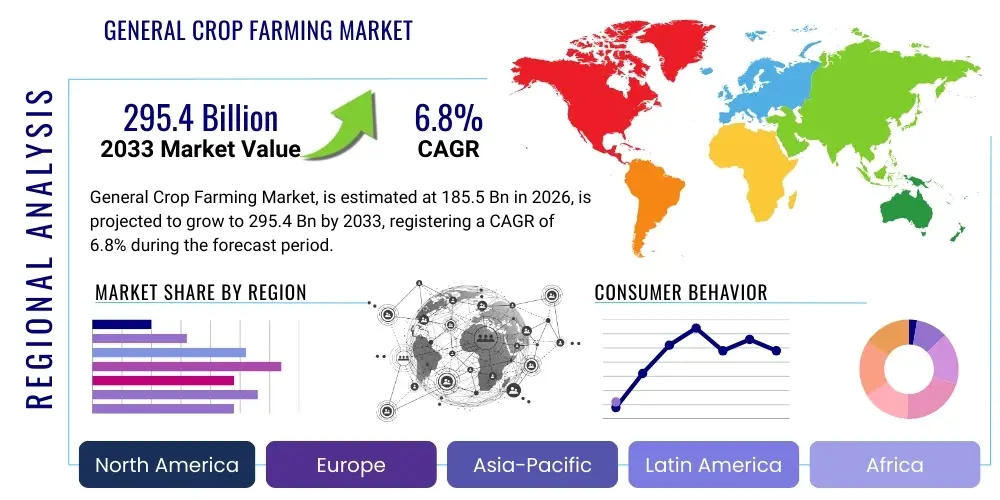

General Crop Farming Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441699 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

General Crop Farming Market Size

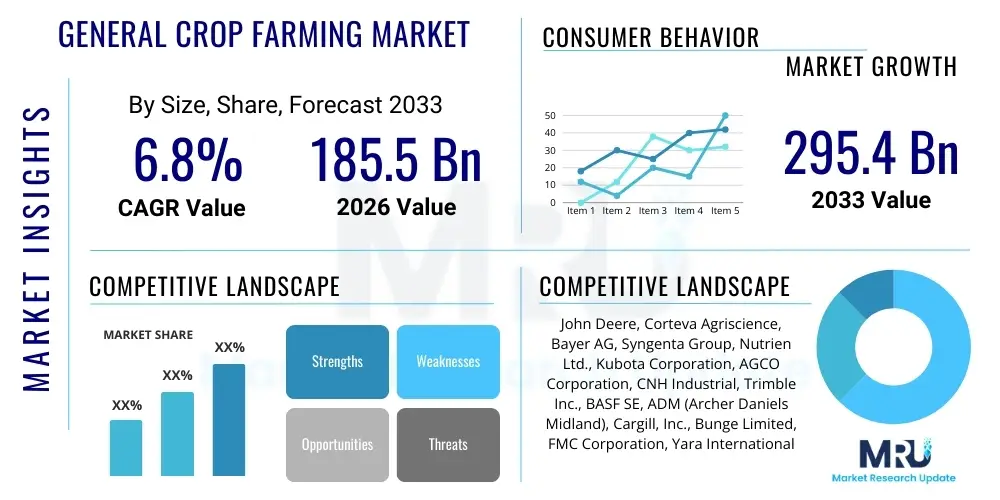

The General Crop Farming Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 185.5 Billion in 2026 and is projected to reach USD 295.4 Billion by the end of the forecast period in 2033. This sustained growth trajectory is underpinned by persistent global demand for food, feed, and biofuel resources, coupled with the accelerating adoption of advanced agricultural technologies designed to enhance yield efficiency and sustainability across diverse geographic regions.

General Crop Farming Market introduction

The General Crop Farming Market encompasses the cultivation of major staple crops, including cereals, oilseeds, fruits, vegetables, and pulses, essential for global food security, livestock feed, and industrial applications such as biofuels and textiles. This market is undergoing a significant transformation driven by the need to maximize productivity on existing arable land while minimizing environmental impact. Key applications span human consumption (direct and processed food), animal nutrition (feed ingredients), and industrial feedstock, creating a robust and complex supply chain that links agricultural producers directly to end-consumers globally. The escalating population and changing dietary habits, particularly in emerging economies, are placing immense pressure on conventional farming methods, necessitating the rapid integration of advanced agricultural practices.

The primary benefits derived from advancements in this market include enhanced crop yield stability, improved nutritional content through genetic engineering and tailored fertilization, and increased resilience against climate change variables, pests, and diseases. Modern crop farming leverages sophisticated tools such as precision irrigation, climate-controlled environments, and digital monitoring systems, leading to optimized resource utilization, particularly water and agrochemicals. These innovations address critical operational challenges, reducing waste and improving the financial viability of farming operations, thereby attracting significant investment in agricultural technology (AgriTech) startups and established machinery providers.

Major driving factors include the global imperative for food security, governmental support through subsidies and favorable regulatory frameworks encouraging sustainable practices, and technological breakthroughs such as biotechnology and vertical farming. The increasing consumer preference for organic, locally sourced, and sustainably produced commodities also significantly influences market dynamics, pushing producers toward certified ecological farming techniques. Furthermore, the integration of data analytics and machine learning provides farmers with unprecedented visibility into soil health, weather patterns, and plant stress indicators, enabling proactive decision-making that boosts overall farm efficiency and output quality across the cultivation spectrum.

General Crop Farming Market Executive Summary

The General Crop Farming Market is characterized by accelerating technological adoption, shifting regulatory landscapes focused on sustainability, and significant consolidation among major agricultural input providers. Current business trends indicate a strong move toward integrated farm management systems (FMS) that combine sensor data, satellite imagery, and predictive analytics to facilitate precision agriculture across large-scale commercial operations and increasingly, smaller farms through affordable subscription models. Geographically, Asia Pacific remains the dominant region due to large populations and extensive agricultural land base, while North America and Europe lead in the deployment of advanced precision technologies, focusing heavily on robotics and genetically engineered (GE) seeds designed for specific climate resilience and maximum yield output under variable weather conditions.

Regional trends reveal diversification in production strategies; while mature markets like North America emphasize data-driven yield optimization and labor efficiency through automation, developing regions, especially in Latin America and Africa, are focusing on improving basic infrastructure, drought-resistant varieties, and accessing global export markets. The European market is highly influenced by the stringent Common Agricultural Policy (CAP) regulations promoting biodiversity and reduced chemical use, propelling investments into organic and sustainable farming methodologies. This dichotomy drives tailored technology development: high-cost, hyper-efficient automation for the West, and low-cost, robust, scalable solutions for the Global South, thereby balancing the global supply-demand equation.

Segment trends highlight the exceptional growth within the Precision Farming segment, specifically related to variable rate technology (VRT) for seed, fertilizer, and pesticide application, dramatically improving input use efficiency. The crop type segment sees cereals and oilseeds maintaining market volume dominance, but the high-value specialty crops (fruits and organic vegetables) are showing the fastest revenue growth due to strong consumer health trends and increased penetration of protected cultivation methods (greenhouses, vertical farms). Furthermore, the biotechnology segment, focusing on CRISPR-Cas9 gene editing and novel hybrid creation, is rapidly overcoming regulatory hurdles to deliver crops resistant to specific regional pathogens and environmental stresses, further polarizing the market based on technological maturity and regulatory acceptance.

AI Impact Analysis on General Crop Farming Market

Common user questions regarding AI’s impact on General Crop Farming revolve primarily around its capacity to optimize resource allocation, predict crop failures, automate labor-intensive tasks, and enhance sustainability metrics. Users are frequently concerned about the cost of implementation, data privacy, and the accessibility of these advanced tools for small and medium-sized enterprises (SMEs). Key themes emerging from these inquiries highlight expectations for AI-driven disease diagnosis, predictive yield modeling based on real-time sensor data, and the deployment of autonomous farming equipment. Concerns often center on the digital divide, ensuring interoperability between diverse hardware platforms, and the necessary skill upliftment for farm managers to effectively utilize complex analytical outputs generated by machine learning models. The consensus is that AI is poised to fundamentally redefine agronomic decision-making, moving farming from reactive management to proactive optimization.

- AI-driven Predictive Analytics: Forecasting yield, disease outbreaks, and weather variability with high accuracy.

- Automated Pest and Weed Detection: Real-time image processing via drones and field robots for targeted, minimal intervention.

- Resource Optimization: Machine learning algorithms determining optimal irrigation schedules and variable rate application of fertilizers (VRT).

- Robotics and Automation: Powering autonomous tractors, harvesters, and planting systems, addressing labor shortages.

- Genetic Optimization: Accelerating breeding programs by analyzing vast genomic and phenotypic datasets.

- Supply Chain Efficiency: Enhancing traceability and forecasting demand volatility from field to consumer.

- Soil Health Monitoring: Analyzing complex soil microbiome and nutrient data to recommend specific amendments.

DRO & Impact Forces Of General Crop Farming Market

The General Crop Farming Market is propelled by critical drivers such as the escalating global population requiring increased food output and the subsequent push for sustainable intensification techniques. Restraints predominantly include the volatile nature of climatic conditions, which introduce unpredictability and risk, alongside the high initial capital investment required for implementing sophisticated precision farming technologies, making adoption challenging for cash-poor farmers. Opportunities are abundant in the development of drought-resistant and climate-resilient crop varieties through biotechnology, the expansion of high-value vertical and indoor farming environments, and leveraging governmental incentives aimed at reducing agriculture's carbon footprint. These forces collectively shape the market’s trajectory, demanding continuous innovation in both crop science and operational farm management practices to maintain global food security while adhering to environmental mandates.

Impact forces stemming from macro-economic and geopolitical events also heavily influence the market. Trade disputes, supply chain disruptions affecting fertilizer and machinery parts, and energy price volatility directly impact production costs and commodity prices globally. Furthermore, the societal pressure for sustainability and ethical farming practices has created strong internal momentum. Farmers are increasingly adopting minimum tillage and crop rotation to improve soil health, driven not just by regulation but by recognizing the long-term economic benefits. The rapid evolution of satellite imaging and IoT sensor technology dramatically reduces the cost of entry for sophisticated data collection, democratizing precision agriculture, thus acting as a strong positive influence offsetting some of the financial barriers to advanced farm technology adoption.

Specifically, regulatory changes, particularly concerning the registration and use of pesticides and genetically modified organisms (GMOs), act as a dual force—restricting certain market segments in regions like the EU while simultaneously driving innovation toward safer, biologically derived crop protection solutions. The increasing scarcity and degradation of arable land due to urbanization and climate change necessitate higher yields from smaller areas, making high-density and controlled environment agriculture (CEA) an immediate opportunity. The synergistic integration of data science and farm machinery is the single largest structural shift, ensuring that future growth is intrinsically linked to digital transformation and the efficient management of agricultural Big Data.

Segmentation Analysis

The General Crop Farming Market is segmented primarily based on Crop Type, Farming Method, Technology Application, and End-Use. Understanding these segments is crucial as they reflect varying levels of technological maturity, regional specialization, and alignment with global demand patterns. The Crop Type segmentation differentiates the volume-driven commodity market (cereals, oilseeds) from the high-growth, specialty crop market (fruits and vegetables). Farming Method analysis highlights the critical shift from traditional conventional farming towards highly efficient, data-driven Precision Agriculture and the growing consumer-driven shift toward certified Organic farming. Technology segmentation demonstrates the reliance on advanced hardware (drones, sensors) and software (farm management systems) to achieve operational efficiencies necessary for modern farming at scale.

The segmentation structure provides a clear picture of investment priorities. For instance, large corporations predominantly invest in segments utilizing cutting-edge technology to handle high-volume crops, ensuring global supply chain stability. Conversely, smaller, localized producers often capitalize on the increasing demand for organic and specialized, locally-sourced produce, focusing on niche market profitability. Geographical segmentation remains vital, linking specific crop types (e.g., corn and soybean in North America, rice and wheat in Asia) with the most suitable farming techniques and technological adoption rates, tailored to specific climate and soil compositions. This multidimensional segmentation allows stakeholders to accurately gauge market penetration and identify emerging growth areas, particularly where technological integration allows for substantial yield increases in resource-constrained environments.

- Crop Type

- Cereals (Wheat, Rice, Maize/Corn, Barley)

- Oilseeds (Soybean, Rapeseed/Canola, Sunflower, Palm)

- Fruits and Vegetables (Specialty Crops, High-Value Produce)

- Pulses and Legumes

- Fiber Crops (Cotton)

- Farming Method

- Conventional Farming

- Organic Farming

- Precision Agriculture/Smart Farming

- Vertical Farming and Controlled Environment Agriculture (CEA)

- Technology Used

- Hardware (Sensors, GPS/Guidance Systems, Drones, Robotics, Automated Machinery)

- Software & Services (Farm Management Systems (FMS), Data Analytics, Climate Modeling, GIS)

- Biotechnology and Crop Protection (Seed Technology, Fertilizers, Pesticides, Biopesticides)

- End-Use Application

- Food Production (Direct Human Consumption, Processed Foods)

- Feed Production (Livestock and Aquaculture)

- Biofuel and Industrial Applications (Ethanol, Biodiesel, Textiles)

Value Chain Analysis For General Crop Farming Market

The value chain for the General Crop Farming Market is highly complex, beginning with upstream activities focused on inputs, moving through midstream cultivation and harvesting, and concluding with downstream processing, distribution, and retail. Upstream analysis involves key players supplying crucial inputs: seed and biotech companies (developing high-yield and resilient varieties), fertilizer and chemical manufacturers (providing nutrients and crop protection), and machinery manufacturers (producing specialized equipment, sensors, and autonomous systems). The quality and price volatility of these inputs directly affect the farmer's profitability, making efficient sourcing and input planning a critical early stage of the chain. Major investment is currently concentrated in developing sustainable alternatives to chemical fertilizers and pesticides, driving the demand for biopesticides and enhanced seed coatings.

Midstream activities center on farm operations, where the cultivation and harvesting occur. This stage is becoming increasingly digitized, utilizing data from sensors and farm management software to maximize operational efficiency and yield quality. The shift towards direct distribution and contract farming is bypassing traditional intermediaries, driven by buyers demanding greater transparency regarding sourcing and sustainability metrics. Downstream activities involve large commodity traders (e.g., ADM, Cargill), food processors, and retailers. These players convert raw agricultural output into final consumer products (food, feed, or industrial materials). Effective cold chain logistics and storage infrastructure are critical, especially for perishable specialty crops, to minimize post-harvest losses and maintain quality from the farm gate to the end market.

Distribution channels are multifaceted, comprising direct sales (farm-to-consumer, or B2B contracts with processors), traditional wholesale markets, and modern integrated supply chains utilizing advanced logistics platforms. Direct channels are increasing in prevalence for specialty and organic produce, capitalizing on consumer desire for freshness and traceability. Indirect channels, typically through brokers and large commodity elevators, remain dominant for staple crops like wheat and corn. The entire value chain is undergoing digital integration, allowing for real-time monitoring of crop conditions, inventory levels, and transportation logistics, minimizing waste, and ensuring compliance with increasing regulatory standards related to food safety and environmental impact across all stages.

General Crop Farming Market Potential Customers

The potential customers and primary end-users of the General Crop Farming Market are highly diversified, reflecting the fundamental role agriculture plays in nearly every industry. The largest segments are Food and Beverage Processing Companies, which rely on crops as raw materials for products ranging from baked goods and oils to alcoholic beverages and packaged foods. These processors require consistent, high-volume, and standardized commodities, often secured through long-term supply contracts directly with large-scale farming operations or commodity traders. Quality parameters such as protein content (for wheat) or oil extraction yield (for soybeans) are crucial factors dictating purchasing decisions and price premiums within this segment.

Another significant customer base includes Livestock Feed Manufacturers and Aquaculture Producers, who demand vast quantities of crops like corn, soybean meal, and specialized grains for animal nutrition. The growing global demand for meat, dairy, and seafood directly translates into increased demand for these feed components, linking the crop farming market intrinsically with the animal agriculture and protein production sectors. Traceability and adherence to specific non-GMO or organic feed standards are becoming mandatory requirements for feed ingredients, driven by both regulatory compliance and consumer preference regarding animal welfare and food safety throughout the supply chain.

Furthermore, Industrial End-Users, including biofuel producers, pharmaceutical companies, and textile manufacturers, represent a growing market segment. Biofuel production, particularly ethanol from corn or sugarcane and biodiesel from oilseeds, is heavily supported by government mandates for renewable energy integration, securing a substantial demand stream. Specialized crops are also utilized in the extraction of high-value compounds for cosmetics and pharmaceuticals. These B2B customers prioritize crops grown to specific industrial specifications (e.g., high starch content, specific fiber length), often requiring specialized contract farming arrangements to ensure compliance and consistent supply tailored to their advanced processing requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Billion |

| Market Forecast in 2033 | USD 295.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | John Deere, Corteva Agriscience, Bayer AG, Syngenta Group, Nutrien Ltd., Kubota Corporation, AGCO Corporation, CNH Industrial, Trimble Inc., BASF SE, ADM (Archer Daniels Midland), Cargill, Inc., Bunge Limited, FMC Corporation, Yara International ASA, The Mosaic Company, Indigo Ag, Taranis, Raven Industries, Precision Planting |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

General Crop Farming Market Key Technology Landscape

The technological landscape of the General Crop Farming Market is undergoing rapid integration of digital, biological, and mechanical systems aimed at optimizing every aspect of the crop lifecycle. Key technologies dominating this shift include advanced sensor technology, encompassing soil moisture probes, nutrient monitors, and weather stations, which provide real-time, granular data crucial for micro-level decision making. Coupled with this is the proliferation of high-resolution satellite imagery and Unmanned Aerial Vehicles (UAVs or drones), which allow farmers to conduct rapid field mapping, monitor crop health through NDVI analysis, and detect early signs of stress or disease across vast land areas. The resulting Big Data is then fed into Farm Management Systems (FMS) and AI platforms to generate precise, actionable insights regarding planting density, watering schedules, and nutrient application rates, minimizing waste and maximizing yield uniformity.

Beyond data collection, automation and robotics are revolutionizing labor dynamics. Autonomous tractors and machinery equipped with GPS-guided steering and implement control systems ensure precise planting and harvesting with sub-centimeter accuracy, reducing fuel consumption and minimizing operator fatigue. Specialized robotics are emerging for high-value tasks such as automated weeding (using computer vision to differentiate crops from weeds), selective harvesting, and detailed phenotyping in breeding research. This mechanized efficiency is critical in regions facing persistent labor shortages and rising wage costs, positioning hardware and automation solutions as major investment areas within the market's technological evolution, requiring strong partnerships between machinery giants and software developers.

Furthermore, biotechnology remains a fundamental technology driver, especially in seed engineering. Advances in genomic editing techniques like CRISPR-Cas9 are allowing for the creation of new crop varieties with enhanced traits, including improved resistance to specific herbicides, increased nutritional value, and tolerance to environmental extremes such as heat, drought, or salinity. The focus is also shifting toward biologicals—biofertilizers and biopesticides derived from natural sources—as alternatives to traditional chemicals, aligning with global regulatory pressure to adopt eco-friendly farming practices. The convergence of these technological streams—Digital (AI/IoT), Mechanical (Robotics), and Biological (Biotech)—is establishing a synergistic ecosystem that fundamentally underpins the sustainable growth and productivity of modern crop farming.

Regional Highlights

The General Crop Farming Market exhibits diverse regional dynamics based on climate, available arable land, government policies, and technological penetration.

- North America (U.S. and Canada): This region is characterized by large-scale, highly mechanized farming operations, particularly for commodity crops like corn, soybeans, and wheat. North America leads the world in the adoption of precision agriculture, utilizing advanced GPS guidance, VRT systems, and genetically modified (GM) seeds. The market is driven by high operational efficiency demands and significant investment in AgriTech startups focused on AI-driven analytics and robotics to manage vast acreage effectively.

- Europe: Highly regulated by the Common Agricultural Policy (CAP), Europe emphasizes sustainable and organic farming practices, driving the adoption of biological crop protection and non-chemical weeding solutions. While the adoption of advanced automation is high in countries like the Netherlands and Germany, there is strong consumer resistance to certain GM crops, fostering specialized growth in high-value horticulture, protected cultivation (CEA), and niche organic food production sectors.

- Asia Pacific (APAC): APAC is the largest market by volume, dominated by staple crops such as rice and wheat, serving the region's massive population base. The market growth is fueled by modernization efforts in countries like India and China, transitioning from subsistence farming to commercial operations. Key drivers include government subsidies for irrigation technologies, high demand for quality seeds, and the rising middle class demanding diverse, high-quality produce.

- Latin America: This region is a major global exporter of soybeans, corn, and sugarcane, especially Brazil and Argentina. The market is expanding rapidly, characterized by extensive agricultural frontiers and high adoption rates of large-scale farm machinery and advanced seed varieties. Growth is volatile, often linked to global commodity prices and infrastructure development needed to support vast agricultural exports.

- Middle East and Africa (MEA): This region faces significant challenges related to water scarcity and desertification. The market is primarily focused on achieving food security through investments in drought-resistant crops, advanced water-saving irrigation techniques (like drip irrigation), and the development of controlled environment agriculture (CEA), especially in the Gulf Cooperation Council (GCC) countries to ensure local food production against harsh climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the General Crop Farming Market, spanning seed producers, agricultural chemical providers, and farm machinery manufacturers.- John Deere

- Corteva Agriscience

- Bayer AG

- Syngenta Group

- Nutrien Ltd.

- Kubota Corporation

- AGCO Corporation

- CNH Industrial

- Trimble Inc.

- BASF SE

- ADM (Archer Daniels Midland)

- Cargill, Inc.

- Bunge Limited

- FMC Corporation

- Yara International ASA

- The Mosaic Company

- Indigo Ag

- Taranis

- Raven Industries

- Precision Planting

Frequently Asked Questions

Analyze common user questions about the General Crop Farming market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the General Crop Farming Market?

The market growth is primarily driven by persistent global population expansion, necessitating higher crop yields; the rapid adoption of precision agriculture technologies (like AI and IoT) for resource efficiency; and increasing consumer demand for diverse, high-quality, and sustainably produced agricultural products globally.

How is precision agriculture transforming crop farming operations?

Precision agriculture uses data-driven insights from sensors, drones, and satellites, processed by AI, to enable variable rate application (VRA) of seeds, fertilizers, and pesticides. This optimization reduces input costs, minimizes environmental impact, and significantly increases yield consistency and quality across the farm.

What role does biotechnology play in enhancing crop resilience against climate change?

Biotechnology, particularly genetic modification and gene editing (CRISPR), allows researchers to develop new crop varieties engineered for tolerance to extreme weather conditions, such as severe drought, high heat, and soil salinity. These resilient seeds are critical for stabilizing production in climate-vulnerable regions and ensuring long-term food security.

Which geographical region dominates the General Crop Farming Market in terms of volume?

The Asia Pacific (APAC) region dominates the market in terms of production volume, driven by high output of staple crops like rice and wheat necessary to feed its dense population, coupled with ongoing government initiatives aimed at modernizing traditional farming practices across large agricultural economies like China and India.

What are the key constraints impacting the profitability of general crop farming?

Major constraints include unpredictable and volatile climate patterns causing yield fluctuations; high initial capital expenditure required for adopting modern technologies; increasing regulatory restrictions on chemical inputs; and persistent volatility in global commodity prices and supply chain costs for energy and fertilizer.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager