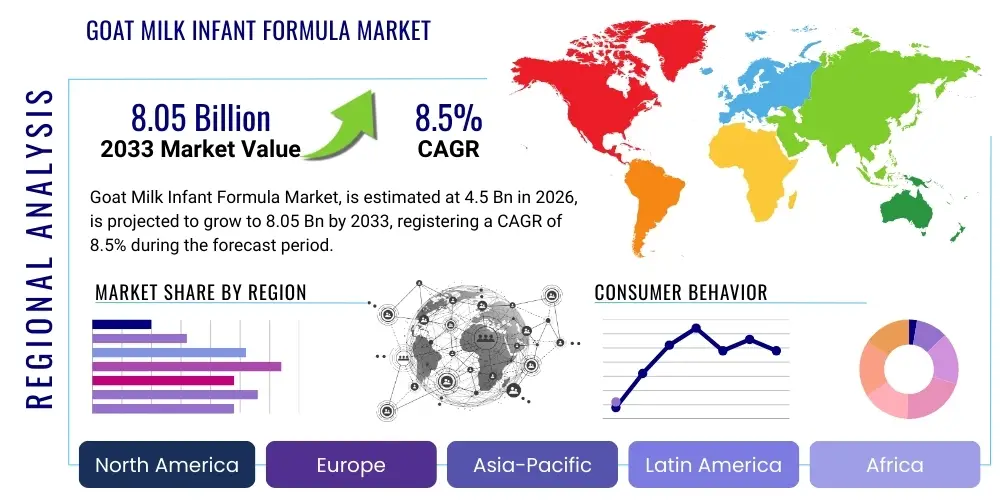

Goat Milk Infant Formula Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442712 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Goat Milk Infant Formula Market Size

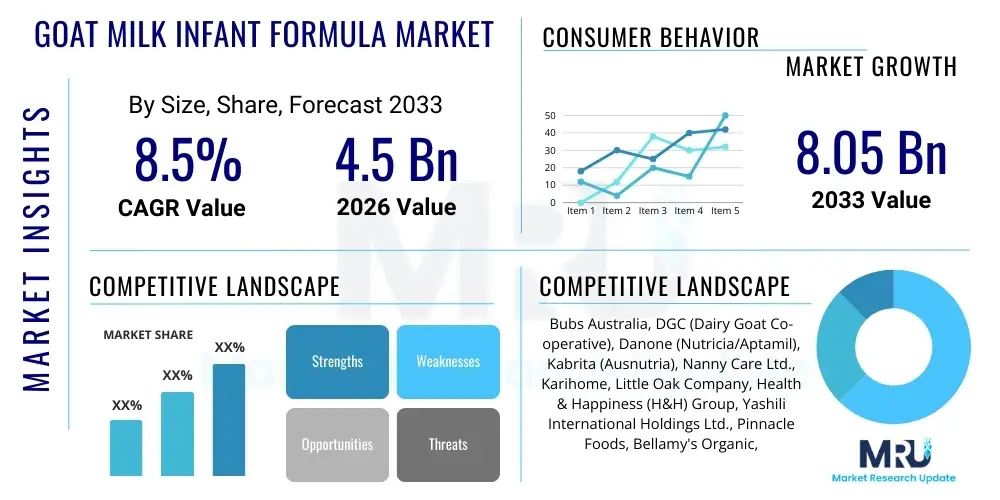

The Goat Milk Infant Formula Market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. This substantial growth trajectory is underpinned by increasing consumer awareness regarding the potential digestive benefits and nutritional profile of goat milk compared to traditional cow milk formulas. The market's expansion is particularly noticeable in developed economies where premium, specialty infant nutrition products are gaining significant traction among affluent and health-conscious parents seeking alternative feeding solutions for their infants.

The market is estimated at USD 4.5 Billion in 2026, driven primarily by strong adoption rates across the Asia Pacific region, particularly China and Southeast Asia, which are major consumption centers for specialty infant nutrition. Regulatory adjustments in key regions, aimed at standardizing the nutritional requirements for goat milk formulas, are also bolstering consumer confidence and market accessibility, positioning the product as a viable and medically acceptable alternative to standard bovine-based formulas.

Based on projected demand escalation and continuous product innovation focusing on enriched formulas (e.g., those containing prebiotics, probiotics, and enhanced DHA/ARA levels), the market is projected to reach USD 8.05 Billion by the end of the forecast period in 2033. This forecast reflects a shift in parental preference away from traditional formulas, motivated by research highlighting the easier digestibility of goat milk proteins, specifically the lower levels of alpha-s1 casein and higher levels of beneficial oligosaccharides naturally present in goat milk.

Goat Milk Infant Formula Market introduction

The Goat Milk Infant Formula Market encompasses the manufacturing, distribution, and sale of specialized nutritional powders and ready-to-feed liquids derived from goat milk, formulated to meet the specific dietary requirements of infants from birth up to 12 months of age. These formulas are processed to mirror, as closely as possible, the nutritional composition of human breast milk, adhering strictly to international standards established by bodies like the Codex Alimentarius Commission and local regulatory agencies such as the FDA and EFSA. The primary applications include full nutritional support for infants whose mothers cannot or choose not to breastfeed, and supplementary feeding alongside breastfeeding.

A significant benefit driving the adoption of goat milk formula is its distinctive protein structure. Goat milk naturally contains smaller fat globules and lower levels of alpha-s1 casein, leading to a softer curd formation in the infant’s stomach. This softer curd is often cited by pediatric nutritionists and consumer testimonials as a factor contributing to easier digestion and reduced gastrointestinal discomfort, such as mild reflux or constipation, commonly associated with cow milk-based formulas. Furthermore, goat milk contains high levels of oligosaccharides, which are crucial prebiotics supporting the development of a healthy gut microbiome in the infant.

Key driving factors for market growth include escalating consumer concerns regarding sensitivities or mild intolerance reactions to cow milk protein, the continuous trend of premiumization in infant nutrition, and extensive marketing efforts emphasizing the natural and holistic attributes of goat milk. Furthermore, increased penetration in emerging markets, coupled with expanding distribution channels, particularly e-commerce platforms, ensures greater accessibility, thereby cementing the formula's position as a high-growth segment within the broader global infant nutrition industry.

Goat Milk Infant Formula Market Executive Summary

The global Goat Milk Infant Formula market is characterized by robust growth, propelled by strong business trends centered on nutritional specialization and clean label movements. Major market players are heavily investing in research and development to enhance formula composition, adding specialized ingredients like Human Milk Oligosaccharides (HMOs) and specific probiotic strains to mimic breast milk closer than ever before. A crucial business trend involves mergers and acquisitions among regional producers and multinational corporations, seeking to consolidate supply chains and gain access to high-quality goat dairy sources, particularly in New Zealand and the Netherlands. The focus on establishing verifiable traceability systems through blockchain technology is also a dominant business strategy, ensuring transparency for the discerning parental demographic.

Regionally, the Asia Pacific (APAC) market remains the undeniable powerhouse, driven by China’s robust demand for high-quality, imported infant formula following previous domestic quality concerns. Europe maintains a steady growth rate, largely due to strong regulatory acceptance and the perception of high-quality sourcing from countries like the Netherlands and Spain. North America, though smaller in consumption volume, leads in value per capita, reflecting the strong willingness of parents to pay a significant premium for specialized, organically certified goat milk options. The regional growth is also sensitive to trade agreements and tariffs impacting cross-border distribution of these specialty goods.

Segment trends indicate that the powder form dominates the market due to cost-effectiveness and longer shelf life, although the ready-to-feed (RTF) segment is experiencing the fastest proportional growth, driven by convenience demands in high-income, time-constrained households. In terms of distribution, online retail channels are outpacing traditional brick-and-mortar sales, leveraging sophisticated direct-to-consumer models that provide educational content alongside product offerings. The "Organic" type segment is consistently capturing a larger market share year-over-year, as parental preference leans toward products free from GMOs, pesticides, and unnecessary additives, reinforcing the market’s overall shift toward premium positioning.

AI Impact Analysis on Goat Milk Infant Formula Market

User queries regarding the impact of Artificial Intelligence (AI) on the Goat Milk Infant Formula market frequently revolve around supply chain integrity, personalized nutritional recommendations, and enhanced quality assurance systems. Consumers are keen to understand how AI can prevent contamination incidents—a historical concern in the broader infant formula industry—by utilizing predictive analytics on supply chain data. There is also significant interest in AI-driven tools that analyze infant health data (growth rates, sleep patterns, digestive symptoms) to recommend the optimal formula variation or feeding schedule, reflecting a demand for hyper-personalized infant care. Manufacturers, conversely, focus their queries on optimizing herd management, maximizing yield, and automating quality control checks, seeking to reduce human error and increase operational efficiency.

The key themes emerging from this analysis center on transparency and precision. Users expect AI to provide granular traceability, linking a can of formula back to the specific farm and batch, thereby building trust. They also anticipate AI-enhanced product development, where machine learning algorithms rapidly analyze clinical trial data and nutritional gaps to accelerate the development of next-generation formulas that better mimic the complex structure of human breast milk. Ultimately, the expectation is that AI will make premium goat milk formula safer, more responsive to individual infant needs, and efficiently manufactured, thereby lowering production costs in the long term, even if initial product prices remain high.

AI's influence extends deeply into market research, allowing companies to use predictive modeling to forecast demand based on demographic shifts, seasonal health trends, and viral social media discussions surrounding infant health. This capability enables more agile inventory management, reducing waste and ensuring fresh product availability globally. Furthermore, sophisticated natural language processing (NLP) is used to analyze vast quantities of pediatric research and regulatory changes faster than traditional methods, ensuring that formulas consistently comply with evolving safety and nutritional standards across diverse international jurisdictions.

- AI optimizes farm management through sensor data analysis (feed composition, goat health, milk yield prediction), ensuring premium raw material quality.

- Predictive analytics enhance supply chain logistics, minimizing delays and spoilage during international cold chain transport, critical for perishable dairy components.

- Machine learning algorithms are employed in quality control to rapidly identify minute variations in formula composition or potential contaminants in real-time during the mixing and canning processes.

- AI-driven tools analyze consumer feedback and sales data to predict regional demand shifts and optimize market targeting for specific formula variants (e.g., lactose-reduced or organic lines).

- Chatbots and personalized recommendation engines use AI to guide parents through formula selection based on infant age, weight, and mild dietary sensitivities, improving customer engagement.

DRO & Impact Forces Of Goat Milk Infant Formula Market

The Goat Milk Infant Formula market is significantly shaped by a confluence of accelerating drivers (D), persistent restraints (R), and compelling opportunities (O), creating distinct impact forces (IF). The primary driver is the scientifically supported ease of digestibility, attributed to the unique protein and fat structure of goat milk, which addresses common parental concerns regarding infant gastrointestinal discomfort. This is compounded by the high natural levels of oligosaccharides, acting as prebiotics that foster a healthier gut environment, thus positioning goat milk as a superior alternative for sensitive infants. Secondly, aggressive marketing and educational campaigns by leading global players highlighting the 'natural' and 'less processed' nature of goat milk ingredients are successfully steering consumer purchasing decisions toward premium products.

Conversely, the market growth is significantly restrained by the high production cost associated with goat farming and formula processing. Goats typically yield lower volumes of milk compared to cows, necessitating premium pricing for the end product, which restricts accessibility primarily to high-income consumer segments. Furthermore, stringent and often disparate international regulatory hurdles surrounding the definition and marketing claims of "Goat Milk Formula" present obstacles for companies seeking broad global distribution. Consumer misconceptions, often conflating goat milk allergy (rare) with general cow milk sensitivity, also act as a subtle restraint, necessitating intensive consumer education efforts.

Opportunities for exponential growth are concentrated in emerging economies, particularly across Southeast Asia and Latin America, where rapid urbanization and increasing disposable incomes are fueling demand for premium, imported infant foods. Strategic product innovation presents another major opportunity, specifically the development of highly specialized formulas tailored for specific stages of infant development or those enriched with advanced nutritional supplements (e.g., specialty lipids, specific micronutrients). Additionally, leveraging advanced e-commerce platforms and establishing direct-to-consumer supply models allows companies to bypass traditional retail limitations and build stronger brand loyalty through transparency and direct engagement.

- Drivers (D): Superior digestibility and reduced allergenicity concerns compared to cow milk protein; Increasing disposable incomes globally, driving premiumization trends; Growing clinical research validating the nutritional adequacy and health benefits of goat milk.

- Restraints (R): Significantly higher retail price point compared to conventional bovine formulas, limiting mass market penetration; Challenges in scaling raw goat milk supply due to lower yield per animal; Complex and varying global regulatory requirements governing infant formula labeling and composition.

- Opportunities (O): Expansion into untapped emerging markets in Asia and Africa; Innovation in ready-to-feed (RTF) goat milk formats for convenience; Integration of sustainability and ethical sourcing practices as a key competitive differentiator.

- Impact Forces (IF): The cumulative positive impact of scientific validation and high consumer confidence strongly outweighs the pressure exerted by pricing restraints, leading to a sustained high-growth trajectory, particularly in the premium segment.

Segmentation Analysis

The Goat Milk Infant Formula market is comprehensively segmented based on Type, Form, and Distribution Channel, reflecting the diverse preferences and logistical needs of the global consumer base. Understanding these segments is crucial for market participants to tailor their product offerings, marketing strategies, and distribution networks effectively. The segmentation by Type, distinguishing between Organic and Conventional products, highlights the premium niche within the market, driven by consumers prioritizing natural ingredients and sustainable farming practices. The Organic segment, though smaller in volume, consistently commands a significantly higher market value, demonstrating robust price inelasticity among its core consumers.

Segmentation by Form differentiates between Powder and Ready-to-Feed (RTF) formulas. Powdered formula remains the dominant segment globally due to its economic viability, extended shelf life, and ease of storage and bulk shipping. However, the RTF segment is experiencing accelerated growth, particularly in North America and Western Europe, where consumer preference for convenience and guaranteed accurate formulation (eliminating potential mixing errors) justifies the higher price tag. This shift towards convenience reflects changing parental lifestyles and the increasing demand for on-the-go nutrition solutions.

The Distribution Channel segmentation, spanning Supermarkets/Hypermarkets, Pharmacies, and Online Retail, reveals a critical trend toward digitalization. While traditional retail (Supermarkets and Pharmacies) still account for the majority of immediate, necessity-based purchases, the Online Retail segment is expanding fastest. This acceleration is driven by the ease of comparing premium imported brands, accessing specialized or niche products not available locally, and the appeal of subscription models for routine replenishment. Companies are increasingly leveraging e-commerce to deliver educational content and build direct relationships with consumers, enhancing brand trust and retention, crucial factors in the sensitive infant nutrition sector.

- By Type:

- Organic Goat Milk Infant Formula

- Conventional Goat Milk Infant Formula

- By Form:

- Powder

- Ready-to-Feed (RTF)

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Pharmacies and Drug Stores

- Online Retail (E-commerce Platforms and Direct-to-Consumer Websites)

- Specialty Retail Stores

- By Stage:

- Stage 1 (0-6 months) - Starter Formula

- Stage 2 (6-12 months) - Follow-on Formula

- Stage 3 (12+ months) - Toddler Formula/Growing-up Milk

Value Chain Analysis For Goat Milk Infant Formula Market

The Value Chain for Goat Milk Infant Formula begins with a critical upstream analysis, focusing on specialized goat farming and raw milk sourcing. Unlike large-scale cow dairy operations, goat farming requires dedicated infrastructure, specific feed management protocols, and strict hygiene standards to ensure the milk meets human consumption requirements and subsequent infant formula processing demands. Key activities at this stage include selective breeding for high-yield, high-quality milk, veterinary care, and rapid chilling/transportation to prevent microbial contamination. Given the premium nature of the final product, establishing robust, transparent relationships with a network of certified, often small-to-medium-sized, dedicated goat farms is paramount for securing a sustainable and high-integrity raw material supply.

The processing and manufacturing stage is highly intensive and centralized. Raw goat milk undergoes several complex procedures, including pasteurization, standardization (adjusting fat and protein levels), fortification with essential vitamins and minerals (DHA, Iron, Folic Acid), homogenization, and finally, spray drying into a fine powder. Stringent quality control checks, often exceeding those for general food products, are integrated at every step to ensure nutritional accuracy and sterility. This midstream process requires specialized equipment capable of handling the unique characteristics of goat milk proteins and fats, along with adhering to Good Manufacturing Practices (GMP) essential for infant food production.

The downstream analysis focuses on efficient distribution channels, encompassing both direct and indirect routes. Indirect distribution predominantly utilizes major Supermarkets/Hypermarkets and established Pharmacy chains, capitalizing on consumer trust and convenience. Direct distribution, primarily through advanced e-commerce platforms and subscription services, allows manufacturers to gain higher margins, control pricing, and directly manage customer relationships. Due to the high value and imported nature of many premium brands, logistical considerations involve cold chain management for storage of certain additives and careful inventory management to prevent counterfeiting and ensure product freshness across international borders.

Goat Milk Infant Formula Market Potential Customers

The core demographic for Goat Milk Infant Formula consists of highly informed, health-conscious parents, predominantly those residing in urban or suburban areas within developed economies, demonstrating high levels of disposable income. These consumers are typically seeking alternatives to standard cow milk formula due to perceived or confirmed mild sensitivities in their infants, such as excessive gas, bloating, or minor regurgitation, where a full cow milk protein allergy has been ruled out. They are willing to invest significantly more in nutrition they perceive as being closer to nature, easier on the infant’s digestive system, and having a superior nutritional profile.

A second significant customer segment includes consumers in Asian markets, particularly China, where there is a deep cultural preference for imported, high-trust infant nutrition brands, often sourced from countries with stringent quality standards like New Zealand, Australia, and the Netherlands. These customers prioritize brand reputation, traceability, and the perceived safety associated with Western-manufactured goods, viewing goat milk formula as a premium status symbol reflecting superior care for their child. Marketing strategies in this region heavily focus on heritage, purity, and the endorsements of pediatricians or key opinion leaders (KOLs).

Furthermore, niche potential customers include parents adhering to organic or clean-label philosophies. For these buyers, the ethical sourcing, non-GMO status, and absence of synthetic additives are primary purchase drivers. They are highly active online, seeking transparency regarding the entire farm-to-can process. Therefore, effective engagement with these customers necessitates comprehensive digital content detailing sustainability initiatives, farming practices, and certification standards. These segments collectively define the market, demanding high quality, demonstrable safety, and continuous nutritional innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.05 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bubs Australia, DGC (Dairy Goat Co-operative), Danone (Nutricia/Aptamil), Kabrita (Ausnutria), Nanny Care Ltd., Karihome, Little Oak Company, Health & Happiness (H&H) Group, Yashili International Holdings Ltd., Pinnacle Foods, Bellamy's Organic, Blue River Dairy, Hengyi, Spring Sheep Milk Co., GMP Pharmaceuticals, NZ Pure Dairy, Holle, Biostime. |

| Regions Covered | North America (USA, Canada), Europe (UK, Germany, France, Netherlands), Asia Pacific (APAC) (China, Japan, South Korea, Australia, New Zealand), Latin America (Brazil, Mexico), Middle East, and Africa (MEA). |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Goat Milk Infant Formula Market Key Technology Landscape

The manufacturing of high-quality Goat Milk Infant Formula relies heavily on specialized dairy processing and advanced analytical technologies to ensure safety, nutritional integrity, and optimal shelf life. A primary technological focus is on precision processing techniques, particularly low-heat spray drying methods. These methods are crucial because they transform the liquid fortified milk into a stable powder while preserving the delicate structure of goat milk proteins and essential heat-sensitive micronutrients. Standard high-heat processing can denature beneficial proteins, reducing the digestive advantage that goat milk inherently offers; thus, advanced thermal processing control is a non-negotiable aspect of modern formula production.

Furthermore, the integration of traceability technologies, most notably blockchain, is becoming standard practice among market leaders. Given the global nature of ingredient sourcing and the high consumer demand for purity assurance in infant nutrition, blockchain provides an immutable, transparent ledger tracking the formula from the specific farm source through processing, packaging, and distribution. This capability allows manufacturers to provide unparalleled transparency and drastically reduces the time required for product recall identification, significantly boosting consumer trust and meeting stringent international regulatory requirements regarding source verification.

In terms of product innovation, the key technological advancements center on lipid and protein modification. Specialized encapsulation technologies are utilized to protect sensitive ingredients like DHA/ARA (essential fatty acids vital for brain development) from oxidation during storage, ensuring their bioavailability upon consumption. Manufacturers also employ advanced analytical chemistry techniques, such as High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry, for rigorous testing of every batch. These technologies ensure precise measurement of nutritional inputs, guarantee the absence of contaminants (e.g., heavy metals, antibiotics, and pesticides), and confirm that the final composition perfectly matches regulatory standards and label claims, cementing the technological infrastructure underpinning the premium market status of goat milk formula.

Regional Highlights

The market for Goat Milk Infant Formula exhibits pronounced regional variations, primarily dictated by cultural acceptance, regulatory frameworks, and consumer purchasing power. The Asia Pacific (APAC) region stands out as the largest and fastest-growing market globally. This dominance is overwhelmingly driven by consumer sentiment in countries like China, where high birth rates (despite recent slowdowns), combined with a deep-seated preference for high-quality, traceable, imported dairy products—especially following previous domestic quality scandals—fuel massive demand for premium New Zealand and Australian-sourced goat milk formulas. Regulatory clarity in key APAC nations is also facilitating easier market entry for international brands.

Europe represents a mature and highly regulated market, where goat milk formula has gained strong acceptance as a recognized alternative to cow milk formulas, sanctioned by the European Food Safety Authority (EFSA). Countries like the Netherlands, Germany, and the UK are crucial production hubs and major consumption centers. European consumers are particularly sensitive to organic certifications and sustainable sourcing, pushing manufacturers to uphold extremely high standards regarding animal welfare and environmental impact. The steady growth in Europe is sustained by a well-established infrastructure and favorable regulatory environment that provides legal clarity for marketing goat milk formula as nutritionally complete.

North America (NA), primarily the United States and Canada, shows strong growth, albeit starting from a smaller base compared to APAC. This market is characterized by a high degree of premiumization, with consumers demonstrating a strong willingness to pay for specialized, imported formulas that address perceived digestive sensitivities. Growth is significantly supported by the rapid expansion of e-commerce channels, which allows specialized European and Australian brands to bypass traditional pharmacy stocking limitations and directly reach affluent consumer segments seeking alternative nutrition options.

- Asia Pacific (APAC): Dominates the market due to massive consumer base and preference for imported premium products, particularly in China and Southeast Asia, driven by historical quality concerns regarding domestic formulas.

- Europe: Characterized by regulatory maturity and strong consumer confidence; major production and innovation hub focused on organic and ethically sourced ingredients (Netherlands, UK).

- North America: Fastest growing market in terms of value, driven by high disposable income, premium pricing acceptance, and rapid adoption through specialized online retail channels targeting digestive sensitivity concerns.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging regions showing initial adoption, primarily in urban centers, fueled by increasing awareness of nutritional benefits and rising middle-class disposable income, though regulatory hurdles remain high.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Goat Milk Infant Formula Market.- Dairy Goat Co-operative (DGC) - (Karihome brand)

- Danone (Nutricia/Aptamil)

- Ausnutria Dairy Corporation Ltd. (Kabrita brand)

- Bubs Australia

- Nanny Care Ltd.

- Little Oak Company

- Health & Happiness (H&H) Group (Biostime brand)

- Yashili International Holdings Ltd.

- Pinnacle Foods

- Bellamy's Organic

- Blue River Dairy

- Spring Sheep Milk Co.

- GMP Pharmaceuticals

- NZ Pure Dairy

- Holle baby food GmbH

- Hengyi Dairy

- Wimm-Bill-Dann Foods (PepsiCo Subsidiary)

- Kendamil (Kendal Nutricare)

- Meyenberg Goat Milk Products

- Nuchev Pty Ltd.

Frequently Asked Questions

Analyze common user questions about the Goat Milk Infant Formula market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes Goat Milk Formula from Cow Milk Formula in terms of infant digestion?

Goat milk formula typically forms a softer, smaller curd in the infant’s stomach compared to cow milk formula. This is due to its naturally lower content of alpha-s1 casein and smaller fat globules. This structural difference often leads to easier and faster digestion, potentially alleviating mild digestive discomfort like constipation or excessive gas in sensitive infants.

Is Goat Milk Infant Formula a safe and nutritionally complete substitute for cow milk formula?

Yes, goat milk infant formulas sold commercially are formulated to be nutritionally complete and safe. Regulatory bodies globally, including the EFSA and FDA, mandate that these formulas meet stringent nutritional standards, ensuring they provide all essential vitamins, minerals, fats (DHA/ARA), and proteins required for healthy infant growth and development from birth.

Why is Goat Milk Infant Formula significantly more expensive than standard cow milk alternatives?

The higher cost is attributed primarily to complex sourcing and lower yield. Goats produce substantially less milk than cows, increasing the raw material cost per volume. Furthermore, the specialized processing equipment, rigorous quality control measures, high standards for certification (e.g., organic), and complex international supply chain logistics necessary for premium imported products contribute to the final elevated retail price.

Which regions are driving the highest demand for premium Goat Milk Infant Formula products?

The Asia Pacific (APAC) region, particularly China, is the dominant driver of market value and volume due to strong consumer preference for imported, high-quality, and traceable infant nutrition brands. Secondary strong growth regions include affluent parts of Europe (e.g., UK, Netherlands) and North America, driven by parental willingness to invest in specialized formulas for perceived digestive benefits.

How are technological advancements impacting the future manufacturing and safety of the Goat Milk Formula market?

Technology is enhancing safety and transparency. Advanced low-heat processing techniques are preserving nutritional integrity, while the adoption of blockchain technology provides verifiable, farm-to-shelf traceability, dramatically improving supply chain integrity. AI is increasingly used for quality assurance, detecting contaminants faster and optimizing complex nutrient blending processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager