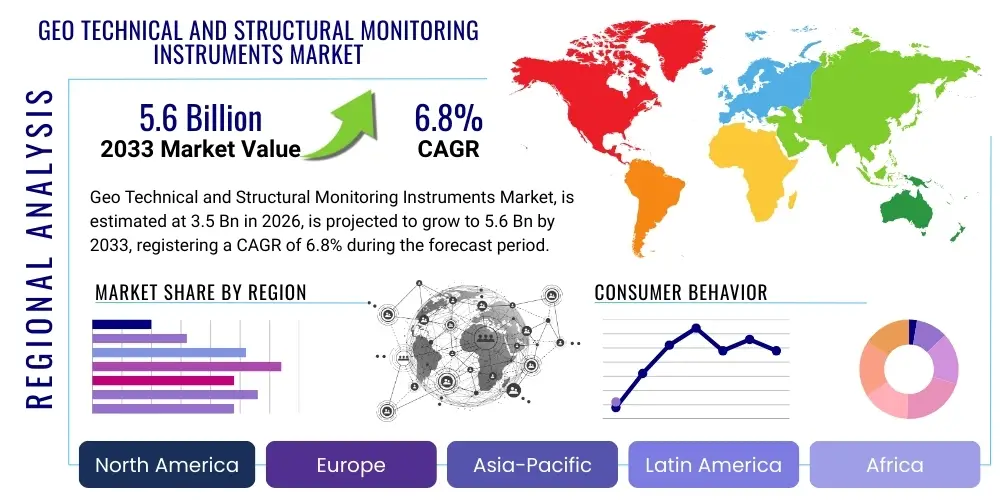

Geo Technical and Structural Monitoring Instruments Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441533 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Geo Technical and Structural Monitoring Instruments Market Size

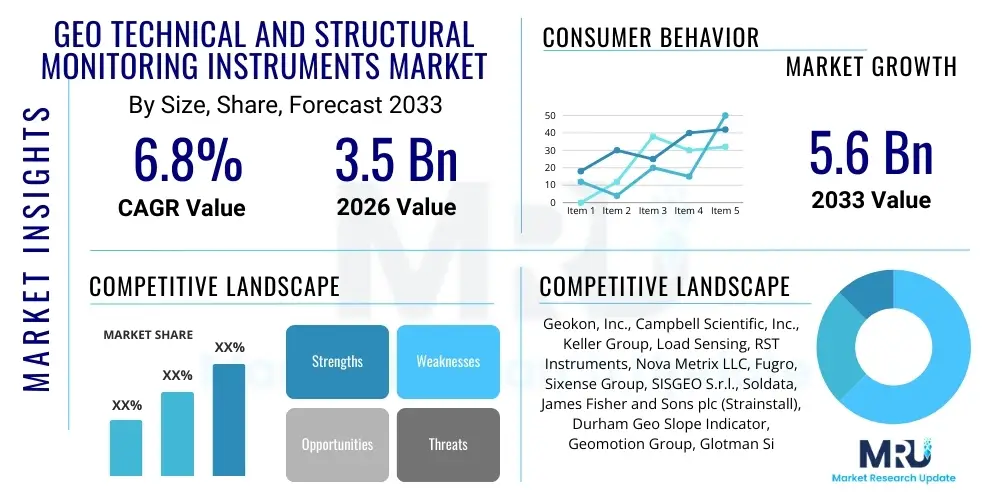

The Geo Technical and Structural Monitoring Instruments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Geo Technical and Structural Monitoring Instruments Market introduction

The Geo Technical and Structural Monitoring Instruments Market provides essential tools and integrated systems crucial for assessing and ensuring the stability, safety, and long-term performance of civil engineering structures and complex geological environments. These specialized instruments, which include sensors for measuring parameters such as pore water pressure, structural strain, inclination, settlement, and vibration, are fundamental in managing risks associated with large infrastructure assets like dams, tunnels, bridges, and high-rise developments. They enable engineers to acquire continuous, quantifiable data related to subsurface conditions and structural health, moving project management from reactive response to proactive, predictive maintenance strategies. The primary goal is to minimize potential hazards, optimize maintenance schedules, and prolong the service life of critical infrastructure assets globally, aligning with increasingly stringent regulatory standards for asset resilience.

Product categories within this market range widely, encompassing traditional mechanical instrumentation—such as magnetic extensometers and manually read crack meters—to highly sophisticated electronic and optical systems. Modern offerings heavily feature advanced data acquisition systems, Fiber Optic Sensing (FOS) technology, and IoT-enabled Wireless Sensor Networks (WSNs). The complexity and scale of contemporary infrastructure projects, particularly in densely populated urban centers or challenging geological terrains, necessitate robust, high-resolution monitoring solutions. Applications extend across various sectors, including urban construction monitoring to protect adjacent buildings, large-scale mining operations for tailings dam integrity, and governmental projects focused on mitigating natural hazards like landslides and ground subsidence.

The core benefits derived from deploying these technologies are substantial, encompassing significant improvements in public safety through early warning systems, reduction in capital costs through optimized repair timing, and enhanced compliance with international engineering standards. Market growth is structurally underpinned by several macro factors: burgeoning global infrastructure investment, particularly in transportation and energy sectors; the critical need to manage and modernize aging civil assets in developed economies; and the accelerating adoption of digital transformation within the construction and engineering sectors. Furthermore, the increasing severity and frequency of extreme weather events and seismic activity are compelling asset owners to mandate sophisticated, continuous monitoring to ensure infrastructure resilience against external stressors.

Geo Technical and Structural Monitoring Instruments Market Executive Summary

The Geo Technical and Structural Monitoring Instruments Market is experiencing robust expansion fueled by a global mandate for asset preservation and risk mitigation. Current business trends illustrate a decisive industry shift toward integrated, end-to-end solutions, where hardware provision is bundled with advanced software analytics and data interpretation services. This move towards 'Monitoring as a Service' (MaaS) is driven by end-users seeking simplified data utilization and reduced complexity in system management. Key commercial activities involve strategic acquisitions, where specialized sensor manufacturers are being absorbed by larger engineering consultancies and software providers to offer comprehensive, turnkey monitoring packages. Competition is intensifying, particularly in the wireless and fiber optic segments, where rapid technological iteration is redefining industry benchmarks for data accuracy and deployment ease.

Geographically, market dynamics are bifurcated: Asia Pacific leads in terms of volume demand, propelled by rapid urbanization and large-scale public infrastructure construction (e.g., dams, high-speed rail, subterranean projects in China and India). Conversely, North America and Europe maintain dominance in value and technological sophistication, focusing on retrofitting existing aging structures with highly automated and intelligent monitoring systems utilizing Artificial Intelligence (AI) for predictive analytics. These mature markets prioritize long-term efficiency and the seamless integration of monitoring data into broader Building Information Modeling (BIM) and Asset Performance Management (APM) frameworks. Emerging markets in Latin America and the Middle East are characterized by significant opportunities tied to resource extraction safety and greenfield mega-city development.

Analysis of segment trends confirms that the Sensor Hardware segment, especially advanced strain gauges and high-resolution displacement sensors, remains the foundational component, yet growth is accelerating within the Software and Services segment. This acceleration is directly attributed to the need to manage the enormous influx of data generated by continuous monitoring systems effectively. Among applications, the monitoring of large transportation infrastructure (bridges and tunnels) and critical water retention structures (dams and reservoirs) consistently accounts for the largest market share, driven by mandatory governmental safety oversight. The overarching executive theme is the transition from hardware-centric sales to a knowledge- and service-centric model, where data analysis and predictive capability drive the ultimate value proposition for customers.

AI Impact Analysis on Geo Technical and Structural Monitoring Instruments Market

Users frequently inquire about AI's transformative capacity, particularly regarding its ability to handle sensor noise, filter extraneous environmental data, and provide reliable, long-term prognostications of structural health, moving beyond simple diagnostic capabilities. Specific concerns revolve around the transparency and explainability of AI models (XAI) in safety-critical applications, ensuring that engineers can trust algorithmic decisions related to structural stability. The expectation is high for AI to autonomously detect subtle shifts in structural behavior indicative of impending failure, integrating diverse datasets—such as InSAR satellite imagery, weather data, and thermal readings—with traditional geotechnical readings. This synthesis is seen as the key to unlocking true predictive power and justifying the investment in next-generation monitoring systems.

The integration of Artificial Intelligence and Machine Learning is profoundly redefining the operational capabilities within the Geo Technical and Structural Monitoring Instruments Market. AI algorithms are essential for processing the massive, continuous streams of data generated by Fiber Optic Sensing and dense Wireless Sensor Networks. Traditional monitoring often relies on setting static thresholds, which can be inefficient and prone to false alarms caused by non-critical environmental variables (e.g., temperature changes or traffic vibration). AI models overcome this limitation by learning the normal, complex operational signatures of a structure or ground condition, allowing for the immediate and accurate identification of true anomalies that signify genuine structural or geological distress.

Beyond anomaly detection, AI facilitates the development of sophisticated predictive maintenance frameworks. By analyzing historical performance data alongside real-time sensor inputs, machine learning models can calculate the Remaining Useful Life (RUL) of an asset or pinpoint the exact geographical areas most susceptible to degradation. This prescriptive capability empowers asset owners to prioritize preventative maintenance activities with unparalleled accuracy, maximizing resource allocation and preventing costly, unscheduled downtime. Furthermore, AI systems are increasingly being deployed to automate regulatory reporting and compliance documentation, significantly reducing the administrative burden on engineering teams and ensuring adherence to safety mandates across large asset portfolios.

- Advanced Signal Processing: AI models filter noise and environmental interference, enhancing data quality from distributed sensor arrays.

- Predictive Modeling: Utilizing ML to forecast structural degradation timelines and estimate asset Remaining Useful Life (RUL).

- Automated Anomaly Scoring: Ranking alerts based on severity and probability of genuine failure, minimizing false positives for maintenance teams.

- Data Fusion and Synthesis: Seamlessly integrating heterogeneous data sources, including sensor readings, weather patterns, and satellite data, for comprehensive risk assessment.

- Optimized Sensor Placement: Using AI simulations to determine the most effective locations for sensor installation during the design phase of monitoring projects.

- Real-Time Structural Diagnostics: Providing engineers with instantaneous, condition-based structural health reports via cloud-based dashboards.

DRO & Impact Forces Of Geo Technical and Structural Monitoring Instruments Market

The market's momentum is fundamentally sustained by two primary drivers: exponential global infrastructure spending, particularly on large-scale renewable energy projects and urban transit systems; and the mandatory adoption of continuous monitoring systems imposed by increasingly strict governmental safety and environmental regulations in key economic regions. A critical opportunity lies in the expanding capability of IoT-enabled, low-power, wide-area network (LPWAN) communications, which dramatically reduces the cost and complexity of deploying instruments in remote or expansive areas, such as long pipelines or vast mining sites. This technological shift is opening up new revenue streams through subscription-based monitoring services (MaaS) and democratizing access to professional-grade monitoring solutions for smaller projects and municipalities previously reliant on manual inspection methods.

However, significant constraints impede faster market penetration. The capital expenditure required for installing comprehensive, high-density sensor networks—especially those involving Fiber Optic Sensing—remains prohibitively high for many smaller asset owners. Furthermore, the specialized knowledge required not only for instrument calibration and installation but also for the critical interpretation of complex, multi-variate data outputs creates a pronounced reliance on highly skilled, often scarce, geotechnical and structural engineers. This shortage necessitates that instrument providers invest heavily in automated data analysis software and extensive training programs for end-users. The third constraint involves interoperability challenges, as proprietary hardware and software systems often struggle to communicate effectively, hindering the formation of integrated asset management platforms across diverse infrastructure portfolios.

The competitive landscape is defined by the impact forces stemming from regulatory evolution and technological convergence. Regulatory intensity is high, particularly post-disaster events, forcing governments to tighten monitoring mandates, thereby securing long-term demand. The threat of substitutes is low for subsurface or long-term dynamic monitoring, as conventional inspection methods cannot replace continuous quantitative data. However, technological rivalry is fierce, driven by innovative start-ups focusing on software analytics and wireless protocols, pressuring established incumbents—historically focused on wired hardware—to rapidly modernize their offerings. Supplier bargaining power is concentrated for highly specialized components (e.g., specific MEMS sensors or FOS interrogators), while customer bargaining power is significant in the governmental sector, where large, standardized procurement contracts dictate long-term pricing and service level agreements, compelling vendors to offer highly customized solutions and competitive lifecycle cost models.

Segmentation Analysis

Segmentation analysis reveals a market deeply categorized by the technological sophistication and specific requirements of end-user applications. The Component segmentation highlights the increasing value placed on the Software and Services elements over the traditional Hardware focus. While sensors remain crucial, the industry's pivot toward data utilization means that advanced analytical platforms capable of data fusion, modeling, and automated report generation now command premium pricing and represent faster growth potential. This segmentation strategy allows vendors to diversify their offerings from mere product sales to comprehensive solution provision, addressing the full scope of client needs from deployment through predictive maintenance planning.

The Application segmentation is vital for tailored product development, recognizing the unique monitoring parameters required for different types of infrastructure. For instance, dam monitoring prioritizes high-accuracy measurements of seepage and pore pressure, requiring instruments such as vibrating wire piezometers, while bridge monitoring emphasizes dynamic structural response measurements using high-frequency accelerometers and strain gauges. The concentration of activity in the Tunnel and Bridge Monitoring segment reflects massive global investment in critical transportation arteries. Furthermore, the rapid growth in Slope and Landslide Monitoring is indicative of heightened awareness regarding climate change effects and the vulnerability of natural geological formations impacting human settlements and linear infrastructure assets.

Categorization by Technology separates the market between legacy wired systems, often preferred for their robustness and redundancy in critical installations, and the high-growth segments of Wireless Monitoring and Fiber Optic Sensing (FOS). FOS is gaining traction due to its advantages in distributed sensing over kilometers, ideal for pipeline and perimeter monitoring, while WSNs offer flexible, rapid deployment options favored by short-term construction projects. The end-user segments underscore the heavy influence of the public sector (Government and Public Works Agencies), whose mandate for safety and compliance drives consistent, large-volume demand for permanent monitoring solutions, differentiating their procurement requirements from the project-cycle driven demands of the Civil Engineering and Construction firms.

- By Component:

- Hardware (Sensors, Data Acquisition Systems, Dataloggers, Communication Modules)

- Software (Data Management Platforms, Visualization Tools, Predictive Analytics Modules)

- Services (Installation, Calibration, Maintenance, Data Interpretation, Monitoring as a Service)

- By Technology:

- Wired Monitoring Instruments (Vibrating Wire, Analog Sensors)

- Wireless Monitoring Instruments (IoT, WSN using LoRaWAN, NB-IoT)

- Fiber Optic Sensing (FOS) Technology (Bragg Grating, Distributed Temperature and Strain Sensing)

- By Application:

- Tunnel and Bridge Monitoring (TBM)

- Dam and Reservoir Monitoring (DRM)

- Building and Structural Health Monitoring (SHM)

- Mining and Excavation Monitoring (Tailings Dams, Slope Stability)

- Slope and Landslide Monitoring (Geo-hazards)

- Utility Infrastructure Monitoring (Pipelines, Power Lines, Wind Turbine Foundations)

- By End-User:

- Civil Engineering and Construction Contractors

- Mining and Quarrying Operators

- Oil & Gas and Energy Transmission Companies

- Government and Public Works Agencies (DoT, Water Authorities)

- Utility Companies (Power and Water)

Value Chain Analysis For Geo Technical and Structural Monitoring Instruments Market

The Geo Technical and Structural Monitoring Instruments value chain commences with critical upstream activities involving the research and precision manufacturing of highly specialized sensors. This phase relies heavily on the availability of advanced materials, such as specific semiconductor components for MEMS sensors, and high-quality optical fibers, often sourced from highly specialized, international suppliers. Manufacturing processes are complex, requiring stringent quality control and high-tolerance calibration capabilities, determining the accuracy and reliability of the final instrument. Upstream efficiency is paramount; vendors that secure resilient supply chains for microelectronics and customized components gain a decisive competitive advantage, mitigating risks associated with global supply bottlenecks and enhancing product longevity.

Midstream activities revolve around the system integration and assembly process carried out by the primary instrument manufacturers. This involves integrating the sensors with robust data acquisition systems (dataloggers), communication modules (telemetry units), and proprietary control software. This integration phase is where compatibility and ease of deployment are established, which are crucial selling points for end-users. Subsequently, the distribution and commercialization stage leverages both direct and indirect channels. Direct sales are utilized for large governmental clients or mega-projects that require extensive customization and high-level technical consultation. Indirect channels, primarily comprising specialized geotechnical distributors, engineering consultants, and regional system integrators, are critical for accessing smaller markets and providing localized installation support and regulatory expertise, especially in emerging economies where manufacturers lack a permanent physical presence.

Downstream value creation is increasingly concentrated in post-installation services and data monetization. This includes professional installation support, critical maintenance, and, most importantly, advanced data interpretation and analytical services. For many clients, the complexity of the raw data necessitates outsourcing the analytical function, leading to the rapid growth of 'Monitoring as a Service' (MaaS). This service model generates recurring revenue streams and allows manufacturers to capture greater lifetime value from their installed base. Effective downstream engagement—characterized by rapid technical support, timely reporting, and predictive insights—is crucial for maintaining customer loyalty and reinforcing the brand reputation for reliability in safety-critical applications.

Geo Technical and Structural Monitoring Instruments Market Potential Customers

The primary cohort of potential customers consists of governmental bodies and municipal agencies responsible for managing large inventories of public assets. These include state and federal departments of transportation, environmental and water resource agencies (managing dams and reservoirs), and public utility providers. Their demand is characterized by a need for permanent, high-reliability monitoring systems capable of continuous operation over decades to ensure regulatory compliance and public safety mandates. Procurement decisions in this sector are driven by proven system longevity, adherence to strict performance specifications, competitive lifecycle costing, and vendor capability to provide comprehensive maintenance and certified data analysis services required for official reporting and auditing purposes.

The second substantial customer group comprises large international and regional civil engineering and construction companies. These firms procure monitoring instruments to mitigate construction risk, ensure regulatory compliance during excavation and tunneling phases, and verify stability metrics for new foundations and structures. Their requirements are typically project-specific and short to medium-term, favoring instruments that are rugged, quick to install, easily removed, and portable, such as wireless tiltmeters and rapid settlement monitoring devices. This segment drives demand for leased equipment and flexible MaaS packages, optimizing capital expenditure for temporary projects while demanding quick turnaround times for installation and calibration services to meet tight construction schedules.

A rapidly growing customer base is found within the extraction industries, notably mining, quarrying, and oil and gas. Mining operators are mandated to monitor the structural integrity of complex earthworks, especially tailings storage facilities (TSFs) and unstable mine slopes, due to severe environmental and safety liabilities. Utility companies require monitoring for remote assets like high-voltage transmission towers, long-distance pipelines, and offshore wind turbine foundations, where instruments must be self-sufficient, highly resistant to environmental corrosion, and equipped with reliable long-range telemetry capabilities. These customers prioritize robustness, remote diagnostic capabilities, and integration with specialized enterprise asset management (EAM) systems tailored to the specific operational hazards of their respective industries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Geokon, Inc., Campbell Scientific, Inc., Keller Group, Load Sensing, RST Instruments, Nova Metrix LLC, Fugro, Sixense Group, SISGEO S.r.l., Soldata, James Fisher and Sons plc (Strainstall), Durham Geo Slope Indicator, Geomotion Group, Glotman Simpson Consulting Engineers, Opsens Solutions, Measurand Inc., MISTRAS Group, Inc., Smart Structures, Geomation Inc., TRE Altamira. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Geo Technical and Structural Monitoring Instruments Market Key Technology Landscape

The key technology landscape is defined by the shift towards distributed, intelligent, and highly automated monitoring systems. Fiber Optic Sensing (FOS) represents a technological pinnacle, utilizing properties like Bragg Gratings (FBG) or Rayleigh scattering (Distributed Acoustic/Temperature/Strain Sensing) to measure continuous parameters over distances up to several kilometers. This non-electrical, high-resolution technology offers crucial advantages in hazardous, magnetically active, or high-vibration environments, making it indispensable for monitoring dams, deep tunnels, and oil and gas pipelines. The ability of FOS systems to simultaneously provide spatially and temporally dense data points using passive sensors significantly reduces the total cost of ownership over the asset lifecycle compared to deploying thousands of conventional electronic sensors.

The convergence of the Internet of Things (IoT) and Wireless Sensor Networks (WSNs) is drastically altering deployment methodologies. Advances in battery longevity, power harvesting, and the adoption of energy-efficient communication protocols (e.g., LoRaWAN, Zigbee, and cellular NB-IoT) facilitate rapid, cable-free installation of large arrays of sensors, such as tiltmeters, accelerometers, and environmental monitors. WSNs allow for real-time, remote access to data, critical for projects in inaccessible locations or those requiring temporary monitoring during construction phases. The success of WSNs is intrinsically linked to robust, edge-computing capabilities within the field dataloggers, enabling preliminary data processing and filtering before transmission, thereby conserving battery power and bandwidth usage and enhancing the overall resilience of the monitoring network.

Furthermore, the evolution of data processing technologies, particularly in cloud-native platforms, is central to current innovation. Modern monitoring systems are integrating advanced visualization software, geographical information systems (GIS), and sophisticated analytical tools capable of data fusion—merging sensor outputs with external data sources like satellite imagery (InSAR) and weather models. This unified data environment supports the deployment of machine learning and AI algorithms that drive predictive maintenance, automated reporting, and complex correlation analysis between structural response and environmental triggers. This digital ecosystem transforms raw measurements into actionable engineering intelligence, serving as the foundational technology for next-generation, high-value consulting and monitoring services.

Regional Highlights

Market growth and technological penetration rates vary significantly across global regions, dictated by localized infrastructure demands, environmental risks, and regulatory adherence. Understanding these regional distinctions is key to developing effective market entry and expansion strategies for instrument providers.

- Asia Pacific (APAC): This region is the undisputed leader in projected market volume, driven by unprecedented investment in new infrastructure projects—including massive dams, metro systems, and coastal construction—necessitated by rapid industrialization and urbanization. Safety concerns related to seismic activity and intense seasonal weather drive the mandatory adoption of robust monitoring systems. China, India, and Southeast Asia present the most dynamic markets for both basic geotechnical instruments and advanced fiber optic sensing solutions.

- North America: The market here is mature and highly technology-focused, characterized primarily by replacement and rehabilitation projects targeting aging structures (over 60,000 structurally deficient bridges in the US alone). Demand centers on IoT-enabled, high-accuracy instruments and sophisticated software analytics (AI/ML) to maximize the remaining lifespan of existing assets. Strong regulatory oversight from bodies like the Federal Highway Administration ensures consistent, high-value demand for continuous structural monitoring.

- Europe: Defined by stringent safety standards (Eurocodes) and a focus on managing complex, interconnected subterranean infrastructure, especially tunnels and underground rail networks. The European market leads in the application of advanced Fiber Optic Sensing and sophisticated remote monitoring services. Sustainable infrastructure goals also drive demand for monitoring systems used in renewable energy assets, such as offshore wind farms and geothermal installations, requiring specialized marine geotechnical monitoring equipment.

- Latin America (LATAM): Market expansion is linked to substantial investments in mining infrastructure, oil and gas exploration, and necessary upgrades to foundational public utilities. The need to monitor slope stability, particularly in resource extraction areas and seismically active zones (Chile, Peru), drives instrument procurement. Price sensitivity and complexity of logistics often favor modular and lower-cost wireless solutions, although large projects demand established, high-precision wired systems.

- Middle East and Africa (MEA): Growth is tied to ambitious, state-led mega-projects (e.g., NEOM in Saudi Arabia, massive port expansions) and hydrocarbon extraction infrastructure. Instruments must be ruggedized to perform reliably in extreme desert climates and corrosive coastal environments. Geotechnical monitoring for large-scale land reclamation, deep excavation, and managing expansive soils is a major demand segment, favoring resilient FOS and bespoke wireless systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Geo Technical and Structural Monitoring Instruments Market.- Geokon, Inc.

- Campbell Scientific, Inc.

- Keller Group

- Load Sensing

- RST Instruments

- Nova Metrix LLC

- Fugro

- Sixense Group

- SISGEO S.r.l.

- Soldata

- James Fisher and Sons plc (Strainstall)

- Durham Geo Slope Indicator

- Geomotion Group

- Glotman Simpson Consulting Engineers

- Opsens Solutions

- Measurand Inc.

- MISTRAS Group, Inc.

- Smart Structures

- Geomation Inc.

- TRE Altamira

Frequently Asked Questions

Analyze common user questions about the Geo Technical and Structural Monitoring Instruments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most significant current technological trend in geotechnical monitoring?

The most significant trend is the adoption of Fiber Optic Sensing (FOS) and IoT-enabled Wireless Sensor Networks (WSNs). FOS provides continuous, high-resolution strain and temperature data over long distances, while WSNs offer cost-effective, rapid deployment options and remote telemetry capabilities crucial for real-time asset management.

How do regulatory requirements influence the purchase of monitoring instruments?

Mandatory safety regulations, particularly those governing high-risk assets like dams, nuclear facilities, and tunnels, compel asset owners (especially government agencies) to invest in permanent, verifiable, and continuously operating monitoring systems to maintain operational compliance and mitigate legal liabilities.

What challenges are associated with implementing AI in structural health monitoring?

Key challenges include ensuring the quality and completeness of historical data used to train AI models, overcoming the high computational resource requirements, and addressing the need for explainability (XAI) so that engineers can confidently trust the algorithmic predictions in safety-critical applications.

Which geographical region is expected to demonstrate the highest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest market growth, driven by unprecedented levels of investment in new infrastructure, rapid urbanization, and mandatory requirements for seismic and geological hazard mitigation in major economies like China and India.

What is the concept of Monitoring-as-a-Service (MaaS) in this industry?

MaaS represents a shift where customers pay a subscription fee for a complete monitoring solution, including the hardware, installation, data acquisition, cloud processing, and expert interpretation services. This model reduces the customer's initial capital expenditure and complexity, making advanced monitoring accessible to a wider market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager