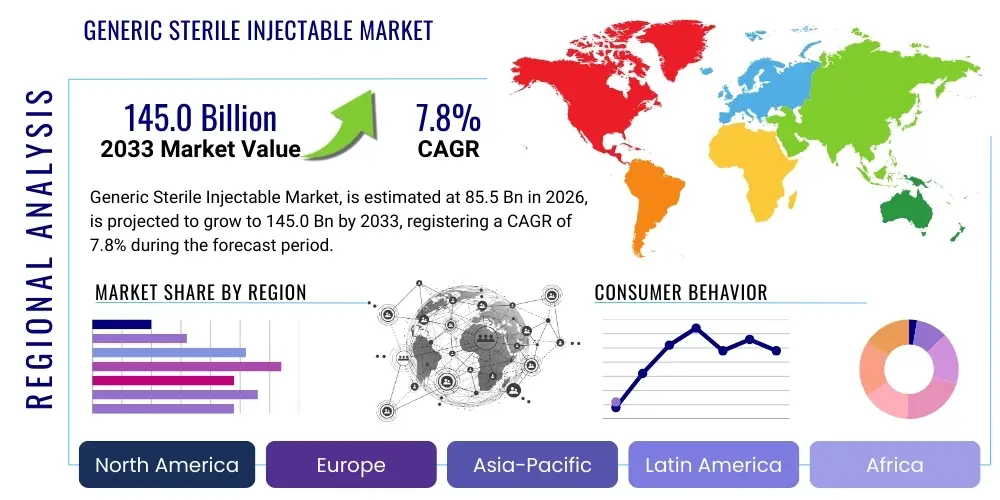

Generic Sterile Injectable Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441927 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Generic Sterile Injectable Market Size

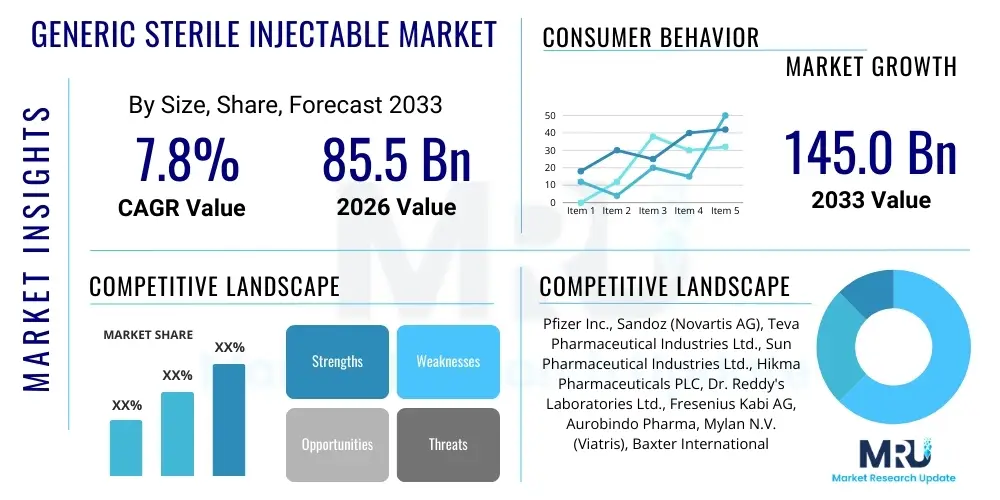

The Generic Sterile Injectable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 85.5 Billion in 2026 and is projected to reach USD 145.0 Billion by the end of the forecast period in 2033.

Generic Sterile Injectable Market introduction

The Generic Sterile Injectable Market encompasses a critical segment of the pharmaceutical industry, focusing on the production and distribution of high-quality, cost-effective injectable medications that are therapeutically equivalent to their branded counterparts but are off-patent. These products, which include solutions, suspensions, and emulsions administered intravenously, intramuscularly, or subcutaneously, are fundamentally important for treating acute and chronic conditions, particularly in hospital settings, emergency medicine, and specialized therapies like oncology and infectious diseases. The rigorous sterilization process ensures patient safety and efficacy, making them indispensable components of global healthcare infrastructure. Generic sterile injectables represent a cornerstone of accessible medicine, addressing rising healthcare expenditure globally by offering affordable alternatives.

Product descriptions within this sector range widely, covering complex molecules such as biosimilars and highly potent drugs, alongside more conventional small-molecule injectables. Major applications span cancer treatment (chemotherapy agents), pain management, antibiotics for critical care, and anticoagulants. The increasing prevalence of chronic diseases, coupled with the imminent patent expiration of several blockbuster branded injectables, creates vast opportunities for generic manufacturers. These products must meet stringent regulatory standards across major markets like the FDA in the US and the EMA in Europe, requiring significant investment in manufacturing quality and compliance.

The primary benefit of generic sterile injectables lies in their ability to dramatically reduce treatment costs, facilitating broader patient access, especially in developing economies. Driving factors include governmental policies promoting generic substitution, the necessity for cost containment within strained healthcare systems, and advancements in sterile manufacturing technologies, such as advanced aseptic processing and isolator technology, which enhance production efficiency and quality assurance. Furthermore, global supply chain resilience has become a major focus, pushing manufacturers to regionalize production and diversify sourcing to prevent critical drug shortages, which frequently affect the sterile injectables segment.

Generic Sterile Injectable Market Executive Summary

The Generic Sterile Injectable Market is characterized by intense price competition, significant regulatory hurdles, and a high volume of demand driven by aging populations and increasing disease burden. Current business trends indicate a strategic shift among major generic players towards specialized, complex injectables, including liposomal formulations and nanosuspensions, which offer higher margins and face fewer competitors than simple, large-volume parenterals (LVPs). Vertical integration, particularly securing captive API (Active Pharmaceutical Ingredient) supply, is a dominant theme, aimed at mitigating supply chain risks and ensuring cost leadership. Furthermore, there is a distinct trend towards forging strategic alliances and partnerships between generic drug developers and Contract Development and Manufacturing Organizations (CDMOs) to accelerate time-to-market for complex generic products requiring specialized aseptic filling capabilities.

Regionally, North America remains the largest revenue generator, primarily due to established healthcare infrastructure, high generic penetration rates, and frequent drug shortages which incentivize new entrants. However, the Asia Pacific (APAC) region, spearheaded by India and China, is projected to exhibit the fastest growth, fueled by expanding domestic healthcare access, favorable government policies encouraging local manufacturing, and their established role as global suppliers of APIs and finished formulations. European markets show stable growth, driven by tender-based purchasing mechanisms and national healthcare systems prioritizing cost savings through mandatory generic substitution. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, though regulatory harmonization and infrastructure development remain key challenges.

Segment trends highlight the dominance of the oncology therapeutic area due to the high costs and complexity of cancer treatments and numerous upcoming patent expirations in this class. Formulation-wise, pre-filled syringes (PFS) are gaining substantial traction over traditional vials, owing to their enhanced safety profile, reduced medication error rates, and convenience for both healthcare providers and patients in outpatient settings. The route of administration segmentation shows sustained growth in intravenous applications, critical for hospital care, but subcutaneous and intramuscular routes are increasingly utilized in patient-friendly, self-administration models, aligning with the shift towards home healthcare and ambulatory care services. Overall, the market trajectory is one of maturation coupled with complexity, where success depends on regulatory finesse, manufacturing excellence, and strategic portfolio diversification.

AI Impact Analysis on Generic Sterile Injectable Market

User queries regarding the impact of Artificial Intelligence (AI) on the Generic Sterile Injectable Market predominantly center on how AI can enhance manufacturing efficiency, streamline regulatory compliance, and mitigate recurring issues like quality control failures and drug shortages. Specific concerns often relate to the adoption curve of advanced AI-driven quality systems (e.g., predictive maintenance and real-time release testing) within highly regulated sterile environments, the associated capital investment required, and the ability of existing workforce to adapt to these technologies. Users are keenly interested in AI’s role in accelerating the R&D process for complex generics, such as analyzing complex formulation data and predicting stability, thereby reducing the lengthy and expensive bioequivalence testing phase. Key themes emerging from this analysis include expectations for AI to deliver predictive quality assurance, optimize supply chain logistics for high-demand injectables, and rapidly detect deviations in critical manufacturing parameters, thereby securing product integrity and regulatory adherence.

- AI optimizes drug formulation development by simulating molecular interactions and predicting stability profiles, significantly reducing pre-clinical experimentation time for generic injectables.

- Predictive maintenance algorithms deployed in aseptic filling lines minimize unexpected equipment failure, increasing operational uptime and reducing the risk of catastrophic batch contamination.

- AI-driven image analysis systems enhance Quality Control (QC) by automatically inspecting sterile vials for particulates or container defects with higher accuracy and speed than manual or traditional automated methods.

- Supply chain risk management utilizes AI to forecast demand fluctuations and identify potential bottlenecks (e.g., API shortages, transport delays), thereby proactively preventing critical drug shortages.

- Regulatory submission processes are streamlined using AI tools for automated document generation, compliance checking, and rapid analysis of vast datasets required for abbreviated new drug applications (ANDAs).

- AI assists in real-time process monitoring (RTPM) during aseptic filling, ensuring critical process parameters remain within validated limits, aligning with advanced regulatory frameworks like Quality by Design (QbD).

DRO & Impact Forces Of Generic Sterile Injectable Market

The Generic Sterile Injectable Market dynamics are fundamentally shaped by a confluence of powerful drivers, structural restraints, and evolving strategic opportunities, all moderated by intense impact forces related to regulatory oversight and market access. The primary driver is the accelerating wave of patent expirations for originator large-molecule and complex small-molecule injectables, opening lucrative avenues for generic entry. This is amplified by immense pressure from healthcare payers and governments globally to control expenditure, directly translating into robust demand for cheaper generic alternatives. However, the inherent complexity and capital-intensive nature of sterile manufacturing, particularly maintaining Grade A/B environments, act as significant restraints. Further constraints include stringent regulatory scrutiny regarding facility compliance and the persistent challenges of managing drug shortages, often stemming from quality lapses or single points of failure in the supply chain.

Opportunities for growth are manifold, revolving around the increasing demand for advanced delivery systems such as long-acting injectables (LAIs) and ready-to-use formulations (pre-filled syringes and auto-injectors) which enhance patient convenience and compliance. Geographical expansion into fast-growing emerging markets represents a secondary opportunity, provided companies can navigate diverse and often fragmented regulatory landscapes. Moreover, adopting advanced manufacturing technologies, including continuous manufacturing and robotics in aseptic filling, offers firms a competitive edge by lowering operational costs and bolstering quality metrics, directly appealing to regulatory bodies and procurement agencies.

The impact forces within this market are predominantly external and regulatory driven. Price erosion due to intense competition and tender processes constitutes a powerful downward force on revenue, compelling manufacturers to achieve extreme efficiencies. Conversely, the high barrier to entry—mandated by stringent Current Good Manufacturing Practice (cGMP) requirements—acts as a protective force for established players, limiting the influx of less capable competitors. Geopolitical instability and trade restrictions also exert significant impact, especially concerning the global API supply chain, necessitating diversified sourcing strategies. Ultimately, market success is determined by a company's ability to consistently meet exacting quality standards while achieving maximum scale and cost efficiency.

Segmentation Analysis

The Generic Sterile Injectable Market is comprehensively segmented based on various technical and commercial parameters, providing a detailed understanding of the market structure and growth pockets. Key segmentation axes include the type of formulation (e.g., small molecule generics vs. biosimilars), product type (vials, ampoules, pre-filled syringes), therapeutic application (oncology, infectious diseases, cardiovascular), and route of administration (intravenous, intramuscular, subcutaneous). This granular analysis helps manufacturers prioritize investment, focusing on high-growth segments such as complex oncology injectables and user-friendly delivery systems, which command premium pricing compared to commodity injectables. The market structure reflects a transition towards higher complexity and patient-centric designs, driven by advancements in drug delivery technology and a persistent focus on minimizing medication errors in clinical settings.

- By Product Type:

- Vials

- Ampoules

- Pre-filled Syringes (PFS)

- Bags/Bottles (Large Volume Parenterals)

- Cartridges

- By Application:

- Oncology

- Anti-infectives (Antibiotics, Antivirals)

- Cardiovascular Diseases (CVD)

- Central Nervous System (CNS) Disorders

- Pain Management/Anesthesia

- Others (e.g., Hormones, Vaccines)

- By Molecule Type:

- Small Molecule Generics

- Biosimilars (Biologic Generics)

- By Route of Administration:

- Intravenous (IV)

- Intramuscular (IM)

- Subcutaneous (SC)

Value Chain Analysis For Generic Sterile Injectable Market

The value chain for the Generic Sterile Injectable Market is complex, beginning with the highly regulated upstream process of Active Pharmaceutical Ingredient (API) synthesis and sourcing. Upstream activities involve sourcing raw materials, manufacturing APIs, and, increasingly, developing formulation excipients specific to injectable stability requirements. Quality control and rigorous analytical testing at the API stage are paramount, as substandard ingredients can lead to significant regulatory issues downstream. Vertical integration among major generic players, securing captive API production, is a core strategic move aimed at ensuring supply reliability, managing cost volatility, and maintaining control over initial product quality and regulatory documentation (Drug Master Files).

Midstream processing focuses on formulation, sterile filtration, and the critical step of aseptic filling, capping, and inspection, often performed by highly specialized CDMOs or large generic pharmaceutical firms. The manufacturing stage is capital-intensive and subject to the highest levels of cGMP scrutiny. Downstream activities involve specialized secondary packaging, labeling, and robust supply chain management to handle temperature-sensitive products (cold chain logistics). The distribution channel is crucial, typically involving a mix of direct sales to large hospital systems and indirect distribution through wholesalers, group purchasing organizations (GPOs), and specialized pharmacy distributors, particularly in markets like the US and Europe. Direct sales ensure higher margin control, while indirect channels provide wider market reach.

The critical difference between direct and indirect distribution channels in this market often revolves around specialized purchasing bodies. Hospital GPOs frequently tender for large volumes of essential injectables, favoring suppliers who can guarantee both competitive pricing and consistent, uninterrupted supply. Indirect distribution, leveraging major pharmaceutical wholesalers, necessitates strict adherence to cold chain protocols and serialization requirements to maintain product integrity and traceability throughout the complex logistics network. Effective navigation of this distribution landscape is vital, as any disruption can lead to severe drug shortages and reputational damage. The integration of advanced tracking technologies, such as blockchain, is becoming increasingly relevant to enhance transparency across the value chain, from API source to final administration.

Generic Sterile Injectable Market Potential Customers

The primary customers and end-users of generic sterile injectables are large-scale institutional buyers who are tasked with maximizing patient care outcomes while managing strict budgetary constraints. Hospitals and clinics represent the largest segment of end-users, relying on these essential medications for emergency care, surgical procedures, intensive care units, and standard patient treatment protocols. The increasing complexity of treatments, particularly in chronic disease management, drives continuous demand from these institutional buyers. Procurement decisions are heavily influenced by the product's cost-effectiveness, the reliability of the supply chain, and proven cGMP compliance of the manufacturer.

A second major customer category includes government agencies and public healthcare organizations, especially those managing national drug reserves or running widespread immunization programs. These entities typically procure through large-scale, competitive tenders, making volume and sustained availability key factors. Furthermore, specialized end-users like ambulatory surgical centers (ASCs), long-term care facilities, and home healthcare providers are increasingly becoming important customers, especially as the healthcare delivery model shifts away from traditional inpatient settings. These customers prioritize ready-to-use formats like pre-filled syringes, which minimize preparation time and reduce the risk of compounding errors.

Finally, pharmaceutical wholesalers and distributors act as crucial intermediaries, purchasing generic sterile injectables in bulk for onward distribution to various healthcare providers. Their potential to influence market access and inventory levels is significant. Ultimate beneficiaries, however, are the patients requiring treatment for conditions ranging from common infections to complex oncological disorders, whose access to affordable, life-saving medication is facilitated by the generic sterile injectable market. The consistent quality and availability of these generics directly impact global public health outcomes, placing significant responsibility on the manufacturers to meet ethical and quality standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.5 Billion |

| Market Forecast in 2033 | USD 145.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pfizer Inc., Sandoz (Novartis AG), Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Hikma Pharmaceuticals PLC, Dr. Reddy's Laboratories Ltd., Fresenius Kabi AG, Aurobindo Pharma, Mylan N.V. (Viatris), Baxter International Inc., Zydus Lifesciences Ltd., Cipla Ltd., Samsung Biologics, Biocon Ltd., Grifols, B. Braun Melsungen AG, Lupin Ltd., Hetero Drugs, Jiangsu Hengrui Medicine Co., Ltd., Wockhardt Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Generic Sterile Injectable Market Key Technology Landscape

The Generic Sterile Injectable Market's technological landscape is defined by the imperative to achieve higher sterility assurance levels (SAL), enhance efficiency, and transition towards patient-friendly formats. The foundation of advanced manufacturing involves sophisticated aseptic processing technologies. Critical advancements include the widespread adoption of Restricted Access Barrier Systems (RABS) and isolator technology. Isolators provide a physically separated, Grade A environment, dramatically reducing human intervention and the corresponding risk of microbial contamination, which is a major cause of manufacturing shutdowns and drug recalls in traditional cleanrooms. Furthermore, the integration of robotics for tasks like component handling, filling, and stoppering ensures precision and consistency while operating within the stringent confines of these barrier systems.

Beyond facility design, process control technologies are undergoing significant transformation. Continuous manufacturing, though challenging to implement in aseptic environments, is being explored to reduce batch sizes, enhance responsiveness to demand, and potentially lower production costs by integrating formulation and filling steps. Analytical technologies, particularly Process Analytical Technology (PAT), are increasingly utilized to monitor critical quality attributes (CQAs) in real-time, moving quality control from end-product testing to in-process monitoring. Spectroscopic methods (e.g., Near-Infrared Spectroscopy) are being leveraged to instantly verify the composition and homogeneity of the bulk drug substance before filtration and filling, ensuring adherence to Quality by Design (QbD) principles mandated by global regulators.

Finally, packaging and delivery innovation represent a major technological focus. The shift towards Pre-filled Syringes (PFS) requires specialized, high-speed filling lines capable of handling fragile glass or polymer components. Advanced materials science contributes through the development of better container closure systems, offering superior barrier properties and reduced interaction with the drug product, which is vital for maintaining the stability of complex generics and biosimilars. The push for self-administration and ease of use has also catalyzed the development of sophisticated auto-injectors and smart devices designed for drug delivery, often incorporating connectivity features to track patient adherence and provide feedback to healthcare providers. These technological shifts collectively aim to de-risk the manufacturing process and enhance the therapeutic value proposition of generic sterile injectables.

Regional Highlights

- North America: This region maintains the largest market share, driven primarily by the immense market size of the United States and Canada, coupled with high healthcare spending and advanced infrastructure. The U.S. market is characterized by frequent drug shortages, which create opportunities for generic manufacturers who can consistently supply critical care injectables. Stringent FDA regulations ensure high product quality, while the complex reimbursement environment favors cost-effective generic alternatives, especially within hospital GPO purchasing structures. The high rate of patent expiries in key therapeutic areas like oncology continues to fuel robust generic pipeline development.

- Europe: The European market demonstrates steady, controlled growth, primarily influenced by national tendering processes and centralized purchasing strategies across major economies like Germany, the UK, and France. Governments actively promote generic substitution to manage healthcare budgets. Regulatory harmonization through the European Medicines Agency (EMA) facilitates market access, but price caps and intense competition ensure razor-thin margins. Focus areas include biosimilar adoption and the transition to ready-to-use formats to improve efficiency in clinical settings across the EU member states.

- Asia Pacific (APAC): APAC is projected as the fastest-growing region, dominated by manufacturing hubs like India and China, which possess substantial capacity for API synthesis and finished product manufacturing, serving both domestic and international markets. The growth is underpinned by rapidly improving healthcare infrastructure, massive patient populations, increasing per capita income, and government initiatives promoting local drug production (e.g., Make in India). While local competition is fierce, the region serves as a crucial global supply base for critical generic injectables.

- Latin America (LATAM): This region is an emerging market characterized by varied regulatory maturity and economic stability. Countries like Brazil and Mexico present significant growth opportunities due to high demand for affordable medications and increasing government investment in public health systems. Challenges include navigating local registration procedures and infrastructure limitations concerning cold chain logistics, which is crucial for temperature-sensitive injectable products.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the Gulf Cooperation Council (GCC) states and South Africa, driven by efforts to diversify economies and enhance local pharmaceutical manufacturing capabilities (localization initiatives). High prevalence of lifestyle diseases and increasing penetration of modern healthcare facilities boost demand. However, the market remains reliant on imports, creating opportunities for generic suppliers capable of ensuring secure, quality-compliant supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Generic Sterile Injectable Market.- Pfizer Inc.

- Sandoz (Novartis AG)

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Hikma Pharmaceuticals PLC

- Dr. Reddy's Laboratories Ltd.

- Fresenius Kabi AG

- Aurobindo Pharma

- Mylan N.V. (Viatris)

- Baxter International Inc.

- Zydus Lifesciences Ltd.

- Cipla Ltd.

- Samsung Biologics

- Biocon Ltd.

- Grifols

- B. Braun Melsungen AG

- Lupin Ltd.

- Hetero Drugs

- Jiangsu Hengrui Medicine Co., Ltd.

- Wockhardt Ltd.

Frequently Asked Questions

What is the primary driver for the growth of the Generic Sterile Injectable Market?

The foremost driver is the significant number of patent expirations for high-value, branded injectable pharmaceuticals, particularly in oncology and complex specialty care segments. These expirations immediately open the market to generic competition, offering therapeutically equivalent, cost-effective alternatives essential for healthcare system sustainability.

How do pre-filled syringes impact market dynamics compared to traditional vials?

Pre-filled syringes (PFS) are rapidly gaining market share because they significantly enhance patient safety and administrative efficiency. They minimize drug wastage, reduce the potential for medication errors during compounding, and simplify self-administration, aligning with the growing trend toward outpatient and home-based healthcare delivery models.

What are the greatest regulatory challenges faced by generic sterile injectable manufacturers?

The primary challenges involve maintaining continuous compliance with stringent global Current Good Manufacturing Practice (cGMP) standards, particularly concerning aseptic processing integrity. Manufacturers must invest heavily in advanced technologies like isolator systems and demonstrate robust quality management systems to gain and retain regulatory approval across major markets like the FDA and EMA.

Which geographic region is expected to show the highest growth rate in this market?

The Asia Pacific (APAC) region, specifically countries like India and China, is projected to exhibit the fastest growth. This acceleration is due to their expanding roles as global manufacturing and API supply hubs, coupled with massive domestic healthcare system expansion and governmental initiatives aimed at promoting affordable, locally produced essential medicines.

How is technology addressing recurring drug shortages in the injectable market?

Technology addresses shortages through the implementation of advanced manufacturing techniques, such as continuous monitoring (PAT) and AI-driven predictive maintenance, which improve facility reliability and reduce quality-related shutdowns. Furthermore, increased adoption of automation and robust supply chain digitalization enhances transparency and allows manufacturers to respond more quickly to unexpected demand spikes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager