Global Augmented Reality Technology Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442509 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Global Augmented Reality Technology Market Size

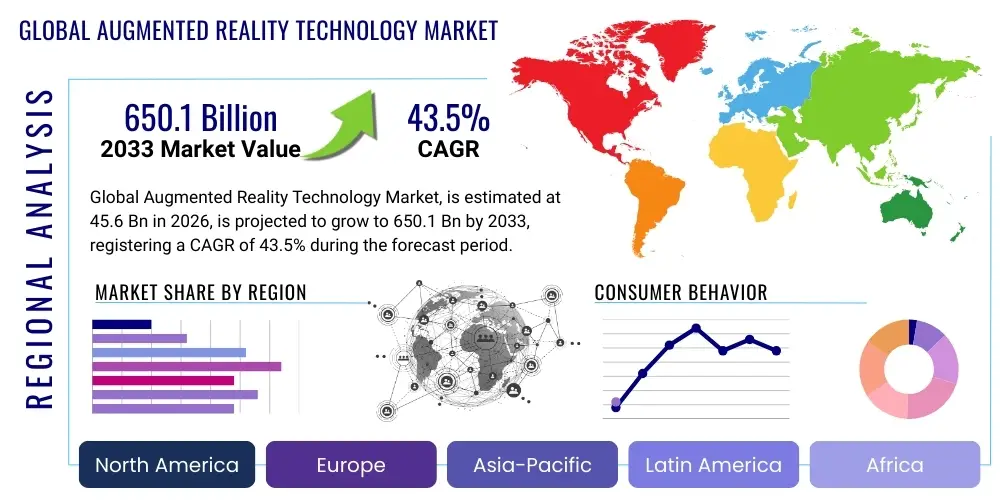

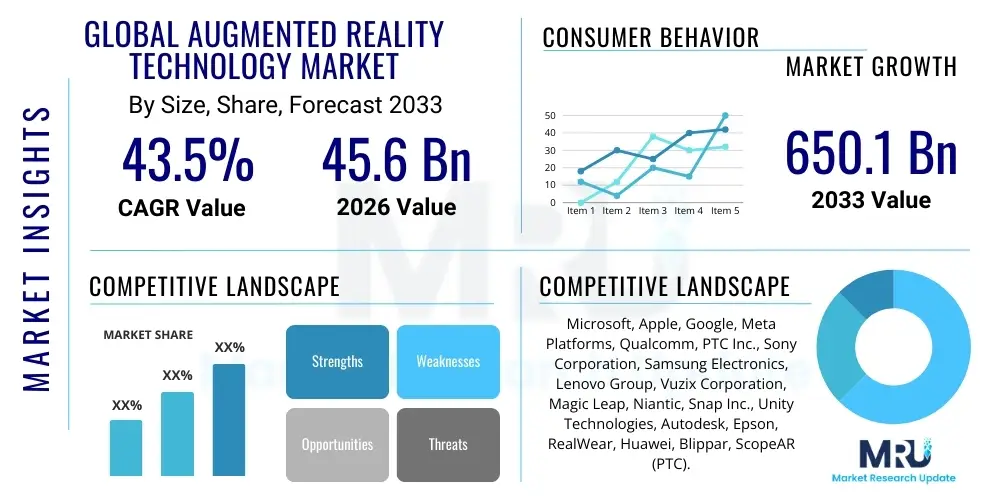

The Global Augmented Reality Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 43.5% between 2026 and 2033. The market is estimated at USD 45.6 Billion in 2026 and is projected to reach USD 650.1 Billion by the end of the forecast period in 2033.

Global Augmented Reality Technology Market introduction

The Global Augmented Reality (AR) Technology Market encompasses the hardware, software, and services that overlay digital content onto the real-world environment, enhancing user perception and interaction. Unlike Virtual Reality (VR), which creates an entirely simulated environment, AR maintains the user's presence in the real world while incorporating contextual digital information. Key products driving this market include smart glasses, head-mounted displays (HMDs), AR software development kits (SDKs) like ARCore and ARKit, and specialized AR applications used across industrial and consumer sectors. The technology fundamentally changes how information is consumed and tasks are executed, providing immediate, context-aware data visualization.

Major applications of AR technology span diverse industries, including healthcare for surgical planning and visualization, education for immersive learning experiences, retail for virtual try-ons and enhanced shopping navigation, and manufacturing for streamlined assembly, quality control, and remote assistance. The core benefit of AR lies in improving efficiency, reducing error rates, and facilitating complex tasks by presenting crucial data visually and spatially relevant to the physical surroundings. This capability translates directly into significant operational cost savings and improved training outcomes across enterprises worldwide.

Market growth is primarily driven by the exponential proliferation of AR-compatible smartphones and tablets, making the technology accessible to the mass consumer base without requiring dedicated hardware investment. Furthermore, the increasing adoption of 5G networks provides the necessary low-latency, high-bandwidth infrastructure required for complex, real-time AR experiences, particularly in industrial IoT and remote collaboration scenarios. Technological advancements in spatial computing, simultaneous localization and mapping (SLAM), and improved display optics are simultaneously lowering the cost and enhancing the performance of dedicated AR devices, further stimulating enterprise and consumer expenditure.

Global Augmented Reality Technology Market Executive Summary

The Global Augmented Reality Technology Market is poised for explosive growth, fundamentally reshaping enterprise operations and consumer engagement models. Key business trends indicate a strong pivot towards vertical integration, where hardware manufacturers are increasingly partnering with specialized software developers to offer industry-specific AR solutions, particularly targeting healthcare, logistics, and automotive sectors. Furthermore, the shift from mobile AR towards dedicated head-worn devices (HWDs) marks a significant evolution, promising more robust, hands-free experiences crucial for frontline workers and complex maintenance tasks. Investments in proprietary micro-display technology and custom silicon optimized for power-efficient spatial processing remain central to competitive strategies.

Regionally, North America maintains market leadership, driven by extensive R&D investments, the presence of major technological pioneers, and early enterprise adoption across defense and technology hubs. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid digitization, massive mobile subscriber bases, and aggressive government initiatives promoting smart manufacturing and digital infrastructure in countries like China, South Korea, and Japan. Europe is characterized by stringent privacy regulations but shows robust adoption in highly regulated industries such as automotive manufacturing and aerospace, focusing heavily on operational efficiency and worker safety applications.

Segment trends reveal that the software segment, particularly encompassing AR platforms, cloud services, and specialized enterprise applications, is expanding faster than the hardware segment, reflecting the market’s focus on content creation and deployment scalability. Within components, sensors and advanced optics are undergoing rapid innovation to improve field of view and reduce latency. End-user wise, the commercial segment (which includes retail, media, and e-commerce) and the industrial segment (manufacturing and energy) are the largest consumers of AR solutions, leveraging the technology for marketing personalization, remote expert guidance, and complex machinery maintenance, establishing clear paths for ROI justification.

AI Impact Analysis on Global Augmented Reality Technology Market

User inquiries regarding the convergence of Artificial Intelligence (AI) and Augmented Reality (AR) predominantly center on how AI enhances AR functionality, specifically concerning real-time environment understanding, content personalization, and computational efficiency. Users frequently ask about the role of machine learning (ML) in improving Simultaneous Localization and Mapping (SLAM) capabilities, enabling more stable and accurate digital overlays regardless of environmental changes. Another key theme involves AI's ability to interpret complex user intentions or behaviors within the AR environment, leading to context-aware content delivery (e.g., predictive maintenance guidance appearing only when a system anomaly is detected). Expectations are high for AI to reduce the processing burden on AR devices, allowing for complex rendering and interaction with minimal latency, thereby addressing the traditional concerns surrounding power consumption and device heat generation.

The integration of deep learning models significantly refines object recognition and tracking within AR applications. AI algorithms are crucial for differentiating between static elements, moving objects, and complex surfaces in real-time video feeds, allowing AR content to interact realistically with the physical world. This advanced perception enables groundbreaking features such as persistent AR experiences—where virtual objects remain anchored in a location even after the user leaves and returns—and sophisticated hand and gaze tracking, which serve as intuitive, hands-free input methods for AR interfaces. Furthermore, generative AI is beginning to impact content creation, automating the process of generating 3D models and textures based on simple prompts or real-world scans, democratizing access to high-fidelity AR asset creation.

AI's influence extends deeply into the personalization layer, transforming general AR applications into highly specific and contextually relevant tools. By analyzing user behavior, location data, and historical interaction patterns, AI systems can dynamically adjust the displayed augmented content, optimizing information delivery for maximal efficiency, whether in training, retail, or navigation. This optimization is vital for enterprise AR, where filtering out irrelevant data is critical for mission success. Consequently, the combination of superior environmental understanding (SLAM enhancement) and intelligent content delivery (personalization) solidifies AI as the core computational engine driving the next generation of highly capable and scalable AR solutions.

- AI-driven Simultaneous Localization and Mapping (SLAM) enhancement leading to superior spatial tracking accuracy and reduced drift in dynamic environments.

- Real-time object recognition and semantic segmentation powered by deep learning for complex visual interaction between virtual and physical objects.

- Generative AI tools accelerating the creation of 3D assets and dynamic virtual environments, reducing content development costs and time.

- Context-aware content delivery (AEO principle) where AI predicts user needs and proactively displays relevant information, enhancing workflow efficiency in industrial settings.

- Optimization of rendering pipelines and power consumption on mobile AR devices through AI-based computational efficiency improvements.

- Implementation of intuitive, hands-free input methods such as gaze tracking and gesture recognition using machine learning algorithms.

DRO & Impact Forces Of Global Augmented Reality Technology Market

The Augmented Reality Technology Market is significantly influenced by a powerful combination of foundational drivers, technological limitations acting as restraints, and pervasive opportunities derived from expanding digital ecosystems. Key drivers include the accelerated adoption of AR in the e-commerce and retail sectors for enhancing customer experience through virtual try-ons and product visualization, alongside the critical need for advanced training and remote assistance solutions in complex industrial settings (Industry 4.0). These drivers are underpinned by the continuous availability of increasingly powerful and smaller microprocessors and sensors, integrated into mobile devices and specialized hardware. However, the market faces restraints related to the high initial cost of enterprise-grade AR hardware, particularly head-mounted displays, and persistent technological hurdles such as limited battery life, narrow field of view (FoV), and the necessity for robust, low-latency connectivity, especially in remote operational environments.

Opportunities for market expansion are abundant, particularly with the global rollout of 5G infrastructure, which unlocks true real-time, cloud-rendered AR experiences, moving processing away from the device and enhancing scalability. The burgeoning concept of the Metaverse, while still nascent, represents a long-term strategic opportunity where AR will serve as the primary gateway connecting physical reality with persistent digital layers, driving massive investment in foundational infrastructure and content creation tools. Furthermore, the market opportunity is expanding into new verticals such as city planning, cultural heritage preservation, and comprehensive patient monitoring in healthcare, areas where spatial data visualization offers unprecedented operational advantages. Successful navigation of these impact forces requires hardware providers to focus on miniaturization and thermal management, while software developers must prioritize robust enterprise integration and user-friendly content development platforms to accelerate mass adoption.

Impact forces dictate the competitive landscape, pushing companies towards strategic partnerships focused on overcoming technology limitations. Regulatory compliance, particularly concerning data privacy when using AR for personal or industrial data visualization, acts as a significant external force shaping deployment strategies. Economic forces, characterized by fluctuating capital expenditure cycles, influence enterprise budget allocation for immersive technology rollout. Ultimately, the rapid pace of component innovation—specifically improvements in optics (waveguides, micro-LEDs) and sensing (LiDAR integration)—remains the most powerful internal force accelerating the viability and decreasing the total cost of ownership (TCO) for advanced AR solutions across global markets.

Segmentation Analysis

The Global Augmented Reality Technology Market is comprehensively segmented across several key dimensions, including Component Type, Display Type, Device Type, Application, and End-User Industry, reflecting the diverse ecosystem required to deliver full AR experiences. This complex segmentation allows market participants to tailor their offerings—ranging from sophisticated optical components and spatial mapping software to industry-specific consultation services—to highly specific demands. The primary differentiating factor lies between the hardware segment, characterized by capital expenditure on dedicated devices and sensors, and the software segment, which generates recurring revenue through platform subscriptions, content licensing, and customized application development services. Analyzing these segments is crucial for understanding market dynamics, as software innovation often precedes and enables new hardware capabilities.

Segmentation by device type highlights the ongoing tension between Mobile AR, which benefits from massive penetration and low barriers to entry, and Head-Mounted Displays (HMDs)/Smart Glasses, which offer higher fidelity and hands-free operation critical for industrial applications. While mobile AR currently holds a large share in volume terms, the growth rate for HMDs is accelerating rapidly due to increasing enterprise deployments aimed at optimizing complex workflows. Furthermore, segmentation by application area reveals distinct value propositions; for instance, the engineering and design segment prioritizes accuracy and real-time simulation capabilities, whereas the gaming and entertainment segment focuses on immersive interaction and visual realism.

The end-user segment analysis is critical, showing varied adoption rates and requirements across major verticals. Retail and E-commerce leverage AR predominantly for marketing and customer engagement, seeking solutions that integrate seamlessly with existing digital sales platforms. Conversely, the Manufacturing and Automotive sectors require robust, durable, and highly precise systems for training, maintenance, and quality assurance, often necessitating custom software integrated with proprietary internal systems. This differentiation in needs means that providers must specialize, offering tailored platforms and consulting services rather than generic AR solutions, ensuring maximum alignment with specific industry compliance and operational standards.

- Component:

- Hardware (Sensors, Displays & Projectors, Semiconductors & Processors, Cameras, Optics, Others)

- Software (AR SDKs, Cloud Services, Platform Solutions, Content Creation Tools, Operating Systems)

- Services (Consulting, Integration, Maintenance, Managed Services)

- Display Type:

- Head-Mounted Display (HMD)

- Head-Up Display (HUD)

- Smartphones/Tablets (Mobile AR)

- Device Type:

- Handheld Devices

- Head-Worn Devices (Smart Glasses, AR Helmets)

- Application:

- Gaming and Entertainment

- Healthcare and Medical Training

- Engineering, Design, and Maintenance

- Retail and E-commerce (Virtual Try-on)

- Education and Training

- Automotive and Transportation

- Defense and Aerospace

- Architecture and Real Estate

- End-User Industry:

- Consumer

- Commercial (Media, Advertising, E-commerce)

- Industrial (Manufacturing, Energy, Utilities)

- Government and Defense

- Education and Research

Value Chain Analysis For Global Augmented Reality Technology Market

The Augmented Reality value chain is complex and highly specialized, beginning with upstream activities focused on the sophisticated design and manufacturing of critical components. The initial stage involves core intellectual property development, specialized materials science for optics (e.g., waveguides and diffractive elements), and the production of custom silicon, including high-performance GPUs and dedicated spatial processors necessary for rendering complex digital environments in real-time. Key players in this upstream segment include semiconductor manufacturers, specialized sensor companies (LiDAR, depth cameras), and micro-display technology developers, whose innovations directly dictate the form factor, visual quality, and power efficiency of the final AR device.

Midstream activities revolve around platform development, software creation, and system integration. This involves the creation of robust AR SDKs and platforms that facilitate rapid application development, alongside the integration of these platforms with existing enterprise IT infrastructure, such as ERP or PLM systems. Content developers, specialized in 3D modeling and spatial design, translate customer requirements into tangible AR experiences. Downstream activities focus heavily on distribution channels and end-user support. Distribution channels can be categorized into direct and indirect routes. Direct channels involve large enterprises purchasing tailored solutions and hardware directly from manufacturers or systems integrators, often including extensive training and maintenance contracts.

Indirect channels primarily leverage mobile app stores for consumer software distribution and partnerships with major telecommunications providers or regional value-added resellers (VARs) for wider hardware market penetration. The increasing prevalence of cloud services is also redefining the downstream segment, as subscription-based delivery models for AR content and remote assistance services become standard. The efficiency of the entire value chain is currently being optimized through greater standardization of SDKs and API protocols, aiming to reduce fragmentation and accelerate the time-to-market for innovative AR applications across global ecosystems.

Global Augmented Reality Technology Market Potential Customers

The potential customer base for Augmented Reality Technology is exceptionally broad, spanning nearly every major economic sector, yet the most immediate and high-value buyers are found within industrial and commercial segments prioritizing operational efficiency and customer engagement. End-users in the manufacturing sector (e.g., automotive, heavy machinery) are primary customers, utilizing AR for guided maintenance, hands-free assembly instructions, remote expert collaboration, and complex quality assurance checks. These buyers seek durable, highly reliable HMDs and integrated software solutions capable of seamless operation in rugged industrial environments, prioritizing quantifiable ROI based on reduced downtime and minimized training costs.

Healthcare professionals and institutions represent another critical segment, purchasing AR systems for surgical visualization, immersive medical training, and patient education. Key requirements here include ultra-high precision, certified compliance with medical data regulations (HIPAA, GDPR), and integration with existing electronic health record (EHR) systems. Furthermore, the commercial sector, including large retail chains and e-commerce platforms, constitutes a massive consumer of AR software for virtual try-on services, personalized in-store navigation, and interactive advertising campaigns, focusing on solutions that drive immediate sales conversion rates and enhance customer loyalty through novel digital interactions.

In addition to these enterprise segments, the mass consumer market remains a vital segment, driven primarily by mobile AR gaming, social media filters, and basic navigation apps. While individual consumer spending is lower per transaction compared to enterprise deals, the volume of users worldwide utilizing AR-enabled mobile devices positions this segment as crucial for generating widespread adoption and familiarizing the global public with AR interactions. Ultimately, the successful AR provider must cater to the distinct purchasing cycles and regulatory mandates of these varied customer profiles, necessitating a dual approach targeting both robust enterprise systems and engaging consumer experiences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.6 Billion |

| Market Forecast in 2033 | USD 650.1 Billion |

| Growth Rate | 43.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Microsoft, Apple, Google, Meta Platforms, Qualcomm, PTC Inc., Sony Corporation, Samsung Electronics, Lenovo Group, Vuzix Corporation, Magic Leap, Niantic, Snap Inc., Unity Technologies, Autodesk, Epson, RealWear, Huawei, Blippar, ScopeAR (PTC). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Global Augmented Reality Technology Market Key Technology Landscape

The technological backbone of the Augmented Reality market is characterized by intense innovation across several interdependent domains, specifically focusing on achieving high fidelity, low latency, and energy efficiency. Central to this landscape are display technologies, moving rapidly from traditional smartphone screens to advanced optics such as waveguides (diffractive and holographic) and micro-LED or micro-OLED displays embedded in smart glasses. Waveguide technology is crucial for achieving a lightweight form factor and better light efficiency, directly addressing the restraint of bulky, uncomfortable head-worn devices. Concurrently, advancements in micro-display technology are focused on increasing brightness and resolution while minimizing power consumption, which is paramount for all-day enterprise use.

Another fundamental technological pillar is spatial computing, encompassing Simultaneous Localization and Mapping (SLAM) algorithms and persistent cloud anchors. Modern AR experiences rely heavily on robust SLAM to accurately track the device's position and orientation within the physical environment, ensuring virtual objects remain anchored realistically. The integration of high-precision sensors, particularly LiDAR (Light Detection and Ranging) systems, into high-end mobile devices and dedicated AR headsets significantly improves depth perception and environmental meshing capabilities, paving the way for intricate and highly interactive AR scenarios. These advancements enable persistent AR clouds, allowing multiple users to share a co-located digital experience over time and space, a key enabler for collaborative industrial applications.

Software architectures and connectivity protocols form the third critical domain. The necessity for real-time interaction mandates low-latency processing, increasingly facilitated by edge computing and 5G networks, which allow complex rendering tasks to be offloaded from the local device to the cloud or edge servers. Key technologies also include specialized AR development platforms and APIs that abstract complex spatial processing, making it easier for developers to create sophisticated applications. Furthermore, the convergence of AI, especially in computer vision and machine learning, is vital for the sophisticated interpretation of user input (e.g., gestures, voice commands) and the dynamic adjustment of AR content based on environmental context, thus defining the state-of-the-art in interactive AR experiences.

Regional Highlights

- North America: Market Leadership and Innovation Hub

North America, particularly the United States, commands the largest share of the global AR market, driven by the presence of global tech giants (e.g., Microsoft, Apple, Google, Meta) who are heavily investing in hardware and foundational software platforms. The region benefits from a robust startup ecosystem, high venture capital funding focused on immersive technologies, and high consumer spending power. Enterprise adoption is mature across defense, aerospace, and advanced manufacturing sectors, often leveraging AR for high-value training and logistics applications. The rapid commercial deployment of 5G networks further solidifies North America's leadership by enabling seamless, data-intensive AR experiences required for large-scale industrial digitalization projects.

- Asia Pacific (APAC): Fastest Growth Trajectory

APAC is projected to exhibit the highest CAGR, primarily fueled by the massive mobile user base in countries like China and India, making mobile AR an immediate growth driver. Government initiatives promoting Industry 4.0 in nations such as South Korea, Japan, and Singapore are accelerating the adoption of enterprise-grade AR for smart factories and quality control. The region is characterized by high levels of digital literacy and a receptive consumer market for AR gaming and e-commerce applications, often incorporating AR features early in the product lifecycle. Investment is heavily focused on establishing regional content creation hubs and developing localized AR experiences.

- Europe: Focus on Industrial Efficiency and Regulatory Compliance

The European market is marked by robust adoption in the automotive, energy, and healthcare sectors, where AR is primarily utilized for enhancing maintenance procedures, streamlining complex assembly lines, and improving surgical visualization. Germany, the UK, and France are key contributors, driven by stringent regulatory environments that favor highly reliable and documented AR solutions for operational safety and training compliance. While slower in consumer adoption compared to APAC or North America, European enterprises are leaders in integrating AR with existing operational technology (OT) systems, demonstrating a strong focus on generating tangible productivity gains and maintaining high data security standards (GDPR compliance).

- Latin America (LATAM): Emerging Market Potential

LATAM represents an emerging market for AR, characterized by increasing smartphone penetration and a growing middle class eager for engaging digital experiences. Adoption is concentrated in commercial applications such as marketing, education, and mobile gaming. Market expansion is heavily reliant on improving digital infrastructure and addressing economic variability, but the low cost of entry provided by mobile AR applications makes it highly accessible. Brazil and Mexico are leading the regional market due to relatively higher technological readiness and investment in digital services.

- Middle East and Africa (MEA): Strategic Investment in Digitalization

The MEA region is witnessing significant investment in large-scale infrastructure and smart city projects, particularly in the Gulf Cooperation Council (GCC) countries. AR adoption is often driven by governmental mandates aimed at rapid digitalization and diversification of the economy (e.g., Saudi Vision 2030). The focus is often on utilizing AR for complex infrastructure maintenance, defense training, and upscale retail experiences. While the overall market size remains smaller than other regions, the strategic governmental push for advanced technology adoption signals substantial future growth potential, especially in high-value industrial and urban planning applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Global Augmented Reality Technology Market.- Microsoft Corporation (HoloLens, Azure AR Services)

- Apple Inc. (ARKit, Vision Pro, LiDAR integration)

- Google LLC (ARCore, Google Glass Enterprise Edition)

- Meta Platforms, Inc. (Spark AR, Quest 3/Pro platforms)

- Qualcomm Technologies, Inc. (Snapdragon XR Platforms)

- PTC Inc. (Vuforia AR Platform, ThingWorx)

- Sony Corporation (Semiconductors, Micro-displays)

- Samsung Electronics Co., Ltd. (Mobile AR, display technologies)

- Lenovo Group Limited (ThinkReality series)

- Vuzix Corporation (Smart Glasses for Enterprise)

- Magic Leap, Inc. (Magic Leap headsets)

- Niantic, Inc. (Pokémon GO, Lightship AR Development Platform)

- Snap Inc. (Snapchat Lenses, Spectacles)

- Unity Technologies (Unity Engine, leading AR development tool)

- Autodesk, Inc. (Integration with design software)

- Epson Corporation (Moverio Smart Glasses)

- RealWear, Inc. (Industrial HMT devices)

- Huawei Technologies Co., Ltd. (AR Engine, hardware components)

- Blippar Ltd. (AR creation and publishing platform)

- ScopeAR (Now part of PTC) (Remote assistance software)

- Pico Interactive (ByteDance subsidiary) (AR/VR solutions)

- Atheer (Enterprise AR solutions)

- Thalmic Labs (Myo Armband, now focusing on device control)

- HoloLight GmbH (Streaming AR/VR solutions)

Frequently Asked Questions

Analyze common user questions about the Global Augmented Reality Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differentiating factors between Augmented Reality (AR) and Virtual Reality (VR)?

AR overlays digital elements onto the real world, maintaining the user’s sense of presence in their physical environment, thus focusing on interaction and visualization of context-aware data. VR, conversely, creates a fully immersive, simulated environment, completely replacing the user’s physical surroundings, primarily focused on simulation, training, and gaming.

Which end-user industries are driving the highest enterprise adoption of AR technology?

The highest enterprise adoption rates are currently driven by the Manufacturing, Automotive, and Aerospace sectors, where AR is critical for optimizing complex workflows, offering guided maintenance instructions, providing remote expert collaboration, and enhancing worker training efficiency, resulting in significant operational savings and reduced error rates.

How is 5G connectivity impacting the scalability of Augmented Reality solutions?

5G connectivity, characterized by ultra-low latency and high bandwidth, fundamentally enables complex, cloud-rendered AR experiences. This allows heavy processing tasks (like complex 3D rendering and large dataset analysis) to be offloaded from local AR devices to the edge cloud, improving device battery life, reducing bulk, and facilitating highly scalable, real-time collaboration across wide geographic distances.

What are the major technological restraints limiting the widespread consumer adoption of smart glasses?

Major restraints include the limited Field of View (FoV) offered by current optical systems, which restricts the amount of augmented content visible simultaneously, the relatively high cost of advanced AR headsets, and persistent challenges related to battery life, thermal management, and achieving a lightweight, socially acceptable form factor.

What role does Artificial Intelligence (AI) play in enhancing Augmented Reality experiences?

AI significantly enhances AR by powering sophisticated Simultaneous Localization and Mapping (SLAM) for superior environmental tracking, enabling real-time object recognition for context-aware content delivery, and facilitating natural user interfaces through advanced gaze and gesture tracking, thereby making AR interactions more intuitive and spatially precise.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager