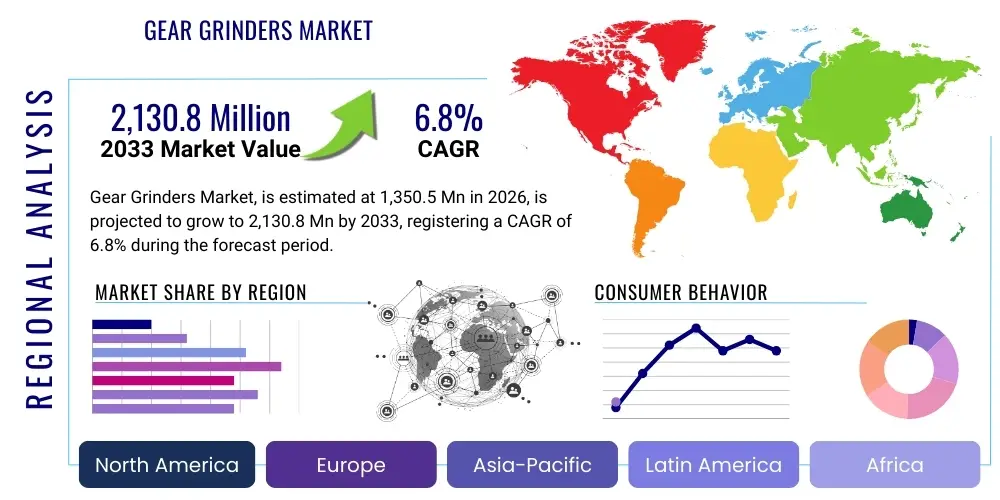

Gear Grinders Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442259 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Gear Grinders Market Size

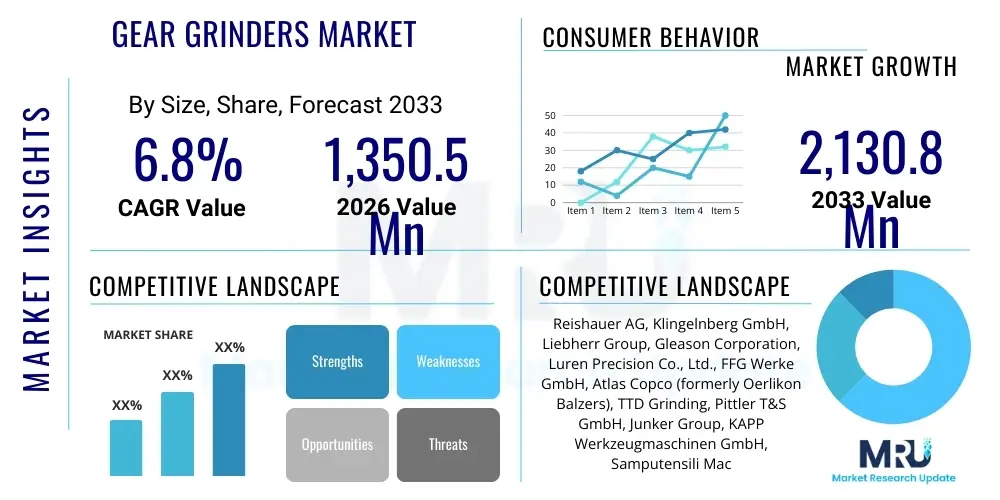

The Gear Grinders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1,350.5 Million in 2026 and is projected to reach USD 2,130.8 Million by the end of the forecast period in 2033.

Gear Grinders Market introduction

The Gear Grinders Market encompasses the machinery and associated tooling used for the precision finishing of gear tooth profiles, ensuring high accuracy, low noise, and maximum efficiency in transmission systems. Gear grinding is critical in industries requiring stringent quality standards, such as aerospace, automotive (especially electric vehicles and high-performance cars), heavy machinery, and wind power generation. The primary goal of gear grinding technology is to correct geometric errors introduced during previous manufacturing steps, like hobbing or shaping, and to achieve highly sophisticated tooth flank modifications necessary for optimal load distribution and noise reduction.

These specialized machines employ various grinding techniques, most notably abrasive grinding, including continuous generating grinding (power skiving analogy) and form grinding (discus wheel or profile grinding). Key benefits delivered by advanced gear grinders include ultra-precise micro-geometry control, superior surface finish (down to sub-micron roughness), and the ability to process extremely hard materials (e.g., case-hardened steels) efficiently. The increasing demand for efficient, quiet, and durable gearboxes, particularly in e-mobility applications and high-torque industrial transmissions, significantly fuels the adoption of sophisticated CNC gear grinding solutions globally. Modern gear grinders integrate advanced metrology and closed-loop feedback systems to minimize thermal deformation and achieve repeatable high-quality results.

Driving factors propelling this market include the global expansion of high-precision manufacturing sectors, stringent regulatory requirements concerning noise emissions and energy efficiency in vehicular systems, and the ongoing technological migration towards automated and digital manufacturing environments. Furthermore, the necessity for refurbishment and re-grinding services for large industrial gears used in mining, cement, and marine applications adds resilience to the market structure. The convergence of hardware precision with integrated software solutions for error compensation and optimization defines the technological trajectory of this sophisticated machinery segment, ensuring its sustained relevance in the modern industrial landscape.

Gear Grinders Market Executive Summary

The Gear Grinders Market is characterized by intense technological competition focused on enhancing precision, automation, and processing speed, particularly through the integration of 5-axis and 6-axis CNC controls and specialized software for complex profile calculations. Current business trends indicate a strong shift towards flexible manufacturing cells capable of handling a wider range of gear sizes and types, reducing setup times, and integrating directly with automated loading systems, such as robotic arms, to facilitate lights-out manufacturing. The push for green manufacturing practices is also influencing the market, driving the development of dry grinding or minimal quantity lubrication (MQL) systems to reduce coolant usage and associated environmental impact. Key industry players are increasingly investing in developing highly rigid machine structures and thermally stabilized components to manage the high forces and heat generated during high-speed grinding operations, ensuring consistent quality required by demanding sectors like aerospace.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, driven by massive investments in automotive manufacturing, industrial machinery production, and the burgeoning aerospace sector in countries like China, India, and South Korea. This region's demand is heavily centered on high-volume production efficiency and cost-effectiveness. Conversely, North America and Europe emphasize technological innovation, demanding machines that specialize in ultra-high precision, specialized large gears (e.g., wind turbine gearboxes), and complex modifications essential for next-generation transmission systems, including planetary and harmonic drive gearing. European manufacturers, often leaders in gear technology, set global benchmarks for quality and automation, maintaining strong demand for sophisticated generating grinding equipment.

In terms of segment trends, the Continuous Generating Grinding segment is experiencing rapid growth due to its inherent efficiency and suitability for mass production lines, significantly outpacing the traditional Form Grinding segment for high-volume automotive applications. However, Form Grinding remains indispensable for larger, non-standard, and highly specialized gears where maximum flexibility and customization are paramount. Furthermore, the market for internal gear grinding solutions is showing robust growth, fueled by the rising complexity of compact transmission systems required for modern vehicle architectures, necessitating specialized tooling and fixture designs to maintain high geometric accuracy within tight confines. The increasing adoption of smart monitoring systems and predictive maintenance capabilities is enhancing the utility and uptime of these high-value assets across all primary end-user sectors.

AI Impact Analysis on Gear Grinders Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Gear Grinders Market often revolve around predictive maintenance capabilities, optimization of complex grinding strategies, and the integration of autonomous quality control systems. Users frequently ask if AI can significantly reduce cycle times while maintaining or improving gear quality, how machine learning algorithms handle dynamic thermal and vibrational inputs, and what the financial return on investment (ROI) is for adopting AI-driven monitoring packages. There is also significant interest in AI's role in synthesizing metrology data with operational parameters to automatically generate and adjust optimal corrective grinding paths, particularly for compensating geometric deviations in real-time. This collective inquiry points towards a strong expectation that AI will transition gear grinding from a highly skilled, manual-adjustment process to a self-optimizing, data-driven manufacturing operation, addressing core manufacturing challenges such as minimizing scrap rates and maximizing equipment longevity.

- AI-driven Predictive Maintenance: Utilizing sensor data (vibration, temperature, power consumption) to forecast potential component failures (e.g., spindles, drives) and optimize grinding wheel replacement schedules, thus maximizing machine uptime.

- Optimized Grinding Parameter Selection: Machine learning algorithms analyze historical production data and current material properties to dynamically select optimal feed rates, dressing parameters, and depth of cut, reducing cycle time by up to 15%.

- Real-Time Thermal Compensation: AI models analyze thermal mapping within the machine structure, predicting distortion and automatically adjusting CNC paths in milliseconds to maintain precise micro-geometry, crucial for high-speed grinding.

- Automated Quality Control and Error Compensation: Integration of AI with in-process or post-process metrology sensors to instantly detect profile errors and automatically generate compensation curves, reducing the need for operator intervention and minimizing scrap.

- Enhanced Process Simulation: AI enhances complex Finite Element Analysis (FEA) simulations, allowing manufacturers to accurately model grinding process results, including surface integrity and residual stress, before production commences.

- Supply Chain and Inventory Management: AI algorithms optimize inventory levels for critical consumables like grinding wheels and dressing tools based on predicted usage patterns and maintenance schedules across multiple machines.

DRO & Impact Forces Of Gear Grinders Market

The Gear Grinders Market dynamics are primarily shaped by robust technological drivers, high structural restraints, significant market opportunities, and complex impact forces relating to industry regulation and global economic shifts. The primary driver is the accelerating requirement for high-precision, low-noise gear systems, especially within the rapidly evolving Electric Vehicle (EV) and high-power density industrial machinery sectors, which mandate stringent gear quality standards (e.g., DIN 1 to DIN 3). These sectors require sophisticated gear micro-geometry modifications—such as crowning, lead, and profile corrections—which only high-end CNC gear grinders can consistently achieve. Coupled with this is the continuous drive towards higher manufacturing automation and efficiency, compelling manufacturers to invest in faster, more flexible grinding solutions capable of integrated loading and automated process monitoring. The opportunity landscape is vast, particularly in emerging Asian markets where industrialization and the establishment of local manufacturing hubs are demanding large volumes of precision machinery. Furthermore, the aftermarket service sector, including the retrofitting and servicing of legacy gear grinding machines, presents a consistent, high-margin revenue stream for key players.

However, the market faces several inherent restraints. The initial capital investment required for high-precision gear grinding machines is exceptionally high, often representing a substantial barrier to entry for smaller manufacturers. Furthermore, the operational complexity demands highly skilled technicians for programming, setup, and maintenance, leading to high labor costs and skill shortages in many industrialized regions. The specialized consumables, particularly high-performance grinding wheels (e.g., CBN, ceramic), are costly and require precise management, adding to the overall cost of ownership. The market is also highly sensitive to cyclical downturns in key end-user industries such as automotive and heavy construction, where large machinery investments are often deferred during economic uncertainty.

Impact forces significantly affecting this market include stringent global environmental regulations promoting energy efficiency, thereby driving demand for near-perfect transmissions that minimize friction losses. Technological advances, such as the increasing commercial viability of additive manufacturing (3D printing) for some specialized gear applications, pose a disruptive long-term threat, although currently, grinding remains essential for high strength and precision. Supply chain resilience, particularly the availability of high-quality components like high-speed spindles and advanced controllers, remains a critical operational factor. Successful navigation of this market hinges upon continuous innovation in grinding techniques (e.g., dry grinding, high-speed dressing) while effectively managing the high operational expenditure and specialized skill requirements associated with ultra-precision machining.

Segmentation Analysis

The Gear Grinders Market is comprehensively segmented based on machine type, application technology, and end-use industry, reflecting the diverse requirements across precision manufacturing sectors. Segmentation by machine type primarily distinguishes between Form Grinding and Generating Grinding, methodologies that cater to different production volumes and complexity levels. Generating grinding, often used for high-volume automotive production, dominates in terms of unit sales due to its high efficiency. Conversely, Form Grinding holds significant value in specialized, large-diameter, or low-volume applications where flexibility is prioritized over cycle time. Further classification by grinding wheel material—CBN (Cubic Boron Nitride) versus Ceramic—highlights the technology spectrum, with CBN gaining traction for its superior performance and lifespan in hard finishing applications.

The segmentation by application is crucial, dividing the market into internal and external gear grinding. Internal gear grinding, while technically challenging, is becoming increasingly vital for compact and high-density gearboxes found in robotic drives and advanced aerospace actuators. External gear grinding remains the largest segment, catering to standard helical and spur gears. The end-use industry segmentation provides insight into demand drivers, with Automotive and Aerospace being the most demanding segments due to their stringent quality requirements (e.g., noise reduction in EVs, safety-critical components in aircraft). The complexity and specific geometry requirements dictated by these end-users heavily influence the technological developments pursued by machine manufacturers.

This structured segmentation allows market participants to tailor their offerings effectively, focusing either on high-throughput solutions for mass industrial machinery or highly specialized, high-accuracy equipment for aerospace and medical applications. The increasing demand for customization across the market is also driving the growth of multi-tasking machines and hybrid solutions, blurring the traditional lines between hobbing, shaping, and grinding technologies, pushing the boundaries of single-setup manufacturing optimization.

- By Machine Type:

- Form Grinding Machines (Profile Grinding)

- Generating Grinding Machines (Continuous Generating Grinding/Creep Feed Grinding)

- Non-Circular Gear Grinding Machines

- By Application:

- External Gear Grinding

- Internal Gear Grinding

- By Grinding Wheel Material:

- CBN (Cubic Boron Nitride) Grinding Wheels

- Ceramic/Corundum Grinding Wheels

- By End-Use Industry:

- Automotive (Passenger Vehicles, Commercial Vehicles, EV Transmissions)

- Aerospace and Defense

- Industrial Machinery (Pumps, Compressors)

- Wind Energy (Turbine Gearboxes)

- Heavy Industry (Mining, Marine, Cement)

Value Chain Analysis For Gear Grinders Market

The value chain for the Gear Grinders Market begins with the upstream suppliers responsible for high-precision components critical to the machines' performance. This includes specialized manufacturers providing high-speed, thermally stable spindles, advanced CNC controllers (e.g., Siemens, Fanuc, Heidenhain), linear motors and high-precision guideways, and specialized raw materials like high-damping cast iron for machine bases. The performance ceiling of the final gear grinder is intrinsically linked to the quality and thermal stability of these core components. Furthermore, the specialized CBN and ceramic grinding wheel manufacturers play a vital upstream role, as wheel technology dictates the attainable surface finish, material removal rate, and operational lifespan, significantly impacting the machine's overall cost of ownership and efficiency.

The mid-stream segment is dominated by the Original Equipment Manufacturers (OEMs) who design, assemble, and integrate the complex mechanical and software systems. This stage involves sophisticated engineering expertise in thermal management, vibration dampening, and the development of proprietary grinding software algorithms (e.g., tooth flank modification calculation packages). Key OEMs often differentiate themselves through superior software integration, offering advanced features such as automatic dressing cycles, in-process measuring systems, and sophisticated collision avoidance mechanisms. After manufacturing, the distribution channel determines how the high-value equipment reaches the end-user. Direct sales are common for major OEMs, particularly for highly customized or large machinery, allowing for direct service relationships and complex technical consultation.

The downstream involves installation, commissioning, training, and crucially, long-term maintenance and technical support. The technical complexity of gear grinders necessitates robust after-sales service, including remote diagnostics and the provision of specialized replacement parts. Indirect distribution, involving specialized machine tool distributors or agents, typically handles standard or mid-range machines, often providing localized support and application engineering services. The continuous demand for consumables, such as grinding wheels and dressing tools, forms a sustainable, high-margin downstream revenue stream. End-users, ranging from large automotive Tier 1 suppliers to specialized gear shops, rely heavily on the machine's uptime and accuracy to meet stringent production quotas and quality standards, making responsive downstream support an essential competitive differentiator in the market.

Gear Grinders Market Potential Customers

The primary customers for high-precision Gear Grinders are entities that require the manufacturing of gears with exceptionally tight tolerances, superior surface finishes, and specific micro-geometry modifications necessary for minimizing noise and maximizing efficiency under high-load conditions. The largest consumer base resides within the Automotive industry, specifically Tier 1 and Tier 2 suppliers involved in producing transmission components for conventional powertrains, and increasingly, specialized high-ratio, low-noise gearboxes for Electric Vehicles (EVs). EV gear production mandates extremely high quality (often AGMA 14 or higher) to mitigate the pronounced noise issues associated with high-speed electric motors, making gear grinding indispensable. These customers prioritize high throughput, automation integration, and minimal deviation across large batches.

Another significant customer segment is the Aerospace and Defense industry, which demands absolute reliability and performance from critical components like helicopter transmission gears and landing gear actuators. These end-users typically require machines capable of handling exotic materials and adhering to specialized certifications, prioritizing flexibility and quality assurance over raw production volume. Furthermore, heavy industrial sectors, including manufacturers of massive gearboxes for wind turbines, mining equipment, and marine propulsion systems, represent a crucial segment. While their volume is lower, the gears are extremely large, requiring specialized, high-capacity grinding machines with robust thermal management and long-travel axes. These customers prioritize machine longevity, rigidity, and the capability for post-hardening correction of significant distortions.

Finally, general industrial machinery manufacturers, including producers of machine tools, robotics, and fluid power equipment (pumps and compressors), consistently require precision gears for their internal mechanisms. Additionally, specialized contract manufacturers and gear job shops act as key customers, investing in flexible gear grinding machinery to service multiple niche industries and respond quickly to prototype and low-volume, high-mix production demands. The adoption curve for advanced machines is steepest among those customers focused on future-proof technology, such as those transitioning to smart factories or engaging in high-end additive post-processing requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,350.5 Million |

| Market Forecast in 2033 | USD 2,130.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Reishauer AG, Klingelnberg GmbH, Liebherr Group, Gleason Corporation, Luren Precision Co., Ltd., FFG Werke GmbH, Atlas Copco (formerly Oerlikon Balzers), TTD Grinding, Pittler T&S GmbH, Junker Group, KAPP Werkzeugmaschinen GmbH, Samputensili Machine Tools, Chongqing Machine Tool Group Co., Ltd., Holroyd Precision Ltd., ZCC Cutting Tools (Europe) GmbH, Nidec Machine Tool Corporation, A. Monforts Werkzeugmaschinen GmbH & Co. KG, EMAG GmbH & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gear Grinders Market Key Technology Landscape

The technological landscape of the Gear Grinders Market is dominated by the ongoing refinement of continuous generating grinding, often referred to as worm-wheel grinding, which offers superior productivity for small to medium-sized gears by simultaneously processing all tooth flanks. The major technological breakthroughs in this area involve high-speed dressing (HSD) and optimizing the synchronization between the grinding wheel and the workpiece to minimize non-productive time and enhance surface quality. Furthermore, the integration of advanced sensors and high-resolution encoders is essential for achieving the required sub-micron accuracy. Contemporary machines leverage sophisticated computer-aided design (CAD) and computer-aided manufacturing (CAM) software, specifically designed for calculating complex gear modifications (e.g., asymmetrical teeth, tip and root relief) that maximize gear efficiency under specific load conditions.

Another critical area of innovation is the widespread adoption of Cubic Boron Nitride (CBN) grinding technology. CBN wheels, particularly plated or electroplated varieties, offer exceptional hardness and thermal conductivity, significantly increasing material removal rates and extending tool life when compared to traditional ceramic abrasives. The challenge lies in developing machines rigid enough to handle the higher operational forces associated with CBN grinding and integrating automated, precise systems for wheel dressing and truing, ensuring the active CBN layer remains perfectly shaped. The transition to dry grinding or Minimal Quantity Lubrication (MQL) techniques is also gaining momentum, driven by cost savings and environmental compliance. MQL systems utilize small amounts of specialized oil mist, minimizing cleanup and disposal costs, though requiring specialized machine designs to handle the increased grinding heat without causing thermal distortion to the workpiece.

Furthermore, the incorporation of advanced monitoring and digitalization technologies is reshaping the market. Smart gear grinders are now equipped with acoustic emission sensors and proprietary software for in-process monitoring of grinding burn and surface integrity, allowing immediate process correction. The development of integrated metrology—where a CMM probe is housed within the grinding machine or immediately adjacent—allows for automated post-process inspection and instantaneous closed-loop feedback for error correction, effectively merging grinding and quality control into a single, high-efficiency operation. This technological convergence is central to the concept of Industry 4.0 within precision machining, offering unparalleled repeatability and minimizing reliance on manual quality checks, which historically bottlenecked high-precision gear production lines.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, largely attributable to the high concentration of automotive production, particularly in China and India, alongside significant government investment in aerospace and defense manufacturing capabilities. China, specifically, drives massive demand for highly automated continuous generating grinding machines for mass production. The region’s focus is balanced between affordable, high-volume machines and high-precision equipment required for advanced industrial applications and EV components, making it a critical hub for both consumption and localized manufacturing of gear grinding technology.

- Europe: Europe remains a powerhouse in technological innovation, home to several leading gear grinder OEMs (e.g., Germany, Switzerland). Demand here is characterized by a strong emphasis on ultra-high precision (often exceeding AGMA/DIN Class 14) and sophisticated custom solutions for complex gear modifications used in wind energy, high-performance automotive, and specialized machinery. European growth is driven less by raw volume expansion and more by the constant replacement and upgrade cycles necessitated by the pursuit of higher quality standards and tighter noise restrictions.

- North America: The North American market is dominated by the demand stemming from the defense and aerospace industries, requiring highly reliable, large-capacity gear grinders for complex, mission-critical parts. The resurgence in domestic automotive and heavy machinery manufacturing, particularly related to energy sector equipment and electric vehicle production, ensures steady demand. North American customers prioritize robust service networks and integrated automation capabilities, often sourcing advanced technology from both domestic and European suppliers.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets characterized by sporadic, project-driven demand, often associated with investments in oil and gas infrastructure, mining, and localized automotive assembly plants. While smaller in market size currently, they offer long-term potential for medium-scale industrial machinery. Demand is price-sensitive but increasingly recognizes the value of durable, serviceable machines capable of handling regional manufacturing challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gear Grinders Market.- Reishauer AG

- Klingelnberg GmbH

- Liebherr Group

- Gleason Corporation

- Luren Precision Co., Ltd.

- FFG Werke GmbH

- Atlas Copco (formerly Oerlikon Balzers)

- TTD Grinding

- Pittler T&S GmbH

- Junker Group

- KAPP Werkzeugmaschinen GmbH

- Samputensili Machine Tools

- Chongqing Machine Tool Group Co., Ltd.

- Holroyd Precision Ltd.

- ZCC Cutting Tools (Europe) GmbH

- Nidec Machine Tool Corporation

- A. Monforts Werkzeugmaschinen GmbH & Co. KG

- EMAG GmbH & Co. KG

- DMG MORI AG

- Okamoto Machine Tool Works, Ltd.

Frequently Asked Questions

Analyze common user questions about the Gear Grinders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Form Grinding and Generating Grinding in the context of gear manufacturing?

Form Grinding (or profile grinding) uses a specialized, pre-profiled abrasive wheel to finish the gear tooth space one by one, offering high flexibility for non-standard gears and large modules. Generating Grinding (continuous generating grinding) uses a worm-shaped wheel to continuously roll against the gear blank, simultaneously grinding both flanks of multiple teeth, which is significantly faster and more suitable for high-volume, standard production.

How is the demand for Gear Grinders specifically affected by the proliferation of Electric Vehicles (EVs)?

EV transmissions require extremely quiet operation due to the absence of engine noise masking gear whine. This necessitates grinding gears to significantly higher quality grades (AGMA 14 or DIN 3), resulting in increased demand for high-precision CNC gear grinders and advanced micro-geometry modification capabilities to manage noise, vibration, and harshness (NVH).

Which grinding wheel material is preferred for high-speed, hard finishing applications and why?

Cubic Boron Nitride (CBN) grinding wheels are highly preferred for hard finishing applications due to their exceptional hardness, superior thermal stability, and ability to maintain a sharp cutting edge longer than traditional ceramic abrasives. CBN significantly increases material removal rates while minimizing grinding burn and extending tool life, crucial for hard-part finishing.

What role does Industry 4.0 play in modern Gear Grinding technology?

Industry 4.0 integration involves equipping gear grinders with advanced sensors and connectivity for real-time data acquisition. This enables predictive maintenance, remote diagnostics, automated process optimization using AI and machine learning, and closed-loop feedback systems for instantaneous quality control and error compensation, driving overall equipment effectiveness (OEE).

What are the key financial restraints affecting the adoption of advanced Gear Grinders?

The primary restraints include the exceptionally high initial capital investment required for sophisticated CNC gear grinding machines, high operational costs associated with specialized consumables (CBN wheels, high-grade coolants), and the continuous need for investment in training highly skilled personnel for complex programming and maintenance operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager