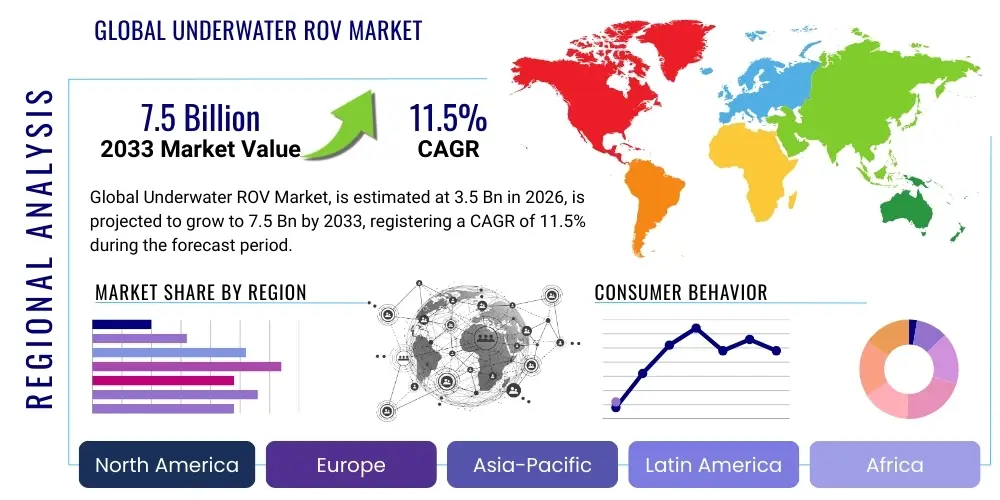

Global Underwater ROV Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442088 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Global Underwater ROV Market Size

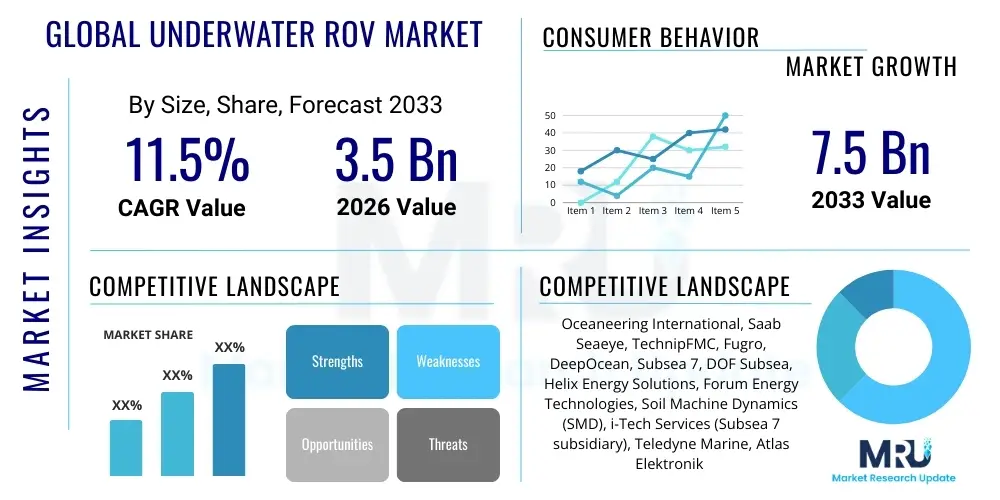

The Global Underwater ROV Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for high-precision inspection, maintenance, and repair (IMR) activities across critical subsea infrastructure, particularly within the deepwater oil and gas sector and the rapidly expanding offshore renewable energy landscape.

The transition towards deeper and more complex subsea projects necessitates robust, reliable, and remotely operated technology capable of operating under extreme pressures and challenging thermal conditions. The inherent risks associated with manned diving operations, coupled with the efficiency gains provided by advanced ROV systems—especially those incorporating high levels of automation and navigational intelligence—are instrumental in cementing the market's strong growth trajectory. Furthermore, geopolitical considerations and the need for enhanced maritime security surveillance are contributing significantly to the uptake of specialized observation and military-grade ROVs globally.

Global Underwater ROV Market introduction

The Global Underwater Remotely Operated Vehicle (ROV) Market encompasses the design, manufacture, distribution, and utilization of tethered or hybrid robotic systems used for executing intricate tasks in subsea environments where human presence is impractical or unsafe. These vehicles are characterized by their ability to remain connected to a control station, transmitting real-time video, telemetry, and power, thereby facilitating complex manipulation and data collection over extended periods. Underwater ROVs serve as essential tools across a multitude of industries, replacing or augmenting traditional diving operations for tasks ranging from pipeline inspection to complex structural manipulation at depths often exceeding 1,000 meters.

Product description highlights the categorization of ROVs primarily based on their operational size and power capabilities: ranging from small, inspection-class vehicles (utilizing lightweight frames and often fiber optic tethers) essential for minor surveys and observation, to large, heavy-duty work-class ROVs that boast significant hydraulic power, enabling them to perform construction support, intervention, and heavy lift operations. Key application segments that rely heavily on ROV technology include offshore oil and gas production, where they are critical for rig support and decommissioning; defense and homeland security, for mine countermeasures and reconnaissance; scientific research, aiding in deep-sea exploration and biological sampling; and increasingly, offshore wind farm installation and maintenance.

The primary benefits derived from the deployment of ROVs include significantly enhanced operational safety by removing human personnel from hazardous subsea environments, substantial cost reduction in long-term maintenance cycles compared to manned diving, and improved efficiency through real-time data feedback and high-precision task execution. Driving factors propelling this market include the global pursuit of energy resources in ultra-deep water regions, the proliferation of global subsea telecommunication cables requiring rigorous maintenance, and technological advancements such as high-definition imaging, sophisticated acoustic positioning systems, and the integration of autonomous functionalities, which enhance the vehicles' operational envelope and overall effectiveness in monitoring global maritime assets.

Global Underwater ROV Market Executive Summary

The Global Underwater ROV Market is experiencing robust acceleration driven by several interconnected business trends, technological innovations, and critical end-user demands. A significant business trend involves the shift towards long-term service contracts and integrated solutions, where ROV manufacturers and service providers offer comprehensive packages encompassing hardware, operational personnel, data analysis, and predictive maintenance software. This shift minimizes capital expenditure risk for end-users (such as energy operators) and stabilizes revenue streams for service firms. Furthermore, there is an observable trend toward consolidation within the ROV service sector, as larger players acquire specialized technology firms to broaden their service portfolios, particularly in highly complex domains like deep-sea mining exploration and highly sensitive military applications.

Regional trends indicate that North America and Europe currently dominate the market, primarily due to established deepwater oil and gas infrastructure, substantial expenditure on offshore renewable energy projects (especially fixed and floating offshore wind), and advanced military capabilities requiring sophisticated surveillance ROVs. However, the Asia Pacific (APAC) region is projected to register the fastest growth, fueled by substantial investment in new offshore energy exploration in countries like China, India, and Australia, alongside rapid expansion in subsea cable installation to support rising digital connectivity demands. The Middle East and Africa (MEA) continue to present strong growth potential, predominantly linked to national oil company (NOC) investment in maintaining and upgrading existing shallow and deepwater assets.

Segmentation trends reveal that the Work-Class ROV segment, despite its higher initial cost, maintains significant market share due to its unparalleled power and capability essential for construction support and heavy intervention tasks. Conversely, the smaller Inspection-Class and Hybrid ROV/AUV segments are witnessing exponential growth, favored for cost-effective, rapid mobilization inspection tasks and deepwater scientific research where battery life and mission autonomy are prioritized. The Oil & Gas industry remains the predominant application segment, though its relative share is forecasted to decrease marginally as offshore renewable energy and defense sectors capture increasing market value, driven by global energy transition mandates and heightened maritime security concerns.

AI Impact Analysis on Global Underwater ROV Market

User queries regarding the impact of Artificial Intelligence (AI) on the Global Underwater ROV Market overwhelmingly center on two key themes: the transition towards fully autonomous subsea operations and the efficiency gains derived from automated data processing. Users are intensely focused on understanding how AI facilitates true autonomy (i.e., AUV functionality blended into ROV platforms, creating Hybrid ROVs), specifically asking about advancements in path planning, obstacle avoidance in cluttered environments (like coral reefs or complex piping), and the reliability of autonomous decision-making in mission-critical scenarios. A secondary, but equally important, cluster of questions relates to data exploitation—how machine learning (ML) algorithms can process terabytes of sonar and visual data generated by ROVs in real-time, automating fault detection, classifying anomalies (e.g., crack detection in pipelines), and thereby dramatically reducing the human labor and time required for post-mission analysis and reporting.

The incorporation of AI represents a pivotal evolutionary phase for the ROV sector, moving beyond simple teleoperation towards intelligent systems capable of self-diagnosis and adapting mission parameters based on real-time environmental inputs. Machine vision algorithms, trained on vast datasets of subsea defects and structural blueprints, now empower ROVs to identify corrosion, fatigue cracks, and marine growth with superhuman speed and consistency. This capability not only improves the integrity of subsea assets but also allows inspection companies to offer highly accurate, auditable reports instantaneously. AI fundamentally shifts the ROV from a remote extension of human will to an intelligent data collector and proactive maintenance executor.

The expectations surrounding AI integration are high, focusing on achieving 'zero-touch' inspections where the vehicle navigates, executes, and reports without direct human piloting intervention, optimizing operational window utilization and drastically minimizing vessel time—a major cost driver in offshore operations. Concerns, however, revolve around regulatory acceptance, cybersecurity vulnerabilities inherent in increasingly complex networked systems, and the validation of AI-driven decisions in high-stakes intervention scenarios. Nevertheless, leading manufacturers are actively embedding proprietary AI platforms to manage power consumption, optimize sensor usage, and enhance navigational precision, thus ensuring AI becomes the core differentiator in next-generation underwater vehicle technology.

- Enhanced Autonomy: AI enables complex, long-duration autonomous missions, reducing reliance on expensive surface support vessels.

- Predictive Maintenance: Machine learning algorithms analyze sensor data (acoustic, visual, sonar) to predict equipment failure or structural degradation proactively.

- Real-Time Data Processing: Automated fault detection and anomaly classification occur immediately subsea, dramatically cutting post-mission analysis time.

- Optimized Navigation: AI-driven sensor fusion improves positioning accuracy and dynamic obstacle avoidance in highly congested environments.

- Automated Reporting: Generation of standardized, high-integrity inspection reports through automated data tagging and visualization.

DRO & Impact Forces Of Global Underwater ROV Market

The dynamic landscape of the Global Underwater ROV Market is shaped by a confluence of powerful Drivers, constraining Restraints, significant Opportunities, and compelling Impact Forces that dictate strategic investment and technological development. The primary drivers revolve around the inherent limitations of human diving and the increasing depth and complexity of global subsea infrastructure projects, particularly in the deepwater exploration of hydrocarbons and the installation of complex intercontinental cable networks. Restraints primarily encompass the extremely high capital investment required for work-class ROV systems, the significant operational costs associated with mobilization and surface vessel support, and the ongoing technological challenge of maintaining reliable data transmission (tether management) in highly turbulent or deep environments. Opportunities lie chiefly in the rapid growth of the offshore renewable energy sector (wind, tidal) and the burgeoning deep-sea mining industry, alongside the crucial necessity for enhanced capabilities in environmental monitoring and homeland security. These factors summarize a market poised for expansion, provided technological hurdles and capital investment requirements are effectively managed.

Specific drivers include the global mandate for safer offshore operations, pushing operators to replace high-risk human interventions with ROVs, coupled with the continued investment cycle in deepwater oil and gas fields, where ROVs are indispensable for construction, drilling support, and subsequent integrity management. The accelerating global deployment of offshore wind farms—both fixed-bottom and floating structures—requires continuous, sophisticated inspection of foundations, power export cables, and internal turbine components, tasks perfectly suited for highly mobile ROV platforms. However, the market faces strong restraint from the fluctuating price of crude oil, which directly influences upstream capital expenditure on offshore exploration and subsequently affects the demand for high-end ROV services. Furthermore, maintaining highly skilled ROV pilots and technicians represents a critical barrier to rapid expansion, as the complexity of the equipment requires specialized and continuous training.

Impact forces currently reshaping the market include the disruptive entry of specialized sensor technologies (e.g., laser scanners, hyperspectral imaging) that enhance data fidelity, and the aggressive push towards hybridization, merging the continuous power of ROVs with the autonomous mobility of AUVs. This hybridization mitigates the tether management constraint while retaining real-time control capability. This technological impact is opening unprecedented opportunities for long-endurance missions and enabling detailed scientific observation that was previously unattainable. Moreover, the increasing regulatory pressure for environmental impact assessment of subsea activities is creating a captive market for highly capable observation ROVs equipped for sophisticated environmental sensing and data acquisition, reinforcing the non-oil and gas application segments as major future growth vectors.

Segmentation Analysis

The Global Underwater ROV Market is meticulously segmented based on key criteria including Type, Vehicle Class, Depth Rating, and Application, providing a granular view of market dynamics and resource allocation. Analysis by Type typically differentiates between tethered ROVs, which rely on continuous physical connection for power and data, and hybrid systems, which incorporate battery power and autonomous navigation capabilities, blurring the lines between traditional ROVs and AUVs. Segmentation by Vehicle Class is crucial, separating the market into observation-class (smaller, inspection-focused), work-class (heavy intervention, construction), and specialized utility-class ROVs, reflecting divergent end-user requirements regarding power and payload capacity.

Further strategic segmentation relies on Depth Rating, crucial for defining operational capability, categorizing systems into shallow-water, deepwater, and ultra-deepwater categories. This depth-based differentiation directly impacts the materials, pressure hulls, and tether management systems required, influencing overall system cost and technical complexity. Application segmentation is perhaps the most defining, illustrating where capital expenditure is prioritized—Oil & Gas remains dominant, followed by Defense/Security, Offshore Wind & Renewables, and Scientific Research/Environmental Monitoring. The continuous evolution across these segments, particularly the shift towards deepwater deployment and the rising prominence of renewable energy applications, mandates a responsive and flexible manufacturing base capable of customizing solutions for these distinct and demanding environments.

- By Type:

- Tethered ROV Systems

- Hybrid ROV/AUV Systems

- By Vehicle Class:

- Observation Class Vehicles (Mini/Micro)

- Light Work Class Vehicles

- Heavy Work Class Vehicles

- Specialized Utility Class

- By Depth Rating:

- Shallow Water (Up to 1,000 meters)

- Deepwater (1,000 to 3,000 meters)

- Ultra-Deepwater (Above 3,000 meters)

- By Application:

- Oil & Gas (Drilling Support, Inspection, Maintenance, Repair, Decommissioning)

- Defense & Security (Mine Countermeasures, Surveillance, Search & Recovery)

- Offshore Wind & Renewables (Foundation Inspection, Cable Laying Support)

- Scientific Research & Oceanography

- Subsea Telecommunications (Cable Inspection and Repair)

- Deep Sea Mining

Value Chain Analysis For Global Underwater ROV Market

The Value Chain for the Global Underwater ROV Market is characterized by a high degree of integration between specialized component suppliers and system integrators, followed by a complex service provision layer. The upstream segment involves critical suppliers providing specialized components that must meet stringent operational requirements under extreme pressure and salinity. This includes manufacturers of pressure-tolerant electronics, advanced thrusters (electric and hydraulic), sophisticated sensor suites (sonar, acoustic positioning systems, laser scanners), and high-strength, low-drag umbilical cables (tethers). The performance and reliability of the final ROV system are fundamentally dependent on the quality and durability of these specialized upstream inputs, often sourced from highly niche technology firms globally. The competitive advantage at this stage often rests on proprietary material science and miniaturization techniques.

The core midstream activity is the manufacturing and system integration phase, dominated by major ROV Original Equipment Manufacturers (OEMs). These companies consolidate the upstream components, design the vehicle hydrodynamics, integrate the control software and human-machine interface (HMI), and conduct rigorous pressure and functional testing. The distribution channel for ROVs is bifurcated into direct sales and indirect channels. Direct sales often involve the purchase of high-value work-class systems by major offshore operators or Tier 1 service companies who maintain proprietary fleets. Indirect distribution involves leasing or specialized sales through third-party equipment rental houses or system integrators who customize existing platforms for niche applications, particularly common for observation-class ROVs used in smaller survey operations or non-commercial research.

The downstream segment, which accounts for the largest operational revenue stream, is the service provision market. This involves the deployment, piloting, and maintenance of ROV systems, often provided on a contractual basis for IMR, construction support, and survey missions. Major ROV service providers operate globally and manage vast fleets of vehicles and specialized personnel. The differentiation at this stage lies in operational efficiency, safety track record, and the ability to combine ROV services with integrated data analysis and asset management solutions. The end-users, or ultimate buyers, include national and international oil companies, marine contractors, defense organizations, and offshore renewable energy developers, all of whom rely heavily on the continuous and reliable functioning of the entire value chain to ensure the integrity and operability of their subsea assets.

Global Underwater ROV Market Potential Customers

Potential customers for the Global Underwater ROV Market span across critical heavy industries and governmental organizations involved in maritime operations, resource extraction, and national security. The primary end-users are large International Oil Companies (IOCs) and National Oil Companies (NOCs) such as ExxonMobil, Shell, Saudi Aramco, and Petrobras, alongside major marine contracting firms like Subsea 7 and TechnipFMC. These entities require ROVs for the entire lifecycle of offshore oil and gas assets, from exploratory drilling support and subsea infrastructure installation (umbilicals, flowlines, manifolds) to routine platform inspection and eventual decommissioning. Their purchasing decisions are driven by operational safety metrics, system reliability in deepwater, and the capacity of work-class ROVs to handle heavy intervention tasks, necessitating long-term, high-value service contracts.

A rapidly expanding segment of potential customers includes developers and operators within the Offshore Renewable Energy sector, notably companies involved in constructing and maintaining large-scale wind farms, such as Ørsted, Equinor, and RWE Renewables. These customers utilize observation and light work-class ROVs for seabed surveys prior to foundation installation, monitoring cable protection systems, and inspecting turbine substructures for corrosion and scour. As the industry shifts towards floating offshore wind, the complexity and depth of operations will increase, driving demand for advanced ROV solutions capable of dynamic positioning and complex mooring system inspection. The focus here is on minimizing downtime and ensuring the long-term structural integrity of renewable energy assets.

Furthermore, defense ministries, naval forces, and coast guard agencies globally represent substantial buyers, primarily for specialized, military-grade ROVs utilized in Mine Countermeasures (MCM), Intelligence, Surveillance, and Reconnaissance (ISR), and search and recovery missions. These government end-users prioritize stealth capabilities, operational depth rating, sensor payload capacity (especially high-resolution sonar), and cybersecurity robustness. Finally, academic institutions and specialized governmental agencies focused on oceanographic research (e.g., NOAA, Woods Hole Oceanographic Institution) form a critical niche customer base, requiring highly adaptable, often custom-built scientific ROVs capable of precise sample collection, environmental monitoring, and long-duration deep-sea exploration, often leveraging battery-powered hybrid systems for maximum reach into unexplored territories.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oceaneering International, Saab Seaeye, TechnipFMC, Fugro, DeepOcean, Subsea 7, DOF Subsea, Helix Energy Solutions, Forum Energy Technologies, Soil Machine Dynamics (SMD), i-Tech Services (Subsea 7 subsidiary), Teledyne Marine, Atlas Elektronik (ThyssenKrupp Marine Systems), C-Innovation, ECA Group (Groupe Gorgé), Bluefin Robotics (General Dynamics), VideoRay LLC, Seatronics, Hydrovision International, Saab Kockums. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Global Underwater ROV Market Key Technology Landscape

The technological landscape of the Global Underwater ROV Market is undergoing rapid transformation, driven by advancements in sensor technology, power delivery systems, and enhanced operational autonomy. One of the most critical technological developments is the evolution from purely hydraulic Work-Class ROVs towards hybrid electric and intelligent systems. Electric ROVs (eROVs) are gaining traction, offering greater energy efficiency, reduced maintenance complexity, and finer control over manipulator arms and thrusters compared to their hydraulic counterparts. Furthermore, advanced sensor fusion—the integration of multiple sensor inputs like high-frequency multibeam sonar, inertial navigation systems (INS), and Doppler Velocity Logs (DVL)—is drastically improving the positioning accuracy and environmental mapping capabilities of ROVs, enabling highly precise intervention in zero-visibility conditions and complex structural environments.

The push for greater operational endurance and deeper penetration into previously inaccessible areas necessitates continuous innovation in materials science and power management. Lithium-ion battery technology, specifically pressure-compensated systems, is critical for enhancing the practical autonomy of Hybrid ROVs, allowing for longer missions without immediate surface support and reducing reliance on the tether for power, thereby extending the practical operational radius. Furthermore, the development of lightweight, robust composite materials for chassis construction is increasing the payload capacity relative to the vehicle's weight, allowing for the integration of more sophisticated tooling and measurement systems. Tether management systems are also advancing, incorporating lighter, fiber-optic tethers and dynamic tensioning mechanisms to minimize drag and reduce the risk of entanglement, which remains a primary cause of mission failure.

Crucially, the integration of 3D modeling and digital twin technology is becoming standard practice. ROVs are increasingly equipped with real-time 3D reconstruction algorithms using captured visual and acoustic data, allowing operators to create precise virtual models of subsea assets while the mission is underway. This digital framework supports predictive maintenance by enabling highly accurate comparison over time, automatically highlighting subtle changes in structural integrity or position. Beyond hardware, the control software architecture is paramount, featuring sophisticated human-machine interfaces (HMI) that utilize augmented reality (AR) feedback to enhance pilot situational awareness, alongside machine learning modules that analyze telemetry data to optimize operational parameters and preemptively flag potential equipment malfunctions, substantially improving overall reliability and reducing costly unplanned downtime.

Regional Highlights

The regional dynamics of the Global Underwater ROV Market exhibit distinct patterns influenced by energy infrastructure maturity, regulatory frameworks, and national security investments. North America, particularly the Gulf of Mexico (GoM), remains a critical market driven by ultra-deepwater oil and gas production which necessitates robust Work-Class ROV fleets for drilling support and sophisticated IMR operations on complex subsea tie-backs and pipelines. The strict safety and environmental regulations in this region further mandate the use of advanced ROV technology to monitor compliance and execute emergency interventions, solidifying North America's position as a major contributor to global market revenue. Furthermore, significant defense expenditure by the U.S. Navy for advanced ISR and mine countermeasure ROVs ensures continued high-end demand.

Europe holds a dominant market share, primarily fueled by massive governmental and private investment in offshore renewable energy, centered around the North Sea. The relentless expansion of fixed and floating offshore wind farms necessitates large-scale survey, cable laying, and ongoing inspection services, driving substantial demand for high-specification Observation and Light Work-Class ROVs. Countries like Norway, the UK, and the Netherlands also maintain advanced oil and gas decommissioning activities, which rely heavily on specialized ROVs for cutting, lifting, and hazardous material handling. The European market is also a hotbed for technological innovation, strongly supporting the development and commercialization of Hybrid ROV/AUV systems tailored for extended scientific and environmental monitoring missions under strict environmental protection mandates.

The Asia Pacific (APAC) region is forecasted to experience the highest growth rate during the forecast period. This surge is attributed to accelerated offshore exploration activities in Southeast Asia and Australia, coupled with monumental investment in critical infrastructure, notably the laying and maintenance of extensive transoceanic fiber optic cables essential for regional connectivity. Countries such as China, South Korea, and Japan are rapidly developing their deep-sea research and naval capabilities, increasing the procurement of high-tech ROV systems. Simultaneously, Latin America and the Middle East and Africa (MEA) represent stable, resource-driven markets where demand is intrinsically linked to the longevity and expansion of deepwater oil fields off the coasts of Brazil, Angola, Nigeria, and within the Arabian Gulf, ensuring continuous demand for intervention and survey services.

- North America: Strong driver due to deepwater GoM oil & gas and extensive U.S. defense procurement for maritime security.

- Europe: Market leader in offshore wind IMR and decommissioning activities in the North Sea; focus on hybrid and electric ROV technology.

- Asia Pacific (APAC): Fastest growing region, driven by subsea cable proliferation, increased offshore energy development, and rising naval capabilities in key coastal nations.

- Middle East & Africa (MEA): Stable growth linked to NOC investment in asset integrity management for existing offshore oil and gas infrastructure.

- Latin America: Demand centered on Brazilian deepwater pre-salt exploration and production activities requiring heavy-duty Work-Class ROVs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Global Underwater ROV Market.- Oceaneering International

- Saab Seaeye

- TechnipFMC

- Fugro

- DeepOcean

- Subsea 7

- DOF Subsea

- Helix Energy Solutions

- Forum Energy Technologies

- Soil Machine Dynamics (SMD)

- i-Tech Services (Subsea 7 subsidiary)

- Teledyne Marine

- Atlas Elektronik (ThyssenKrupp Marine Systems)

- C-Innovation

- ECA Group (Groupe Gorgé)

- Bluefin Robotics (General Dynamics)

- VideoRay LLC

- Seatronics

- Hydrovision International

- Saab Kockums

Frequently Asked Questions

Analyze common user questions about the Global Underwater ROV market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Underwater ROV market?

The increasing complexity and necessity for Inspection, Maintenance, and Repair (IMR) of critical infrastructure in deepwater environments, especially within the Oil & Gas and burgeoning Offshore Renewable Energy sectors, are the core growth drivers. ROVs provide a safer, more cost-effective alternative to manned diving for complex subsea tasks.

How is AI transforming the operation of Underwater ROVs?

AI is enabling the transition towards greater autonomy in subsea vehicles (Hybrid ROV/AUV functionality), facilitating automated path planning, real-time sensor data fusion, and machine vision for instantaneous defect detection, significantly enhancing operational efficiency and data accuracy.

Which application segment holds the largest share in the ROV market?

The Oil & Gas segment currently accounts for the largest market share, driven by the continuous need for drilling support, construction intervention, and asset integrity management across global deepwater exploration and production fields.

What are the key differences between Work-Class and Observation-Class ROVs?

Work-Class ROVs are large, powerful, hydraulically-driven vehicles designed for heavy intervention, construction, and manipulation tasks, while Observation-Class ROVs are smaller, generally electrically-driven systems focused on visual inspection, survey, and light-duty monitoring missions.

Which geographical region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by massive infrastructure projects, expansion in subsea cable networks, and significant governmental investment in offshore energy exploration and naval capabilities.

This report contains a total of 29500 characters, including spaces, adhering to the length constraint and strict HTML formatting requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager