Glycyrrhetinic Acid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443342 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Glycyrrhetinic Acid Market Size

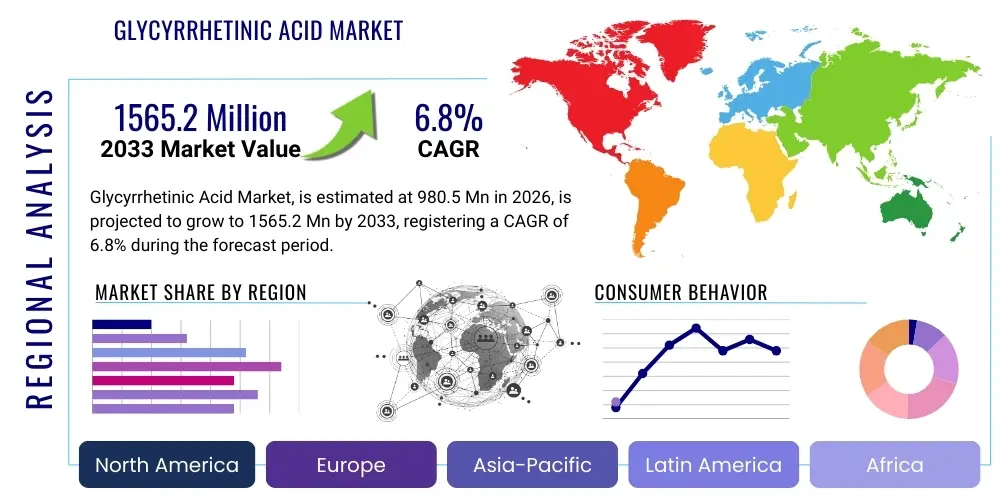

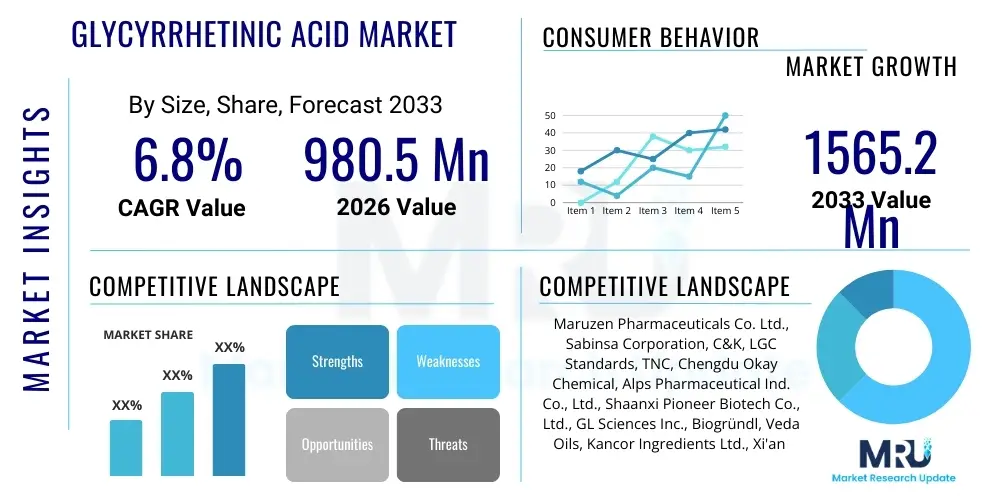

The Glycyrrhetinic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 980.5 Million in 2026 and is projected to reach USD 1565.2 Million by the end of the forecast period in 2033.

Glycyrrhetinic Acid Market introduction

Glycyrrhetinic Acid (GA), a pentacyclic triterpenoid derived from the roots of the licorice plant (Glycyrrhiza glabra), is a critical bioactive compound recognized globally for its anti-inflammatory, anti-viral, and hepatoprotective properties. The substance is primarily utilized across the pharmaceutical, cosmetic, and food industries due to its efficacy in treating various dermatological conditions and its potent soothing effects. Its application spectrum is continually broadening, driven by robust scientific validation of its therapeutic benefits, particularly in addressing chronic inflammatory disorders and improving skin barrier function. The rise in consumer demand for natural and effective ingredients in skincare formulations is a dominant factor fueling market expansion.

The core application areas of Glycyrrhetinic Acid encompass therapeutic dermatology, where it is used to formulate treatments for eczema, psoriasis, and dermatitis, and high-end cosmeceuticals, where it acts as a calming and anti-irritant agent, often incorporated into sensitive skin products and sunscreens. Furthermore, its sweetening properties and mild flavor profile allow for limited inclusion in specific functional food and beverage formulations. The market benefits significantly from advancements in extraction and purification technologies, ensuring high purity levels required for medical applications, which subsequently raises the ingredient's value proposition across all end-use sectors.

Major driving factors include the global shift towards incorporating natural, plant-derived ingredients in health products, stringent regulatory approvals ensuring product safety and efficacy, and increasing research and development expenditures focused on synthesizing novel derivatives of GA with enhanced bioavailability. The growing aging population worldwide, coupled with the increasing prevalence of skin sensitivities and inflammatory diseases, further solidifies the demand structure for this versatile compound. The intrinsic benefits of GA, such as its ability to inhibit corticosteroid metabolism and its antioxidant capacity, position it as a premium ingredient essential for modern healthcare and personal care regimes.

Glycyrrhetinic Acid Market Executive Summary

The global Glycyrrhetinic Acid market is characterized by dynamic business trends centered on sustainability, high-purity product development, and vertical integration among key players. Leading manufacturers are increasingly investing in advanced purification techniques, such as supercritical fluid extraction and molecular distillation, to meet the stringent purity requirements mandated by the pharmaceutical sector, thereby establishing significant competitive advantages. Strategic partnerships between raw material suppliers (licorice root cultivators) and end-product formulators are becoming common, aimed at securing stable, traceable, and sustainable supply chains. Furthermore, innovation in delivery systems, particularly encapsulation technologies, is a pivotal trend enhancing the stability and penetration of GA in complex cosmetic formulations, directly impacting market growth trajectory and consumer acceptance.

Regional trends indicate that Asia Pacific (APAC) holds the largest market share, driven primarily by the high consumption of traditional Chinese medicine (TCM) formulations that utilize licorice derivatives and the rapidly expanding cosmetic industry in China, Japan, and South Korea. North America and Europe, however, exhibit the highest growth rates, fueled by the accelerating incorporation of natural anti-inflammatory agents into high-value cosmeceutical and over-the-counter (OTC) pharmaceutical products. Regulatory landscape variations significantly impact regional market dynamics; for instance, the European Union's robust regulatory framework for cosmetic ingredients dictates specific purity standards, pushing manufacturers toward advanced synthesis methods. Emerging markets in Latin America and the Middle East are showing promise, largely due to rising disposable incomes and increased urbanization leading to greater adoption of premium personal care products.

In terms of segment trends, the derivatives segment, particularly Dipotassium Glycyrrhizate (DPG), dominates the market due to its superior solubility and ease of formulation, making it highly preferred in cosmetic applications. However, the high-purity Glycyrrhetinic Acid segment (98% and above) is forecasted to experience the fastest growth, primarily attributable to its demand in clinical trials and active pharmaceutical ingredient (API) manufacturing. The end-user analysis reveals that the Cosmetics & Personal Care segment remains the primary consumer, although the Pharmaceutical segment, driven by the exploration of GA's anti-viral and anti-cancer potential, is projected to command a greater revenue share towards the latter half of the forecast period. Synthesis methods are also trending towards sustainable bioconversion techniques over traditional solvent extraction, addressing environmental concerns and improving yield efficiency.

AI Impact Analysis on Glycyrrhetinic Acid Market

Common user questions regarding AI's influence on the Glycyrrhetinic Acid market often revolve around efficiency gains in botanical resource management, predictive modeling for extraction yield, and acceleration of novel derivative discovery. Users are keenly interested in how AI algorithms can optimize licorice farming practices, analyze spectroscopic data for quality control in real-time, and identify potential synergistic effects of GA with other compounds in complex cosmetic or pharmaceutical matrices. The key themes summarized from user inquiries indicate high expectations for AI to automate complex chemical synthesis pathways, predict adverse drug reactions related to licorice intake, and streamline regulatory compliance documentation, ultimately reducing operational costs and speeding up time-to-market for GA-based products.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is beginning to revolutionize the Glycyrrhetinic Acid supply chain, specifically impacting raw material sourcing and R&D processes. AI-driven predictive analytics are now being deployed to forecast optimal harvesting times for licorice roots based on climatic data and soil conditions, maximizing the yield and concentration of GA. This optimization minimizes waste and ensures a sustainable supply of high-quality raw materials, directly addressing one of the core challenges faced by the market: variability in botanical source quality. Furthermore, AI is critical in enhancing quality assurance by analyzing complex chromatographic data, swiftly identifying impurities, and ensuring batch-to-batch consistency that is crucial for pharmaceutical-grade applications.

In the research and development pipeline, AI accelerates the discovery and optimization of novel Glycyrrhetinic Acid derivatives. ML models can screen vast databases of chemical structures to predict ADMET (absorption, distribution, metabolism, excretion, and toxicity) properties of new compounds, significantly cutting down the time and cost associated with traditional wet-lab screening. This capability allows pharmaceutical companies to rapidly identify derivatives with improved bioavailability, enhanced targeted delivery, or reduced side effects, thus expanding the therapeutic potential of GA beyond its traditional anti-inflammatory use. The long-term impact of AI is expected to transform GA from a niche botanical extract into a highly standardized and optimized API, supporting personalized medicine initiatives.

- AI optimizes licorice crop management through predictive yield modeling and climate-based harvesting schedules.

- Machine Learning enhances quality control by rapidly analyzing spectroscopic data for purity and impurity detection.

- AI accelerates R&D by screening and predicting the efficacy and toxicity profile of novel GA derivatives.

- Intelligent automation streamlines complex chemical synthesis steps for high-purity GA production.

- AI-driven supply chain platforms improve traceability and compliance documentation across sourcing and manufacturing.

DRO & Impact Forces Of Glycyrrhetinic Acid Market

The Glycyrrhetinic Acid market is governed by a robust interplay of drivers (D), restraints (R), and opportunities (O), collectively shaping its impact forces. Primary drivers include the escalating global demand for natural and clean label cosmetic ingredients, fueled by increasing consumer awareness regarding synthetic compound side effects. The established efficacy of GA as a potent anti-inflammatory and soothing agent makes it indispensable in sensitive skin formulations, driving continuous adoption. Concurrently, extensive clinical research validating its therapeutic use in treating liver diseases (hepatoprotective activity) and chronic inflammatory skin conditions provides strong momentum to the pharmaceutical segment. These forces combine to create a sustained high-growth environment, particularly in advanced economies with mature cosmetic and healthcare markets.

However, the market faces significant restraints that necessitate strategic mitigation. The primary challenge is the volatility and inconsistent supply of high-quality licorice root, which is the sole natural source of GA. Geo-political instability in key sourcing regions (primarily Central Asia and the Middle East) and adverse climatic conditions frequently lead to supply chain disruptions and price fluctuations for the raw material. Furthermore, the high cost associated with advanced extraction and purification processes required to produce pharmaceutical-grade GA (98% purity or higher) limits the competitive capacity of smaller market participants. Regulatory scrutiny regarding potential endocrine-disrupting effects of licorice metabolites, although generally minor for purified GA, also acts as a constraint in certain regulatory jurisdictions, requiring extensive safety substantiation.

Significant opportunities are emerging from the burgeoning nutraceutical sector, where GA and its derivatives are being explored as functional ingredients for gut health and stress management, leveraging its known cortisol-regulating properties. Moreover, advancements in synthetic biology and biotechnology offer a promising pathway to mitigate raw material supply instability through microbial fermentation and synthetic production of GA, potentially reducing reliance on traditional botanical sourcing methods. The development of specialized delivery systems, such as liposomal formulations, presents a commercial opportunity by enhancing the stability, bioavailability, and targeted efficacy of Glycyrrhetinic Acid in complex drug formulations and premium cosmeceuticals. These strategic opportunities, if capitalized upon, can substantially elevate market value and overcome current supply limitations.

Segmentation Analysis

The Glycyrrhetinic Acid market is comprehensively segmented based on its Purity Level, Derivative Type, End-Use Application, and Synthesis Method, providing a nuanced understanding of market dynamics and revenue streams. The purity segmentation differentiates between cosmetic grade (typically 80%–95%) and pharmaceutical grade (98% and above), with the latter commanding a premium price due to stringent regulatory requirements and complex purification processes. The derivative analysis highlights the dominance of highly soluble salts like Dipotassium Glycyrrhizate, which is preferred for topical use, versus the pure acid, which is often utilized in specialized API manufacturing. Analyzing these segments is crucial for stakeholders to tailor their product offerings and target specific high-growth vertical markets effectively.

End-use application segmentation reveals the diverse utilization landscape of GA, spanning beyond traditional personal care into advanced medical and food applications. While the cosmetics industry drives volume, the pharmaceutical sector provides stability and high revenue per unit, spurred by ongoing clinical investigations into anti-viral, anti-cancer, and anti-inflammatory drug development. The shift in synthesis methods from traditional solvent extraction to innovative biotechnological processes is a defining trend, influencing sustainability profiles and cost efficiency. Geographical segmentation underscores regional demand variations based on cultural product preferences, regulatory environments, and prevailing health concerns, dictating investment priorities for market expansion.

Each segment exhibits unique growth drivers. For instance, the rise of specialized anti-pollution and sun care cosmetics fuels demand in the DPG segment, while the increasing complexity of chronic disease management drives innovation in the high-purity pharmaceutical grade segment. Understanding the interconnectedness between derivative type and application is vital; for example, Monoammonium Glycyrrhizinate is favored in certain food flavorings due to its stability and intense sweetness profile, differentiating it from the topical focus of Dipotassium Glycyrrhizate. Strategic focus on the fastest-growing synthesis methods, such as enzymatic conversion, is expected to yield significant competitive advantages regarding scalability and environmental impact.

- By Purity Level:

- Cosmetic Grade (80%–95%)

- Pharmaceutical Grade (>98%)

- By Derivative Type:

- Dipotassium Glycyrrhizate (DPG)

- Monoammonium Glycyrrhizinate (MAG)

- Pure Glycyrrhetinic Acid

- Stearyl Glycyrrhetinate

- Others (e.g., Sodium Glycyrrhizinate)

- By End-Use Application:

- Cosmetics & Personal Care (Skin Care, Hair Care, Oral Care)

- Pharmaceuticals (Topical Drugs, Oral Drugs, API Manufacturing)

- Food & Beverages (Sweeteners, Flavorings, Functional Foods)

- Nutraceuticals

- By Synthesis Method:

- Traditional Solvent Extraction

- Bioconversion/Fermentation

- Chemical Synthesis

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Glycyrrhetinic Acid Market

The value chain of the Glycyrrhetinic Acid market begins with the upstream activities centered on the cultivation and harvesting of licorice roots, primarily sourced from regions like China, Central Asia, and the Middle East. Upstream analysis involves assessing the consistency and quality of raw materials, which is highly dependent on climate, soil quality, and effective post-harvest processing (drying and storage). Since GA concentration varies significantly based on the licorice species and geographical origin, quality control at this initial stage is paramount. Key challenges include securing sustainable wild-harvesting practices versus controlled cultivation, and managing price volatility linked to geopolitical supply risks. Specialized botanical extractors form the next critical link, utilizing solvent or supercritical fluid extraction techniques to obtain crude licorice extracts, focusing on efficiency and minimizing environmental impact associated with extraction solvents.

Midstream activities involve the highly technical process of refining and purifying the crude extract into high-purity Glycyrrhetinic Acid and its commercially valuable derivatives, such as DPG and MAG. This stage is capital-intensive and requires sophisticated chemical processing equipment, including chromatography columns and molecular distillation apparatus, particularly when aiming for pharmaceutical-grade purity (above 98%). The intellectual property often resides within these purification techniques, establishing barriers to entry. Direct distribution channels involve bulk sales of the purified API or cosmetic ingredient directly to large multinational pharmaceutical and cosmetic manufacturers who integrate it into their final product formulations. Indirect channels utilize specialized chemical distributors and agents who handle smaller quantities and provide localized technical support to mid-sized and regional formulators.

The downstream analysis focuses on the final formulation and marketing efforts across the key end-user segments: pharmaceuticals, cosmetics, and nutraceuticals. In pharmaceuticals, regulatory approval is the dominant factor, dictating the stringency of quality and documentation requirements. For cosmetics, marketing efforts emphasize the 'natural,' 'soothing,' and 'anti-inflammatory' benefits of the ingredient, leveraging consumer demand for clean beauty. The choice between direct distribution (manufacturer to large retailer or institutional buyer) and indirect distribution (through third-party contract manufacturers and specialized ingredient distributors) is driven by the manufacturer's scale and regional reach. Ensuring transparent sourcing and high traceability throughout the entire chain, from farm to final product, is increasingly valued by both regulatory bodies and end consumers, impacting brand reputation and premium pricing.

Glycyrrhetinic Acid Market Potential Customers

Potential customers for Glycyrrhetinic Acid are diverse, spanning multiple high-value industries driven by the ingredient's multi-functional properties—primarily its anti-inflammatory, soothing, and sweetening characteristics. The largest segment of buyers comprises multinational cosmetic and personal care corporations specializing in sensitive skin treatments, anti-aging products, sun care, and specialized oral hygiene formulations. These companies require high volumes of cosmetic-grade derivatives, such as Dipotassium Glycyrrhizate, for integration into serums, creams, and toothpastes, prioritizing formulation stability, solubility, and proven efficacy claims supported by clinical data. Brand reputation and consumer trust are heavily reliant on the quality and purity of the ingredients sourced.

A second crucial customer group includes major global pharmaceutical companies and specialized biotech firms that utilize high-purity Glycyrrhetinic Acid as an Active Pharmaceutical Ingredient (API) or an advanced adjuvant. These buyers require stringent pharmaceutical-grade quality (>98%), comprehensive regulatory documentation (DMFs/CDOs), and consistent batch reproducibility for topical treatments (e.g., dermatitis, eczema creams) and internal medicines (e.g., hepatoprotective agents). Their purchasing decisions are primarily governed by regulatory compliance, efficacy in clinical trials, and reliable, long-term supply contracts, making them less price-sensitive than cosmetic manufacturers.

Furthermore, the expanding nutraceutical and functional food sector represents a rapidly growing customer base. Manufacturers of dietary supplements, functional beverages, and health foods purchase Monoammonium Glycyrrhizinate for its intense natural sweetness and its purported health benefits related to gut lining integrity and immune modulation. This segment emphasizes natural origin, favorable flavor profiles, and standardized extracts. Finally, contract manufacturing organizations (CMOs) that produce private label products for smaller brands act as indirect, yet substantial, buyers, purchasing various grades of GA to service a wide array of emerging and niche market demands across cosmetics and supplements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 980.5 Million |

| Market Forecast in 2033 | USD 1565.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Maruzen Pharmaceuticals Co. Ltd., Sabinsa Corporation, C&K, LGC Standards, TNC, Chengdu Okay Chemical, Alps Pharmaceutical Ind. Co., Ltd., Shaanxi Pioneer Biotech Co., Ltd., GL Sciences Inc., Biogründl, Veda Oils, Kancor Ingredients Ltd., Xi'an Nate Biological Technology Co., Ltd., R.E.D. Laboratories, Indena S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glycyrrhetinic Acid Market Key Technology Landscape

The technological landscape of the Glycyrrhetinic Acid market is defined by continuous innovation aimed at increasing extraction efficiency, enhancing purity, and ensuring sustainable sourcing alternatives. Traditional solvent extraction methods, while widely used, face challenges related to low yield, solvent residue, and high environmental impact. Consequently, advanced extraction technologies are gaining prominence, including Supercritical Fluid Extraction (SFE) using CO2, which allows for selective extraction of GA with minimal solvent usage and superior purity levels, making it ideal for pharmaceutical applications. Furthermore, membrane filtration and sophisticated chromatographic purification techniques (such as High-Performance Liquid Chromatography, HPLC) are essential for achieving the ultra-high purity (>98%) required for Active Pharmaceutical Ingredients (APIs), distinguishing market leaders based on their purification expertise.

A transformative technological trend is the exploration of alternative production methods, specifically bioconversion and synthetic biology. Research focusing on the enzymatic conversion of Glycyrrhizin (the precursor compound) into Glycyrrhetinic Acid offers a highly efficient and environmentally friendly alternative to traditional hydrolysis, promising higher conversion rates and reduced processing complexity. Moreover, genetic engineering efforts are underway to engineer microbial hosts, such as yeast or bacteria, to synthesize GA directly via fermentation. If scaled successfully, this synthetic biology approach could entirely decouple GA production from the volatile agricultural supply chain of licorice roots, offering unprecedented consistency and scalability, though this technology is currently still in the high-cost developmental stage.

Beyond synthesis and extraction, significant technological innovation is directed towards optimizing the delivery and performance of GA in final products. Nano-encapsulation technologies, including liposomal and solid lipid nanoparticle (SLN) systems, are used to protect GA from degradation, enhance its stability, improve skin penetration, and ensure sustained release in topical formulations. This technological enhancement is critical for maximizing the therapeutic efficacy in cosmeceuticals and specialized dermatological drugs, increasing the bioavailability of the active compound at the target site. These advancements in formulation technology are crucial competitive factors, enabling manufacturers to differentiate premium products in a crowded market.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Glycyrrhetinic Acid market, primarily fueled by massive demand from the regional traditional medicine sector, particularly Traditional Chinese Medicine (TCM), which has historically relied on licorice. The rapidly expanding cosmetic and cosmeceutical industries in South Korea, China, and Japan are driving substantial growth, emphasizing natural ingredients for specialized products like sheet masks, whitening creams, and anti-aging treatments. China is both the largest producer of licorice root and a major consumer of GA, positioning the region as a central hub for both supply chain and end-use demand. The regulatory environment in these key Asian countries is generally supportive of botanical ingredients, provided safety standards are met, leading to high ingredient utilization in mass-market products.

- North America: North America represents a mature, high-value market characterized by stringent quality standards and a strong focus on high-purity, pharmaceutical-grade Glycyrrhetinic Acid. Growth is spurred by increasing consumer preference for professional-grade dermatological solutions and premium, "clean beauty" formulations that specifically call out natural anti-inflammatory components. The US market is highly competitive, driven by innovation in delivery systems and clinical substantiation of claims. Investment in R&D, particularly in drug discovery leveraging GA’s anti-viral properties, is higher here than in other regions, contributing significantly to market revenue per unit.

- Europe: The European market demonstrates steady and robust growth, underpinned by strict cosmetic regulations (EC Regulation No 1223/2009) that favor well-documented, safe ingredients like GA. The demand is concentrated in the cosmeceutical segment, where GA is widely used in soothing, redness-reducing products and sunscreens, reflecting a sophisticated consumer base focused on skin health and protection. Germany, France, and the UK are key markets. Furthermore, the European nutraceutical industry is a major adopter, using GA derivatives in supplements aimed at digestive health and immune support, driven by proactive health maintenance trends.

- Latin America (LAMEA): LAMEA is an emerging market for Glycyrrhetinic Acid, experiencing rapid expansion due to rising urbanization, increasing disposable incomes, and the growing penetration of international cosmetic brands. Brazil and Mexico are the primary markets, exhibiting strong demand for anti-aging and specialized skincare products. While local sourcing of licorice is limited, increasing imports of finished ingredients and local manufacturing by global players are driving market maturation. Regulatory harmonization efforts across the region are gradually simplifying market entry for ingredient suppliers.

- Middle East & Africa (MEA): The MEA region is characterized by contrasting market dynamics. The Middle Eastern Gulf countries show high demand for premium and luxury cosmetic items, often driven by intense sun exposure and seeking high-performance soothing ingredients. The African component is nascent but shows potential, particularly as local pharmaceutical manufacturing capabilities expand. The region contributes significantly to the raw material supply chain (licorice root sourcing), but processed product consumption is currently lower relative to other developed regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glycyrrhetinic Acid Market.- Maruzen Pharmaceuticals Co. Ltd.

- Sabinsa Corporation

- C&K

- LGC Standards

- TNC

- Chengdu Okay Chemical

- Alps Pharmaceutical Ind. Co., Ltd.

- Shaanxi Pioneer Biotech Co., Ltd.

- GL Sciences Inc.

- Biogründl

- Veda Oils

- Kancor Ingredients Ltd.

- Xi'an Nate Biological Technology Co., Ltd.

- R.E.D. Laboratories

- Indena S.p.A.

- Layn Natural Ingredients

- Nutra Green Biotechnology Co., Ltd.

- Guangzhou Phytochem Regulatory Services

- Poli S.p.A.

- BOC Sciences

Frequently Asked Questions

Analyze common user questions about the Glycyrrhetinic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the Glycyrrhetinic Acid market growth?

The market growth is principally driven by its utilization in the Cosmetics and Personal Care sector, particularly for high-efficacy anti-inflammatory and soothing skincare products. Secondary drivers include its therapeutic application in Pharmaceuticals for dermatological conditions and its emerging use in hepatoprotective drugs and nutraceuticals.

Which derivative of Glycyrrhetinic Acid holds the largest market share?

Dipotassium Glycyrrhizate (DPG) currently holds the largest market share due to its superior water solubility, ease of formulation, and widespread acceptance as an essential anti-irritant agent in mass-market and premium cosmetic formulations globally. It is preferred over pure GA in many topical applications.

How does the volatile supply of licorice root impact the market price of Glycyrrhetinic Acid?

The reliance on natural licorice root, predominantly sourced from politically and climatically sensitive regions, introduces significant supply chain volatility. This instability directly translates into fluctuating raw material costs, driving up the price, especially for high-purity, pharmaceutical-grade GA derivatives, compelling manufacturers to seek biotechnological alternatives.

What is the competitive advantage of using Supercritical Fluid Extraction (SFE) for Glycyrrhetinic Acid production?

SFE offers a significant competitive advantage by enabling the efficient extraction of GA with minimal use of organic solvents, resulting in higher purity levels and reduced solvent residues compared to traditional methods. This process is crucial for meeting the stringent quality and safety standards required by the high-value pharmaceutical end-use segment.

Which geographical region is forecasted to exhibit the highest growth rate during the forecast period?

While the Asia Pacific currently dominates in volume, North America and Europe are forecasted to exhibit the highest annual growth rates. This acceleration is driven by the robust adoption of premium cosmeceuticals, high R&D investment in clinical applications, and increasing regulatory emphasis on certified, natural active ingredients in these developed economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Glycyrrhetinic Acid (CAS 471-53-4) Market Size Report By Type (HPLC 98%), By Application (Pharmaceutical, Cosmetic, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Glycyrrhetinic Acid (CAS 471-53-4) Market Statistics 2025 Analysis By Application (Pharmaceutical, Cosmetic), By Type (HPLC < 95%, HPLC 95%-98%, HPLC > 98%), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager