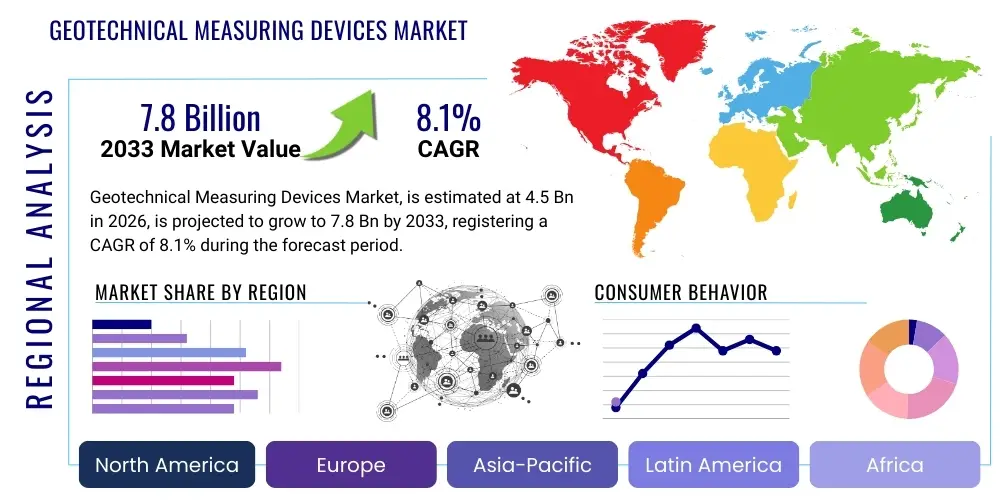

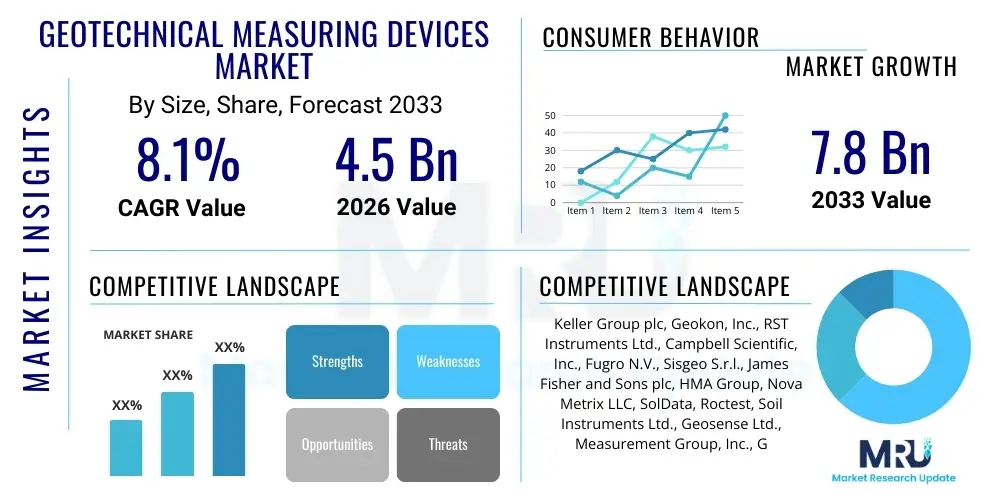

Geotechnical Measuring Devices Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441066 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Geotechnical Measuring Devices Market Size

The Geotechnical Measuring Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of [8.1]% between 2026 and 2033. The market is estimated at [4.5] Billion USD in 2026 and is projected to reach [7.8] Billion USD by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by escalating global infrastructure development, particularly in emerging economies focusing on smart cities, high-speed rail networks, and sustainable energy projects like large-scale offshore wind farms. Geotechnical instrumentation is critical for ensuring the safety, longevity, and regulatory compliance of these massive projects, necessitating constant monitoring of soil, rock, and structure interaction under various environmental stresses. Furthermore, increasing regulatory requirements concerning structural health monitoring (SHM) and hazard mitigation, especially in seismically active regions, propel the demand for sophisticated, reliable, and real-time data-logging geotechnical devices. The integration of IoT and cloud computing capabilities into these instruments is also enhancing their utility and driving market valuation upwards.

Geotechnical Measuring Devices Market introduction

The Geotechnical Measuring Devices Market encompasses the manufacturing, distribution, and utilization of sophisticated instruments designed to measure and monitor physical properties and parameters of soil, rock masses, and groundwater both in situ and in laboratory environments. These devices, ranging from traditional mechanical gauges to advanced digital sensors, are indispensable tools across numerous high-stakes engineering disciplines, including civil engineering, mining, oil and gas exploration, and environmental remediation. Key products include piezometers, inclinometers, extensometers, load cells, settlement systems, and tiltmeters, which collectively provide crucial data regarding deformation, strain, pressure, temperature, and fluid movement within geotechnical structures and surrounding geological formations. Major applications span structural health monitoring (SHM) of bridges, dams, tunnels, and deep foundations, slope stability assessment in open-pit mines and natural hillsides, groundwater level monitoring, and the verification of design assumptions during and after construction phases. The primary benefits derived from using these devices include enhanced safety margins, optimization of construction timelines and materials usage, early detection of potential failures, and compliance with stringent international engineering standards. Driving factors include the global boom in large-scale infrastructure projects, the necessity for robust monitoring systems in areas prone to natural hazards (e.g., landslides and earthquakes), and the continuous innovation leading to more accurate, durable, and interconnected wireless instrumentation systems.

Geotechnical Measuring Devices Market Executive Summary

The Geotechnical Measuring Devices Market is characterized by robust growth, propelled primarily by global investments in critical national infrastructure and heightened awareness regarding geotechnical risks. Business trends indicate a strong shift towards digitalization and automation, with manufacturers integrating wireless connectivity, cloud storage, and advanced data analytics platforms into traditional sensing technologies. This transition enables real-time, remote monitoring, drastically reducing operational costs and improving data fidelity, appealing strongly to project managers overseeing complex and geographically dispersed construction sites. Furthermore, strategic mergers, acquisitions, and partnerships are common as established players seek to absorb specialized technology startups focusing on IoT integration and software solutions, solidifying a competitive landscape dominated by technological sophistication. Regional trends highlight Asia Pacific (APAC) as the fastest-growing market due to massive urbanization and government-led infrastructure initiatives in China, India, and Southeast Asian nations, where stringent safety codes for high-density infrastructure are rapidly evolving. North America and Europe, while mature, remain dominant markets for high-precision, premium instrumentation, driven by maintenance, repair, and overhaul (MRO) activities related to aging infrastructure and stringent environmental monitoring mandates.

In terms of segmentation, the market exhibits segmentation based on product type, application, and end-user. The inclinometer segment currently holds a significant market share due to its essential role in monitoring lateral deformation and stability of slopes and retaining walls, crucial for landslide prevention. However, the rapidly expanding Fiber Optic Sensor (FOS) segment is anticipated to witness the highest growth rate, driven by its inherent advantages, such as immunity to electromagnetic interference, long service life, and high sensitivity over long distances, making them ideal for tunnels and deep foundations. Application-wise, the Infrastructure segment (dams, bridges, and tunnels) accounts for the largest revenue share, reflecting the sheer scale and capital intensity of global infrastructure investment. Conversely, the Mining segment is showing accelerated adoption rates, especially as mining operations delve deeper and require more complex stability analysis of pit walls and tailings dams. End-user analysis reveals that Construction and Engineering Consulting firms are the primary purchasers, relying heavily on accurate geotechnical data to validate designs and mitigate project risks, fostering continuous demand for calibration services and advanced analytical software packages that complement the hardware devices.

Overall, the Geotechnical Measuring Devices market environment is conducive to continued high growth, underpinned by non-cyclical demand for safety and compliance in engineering projects worldwide. Key strategic imperatives for market players include developing AI-powered predictive maintenance tools that move beyond simple data logging to genuine risk forecasting, establishing robust supply chains to cater to the immense scale of APAC demand, and specializing in highly resilient sensors capable of operating reliably in harsh environments (e.g., high pressure, extreme temperatures, or corrosive conditions). The convergence of geotechnical instrumentation with broader Industrial IoT (IIoT) platforms is not merely a trend but a fundamental reshaping of the value proposition, shifting from selling discrete instruments to providing integrated, data-as-a-service monitoring solutions, which promises higher recurring revenue streams and deeper client engagement across the infrastructure lifecycle.

AI Impact Analysis on Geotechnical Measuring Devices Market

Users commonly inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can move geotechnical practices beyond traditional threshold alarms and static data interpretation. Key themes revolve around leveraging AI for predictive analytics, automating data processing and anomaly detection in massive sensor datasets, and optimizing the placement and calibration of geotechnical instruments. Concerns often center on the accuracy and reliability of AI models trained on heterogeneous and often incomplete historical geotechnical data, as well as the initial costs and specialized expertise required to integrate these complex systems into existing monitoring frameworks. Expectations are high regarding AI's potential to dramatically reduce false positives, identify subtle precursory failure patterns that human analysts might miss, and ultimately provide real-time risk scores rather than just raw sensor readings, thereby transforming reactive maintenance into proactive asset management strategies across civil and mining applications.

The integration of AI algorithms, particularly deep learning models, is set to revolutionize data interpretation and predictive maintenance within the Geotechnical Measuring Devices Market. Traditional monitoring systems generate vast quantities of time-series data from hundreds of sensors, making manual analysis inefficient and susceptible to human error. AI systems excel at processing these large, complex, and multivariate datasets from devices like extensometers, tiltmeters, and distributed fiber optic sensors, enabling rapid identification of correlations between various measured parameters—such as pore pressure fluctuations coinciding with minor ground movements or temperature changes affecting material strain. This capability allows engineering firms to establish sophisticated baseline models of structural behavior and environmental interactions. When actual sensor readings deviate significantly or trend towards previously identified failure signatures, the AI can issue high-confidence warnings long before traditional alarm limits are breached, significantly enhancing the safety and operational lifespan of critical infrastructure like dams and large tailings facilities. Furthermore, ML techniques are being applied to optimize sensor network design, determining the most strategic locations for instrument placement based on probabilistic failure models and geological variability, ensuring maximum data yield with minimum hardware deployment.

However, the implementation of AI is not without its challenges. The reliability of AI models is heavily dependent on the quality and volume of training data, and geotechnical data often suffers from sparsity, inconsistencies, and biases related to specific site conditions or sensor drift over long deployment periods. Market adoption requires significant investment not only in advanced instrumentation capable of transmitting high-frequency data but also in robust, secure cloud infrastructure and specialized geotechnical data scientists capable of developing and validating site-specific ML models. Despite these hurdles, the long-term economic and safety benefits—including reduced inspection costs, minimized downtime following hazard events, and improved regulatory compliance through demonstrable data-driven risk management—are compelling the industry towards this technological transformation. Manufacturers are increasingly partnering with software providers to offer end-to-end solutions that include automated reporting and visualization dashboards powered by embedded analytical intelligence, moving the market focus from merely selling hardware to providing comprehensive, predictive risk intelligence services.

- AI-driven predictive failure analysis enhances proactive risk management in slope and structural stability.

- Machine Learning automates the processing of massive sensor datasets, improving anomaly detection accuracy.

- Optimization of sensor placement using algorithmic models maximizes data efficiency and coverage.

- Cloud-based AI platforms offer real-time risk scoring, transforming data into actionable geotechnical intelligence.

- Deep learning models facilitate the correlation of disparate geotechnical parameters (e.g., pressure, temperature, movement) for holistic system health assessment.

- Integration of AI reduces reliance on manual data interpretation and decreases the incidence of false positive alarms.

DRO & Impact Forces Of Geotechnical Measuring Devices Market

The Geotechnical Measuring Devices Market is primarily driven by rigorous safety standards and the ongoing global infrastructure renaissance, particularly the intensive focus on resilience against natural hazards and the maintenance of aging infrastructure. Restraints often center on the high initial capital expenditure required for premium, interconnected digital systems and the persistent shortage of highly specialized geotechnical engineers skilled in implementing and interpreting advanced sensor network data. Opportunities are abundant in emerging economies characterized by rapid urbanization and large, greenfield infrastructure projects, coupled with the ongoing technological shift towards fully integrated, wireless monitoring systems and the commercialization of highly sensitive distributed sensing technologies. The market is subject to significant impact forces, including stringent governmental regulations (e.g., mandatory structural health monitoring codes), geological volatility (driving demand after major seismic or weather events), and technological diffusion which continues to democratize access to advanced, previously inaccessible monitoring capabilities, fostering a continuous cycle of innovation and replacement demand.

Drivers: A primary driver is the accelerating pace of global infrastructure development, especially complex projects such as long-span bridges, deep underground tunnels, metro systems, and mega-dams in regions like Asia and the Middle East. These large civil engineering undertakings mandate continuous, high-precision monitoring throughout their entire lifecycle, from excavation and construction through decades of operation, creating sustained demand for reliable geotechnical instrumentation. Furthermore, environmental and safety regulations, particularly those concerning the stability of high-risk structures like nuclear power plant foundations, large retaining walls, and mine tailings dams, have become increasingly stringent globally, necessitating the use of certified and accurate measuring devices to ensure legal compliance and public safety. Another significant driver is the increasing complexity of geological conditions encountered in modern projects—such as building in soft ground, areas of high seismic activity, or deep marine environments—which requires highly specialized, robust, and real-time monitoring solutions to mitigate construction risks and ensure long-term structural integrity. The cost of failure in modern infrastructure is astronomical, making investment in preventative monitoring technologies economically rational.

Restraints: The market faces significant restraints, including the substantial initial investment required for the procurement and installation of advanced digital geotechnical monitoring systems. While traditional mechanical gauges are relatively inexpensive, modern IoT-enabled wireless sensors, data loggers, and accompanying analytical software platforms represent a significant capital outlay, which can be prohibitive for smaller construction firms or projects with tight budgetary constraints. A crucial non-monetary restraint is the specialized expertise required for the proper installation, calibration, maintenance, and interpretation of data generated by these complex instruments. There is a documented global skills gap in geotechnical data science, limiting the rate at which advanced predictive monitoring systems can be effectively adopted and utilized across all geographical markets. Moreover, the environmental ruggedness required for many geotechnical devices (e.g., resistance to moisture, corrosion, and extreme temperatures over several decades) poses a continuous technological hurdle and adds complexity and cost to the manufacturing process, sometimes limiting the pace of technological innovation.

Opportunities: Significant growth opportunities are emerging through the adoption of wireless and remote monitoring technologies. The transition from cumbersome, wired systems requiring frequent site visits to maintenance-free, self-logging, solar-powered wireless networks dramatically reduces operational costs and expands the viability of monitoring remote or hazardous sites (e.g., active landslides or deep tunnels). The development and commercialization of distributed fiber optic sensing (DFOS) technology present a major opportunity, allowing for continuous monitoring along kilometers of fiber optic cable, providing unparalleled spatial resolution for strain and temperature measurements in tunnels, pipelines, and deep foundations—areas where discrete sensors are inadequate. Furthermore, the growing focus on environmental monitoring, specifically related to the effects of climate change, such as permafrost thawing in Arctic regions and increased incidence of coastal erosion, is creating a niche market for specialized geotechnical devices capable of monitoring extremely sensitive and challenging environmental shifts. Expanding government-led smart city initiatives globally also mandate robust, data-driven infrastructure monitoring, opening pathways for long-term service contracts.

Impact Forces: The market is heavily impacted by regulatory policy changes. When governments mandate stricter geotechnical risk assessment and structural monitoring standards for public works, the demand for certified devices experiences a sharp increase. Macroeconomic cycles related to construction and mining activity directly influence procurement decisions; periods of high infrastructure spending correlate strongly with market expansion. Technological innovation acts as a continuous impact force, with manufacturers constantly striving to offer instruments with better resolution, lower power consumption, faster data acquisition rates, and greater immunity to environmental noise, leading to obsolescence cycles for older analog equipment. Geopolitical stability and global trade dynamics also play a role, influencing the cost and availability of raw materials (such as specialized alloys and microelectronics) necessary for sensor production. Finally, the increasing frequency and severity of natural disasters elevate public and governmental pressure to implement better predictive monitoring and warning systems, providing a reactive yet powerful boost to the market.

Segmentation Analysis

The Geotechnical Measuring Devices Market is systematically segmented primarily based on the type of device utilized, the specific application or structure being monitored, and the end-user industry driving the demand. Understanding these segments is crucial for strategic market positioning, as each category exhibits unique growth drivers, technological maturity levels, and competitive dynamics. Device segmentation separates the market into displacement sensors (e.g., extensometers, inclinometers), pressure sensors (e.g., piezometers, load cells), and other monitoring tools (e.g., tiltmeters, temperature sensors). Application segmentation details usage across infrastructure (dams, tunnels, bridges), mining, oil and gas, and environmental monitoring, reflecting diverse performance requirements. End-user segmentation identifies the primary consumers, such as engineering firms, construction companies, government agencies, and research institutions, each with distinct purchasing criteria and technology preferences. The strongest growth is currently observed within the advanced digital instrumentation segments, particularly those utilizing fiber optic technology or integrating seamless wireless data transmission capabilities for large-scale, continuous monitoring projects across high-risk civil infrastructure environments globally.

- By Product Type:

- Inclinometers (Used for measuring subsurface lateral movement and deformation).

- Piezometers (Monitoring pore water pressure in soil and rock).

- Extensometers (Measuring displacement and deformation along one or more axes).

- Load Cells (Measuring compressive and tensile forces in structural supports).

- Strain Gauges (Measuring small strains in structural materials).

- Tiltmeters and Settlement Systems (Monitoring angular deformation and vertical movement).

- Temperature Sensors and Thermistors (Monitoring temperature changes in concrete and ground).

- Fiber Optic Sensors (DFOS and conventional FBG sensors).

- By Technology:

- Vibrating Wire Technology (Standard for pressure and load measurements due to ruggedness).

- MEMS (Micro-Electro-Mechanical Systems) Technology (Used in smaller, high-precision inclinometers and tiltmeters).

- Digital and Wireless Sensors (Enabling remote, real-time data acquisition).

- Analog Devices.

- By Application:

- Infrastructure (Dams, Bridges, Tunnels, Highways, Retaining Walls).

- Mining (Pit slope stability, Tailings dam monitoring, Underground mining operations).

- Oil and Gas (Pipeline integrity, Foundation monitoring for offshore platforms).

- Environmental Monitoring (Landslide zones, Groundwater levels, Permafrost monitoring).

- By End User:

- Civil Engineering and Construction Firms.

- Mining Companies.

- Government Agencies (Regulatory bodies, Public Works Departments).

- Research and Academic Institutions.

- Geotechnical Consulting Firms.

Value Chain Analysis For Geotechnical Measuring Devices Market

The value chain for the Geotechnical Measuring Devices Market is complex, beginning with raw material sourcing and highly specialized sensor manufacturing, transitioning through rigorous calibration and integration, and concluding with downstream deployment, data services, and long-term maintenance. Upstream activities involve the procurement of specialized materials, including high-precision metals, advanced polymers, and sensitive electronic components (e.g., microprocessors, ASIC chips, and fiber optic cables). This stage requires robust quality control as the long-term reliability of the sensor in harsh subsurface environments is paramount. Key upstream players include specialized component manufacturers and technology suppliers focusing on MEMS or vibrating wire technology patents. The central stage involves the assembly, integration, and proprietary calibration of the measuring devices, often incorporating custom software and ruggedized casings suitable for deep burial or exposure to extreme geological conditions. This manufacturing stage is dominated by core market players who invest heavily in R&D to enhance sensor longevity, accuracy, and data logging capabilities, often integrating proprietary firmware for seamless data communication.

Downstream analysis focuses on the distribution, installation, data acquisition, and interpretation services. Distribution channels are typically a mix of direct sales teams for large governmental or multi-year infrastructure contracts and specialized regional distributors or engineering consulting firms who act as value-added resellers, providing local technical support and installation expertise. The installation process is often highly complex and site-specific, requiring specialized drilling and grouting techniques to ensure proper sensor coupling with the soil or rock mass, creating a significant barrier to entry for generalized hardware providers. Post-installation, the value shifts significantly towards data management and interpretation. Consulting engineers and specialized data service providers utilize proprietary software platforms to process, analyze, and report on the continuous stream of geotechnical data. The downstream sector, increasingly leveraging cloud computing and AI for predictive analytics, holds the highest potential for recurring revenue streams, moving the business model away from a single hardware sale to a long-term service provision contract.

The distribution channel is dichotomous: Direct channels are preferred for high-value, custom-engineered projects, such as major dam safety projects or nuclear facility foundation monitoring, where the manufacturer provides end-to-end support, including installation supervision and specialized training. Indirect channels, involving third-party distributors and specialized geotechnical instrumentation rental companies, serve smaller construction projects or regions where the manufacturer lacks a direct physical presence. The distinction between direct and indirect sales often blurs when engineering consulting firms act as strategic partners, not just resellers, by incorporating the devices into comprehensive project monitoring plans. This channel structure emphasizes expertise and service capability over mere product delivery. Effective value chain management, particularly streamlining the integration of hardware manufacturing with software analytics and robust service provision, is the key determinant of market success and competitive advantage, ensuring that the critical data gathered by the devices is translated efficiently into actionable engineering decisions for end-users like asset owners and regulatory bodies.

Geotechnical Measuring Devices Market Potential Customers

The primary consumers and end-users of geotechnical measuring devices are organizations responsible for designing, constructing, maintaining, and regulating large-scale civil, mining, and energy infrastructure. These potential customers fall into several distinct categories, each utilizing the instrumentation for specific risk mitigation and compliance purposes. Foremost among them are Civil Engineering and Construction Firms, which use the devices extensively during active construction phases to verify design assumptions, monitor ground movement during excavation, and ensure the structural integrity of temporary and permanent works like deep foundations and tunnels. Their demand is driven by project timelines, safety requirements, and the need to optimize material use, making cost-effectiveness and rugged durability key purchasing criteria. Government Agencies, including departments of transportation, public works authorities, and regulatory bodies overseeing water resources (e.g., dam safety commissions), represent a major stable demand segment, often requiring long-term monitoring systems for critical public assets to ensure decades of operational safety and compliance with national standards, focusing on high reliability and long service life.

Another crucial customer segment consists of Mining Companies, particularly those involved in open-pit and deep underground operations. Geotechnical instrumentation is vital for monitoring the stability of pit walls, assessing rock mass behavior, and ensuring the safety of tailings storage facilities (TSFs), which are subject to increasingly strict global regulations following high-profile failures. Mining operations often require highly durable and specialized sensors capable of operating reliably in corrosive environments and remote locations, prioritizing robust communication technologies. Geotechnical Consulting Firms are also significant indirect consumers and powerful influencers, as they specify, procure, and install the majority of instrumentation for their clients, providing the crucial interpretation and analysis services. These consultants require devices that are easy to integrate into their established data platforms and offer highly reliable, accurate data streams to support their professional engineering recommendations and risk assessments.

Finally, the growing sectors of Renewable Energy and Environmental Monitoring represent rapidly expanding customer bases. Developers of large-scale offshore wind farms and geothermal projects require specialized geotechnical devices to monitor the stability of complex foundation structures in dynamic marine or deep subsurface environments. Environmental agencies and research institutions use these instruments for studying and tracking natural hazards, such as the mechanisms of landslides, monitoring the creep rate of unstable slopes, or measuring the impact of climate change on permafrost and groundwater resources. These customers often prioritize specialized, highly sensitive sensors (like Distributed Fiber Optic Sensors) capable of providing broad spatial coverage and real-time data transmission for early warning systems, necessitating a focus on integration capabilities with broader environmental monitoring networks and high data fidelity under extreme operating conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | [4.5] Billion USD |

| Market Forecast in 2033 | [7.8] Billion USD |

| Growth Rate | CAGR [8.1]% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Keller Group plc, Geokon, Inc., RST Instruments Ltd., Campbell Scientific, Inc., Fugro N.V., Sisgeo S.r.l., James Fisher and Sons plc, HMA Group, Nova Metrix LLC, SolData, Roctest, Soil Instruments Ltd., Geosense Ltd., Measurement Group, Inc., Geoconsult, Acuitas, Senceive, GKM Consultants, Setpoint Systems, and Durham Geo Slope Indicator. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Geotechnical Measuring Devices Market Key Technology Landscape

The technological landscape of the Geotechnical Measuring Devices Market is rapidly evolving, moving away from purely analog and labor-intensive systems toward highly digitized, integrated, and remotely managed smart networks. Key technological advancements center around enhancing sensor accuracy, improving power efficiency, and enabling seamless, secure data transmission. The transition from traditional electrical resistance strain gauges to more robust Vibrating Wire (VW) technology remains a foundational trend, especially for long-term monitoring in harsh environments, owing to VW sensors' superior immunity to electrical noise and capability for long cable runs without signal degradation. However, the most transformative recent shift involves the miniaturization and precision enhancement offered by MEMS (Micro-Electro-Mechanical Systems) technology, which allows for the creation of smaller, highly accurate inclinometers and tiltmeters that are easier and quicker to install, offering high spatial resolution for monitoring detailed movement profiles in critical structures.

The most disruptive technologies driving current innovation are Distributed Fiber Optic Sensing (DFOS) and advanced wireless communication protocols utilizing IoT and 5G networks. DFOS, including technologies like Brillouin Scattering (BOTDR/BOTDA) and Rayleigh Scattering, enables engineers to use a standard fiber optic cable as a continuous linear sensor up to several kilometers long. This allows for distributed measurement of strain and temperature along the entire length of a structure (like a tunnel or pipeline), providing data density unachievable with discrete sensors. This technology is proving invaluable for large-scale infrastructure monitoring and is quickly becoming the gold standard for long-distance structural health applications. Concurrently, the proliferation of low-power, wide-area networks (LPWAN) like LoRaWAN and Narrowband IoT (NB-IoT) has fundamentally enabled truly reliable wireless geotechnical monitoring. These wireless systems drastically reduce cabling costs and installation complexity, allowing for the deployment of self-powered sensor networks in remote or inaccessible locations, delivering real-time data to cloud platforms for immediate analysis and significantly expanding the market reach into remote mining and landslide mitigation sites.

Future technological advancements are focused on the integration of these sensing technologies with sophisticated data analytics. The rise of Edge Computing is crucial, allowing sensor data loggers to process and filter data locally before transmission, reducing bandwidth requirements and increasing the responsiveness of the monitoring system. Furthermore, ongoing R&D focuses on developing truly self-healing or adaptive sensor materials capable of maintaining calibration and integrity over predicted decades-long lifespans in aggressive subsurface chemical environments. The convergence of hardware development with advanced AI/ML algorithms embedded within the cloud infrastructure is redefining the industry, shifting the focus from simply collecting raw data to delivering predictive, actionable engineering insights. This shift mandates that technology providers focus not only on the physical instrument's resilience but also on its complete digital ecosystem, including software interface, data security, and API compatibility with broader asset management systems.

Regional Highlights

The Geotechnical Measuring Devices Market exhibits diverse growth trajectories and maturity levels across different global regions, heavily influenced by local regulatory environments, the status of infrastructure development, and susceptibility to natural hazards.

- Asia Pacific (APAC): This region is the undisputed powerhouse for market growth, characterized by rapid urbanization, massive government-funded infrastructure projects (e.g., China's Belt and Road Initiative, India's smart city mission), and increasing regulation over critical infrastructure safety, especially concerning high-speed rail, metro tunnels, and massive dam construction. Countries like China, India, and Southeast Asian nations are driving demand for both high-volume, reliable instrumentation and advanced DFOS systems due to the sheer scale and complexity of their projects. The need to monitor stability in seismically active regions further amplifies market expansion, positioning APAC as the largest revenue generator and the fastest-growing market globally.

- North America: Representing a mature yet consistently strong market, North America is driven less by greenfield construction and more by the maintenance, repair, and upgrade (MR&U) of aging infrastructure (bridges, highways, dams) and stringent regulatory requirements, particularly in dam safety and oil/gas pipeline integrity monitoring. The US and Canada are leaders in adopting high-precision, digital, and wireless geotechnical monitoring systems, heavily utilizing IoT integration and predictive analytics software to maximize the lifespan of existing assets. High labor costs also accelerate the adoption of remote monitoring solutions, favoring sophisticated, low-maintenance hardware.

- Europe: The European market is characterized by a strong focus on high standards, environmental protection, and innovative technology adoption. Demand is driven by complex underground civil works (e.g., cross-border tunnels, deep metro lines) and strict monitoring mandates for high-risk industrial sites. Countries like Germany, France, and the UK are major consumers of advanced vibrating wire and fiber optic sensors. The emphasis on sustainable engineering and mitigating environmental impact means high demand for specialized instruments monitoring groundwater contamination and historical site stability adjacent to new construction.

- Latin America (LATAM): Growth in LATAM is variable but significant, heavily reliant on mining sector investments (Chile, Peru, Brazil) and urban infrastructure expansion in major metropolitan areas. The market often favors cost-effective, robust solutions, but there is growing investment in advanced systems for monitoring high-risk structures like large mining tailings dams, where safety concerns are paramount. Economic stability remains a key factor influencing the pace of high-tech instrumentation adoption.

- Middle East and Africa (MEA): The MEA region is witnessing high demand driven by massive investments in megaprojects (e.g., NEOM in Saudi Arabia, UAE infrastructure expansion) and oil and gas infrastructure monitoring. The deployment of geotechnical devices in this region is often required to address challenging conditions such as extreme heat, sandy soils, and large desert developments. Demand is high for reliable, robust, and remotely operable systems to manage projects across vast and often sparsely populated areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Geotechnical Measuring Devices Market.- Keller Group plc

- Geokon, Inc.

- RST Instruments Ltd.

- Campbell Scientific, Inc.

- Fugro N.V.

- Sisgeo S.r.l.

- James Fisher and Sons plc

- HMA Group

- Nova Metrix LLC

- SolData

- Roctest

- Soil Instruments Ltd.

- Geosense Ltd.

- Measurement Group, Inc.

- Geoconsult

- Acuitas

- Senceive

- GKM Consultants

- Setpoint Systems

- Durham Geo Slope Indicator

Frequently Asked Questions

Analyze common user questions about the Geotechnical Measuring Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the increased adoption of geotechnical monitoring devices globally?

The primary drivers are escalating global investment in critical infrastructure (dams, bridges, metro systems), stringent governmental safety regulations (especially for high-risk assets like mining tailings dams), and the growing need to monitor and maintain aging infrastructure in developed nations. Furthermore, the increasing complexity of geological conditions encountered in modern engineering projects necessitates continuous, high-precision measurement systems to mitigate catastrophic failure risks and ensure regulatory compliance, thereby mandating advanced monitoring device deployment across all major construction and mining sectors.

How is Fiber Optic Sensing (FOS) technology impacting the traditional geotechnical instrumentation market?

Fiber Optic Sensing (FOS), particularly Distributed Fiber Optic Sensing (DFOS), is acting as a disruptive force by offering unparalleled spatial data resolution and immunity to electromagnetic interference over long distances. Unlike traditional discrete sensors, DFOS allows for continuous measurement of strain and temperature along kilometers of fiber cable, providing comprehensive structural integrity data for tunnels, pipelines, and deep foundations. This superior performance is leading to the displacement of many discrete electronic sensors in large, critical, and linear infrastructure projects, driving market innovation towards integrated, long-term monitoring solutions.

What role does Artificial Intelligence (AI) play in modern geotechnical data analysis and risk mitigation?

AI and Machine Learning (ML) are crucial for moving geotechnical monitoring beyond simple data logging to proactive risk prediction. AI algorithms process massive, continuous datasets from integrated sensor networks to automatically identify subtle anomalies, correlate multivariate parameters, and predict potential failures long before traditional, static alarm thresholds are reached. This capability significantly enhances structural safety, reduces false alarms, and optimizes asset management by providing real-time risk scores and enabling data-driven preventative maintenance strategies.

What are the key technological restraints limiting the widespread deployment of advanced wireless geotechnical systems?

Key technological restraints include ensuring the long-term power autonomy of remote wireless sensor nodes, particularly in deeply buried or non-solar accessible environments, and addressing the technical challenges related to data security and network robustness across vast and geographically challenging sites. Furthermore, while wireless systems reduce cable installation costs, they require reliable, low-power, wide-area network (LPWAN) infrastructure coverage, which is not universally available, thereby limiting deployment in the most remote areas critical to geotechnical monitoring, necessitating specialized, ruggedized solutions.

Which geographical region is expected to demonstrate the highest Compound Annual Growth Rate (CAGR) for geotechnical measuring devices?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to unprecedented levels of government and private sector investment in large-scale infrastructure development, including high-speed railways, extensive metro networks, and vast urban development projects, particularly in rapidly industrializing nations such as China and India. The associated increases in regulatory oversight and compulsory safety requirements for these complex structures further fuel the massive and sustained demand for high-quality geotechnical measuring instruments and comprehensive monitoring solutions in the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager