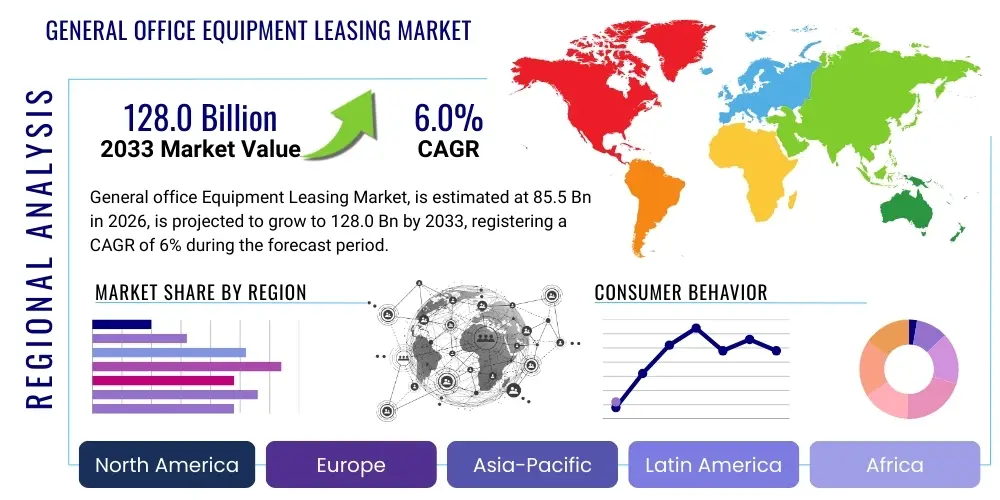

General office Equipment Leasing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443428 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

General office Equipment Leasing Market Size

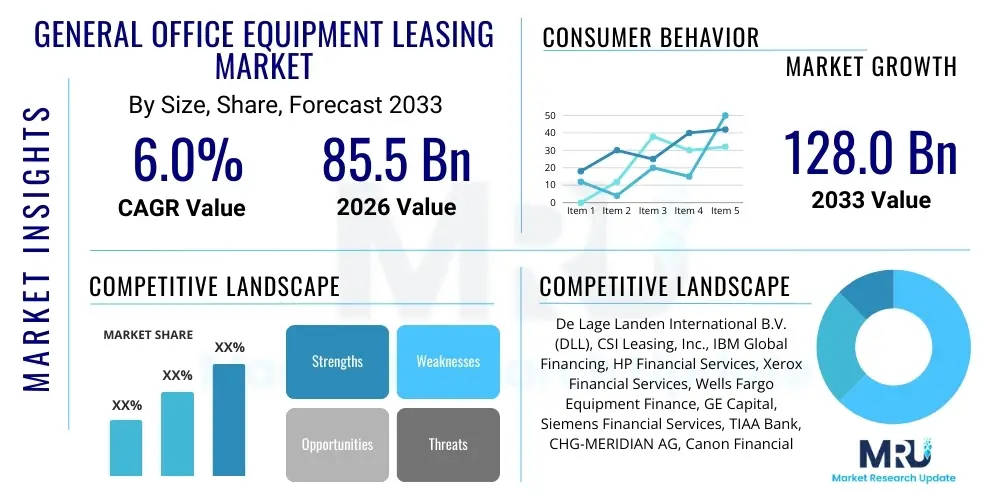

The General office Equipment Leasing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% between 2026 and 2033. The market is estimated at $85.5 Billion USD in 2026 and is projected to reach $128.0 Billion USD by the end of the forecast period in 2033.

General office Equipment Leasing Market introduction

The General Office Equipment Leasing Market encompasses the provision of various essential workplace tools and technology—ranging from printers, copiers, and scanners to sophisticated communication systems, furniture, and IT infrastructure—on a rental or lease basis rather than outright purchase. This model is increasingly favored by businesses of all sizes, particularly Small and Medium Enterprises (SMEs), due to the imperative to manage capital expenditures (CapEx) effectively while maintaining access to the latest, high-performance equipment. The market thrives on the fundamental shift in business budgeting philosophy, moving operational costs (OpEx) to the forefront, allowing companies greater financial flexibility and scalability in their technology adoption cycles. The core product offering includes operating leases, which cover short to medium-term usage without transferring ownership risk, and finance leases, which function closer to asset purchase arrangements.

Major applications of leased office equipment span across virtually every industry vertical, including financial services, healthcare, education, government, and professional services, where reliable document management, secure data handling, and efficient communication are paramount. Specific applications include high-volume printing and copying in corporate environments, specialized scanning solutions for legal and medical records, and integrated unified communications equipment essential for hybrid work models. The utility of leasing extends beyond merely acquiring the physical asset; it often bundles comprehensive maintenance, supplies replenishment, and technological refresh cycles, transforming a simple asset acquisition into an integrated service contract.

The primary benefits driving market expansion include enhanced financial liquidity, reduced risk of technological obsolescence, and simplified asset management. By leasing, organizations can conserve working capital that would otherwise be tied up in depreciating assets, enabling strategic investment in core business areas. Furthermore, the leasing model naturally incorporates equipment upgrades, allowing businesses to stay current with advancements in energy efficiency, security features, and speed without incurring significant unplanned replacement costs. This predictability of expenditure, coupled with the ability to scale up or down rapidly based on business demands, solidifies the value proposition of office equipment leasing in the modern dynamic business landscape, fueling consistent demand growth globally.

General office Equipment Leasing Market Executive Summary

The General Office Equipment Leasing Market is undergoing rapid transformation, characterized by strong business trends focusing on "Everything-as-a-Service" (XaaS) models and sustainable leasing practices. Businesses are prioritizing flexible, short-term lease agreements that allow for dynamic scaling of equipment fleets in response to fluctuating economic conditions and the widespread adoption of hybrid work environments. Key industry players are pivoting from transactional leasing to integrated solutions providers, bundling hardware, software, security, and consumables into single, predictable monthly payments. This strategic shift is driven by the need to capture higher value through managed services contracts, ensuring long-term customer retention and maximizing asset utilization through efficient end-of-life refurbishment and remarketing programs. Furthermore, regulatory changes promoting greater sustainability and circular economy principles are influencing leasing terms, favoring equipment with proven longevity and high recycling potential.

Regionally, North America and Europe remain the dominant markets, primarily due to the maturity of their corporate infrastructure and high penetration rates of sophisticated financial service offerings. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth CAGR, spurred by rapid industrialization, burgeoning SME sectors, and increasing foreign direct investment (FDI) leading to substantial growth in office space and subsequent demand for professional equipment. Emerging economies in Latin America and the Middle East & Africa (MEA) are also showing promising acceleration, driven by digital transformation initiatives and government efforts to modernize public sector services. The adoption rates in these developing regions are strongly linked to favorable credit environments and the availability of standardized leasing frameworks tailored to localized regulatory landscapes and fluctuating currency risks.

Segmentation trends highlight the increasing dominance of technology-focused leases, specifically multifunction printers (MFPs) and IT peripheral equipment, over traditional standalone products. By Lease Type, operating leases continue to hold the largest share, preferred for their off-balance-sheet treatment and flexibility, especially for high-turnover assets. The End-User segment analysis reveals significant growth in the BFSI (Banking, Financial Services, and Insurance) sector, driven by stringent regulatory compliance requiring secure, traceable document workflows, and the robust expansion of the SME segment seeking cost-effective scaling solutions. The leasing market is adapting by offering highly customized, usage-based contracts, often facilitated by advanced IoT sensors embedded within the equipment to track actual utilization and optimize service delivery, thereby maximizing both lessor profitability and lessee satisfaction.

AI Impact Analysis on General office Equipment Leasing Market

User queries regarding AI's influence on the General Office Equipment Leasing Market predominantly revolve around three key themes: predictive maintenance and asset optimization, the integration of AI-powered features into leased equipment, and the risk assessment capabilities for lease underwriting. Users frequently question how AI algorithms can reduce equipment downtime, specifically asking about the feasibility of ‘zero-downtime’ contracts achievable through machine learning-driven failure prediction. Another significant area of interest is how AI embedded in modern office devices (like smart MFPs capable of automated document classification or voice-activated controls) affects the perceived value and necessary service complexity of the leased asset. Finally, lessees and lessors alike inquire about AI's role in refining credit scoring and risk models, allowing for more dynamic, personalized lease terms based on real-time operational data rather than historical financial metrics, thereby influencing the overall cost of capital and accessibility of financing for smaller businesses.

- AI optimizes predictive maintenance schedules, reducing equipment downtime by forecasting component failures.

- Integration of AI into MFPs (e.g., automated workflow, security scanning) increases the value and complexity of leased assets.

- AI-driven usage monitoring facilitates dynamic, consumption-based lease pricing models (Pay-per-use).

- Machine learning enhances credit scoring and risk assessment for lease underwriting, enabling faster approvals.

- Automated inventory management of consumables (toner, paper) through AI reduces operational burden for lessees.

- Intelligent chatbots and virtual assistants streamline customer service and technical support for leased equipment.

- AI-powered asset tracking improves recovery rates and refurbishment efficiency at the end of the lease term.

DRO & Impact Forces Of General office Equipment Leasing Market

The General Office Equipment Leasing Market is primarily driven by the escalating pressure on businesses to conserve capital expenditure and enhance operational agility. The fundamental driver is the shift from CapEx to OpEx models, which allows companies, especially those undergoing rapid expansion or facing cyclical revenue patterns, to access high-quality equipment immediately without significant upfront investment. Furthermore, the relentless pace of technological evolution in office equipment—faster processors, advanced security features, and improved energy efficiency—renders purchased assets obsolete quickly, making leasing an economically superior choice as the lessor bears the depreciation risk and manages the technology refresh cycle. Government initiatives promoting digitalization and the growth of the global SME segment further amplify the demand for flexible leasing options that cater to limited budgets and scaling needs.

Conversely, the market faces notable restraints, chiefly including the increasing prevalence of cloud-based solutions and digitization, which reduces the dependency on physical documentation and hardware like high-volume printers and dedicated scanners. Security and data privacy concerns associated with leased devices, particularly around end-of-lease data wiping and asset recovery, can deter highly regulated industries from adopting certain leasing models. Additionally, the fragmented regulatory landscape regarding lease accounting standards (such as ASC 842 and IFRS 16) introduces complexity, requiring lessors and large lessees to invest significantly in sophisticated accounting software and expertise to ensure compliance, potentially dampening the uptake of complex finance leases.

Significant opportunities for market expansion reside in the integration of managed services and the emphasis on sustainability. Lessors can capitalize on the growing demand for comprehensive managed print services (MPS) and managed IT services (MITS), moving beyond equipment rental to become integral partners in a client's workflow optimization. The circular economy trend provides a massive opportunity; leasing inherently supports sustainability by extending asset lifecycles through professional refurbishment and remarketing, appealing directly to businesses committed to Environmental, Social, and Governance (ESG) criteria. The impact forces—ranging from economic fluctuations influencing capital availability to technological disruption altering equipment necessity—exert intense pressure, forcing leasing companies to innovate constantly, focusing on flexibility, digital integration, and transparent pricing structures to maintain competitive edge and market relevance in a rapidly evolving business ecosystem.

Segmentation Analysis

The General Office Equipment Leasing Market is comprehensively segmented based on Lease Type, Equipment Type, and End-User, reflecting the diverse needs and financial capabilities across the commercial spectrum. The segmentation allows lessors to tailor financing products and service bundles effectively, addressing specific client requirements, such as the need for off-balance-sheet financing or high-volume, continuous asset replacement. The structure of the market is heavily influenced by the adoption rates of digital technologies, with high-value, integrated technology assets commanding premium leasing rates and driving complex service contracts, while basic peripherals remain highly commoditized and price-sensitive. Understanding these nuanced segments is critical for developing targeted marketing strategies and optimizing fleet management based on asset lifecycle expectations and utilization profiles.

- By Lease Type:

- Operating Lease

- Finance Lease (Capital Lease)

- Sales-Type Lease

- Usage-Based/Flexible Lease

- By Equipment Type:

- Printers and Multifunction Devices (MFDs/MFPs)

- Computers and Peripherals (Laptops, Desktops, Monitors)

- Communication Equipment (PBX Systems, VoIP Devices)

- Office Furniture and Fixtures

- Security and Surveillance Equipment (Access control, Cameras)

- Projectors and Display Systems

- By End-User:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Government and Public Sector

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Education

- By Region:

- North America (U.S., Canada)

- Europe (U.K., Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East & Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For General office Equipment Leasing Market

The value chain for the General Office Equipment Leasing Market begins with the Upstream Analysis, which focuses on the manufacturers and suppliers of the office equipment itself. Key upstream stakeholders include major OEMs (Original Equipment Manufacturers) like Canon, Xerox, HP, and Dell, who design, produce, and sell the assets (printers, PCs, servers) to the leasing companies or directly to large corporate clients through vendor financing programs. The quality, reliability, and technological features of this equipment directly impact the lease residual values and the maintenance costs borne by the lessor. Effective relationships with these manufacturers, often involving strategic bulk purchasing agreements and certified refurbishment partnerships, are crucial for securing favorable pricing and ensuring a steady supply of high-demand, late-model assets necessary for lease portfolio management.

The Midstream component involves the core operations of the leasing companies, which encompass asset acquisition, structuring the financing products (lease type, terms, residual calculations), risk assessment, legal documentation, and ongoing asset management. Distribution Channels play a critical role here. Direct distribution involves the lessor engaging directly with the end-user, often utilized by large, captive leasing arms of OEMs (e.g., HP Financial Services). Indirect distribution involves working through brokers, independent financial intermediaries, and dealer networks (Value-Added Resellers or VARs) who sell the equipment and then bundle a third-party lease agreement with the sale. The indirect channel significantly expands market reach, particularly into the SME segment, but requires robust commission structures and training to ensure standardized contract execution and accurate representation of lease terms.

Downstream analysis centers on the asset usage, service, and end-of-life management. This phase includes the delivery, installation, maintenance (often through managed services contracts), technical support, and eventual de-installation and recovery of the asset. The profitability of a lease is heavily dependent on the efficiency of the asset remarketing process, where recovered equipment is refurbished, certified, and either sold or leased again (secondary market). Lessors increasingly focus on sophisticated logistics and secure data destruction protocols during de-installation to mitigate client data risk, thus completing the circular loop of the leasing model and providing maximum residual value retention, which ultimately allows for more competitive rates offered to the initial lessee.

General office Equipment Leasing Market Potential Customers

Potential customers for the General Office Equipment Leasing Market span virtually all sectors requiring consistent access to high-quality, up-to-date office infrastructure without the burden of large capital outlay. The largest and most attractive segment consists of Small and Medium Enterprises (SMEs) that lack substantial capital reserves but require professional-grade equipment to compete effectively. For SMEs, leasing provides immediate scalability, enabling them to match their equipment fleet precisely to current headcount or project needs, a feature crucial during periods of rapid growth or necessary contraction. They typically prioritize operating leases coupled with comprehensive service agreements to minimize internal IT support requirements and maximize cost predictability.

Large Enterprises, while possessing greater capital, are also significant end-users, primarily driven by strategic financial management and risk mitigation. For these multinational corporations, leasing provides standardized equipment deployment across multiple geographies, simplifying procurement, fleet management, and adherence to varying local tax and accounting regulations. They often utilize highly structured finance leases for long-term assets or master leases that allow for flexible additions and removals of equipment under a single overarching contract. Furthermore, regulated sectors such as BFSI (Banking, Financial Services, and Insurance) and Healthcare are key buyers, demanding leased equipment that meets stringent compliance requirements regarding data security, audit trails, and physical security features, necessitating specialized service level agreements (SLAs).

Additionally, the Government and Public Sector entities represent a stable, substantial customer base. These organizations are often bound by strict annual budgeting cycles and statutory procurement limitations, making leasing an ideal vehicle for acquiring necessary technology upgrades without exceeding annual appropriations. Educational institutions, from universities to school districts, also heavily rely on leasing to rapidly refresh technology labs and administrative infrastructure, balancing budgetary constraints with the need to provide students and staff with access to current technology. These customer segments collectively define the demand profile, characterized by a preference for bundled services, predictable OpEx, and built-in technological obsolescence protection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $85.5 Billion USD |

| Market Forecast in 2033 | $128.0 Billion USD |

| Growth Rate | CAGR 6.0% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | De Lage Landen International B.V. (DLL), CSI Leasing, Inc., IBM Global Financing, HP Financial Services, Xerox Financial Services, Wells Fargo Equipment Finance, GE Capital, Siemens Financial Services, TIAA Bank, CHG-MERIDIAN AG, Canon Financial Services, Ricoh Global Services, SHI International Corp., CIT Group, BNP Paribas Leasing Solutions, Insight Enterprises, Marlin Capital Solutions, Lenovo Financial Services, Sumitomo Mitsui Finance and Leasing Company, Ltd., Société Générale Equipment Finance. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

General office Equipment Leasing Market Key Technology Landscape

The technological landscape of the General Office Equipment Leasing Market is rapidly evolving, driven primarily by the integration of Internet of Things (IoT) sensors and advanced analytics into leased assets. IoT technology is foundational, allowing lessors to remotely monitor the operational status, utilization rates, and performance parameters of equipment such as MFPs and network switches in real-time. This capability enables true usage-based billing models, moving away from fixed rates to charging based on actual prints, scans, or uptime, which is highly appealing to lessees seeking maximum cost efficiency. Furthermore, predictive analytics, powered by the data collected via IoT, facilitates proactive maintenance alerts, enabling technicians to intervene before a failure occurs, dramatically improving Service Level Agreement (SLA) adherence and maximizing equipment lifespan within the lease contract period.

The second critical area involves the rise of sophisticated security and asset management software specifically designed for the leasing ecosystem. With increasing cybersecurity threats, leased equipment must incorporate advanced features like encrypted hard drives, remote data wiping capabilities (essential at the end of the lease), and network intrusion detection features. Lessors are increasingly offering Device-as-a-Service (DaaS) models, where the software layer—including operating system licenses, security patches, and application suites—is bundled with the hardware lease. This shifts the complexity of maintaining regulatory compliance and software licensing entirely to the lessor, presenting a higher-value, stickier service offering compared to simple hardware rental.

Finally, the operational efficiency of the lessors themselves is being transformed by digital platforms leveraging robotic process automation (RPA) and blockchain technologies. RPA is used to automate repetitive, high-volume tasks in lease administration, such as contract generation, invoice processing, and credit application review, significantly speeding up the time-to-delivery for new contracts. While still nascent, blockchain is being explored for creating immutable, transparent records of asset ownership, maintenance history, and residual value calculations, which could revolutionize asset tracking and reduce fraud in the secondary equipment market. These internal technological advancements allow leasing companies to manage larger portfolios with lower overheads, translating into more competitive pricing and faster customer service response times in a highly contested market environment.

Regional Highlights

- North America: This market is characterized by high maturity, sophisticated financial services, and early adoption of DaaS (Device-as-a-Service) models. Demand is robust, driven by large corporate clients focused on maximizing off-balance-sheet financing and managing complex, multi-site deployments. The U.S. remains the largest regional market, with strong activity in technology and managed services leasing, underpinned by favorable tax depreciation rules and an advanced IT infrastructure.

- Europe: Europe exhibits strong growth, heavily influenced by sustainability mandates and the push toward circular economy practices. Germany and the UK lead in advanced leasing agreements, prioritizing integrated solutions (Managed Print Services and IT services) that align with rigorous European data protection regulations (GDPR). The market is complex due to varied national legal frameworks concerning asset classification and tax implications (post-IFRS 16 implementation).

- Asia Pacific (APAC): Expected to be the fastest-growing region, driven by rapid urbanization, massive infrastructure development, and the explosive growth of the SME segment, particularly in India and Southeast Asia. The increasing need for formal document management in developing bureaucratic and commercial environments fuels demand for MFPs and communication equipment leasing. Price sensitivity is higher, leading to strong growth in used and refurbished equipment leasing segments.

- Latin America: Growth is steady but challenged by economic volatility and currency fluctuations. Leasing provides a crucial defense mechanism against high inflation by stabilizing equipment costs over time. Major markets like Brazil and Mexico show strong potential, focusing on government and educational sector contracts. Lessors focus on highly secure and reliable asset tracking technologies due to higher operational risks.

- Middle East and Africa (MEA): This region is seeing significant government investment in digitalization and infrastructure, particularly in the GCC countries (Saudi Arabia, UAE). Leasing supports these mega-projects by providing flexible, temporary, or scale-up solutions for large corporate and public sector offices. The African sub-region relies on leasing to bridge the gap created by high upfront capital costs associated with new technology imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the General office Equipment Leasing Market.- De Lage Landen International B.V. (DLL)

- CSI Leasing, Inc.

- IBM Global Financing

- HP Financial Services

- Xerox Financial Services

- Wells Fargo Equipment Finance

- GE Capital

- Siemens Financial Services

- TIAA Bank

- CHG-MERIDIAN AG

- Canon Financial Services

- Ricoh Global Services

- SHI International Corp.

- CIT Group

- BNP Paribas Leasing Solutions

- Insight Enterprises

- Marlin Capital Solutions

- Lenovo Financial Services

- Sumitomo Mitsui Finance and Leasing Company, Ltd.

- Société Générale Equipment Finance

Frequently Asked Questions

Analyze common user questions about the General office Equipment Leasing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between an operating lease and a finance lease?

The primary difference lies in risk and ownership transfer. An operating lease is generally short-term, does not transfer ownership, and is typically treated as an operational expense (OpEx) off-balance-sheet. A finance lease (or capital lease) is longer-term, often covers the asset's useful life, and must be recorded on the lessee's balance sheet as an asset and a liability under modern accounting standards (like IFRS 16 and ASC 842), functionally acting as a financed purchase.

How does equipment leasing mitigate the risk of technological obsolescence for businesses?

Leasing agreements inherently mitigate technological obsolescence because the lessor retains the burden of the equipment's residual value risk. Contracts are structured with shorter terms (typically 3-5 years) that align with technology refresh cycles, allowing the lessee to seamlessly upgrade to the latest equipment model upon the expiration of the original lease without incurring the cost of disposing of outdated assets.

Is Managed Print Services (MPS) considered part of the General Office Equipment Leasing Market?

Yes, Managed Print Services (MPS) is a critical growth driver and component of the modern leasing market. MPS extends beyond simple hardware leasing to include the hardware, predictive maintenance, supplies replenishment (toner, paper), and software solutions, bundled into a single, comprehensive monthly service contract, effectively integrating leasing with IT management.

How are environmental, social, and governance (ESG) factors influencing office equipment leasing trends?

ESG factors strongly influence leasing by promoting the circular economy. Lessees increasingly prefer providers who offer 'green leases' guaranteeing that retired equipment will be responsibly refurbished, recycled, or remarketed. Leasing supports sustainability by maximizing asset utilization and reducing electronic waste compared to frequent outright purchases.

What impact does the growth of the hybrid work model have on the demand for leased office equipment?

The hybrid work model increases the complexity and geographic distribution of equipment needs. While central office printing volumes may decrease, there is a surge in demand for smaller, secured, networked MFPs, high-end communication peripherals (VoIP phones, collaboration screens), and personal computing devices leased for home office setups, necessitating flexible and decentralized leasing logistics and support.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager