Glassy Carbon Coating Graphite Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442266 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Glassy Carbon Coating Graphite Market Size

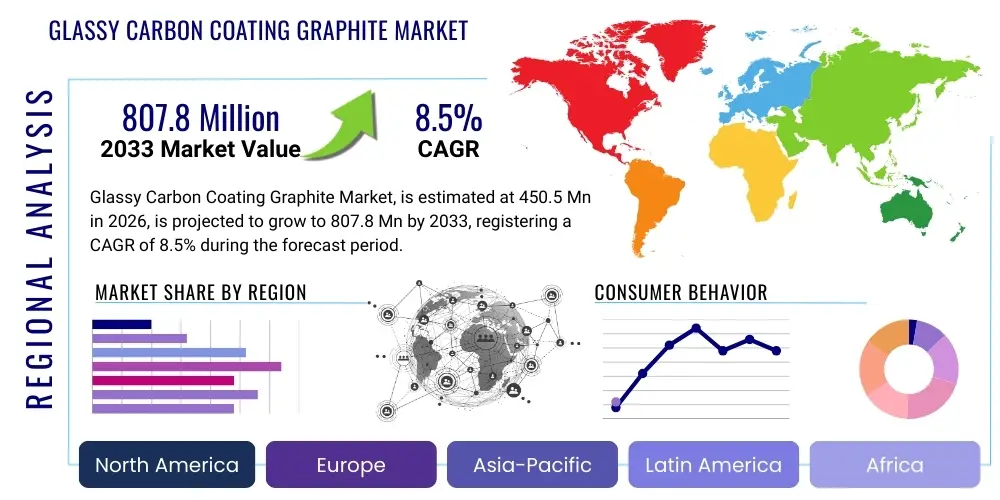

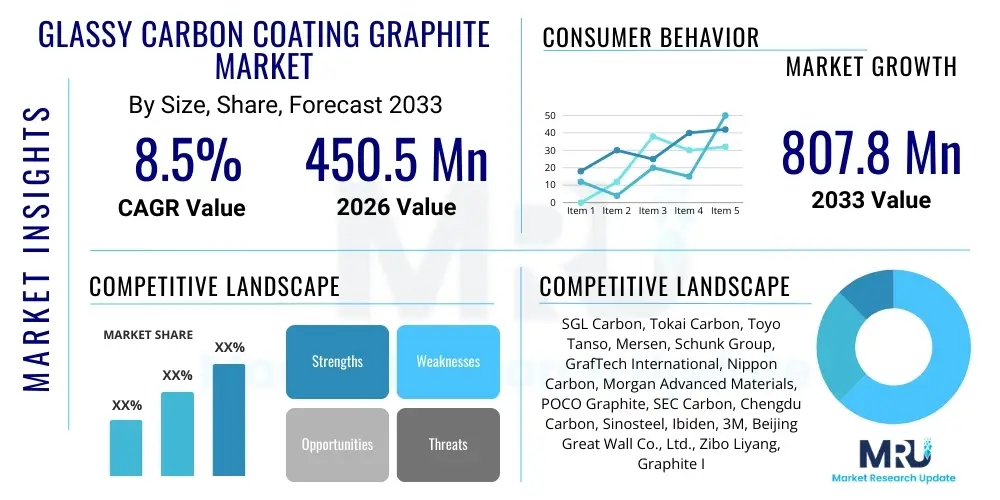

The Glassy Carbon Coating Graphite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 807.8 Million by the end of the forecast period in 2033.

Glassy Carbon Coating Graphite Market introduction

The Glassy Carbon Coating Graphite Market encompasses the production, distribution, and application of advanced materials where a layer of glassy carbon (also known as vitreous carbon) is deposited onto high-purity graphite substrates. Glassy carbon is an impermeable, highly pure, and non-graphitizing carbon material that exhibits exceptional thermal, electrical, and chemical resistance. This unique combination of properties makes the resulting composite material indispensable in demanding industrial environments, particularly where corrosion resistance, high temperature stability, and ultra-purity are paramount.

The primary applications of Glassy Carbon Coating Graphite are centered around industries requiring robust materials for extreme conditions. Major sectors include semiconductor manufacturing, particularly in epitaxial growth processes (MOCVD/CVD) where graphite susceptors and components require protection from corrosive precursors; aerospace and defense, utilized in nozzle throats and high-temperature fixtures; and medical devices, due to its excellent biocompatibility. The superior characteristics of the coating—such as negligible porosity, high hardness, and chemical inertness to strong acids and bases—position it as a critical enabling technology for next-generation manufacturing processes.

Market growth is predominantly driven by the rapid expansion of the global electronics and semiconductor industry, necessitating ultra-pure process equipment to maintain high wafer yields. Additionally, the increasing focus on advanced energy storage systems, including high-performance batteries, where carbon materials play a vital role, further stimulates demand. The material’s ability to withstand temperatures exceeding 2000°C while maintaining structural integrity and purity distinguishes it from traditional carbon or metallic materials, cementing its role as a high-value specialty product.

Glassy Carbon Coating Graphite Market Executive Summary

The Glassy Carbon Coating Graphite Market is poised for substantial growth, characterized by strong demand originating from the high-tech manufacturing sectors globally. Business trends indicate a shift towards enhanced chemical vapor deposition (CVD) techniques, allowing for more uniform and ultra-thin glassy carbon layers, which are critical for increasing the efficiency and lifespan of semiconductor processing components like susceptors and liners. Strategic collaborations between material providers and equipment manufacturers are intensifying, focusing on customized material solutions tailored for specific fabrication processes, driving premium pricing and technological differentiation within the market landscape.

Regionally, the Asia Pacific (APAC) area dominates the market due to the overwhelming concentration of semiconductor fabrication facilities (Fabs) in countries such as Taiwan, South Korea, China, and Japan. This dominance is further reinforced by robust investments in 5G technology infrastructure and advanced memory and logic chip production, which are primary consumers of coated graphite materials. North America and Europe also maintain significant market shares, driven by established aerospace industries, stringent quality requirements in high-purity chemical processing, and ongoing research into nuclear energy applications, where these materials are essential for safety and performance.

Segment trends highlight the ultra-thin coating segment as the fastest-growing area, driven by miniaturization trends in electronics requiring precise material tolerances. Application-wise, semiconductor manufacturing remains the largest segment, though energy storage components and high-temperature furnace applications are exhibiting accelerated adoption rates. The competitive environment is moderately fragmented, with specialized material science firms focusing heavily on proprietary coating methodologies and high barriers to entry related to capital expenditure and technical expertise, ensuring sustained profitability for established players.

AI Impact Analysis on Glassy Carbon Coating Graphite Market

Analysis of common user questions reveals significant interest regarding how Artificial Intelligence (AI) and Machine Learning (ML) optimization will influence the production and application of Glassy Carbon Coating Graphite. Key user concerns revolve around improving the efficiency and consistency of the Chemical Vapor Deposition (CVD) process—the most common method for applying the coating. Users frequently ask about AI's role in predictive maintenance for high-temperature furnaces, optimizing precursor gas flows, and ensuring precise thickness uniformity across large graphite substrates, thereby reducing material waste and lowering production costs. Furthermore, there is curiosity about leveraging AI for accelerating new material discovery and simulating the performance of coated materials under extreme operational stresses, shortening the R&D cycle for next-generation semiconductor components.

The primary expectation is that AI will transform quality control from reactive inspection to proactive process adjustment. By continuously analyzing sensor data collected during the coating process—including temperature profiles, pressure fluctuations, and gas composition—AI algorithms can identify subtle deviations that lead to material defects. This level of automated process refinement is crucial in an industry where component failure due to microscopic imperfections can result in multimillion-dollar losses in semiconductor fabrication. Consequently, AI integration is expected to raise the baseline quality standards for commercially available coated graphite products.

While AI does not directly replace the physical process of coating, its analytical and optimization capabilities are set to become indispensable tools for manufacturers seeking competitive advantages. The market anticipates that companies adopting advanced AI-driven manufacturing execution systems (MES) will achieve higher throughput, superior coating quality, and greater material utilization, leading to a differentiation in product offerings and potentially consolidating market share among technologically advanced producers.

- AI-driven optimization of CVD parameters (temperature, pressure, gas flow) for uniform coating thickness.

- Predictive maintenance analytics for high-temperature coating reactors, minimizing downtime and increasing operational efficiency.

- Accelerated simulation of material performance under extreme thermal cycling and chemical exposure.

- Enhanced quality control through real-time defect detection using machine vision and pattern recognition during production.

- Optimization of raw material sourcing and inventory management for graphite precursors based on demand forecasting.

- AI support for developing novel glassy carbon composite structures with tailored properties.

DRO & Impact Forces Of Glassy Carbon Coating Graphite Market

The Glassy Carbon Coating Graphite Market is profoundly influenced by a complex interplay of demand drivers, operational constraints, and technological opportunities, summarized effectively by the DRO framework. Key drivers include the exponential growth in global semiconductor capital expenditure, particularly in advanced nodes requiring ultra-clean, high-purity process components, which only glassy carbon coated graphite can reliably provide. The superior resistance of the coating to aggressive plasma etching chemicals, such as fluorinated gases used in wafer processing, ensures prolonged component life and higher throughput. Simultaneously, the expanding research into sustainable energy technologies, including high-efficiency solid oxide fuel cells (SOFCs) and advanced nuclear reactors, presents niche but high-value opportunities for specialized material usage, pushing market boundaries beyond traditional electronics.

However, market expansion faces notable restraints. The capital intensity and technological complexity associated with establishing and operating high-quality CVD facilities constitute a significant barrier to entry, limiting the number of producers and potentially restricting supply growth relative to accelerating demand. Furthermore, the high cost of the final coated product, driven by the expensive precursor materials and the energy-intensive coating process, can lead end-users, particularly in less demanding applications, to seek lower-cost alternative materials, thereby limiting market penetration in certain industrial segments. Ensuring scalable, consistent coating quality across very large graphite components also remains a technical hurdle for mass production.

Opportunities for market growth are vast, centered on technological advancements and diversification. The most prominent opportunity lies in the development of next-generation lithium-ion and sodium-ion batteries, where highly purified, stable carbon components can significantly improve energy density and cycle life. Additionally, the ongoing transition of the aerospace industry towards high-temperature, lightweight materials for thermal protection systems opens new avenues for coated graphite composites. The primary impact force on the market is the semiconductor capital investment cycle; any global fluctuation in chip demand directly and immediately affects the need for new coated graphite components, making the market highly sensitive to macroeconomic trends in the electronics sector.

Segmentation Analysis

The Glassy Carbon Coating Graphite Market is primarily segmented based on the coating thickness, which dictates the performance characteristics and cost, the end application, which drives demand specificity, and the end-use industry, which categorizes the consuming sector. This segmentation allows market players to strategically focus their technological development and marketing efforts on high-growth, high-margin niches, such as the ultra-thin coating required for leading-edge semiconductor lithography equipment. Comprehensive segmentation provides a clear view of market dynamics, distinguishing between volume-driven segments, such as large-scale furnace components, and value-driven segments, like specialized medical or analytical instruments.

Detailed analysis of the application segments reveals that semiconductor manufacturing holds the dominant share, owing to the non-negotiable requirement for ultra-high-purity susceptors, wafer carriers, and process tubes in critical fabrication steps. Within the thickness segments, the standard thickness coating still accounts for significant revenue, primarily serving high-temperature furnace linings and broader chemical processing equipment where cost-effectiveness and robustness are prioritized over absolute purity. Geographical segmentation underscores the critical role of East Asian manufacturing hubs in dictating overall market trends and technology adoption rates.

- By Coating Thickness:

- Ultra-thin Coating (< 50 µm)

- Standard Thickness Coating (50 µm – 200 µm)

- Thick Coating (> 200 µm)

- By Application:

- Semiconductor Manufacturing (Susceptors, Liners, Carriers)

- Aerospace and Defense Components

- High-Temperature Vacuum and Inert Gas Furnaces

- Medical and Analytical Instruments

- Energy Storage Components (Battery Manufacturing)

- By End-Use Industry:

- Electronics and Electrical

- Chemical and Petrochemical Processing

- Nuclear and Energy Sector

- Metallurgical Industry

- Research and Development

Value Chain Analysis For Glassy Carbon Coating Graphite Market

The value chain for the Glassy Carbon Coating Graphite Market is inherently sophisticated, beginning with the highly specialized upstream production of pristine raw graphite and the synthesis of precursor gases. Upstream activities are dominated by specialized carbon material manufacturers who must ensure extremely low impurity levels in the graphite substrate, often requiring multiple purification stages. The quality of this substrate directly impacts the adhesion and uniformity of the subsequent glassy carbon layer. Key components also include the provision of high-purity hydrocarbons (e.g., methane, propane) and inert carrier gases necessary for the Chemical Vapor Deposition (CVD) process, which are sourced from industrial gas suppliers.

The core of the value chain involves the complex coating process itself, typically performed by a limited number of specialized coating houses or integrated material companies. This midstream phase requires significant capital investment in advanced CVD reactors capable of maintaining high temperatures and precise atmospheric control. Technological expertise in process control, temperature uniformity, and layer characterization is the primary value driver here. Finished coated components are then distributed through two primary channels: direct sales to Original Equipment Manufacturers (OEMs) in the semiconductor and aerospace sectors, and indirect sales via specialized distributors who manage inventory and provide technical support to smaller end-users in research or chemical processing.

Downstream activities include integration into high-value machinery, such as plasma etching equipment or epitaxy reactors in semiconductor fabs, and end-user consumption in demanding environments. Direct distribution is favored for large contracts and customized components, ensuring stringent quality assurance and tailored specifications are met precisely. Indirect channels facilitate broader market reach for standardized components and spare parts. The efficiency and reliability of the logistics network are crucial, given the fragile nature of some high-purity components and the global nature of the consuming industries, particularly in APAC.

Glassy Carbon Coating Graphite Market Potential Customers

Potential customers for Glassy Carbon Coating Graphite are predominantly concentrated in high-technology sectors requiring materials with exceptional thermal, chemical, and purity characteristics that standard engineering materials cannot meet. The largest group of buyers includes semiconductor device manufacturers (Fabs) and the equipment suppliers (OEMs) that build the lithography, etching, and deposition tools. These customers purchase coated susceptors, wafer boats, and liners, viewing the coating as essential for protecting capital equipment and ensuring high yields of advanced microchips. Their purchasing decisions are driven by purity specifications, thermal stability, and documented mean time between failures (MTBF).

Another critical set of buyers comprises the aerospace and defense industries, particularly those involved in missile systems, spacecraft components, and high-performance jet engines. These applications demand materials that maintain structural integrity and low ablation rates under extreme temperature differentials and mechanical stress, often utilizing thick coatings for erosion resistance. Furthermore, companies specializing in advanced energy systems, such as developers of solid oxide fuel cells (SOFCs), specialized battery components, and fusion energy research facilities, represent rapidly growing customer segments, focusing on the material’s chemical inertness and stable electrical conductivity.

Secondary potential customers include analytical laboratories and medical device manufacturers. In the medical field, the high biocompatibility and non-reactive nature of glassy carbon lead to its use in certain implantable devices or components for analytical instruments like mass spectrometers. Research institutions and universities engaged in materials science and high-temperature physics also constitute a stable customer base, procuring smaller quantities for experimental setups and developmental projects where material purity is non-negotiable for reliable results.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 807.8 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGL Carbon, Tokai Carbon, Toyo Tanso, Mersen, Schunk Group, GrafTech International, Nippon Carbon, Morgan Advanced Materials, POCO Graphite, SEC Carbon, Chengdu Carbon, Sinosteel, Ibiden, 3M, Beijing Great Wall Co., Ltd., Zibo Liyang, Graphite India, Jiangsu Beihai Carbon, Entegris, NeoGraf Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glassy Carbon Coating Graphite Market Key Technology Landscape

The technology landscape of the Glassy Carbon Coating Graphite Market is dominated by sophisticated chemical vapor deposition (CVD) techniques, which are essential for producing the highly pure, dense, and non-porous layer required for high-performance applications. The primary technology involves pyrolysis of hydrocarbon precursor gases, such as methane or acetylene, in a high-temperature, controlled-atmosphere reactor (typically above 1000°C). Variations of CVD, including plasma-enhanced CVD (PECVD) and fluidized bed CVD (FBCVD), are also employed to achieve specific microstructure or adherence properties, though standard thermal CVD remains the industrial standard due to its ability to yield high-purity coatings.

Recent technological advancements focus heavily on improving the scalability and uniformity of the coating process across large, complex geometries, a critical challenge in semiconductor manufacturing where susceptor dimensions are continuously increasing. Innovations include advanced reactor design leveraging computational fluid dynamics (CFD) modeling to ensure precise and laminar gas flow across the substrate surface, minimizing thickness variations and maximizing material utilization. Furthermore, real-time optical monitoring and spectroscopic analysis are being integrated into CVD systems to provide immediate feedback on coating quality and thickness, enabling adaptive process control and reducing material wastage caused by imperfect deposition runs.

Another emerging area is the development of ultra-thin film deposition technologies, often coupled with surface modification techniques for enhancing adhesion, particularly important for applications requiring extreme resistance to thermal shock. Research is also ongoing into alternative non-pyrolytic methods, although they have yet to achieve the high purity and density characteristic of traditional glassy carbon coatings. Intellectual property related to the stabilization of precursors, reactor geometry, and post-coating purification remains highly guarded by key market players, defining the competitive technological edge.

Regional Highlights

The geographical distribution of the Glassy Carbon Coating Graphite Market is intrinsically linked to the global semiconductor and high-tech manufacturing footprint. Asia Pacific (APAC) stands as the undisputed leader, commanding the largest market share and exhibiting the highest growth rate. This dominance is directly attributable to the presence of the world’s major semiconductor foundries and memory chip manufacturers in countries like South Korea (Samsung, SK Hynix), Taiwan (TSMC), and increasingly, mainland China, which has heavily invested in localizing its semiconductor supply chain. The continuous expansion of 5G, IoT, and AI infrastructure further fuels the demand for ultra-pure process components in the region.

North America holds a significant share, driven by strong domestic aerospace and defense sectors, along with established high-end semiconductor R&D and manufacturing centers. The demand here is characterized by high requirements for material traceability and adherence to stringent military and safety standards. The U.S. market is a key consumer for specialized, thick-coated components used in high-temperature testing equipment and research facilities focusing on advanced energy technologies.

Europe represents a mature but stable market, focusing primarily on high-temperature industrial furnaces, specialized chemical processing equipment, and niche applications in the medical and analytical instrument sectors. Countries such as Germany and France, with strong engineering and materials science heritage, drive demand for high-quality, long-lasting coated components, particularly in the metallurgical and high-purity chemical industries.

- Asia Pacific (APAC): Dominates due to concentrated semiconductor fabrication capacity; high investment in advanced electronics and memory chip production (Taiwan, South Korea, China).

- North America: Significant consumer driven by aerospace, defense, and advanced R&D in semiconductor and nuclear technologies.

- Europe: Key market for specialized industrial applications, high-temperature processing, and analytical instrumentation, focusing on quality and longevity.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging regions with nascent demand tied mainly to chemical processing and localized metallurgical industries, offering long-term growth potential as industrialization accelerates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glassy Carbon Coating Graphite Market.- SGL Carbon

- Tokai Carbon

- Toyo Tanso

- Mersen

- Schunk Group

- GrafTech International

- Nippon Carbon

- Morgan Advanced Materials

- POCO Graphite

- SEC Carbon

- Chengdu Carbon

- Sinosteel

- Ibiden

- 3M

- Beijing Great Wall Co., Ltd.

- Zibo Liyang

- Graphite India

- Jiangsu Beihai Carbon

- Entegris

- NeoGraf Solutions

Frequently Asked Questions

Analyze common user questions about the Glassy Carbon Coating Graphite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of glassy carbon coating on graphite?

The glassy carbon coating serves to protect the underlying graphite substrate from chemical attack, oxidation, and erosion, especially in high-temperature and highly corrosive environments, such as those found in semiconductor plasma etching processes. It also enhances purity by preventing outgassing from the porous graphite.

Which industries are the major consumers of coated graphite materials?

The semiconductor manufacturing industry is the largest consumer, utilizing coated graphite for critical components like susceptors and liners in CVD/MOCVD reactors. Other key consumers include aerospace, high-temperature furnace manufacturing, and the analytical and medical device sectors.

What are the main methods used for applying glassy carbon coatings?

The dominant method for applying glassy carbon coating is Chemical Vapor Deposition (CVD), where hydrocarbon gases are pyrolyzed in a high-temperature reactor under precise atmospheric control to deposit a dense, non-porous carbon layer onto the graphite substrate.

How does the high cost of production impact market growth?

The high cost, driven by the specialized CVD equipment and high-purity raw materials required, acts as a restraint, limiting the use of coated graphite to only the most demanding, high-value applications where no alternative material provides comparable performance and purity standards.

Which region currently leads the global Glassy Carbon Coating Graphite Market?

Asia Pacific (APAC) leads the global market due to the concentration of major semiconductor fabrication facilities (Fabs) in countries such as Taiwan, South Korea, and China, which are the largest end-users of high-purity coated graphite components.

The preceding report provides a detailed overview of the Glassy Carbon Coating Graphite Market, focusing on quantitative forecasts, strategic segmentation, technological landscape, and regional dynamics. The analysis confirms the market's robust growth trajectory, intrinsically linked to global advancements in semiconductor technology and the increasing demand for ultra-pure, high-performance materials across multiple industrial sectors. Strategic investments in advanced Chemical Vapor Deposition (CVD) techniques and process optimization, increasingly driven by AI and machine learning, are expected to be key differentiators among leading market participants in the forecast period. The high barrier to entry, necessitated by the capital-intensive nature of production and stringent quality control requirements, ensures that established players with proprietary coating technologies will maintain a strong competitive edge. Furthermore, the rising adoption of these materials in emerging fields such as fusion energy and advanced battery systems presents compelling long-term opportunities for market diversification and sustained revenue growth. The intense focus on supply chain resilience and quality assurance within the electronics industry underscores the irreplaceable role of glassy carbon coated graphite in enabling next-generation technological development.

Future market evolution will likely be characterized by greater emphasis on environmental sustainability within the materials production lifecycle, alongside continued innovation in coating materials to withstand even higher operating temperatures and more aggressive chemical exposures. Companies that successfully bridge the gap between high-volume manufacturing capabilities and the ultra-high purity requirements of leading-edge semiconductor nodes will be best positioned for market leadership. Regional expansion strategies must prioritize engagement with emerging semiconductor clusters in China and Southeast Asia, while maintaining strong relationships with legacy high-specification customers in North America and Europe. The material's unique combination of properties guarantees its continued relevance as an essential component in the most technologically advanced and mission-critical applications worldwide.

Finally, the competitive landscape necessitates continuous investment in research and development to address the persistent challenges related to cost reduction and scalability. As electronic components continue to miniaturize, the demand for flawless, uniform, and thin glassy carbon coatings will only intensify, requiring breakthroughs in materials engineering and manufacturing precision. The long-term outlook for the Glassy Carbon Coating Graphite Market remains exceptionally positive, driven by fundamental technological needs that cannot be met by conventional alternatives, securing its position as a high-growth specialty materials sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager