Glass Floor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443059 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Glass Floor Market Size

The Glass Floor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing global emphasis on innovative architectural designs that prioritize natural light infusion and visual connectivity within built environments, particularly in high-end commercial and public infrastructure projects. The structural integrity and enhanced safety features of modern laminated and tempered glass products have successfully addressed historical concerns regarding durability, positioning glass flooring as a premium, viable construction material for load-bearing applications.

Glass Floor Market introduction

The Glass Floor Market encompasses the design, manufacture, and installation of load-bearing glass panels used as flooring elements in various structures. These floors, often constructed using multi-layered laminated safety glass or highly tempered glass, are integrated into commercial complexes, residential luxury homes, museums, and public spaces to enhance aesthetic appeal, maximize natural daylight penetration, and create visually striking architectural features. The primary product description centers on highly engineered glass systems that must meet stringent building codes for impact resistance, load capacity, and anti-slip properties, differentiating them significantly from standard architectural glazing. Key applications span across retail areas seeking high visual impact, corporate headquarters requiring open-plan aesthetics, and historical renovations aiming to expose underlying structures while maintaining accessibility.

Major applications of glass flooring are broadly categorized into architectural features, where the primary function is aesthetic enhancement, and structural elements, where the floor serves as a primary walkway or mezzanine level. The inherent benefits, such as superior light transmission and the perception of increased space, coupled with modern fabrication techniques allowing for various finishes (e.g., frosted, textured, or switchable glass), are accelerating adoption. Furthermore, the ability of glass floors to integrate seamlessly with lighting systems offers unparalleled design flexibility, contributing significantly to modern interior design trends that favor transparency and minimalism.

Driving factors contributing to the market's robust growth include the global surge in luxurious commercial construction projects, rising disposable incomes leading to higher investment in sophisticated residential architecture, and continuous advancements in glass manufacturing technology that enhance durability and safety. Stricter global safety regulations pertaining to public access areas mandate the use of highly secure laminated safety glass assemblies, reducing liability concerns for developers and increasing confidence in the material's structural performance. The aesthetic advantage, coupled with certified structural reliability, cements glass flooring as a crucial component of contemporary sustainable and visually striking architecture.

Glass Floor Market Executive Summary

The Glass Floor Market Executive Summary confirms a trajectory of high growth, primarily fueled by sustained investment in commercial real estate development across emerging economies and the escalating demand for unique, high-value architectural solutions. Business trends indicate a significant shift toward customizable glass solutions, integrating specialized features such as anti-slip coatings, heating elements, and smart glass technology, positioning the market away from standardized products toward bespoke, project-specific installations. Key stakeholders, including glass manufacturers and specialized installers, are focusing on strategic partnerships with architecture and engineering firms (A&E) to ensure early involvement in complex, large-scale projects, thereby securing market share and dictating technological implementation standards.

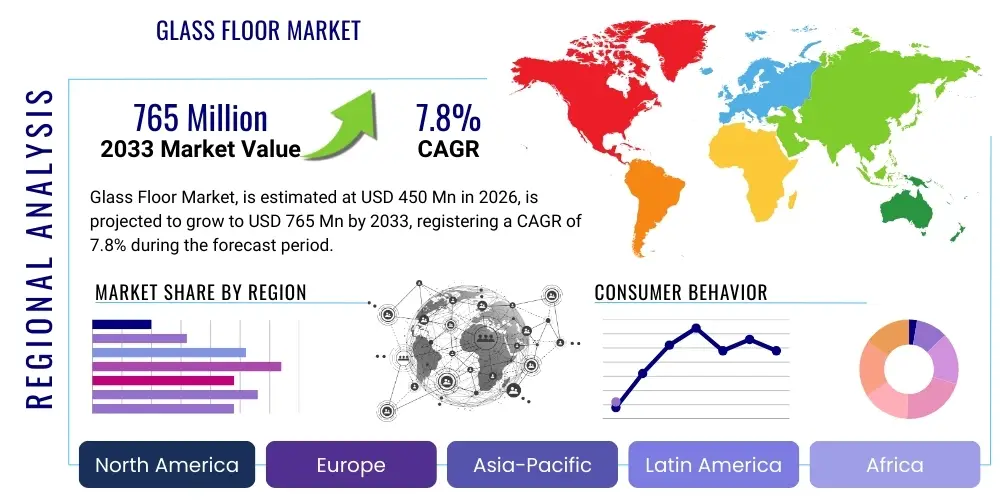

Regionally, the market dynamics are heavily skewed towards Asia Pacific (APAC) due to the unprecedented pace of urbanization and the construction of massive commercial and governmental infrastructure projects in countries like China and India. North America and Europe, while mature markets, demonstrate growth through renovation and refurbishment activities, particularly in high-traffic urban centers where developers seek to modernize existing structures using light-enhancing materials. Regional trends also show varying regulatory adoption rates; Europe leads in implementing rigorous safety standards (e.g., requiring specific load calculations and testing protocols), influencing product development globally towards ultra-high-strength laminated glass assemblies.

Segment trends highlight the dominance of the Laminated Glass segment, which is universally preferred for its superior safety characteristics, preventing catastrophic failure through the interlayer film. Application analysis shows that the Commercial sector, encompassing retail centers, corporate towers, and hotels, remains the largest revenue generator, driven by the necessity for striking visual elements that attract clientele. Moving forward, the residential segment is expected to exhibit the fastest growth rate, spurred by the integration of glass flooring into luxury penthouse designs and modern home renovations that emphasize open-plan living and maximum natural light exposure.

AI Impact Analysis on Glass Floor Market

Common user questions regarding AI's impact on the Glass Floor Market revolve primarily around three core themes: the potential for AI-driven parametric design in complex architectural structures, the optimization of manufacturing processes to minimize material waste and enhance precision, and the integration of predictive maintenance and smart features within installed glass systems. Users frequently inquire about how AI algorithms can simulate real-world load distribution and environmental stresses on large glass panels, ensuring optimal safety factors without over-engineering. There is also significant user interest in how AI can streamline the complex supply chain, from raw material sourcing (silica sand, PVB/SGP interlayers) to just-in-time delivery for large, precision-dependent installation projects. The overriding expectation is that AI will reduce costs, accelerate design cycles, and significantly enhance the structural reliability and longevity of glass floor installations globally.

AI is beginning to revolutionize the glass floor manufacturing pipeline, particularly in quality control and customization. Machine learning models are being deployed to analyze sensor data during the lamination and tempering processes, identifying minute defects or inconsistencies that human inspectors might miss. This proactive quality assurance dramatically reduces product failure rates and ensures compliance with strict international load-bearing standards, which is critical for structural glass components. Furthermore, generative design algorithms powered by AI allow architects to input functional and aesthetic constraints, quickly generating multiple complex glass floor geometries that optimize light transmission and structural stability simultaneously, drastically shortening the time required for structural engineering sign-off.

In the application phase, AI is integral to the development of 'smart' glass floors. While currently niche, the potential integration of pressure sensors and data analysis platforms allows for real-time monitoring of foot traffic and structural loads, enabling predictive maintenance schedules. AI can analyze usage patterns to detect anomalous stress points or gradual structural shifts, alerting maintenance crews before issues become critical. This not only enhances user safety but also increases the operational lifespan of the installation, lowering overall lifetime ownership costs for commercial property owners. This move towards intelligent structural monitoring represents a major future growth avenue enabled by AI integration.

- AI-driven Parametric Design: Optimizes complex load-bearing glass structures, accelerating architectural planning.

- Automated Quality Control: Machine learning detects micro-defects in lamination and tempering processes, ensuring structural compliance.

- Predictive Maintenance Systems: Utilizes real-time sensor data and AI analytics to forecast potential structural failures based on usage and stress.

- Supply Chain Optimization: AI algorithms manage inventory of specialized interlayers and glass types, improving material flow for bespoke projects.

- Smart Glass Integration: Facilitates the development of interactive or switchable glass flooring systems managed by intelligent algorithms.

DRO & Impact Forces Of Glass Floor Market

The market's dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces. Key drivers include the escalating global demand for aesthetically pleasing and unique architectural features in both commercial and high-end residential sectors. Architects increasingly specify glass floors to achieve visual transparency, maximize spatial perception, and enhance natural light distribution within confined urban structures. This architectural trend is strongly supported by advancements in high-strength glass technology, particularly the use of SentryGlas Plus (SGP) interlayers, which offer superior rigidity and post-breakage performance compared to traditional PVB interlayers, thus mitigating safety concerns and broadening application scope.

However, the market faces considerable restraints. The primary challenge is the high upfront cost associated with the material, manufacturing, and specialized installation of structural glass floors compared to conventional flooring materials like concrete or timber. Furthermore, maintenance requirements, specifically related to cleaning and the potential for surface scratching in high-traffic areas, deter some potential adopters. Complexity in adhering to stringent, sometimes conflicting, international and local building codes for load-bearing glass structures also acts as a restraint, requiring specialized engineering oversight that increases project complexity and costs.

Opportunities for market expansion are abundant, particularly through technological innovation and geographical diversification. The opportunity to integrate functional technologies, such as anti-slip coatings, LED lighting, heating elements, and photovoltaic elements into glass panels, creates high-value niche products. Additionally, emerging markets in Asia and the Middle East, characterized by ambitious construction programs for skyscrapers, retail malls, and luxury resorts, present untapped potential for large-scale installation of structural glass elements. The development of standardized, modular glass floor systems that simplify installation and potentially reduce overall costs offers a promising avenue for market penetration into mid-range construction projects.

Segmentation Analysis

The Glass Floor Market is intricately segmented based on material composition, application area, and end-user type, allowing for precise market targeting and product differentiation. Understanding these segments is crucial for manufacturers developing specialized glass products, such as those requiring ultra-high impact resistance or specific fire ratings. The market analysis reveals a clear preference for safety-enhanced products, primarily driving the laminated glass segment's market share, while the application analysis underscores the critical role of commercial infrastructure in driving immediate revenue growth. Future segmentation strategies will likely incorporate distinctions based on smart features, such as switchable transparency or integrated digital displays, reflecting evolving technological capabilities and client demands.

- By Type:

- Laminated Glass Floor

- Tempered Glass Floor

- Laminated Tempered Glass Floor (Structural)

- Heat-Strengthened Glass Floor

- By Application:

- Commercial Buildings (Retail, Corporate, Hospitality)

- Residential Buildings (Luxury Homes, Penthouses)

- Public Infrastructure (Museums, Airports, Bridges)

- Industrial Facilities (Observation Decks, Specific Zones)

- By End-User:

- New Construction Projects

- Renovation and Retrofitting Projects

- By Interlayer Material:

- Polyvinyl Butyral (PVB)

- SentryGlas Plus (SGP)

- Ethylene-Vinyl Acetate (EVA)

Value Chain Analysis For Glass Floor Market

The value chain for the Glass Floor Market is characterized by highly technical processes spanning raw material extraction to specialized installation. The upstream segment involves the sourcing of primary materials, mainly high-quality silica sand, which is critical for producing architectural-grade float glass. It also includes the procurement of specialized polymeric interlayers (such as PVB, EVA, or the higher-performance SGP film), which are essential for creating the laminated assembly that provides structural integrity and safety. Consolidation in the raw glass manufacturing sector means that glass floor producers often rely on a few large global suppliers for the base glass sheets, introducing a moderate level of supply risk depending on commodity price fluctuations and capacity utilization.

The midstream segment, fabrication and processing, represents the highest value-add stage. This involves precise cutting, edge working, tempering (heat treating), and the critical lamination process, which binds multiple glass layers together under heat and pressure. Manufacturers specializing in structural glass must invest heavily in advanced lamination ovens and quality control testing facilities to ensure the final product meets rigorous load-bearing and impact resistance standards (e.g., ASTM or European standards). The complexity of bespoke projects often necessitates customized engineering and testing for each unique installation, driving up the costs in this stage.

The downstream segment focuses on distribution, logistics, and installation. Due to the weight, fragility, and specific dimensions of glass floor panels, distribution channels are often direct or semi-direct, bypassing broad wholesale networks. Direct sales involve manufacturers collaborating directly with large construction firms or specialized architectural design houses. Indirect channels utilize specialized glass distributors equipped with the capacity to handle large, fragile components and provide localized support. Installation is a highly specialized task performed by contractors certified in structural glass installation, given the critical safety implications, thereby creating a distinct, high-margin service sector within the overall market.

Glass Floor Market Potential Customers

Potential customers for the Glass Floor Market are predominantly large organizations and affluent individuals involved in high-value construction and design projects where aesthetics and architectural novelty are paramount considerations. The primary end-users fall within the institutional and high-end commercial segments, seeking unique branding opportunities and enhanced user experience through innovative structural design. These buyers possess substantial project budgets and a willingness to invest in materials that offer long-term architectural distinction and superior light management capabilities, often prioritizing safety and durability certifications above initial material cost.

Architectural firms and specialized structural engineering consultancies frequently serve as crucial gatekeepers, dictating product specifications and material selection based on project requirements and design vision. These professionals rely heavily on technical data, load testing documentation, and established track records of glass floor manufacturers. Consequently, marketing efforts must target these influencers by providing comprehensive technical support, project case studies, and compliance documentation demonstrating adherence to global structural safety standards, making them indirect but highly critical potential customers.

Direct buyers include luxury residential developers focusing on premium housing markets (penthouse towers, custom villas), high-profile hospitality groups (boutique hotels, resorts), and public sector entities managing high-traffic assets such as museums, art galleries, and modern transportation hubs. These end-users are primarily motivated by the floor's ability to create memorable, dramatic spaces while meeting strict public safety and maintenance criteria, making robust laminated and anti-slip options highly desirable across all purchasing categories.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Guardian Glass, Saint-Gobain, AGC Inc., Pilkington (NSG Group), Schott AG, Corning Incorporated, Sika AG, sedak GmbH & Co. KG, G&L & Sons Glass Co. Inc., Technical Glass Products (TGP), Bendheim, JE Berkowitz, Novum Structures, ESCO, Pulp Studio |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glass Floor Market Key Technology Landscape

The technology landscape of the Glass Floor Market is defined by continuous innovation aimed at enhancing safety, durability, and functional integration. A pivotal technological advancement is the widespread adoption of SentryGlas Plus (SGP) interlayers in laminated glass assemblies. SGP, a proprietary ionoplast polymer, offers significantly higher rigidity, strength, and post-breakage residual load-bearing capacity compared to traditional Polyvinyl Butyral (PVB). This advancement allows for the construction of larger, thinner, and structurally safer glass panels, meeting the increasing architectural demand for expansive, seamless glass surfaces while adhering to strict structural engineering requirements.

Another crucial area of innovation is in surface treatments, specifically the development of highly durable anti-slip coatings and etching techniques. Since standard glass surfaces pose inherent slip hazards, manufacturers employ specialized ceramic frit application, chemical etching, or nano-coating technologies to create textured, high-friction surfaces that comply with global slip resistance standards (e.g., PTV, R rating systems). These treatments must be highly resistant to wear from heavy foot traffic, ensuring long-term safety and maintaining the aesthetic clarity or desired opaqueness of the floor system. The integration of these anti-slip solutions is now a mandatory feature for most public and commercial glass floor installations.

Furthermore, the market is witnessing the emergence of advanced structural support systems and smart integration technologies. Structural solutions include proprietary point-supported glass systems (using specialized fasteners and spider fittings) and completely monolithic structural glass assemblies that rely solely on the rigidity of the multi-layered laminated panel. In the realm of smart technology, research is focused on integrating electrochromic or switchable glass elements that allow the user to control the opacity of the floor (offering privacy on demand) or embed LED lighting and interactive display layers within the lamination, transforming the floor into a dynamic, functional architectural element capable of displaying media or directional cues.

Regional Highlights

The regional analysis reveals distinct growth patterns influenced by architectural trends, regulatory environments, and construction activity levels. North America (NA) represents a mature market characterized by high regulatory adherence and strong demand for premium, custom glass solutions, particularly within the hospitality and high-end retail sectors. The market growth here is driven primarily by refurbishment projects in major metropolitan areas, focusing on sustainable design and innovative interior architecture. Specialized suppliers in the U.S. and Canada focus on producing complex, thermally efficient laminated glass assemblies that meet stringent seismic and hurricane safety standards, offering high-margin products.

Europe stands as a leader in implementing robust safety and environmental standards, significantly influencing product development towards highly sustainable and energy-efficient structural glass. Countries like Germany and the UK exhibit high adoption rates, particularly in public spaces and historical building renovations where maintaining the integrity of the existing structure while introducing modern, light-enhancing elements is crucial. The European market emphasizes precision engineering and aesthetic integration, favoring manufacturers who can provide comprehensive structural warranties and compliance certifications across multiple European Union member states.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period, powered by massive infrastructural investments and rapid commercial development. China, India, and Southeast Asian nations are undergoing large-scale urbanization, fueling demand for modern, visually striking building materials. This region is highly receptive to innovative architectural statements, leading to widespread adoption in new skyscraper construction, luxury malls, and entertainment complexes. While price sensitivity remains a factor, the sheer volume of construction activity ensures APAC's dominance in market share expansion. The Middle East and Africa (MEA) also show strong potential, driven by ambitious mega-projects in the GCC nations that require unique, high-value architectural features, positioning them as key emerging centers for custom structural glass installations.

- Asia Pacific (APAC): Highest projected CAGR due to unprecedented commercial and public infrastructure construction booms in China and India. Focus on large-scale, high-visibility projects.

- North America (NA): Mature market focusing on high-end custom installations, renovation projects, and adherence to rigorous safety standards (e.g., impact and seismic resistance).

- Europe: Leading market for structural safety compliance, emphasizing sustainable manufacturing and high-precision engineering in both new builds and historical renovations.

- Middle East & Africa (MEA): Emerging market driven by luxury architectural projects and government-backed mega-developments in the Gulf Cooperation Council (GCC) states.

- Latin America: Gradual adoption driven by increasing investment in modern commercial spaces and specialized architectural projects, though regulatory standards vary significantly.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glass Floor Market, highlighting their strategic initiatives, technological contributions, and market positioning.- Guardian Glass

- Saint-Gobain

- AGC Inc.

- Pilkington (NSG Group)

- Schott AG

- Corning Incorporated

- Sika AG (Interlayer Specialist)

- sedak GmbH & Co. KG

- G&L & Sons Glass Co. Inc.

- Technical Glass Products (TGP)

- Bendheim

- JE Berkowitz

- Novum Structures

- ESCO

- Pulp Studio

- Trosifol (Kuraray Group)

- Interpane Glas Industrie AG

- Vitrocsa

- Sky-Frame

- Dlubak Glass Co.

Frequently Asked Questions

Analyze common user questions about the Glass Floor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What type of glass is structurally required for safe glass flooring?

Structural glass floors must utilize multi-layered laminated safety glass, often incorporating three or more plies of tempered or heat-strengthened glass bonded with highly rigid interlayers, such as SentryGlas Plus (SGP), to ensure the assembly maintains load-bearing capacity even after primary glass layer failure.

Are glass floors slippery, and how is anti-slip compliance achieved?

Standard annealed glass is inherently slippery. Compliance is achieved through specialized surface treatments, including ceramic frit application, acid etching, or permanent anti-slip coatings, which increase surface friction and texture to meet established international pedestrian safety standards (e.g., OSHA, DIN 51097).

What is the typical lifespan and maintenance requirement of a commercial glass floor installation?

A properly installed, high-quality laminated glass floor system has a structural lifespan comparable to the building itself (50+ years). Maintenance primarily involves routine cleaning and periodic inspection of sealants and support structures; the glass panels themselves are highly durable against wear, especially when equipped with scratch-resistant coatings.

How does the cost of glass flooring compare to traditional flooring materials?

Glass flooring typically incurs a significantly higher upfront cost (material, fabrication, and specialized installation) compared to standard concrete, wood, or tile. However, this high initial investment is often justified by the unique aesthetic value, superior light transmission benefits, and long-term architectural distinction provided by the structural glass system.

Which geographic region currently dominates the adoption of structural glass floors?

The Asia Pacific (APAC) region currently exhibits the highest growth and adoption rate, driven by expansive new commercial and public infrastructure projects and a strong appetite for modern, transparent architectural designs in major developing economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager