for silicon wafers, photolithography chemicals, and advanced manufacturing equipment necessary for the extremely tight process nodes required for high-speed memory production. Key players in this phase include equipment manufacturers specializing in deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography tools, forming a highly concentrated bottleneck in the global semiconductor ecosystem.

The core manufacturing process, conducted by Integrated Device Manufacturers (IDMs) like Samsung, Micron, and SK Hynix, constitutes the midstream of the value chain, where the capital expenditure requirements are astronomical due to the necessity of building and maintaining cutting-edge fabrication facilities (fabs). These IDMs are responsible for the entire process from wafer fabrication to packaging and testing of the final GDDR modules. Downstream analysis focuses on the systems integrators and Original Equipment Manufacturers (OEMs), such as NVIDIA, AMD, Sony, Microsoft, and various automotive Tier 1 suppliers, who purchase the GDDR components and integrate them onto graphics cards, consoles, or accelerator boards. This downstream phase is characterized by intense design validation and optimization to maximize the performance potential of the memory.

Distribution channels for GDDR SDRAM are highly formalized, utilizing both direct and indirect routes. Direct distribution involves large volume contracts between memory manufacturers (e.g., Samsung) and key, high-volume customers (e.g., NVIDIA or Apple), ensuring streamlined supply security and customized product specifications. Indirect channels involve authorized distributors and specialized component resellers who cater to smaller system builders, industrial integrators, and the DIY PC market. The efficiency of both direct and indirect logistics is critical, given the high value and sensitive nature of semiconductor components, demanding specialized packaging and swift transit to maintain competitive pricing and speed-to-market.

GDDR SDRAM Market Potential Customers

Potential customers and end-users of GDDR SDRAM technology represent a broad spectrum of industries unified by the need for massive computational throughput and high-fidelity graphics rendering. The primary consumers are Original Equipment Manufacturers (OEMs) specializing in computing hardware, including manufacturers of high-end consumer electronics and specialized enterprise equipment. These buyers are typically large, multinational corporations that procure GDDR memory in massive volumes directly from the key IDMs to ensure integration consistency and supply chain control. Their purchasing decisions are critically driven by performance specifications (Gbps, latency), long-term supply agreements, and price per gigabyte.

The largest segment of end-users are the producers of discrete graphics cards, namely NVIDIA and AMD, who integrate GDDR into their consumer and professional GPU lineups. Following closely are the gaming console manufacturers (Sony and Microsoft), whose fixed hardware platforms rely on GDDR memory for their generational performance targets. Emerging high-growth customer segments include cloud service providers (CSPs) and Hyperscalers (e.g., Google, Amazon, Microsoft Azure), who are rapidly deploying custom AI accelerator cards within their data centers to handle inference and training workloads, thereby becoming significant, sophisticated buyers demanding customized GDDR solutions optimized for power and density.

Furthermore, the automotive industry, specifically companies developing Advanced Driver-Assistance Systems (ADAS) and fully autonomous driving platforms, represents a critical emerging customer base. These systems require embedded, high-reliability GDDR memory for real-time processing of sensor data (Lidar, Radar, Cameras) and fast execution of complex navigational AI algorithms. Industrial and professional visualization sectors, including CAD/CAM workstations and medical imaging device manufacturers, also rely heavily on GDDR SDRAM for specialized, intensive rendering tasks. These diverse customer bases necessitate differentiated product offerings, ranging from high-performance consumer-grade GDDR to industrial-grade, ruggedized, and long-lifecycle components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics Co. Ltd., Micron Technology Inc., SK Hynix Inc., NVIDIA Corporation, Advanced Micro Devices (AMD), Intel Corporation, Powerchip Semiconductor Manufacturing Corp. (PSMC), Nanya Technology Corporation, Winbond Electronics Corporation, TSMC (Taiwan Semiconductor Manufacturing Company), GlobalFoundries Inc., Texas Instruments Incorporated, Broadcom Inc., Renesas Electronics Corporation, Western Digital Corporation, Kioxia Corporation, ISSI (Integrated Silicon Solution Inc.), Fuji Xerox, IBM, T-Micro. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

GDDR SDRAM Market Key Technology Landscape

The technology landscape of the GDDR SDRAM market is defined by constant efforts to maximize data rate (bandwidth) while managing power efficiency and signal integrity across high-speed interfaces. Modern GDDR standards, specifically GDDR6 and GDDR6X, utilize advanced signaling techniques such as PAM4 (Pulse Amplitude Modulation 4-Level) in GDDR6X to achieve speeds exceeding 21 Gbps per pin, significantly increasing the amount of data transferred per clock cycle compared to the NRZ (Non-Return-to-Zero) signaling used in GDDR6 and earlier versions. This technical innovation, while boosting performance, introduces substantial complexities in physical layer design, demanding advanced channel equalization and sophisticated package technologies to maintain data stability over short but critical traces.

Further technological advancements focus heavily on manufacturing process nodes. Memory manufacturers are transitioning GDDR production to increasingly smaller nodes (e.g., 10nm class and below) to enhance transistor density, reduce power leakage, and ultimately enable higher operating frequencies. These process shrinkage techniques are coupled with design optimizations like improved core voltage regulation and advanced thermal management packaging, crucial for operating modules at high temperatures common in densely packed server environments. The continual shrinking of the feature size allows for higher capacity GDDR chips, supporting the graphics industry’s need for larger frame buffers necessary for 8K gaming and complex scientific simulations.

Looking ahead, the development of GDDR7 technology centers on pushing the data rate towards 36 Gbps and beyond, likely employing more advanced multi-level signaling schemes or new architectural designs to overcome the physical limits of current interfaces. Key focus areas include improved error correction mechanisms and enhanced integration with chiplet architectures in GPUs and accelerators. The memory controller design within the GPU is becoming inextricably linked with the GDDR standards, leading to closer collaboration between memory vendors and GPU designers to optimize memory access protocols, minimize latency, and ensure reliable high-speed operation, which is paramount for competitive advantage in the high-performance segment.

Regional Highlights

The global GDDR SDRAM market demonstrates distinct regional dynamics, influenced heavily by semiconductor manufacturing concentration, technological adoption rates, and regional demand from key application sectors. Asia Pacific (APAC) stands as the undisputed epicenter of both production and consumption. North America leads in innovation and high-value consumption, particularly in data center and AI segments, while Europe shows specialized strength in automotive and industrial applications. This geopolitical distribution of capabilities and demand creates complex supply chain dependencies and investment priorities for market participants.

- Asia Pacific (APAC): Dominates the market in terms of production volume due to the concentration of key manufacturing facilities (fabs) operated by Samsung, SK Hynix, and Micron in South Korea, Taiwan, and China. APAC is also the largest consumer, driven by the massive consumer electronics market, a vast PC gaming population, and rapid expansion of domestic data centers and cloud services. Japan and South Korea are key R&D hubs for advanced memory packaging and testing.

- North America: Exhibits the highest CAGR in the application segment, driven by leading hyperscale cloud providers, extensive AI/ML research, and the presence of major GPU designers (NVIDIA, AMD). The region focuses on adopting the highest performance GDDR standards (GDDR6X and GDDR7) for high-performance computing (HPC) and professional visualization markets, demanding robust supply reliability and cutting-edge specifications.

- Europe: Characterized by strong growth in specialized industrial applications and the automotive sector. Regulatory pushes towards electric and autonomous vehicles necessitate high-reliability GDDR components for complex ADAS systems. Germany, France, and the UK are crucial markets for professional visualization and high-end workstation usage in engineering and design fields.

- Latin America (LATAM): A rapidly growing market, particularly in the consumer gaming and entry-to-mid-level data center expansion segments. Demand is primarily fulfilled through imported components and assembled systems, making it highly sensitive to global pricing fluctuations and currency exchange rates.

- Middle East and Africa (MEA): Emerging markets with incremental growth driven by nascent data center development initiatives and infrastructure modernization projects, particularly in Gulf Cooperation Council (GCC) countries. Consumption focuses primarily on mainstream GDDR technology for commercial computing infrastructure and limited high-end gaming.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the GDDR SDRAM Market.- Samsung Electronics Co. Ltd.

- Micron Technology Inc.

- SK Hynix Inc.

- NVIDIA Corporation

- Advanced Micro Devices (AMD)

- Intel Corporation

- Powerchip Semiconductor Manufacturing Corp. (PSMC)

- Nanya Technology Corporation

- Winbond Electronics Corporation

- TSMC (Taiwan Semiconductor Manufacturing Company)

- GlobalFoundries Inc.

- Texas Instruments Incorporated

- Broadcom Inc.

- Renesas Electronics Corporation

- Western Digital Corporation

- Kioxia Corporation

- ISSI (Integrated Silicon Solution Inc.)

- Fuji Xerox

- IBM

- T-Micro

Frequently Asked Questions

Analyze common user questions about the GDDR SDRAM market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between GDDR SDRAM and standard DDR SDRAM?

GDDR SDRAM (Graphics DDR) is optimized for exceptionally high bandwidth and parallel access required by GPUs, achieving much higher clock speeds and data rates than standard DDR SDRAM, which is optimized for lower latency and general-purpose system memory tasks.

Is GDDR SDRAM being replaced by High-Bandwidth Memory (HBM) in the high-end market?

While HBM dominates specialized, ultra-high-end applications like supercomputing and premium AI training due to superior density and stacking efficiency, GDDR SDRAM (especially GDDR6X and GDDR7) continues to be essential for high-volume markets, including mainstream graphics cards and AI inference, offering a better balance of performance, thermal management, and cost.

Which GDDR memory type currently holds the largest market share?

GDDR6 currently holds the largest market share by volume. It serves as the standard memory for current-generation mainstream and high-end discrete graphics cards, as well as the primary memory solution for major gaming consoles like the PlayStation 5 and Xbox Series X.

How do GDDR manufacturers plan to achieve the increased data rates required by future GPUs?

Manufacturers are leveraging advanced signaling techniques like PAM4 (Pulse Amplitude Modulation 4-Level, used in GDDR6X), moving to denser semiconductor process nodes (smaller nm processes), and optimizing memory controller architecture. The upcoming GDDR7 standard is expected to significantly push data transfer limits beyond 36 Gbps per pin.

What role does the Automotive sector play in the future demand for GDDR SDRAM?

The Automotive sector, specifically in the development of Advanced Driver-Assistance Systems (ADAS) and autonomous driving, is a critical high-growth area. GDDR is necessary for the high-speed processing of sensor fusion data (Lidar, camera, radar) and the execution of real-time deep learning algorithms on embedded vehicle platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager