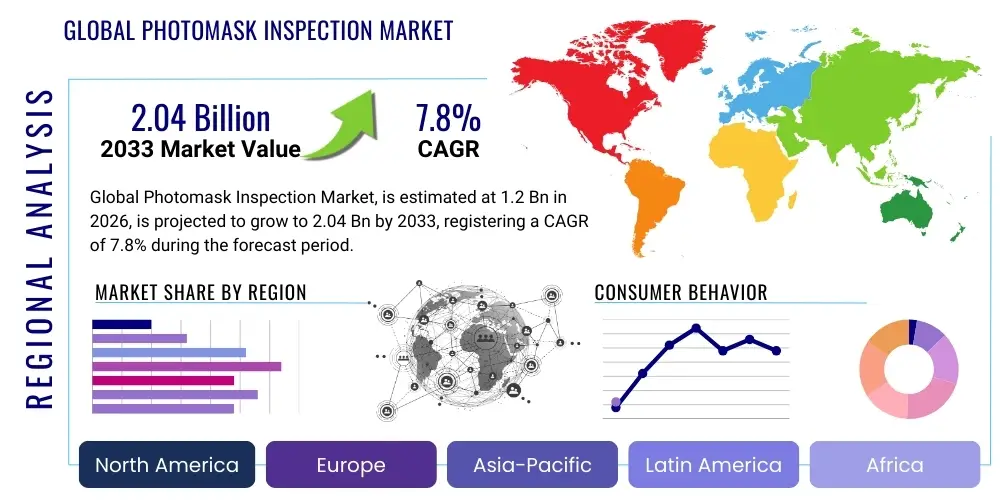

Global Photomask Inspection Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442833 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Global Photomask Inspection Market Size

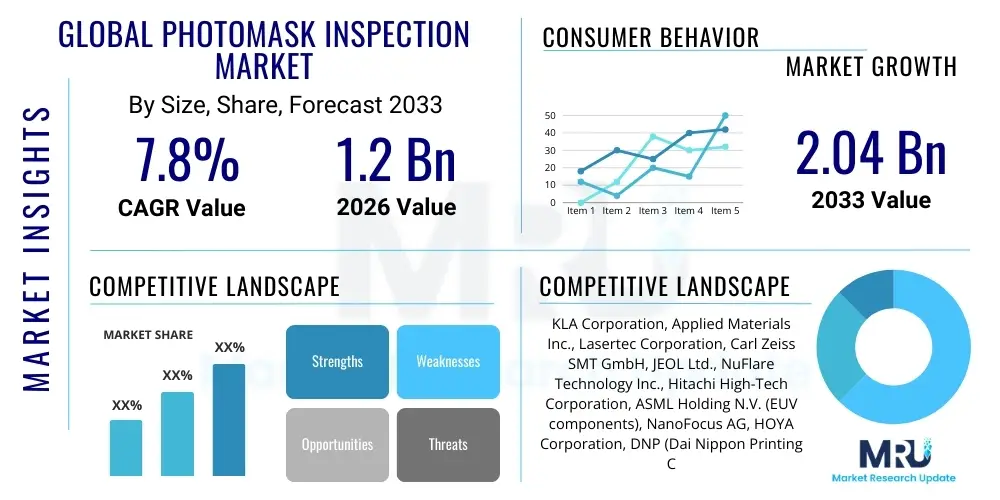

The Global Photomask Inspection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.04 Billion by the end of the forecast period in 2033.

Global Photomask Inspection Market introduction

The Global Photomask Inspection Market plays an absolutely critical role within the semiconductor manufacturing ecosystem, serving as the primary quality control mechanism for lithography masks. Photomasks, often referred to as the "master blueprints" of integrated circuits (ICs), must be meticulously defect-free, as even sub-nanometer imperfections can lead to significant yield loss during the high-volume production of semiconductor wafers. Photomask inspection involves using highly sophisticated optical and electron-beam systems to detect, classify, and repair minuscule defects on the mask patterns, ensuring the fidelity of the transferring design onto silicon. The increasing complexity of IC designs, coupled with the relentless scaling dictated by Moore's Law and the transition to advanced nodes like 5nm and 3nm, directly drives the necessity for more sensitive and precise inspection technologies.

The core function of these inspection systems is to compare the manufactured mask structure against its design database (Die-to-Database inspection) or against an adjacent, identical die pattern (Die-to-Die inspection). These processes are essential for both blank masks (prior to pattern generation) and patterned masks (after etching and repair), as well as during subsequent cleaning cycles. Major applications span across logic device manufacturing, advanced memory production (NAND, DRAM), and specialized areas such as MEMS and advanced packaging lithography. The paramount benefit provided by these systems is the maintenance of high manufacturing yields and the prevention of catastrophic failures at the wafer level, which could result in millions of dollars in losses per batch, thereby justifying the substantial capital investment in inspection equipment.

Driving factors for sustained market growth are primarily anchored in technological transitions, particularly the widespread adoption of Extreme Ultraviolet (EUV) lithography. EUV masks present entirely new inspection challenges related to multilayer reflectivity, absorber material defects, and actinic inspection requirements, necessitating the development of completely novel inspection tools. Furthermore, the global expansion of foundry capacity, the increasing demand for high-performance computing (HPC), artificial intelligence accelerators, and 5G/6G communication chips, all requiring leading-edge nodes, compel mask shops and integrated device manufacturers (IDMs) to continually upgrade their inspection capabilities to maintain competitive defectivity rates below one defect per mask (DPM).

Global Photomask Inspection Market Executive Summary

The Global Photomask Inspection Market is undergoing a rapid evolution characterized by intense technological centralization and regional market divergence. Business trends indicate a continued dominance by a few key equipment manufacturers, driven by the extremely high barriers to entry related to precision engineering and software sophistication required for sub-10nm defect detection. A notable shift includes the rising prominence of software-based defect classification and data analysis tools, integrating AI and machine learning to reduce false positives and accelerate the defect review cycle, moving the market toward integrated defect metrology and inspection solutions rather than standalone tools. Furthermore, the industry is witnessing an increased focus on Actinic Patterned Mask Inspection (APMI) and specialized pellicle inspection solutions, addressing the unique requirements of EUV adoption which is now moving into high-volume manufacturing (HVM) phases, transforming previously niche segments into core revenue streams.

Regional trends are overwhelmingly focused on the Asia Pacific (APAC) region, which commands the largest market share due to the concentration of the world’s leading semiconductor foundries, advanced memory manufacturers (particularly in South Korea and Taiwan), and burgeoning mask shops in Mainland China. Investment in advanced process nodes drives procurement decisions in these regions, making them the primary demand centers for next-generation inspection tools. North America and Europe, while possessing strong R&D capabilities and housing major semiconductor equipment suppliers, represent smaller end-user markets but are critical for technological innovation and early deployment of cutting-edge solutions. The ongoing geopolitical climate, particularly regarding technology export controls, significantly influences the supply chain and regional investment strategies, particularly affecting access to the most advanced EUV inspection systems.

Segment trends highlight the shift from traditional DUV (Deep Ultraviolet) optical inspection towards more complex methodologies. The e-beam inspection segment is experiencing robust growth, primarily utilized for ultra-high-resolution critical dimension (CD) monitoring and detecting complex, non-visual defects that optical methods cannot resolve, especially at advanced nodes. The key segmentation pivot is related to the mask type: while traditional ArF (Argon Fluoride) masks still require significant inspection throughput, the investment cycle is heavily weighted toward EUV mask inspection equipment. This specialized segment demands tools capable of handling the unique challenges of EUV, including phase defects, buried defects, and maintaining vacuum integrity, signaling a structural change in the market where inspection technologies are becoming increasingly node-specific and specialized, requiring greater investment in maintenance and software optimization.

AI Impact Analysis on Global Photomask Inspection Market

User questions regarding AI's influence in the photomask inspection market center primarily on its ability to enhance defect detection accuracy, reduce the costly problem of false positives (nuisance defects), and accelerate the decision-making process for repair or disposition. Key concerns often revolve around the training data requirements for highly specific defect types (e.g., EUV phase defects), the integration complexity of AI models into legacy inspection hardware, and the reliability of automated defect classification (ADC) systems in highly regulated fabrication environments. Users expect AI to move beyond simple image processing to provide predictive analytics regarding mask degradation and optimize inspection recipes automatically based on yield data feedback, fundamentally reducing the total time required for mask qualification and accelerating the time-to-market for new semiconductor designs.

- AI algorithms significantly improve Automated Defect Classification (ADC) accuracy, drastically reducing the necessity for manual review by highly trained engineers, thereby enhancing operational throughput.

- Machine Learning (ML) models are deployed to optimize inspection recipes and parameters, dynamically adjusting sensitivity settings based on real-time process variations and known defect patterns, lowering false positive rates.

- Predictive maintenance analytics, powered by AI, monitor inspection tool performance and proactively schedule calibration or repairs, maximizing equipment uptime and ensuring consistent measurement reliability.

- Deep Learning networks enable the detection of subtle, previously undetectable defects (e.g., subtle phase shifts or low-contrast buried defects in EUV masks) that traditional rule-based algorithms frequently miss.

- AI-driven data integration facilitates the correlation of mask inspection data with subsequent wafer-level inspection and metrology results, establishing a clearer link between mask quality and final device yield.

- Generative AI models are utilized in simulating defect images for training purposes, allowing inspection software to become robust against rare or novel defect types without needing extensive physical mask library acquisition.

DRO & Impact Forces Of Global Photomask Inspection Market

The market trajectory is significantly influenced by a powerful combination of technological mandates (Drivers), complex economic and technical barriers (Restraints), and the emergence of specialized application areas (Opportunities). The primary driver is the pervasive move towards smaller critical dimensions and the commercialization of EUV lithography, which demands completely new, highly sensitive inspection methodologies that are far more expensive and complex than previous generations. Furthermore, the relentless global competition among semiconductor manufacturers necessitates flawless mask quality, driving continuous investment in next-generation inspection tools to maintain competitive yield curves. Economic forces, such as the massive government incentives fueling regional semiconductor manufacturing buildouts, further accelerate the adoption of advanced inspection equipment globally.

However, the market growth faces substantial restraints, predominantly centered around the exorbitantly high capital expenditure required for advanced inspection systems, often exceeding tens of millions of dollars per unit, which limits adoption primarily to the world’s largest mask shops and IDMs. Technical constraints include the increasing difficulty of inspecting complex 3D structures and non-standard mask materials, alongside the challenge of maintaining high inspection throughput while simultaneously increasing sensitivity to nanoscale defects. The issue of 'nondetects'—defects that are critical but remain undetected by current tools—remains a persistent technical hurdle, requiring continuous research into novel illumination and detection techniques, often necessitating long and costly R&D cycles.

Opportunities for market expansion are primarily found in the rapid commercialization of specialized inspection services, particularly for EUV pellicles and mask repair verification, which are high-margin service segments. Furthermore, the development of integrated software platforms leveraging AI for comprehensive defect review and yield management represents a major growth avenue, shifting revenue streams towards software and service subscriptions rather than solely relying on hardware sales. Emerging applications in high-density advanced packaging (e.g., fan-out wafer level packaging, 2.5D/3D integration) are also opening new, high-growth niche markets that require tailored, high-resolution inspection solutions for non-traditional mask substrates and patterns, expanding the overall addressable market beyond core IC fabrication.

Segmentation Analysis

The Global Photomask Inspection Market is systematically segmented based on the type of technology employed, the mask type being inspected, the application area of the final semiconductor device, and the geographical region. Analyzing these segments provides strategic insights into investment hot spots, technological maturation curves, and specific end-user demands. The core technological segmentation differentiates between optical and e-beam systems, reflecting the trade-offs between speed (optical) and resolution/sensitivity (e-beam). Mask type segmentation, especially the distinction between standard DUV/i-line masks and advanced EUV masks, is now paramount, dictating the design and cost structure of the inspection equipment. Application segmentation helps track demand intensity across major semiconductor market verticals like logic, memory, and specialized components.

- By Type:

- Optical Inspection Systems (Deep Ultraviolet (DUV), Argon Fluoride (ArF), Actinic Inspection)

- E-beam Inspection Systems (Electron Beam Inspection)

- Repair Verification Systems

- Pellicle Inspection Systems

- By Mask Type:

- DUV Photomasks (193nm, 248nm)

- EUV Photomasks (Extreme Ultraviolet)

- Phase Shift Masks (PSM)

- Others (Mask Blanks, Specialized Masks)

- By Application/End-User:

- Foundries

- Integrated Device Manufacturers (IDMs)

- Mask Shops

- Memory Manufacturers (DRAM, NAND)

- Others (R&D Labs, Specialized Components)

- By Defect Type:

- Chrome Defects (Pattern Defects)

- Glass Defects (Substrate Defects)

- Contamination Defects

- Phase Defects (EUV)

Value Chain Analysis For Global Photomask Inspection Market

The value chain for the photomask inspection market is highly concentrated and vertically specialized, beginning with complex upstream component suppliers and culminating in the highly demanding semiconductor manufacturing environment. Upstream analysis focuses on vendors providing critical sub-systems such as ultra-high-resolution optics (lenses, illumination sources), precision stages capable of nanoscale movement, and advanced detector arrays for both optical and e-beam technologies. These suppliers, often based in specialized regions like Japan, Germany, and the US, represent a highly specialized ecosystem, providing bespoke components that are integral to the inspection system's overall performance. The core value addition at this stage is the technological sophistication and precision required to achieve sub-10nm resolution, serving as a high-cost input for the main equipment manufacturers.

Midstream activities are dominated by the Original Equipment Manufacturers (OEMs) who integrate these components, develop proprietary inspection software (the true core of competitive advantage), and handle system assembly and rigorous calibration. Success at this stage relies heavily on deep intellectual property in image processing, defect classification algorithms, and system integration. Distribution channels are predominantly direct, given the high unit cost, complexity, and installation requirements of the inspection tools. Sales cycles are long, consultative, and involve direct negotiation between the OEM and the end-user (foundry, mask shop), often requiring extensive on-site support and customization before final procurement, minimizing the role of traditional third-party distributors.

Downstream analysis centers on the end-users: independent mask shops (e.g., Photronics, Toppan), captive mask shops operated by IDMs (e.g., Intel, Samsung, TSMC), and dedicated semiconductor foundries. These entities leverage the inspection systems to ensure mask quality before high-volume manufacturing commences, directly impacting multi-billion-dollar wafer fabrication processes. The indirect distribution impact comes primarily from long-term service contracts and software updates, where OEMs provide maintenance, repair, and critical software upgrades, forming a continuous revenue stream post-installation. The intense capital requirements and high criticality of the equipment create a high-dependency model, binding the downstream users closely to the few dominant upstream equipment suppliers, thereby creating a highly stable but concentrated market structure.

Global Photomask Inspection Market Potential Customers

The primary consumers and potential customers for advanced photomask inspection equipment are large-scale enterprises deeply invested in cutting-edge semiconductor manufacturing. This group primarily consists of dedicated semiconductor foundries, which require the highest levels of defectivity control as they handle outsourced production for hundreds of fabless design companies. Foundries like TSMC, Samsung Foundry, and GlobalFoundries are continuous investors in the latest inspection technology, specifically those systems capable of handling 5nm and 3nm node requirements, often purchasing tools in large batches to outfit new fabrication facilities (fabs) or upgrade existing ones.

Integrated Device Manufacturers (IDMs) represent the second major customer segment. These companies, such as Intel, Micron, and SK Hynix, manage both design and fabrication (including captive mask shops). Their procurement decisions are driven by the internal necessity to secure proprietary device yield and maintain control over highly sensitive intellectual property. Memory manufacturers within this group are particularly heavy users, given the dense, repetitive patterns on DRAM and NAND masks which require exceptionally high-throughput, low-defectivity inspection capabilities to minimize yield loss associated with repetitive bit errors.

The third critical segment comprises specialized independent photomask manufacturers, such as those that service the broader semiconductor ecosystem globally. These independent mask shops must maintain state-of-the-art inspection capabilities to compete for contracts from fabless companies and smaller IDMs that do not have captive facilities. Their purchasing decisions are highly sensitive to the technological demands of their client base, particularly concerning advanced phase shift mask inspection and the relatively newer domain of EUV mask blank qualification. Furthermore, research institutions and governmental labs involved in next-generation lithography research also represent niche buyers, focusing on prototype inspection and advanced defect mechanism analysis.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.04 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KLA Corporation, Applied Materials Inc., Lasertec Corporation, Carl Zeiss SMT GmbH, JEOL Ltd., NuFlare Technology Inc., Hitachi High-Tech Corporation, ASML Holding N.V. (EUV components), NanoFocus AG, HOYA Corporation, DNP (Dai Nippon Printing Co., Ltd.), Toppan Photomasks, Inc., Photronics Inc., EBARA Corporation, Advantest Corporation, AIMS Metrology, Inc., R&D Altanova, Vistec Electron Beam GmbH, V-TEK International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Global Photomask Inspection Market Key Technology Landscape

The technological landscape of the photomask inspection market is characterized by a high degree of specialization and continuous innovation, driven by the shift from 193nm immersion lithography to EUV. The foundational technology remains high-resolution deep ultraviolet (DUV) optical inspection, optimized for high throughput using either Die-to-Die (DD) or Die-to-Database (DB) comparison modes. However, the limitation of DUV inspection is its inability to effectively detect defects smaller than the wavelength of the inspection light, especially critical defects in sub-20nm half-pitch patterns. This constraint has spurred intense R&D into compensating techniques, such as utilizing advanced computational lithography models to predict the printability risk of subtle defects rather than relying solely on physical dimensions.

A major technological pivot involves the adoption of electron-beam (e-beam) inspection systems. E-beam technology provides significantly higher resolution, enabling the detection and detailed characterization of nanoscale defects that are invisible to optical systems. While e-beam inspection is substantially slower, making it unsuitable for 100% mask coverage during high-volume production, it is indispensable for reviewing critical defect zones, verifying repairs, and qualifying complex OPC (Optical Proximity Correction) structures. The market is now seeing hybrid systems that integrate rapid optical pre-screening with targeted e-beam review, aiming to maximize both sensitivity and throughput, bridging the gap between resolution demands and production timelines.

The most transformative technology is Actinic (EUV-wavelength) Photomask Inspection. Since EUV uses a 13.5nm wavelength, traditional DUV inspection cannot accurately simulate the interaction of the EUV light with the reflective mask structure, making Actinic inspection crucial. These specialized systems use 13.5nm light to identify critical phase defects (imperfections in the multilayer substrate) which dramatically affect reflectivity and printability. Furthermore, specialized inspection tools for the EUV pellicle—a thin membrane protecting the mask—are emerging as a necessary sub-segment, ensuring the pellicle itself is free of particles that could compromise lithographic yield. The entire technological ecosystem is moving toward integrated software platforms that manage, analyze, and correlate data generated by these diverse inspection systems, providing a unified view of mask quality assurance.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocally dominant market for photomask inspection, accounting for the largest share of revenue and new installations. This dominance is driven by the massive capital expenditure of major players in Taiwan (TSMC, UMC), South Korea (Samsung, SK Hynix), and Mainland China. These regions are the global hubs for advanced semiconductor manufacturing (logic and memory), demanding continuous upgrades to EUV and advanced DUV inspection systems to support sub-7nm and sub-5nm production nodes. Government initiatives, particularly in China, aimed at achieving semiconductor self-sufficiency, further accelerate the procurement of high-end equipment, making APAC the primary strategic focus for equipment vendors.

- North America: North America represents a critical market segment defined less by high-volume manufacturing and more by advanced R&D, intellectual property development, and the presence of leading IDMs (e.g., Intel) and major equipment manufacturers (e.g., KLA, Applied Materials). The market demand is driven by the early adoption and qualification of cutting-edge technologies, particularly Actinic inspection tools for EUV and advanced e-beam solutions for process development. Recent policy shifts encouraging domestic chip production (like the CHIPS Act) are expected to stimulate significant capital investment in new fabs, boosting demand for inspection equipment post-2025.

- Europe: The European market, while smaller in terms of pure wafer output, is highly significant due to its leadership in lithography technology, centered around ASML and Carl Zeiss. Demand here is typically centered on specialized mask shops supporting niche industrial, automotive, and high-security computing applications, alongside extensive R&D collaboration related to EUV infrastructure. Procurement is characterized by high precision requirements for specialized applications and a focus on integrating inspection data with advanced process control software, driven by collaboration between regional equipment providers and research centers like imec.

- Latin America, Middle East, and Africa (MEA): These regions currently hold a marginal share of the global photomask inspection market. Demand is primarily confined to established legacy fabrication sites and specialized electronics manufacturing, focusing mainly on mid-range DUV inspection systems rather than leading-edge EUV tools. Growth prospects remain modest but may emerge in niche segments related to regional electronics assembly and repair facilities, though substantial investment in advanced lithography capacity is not immediately projected for the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Global Photomask Inspection Market.- KLA Corporation

- Applied Materials Inc.

- Lasertec Corporation

- Carl Zeiss SMT GmbH

- JEOL Ltd.

- NuFlare Technology Inc.

- Hitachi High-Tech Corporation

- ASML Holding N.V. (EUV components)

- EBARA Corporation

- Advantest Corporation

- HOYA Corporation

- DNP (Dai Nippon Printing Co., Ltd.)

- Toppan Photomasks, Inc.

- Photronics Inc.

- Vistec Electron Beam GmbH

- NanoFocus AG

- R&D Altanova

- AIMS Metrology, Inc.

- Mitsui Chemicals, Inc.

- Shin-Etsu Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Global Photomask Inspection market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between optical and e-beam photomask inspection?

Optical inspection utilizes Deep Ultraviolet (DUV) light for high-speed, full-mask coverage, ideal for detecting larger pattern and contamination defects. E-beam inspection uses electron beams, offering superior resolution necessary for detecting nanoscale, complex defects (e.g., subtle bridge defects or tiny pits) critical at sub-10nm nodes, though it operates at a much slower throughput.

How does the transition to EUV lithography impact the demand for inspection equipment?

The shift to Extreme Ultraviolet (EUV) dramatically increases demand for specialized inspection tools, specifically Actinic Patterned Mask Inspection (APMI) systems. Traditional DUV tools cannot effectively inspect EUV reflective masks for critical phase defects; therefore, mandatory use of Actinic systems and specialized pellicle inspection drives significant new capital investment in this niche, high-cost segment.

What role does Artificial Intelligence (AI) play in modern photomask inspection?

AI, primarily through machine learning and deep learning, enhances Automated Defect Classification (ADC), reducing the error rate (false positives) and accelerating the review time for engineers. AI also optimizes inspection recipes and parameters dynamically based on known yield data, improving overall tool sensitivity and operational efficiency.

Which geographical region dominates the global market for photomask inspection?

The Asia Pacific (APAC) region dominates the market. This is due to the concentration of the world's largest semiconductor foundries and memory manufacturers (particularly in Taiwan, South Korea, and Mainland China) who are leading the transition to advanced process nodes (5nm and 3nm) requiring the most advanced and numerous inspection systems.

What are the key restraint factors limiting market growth?

The primary restraint is the extremely high capital investment required for advanced inspection systems, which can cost tens of millions of dollars per unit, limiting their widespread adoption to the largest, most financially robust mask shops and IDMs. Technical constraints related to increasing inspection sensitivity while maintaining production throughput also pose significant challenges.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager