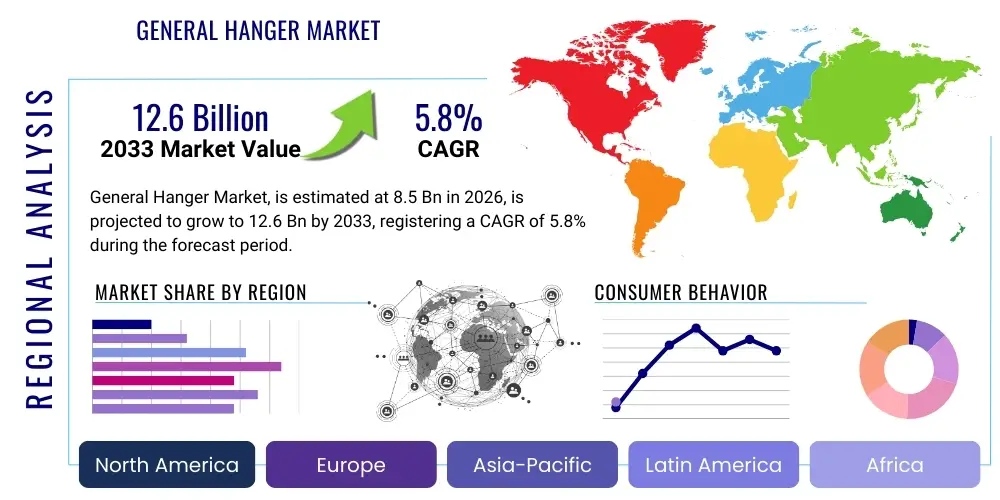

General Hanger Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442676 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

General Hanger Market Size

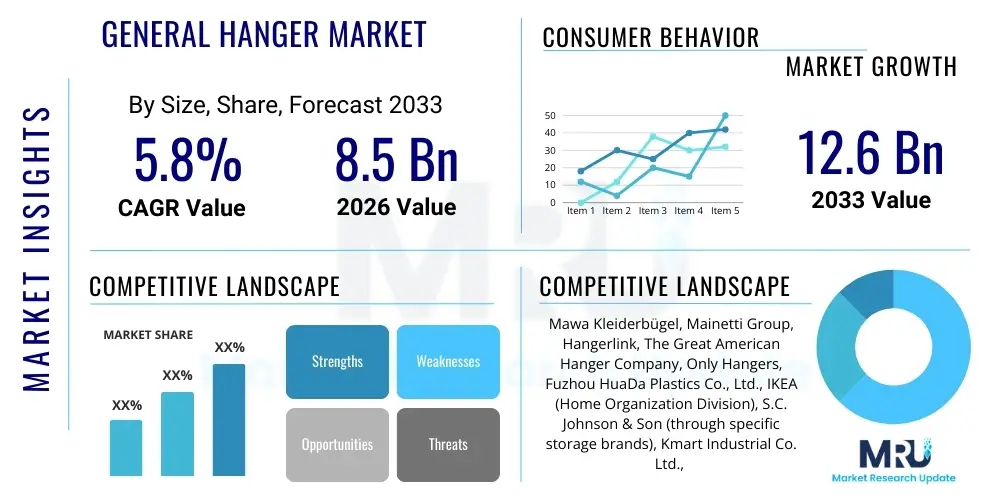

The General Hanger Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $8.5 Billion USD in 2026 and is projected to reach $12.6 Billion USD by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the continuous expansion of the global apparel and retail industry, alongside increasing consumer focus on home organization and garment preservation. The market encompasses a broad spectrum of products, ranging from utilitarian wire hangers used in dry cleaning to premium wooden and specialized velvet hangers catering to high-end fashion and luxury retail display requirements. Economic expansion in developing regions, coupled with the significant penetration of e-commerce platforms requiring specialized packaging solutions, further solidify the optimistic forecast for the market size expansion over the next seven years, necessitating robust supply chain adjustments.

General Hanger Market introduction

The General Hanger Market is defined by the manufacturing, distribution, and sale of devices designed to support garments for storage, display, or transport. Historically, hangers were utilitarian tools, primarily made of metal wire or basic plastic, serving basic functional needs in homes and dry-cleaning establishments. However, the modern market has evolved significantly, incorporating advanced material science and design aesthetics to address specialized applications such as high-end garment protection, anti-slip functionality, and sustainable material integration. Key product descriptions now include wooden hangers (known for durability and luxury appeal), plastic hangers (valued for cost-effectiveness and versatility), metal hangers (used heavily in industrial settings), and fabric/velvet hangers (offering anti-slip properties crucial for delicate garments).

Major applications of general hangers span across diverse sectors, including commercial retail (store displays and visual merchandising), industrial laundry and dry cleaning services, e-commerce packaging and shipping, and extensive residential use for closet organization and storage optimization. The inherent benefits of utilizing appropriate hangers include preserving the shape and structure of clothing, maximizing storage space efficiency, and enhancing the presentation of garments both in retail settings and personalized closet systems. Furthermore, the selection of premium or eco-friendly hangers often reflects a brand's commitment to quality and environmental stewardship, becoming an integrated element of the overall consumer experience and brand perception, especially within the luxury segment.

Driving factors fueling this market expansion are multifaceted, anchored significantly by the massive growth of the global apparel industry, particularly fast fashion and luxury goods which require specialized handling and display solutions. The increasing consumer disposable income, particularly in emerging economies, leads to higher spending on organized and aesthetic storage solutions. Furthermore, the proliferation of large-scale retail chains and specialized dry-cleaning franchises necessitates high volumes of durable and standardized hangers. The recent regulatory push toward sustainable manufacturing and the subsequent consumer demand for recyclable or biodegradable materials are compelling manufacturers to innovate rapidly, offering opportunities for market differentiation and premium pricing based on ecological criteria and material sourcing ethics.

General Hanger Market Executive Summary

The General Hanger Market is characterized by vigorous competitive dynamics driven by innovation in materials science and supply chain resilience. Current business trends indicate a definitive shift toward sustainable and recycled raw materials, influencing both pricing strategies and brand positioning, particularly among manufacturers targeting European and North American consumer bases. Leading market players are strategically investing in automated manufacturing processes to enhance scalability and reduce labor costs, allowing them to compete effectively against low-cost producers while maintaining high quality standards required by premium retail partners. Furthermore, the integration of digital tools for inventory management and direct-to-consumer (D2C) fulfillment logistics represents a critical pathway for optimizing operational efficiency and responding swiftly to fluctuating demand signals across different seasonality cycles and retail formats globally.

Regionally, the market exhibits divergent growth profiles. Asia Pacific (APAC) dominates the manufacturing landscape due to established industrial infrastructure and access to cost-effective raw materials, simultaneously serving as a massive consumption hub driven by its burgeoning middle class and expanding retail footprint. North America and Europe, conversely, are key markets for high-value specialty hangers, focusing heavily on eco-friendly certifications, premium wood finishes, and integrated technology solutions like RFID tagging for inventory tracking. These developed regions are setting the global standard for sustainability in hanger production, compelling global supply chains to adapt to stricter material usage policies and higher consumer expectations regarding product lifespan and environmental impact disclosure.

Segment trends reveal that the Wooden Hangers segment is experiencing robust growth, primarily due to their perceived quality, durability, and aesthetic appeal in the luxury and high-end residential storage markets. Simultaneously, the demand for Specialty Hangers—including those designed for specific items like belts, ties, or lingerie—is expanding rapidly, reflecting a consumer trend toward detailed closet organization and maximization of limited urban living spaces. The distribution channel analysis highlights the increasing dominance of the E-commerce & Online Retail segment, which requires manufacturers to prioritize durable, space-saving designs optimized for direct shipping and minimal damage during transit, contrasting sharply with the bulk shipments traditionally supplied to brick-and-mortar retail establishments and wholesale distribution centers.

AI Impact Analysis on General Hanger Market

Analysis of common user questions regarding the General Hanger Market and AI reveals core themes centered around efficiency, sustainability tracking, and retail personalization. Users frequently inquire about how AI can optimize hanger production costs, whether machine learning algorithms are used in demand forecasting for specific hanger types (e.g., velvet vs. wood), and the role of computer vision in automating quality control checks for aesthetic defects. Furthermore, there is significant interest in how AI can manage complex global supply chains for raw materials (plastics, wood sourcing), especially concerning ethical and sustainable procurement verification, ensuring compliance with global environmental mandates and consumer trust requirements. The key user concern synthesizes around leveraging AI not just for cost reduction but for creating a more responsive, transparent, and environmentally responsible hanger supply chain that can rapidly adjust to micro-seasonal trends in the apparel industry.

AI's primary influence is manifesting in enhancing operational efficiencies and tailoring product offerings. Predictive analytics powered by machine learning allows manufacturers to forecast the demand for different hanger types with unprecedented accuracy, minimizing overstocking and reducing waste related to obsolete inventory. This precision extends to procurement, where AI models optimize raw material purchasing based on projected prices and logistical constraints, stabilizing production costs despite market volatility. By integrating AI-driven systems into the design phase, companies can simulate the durability and structural integrity of new hanger prototypes, accelerating the product development cycle and ensuring functional superiority prior to mass production commitments.

In retail and B2B contexts, AI is transforming how hangers are categorized and recommended. Large apparel retailers use AI algorithms to analyze sales data and recommend the optimal hanger style and material for new clothing lines, improving visual merchandising effectiveness and garment lifespan. For e-commerce fulfillment, AI-optimized warehouse management systems determine the most efficient packaging method, often selecting specialized flat-pack or modular hangers that minimize shipping volume and associated environmental footprint. The future expansion of AI into the market will likely focus on implementing advanced robotic assembly lines capable of handling diverse materials and personalized customization requests at scale, moving production closer to the consumer base.

- AI-driven Demand Forecasting: Optimizing inventory levels for retailers and manufacturers based on real-time apparel sales data and seasonal shifts.

- Automated Quality Control: Utilizing computer vision systems to inspect finished hangers for material flaws, surface defects, and structural inconsistencies at high speed.

- Supply Chain Optimization: Employing machine learning to predict raw material price fluctuations and optimize logistics routes for sustainable sourcing and distribution.

- Personalized Retail Merchandising: AI recommending specific hanger styles (material, color, size) to retailers based on garment specifications and target aesthetic goals.

- Robotic Manufacturing Integration: Using AI to manage flexible manufacturing cells capable of producing customized hanger batches efficiently.

- Sustainability Verification: Tracking and verifying the provenance of recycled plastics or certified wood using blockchain integrated with AI verification models.

DRO & Impact Forces Of General Hanger Market

The General Hanger Market is propelled forward by significant drivers, chief among them the continuous, rapid expansion of the global apparel and fashion industry, which requires millions of hangers annually for presentation and storage. Complementary to this, the exponential growth of e-commerce channels necessitates specialized packaging and shipping solutions, often favoring durable, branded, or space-saving hanger designs optimized for D2C logistics. Opportunities arise primarily from the burgeoning global mandate for sustainability, pushing manufacturers to invest heavily in biodegradable polymers, recycled plastics, and certified sustainable wood sources, establishing a premium segment focused entirely on ecological responsibility and circular economy principles. Furthermore, the increasing consumer focus on aesthetic and organized home storage solutions drives demand for specialty and high-end materials, allowing for higher profit margins in residential sectors.

Conversely, the market faces notable restraints, most significantly the high volatility and fluctuating cost of key raw materials, including polyethylene, polypropylene, and various lumber species, which directly impact production economics and pricing stability. Secondly, the market is highly fragmented and characterized by intense price competition, especially from low-cost manufacturing hubs in Asia, which often compress profit margins for standardized product lines. Environmental regulations imposing stricter controls on non-recyclable plastics and certain chemical treatments pose logistical and financial challenges, requiring continuous innovation and potentially expensive retooling of manufacturing facilities to ensure ongoing compliance, particularly in stringent regulatory environments like the EU and California.

Impact forces within this ecosystem dictate market movement and competitive survival. The bargaining power of buyers, particularly large retail chains and global dry-cleaning franchises, remains high due to the standardized nature of many hanger products and the large volumes they command, forcing suppliers to maintain competitive pricing structures and efficient bulk delivery logistics. Simultaneously, the threat of substitutes is moderate but growing, stemming from alternative garment storage solutions such as specialized folding techniques, modular shelving systems, or garment bags, though these rarely offer the same structural preservation as traditional hangers. The most influential force remains technological advancement in material science, which offers pathways to mitigating raw material volatility through the development and adoption of innovative, cost-effective, and sustainable composite materials, allowing manufacturers to future-proof their product portfolios against evolving consumer and regulatory pressures.

Segmentation Analysis

The General Hanger Market is structurally segmented based on Material Type, Product Type, Application, and Distribution Channel, each influencing market dynamics and strategic focus for manufacturers. Material segmentation—covering plastic, wood, metal, and fabric—is crucial as it directly relates to cost structure, durability, aesthetic value, and compliance with sustainability standards. Product type segmentation differentiates standard garment support from specialized items like suit hangers, skirt clips, or tie racks, reflecting the granularity of consumer demand for detailed organizational solutions. The application scope separates industrial and commercial use from residential consumption, defining volume requirements and quality specifications. Finally, the distribution channel analysis distinguishes between traditional retail and the rapidly expanding e-commerce landscape, dictating packaging and logistics strategies necessary for market penetration across diverse geographical areas.

Understanding these segments is essential for strategic planning. For instance, companies focusing on the high-end residential Application segment typically prioritize Wood and Fabric Materials, utilizing specialty designs sold through dedicated online luxury home goods retailers. In contrast, manufacturers serving the Industrial Laundry Application segment prioritize high-volume, durable, and cost-efficient Plastic and Metal materials distributed via direct B2B contracts. The shifts in global retail consumption, particularly the increasing preference for online purchasing, necessitates strategic alignment across all segments, pushing even traditional material manufacturers to consider packaging efficiency and structural robustness optimized for direct consumer delivery, thereby blurring the traditional lines between wholesale and retail distribution models.

The segmentation structure provides a clear roadmap for identifying underserved niches, such as premium hangers made entirely from ocean-bound plastic or modular, customizable closet systems integrating specialized hanger components. Market leaders leverage this granularity to tailor marketing efforts and R&D expenditures, ensuring they capture value across the entire spectrum, from basic utilitarian needs satisfied by bulk plastic offerings to sophisticated, environmentally conscious solutions demanded by discerning, high-income consumers globally. The continuous innovation in plastic recycling techniques, coupled with advancements in lightweight metal alloys, ensures that all material segments remain dynamic and subject to ongoing competitive pressures regarding cost and sustainability performance metrics.

- Material Type

- Plastic Hangers (e.g., Polypropylene, Polyethylene, Recycled Plastic)

- Wooden Hangers (e.g., Maple, Cedar, Bamboo)

- Metal Hangers (e.g., Wire, Aluminum)

- Fabric/Velvet Hangers (e.g., Padded, Anti-slip Flocked)

- Product Type

- Standard Hangers (Shirt, Coat)

- Suit Hangers (Contoured)

- Bottom Hangers (Clip/Clamp)

- Specialty/Accessory Hangers (Tie, Belt, Scarf)

- Application

- Residential Use

- Commercial Retail Stores

- Industrial (Dry Cleaning/Laundry Services)

- E-commerce Packaging

- Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores (Home Goods, Container Stores)

- E-commerce & Online Retail

- Direct Sales/B2B Contracts

Value Chain Analysis For General Hanger Market

The value chain for the General Hanger Market begins with Upstream Analysis, focusing intensely on the sourcing of critical raw materials. This stage involves the extraction and processing of timber, the refinement of petrochemicals into plastic polymers, and the mining/processing of metal ores used for wire hangers. The efficiency and sustainability certifications (such as FSC for wood or recycled content verification for plastics) at this upstream stage significantly determine the final product cost and environmental credibility. Manufacturers are heavily reliant on stable global commodity markets, and disruptions or price volatility in polymer or lumber supply chains necessitate robust hedging and long-term procurement contracts. Integration with raw material suppliers who offer advanced recycled content solutions is becoming a critical competitive differentiator, allowing market players to meet evolving regulatory benchmarks for material lifecycle management.

The Midstream component involves manufacturing and assembly. This phase transforms raw materials into finished hangers through processes like injection molding (for plastic), milling and finishing (for wood), and wire forming (for metal). Automation and precision engineering are paramount here to achieve high volume production while maintaining consistent quality, especially for contoured suit hangers that require detailed shaping. Downstream analysis focuses on getting the finished product to the end consumer. This involves primary packaging, warehousing, and optimizing logistics for both large bulk shipments (to retail stores and dry cleaners) and individualized direct-to-consumer (D2C) shipments facilitated by the e-commerce boom. Efficient packaging that minimizes damage and volumetric weight is crucial in this stage, directly impacting shipping costs and overall profitability in a high-volume, low-margin industry.

The Distribution Channel structure is complex, involving both Direct and Indirect pathways. Indirect distribution heavily utilizes large wholesale distributors, home goods specialty retailers, and hypermarkets that handle high volumes, leveraging their existing logistical networks to reach the mass market. Direct distribution involves B2B contracts with large apparel chains, luxury brands, and industrial laundry services, where manufacturers often provide customized, branded solutions. The fastest-growing component is the E-commerce channel, which serves both residential and smaller commercial clients, requiring manufacturers to maintain strong digital presence, optimized online product listings, and streamlined fulfillment operations. Successfully managing this diversified channel strategy, ensuring product availability and minimizing logistical friction across all routes, is essential for maximizing market penetration and maintaining relevance across both the traditional and modern retail ecosystems.

General Hanger Market Potential Customers

The primary end-users or buyers of general hanger products encompass a wide range of commercial entities and individual consumers, segmented largely by volume and specification requirements. Major B2B customers include large-scale apparel retailers and department stores, such as global fashion chains and specialty boutiques, which purchase high volumes of aesthetically tailored hangers for visual merchandising, ensuring brand consistency and enhancing the consumer in-store experience. Secondly, industrial service providers, notably commercial laundry and dry-cleaning franchises, represent a substantial and consistent demand base for highly durable, utilitarian, and cost-effective hangers (primarily metal wire and basic plastic) required for service delivery and temporary storage of cleaned garments. These buyers prioritize operational durability and bulk pricing over premium design features.

A rapidly expanding segment of potential customers includes e-commerce and logistics providers who require specialized, robust, yet lightweight hangers for shipping garments directly to consumers. This category demands innovative packaging solutions, often favoring modular or flat-pack designs to minimize freight costs and prevent garment damage during transit, thereby optimizing the final mile delivery experience. Furthermore, hotel chains and hospitality providers constitute another stable B2B segment, requiring substantial quantities of theft-resistant or specialized non-removable security hangers tailored for institutional use in guest rooms and cloakrooms, prioritizing functionality and long-term investment value.

The third critical segment is the Residential End-User, comprising individual consumers focused on home organization, storage optimization, and garment care. This segment is highly fragmented but contributes significantly to premium market growth, driving demand for specialized anti-slip velvet hangers, heavy-duty wooden suit hangers, and aesthetic, color-coordinated closet systems. Purchasing decisions here are influenced by lifestyle trends, social media visibility of organization techniques, and perceived quality benefits, leading to higher average selling prices for specialty products sold through online retailers and premium home goods stores. Manufacturers must address the distinct quality, volume, and logistical needs of all three broad customer groups—Retailers, Industrial Services, and Residential Consumers—to maintain a balanced and resilient market presence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion USD |

| Market Forecast in 2033 | $12.6 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mawa Kleiderbügel, Mainetti Group, Hangerlink, The Great American Hanger Company, Only Hangers, Fuzhou HuaDa Plastics Co., Ltd., IKEA (Home Organization Division), S.C. Johnson & Son (through specific storage brands), Kmart Industrial Co. Ltd., Nanjing Easthide Plastic Manufacturing Co., Ltd., Whitmor Inc., Honey-Can-Do International LLC, InterDesign, Inc., Guangdong Hotata Technology Co., Ltd., Clipper Retail, Hangzhou Tenglong Co., Ltd., Zhejiang Hentec Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

General Hanger Market Key Technology Landscape

The technological landscape of the General Hanger Market is rapidly evolving, driven less by revolutionary product inventions and more by continuous process optimization, material science breakthroughs, and integration with digital tracking systems. The shift towards sustainable manufacturing mandates the adoption of advanced polymer recycling technologies, enabling the efficient processing of post-consumer and post-industrial plastics into high-quality, durable hanger materials without compromising structural integrity or aesthetic finish. Precision injection molding and computerized numerical control (CNC) machining for wooden hangers are standard technologies, but manufacturers are now leveraging multi-cavity molds and automated robotic handling systems to dramatically increase output rates and maintain ultra-low tolerance levels, crucial for satisfying high-volume B2B orders with stringent quality specifications and minimizing material waste during production cycles.

Another crucial technological development involves the integration of Smart Hanger components, specifically the embedding of Radio-Frequency Identification (RFID) tags or Near Field Communication (NFC) chips directly into the hanger structure during the molding or assembly process. This technology is indispensable for major retailers utilizing automated inventory management, allowing for instantaneous, accurate tracking of garment location, stock levels, and theft prevention throughout the supply chain, from the distribution center to the sales floor. Furthermore, advancements in specialized surface treatments, such as flocking processes for velvet hangers, now utilize electrostatic technology to ensure superior adhesion and minimal fiber shedding, enhancing the anti-slip performance and longevity of these premium products required by delicate garments.

Looking forward, the adoption of Industry 4.0 principles, including the Internet of Things (IoT) sensors within manufacturing equipment, allows for real-time performance monitoring and predictive maintenance, minimizing unplanned downtime and ensuring consistent operational efficiency across global facilities. Additive manufacturing (3D printing) is also beginning to play a small but growing role, primarily in the rapid prototyping of highly customized, complex hanger designs for luxury brands or for creating specialized fixture components used in retail displays. These combined technological improvements—focused on material sustainability, digital tracking, and operational automation—are collectively defining the modern competitive edge within the General Hanger manufacturing sector, enabling greater personalization and efficiency throughout the product lifecycle management process.

Regional Highlights

The General Hanger Market exhibits distinct regional consumption and production patterns, influencing investment and distribution strategies globally. Asia Pacific (APAC) holds the dominant share in terms of manufacturing volume, driven by countries like China, India, and Vietnam, which possess extensive production capacities, access to raw materials, and lower operational costs. APAC is not only the world’s manufacturing hub but also a rapidly expanding consumption market, fueled by increasing urbanization, rising disposable incomes, and the corresponding growth of local and international retail chains requiring standardized and premium display solutions. Investments in APAC are heavily geared towards scaling production and improving supply chain resilience to serve both internal and export markets.

North America and Europe represent the mature, high-value consumption markets characterized by a strong demand for premium, specialized, and sustainable hangers. Consumers and regulators in these regions place a premium on eco-friendly materials (FSC-certified wood, recycled plastics) and sophisticated organizational systems, driving innovation in design and material composition. The European market, particularly, is influenced by stringent directives concerning plastic waste and recyclability, pushing local manufacturers and importers to rapidly transition toward circular economy models. These regions focus intensely on branding, aesthetic quality, and technological integration, such as RFID tagging, catering primarily to the high-end residential and luxury commercial retail segments.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets demonstrating substantial growth potential. LATAM's market expansion is tied to the modernization of its retail infrastructure and the increasing penetration of global apparel brands, leading to a rising demand for standard commercial hangers and basic residential solutions. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, shows strong demand for luxury and specialty hangers due to high disposable incomes and a concentration of global luxury retail outlets, alongside significant infrastructure development in hospitality and residential sectors. These regions are often characterized by high import dependency for specialized products but offer significant opportunities for localized assembly and distribution networks targeting diverse socio-economic strata and seasonal demands.

- North America: Focus on premium wood and eco-friendly plastic hangers; high demand for closet organization systems and smart retail integration (RFID).

- Europe: Strict regulatory environment driving rapid adoption of recycled and biodegradable materials; strong market for highly aesthetic and durable products.

- Asia Pacific (APAC): Global manufacturing center; rapidly growing consumer market for both cost-effective bulk hangers and emerging premium residential products.

- Latin America: Growing retail formalization and modernization; increasing demand for commercial and basic residential plastic hangers.

- Middle East & Africa (MEA): High demand for luxury hangers in GCC states (driven by high-end retail and hospitality); increasing infrastructure development boosting overall demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the General Hanger Market, analyzing their product portfolios, strategic initiatives, regional presence, and financial performance. These companies are instrumental in defining market trends and technological standards.- Mainetti Group

- Mawa Kleiderbügel GmbH

- The Great American Hanger Company

- Hangerlink (Guangzhou) Co., Ltd.

- Only Hangers

- Fuzhou HuaDa Plastics Co., Ltd.

- Kmart Industrial Co. Ltd.

- Whitmor Inc.

- Honey-Can-Do International LLC

- Clipper Retail

- Nanjing Easthide Plastic Manufacturing Co., Ltd.

- Guangdong Hotata Technology Co., Ltd.

- Zhejiang Hentec Industry Co., Ltd.

- InterDesign, Inc. (now iDesign)

- Hangzhou Tenglong Co., Ltd.

- IKEA (Home Organization Division)

- S.C. Johnson & Son (through specific storage brands)

Frequently Asked Questions

Analyze common user questions about the General Hanger market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the General Hanger Market?

The primary factor driving demand is the consistent global expansion of the apparel and retail industry, particularly the rapid growth of both fast fashion and luxury clothing segments, coupled with the necessity for specialized packaging solutions driven by e-commerce logistics. This growth requires high volumes of both functional and aesthetic hangers for storage, display, and transit purposes.

How are sustainability trends impacting material choice for manufacturers?

Sustainability trends are critically impacting material choice by shifting industry focus toward recycled polymers, certified sustainable wood (FSC), and biodegradable materials. Manufacturers must now invest in advanced material science and secure certifications to comply with stringent European regulations and meet increasing consumer preference for eco-friendly, durable, and ethically sourced hanger products, often commanding a premium price.

Which segment of the General Hanger Market is projected to exhibit the fastest growth?

The E-commerce & Online Retail distribution channel segment and the Specialty Hangers product segment are projected to exhibit the fastest growth. E-commerce necessitates unique, durable hangers optimized for D2C shipping, while specialty hangers address the growing residential consumer demand for detailed, space-saving closet organization systems, reflecting higher disposable incomes and focus on home aesthetics.

What role does technology such as RFID play in the General Hanger Market?

Technology, specifically Radio-Frequency Identification (RFID), plays a crucial role in enabling smart inventory management within commercial retail and logistics. By embedding RFID chips into hangers, retailers can achieve real-time, highly accurate tracking of individual garments throughout the supply chain, significantly improving stock visibility, loss prevention, and supply chain efficiency, thus transforming the hanger from a static tool to an intelligent asset.

What are the main challenges faced by manufacturers in the General Hanger Market?

The main challenges include managing the high volatility and unpredictable pricing of raw materials (polymers and lumber), navigating intense global price competition from high-volume manufacturers, and ensuring continuous compliance with increasingly stringent global environmental regulations concerning plastic usage and material traceability, requiring significant capital investment in operational modernization and compliance verification.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager