Gold Jewelry, Gold Bar, Silver Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442811 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Gold Jewelry, Gold Bar, Silver Market Size

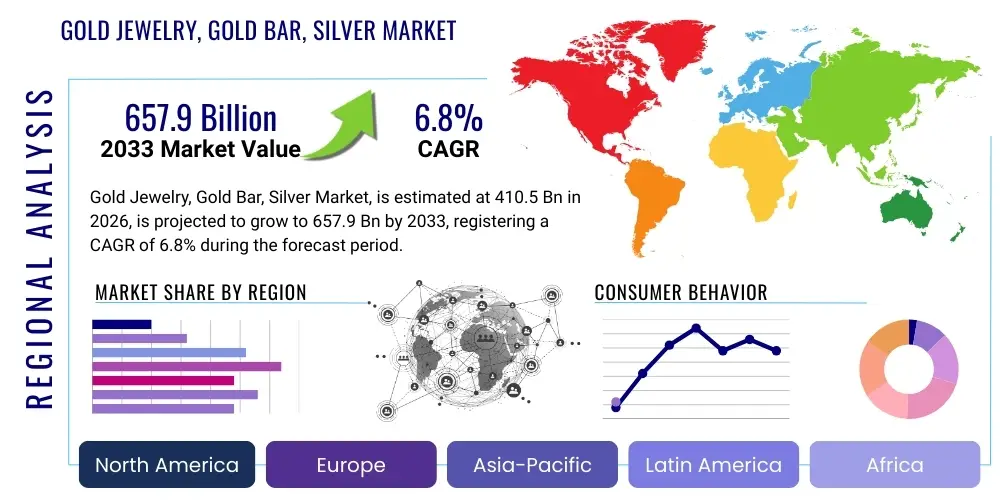

The Gold Jewelry, Gold Bar, Silver Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 410.5 Billion in 2026 and is projected to reach USD 657.9 Billion by the end of the forecast period in 2033. This robust expansion is fueled by persistent demand for safe-haven assets amidst global economic volatility, coupled with rising disposable incomes in key emerging economies, particularly across the Asia Pacific region. Furthermore, technological advancements in refining and crafting processes are enhancing product quality and consumer appeal, supporting higher valuation.

The valuation of the precious metals market, encompassing gold jewelry, gold bars (bullion), and silver, is intrinsically linked to macroeconomic factors, including interest rate movements, inflation expectations, and geopolitical stability. Gold, in particular, maintains its historical role as a hedge against currency devaluation, driving substantial investment demand during periods of uncertainty. Silver exhibits a dual demand profile, serving both as an investment vehicle and an essential industrial input, particularly within the burgeoning electronics, solar energy, and medical device sectors. This diversification provides inherent resilience to the overall market size projection.

Market growth is also significantly influenced by evolving consumer preferences towards certified, ethically sourced, and transparently traded products. The professionalization of the bullion market, facilitated by digital trading platforms and standardized regulatory frameworks, enhances accessibility for institutional and retail investors globally. Consequently, the convergence of cultural demand for jewelry and institutional demand for investment-grade metals solidifies the market's trajectory towards the projected 2033 valuation.

Gold Jewelry, Gold Bar, Silver Market introduction

The Gold Jewelry, Gold Bar, Silver Market encompasses the mining, refining, manufacturing, distribution, and retail sale of gold and silver products across consumption and investment categories. Gold jewelry, ranging from intricate handcrafted pieces to mass-produced designs, represents the largest segment by volume consumption, driven predominantly by cultural traditions, particularly in countries like India and China, and luxury expenditure globally. Gold bars and coins constitute the investment segment, where metal purity and weight are standardized for fungibility and serve as critical tools for wealth preservation, portfolio diversification, and monetary hedging against systemic risks. Silver, while sharing similar investment characteristics, is uniquely defined by its substantial industrial application in photovoltaic cells, electronics, and brazing alloys, making its demand cycle sensitive to global manufacturing output and green energy transitions.

The primary application of these precious metals falls into four broad categories: investment (bars, coins, ETFs), industrial use (electronics, catalysts, dental), jewelry (ornamentation and cultural artifacts), and central bank reserves (monetary holdings). The collective benefits derived from participation in this market include stable inflation protection, high liquidity, global recognition, and, for jewelry, symbolic and aesthetic value. The inherent scarcity and historical monetary role of gold and silver underscore their long-term appeal. The primary driving factors sustaining market vitality include consistently low real interest rates globally, the persistent threat of geopolitical instability stimulating safe-haven buying, accelerating wealth accumulation among middle and upper classes in emerging economies, and the continuous technological advancement demanding silver in high-growth industries like 5G infrastructure and solar power generation.

The market structure is characterized by a complex global supply chain, beginning with large-scale industrial mining and artisanal and small-scale mining (ASM), transitioning through specialized refining centers (e.g., London Bullion Market Association (LBMA) accredited), and finally reaching consumers via wholesale distributors, specialized bullion dealers, and integrated retail jewelry chains. Regulatory compliance, particularly concerning anti-money laundering (AML) and responsible sourcing (conflict minerals reporting), is increasingly stringent, influencing operational costs and market access. The introduction of digital gold trading and tokenization further democratizes access but necessitates continuous adaptation of regulatory frameworks to ensure market integrity and transparency across the value chain.

Gold Jewelry, Gold Bar, Silver Market Executive Summary

The Gold Jewelry, Gold Bar, Silver Market is experiencing transformative business trends characterized by heightened institutional interest in tangible assets and a decisive shift toward supply chain transparency and ethical sourcing. Regional trends confirm the dominance of Asia Pacific, particularly China and India, in driving physical jewelry demand, while North America and Europe remain pivotal centers for investment and trading activities, setting global price benchmarks. Segment trends highlight a bifurcation: investment demand for gold bars shows inelasticity to short-term price fluctuations due to macro-economic uncertainty, whereas the silver market is increasingly defined by industrial demand, correlating strongly with global manufacturing Purchasing Managers' Indices (PMIs), specifically in green technology deployment. This dynamic interplay between consumer luxury, financial hedging, and industrial necessity underscores the complexity and overall resilience of the precious metals ecosystem.

A significant business trend involves the integration of technology, notably the adoption of blockchain for provenance tracking and the establishment of digital platforms for fractional ownership of physical bullion. These innovations address core market requirements for security, authenticity verification, and fractional accessibility, attracting a new generation of younger investors who prefer digitally native assets. Regional analysis indicates that the Middle East and Africa (MEA) are solidifying their position as important refining and trading hubs, leveraging strategic geographic locations and government support for diversification away from fossil fuels, contributing to global liquidity. Simultaneously, rising geopolitical friction compels Central Banks globally to increase gold reserves, providing a fundamental base layer of demand that stabilizes the investment segment.

In terms of segment performance, the gold jewelry segment is adapting rapidly to consumer desire for sustainability, with an emphasis on recycled gold and detailed provenance reporting, mitigating reputational risk for major retailers. The silver market is witnessing an unprecedented demand surge from the renewable energy sector, positioning silver as a critical strategic material, rather than purely a secondary precious metal. Overall, the market's trajectory is defined by structural growth driven by wealth accumulation, counter-cyclical stability provided by investment demand, and secular growth in industrial applications tied to global decarbonization efforts, requiring market participants to focus intensely on operational efficiency and robust risk management protocols.

AI Impact Analysis on Gold Jewelry, Gold Bar, Silver Market

User queries regarding the impact of Artificial Intelligence (AI) on the precious metals market primarily revolve around three critical themes: price forecasting accuracy, efficiency improvements in the extraction and refining phases, and enhancing security and authenticity in trading and retail. Users frequently question whether AI-driven algorithmic trading will destabilize traditional gold and silver price discovery mechanisms, expressing concerns about volatility amplification. Simultaneously, there is significant interest in how AI can optimize geological surveying and mining operations, specifically focusing on predictive maintenance for heavy machinery and sophisticated ore sorting using machine vision to minimize waste and reduce energy consumption. Furthermore, consumers and regulators are keen on AI applications for combating counterfeiting, utilizing advanced image recognition and data analytics to verify jewelry authenticity and trace bullion provenance across complex supply chains, addressing crucial trust and compliance issues.

AI's primary influence is manifesting through sophisticated data modeling, offering market participants capabilities far beyond traditional statistical methods. In financial trading, machine learning algorithms analyze high-frequency trading data, geopolitical sentiment extracted from news feeds, and macroeconomic indicators simultaneously to generate predictive models that inform hedging strategies and optimize inventory management for bullion dealers. This application leads to marginally tighter spreads and more efficient market liquidity, though it also introduces the risk of algorithmic flash crashes. Within the physical supply chain, AI is transforming labor-intensive processes. Advanced robotics, guided by AI, are deployed in hazardous environments for tasks such as deep-sea exploration or remote mining operations, thereby improving worker safety and accessing previously uneconomical ore bodies. This technological integration is mandatory for maintaining competitive operational costs globally.

Beyond extraction and trading, AI significantly enhances the retail and manufacturing facets of the gold and silver industry. In jewelry design, generative AI tools assist designers in creating unique, complex prototypes quickly, reducing the time-to-market for new collections while analyzing consumer demand patterns in real-time to tailor production. Crucially, AI-powered systems are being implemented to scrutinize compliance data, identifying anomalous transactions that may indicate money laundering or trade-based financing of illicit activities, significantly bolstering regulatory compliance frameworks. The net effect is a move toward a hyper-efficient, highly traceable, and data-driven precious metals market, necessitating substantial investment in digital infrastructure and specialized personnel skilled in data science and materials engineering to leverage these advancements fully.

- AI-driven Predictive Price Modeling: Enhances forecasting accuracy by integrating high-frequency trading data, geopolitical sentiment, and macroeconomic indicators, optimizing inventory and risk management.

- Optimized Mining Operations: Implementation of AI for predictive maintenance, geological mapping, and autonomous equipment operation, reducing operational costs and improving safety standards.

- Advanced Refining Efficiency: Utilization of machine learning for process optimization in smelting and refining, ensuring higher purity yields and lower energy consumption per unit of refined metal.

- Supply Chain Transparency via Computer Vision: AI algorithms analyzing visual data and documentation to verify authenticity, detect counterfeit products, and ensure compliance with ethical sourcing mandates.

- Personalized Jewelry Design: Generative AI tools assisting designers in rapid prototyping and customizing jewelry based on real-time consumer trend analysis.

- Enhanced Regulatory Compliance: AI systems monitoring transaction flows and identifying suspicious patterns (AML, KYC compliance) in bulk bullion movements.

DRO & Impact Forces Of Gold Jewelry, Gold Bar, Silver Market

The dynamics of the Gold Jewelry, Gold Bar, Silver Market are determined by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the critical Impact Forces influencing market direction. Key drivers include persistent global geopolitical instability, which consistently bolsters safe-haven demand for gold, and accelerating inflation rates worldwide, which diminishes the real returns on fixed-income assets, channeling capital into tangible wealth storage options. Counterbalancing these drivers are significant restraints, primarily regulatory uncertainties related to mining permits and environmental standards, coupled with high initial capital requirements for large-scale mining projects, which slow new supply introduction. However, substantial opportunities exist through the monetization of digital gold assets and the expanding industrial application of silver in the transition to sustainable energy infrastructure, providing resilient secular growth paths. These forces create a volatile yet fundamentally ascending market environment, requiring sophisticated risk management and strategic positioning.

Specific drivers merit closer examination. The demographic shift in Asia, particularly the expanding middle class in India and China, generates structural, long-term growth in jewelry demand, a culturally ingrained preference that is relatively inelastic to short-term price fluctuations. Simultaneously, the sustained policy of monetary easing by global central banks, maintaining historically low real interest rates, fundamentally lowers the opportunity cost of holding non-yielding assets like gold. Conversely, significant restraints include the volatility in exchange rates, particularly the strengthening U.S. Dollar, which often makes dollar-denominated commodities more expensive for international buyers, temporarily dampening demand. Furthermore, increasingly stringent environmental, social, and governance (ESG) standards imposed by institutional investors and consumers demand higher accountability in sourcing, increasing operational complexity and costs for producers not adhering to best practices.

The opportunities presented in this market are transformative. The accelerating global commitment to decarbonization, embodied by widespread solar panel installation and electric vehicle manufacturing, positions silver as an essential strategic metal, shifting its demand from auxiliary to primary industrial input. Digitization presents another formidable opportunity: the tokenization of physical gold bars on blockchain platforms enables fractional ownership, enhances liquidity, and reduces transactional friction, effectively broadening the investor base to include retail investors with smaller capital allocations. The primary impact forces driving the market are the fundamental law of scarcity combined with global trust erosion in fiat currencies, ensuring that gold and silver remain anchors of value, compelling producers to focus on sustainable extraction and innovative retail distribution strategies to capture market share within this perpetually expanding landscape.

- Drivers: Geopolitical Instability, Inflationary Pressures, Rising Disposable Incomes in APAC, Central Bank Accumulation, Low Real Interest Rates.

- Restraints: Strong U.S. Dollar Exchange Rate, Stringent ESG and Environmental Regulations on Mining, High Capital Expenditure for New Mining Projects, Competing Financial Instruments (e.g., Cryptocurrencies).

- Opportunities: Accelerating Industrial Demand for Silver (Solar/5G/EVs), Digitalization and Fractional Ownership (Tokenization), Advancements in Sustainable and Recycled Sourcing Technologies, Expansion into Untapped Retail Markets in Africa and Latin America.

- Impact Forces: Safe-Haven Asset Demand, Industrial Transition towards Green Technology, Global Monetary Policy Shifts, Supply Chain Transparency Mandates.

Segmentation Analysis

The Gold Jewelry, Gold Bar, Silver Market is systematically segmented based on product type, end-user application, and geographical distribution to provide granular insights into market dynamics and consumption patterns. Product segmentation distinctly separates gold jewelry (items crafted for ornamentation), gold bars (high-purity bullion for investment and central bank reserves), and silver (covering both investment bullion and industrial inputs). This differentiation is critical because the price elasticity and demand drivers for each segment vary significantly; jewelry demand is influenced by cultural events and discretionary spending, while bullion demand is primarily driven by macro-economic and hedging requirements. Understanding these segment behaviors allows producers and investors to align supply chain and capital allocation strategies effectively.

Further segmentation by end-user application clarifies the market's diverse utilization structure. Gold applications include Investment (ETFs, physical bars), Jewelry, and Technology (electronics, dentistry). Silver applications show a robust split between Investment, Jewelry, and Industrial Use, with the latter segment encompassing critical high-growth areas such as photovoltaic cells, electrical contacts, and medical imaging. The industrial segment for silver is currently experiencing disproportionate growth due to global decarbonization mandates. Geographic segmentation remains crucial, highlighting the dominance of Asian markets in physical consumption versus the leading role of Western markets in price-setting and derivatives trading. Each geographic segment presents unique regulatory challenges and consumer preferences that necessitate localized marketing and distribution strategies.

The detailed segmentation structure facilitates comprehensive market forecasting and competitive landscape assessment. By analyzing sub-segments, such as gold purity levels (e.g., 24K, 18K) within the jewelry category or investment vehicle types (physical vs. paper), stakeholders can identify niche markets offering superior growth potential. For instance, the demand for recycled gold jewelry, driven by ethical consumerism, represents a distinct and rapidly expanding sub-segment that requires specific sourcing and certification protocols. Effective segmentation provides the foundational data for strategic decision-making, ensuring that product development and market penetration efforts are accurately targeted toward the most profitable and resilient areas of the precious metals market.

- By Product Type:

- Gold Jewelry (Necklaces, Rings, Earrings, Bracelets)

- Gold Bar & Bullion (Physical Bars, Coins, Exchange Traded Funds - ETFs)

- Silver (Physical Bullion, Industrial Grade Powder/Grain, Silver Jewelry)

- By Application (Gold):

- Investment (Wealth Preservation)

- Jewelry & Ornamentation

- Technology & Industrial Use (Electronics, Dental, Medical)

- By Application (Silver):

- Industrial (Photovoltaics, Electrical Contacts, Automotive, Medical)

- Investment (Hedge and Speculation)

- Jewelry & Silverware

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Digital Bullion Dealers)

- Offline Retail (Jewelry Boutiques, Dedicated Bullion Shops, Banks)

- By Purity Grade:

- 99.9% (Investment Grade/4 Nines)

- 99.5% and Below (Industrial/Jewelry Grades)

Value Chain Analysis For Gold Jewelry, Gold Bar, Silver Market

The value chain for the Gold Jewelry, Gold Bar, Silver Market is characterized by highly specialized stages, beginning with rigorous upstream activities and culminating in diversified downstream distribution. Upstream analysis focuses on exploration, mining (both primary industrial operations and ASM), and concentration processes, which are capital-intensive and subject to significant environmental regulations and geopolitical risk. Key upstream activities involve advanced geological surveying and securing necessary extraction permits, followed by the actual mining and initial processing of ore into doré bars or concentrate. Efficiency in this stage, driven by technological adoption such as autonomous hauling and predictive maintenance, directly influences the final cost of the refined product. Ethical sourcing compliance is now an integrated component of upstream viability, dictated by downstream market demands.

The midstream phase involves transportation, refining, and manufacturing. Refining is a critical bottleneck, where doré bars are purified to investment grade (e.g., 99.99% for gold), typically carried out by LBMA-accredited facilities, which act as crucial gatekeepers of market quality and integrity. Manufacturing involves converting refined metals into standardized investment products (bars, coins) or into specialized alloys for jewelry production or industrial components. This phase requires precision engineering and stringent quality control, especially for industrial silver destined for sensitive electronic or photovoltaic applications. The efficiency of the refining process directly impacts global supply liquidity and determines eligibility for various financial trading platforms.

Downstream analysis covers distribution channels, market making, and retail sales. Distribution channels are bifurcated into direct sales (e.g., mine-to-refiner-to-central bank/major institutional investor) and indirect channels. Indirect distribution for jewelry involves complex networks of wholesalers, distributors, and franchised retail outlets, heavily reliant on branding and logistics optimization. For investment products, indirect distribution utilizes banks, specialized online bullion dealers, and commodity exchanges (e.g., COMEX, LME). Direct channels often characterize large-volume, high-value transactions involving sovereign wealth funds and central banks. The distinction is paramount: direct channels prioritize security and confidentiality, while indirect channels prioritize market reach and consumer accessibility. The increasing reliance on e-commerce platforms represents a significant transformation in the indirect distribution model, democratizing access to physical metal ownership and requiring robust logistical security.

Gold Jewelry, Gold Bar, Silver Market Potential Customers

The potential customer base for the Gold Jewelry, Gold Bar, Silver Market is highly heterogeneous, spanning sovereign entities, institutional investors, manufacturers, and billions of individual retail consumers. Central banks and sovereign wealth funds represent the most stable and significant purchasers of physical gold bullion, utilizing it as a foundational monetary reserve asset and a hedge against systemic economic risk. Institutional investors, including pension funds, hedge funds, and insurance companies, allocate capital to precious metals via physical holdings, Exchange Traded Funds (ETFs), and derivatives to diversify portfolios and manage volatility exposure. This segment demands high purity, liquidity, and standardized investment vehicles that adhere strictly to international accreditation standards.

Industrial end-users form a distinct customer group, predominantly consuming silver and specific gold alloys for high-technology manufacturing. Key buyers include semiconductor producers, solar panel manufacturers (photovoltaic industry), automotive electronics suppliers (EV technology), and manufacturers of medical devices. These customers prioritize technical specifications, consistent quality, and long-term supply agreements over speculative price movements. Their purchasing decisions are intrinsically linked to capital expenditure cycles and innovation timelines within their respective industries, positioning them as a source of secular growth for the silver market specifically.

The vast retail segment comprises consumers purchasing gold and silver jewelry for personal adornment, gifting, and cultural ceremonies, alongside individual retail investors buying small-denomination bars, coins, or digital gold products for personal savings and speculative purposes. Retail customers are highly sensitive to price, brand reputation, ethical sourcing certifications, and design aesthetics. In key Asian markets, jewelry purchases often function as a form of familial wealth transfer and cultural investment. The expanding reach of digital platforms is rapidly converting traditional savers into retail bullion investors, defining a customer profile that values convenience, transparency, and fractional ownership accessibility, making this segment critical for sustaining overall market volume.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 410.5 Billion |

| Market Forecast in 2033 | USD 657.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Newmont Corporation, Barrick Gold Corporation, Freeport-McMoRan, Agnico Eagle Mines Limited, Polymetal International plc, Kinross Gold Corporation, Kirkland Lake Gold Ltd., Royal Gold, Inc., Wheaton Precious Metals Corp., Pan American Silver Corp., Fresnillo plc, Randgold Resources Limited, AngloGold Ashanti Limited, Gold Fields Limited, Harmony Gold Mining Company Limited, Hochschild Mining plc, Hecla Mining Company, Tiffany & Co., Richemont Group, Chow Tai Fook Jewellery Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gold Jewelry, Gold Bar, Silver Market Key Technology Landscape

The Gold Jewelry, Gold Bar, Silver Market is undergoing a significant technological evolution, moving beyond traditional mining and crafting methods toward integrated digital solutions focusing on efficiency, security, and sustainability. Key technology adoption is centered around advanced mining automation, sophisticated refining process controls, and the integration of distributed ledger technology (blockchain) for enhanced supply chain management. In mining, the deployment of autonomous vehicles, drone-based surveying, and IoT sensors enables real-time monitoring of operations, leading to optimized ore extraction, improved energy consumption metrics, and significantly reduced exposure to hazardous working conditions. These technological shifts are critical for minimizing the environmental footprint and meeting the stringent ESG criteria increasingly demanded by institutional investors and global regulators, thus ensuring long-term operational viability.

The technology landscape in the downstream segment is dominated by solutions aimed at verifying authenticity and combating counterfeiting, which is crucial for maintaining market trust. Blockchain technology, specifically, is being leveraged to create immutable digital ledgers tracking the provenance of precious metals from the mine gate through to the final point of sale, providing consumers and financial institutions with unparalleled transparency regarding the metal's origin and ethical sourcing credentials. This transition addresses the critical need for verifiable Chain of Custody (CoC) documentation, particularly for conflict-sensitive minerals. Furthermore, advanced material science is improving the durability and aesthetic quality of jewelry, utilizing computer-aided design (CAD) and high-precision 3D printing techniques to create complex geometries that traditional casting could not achieve, accelerating product innovation cycles and reducing material waste.

Another pivotal technological area is the rapid evolution of financial technology (FinTech) solutions, specifically impacting the investment segment. The rise of digital trading platforms and mobile applications enables retail investors to purchase fractional ownership of physical bullion stored in secure vaults, significantly lowering the barrier to entry for precious metal investment. This technological access, combined with the security provided by tokenization, is transforming gold and silver from purely high-value, physical assets into digitally liquid, easily traded financial instruments. The continuous development of spectroscopic analysis techniques and non-destructive testing (NDT) methodologies further ensures the purity and integrity of bars and jewelry without requiring physical alteration, supporting quality assurance across the global refining network and strengthening consumer confidence in the purity claims of the products they purchase.

Regional Highlights

- Asia Pacific (APAC): APAC is the global epicenter for physical consumption, primarily driven by India and China, which collectively account for the largest share of global gold jewelry demand. This demand is culturally entrenched, linking jewelry purchases to weddings, festivals, and generational wealth transfer. The region is also rapidly expanding its investment bullion market, driven by rising household savings and a desire to hedge against local currency depreciation. Infrastructure developments, particularly in solar energy deployment, ensure robust, long-term industrial demand for silver across Southeast Asia and China.

- North America: North America (primarily the United States and Canada) functions as a crucial hub for mining, financial trading, and innovation. The region houses many of the world's largest gold and silver mining corporations and is the leading center for futures trading (COMEX) and the establishment of gold and silver ETFs. Demand here is characterized by high institutional investment activity and a strong correlation with global macroeconomic indicators, with retail demand emphasizing high-quality, investment-grade bullion and luxury jewelry brands.

- Europe: Europe, centered around the London Bullion Market (LBMA), is the world’s foremost over-the-counter (OTC) trading hub, setting global refining standards and price benchmarks. Switzerland remains critical due to its concentration of major refiners accredited by the LBMA, facilitating global movement and storage of investment-grade metals. European demand is sophisticated, focusing on ESG compliance, responsible sourcing, and high-end luxury jewelry manufacturing, often emphasizing recycled precious metals.

- Middle East and Africa (MEA): Africa is fundamentally critical to the market as a primary source of mined gold and silver, hosting vast mineral reserves. The Middle East, particularly Dubai, acts as a pivotal trading and re-export hub, benefiting from favorable regulatory environments and strategic logistical positioning between Asian consumers and Western financial markets. Demand in MEA is driven by high net-worth individual investment and strong cultural preferences for gold jewelry, often translating into high-purity product demand.

- Latin America: Latin America is a significant global producer of both gold and silver, with countries like Peru, Mexico, and Chile hosting major mining operations. The region faces challenges related to infrastructure, regulatory stability, and artisanal mining issues, yet its importance as an upstream supplier is undeniable. Local demand for jewelry is robust, but the region’s primary impact is on global supply volume and geopolitical risk associated with resource nationalism.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gold Jewelry, Gold Bar, Silver Market.- Newmont Corporation

- Barrick Gold Corporation

- Freeport-McMoRan

- Agnico Eagle Mines Limited

- Polymetal International plc

- Kinross Gold Corporation

- Kirkland Lake Gold Ltd.

- Royal Gold, Inc.

- Wheaton Precious Metals Corp.

- Pan American Silver Corp.

- Fresnillo plc

- Randgold Resources Limited

- AngloGold Ashanti Limited

- Gold Fields Limited

- Harmony Gold Mining Company Limited

- Hochschild Mining plc

- Hecla Mining Company

- Tiffany & Co.

- Richemont Group

- Chow Tai Fook Jewellery Group

Frequently Asked Questions

Analyze common user questions about the Gold Jewelry, Gold Bar, Silver market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors influence the global price volatility of gold and silver?

The global prices of gold and silver are primarily influenced by real interest rates, the strength of the U.S. Dollar, global inflation expectations, and geopolitical instability. Gold typically exhibits an inverse relationship with real rates, strengthening when rates are low or negative, and benefits significantly from demand for safe-haven assets during conflict or economic crises. Silver, due to its industrial usage, is also highly responsive to global manufacturing performance and green technology investment cycles.

How is ethical sourcing impacting the Gold Jewelry and Bullion segment?

Ethical sourcing, driven by stringent ESG criteria and consumer demand for transparency, is fundamentally reshaping the market. Major refiners and retailers are adopting rigorous Chain of Custody (CoC) protocols, often utilizing blockchain technology, to verify that precious metals are not sourced from conflict zones and that they adhere to high environmental and labor standards. This requires certified provenance documentation, increasing costs but enhancing brand trust and market access.

What is the role of digital currencies and tokenization in the gold market?

Digital currencies and tokenization are expanding market accessibility by enabling fractional ownership of physical gold held in secured vaults. Tokenization facilitates enhanced liquidity, reduces transaction fees associated with physical transfers, and allows smaller investors to participate easily. While cryptocurrencies like Bitcoin occasionally compete for safe-haven capital, tokenized gold provides a digital representation linked directly to a tangible, audited asset, mitigating extreme volatility inherent in unbacked digital assets.

Which geographical regions are the most significant consumers of physical gold jewelry?

Asia Pacific, particularly India and China, are the world's most significant consumers of physical gold jewelry. Demand in these regions is deeply rooted in cultural traditions, where gold serves dual purposes as ornamentation and as a critical form of portable family wealth. This demand pattern is highly structural and is further bolstered by sustained growth in disposable income and expanding middle-class demographics.

Why is industrial demand critical for the future growth of the silver market?

Industrial demand is critical for silver's long-term growth due to its essential use in high-growth sectors, particularly photovoltaic (solar) energy, 5G technology infrastructure, and electric vehicle (EV) manufacturing. As global decarbonization efforts accelerate, silver is positioned as a strategic material indispensable for achieving sustainable energy transitions, insulating its market trajectory from purely speculative investment cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager