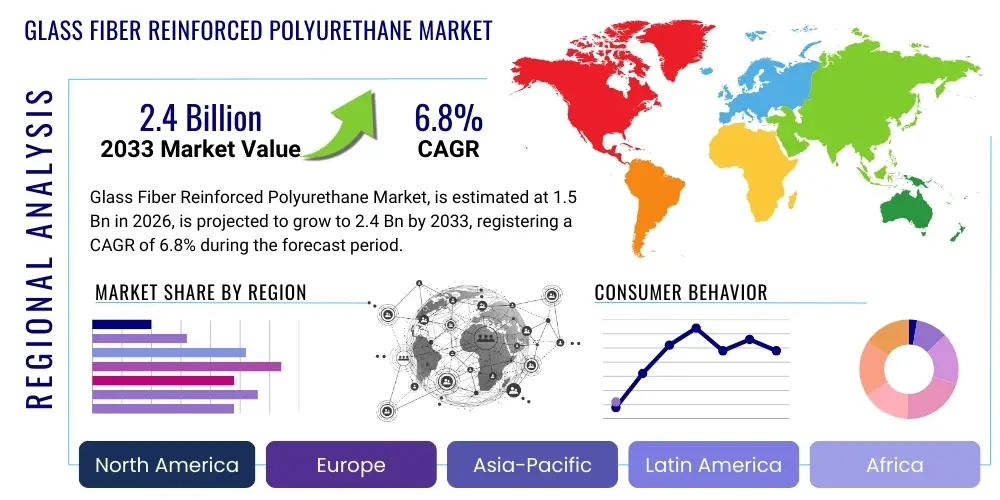

Glass Fiber Reinforced Polyurethane Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442238 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Glass Fiber Reinforced Polyurethane Market Size

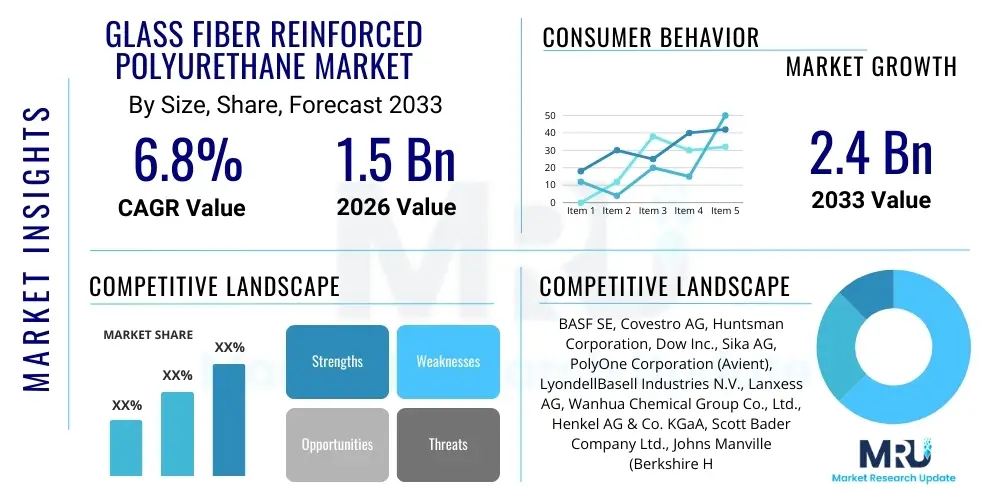

The Glass Fiber Reinforced Polyurethane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Glass Fiber Reinforced Polyurethane Market introduction

The Glass Fiber Reinforced Polyurethane (GFRPu) market encompasses the entire value chain associated with the production, application, and distribution of high-performance composite materials synthesized by incorporating glass fibers into a thermoset polyurethane matrix. Polyurethane, derived from the reaction of polyols and isocyanates, provides exceptional resilience, flexibility, and impact resistance, while the strategically embedded glass fibers—either short, continuous, or woven—deliver paramount stiffness, tensile strength, and structural integrity. This combination yields composites that offer a superior strength-to-weight ratio, essential characteristics for modern engineering applications seeking weight reduction without compromising safety or performance. The sophistication of the material allows for tailored properties through adjustments in fiber loading, orientation, and the chemical structure of the polyurethane backbone, supporting its broad utility in demanding environments and driving its increasing adoption across various global industrial sectors. The material's unique characteristics, combining the high mechanical performance of glass reinforcement with the versatility and low-density attributes of polyurethane, make it a pivotal solution in the transition toward sustainable and efficient material consumption in global manufacturing.

GFRPu materials are processed using specialized methods optimized for reactive systems, predominantly including Reaction Injection Molding (RIM) and various pultrusion techniques. RIM is particularly valued in high-volume industries like automotive manufacturing for producing lightweight exterior body parts such as fenders, bumpers, and spoilers, owing to its ability to yield intricate geometries with excellent surface finish and short cycle times. Pultrusion, conversely, focuses on creating long, constant-cross-section profiles, indispensable for high-stress structural applications in construction (e.g., window and door profiles) and the manufacturing of massive, durable wind turbine blades. The inherent moisture resistance, thermal stability, and low coefficient of thermal expansion of GFRPu further enhance its suitability for exposed outdoor applications, providing longevity and reduced maintenance costs compared to traditional plastic or metal alternatives, thereby promoting its increasing adoption across global industrial sectors. Furthermore, the material exhibits excellent adhesion properties, facilitating hybridization with other materials in multi-material systems, which is increasingly relevant in complex modern assembly processes seeking structural optimization.

The market growth is intrinsically linked to global trends toward sustainable mobility and energy-efficient construction. In the transportation sector, GFRPu plays a critical role in meeting stringent regulatory targets for CO2 emission reduction by facilitating vehicle lightweighting. This factor is particularly salient in the rapidly expanding Electric Vehicle (EV) market, where reducing vehicle mass is directly proportional to extending battery range and performance, leading to the use of GFRPu in battery enclosures and structural elements. Beyond automotive, the material’s structural integrity and resistance to chemical attack drive its use in chemical processing equipment, piping, and maritime components. Continuous innovation in polyurethane chemistry, including the development of low-VOC (volatile organic compound) systems and highly flame-retardant formulations, is further broadening the application scope and reinforcing GFRPu's competitive edge against alternative lightweight composites such as glass fiber reinforced thermoplastics or sheet molding compounds (SMC) based on polyester resins, guaranteeing sustained market expansion and technological leadership in composite materials engineering.

Glass Fiber Reinforced Polyurethane Market Executive Summary

The global Glass Fiber Reinforced Polyurethane market is exhibiting a robust compound annual growth trajectory, primarily fueled by the surging global demand for durable, lightweight materials essential for sustainable development initiatives and regulatory compliance across mature and emerging economies. Key business trends highlight a significant strategic shift toward vertical integration among major chemical producers, aiming to secure the supply chain for precursor materials (polyols and isocyanates) and specialized composite additives, thereby mitigating volatility risks associated with petrochemical sourcing. There is an accelerating pace of consolidation and strategic alliances, particularly between material scientists and high-volume manufacturers, focusing on the joint development of application-specific, high-modulus GFRPu systems designed for complex structural loads. Furthermore, intense research efforts are being directed toward improving recyclability protocols and developing bio-content polyurethanes, aligning the market with global circular economy goals and attracting investments from environmentally conscious end-users seeking greener material solutions that maintain industrial performance standards.

Regionally, the Asia Pacific (APAC) continues to assert its dominance, acting as the epicenter of growth due to massive investments in renewable energy infrastructure, particularly large-scale wind power projects requiring vast amounts of composite materials, and the unparalleled scale of its automotive and construction industries, especially in economic powerhouses like China, Japan, and South Korea. North America and Europe, while being mature markets, are experiencing heightened growth spurred by strict regulatory enforcement of emissions standards and energy conservation mandates. These regions are characterized by technological maturity, high adoption rates of advanced manufacturing processes such as Pultrusion and HP-RIM, and a strong pipeline of innovative applications in aerospace components and advanced structural profiles, positioning them as key centers for high-value composite production and sophisticated material deployment. The European market, in particular, focuses heavily on thermal performance and longevity for construction applications, reinforcing regional composite material specifications.

Analysis of market segments reveals that the automotive and construction sectors collectively represent the largest market share, driven by their critical needs for strength, stiffness, insulation, and corrosion resistance capabilities. Within the fiber type segmentation, continuous glass fiber reinforcement is projected to register the fastest growth, primarily owing to its indispensable role in structural components that require maximum load-bearing capacity and fatigue resistance, such as those found in wind turbine blades and high-end construction profiles demanding decades of service life. Segment trends also indicate a rising demand for GFRPu systems optimized for fire resistance (UL-rated formulations) and enhanced dimensional stability across extreme temperature variations, expanding penetration into specialized industrial and electrical enclosure markets where safety and performance integrity are non-negotiable requirements. This diversification across high-specification segments ensures market resilience against cyclical downturns in any single end-use industry.

AI Impact Analysis on Glass Fiber Reinforced Polyurethane Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the GFRPu market typically center on enhancing material characterization, accelerating the formulation discovery process, and optimizing complex manufacturing workflows to reduce material waste and energy consumption. Users frequently inquire about the feasibility of using machine learning algorithms to predict the mechanical behavior of novel composite blends—varying fiber length, type, and chemical interfaces—without extensive physical prototyping, thereby significantly reducing research and development timelines. A significant area of concern and interest is the application of computer vision and sensor fusion, powered by AI, to ensure real-time, non-destructive quality control (NDQC) during continuous processes like pultrusion and high-pressure injection, aiming to detect and remediate subsurface defects instantly, ensuring impeccable product consistency and reducing waste streams originating from defective batches. The overarching expectation is that AI integration will substantially compress the time-to-market for new GFRPu products while simultaneously elevating final product reliability and operational cost-efficiency across the entire value chain.

The integration of AI into GFRPu R&D is transforming the traditional empirical approach to material science into a highly accurate, data-driven predictive model. AI models are trained on extensive datasets detailing precursor chemistry, processing parameters (temperature, pressure, catalyst levels), and resulting physical properties (tensile strength, impact resistance, glass transition temperature (Tg)). This analytical power allows researchers to rapidly navigate the vast compositional space, identifying optimal polyurethane system components and reinforcement strategies that maximize target performance metrics, such as maximizing modulus while minimizing density, essential for advanced lightweight applications. By deploying AI-driven simulation platforms, companies can accurately model complex phenomena like viscoelastic behavior, creep under load, and long-term environmental degradation, providing unprecedented confidence in material specifications before costly large-scale manufacturing trials commence, thereby revolutionizing the innovation efficiency and technical risk assessment within the GFRPu industry.

In the production landscape, AI is instrumental in achieving operational excellence and boosting profitability, moving manufacturing towards Industry 4.0 standards. Advanced machine learning algorithms monitor hundreds of sensor inputs across RIM and pultrusion lines, predicting equipment failure with high accuracy through sophisticated predictive maintenance routines, thus drastically reducing unplanned downtime and enhancing overall equipment effectiveness (OEE) by proactively scheduling interventions. Furthermore, AI-enabled control systems autonomously adjust process variables—such as mixing ratio precision, mold temperature profiles, and curing times—in real-time to compensate for natural variations in raw material batches or ambient environmental changes. This dynamic adjustment ensures that the output composite consistently meets strict engineering tolerances, minimizing deviation and reinforcing the reputation of GFRPu as a reliable high-quality material for safety-critical applications in automotive and aerospace industries. This capability for instantaneous process optimization represents a paradigm shift from traditional, reactive quality control methodologies, fostering a new standard of material homogeneity.

- AI-driven optimization of polyurethane chemical formulations for enhanced mechanical performance and accelerated cure characteristics.

- Implementation of machine vision systems for automated, real-time quality inspection and structural integrity verification of complex molded and pultruded parts.

- Predictive analytics leveraging historical operational data to forecast equipment maintenance needs, thereby maximizing production uptime and asset utilization in composite manufacturing facilities.

- Use of deep learning models to simulate and predict the long-term aging and fatigue performance of GFRPu components under various thermal, mechanical, and environmental stresses.

- Supply chain optimization using AI to manage volatile raw material procurement and ensure optimal inventory levels for specialized polyols, isocyanates, and glass fibers, enhancing resilience against market shocks.

DRO & Impact Forces Of Glass Fiber Reinforced Polyurethane Market

The core Drivers of the Glass Fiber Reinforced Polyurethane market are fundamentally intertwined with global macro-economic shifts toward sustainable and efficient material consumption, particularly the increasing legislative mandates for lightweighting across the transportation sector. Paramount among these is the regulatory push for vehicle lightweighting globally; mandates established by agencies such as the European Union’s CO2 emission targets and US CAFE standards necessitate material substitution in transport, making GFRPu an attractive, durable alternative to heavy metals and conventional plastics. Furthermore, the accelerating global deployment of wind energy necessitates composites that can withstand extreme fatigue and environmental loading over multi-decade lifecycles, favoring the high-strength, low-maintenance characteristics of GFRPu pultruded components for massive turbine blades. The material's superior insulation and moisture resistance also drive significant adoption within the construction sector, particularly for high-efficiency window and door frames, capitalizing on energy conservation imperatives across residential and commercial building codes globally, further ensuring robust market momentum.

Conversely, the market faces inherent Restraints that require strategic mitigation and technological investment. The primary hurdle is the relatively high upfront capital expenditure required for setting up sophisticated GFRPu manufacturing facilities, particularly those utilizing high-pressure RIM or complex automated pultrusion lines, which limits the entry of smaller firms and favors established chemical giants with extensive financial capacity. Another significant constraint is the complexity and cost associated with post-consumer recycling of thermoset polyurethane composites; though chemical recycling research is advancing, large-scale, economical recycling infrastructure remains underdeveloped compared to thermoplastic systems, posing environmental and logistical challenges in meeting circular economy mandates. Lastly, volatility in the petrochemical feedstock market—affecting the price of crude oil-derived polyols and isocyanates—can introduce significant uncertainties into production costs and compress profit margins, requiring manufacturers to employ complex hedging and long-term contractual procurement agreements to maintain pricing stability.

Significant Opportunities exist in technological innovation and strategic geographical expansion, promising future market growth diversification. The development and commercialization of bio-based polyols derived from sustainable natural oils (e.g., soy, castor, algae) represent a pivotal opportunity to produce 'green' GFRPu, attracting environmentally focused consumers and meeting increasing regulatory demands for sustainable composite solutions, potentially commanding a market premium and unlocking new public sector contracts. Geographically, expanding penetration into emerging markets in Latin America and the Middle East, driven by significant government-backed infrastructure expenditure and rising demand for durable, climate-resistant building materials, offers substantial untapped growth potential. Furthermore, niche applications in specialized industries, such as high-pressure piping for chemical processing, advanced marine structures, and specialized ballistic protection components, demand the unique combination of strength and resilience offered by GFRPu, ensuring diverse and high-value long-term revenue streams beyond the core automotive and construction segments.

The Impact Forces shaping the competitive dynamics are both internal technological advancements and external socio-economic pressures that influence material choice. Technological advances in coupling agent chemistry—improving the fundamental bonding interface between the glass fiber and the polyurethane matrix—are continually elevating the performance ceiling of GFRPu composites, widening their application viability in highly stressed and safety-critical environments. External competitive pressure from rival lightweight materials, such as carbon fiber reinforced plastics (CFRP) in high-end structural uses and advanced engineering thermoplastics in high-volume molded applications, compels continuous cost optimization and innovation within the GFRPu market to maintain cost-effectiveness. Moreover, the shifting geopolitical landscape and evolving trade policies impacting global supply chains for crucial precursor chemicals exert a potent influence on operational costs and regional market pricing, necessitating a flexible and geographically diverse manufacturing footprint for market leaders to ensure consistent material access and cost mitigation.

Segmentation Analysis

The comprehensive segmentation of the Glass Fiber Reinforced Polyurethane market provides a granular view of demand drivers and technological specialization within the industry, enabling targeted strategic investment. Segmentation by fiber type—continuous fiber versus short/chopped fiber—is critical as it delineates the performance capabilities and suitable end-use applications. Continuous fiber systems, typically utilized in pultrusion, deliver maximal unidirectional strength and stiffness, making them indispensable for primary structural elements like load-bearing beams, bridge components, and massive wind turbine spars that require exceptional fatigue life. Conversely, short fibers, often used in Reaction Injection Molding (RIM) or compression molding, facilitate the production of complex, isotropic parts, prioritizing impact resistance, good surface finish, and dimensional stability for automotive exterior components and enclosures where cost-efficiency and quick cycle times are paramount considerations for mass production.

Process segmentation, encompassing RIM, Pultrusion, and Compression Molding, directly reflects the preferred method for achieving specific manufacturing efficiency and handling the geometric complexity required by distinct industries. Reaction Injection Molding (RIM) dominates automotive applications due to its capacity for rapid curing and intricate molding under low pressure, enabling the integration of features and producing large parts with excellent Class A surface finishes suitable for exterior use. Pultrusion, involving the pulling of continuous fibers through a liquid polyurethane bath and a heated die, is the preferred technique for straight profiles that demand exceptional longitudinal strength, thereby serving the construction and utilities markets efficiently with highly corrosion-resistant products. The continuous development of automated systems and process control using digital technologies within these processes is key to maintaining high-volume competitiveness against metallic fabrication and other, slower composite molding techniques, pushing the boundaries of possible part size and complexity.

The end-use industry segmentation confirms the market's reliance on high-volume, performance-critical sectors. The Transportation segment, including both passenger vehicles and heavy commercial transport, remains the largest consumer, driven by ongoing regulatory pressure to reduce vehicle mass and the need for durable, crash-resistant materials. However, the Construction and Infrastructure segment is growing rapidly, propelled by the demand for highly durable, insulating, and low-maintenance materials for modernizing public infrastructure and enhancing building energy performance (e.g., highly insulating thermal break window frames). The Wind Energy sector, focusing on manufacturing increasingly large turbine blades requiring materials with superior fatigue resistance and long service life under constant stress, is emerging as the fastest-growing application segment, underscoring the material’s vital role in the global transition to renewable power sources and affirming the robust, versatile nature of GFRPu composites.

- By Fiber Type:

- Continuous Glass Fiber: Preferred for high-strength structural components requiring maximal stiffness and fatigue resistance, typically processed via pultrusion.

- Short Glass Fiber (Chopped Strand Mat, Milled Fiber): Used in molded parts requiring isotropic strength, impact resistance, and complex geometries, common in RIM applications for automotive panels.

- Woven Roving: Utilized for specialized parts needing multi-directional reinforcement and high impact tolerance, often used in compression molding.

- By Process:

- Reaction Injection Molding (RIM): High-volume, fast-cycle molding for complex automotive and industrial parts requiring integrated features and surface quality.

- Pultrusion: Continuous processing for high-strength, constant cross-section profiles (e.g., structural beams, utility poles, window profiles) demanding high longitudinal rigidity.

- Compression Molding: Used for SMC-like sheet production and large, flat panels requiring high fiber volume fraction and uniform thickness.

- Spray Lay-up: A less automated method, generally reserved for specific, large-format custom applications in specialized low-volume manufacturing sectors.

- By End-Use Industry:

- Automotive & Transportation (Passenger Vehicles, Commercial Vehicles, Rail, Off-Road): Focus on lightweighting, NVH (Noise, Vibration, Harshness) reduction, and crash management structures.

- Construction & Infrastructure (Window Profiles, Door Frames, Rebar, Bridge Components): Demand driven by longevity, superior thermal insulation, and corrosion resistance in exposed environments.

- Wind Energy (Turbine Blades, Nacelle Covers, Structural Spars): Requires extreme fatigue resistance, high strength, and dimensional stability for extended operational periods.

- Electrical & Electronics (Enclosures, Insulators, Housings): Need for flame retardancy, dielectric strength, and dimensional stability under thermal cycling.

- Industrial & Consumer Goods (Machinery Parts, Tanks, Sports Equipment): Customized solutions for durability, chemical inertness, and specific physical characteristics tailored to niche markets.

Value Chain Analysis For Glass Fiber Reinforced Polyurethane Market

The Glass Fiber Reinforced Polyurethane value chain initiates with the upstream supply of essential chemical and reinforcement feedstocks, a stage heavily reliant on large, integrated chemical producers. This initial segment is dominated by manufacturers responsible for producing high-quality polyether and polyester polyols, which form the soft segment of the PU, along with crucial isocyanates (primarily polymeric MDI), which define the hard segment and reactivity. Simultaneously, specialized textile companies manufacture the various forms of glass fiber reinforcement, including continuous roving, chopped strands, and specialized mats, often incorporating proprietary sizing agents crucial for optimal chemical bonding (adhesion) with the polyurethane matrix. The integration of high-purity and consistently performing raw materials at this foundational level is non-negotiable, as deviations in precursor quality can dramatically affect the final composite material's mechanical properties, making the upstream market characterized by strict ISO certifications, rigorous quality control standards, and often long-term contractual agreements between feedstock suppliers and composite compounders.

Moving downstream, the value chain progresses to the compounding and processing stage, where material formulators and component manufacturers operate. Compounders develop the specific, application-ready polyurethane systems, often custom-blended with performance-enhancing additives such as catalysts, blowing agents, specialized fire retardants, UV stabilizers, and advanced coupling agents tailored for the chosen manufacturing process (e.g., RIM, pultrusion). Component manufacturers then transform these systems into finished parts using highly specialized and capital-intensive machinery. Direct channels involve these component manufacturers selling finished parts directly to large Original Equipment Manufacturers (OEMs), particularly in the automotive and wind energy sectors, where customized design, high-volume consistency, and complex quality assurance necessitate close technical collaboration and supply chain integration. This direct model simplifies logistics for bespoke components and ensures rapid feedback loops regarding performance adjustments, crucial for maintaining OEM assembly line schedules.

Conversely, indirect distribution channels are more prevalent for standardized GFRPu products, such as construction profiles, commodity industrial parts, and general consumer goods components where high customization is not required. In this model, finished products are moved through a network of specialized composite distributors, regional wholesalers, and building material suppliers who handle inventory management and localized logistics, providing essential just-in-time delivery services. These indirect partners provide essential technical support and immediate stock availability to smaller fabrication shops and construction contractors who cannot purchase directly in OEM volumes. Efficient management of the downstream logistics, including minimizing transportation costs and ensuring regional stock availability, is essential for capitalizing on localized market opportunities and maintaining competitive pricing for standardized GFRPu goods, contributing to market depth and accessibility across varied geographical regions.

Glass Fiber Reinforced Polyurethane Market Potential Customers

The primary cohort of potential customers for Glass Fiber Reinforced Polyurethane materials is comprised of major players in the global automotive manufacturing ecosystem, including Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers. These customers utilize GFRPu extensively for weight reduction applications, notably in external body panels such as roofs, fenders, and liftgates, as well as crucial internal components like structural supports, underbody shielding, and specialized battery housing units, especially in the fast-evolving electric vehicle segment where mass reduction is critical for range optimization. Their purchasing decisions are heavily influenced by a material's capacity to meet rigorous safety standards (e.g., crash management zones), specific lightweighting targets, and the manufacturing process’s ability to deliver consistent, certified quality at high volumes and competitive cycle times, making GFRPu system suppliers with strong technical support and localized manufacturing capabilities highly favored partners.

A second substantial customer base resides within the commercial and residential construction industry, encompassing general contractors, specialty window and door manufacturers, and large infrastructure developers. For these customers, GFRPu's appeal lies in its exceptional thermal insulating properties (low U-factors which meet energy codes), high durability against weathering, and intrinsic corrosion resistance, particularly for applications like pultruded window and door profiles, and composite rebar used in coastal or high-corrosion environments where steel longevity is compromised. These buyers prioritize materials that offer long-term performance guarantees, contribute positively to building energy efficiency certifications (like LEED and Passive House standards), and comply strictly with regional fire safety and structural building codes, focusing heavily on lifecycle cost benefits and minimizing long-term maintenance rather than solely on upfront material costs, recognizing the material's superior longevity.

Furthermore, the rapidly expanding renewable energy sector, specifically manufacturers of wind power generation equipment and ancillary components, constitutes a highly strategic and high-growth customer segment. These companies require vast, highly engineered composite structures, most notably for the spars and shells of multi-megawatt turbine blades, where GFRPu offers the necessary balance of rigidity, low mass, and supreme fatigue resistance required to withstand continuous loading for over multi-decade service periods in harsh environments (both onshore and offshore). Other key customers include specialized industrial manufacturers utilizing GFRPu for chemical resistance (tanks, process piping), electrical insulation (switchgear housing), and high-performance sectors like marine and rail transport applications requiring tailored strength profiles and inherent flame retardancy. These niche customers often require highly customized GFRPu formulations, making them prime targets for suppliers capable of providing bespoke material science solutions and specialized small-batch production.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Covestro AG, Huntsman Corporation, Dow Inc., Sika AG, PolyOne Corporation (Avient), LyondellBasell Industries N.V., Lanxess AG, Wanhua Chemical Group Co., Ltd., Henkel AG & Co. KGaA, Scott Bader Company Ltd., Johns Manville (Berkshire Hathaway), Owens Corning, Teijin Limited, Toray Industries, Inc., Gurit Holding AG, Mitsubishi Chemical Corporation, SABIC, Reichhold LLC, Arkema S.A., Hexion Inc., AOC Resins |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glass Fiber Reinforced Polyurethane Market Key Technology Landscape

The technological evolution within the Glass Fiber Reinforced Polyurethane market is centered on enhancing material efficiency, optimizing manufacturing speed, and broadening the application envelope through advanced chemistry and process control. Reaction Injection Molding (RIM) technology has progressed significantly, shifting towards High-Pressure RIM (HP-RIM) systems which offer superior mixing quality of the highly reactive components, leading to faster polymerization and significantly shorter demolding times—critical for economic viability in mass production environments like automotive assembly. Recent technological advancements include the integration of highly effective, permanent internal mold release (IMR) agents directly into the polyurethane formulation, drastically reducing the need for external mold preparation between cycles, thus boosting production throughput, minimizing operational labor requirements, and enhancing overall surface quality of the final GFRPu components produced.

In parallel, Pultrusion technology has seen transformative improvements focused on increasing processing speed and ensuring composite consistency, essential for the continuous production of large structural profiles required by the construction and renewable energy (wind) sectors. Manufacturers are deploying advanced die heating and cooling control systems, often regulated by sophisticated AI-enhanced monitoring, to precisely manage the exotherm and cure profile of the polyurethane resin as it passes through the die, ensuring optimal fiber wet-out and preventing internal stress or micro-void formation which can compromise structural integrity. The key differentiator remains the continuous research and development into novel coupling agent chemistry. These specialized sizing agents, applied to the glass fiber surface, dramatically improve the interfacial shear strength between the reinforcement and the polymer matrix, which is paramount for components subjected to high fatigue loading and demanding structural performance requirements over extended service periods, such as large wind turbine blade spars.

Furthermore, the material science landscape is witnessing profound innovation in polyurethane chemistry itself, driven by sustainability and safety requirements. There is a concerted industry effort to develop advanced flame-retardant (FR) GFRPu systems that meet stringent fire safety standards (e.g., European EN 45545-2 for rail and UL 94 V-0 for electronics) without significantly compromising mechanical integrity or substantially increasing the material density, thereby unlocking new applications in specialized transportation and electrical enclosures. Simultaneously, advancements in digital manufacturing, particularly the adoption of Digital Twin technology and sophisticated simulation software (CFD and FEA), enable manufacturers to virtualize and optimize the entire production process—from mold filling simulation in RIM to detailed stress analysis in a pultruded beam—reducing the need for expensive physical prototypes, accelerating the introduction of highly complex, structurally optimized GFRPu parts into the highly competitive and regulated marketplace, ensuring performance validation before mass production.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market due to unprecedented levels of construction activity, rapid urbanization, and its established status as the global manufacturing hub for automobiles, electric vehicles, and electronics. China, in particular, drives immense demand for GFRPu in massive wind energy projects and infrastructure upgrades. Favorable government policies supporting domestic manufacturing and foreign investment further catalyze the widespread adoption of high-performance composites across the region’s diverse industrial base, reflected by substantial investments in high-speed, automated pultrusion and RIM lines to meet scaling demand.

- North America: The market here is mature and characterized by high technological sophistication and a demand for premium materials. Growth is robustly supported by strict federal regulations promoting vehicle efficiency (fuel economy and emissions) and mandatory standards for energy-efficient commercial and residential buildings. The US and Canada are major consumers of GFRPu for structural components in the aerospace industry, advanced military applications, and the swiftly expanding North American electric vehicle manufacturing ecosystem, demanding certified, reliable composite materials that offer superior long-term performance in diverse climates.

- Europe: Europe maintains a significant market share, distinguished by its leadership in sustainability, circular economy initiatives, and highly stringent green building standards. Strong demand emanates from the German automotive sector for structural components and widespread adoption of highly insulating GFRPu window and door profiles across the continent, driven by thermal efficiency mandates. Furthermore, Europe's dominant position in offshore wind farm development drives immense demand for highly durable, fatigue-resistant, continuous glass fiber reinforced pultruded structures, with innovation focusing on maximizing component service life and adherence to rigorous fire and safety standards.

- Latin America (LAMEA): This emerging region offers steady growth potential, concentrated primarily in major economies like Brazil and Mexico, fueled by recovering automotive production volumes and necessary modernizations in public infrastructure and utilities. The demand is often concentrated in applications where durability and corrosion resistance are key, such as public transport elements and specialized industrial facilities, providing a reliable alternative to conventional materials prone to rapid degradation in challenging tropical or subtropical climates, emphasizing GFRPu’s lifecycle value.

- Middle East and Africa (MEA): Growth in MEA is primarily project-driven, linked to large-scale, state-funded construction and economic diversification megaprojects in the GCC countries. GFRPu is highly valued here for its resistance to extreme heat, intense UV degradation, and corrosive salts in coastal zones, making it an excellent material choice for external building elements, specialized piping systems, and industrial infrastructure. Significant demand is also generated by the necessity for highly insulated building envelopes to reduce extreme energy consumption for air conditioning, where GFRPu profiles offer outstanding thermal break performance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glass Fiber Reinforced Polyurethane Market.- BASF SE

- Covestro AG

- Huntsman Corporation

- Dow Inc.

- Sika AG

- PolyOne Corporation (Avient)

- LyondellBasell Industries N.V.

- Lanxess AG

- Wanhua Chemical Group Co., Ltd.

- Henkel AG & Co. KGaA

- Scott Bader Company Ltd.

- Johns Manville (Berkshire Hathaway)

- Owens Corning

- Teijin Limited

- Toray Industries, Inc.

- Gurit Holding AG

- Mitsubishi Chemical Corporation

- SABIC

- Reichhold LLC

- Arkema S.A.

- Hexion Inc.

- AOC Resins

- Ariel Corporation

- Bayer MaterialScience AG (now Covestro)

Frequently Asked Questions

Analyze common user questions about the Glass Fiber Reinforced Polyurethane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Glass Fiber Reinforced Polyurethane (GFRPu) over traditional composites?

GFRPu systems offer exceptional dynamic performance characteristics, including high impact energy absorption, superior rigidity at low density, and faster processability via Reaction Injection Molding (RIM). These attributes make it highly advantageous for applications requiring excellent durability, thermal stability, and essential lightweighting in transportation sectors.

Which end-use industry drives the highest demand for GFRPu?

The Automotive and Transportation sector is the single largest consumer of GFRPu, driven by global regulatory requirements for reduced vehicle emissions and the critical need for weight compensation in electric vehicle (EV) battery packs to maximize driving range and overall energy efficiency.

Is Glass Fiber Reinforced Polyurethane difficult to recycle?

While GFRPu, being a thermoset, is technically challenging to recycle compared to thermoplastics, ongoing innovation in advanced mechanical processing and chemical recycling methods (such as solvolysis or glycolysis) is improving the material's recyclability profile, addressing long-term sustainability concerns in the industry and supporting circular economy objectives.

What is the role of Reaction Injection Molding (RIM) in the GFRPu market?

RIM is the dominant processing method for high-volume GFRPu parts, facilitating rapid production cycles and the creation of complex, detailed geometries with excellent surface quality under low pressure. This efficiency is crucial for meeting the just-in-time production demands of the automotive and mass-produced industrial components markets globally.

Which region shows the fastest projected growth in the GFRPu market?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest growth rate, fueled by aggressive infrastructural spending, the rapid expansion of the manufacturing base for both conventional and electric vehicles, and massive investments into large-scale renewable energy infrastructure projects, particularly in China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager