Glass Mat Reinforced Thermoplastic Composite Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442401 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Glass Mat Reinforced Thermoplastic Composite Market Size

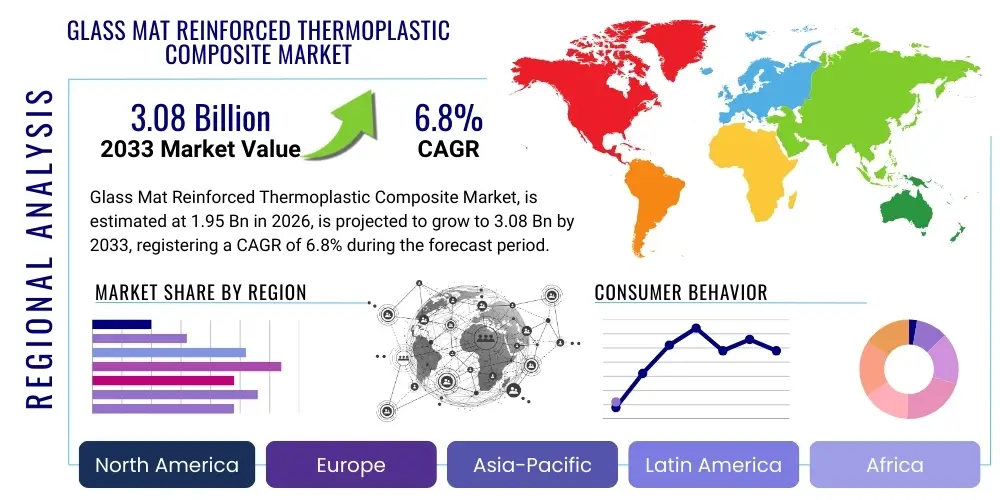

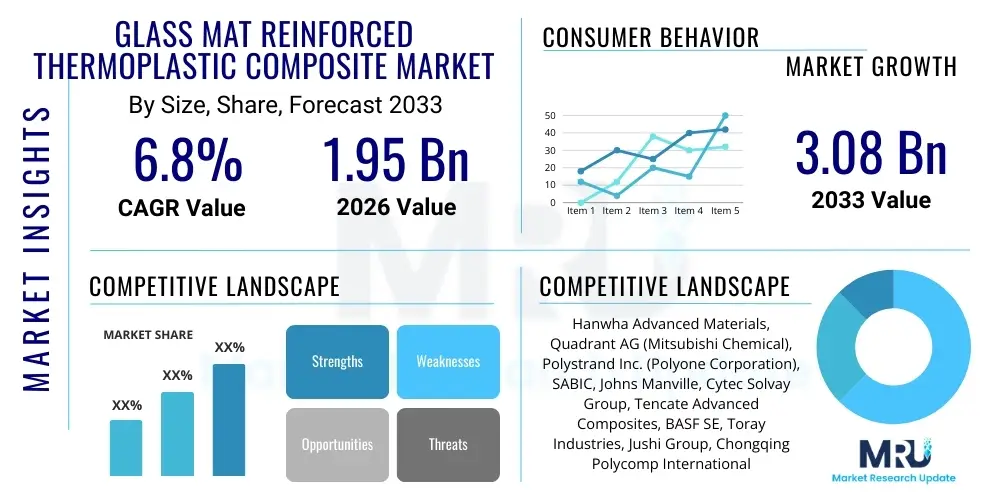

The Glass Mat Reinforced Thermoplastic Composite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $3.08 Billion by the end of the forecast period in 2033.

Glass Mat Reinforced Thermoplastic Composite Market introduction

The Glass Mat Reinforced Thermoplastic (GMT) composite market encompasses the production, distribution, and application of advanced composite materials characterized by continuous glass fiber mats embedded within a thermoplastic matrix, typically polypropylene (PP), polyamide (PA), or polyethylene terephthalate (PET). These materials are prized for their exceptional mechanical strength, superior impact resistance, low weight, and inherent recyclability, positioning them as critical alternatives to traditional metallic and thermoset materials across demanding industries. The specific structure of the glass mat reinforcement provides isotropic or near-isotropic properties in the molded part, which is a significant advantage over short-fiber reinforced compounds, particularly in applications requiring high energy absorption and structural integrity.

Product descriptions of GMT composites typically emphasize their ease of processing through conventional high-volume methods such as compression molding, enabling rapid cycle times crucial for automotive mass production. Unlike thermoset composites that require long curing times, GMT materials can be heated, molded, and cooled quickly, drastically enhancing manufacturing efficiency and reducing overall system costs. Major applications span structural components in the automotive sector, including bumper beams, front-end modules, seat structures, and underbody shields, where weight reduction directly translates to improved fuel efficiency and reduced emissions. Furthermore, the material’s resistance to corrosion and harsh environmental factors extends its utility into electrical and construction industries.

The core benefits driving market adoption include significant weight reduction compared to steel or aluminum, offering a substantial advantage in electric vehicle (EV) manufacturing where battery weight optimization is paramount. The recyclability of thermoplastic matrices addresses growing environmental and regulatory pressures for sustainable material usage in manufacturing. The market expansion is primarily driven by stringent regulations regarding vehicle emissions and safety standards, which necessitate lighter yet stronger materials. Additionally, technological advancements in compounding and molding processes, coupled with the development of novel matrix materials offering enhanced thermal stability, are further propelling the integration of GMT composites into new high-performance applications previously dominated by metals.

Glass Mat Reinforced Thermoplastic Composite Market Executive Summary

The Glass Mat Reinforced Thermoplastic (GMT) Composite Market is characterized by robust growth, primarily fueled by the accelerating global transition within the automotive industry toward electric and lightweight vehicles. Business trends highlight strategic capacity expansions by key manufacturers in high-growth regions, particularly Asia Pacific, focusing on establishing localized supply chains to serve major original equipment manufacturers (OEMs). There is a noticeable trend towards incorporating bio-based or recycled content into thermoplastic matrices, driven by corporate sustainability mandates and consumer demand for circular economy solutions. Furthermore, partnerships between material suppliers and Tier 1 automotive parts manufacturers are intensifying, aiming to co-develop specialized GMT formulations that meet increasingly strict performance criteria for structural battery casings and internal structural components in new vehicle architectures.

Regional trends indicate that Asia Pacific holds the dominant market share, largely due to the massive scale of automotive production in China, Japan, and South Korea, coupled with rapidly expanding infrastructure and construction activities requiring lightweight, durable materials. North America and Europe are experiencing steady growth, driven by stringent carbon emission standards (e.g., CAFE standards in the US and Euro 7 in the EU), which necessitate the deep integration of lightweight composites. European growth is also supported by advanced research and development initiatives focused on high-performance polyamide-based GMTs suitable for under-the-hood applications where thermal management is critical. The mature manufacturing ecosystems in these regions facilitate the rapid adoption of new material technologies and high-pressure molding techniques required for GMT processing.

Segment trends reveal that the polypropylene (PP) matrix segment continues to dominate the market owing to its cost-effectiveness, ease of processing, and versatile performance profiles suitable for non-structural and semi-structural automotive components. However, the polyamide (PA) segment, particularly PA6 and PA66, is witnessing the fastest growth rate. This accelerated adoption is attributed to their superior mechanical properties, including higher heat deflection temperatures and improved chemical resistance, making them ideal for demanding structural and engine-adjacent applications. Application-wise, the automotive sector remains the primary end-user, but the expansion into construction (e.g., non-corrosive structural panels, pedestrian bridges) and consumer goods demanding high strength-to-weight ratios demonstrates diversification and untapped growth potential for GMT materials.

AI Impact Analysis on Glass Mat Reinforced Thermoplastic Composite Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Glass Mat Reinforced Thermoplastic (GMT) Composite Market primarily center on how AI can optimize material formulation, predict component performance, and streamline complex manufacturing processes like compression molding. Common concerns involve the application of machine learning (ML) for characterizing subtle variations in fiber dispersion and predicting the resulting mechanical properties, which is crucial for quality control in high-volume production. Users expect AI tools to significantly reduce the time and cost associated with iterative physical prototyping by employing digital twin technology for simulation. Key themes revolve around improving predictive maintenance for molding equipment, optimizing material flow dynamics during compression to minimize defects, and utilizing generative design algorithms to create complex, lightweight structures specifically tailored for GMT composite capabilities, thereby pushing the boundaries of what is structurally feasible in automotive and aerospace design.

- AI optimizes composite material formulation by predicting property outcomes based on fiber length, matrix composition, and processing parameters, accelerating R&D cycles.

- Machine Learning (ML) algorithms enhance quality control by analyzing real-time sensor data from molding processes, identifying defects (e.g., uneven fiber distribution) and adjusting parameters instantaneously.

- AI-driven simulation tools, utilizing Finite Element Analysis (FEA) and digital twins, predict the crash performance and long-term durability of GMT components, reducing reliance on expensive physical testing.

- Generative design algorithms leverage GMT characteristics (high stiffness, low density) to propose novel, topologically optimized lightweight structures for vehicle chassis and frames.

- Predictive maintenance systems, powered by AI, monitor the health and performance of high-pressure compression molding equipment, minimizing downtime and optimizing production throughput.

- Supply chain optimization using AI improves logistics and raw material procurement (glass fiber and polymer resins), ensuring efficient delivery and inventory management for large-scale GMT production.

DRO & Impact Forces Of Glass Mat Reinforced Thermoplastic Composite Market

The Glass Mat Reinforced Thermoplastic (GMT) composite market’s dynamic growth trajectory is fundamentally shaped by powerful synergistic forces: stringent governmental regulations pushing vehicle lightweighting (Drivers), inherent material limitations such as surface finish challenges (Restraints), and the burgeoning electric vehicle sector creating vast structural applications (Opportunities). The primary driving force remains the global regulatory push for lower carbon emissions and enhanced vehicle fuel economy, mandating the replacement of heavier metallic parts with lightweight alternatives. This is coupled with consumer demand for safer vehicles, which GMT composites facilitate through excellent energy absorption characteristics critical for crashworthiness. However, the relatively higher cost of raw materials (especially specialized resins) compared to traditional steel and the initial investment required for high-tonnage compression molding machinery present significant constraints, particularly for smaller manufacturing entities. Opportunities are predominantly centered on the EV market, where GMT can be used for large, complex battery enclosures and protection plates, capitalizing on its impact resistance and electrical non-conductivity. This intricate balance of drivers and restraints is continually influenced by shifting oil prices, regulatory updates, and technological breakthroughs in processing and material science.

Specifically regarding the Drivers, the shift in automotive design philosophies from conventional Internal Combustion Engines (ICE) to Battery Electric Vehicles (BEVs) is profoundly impacting material choice. In BEVs, weight reduction is not merely about fuel efficiency but directly extends driving range, making lightweight GMT components essential for competitive EV models. Furthermore, the increasing use of GMT in non-automotive sectors, such as the construction of modular buildings, railway carriage interiors, and industrial handling equipment (pallets, crates), diversifies the market risk and ensures sustained demand across multiple economic cycles. The advancements in automated processing techniques, including robotic material handling and automated preform placement, contribute significantly to reducing labor costs and improving the consistency and complexity of molded parts, effectively broadening the scope of GMT application.

Restraints are not solely tied to cost; technical challenges remain significant hurdles. Achieving a Class A surface finish directly from the molding process is difficult with GMT due to the presence of long fibers, often necessitating secondary finishing operations, which negates some of the cost and time advantages. Additionally, the limited number of compatible polymer matrices (historically dominated by PP) restricts the material’s utility in very high-temperature or highly chemically aggressive environments. Nonetheless, opportunities are actively mitigating these restraints. The development of advanced GMTs using higher-performance matrices like polyphenylene sulfide (PPS) or polyetherimide (PEI) addresses thermal limitations. Simultaneously, increased focus on material recycling initiatives and circular economy models allows manufacturers to capitalize on the inherent thermoplastic nature of GMTs, positioning them favorably against non-recyclable thermoset composites and aligning with future sustainable procurement policies of major end-users. These impact forces collectively dictate the adoption rate and regional penetration strategies of GMT composite manufacturers globally.

Segmentation Analysis

The Glass Mat Reinforced Thermoplastic Composite Market is comprehensively segmented based on the critical characteristics of the material itself (Resin Type), the type of reinforcement structure (Product Type), and the primary industries where the final components are utilized (Application/End-Use). Analyzing these segments provides a nuanced understanding of market dynamics, revealing which formulations are gaining traction and where future technological investment is concentrated. The segmentation by resin type—chiefly Polypropylene (PP), Polyamide (PA), and others—is essential as the matrix polymer dictates the final part's thermal, chemical, and cost performance profile. Product type segmentation, covering general-purpose GMT and specialized long fiber GMT (LGF-GMT), reflects varying requirements for stiffness, impact, and structural complexity. Finally, the application analysis confirms the automotive industry as the bedrock of demand, while other sectors like construction and electrical represent significant diversification avenues.

The dominance of Polypropylene (PP) GMT stems from its excellent cost-to-performance ratio and superior impact resistance, making it the default choice for semi-structural and non-load-bearing components such as underbody shields and battery tray covers. However, the rapidly expanding Polyamide (PA) segment, including engineering plastics like Nylon 6 and Nylon 66, is critical for high-performance applications that demand higher thermal stability and mechanical strength, such as engine mounts, transmission supports, and complex interior structures. The 'Others' category includes high-performance thermoplastics like Polyethylene Terephthalate (PET), Polycarbonate (PC), and specialized bio-polymers, which are being explored for niche applications requiring specific chemical resistance or environmental compatibility, driving future innovation in materials science.

Furthermore, segmentation by application highlights the strategic importance of the automotive industry, which consumes the largest volume of GMT composites for both ICE and EV platforms. Within automotive, key applications include exterior components (e.g., bumper systems), interior structures (e.g., seat backs, instrument panels), and critical structural elements (e.g., front-end carriers, battery housing). The growing adoption in the electrical and electronics sector involves using GMT for protective casings and components requiring dimensional stability and insulation properties. The construction industry leverages GMT's durability and resistance to moisture and corrosion for modular construction elements and specialized infrastructure, providing steady, albeit lower volume, demand compared to the cyclical automotive sector.

- By Resin Type:

- Polypropylene (PP)

- Polyamide (PA) (e.g., PA6, PA66)

- Others (e.g., PET, PC, PPS)

- By Product Type:

- General Purpose GMT

- Long Fiber GMT (LGF-GMT)

- By Application:

- Automotive

- Exterior Components

- Interior Components

- Structural Components

- Powertrain Components

- Construction

- Electrical & Electronics

- Industrial

- Others (e.g., Consumer Goods, Sports Equipment)

- Automotive

Value Chain Analysis For Glass Mat Reinforced Thermoplastic Composite Market

The value chain of the Glass Mat Reinforced Thermoplastic (GMT) Composite Market begins with the upstream suppliers responsible for the core raw materials: glass fiber producers and polymer resin manufacturers. Upstream analysis focuses on the cost and availability of these key inputs, particularly specialty glass fiber mats and engineering-grade thermoplastic resins like Polyamide 6 (PA6) or specialty Polypropylene (PP) grades. Fluctuations in crude oil prices directly affect the cost of polymer matrices, introducing volatility to the production economics. Key manufacturers in this segment often specialize in formulating high-performance resin systems optimized for fiber wetting and adhesion to ensure maximal composite performance. Vertical integration by large chemical companies into composite material formulation aims to secure supply and standardize quality across the chain.

Midstream activities involve the crucial process of manufacturing the GMT semi-finished product. This typically involves impregnating the continuous or chopped glass fiber mat with the molten thermoplastic resin matrix, often through specialized pultrusion or double-belt pressing technologies to create consolidated sheets or blanks. This segment is characterized by specialized equipment and proprietary processing know-how, ensuring uniform fiber distribution and void minimization, which are critical determinants of the final component’s structural integrity. These semi-finished GMT sheets are then supplied to Tier 1 and Tier 2 converters for final part manufacturing. Innovation in this stage focuses on developing hybrid mats combining different fiber types or incorporating recycled content to meet sustainability targets while maintaining performance.

The downstream segment encompasses the molding and fabrication of the final structural parts, primarily through high-speed compression molding, which demands significant capital investment in large tonnage presses and associated handling robotics. Distribution channels are predominantly direct, linking the major GMT sheet manufacturers directly to large automotive OEMs (either Tier 1 suppliers or in-house molding facilities). Indirect channels exist for smaller, specialized fabricators serving niche markets like industrial equipment or smaller volume construction projects, often relying on specialized distributors or agents. Efficiency in the downstream section is critical, as fast cycle times (often less than 60 seconds) are essential for making GMT competitive with traditional materials in high-volume production environments like the automotive assembly line. Success in the downstream market depends heavily on application engineering support and collaborative design expertise to maximize material advantages.

Glass Mat Reinforced Thermoplastic Composite Market Potential Customers

The primary cohort of potential customers for the Glass Mat Reinforced Thermoplastic (GMT) Composite Market resides in the automotive sector, specifically encompassing Original Equipment Manufacturers (OEMs) and their extensive network of Tier 1 and Tier 2 component suppliers. Automotive OEMs, including major players across conventional, luxury, and especially electric vehicle segments, are the largest end-users, requiring GMT for structural components that contribute to vehicle lightweighting, enhanced crash performance, and battery protection. Key buying centers within these organizations are focused on materials engineering, procurement, and advanced research departments, prioritizing materials that offer a superior strength-to-weight ratio, rapid manufacturability, and proven longevity under stress. The demand from the EV segment is exceptionally high, as GMT provides ideal characteristics for complex, large format components such as protective underbody panels, battery pack housings, and integrated front-end carriers that combine several functions into one molded part.

Beyond the core automotive domain, significant potential customers exist within the infrastructure and construction industries. This segment includes manufacturers of modular building systems, specialized bridge components, and industrial infrastructure requiring corrosion-resistant, high-strength materials that are lighter than steel or traditional concrete. Purchasers in this segment value durability, low maintenance costs, and resistance to environmental degradation, making GMT composites suitable for non-load-bearing external cladding, internal structural supports, and industrial flooring systems. The push towards prefabricated and modular construction methodologies further supports the adoption of lightweight GMT panels that simplify transportation and on-site assembly processes, reducing overall project timelines and labor intensity.

A third crucial segment of potential customers includes manufacturers in the electrical and electronics sector, particularly those involved in producing large electrical enclosures, high-voltage insulators, and specialized structural components for renewable energy systems (e.g., solar panel frames, wind turbine nacelle covers). These buyers require materials with excellent dimensional stability, superior dielectric properties, and flame retardancy, attributes that high-performance GMT formulations can effectively provide. Industrial equipment manufacturers, producing heavy-duty storage containers, transport pallets, and machine guarding components, also represent key customers, capitalizing on the high impact resistance and chemical inertness of GMT to create durable, long-lasting industrial assets that are often subjected to harsh operational conditions and repeated handling stresses.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $3.08 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hanwha Advanced Materials, Quadrant AG (Mitsubishi Chemical), Polystrand Inc. (Polyone Corporation), SABIC, Johns Manville, Cytec Solvay Group, Tencate Advanced Composites, BASF SE, Toray Industries, Jushi Group, Chongqing Polycomp International Corp (CPIC), China Fiberglass Co. Ltd., PPG Industries, Owens Corning, 3B - The Fibreglass Company, SGL Carbon, Gurit Holding AG, Dieffenbacher, KraussMaffei Group, Cannon Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glass Mat Reinforced Thermoplastic Composite Market Key Technology Landscape

The technological landscape of the Glass Mat Reinforced Thermoplastic (GMT) market is defined by advancements aimed at enhancing material performance, improving manufacturing efficiency, and broadening the design capabilities of the final product. The core technology centers around the production of GMT sheets, utilizing sophisticated double-belt press systems or specialized pultrusion lines that ensure optimal resin penetration into the glass fiber mat structure, guaranteeing homogeneity and maximizing composite integrity. Continuous innovation focuses on optimizing the impregnation process—often involving melt impregnation—to handle higher viscosity engineering thermoplastics like PEEK or PEI, thereby expanding the applicability of GMT into aerospace and high-temperature industrial environments. Furthermore, techniques are evolving to manage fiber orientation more precisely within the mat, allowing for semi-tailored GMT blanks that provide localized reinforcement where peak stresses are anticipated in the molded component, optimizing material usage and weight.

In the processing stage, the critical technology is high-speed, high-tonnage compression molding. Recent advancements involve integrating process monitoring and control systems, including real-time temperature and pressure sensors, coupled with AI-driven analytics, to maintain strict quality control and minimize cycle times. The use of robotics for automated loading and unloading of the heated GMT blanks is standard practice, supporting the high-volume requirements of the automotive sector. A significant area of development is related to mold technology, including specialized tooling that incorporates cooling channels and venting systems optimized for fast solidification cycles without compromising part integrity or surface quality. This focus on rapid, defect-free molding is paramount to achieving cost parity with traditional metallic stamping operations, which are inherently high-speed processes.

Furthermore, technology related to material preparation and recycling is gaining prominence. Innovations in GMT scrap handling and reprocessing techniques are crucial, given the emphasis on circular economy principles. New technologies facilitate the separation of the glass fiber from the thermoplastic matrix, allowing for the regeneration of the polymer for reuse in secondary or non-critical applications, thereby minimizing landfill waste. Additionally, the development of hybrid GMTs, which combine glass fibers with natural or carbon fibers, represents a technological effort to achieve specific performance targets (e.g., higher stiffness or enhanced sustainability) while retaining the core processability advantages of the thermoplastic system. The ongoing refinement of fiber surface treatments and sizing chemistries to improve the interfacial adhesion between the glass fiber and the thermoplastic matrix is a continuous technological focus aimed at boosting mechanical strength and durability.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for GMT composites, driven primarily by the colossal automotive manufacturing base in China, which is the world’s largest producer of both conventional vehicles and Electric Vehicles (EVs). Robust industrial growth, rapid urbanization, and massive infrastructure development across Southeast Asia, India, and China further boost the demand for lightweight, durable materials in construction and industrial applications. The region benefits from a cost-competitive manufacturing environment and high domestic demand, encouraging global players to establish large-scale production facilities locally. Furthermore, regional regulatory bodies are increasingly implementing safety and emission standards that align with global benchmarks, accelerating the adoption of advanced composites for vehicle lightweighting. This confluence of high production volume, strong domestic consumption, and supportive industrial policies cements APAC's market leadership.

- Europe: Europe is characterized by mature automotive manufacturing and a strong emphasis on high-performance and sustainability. The European market exhibits high consumption of advanced GMT formulations, particularly those based on Polyamide (PA) and other specialized engineering plastics, used in premium and complex structural components. Regulatory mandates such as the European Union’s Circular Economy Package and stringent CO2 emission targets are powerful drivers, compelling OEMs to aggressively integrate lightweight materials. Europe also serves as a hub for advanced research and development in composite manufacturing, focusing heavily on recycling technologies and the integration of bio-based matrix polymers into GMT production to meet stringent environmental standards. Germany, France, and the UK are key countries due to their leading positions in automotive engineering and composite science.

- North America: The North American market, centered in the United States and Canada, shows steady growth, driven by recovering automotive production volumes, particularly in the pickup truck and SUV segments, and significant investment in the rapidly expanding domestic EV production capabilities. The market is highly responsive to lightweighting solutions necessitated by US Corporate Average Fuel Economy (CAFE) standards. North American demand is notable for large-format GMT parts, such as complex underbody shields and battery enclosures, which require the high impact resistance and large-area molding capability of GMT. Furthermore, applications in the aerospace (non-structural parts) and industrial sectors are expanding, supported by a strong domestic innovation ecosystem and a focus on high-quality, engineered materials.

- Latin America (LATAM) and Middle East & Africa (MEA): While currently smaller in market size, these regions present significant long-term growth potential. LATAM growth is closely linked to the recovery and modernization of the automotive industry in Brazil and Mexico, where regional manufacturing hubs are increasingly adopting global material standards. The MEA region’s growth is fueled by massive infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries, requiring durable, corrosion-resistant materials for construction and utilities infrastructure. The shift towards diversification away from oil economies in the Middle East is promoting investment in manufacturing and localized assembly operations, creating new avenues for GMT consumption, especially in industrial applications where high temperatures and harsh chemical environments are common operational constraints.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glass Mat Reinforced Thermoplastic Composite Market.- Hanwha Advanced Materials

- Quadrant AG (Mitsubishi Chemical)

- Polystrand Inc. (Polyone Corporation)

- SABIC

- Johns Manville

- Cytec Solvay Group

- Tencate Advanced Composites

- BASF SE

- Toray Industries

- Jushi Group

- Chongqing Polycomp International Corp (CPIC)

- China Fiberglass Co. Ltd.

- PPG Industries

- Owens Corning

- 3B - The Fibreglass Company

- SGL Carbon

- Gurit Holding AG

- Dieffenbacher

- KraussMaffei Group

- Cannon Group

Frequently Asked Questions

Analyze common user questions about the Glass Mat Reinforced Thermoplastic composite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the growth of the GMT composite market?

The primary growth driver is the automotive sector, specifically the production of structural and semi-structural components for Battery Electric Vehicles (BEVs), including battery casings, front-end modules, bumper beams, and seat structures, due to the need for lightweighting and enhanced crash safety performance.

How do Glass Mat Reinforced Thermoplastics (GMT) differ from Sheet Molding Compounds (SMC)?

GMTs utilize thermoplastic resins (e.g., PP, PA) and are processed via high-speed compression molding with faster cycle times and inherent recyclability. SMCs use thermoset resins (e.g., polyester) and require longer curing times, offering different mechanical properties and generally being non-recyclable in a closed-loop system.

Which geographic region dominates the GMT composite market and why?

The Asia Pacific (APAC) region dominates the GMT composite market due to the high volume of automotive manufacturing, particularly in China, coupled with extensive investments in new EV production capacities and a rapidly growing demand for lightweight materials across industrial and construction sectors.

What are the main technical challenges in manufacturing components using GMT?

Key technical challenges include the difficulty in achieving a paint-ready Class A surface finish directly from the mold due to fiber visibility, the relatively higher raw material cost compared to steel, and the substantial initial capital investment required for high-tonnage compression molding machinery.

Is the use of recycled content feasible in Glass Mat Reinforced Thermoplastics?

Yes, feasibility is a core strength. Since GMT uses thermoplastic matrices, the material waste can be melted and reformed. Industry efforts are focused on integrating recycled glass fibers and reclaimed thermoplastic resins back into the production cycle to support circular economy goals without severely compromising structural integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager