General Liability Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441422 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

General Liability Insurance Market Size

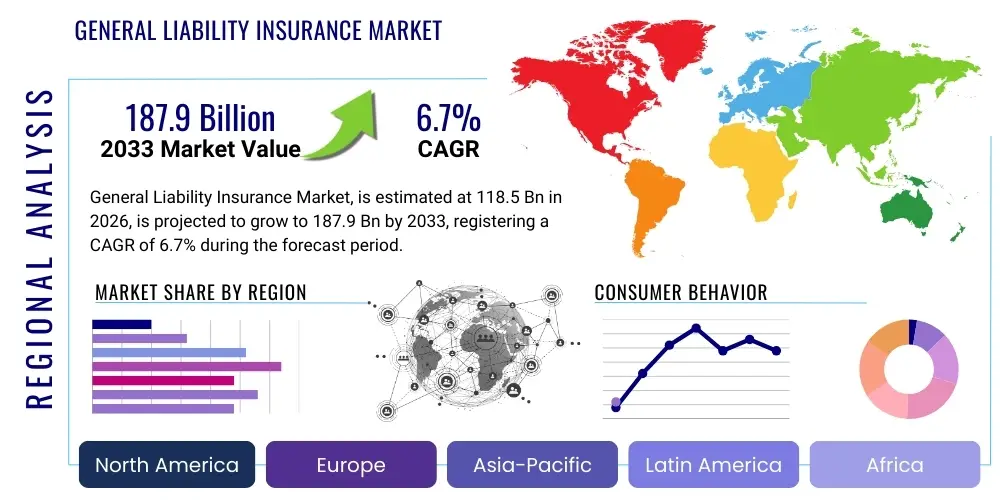

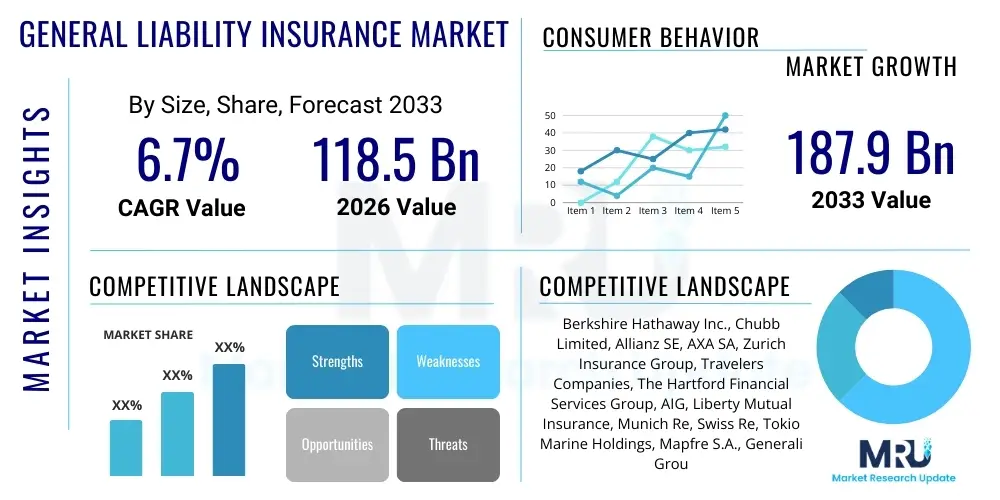

The General Liability Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 118.5 Billion in 2026 and is projected to reach USD 187.9 Billion by the end of the forecast period in 2033.

General Liability Insurance Market introduction

General Liability Insurance (GLI), often referred to as Commercial General Liability (CGL), serves as a fundamental pillar of risk management for businesses globally. This crucial insurance product provides financial protection against claims of bodily injury, property damage, personal injury (such as libel or slander), and advertising injury arising out of business operations, premises, or products. The necessity of GLI transcends industry sectors, making it indispensable for enterprises ranging from small, independent contractors to large multinational corporations. Key applications include mitigating risks associated with customer visits to business locations, managing liabilities stemming from completed projects or delivered products, and addressing unforeseen mishaps during standard business activities. The core benefit is ensuring business continuity by shielding assets from potentially devastating litigation costs and compensatory damages, thereby stabilizing the financial health of the insured entity.

The market is defined by a landscape of increasing litigation severity and frequency, pushing businesses towards higher coverage limits and specialized endorsements. Driving factors for market expansion include escalating urbanization, which naturally increases commercial density and interaction, coupled with the rapid growth of the Small and Medium-sized Enterprise (SME) sector, which represents a massive segment of uninsured or underinsured businesses globally. Furthermore, the complexity of modern supply chains means that a liability incident can have far-reaching consequences, necessitating robust GLI policies that account for global operations and product traceability. Regulatory mandates in various jurisdictions often require businesses to hold minimum levels of liability coverage, further cementing its demand.

Product innovation within the GLI market is shifting towards more comprehensive packages that integrate traditional liability coverage with emerging risks such as data breach liability (often bundled with cyber insurance) and environmental liability endorsements. The rise of the digital economy and the proliferation of virtual business models are compelling insurers to adapt policy wordings to accurately reflect risks associated with online operations, intellectual property disputes, and digital advertising. The ongoing evolution of case law regarding negligence and damages awards continues to place pressure on underwriting profitability, driving the adoption of sophisticated data analytics and risk modeling to accurately price and manage these shifting exposures.

General Liability Insurance Market Executive Summary

The General Liability Insurance Market is currently navigating a period of significant transition, characterized by tightening underwriting standards (a 'hard market' cycle), technological acceleration, and pronounced regional divergence in legal environments. Business trends indicate a strong move towards integrated risk solutions, where pure GLI policies are often packaged with property, professional liability, and cyber coverage to provide holistic protection. Insurers are leveraging advanced analytics to enhance risk selection, moving away from generalized pricing models toward highly granular assessments based on industry-specific exposure data and claims history. This shift is crucial as insurers seek to maintain solvency amidst rising catastrophic losses and increasing social inflation—the trend of rising damage awards in court cases—which disproportionately affects long-tail liability lines like CGL. Investment in InsurTech capabilities remains a key competitive factor, focusing on optimizing distribution channels and enhancing customer experience, particularly for the digitally native SME segment.

Regional trends reveal that North America, driven by its litigious culture and high concentration of large corporations, remains the dominant revenue contributor, yet Asia Pacific (APAC) is emerging as the fastest-growing region. This APAC expansion is underpinned by vast infrastructure investment, rapid industrialization, and the increasing formalization of small businesses, coupled with a nascent but growing awareness of liability exposure. European markets are defined by stringent regulatory environments, particularly around consumer protection and environmental standards, which necessitates highly localized GLI products. Meanwhile, Latin America and the Middle East & Africa (MEA) offer long-term growth potential, provided carriers can overcome challenges related to economic volatility and lower insurance penetration rates.

Segment trends highlight strong growth in the construction, professional services, and manufacturing sectors due to inherent operational complexities and higher exposure to third-party claims. From a distribution perspective, the brokerage channel continues to dominate complex risk placement, though digital direct channels are gaining traction for simpler, standardized policies targeted at micro-enterprises. Furthermore, the increasing acceptance and integration of parametric insurance solutions, while not traditional GLI, demonstrate a broader trend towards innovative risk transfer mechanisms that may eventually influence how GLI exposure is quantified and paid out. The confluence of regulatory scrutiny regarding solvency and capital adequacy, alongside market demand for adaptable coverage, is setting the strategic agenda for major global carriers throughout the forecast period.

AI Impact Analysis on General Liability Insurance Market

User queries regarding AI in General Liability Insurance predominantly revolve around efficiency gains, the potential for automated underwriting, and ethical implications concerning claim fairness and data privacy. Key themes include how AI can be used to predict the likelihood and severity of GLI claims, specifically focusing on identifying high-risk policyholders or operational environments. Concerns often center on the 'explainability' of AI models (XAI), particularly when an algorithm denies coverage or adjusts premiums significantly, leading to potential regulatory challenges regarding discrimination or lack of transparency. Users are also keen to understand how AI-powered claims processing can accelerate resolution times for common liability claims, and whether this automation will result in significant job displacement within claims adjusting and brokerage roles.

The integration of Artificial Intelligence and Machine Learning (ML) algorithms is fundamentally reshaping the operational framework of General Liability Insurance, migrating processes from manual review to predictive modeling. AI facilitates the ingestion and analysis of massive, unstructured datasets—including geospatial data, social media sentiment, safety inspection reports, and complex legal texts—allowing underwriters to assess risk profiles with unprecedented accuracy. This capability helps in differentiating between low-risk and high-risk entities far more effectively than traditional methods, leading to fairer pricing and optimization of capital deployment. Moreover, in claims management, AI enhances fraud detection capabilities by identifying patterns indicative of inflated or fabricated claims, which is critical in a line of business susceptible to organized fraud rings, thereby protecting the overall profitability of the GLI portfolio.

Looking ahead, the next phase of AI integration will focus heavily on proactive risk mitigation. Insurers are beginning to use predictive maintenance algorithms and real-time monitoring data (where applicable, such as IoT sensors in commercial properties) to alert clients to potential hazards before they result in a liability claim. For instance, using AI to monitor building maintenance logs could proactively identify a tripping hazard, preventing a bodily injury lawsuit. However, this raises new questions about the insurer's duty of care and the boundaries of risk advisory services versus traditional insurance coverage. The long-term impact is expected to lead to highly customized, dynamic GLI policies where premiums adjust in near real-time based on observed operational risk exposure, driven entirely by AI and ML infrastructure.

- Enhanced Underwriting Accuracy: AI algorithms analyze vast datasets to determine precise risk profiles, leading to optimized premium pricing.

- Automated Claims Processing: Use of Natural Language Processing (NLP) and machine vision for rapid analysis and initial triaging of liability claims documentation.

- Fraud Detection Improvement: ML models identify subtle or complex patterns of fraudulent activity in claims submission that human reviewers might overlook.

- Predictive Risk Modeling: Utilizing AI to forecast potential liability incidents based on operational data, weather patterns, and socio-economic indicators.

- Operational Efficiency: Streamlining back-office tasks, documentation processing, and compliance checking, reducing administrative costs.

- Personalized Policy Generation: Enabling the creation of highly customized, modular GLI policies tailored to specific, real-time business exposures.

DRO & Impact Forces Of General Liability Insurance Market

The dynamics of the General Liability Insurance market are governed by a complex interplay of systemic drivers (D), constraining factors (R), and significant opportunities (O), collectively shaping the operating environment and defining the impact forces. The primary drivers include the escalating global phenomenon of social inflation, characterized by increasingly large jury awards and litigation financing, which elevates the cost of claims payouts. Concurrently, increasing global business interconnectedness and regulatory requirements mandating minimum liability coverage in high-growth sectors, such as professional services and technology, sustain demand. The emergence of new and complex risks, particularly those related to intangible assets and cyber-physical systems, consistently broadens the scope of liabilities that businesses must transfer, providing a continuous impetus for market growth and policy innovation.

Restraints on market expansion primarily stem from the cyclical nature of the insurance industry, often resulting in periods of intense price competition (soft markets) that compress underwriting margins and hinder capital accumulation necessary for handling large catastrophic losses. Regulatory heterogeneity across different global jurisdictions complicates policy standardization and compliance, increasing operational complexity for international carriers. Furthermore, the persistent challenge of accurately modeling and pricing long-tail liabilities, where claims may emerge many years after the policy period, introduces considerable volatility and capital reserve requirements that limit participation and growth, particularly among smaller or niche insurers. The adoption hurdle for advanced technologies in traditional insurance systems also acts as a restraint, slowing down the implementation of efficiency-boosting automation.

Significant opportunities exist in the integration of specialized liability products, such as embedding cyber liability and employment practices liability (EPL) endorsements directly into core CGL policies, meeting the market demand for comprehensive, unified risk solutions. The untapped potential of the SME sector, particularly in emerging economies where penetration rates remain low, presents a vast addressable market for technologically streamlined, affordable GLI products. Additionally, the increasing availability of sophisticated, third-party data sources (e.g., satellite imagery, aggregated economic activity data) offers carriers the opportunity to dramatically refine their exposure modeling, leading to superior risk selection and reduced overall loss ratios. These opportunities, coupled with the impact forces of legal reform and technology adoption, suggest a shift towards a more data-driven, client-centric market structure.

Segmentation Analysis

The General Liability Insurance market is highly fragmented and analyzed across several critical dimensions, enabling insurers to tailor products and pricing strategies effectively. Key segmentation criteria include the type of coverage (e.g., standard CGL, excess liability, umbrella liability), the size of the enterprise (Small, Medium, Large), the industry vertical served (e.g., Manufacturing, Construction, Retail, Technology), and the distribution channel employed (e.g., Brokers, Agents, Direct Channels). This granular approach is essential because the liability risk profile differs drastically; for instance, a construction firm faces high bodily injury and property damage risks from premises and operations, whereas a technology firm primarily faces risks related to personal and advertising injury, and intellectual property disputes, necessitating different coverage structures and endorsements.

Current analysis indicates that the medium and large enterprise segments account for the highest share of the market value, primarily due to their higher revenue bases, larger operational footprints, and propensity to purchase higher limits of liability and comprehensive umbrella policies. However, the small and medium-sized enterprise (SME) segment is forecast to exhibit the highest CAGR, driven by global entrepreneurship, regulatory enforcement requiring liability insurance for contractual work, and improved accessibility to standardized policies via digital platforms. Geographically, segmentation is also crucial, as legal precedents and jury award sizes vary widely, requiring carriers to maintain region-specific capital reserves and underwriting guidelines. The manufacturing and construction verticals remain the perennial backbone of the GLI market, though the services sector, particularly professional and technology services, is accelerating its uptake of CGL as foundational risk coverage.

The shift in distribution strategy also represents a major segmentation trend. While traditional brokerages still handle the majority of complex, tailored risk placement for large accounts, the market for standardized, off-the-shelf GLI policies is rapidly migrating towards digital direct-to-consumer or direct-to-SME platforms. This channel optimization aims to reduce acquisition costs and improve efficiency for the smaller policy segment. Furthermore, the segmentation by coverage type reveals increasing demand for "occurrence-based" policies over "claims-made" policies, particularly in sectors where long-tail claims are prevalent, providing better peace of mind regarding future unknown liabilities. The ability of carriers to efficiently cross-sell specialized endorsements within these segmented offerings is a key performance differentiator.

- By Coverage Type:

- Commercial General Liability (CGL)

- Excess Liability Insurance

- Umbrella Liability Insurance

- By Enterprise Size:

- Small Enterprises (SMEs)

- Medium Enterprises

- Large Enterprises

- By Industry Vertical:

- Construction and Real Estate

- Manufacturing

- Retail and Wholesale Trade

- Professional Services (Legal, Accounting)

- Healthcare

- Technology and Telecommunications

- Hospitality

- By Distribution Channel:

- Agents and Brokers

- Direct Writers

- Bancassurance

Value Chain Analysis For General Liability Insurance Market

The value chain of the General Liability Insurance market begins upstream with the foundational elements of risk and capital. Upstream activities involve reinsurance entities, which absorb significant portions of risk transferred by primary carriers, particularly for catastrophic liability exposure. Data providers and catastrophe modeling firms also occupy a crucial upstream position, offering the statistical intelligence and predictive tools necessary for accurate risk assessment and pricing. This stage is characterized by high capital intensity and sophisticated analytical requirements, forming the foundation upon which pricing models are constructed and policy language is defined. Robust relationships between primary carriers and reinsurers are vital for maintaining market capacity, especially during periods of high social inflation or regulatory changes.

The midstream segment is dominated by the primary insurance carriers, which undertake the core functions of underwriting, policy administration, and marketing. Distribution channels—comprising independent agents, national brokers, and increasingly, digital direct platforms—act as the critical interface between the carrier and the end-user. The efficacy of this segment relies heavily on maintaining a balance between underwriting prudence and market responsiveness. Carriers must leverage technology to streamline policy issuance and compliance while also ensuring that agents and brokers are equipped with appropriate training and technology tools to accurately represent complex products. Direct channels are disrupting this segment by offering speed and transparency for standardized products, forcing traditional intermediaries to focus on bespoke, high-value advisory services.

The downstream activities center around the realization of the insurance promise: claims management and customer service. Claims processing involves complex loss adjustment, litigation management, and ultimate settlement. This stage is highly labor-intensive and increasingly reliant on advanced technology like AI-driven claims triage and digital documentation handling to control loss adjustment expenses (LAE). Effective claims handling, characterized by speed, fairness, and transparency, is paramount for customer retention and brand reputation. The downstream also includes legal defense counsel and third-party claims administrators (TPAs), who specialize in managing highly technical or complicated liability litigation. The shift toward digital communication across the entire value chain is optimizing operational efficiency, reducing cycle times, and enhancing data flows for continuous underwriting refinement.

General Liability Insurance Market Potential Customers

Potential customers for General Liability Insurance span the entire commercial spectrum, driven by the universal need to shield corporate assets from unexpected third-party claims. Small and Medium-sized Businesses (SMBs) represent a massive, continuously renewing customer base. For SMBs, GLI is often non-negotiable, particularly when contractual agreements with larger clients or landlords mandate minimum coverage levels. These entities are highly sensitive to price and convenience, making them ideal targets for streamlined, digitally distributed policies. Specific high-risk sectors are perennial buyers, including general and specialized contractors in the construction industry, manufacturers dealing with product liability exposures, and the retail and hospitality sectors which see high volumes of public traffic, significantly increasing premises liability risk.

Large multinational corporations constitute the second core demographic, requiring sophisticated, often global, insurance programs that integrate local primary policies with high-limit umbrella coverage. These customers require complex policy endorsements, high service levels for international claims handling, and specialized legal risk management advisory services. Furthermore, emerging customer segments driven by the gig economy and technology platforms, such as rideshare companies, delivery services, and short-term rental platforms, are increasingly purchasing GLI to cover the activities of their contract workers and the operational liabilities arising from their platform activities. This technological sector often demands customized liability policies that address risks specific to intangible assets, data, and digital interactions.

Beyond traditional businesses, non-profit organizations, educational institutions, and public sector entities are also significant consumers of GLI, seeking protection against premises liability, directors' and officers' liability exposures (often bundled), and liability arising from large public events. The market recognizes that any entity interacting physically or commercially with third parties, regardless of profit motive, necessitates liability protection. The trend towards proactive risk management means that even organizations with historically low claims activity are upgrading their GLI coverage to higher limits, anticipating the impact of social inflation on potential damage awards and demonstrating sound corporate governance by protecting stakeholders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 118.5 Billion |

| Market Forecast in 2033 | USD 187.9 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Berkshire Hathaway Inc., Chubb Limited, Allianz SE, AXA SA, Zurich Insurance Group, Travelers Companies, The Hartford Financial Services Group, AIG, Liberty Mutual Insurance, Munich Re, Swiss Re, Tokio Marine Holdings, Mapfre S.A., Generali Group, CNA Financial Corporation, QBE Insurance Group, R+V Versicherung AG, Sompo Holdings, Arch Capital Group, W.R. Berkley Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

General Liability Insurance Market Key Technology Landscape

The General Liability Insurance market is increasingly leveraging a suite of advanced technologies, collectively known as InsurTech, to manage complexity and reduce expense ratios. A key technological pillar is the adoption of sophisticated predictive analytics and machine learning (ML) models. These models move beyond basic linear regression, using vast, non-traditional data sources (e.g., permits data, building code violations, aggregated industry safety statistics) to achieve highly refined loss prediction and accurate risk scoring at the individual policy level. The implementation of application programming interfaces (APIs) is also fundamental, allowing carriers to seamlessly integrate with third-party data providers, brokerage systems, and claims processing software, thereby creating an efficient, interconnected ecosystem that speeds up quotation and policy issuance processes, especially critical for GLI’s high-volume SME segment.

Furthermore, the digital transformation relies heavily on the use of Robotic Process Automation (RPA) and intelligent automation tools for managing routine, repetitive administrative tasks that characterize the GLI lifecycle, such as policy renewal notices, endorsement processing, and preliminary documentation review. This frees human underwriters and adjusters to focus on complex, bespoke risk placements and litigation-heavy claims. The emergence of blockchain technology holds significant promise, particularly for shared risk pools and for creating immutable records of policy issuance, claims filings, and premium payments, enhancing transparency and reducing compliance costs associated with multi-jurisdictional policies. While full-scale blockchain adoption is nascent, proofs of concept show potential for radically simplifying reinsurance and subrogation processes within the GLI context.

Finally, the growing use of telematics and Internet of Things (IoT) devices, though more commonly associated with property and motor insurance, is beginning to influence GLI pricing, particularly in industrial, construction, and fleet operations. Data derived from these sensors can provide real-time indicators of operational safety and compliance, allowing insurers to offer usage-based liability policies or proactive risk mitigation advice. The reliance on cloud computing infrastructure is non-negotiable for handling the petabytes of claims data required by ML models, ensuring scalability, security, and accessibility across global operations, thereby underpinning the entire technological advancement across the General Liability Insurance value chain.

Regional Highlights

- North America: This region maintains its position as the largest market for General Liability Insurance globally, primarily driven by the highly developed commercial infrastructure of the United States and Canada, coupled with an exceptionally litigious legal environment. Social inflation—the tendency for jury awards and settlements to increase beyond normal economic inflation—significantly impacts underwriting profitability and drives the continuous need for higher policy limits. The market is characterized by high penetration, sophisticated product offerings, and a robust regulatory framework. Technological adoption, particularly in claims adjudication and data-driven underwriting, is advanced, often setting global standards for efficiency. The primary focus for carriers here remains managing volatility associated with class action lawsuits and complex environmental and professional liabilities, which often necessitate substantial reserve requirements. The high density of large corporations and complex supply chains further solidifies the region's premium value.

- Europe: The European GLI market is defined by regulatory fragmentation, though the overarching influence of EU directives necessitates adherence to high standards of consumer and corporate liability. Western European nations, such as Germany, the UK, and France, exhibit mature markets with high insurance penetration rates, characterized by specialized product lines catering to industrial and public liability. Eastern Europe is experiencing faster growth rates, though from a smaller base, driven by foreign direct investment and industrialization. The focus in Europe is heavily skewed towards compliance with environmental standards, employment practices liability, and product safety regulations, which are frequently enforced through national laws. The varying legal systems—common law vs. civil law—impact claims settlement processes and the severity of jury awards, requiring carriers to maintain hyper-localized legal expertise.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by rapid urbanization, massive infrastructure projects (especially in China, India, and Southeast Asia), and the burgeoning middle class driving SME formation. While GLI penetration remains relatively lower compared to North America or Europe, the pace of adoption is accelerating as contractual requirements and legal awareness increase. The growth opportunity lies largely in standardizing policies and making them accessible to the vast number of emerging businesses. Challenges include navigating diverse regulatory landscapes, overcoming cultural barriers to insurance adoption, and managing exposures related to rapid industrial growth and complex cross-border logistics. Digital distribution channels are highly favored in this region due to the high mobile and internet penetration rates, facilitating lower-cost policy acquisition.

- Latin America (LATAM): The LATAM market, while generally smaller, holds significant long-term growth potential. Economic volatility, high inflation, and political instability historically challenged insurance carrier investment, yet modernization and regulatory stability in key economies like Brazil and Mexico are improving market conditions. Demand is primarily driven by multinational companies operating in the region and by the necessity for coverage in the energy, mining, and construction sectors. Low insurance awareness among domestic small businesses remains a key constraint, requiring carriers to invest heavily in consumer education and simplification of policy terms.

- Middle East and Africa (MEA): This region presents a diverse set of opportunities and challenges. In the Middle East, large-scale infrastructure and real estate development projects create high demand for project-specific liability coverage, often mandated by government bodies. African markets, particularly South Africa and Nigeria, are seeing increasing formalization of businesses and foreign investment, leading to incremental GLI growth. Challenges include regulatory maturity, currency risk, and the establishment of reliable claims data infrastructure. The market development is intrinsically linked to government initiatives aimed at modernizing commercial codes and enforcing higher safety standards across industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the General Liability Insurance Market.- Berkshire Hathaway Inc.

- Chubb Limited

- Allianz SE

- AXA SA

- Zurich Insurance Group

- Travelers Companies

- The Hartford Financial Services Group

- American International Group (AIG)

- Liberty Mutual Insurance

- Munich Re

- Swiss Re

- Tokio Marine Holdings

- Mapfre S.A.

- Generali Group

- CNA Financial Corporation

- QBE Insurance Group

- R+V Versicherung AG

- Sompo Holdings

- Arch Capital Group

- W.R. Berkley Corporation

- Sentry Insurance

- FM Global

- Great American Insurance Group

Frequently Asked Questions

Analyze common user questions about the General Liability Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between CGL and Umbrella Liability Insurance?

Commercial General Liability (CGL) provides foundational protection against specific covered claims (bodily injury, property damage). Umbrella Liability provides extra coverage that goes above the limits of the underlying CGL policy and often extends coverage to claims excluded by the primary policy, acting as a critical buffer against catastrophic losses.

How is "social inflation" impacting the cost and availability of General Liability Insurance?

Social inflation refers to the rising cost of claims due to factors like larger jury awards, increased litigation funding, and shifting public sentiment toward corporations. This trend significantly elevates the carrier's expected loss costs, leading to higher premiums, reduced limits, and stricter underwriting standards across the GLI market.

Which industry vertical is currently driving the highest growth demand in the General Liability market?

While the construction and manufacturing sectors remain dominant in volume, the Professional Services and Technology verticals are experiencing the highest growth acceleration. This is due to increasing liability exposures related to personal and advertising injury, professional negligence (often bundled), and complex intellectual property disputes arising from digital operations.

What role does Artificial Intelligence play in General Liability underwriting?

AI is used to enhance underwriting accuracy by analyzing massive, unstructured data sets (e.g., legal precedents, operational data, inspection reports) to precisely quantify risk. This allows insurers to move away from generalized pricing to highly granular, predictive risk scoring, optimizing capital deployment and policy pricing.

Are small businesses required to purchase General Liability Insurance?

While often not legally mandated by the government for all businesses, GLI is practically required. Landlords, clients, and partners frequently mandate it via contractual obligations. Furthermore, given the significant risk of premises or operational mishaps, it is considered a fundamental necessity for protecting small business assets from devastating lawsuits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager