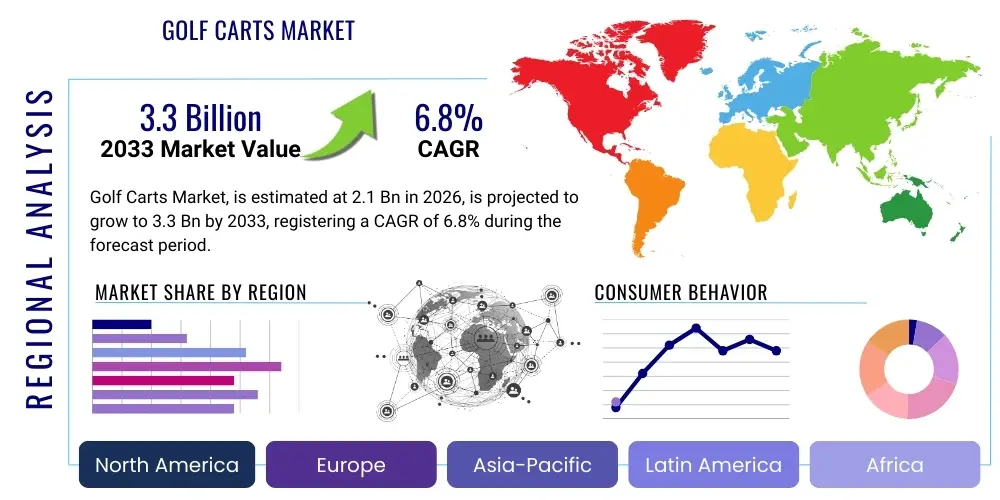

Golf Carts Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442224 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Golf Carts Market Size

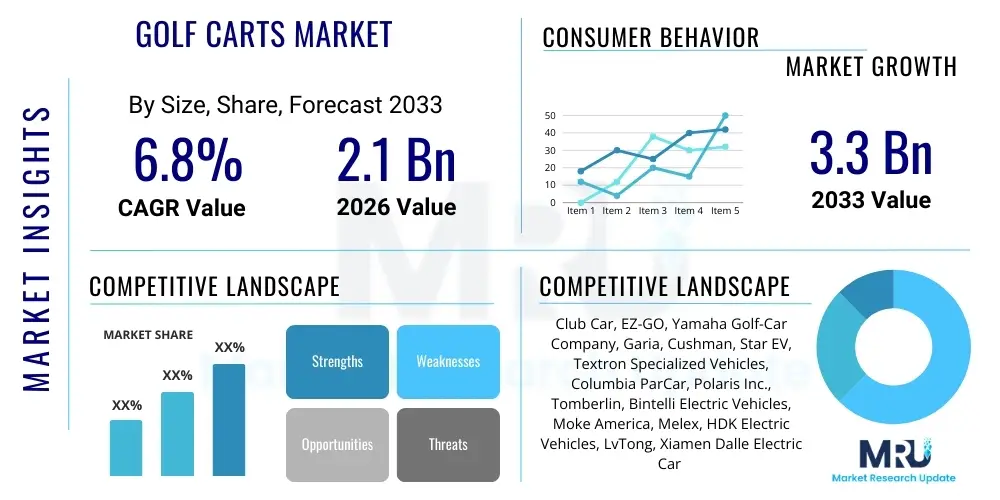

The Golf Carts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.3 Billion by the end of the forecast period in 2033.

Golf Carts Market introduction

The Golf Carts Market encompasses the manufacturing, distribution, and sale of small, motorized vehicles primarily designed for transporting golfers and their equipment around a golf course. However, the scope of these vehicles has significantly broadened in recent years, transforming them into versatile utility vehicles utilized across numerous sectors including industrial complexes, educational campuses, large-scale resorts, sprawling airports, and sophisticated private residential communities. This evolution is driven by the need for efficient, environmentally friendly, and low-speed transportation solutions suitable for confined or regulated environments where standard road vehicles are impractical or prohibited. The foundational product categories include traditional two-passenger carts, multi-passenger variants (four, six, or eight seats), and robust utility terrain vehicles (UTVs) engineered with enhanced cargo capacity and towing capabilities for maintenance and logistics purposes.

Historically, the market was dominated by internal combustion engine models, which offered reliable power and range, particularly in rugged terrains. However, the industry is currently undergoing a substantial and permanent transition towards electric and battery-powered golf carts. This fundamental shift is catalyzed by several macroeconomic and regulatory factors, including stricter global environmental protection mandates, the volatile costs of fossil fuels, and a growing consumer preference for quieter, zero-emission vehicles. Consequently, manufacturers are heavily investing in research and development focused on optimizing electric drivetrain efficiency, improving charging infrastructure compatibility, and integrating advanced energy management systems to maximize operational range and minimize downtime, ensuring that electric models can reliably meet demanding commercial schedules while adhering to modern sustainability standards.

Major applications of golf carts revolve around leisure, utility transport, and specific institutional use. While golf courses remain the fundamental end-user segment, relying on these vehicles for seamless player movement, operational efficiency, and revenue generation through rental fleets, the non-golf segment is experiencing exponential growth. This expansion includes hospitality sectors requiring stylish and comfortable guest transport, large warehousing operations needing quick-access utility vehicles, and municipal applications demanding specialized low-speed maintenance units. The core benefits offered by modern golf carts—low operating noise, reduced maintenance requirements, excellent maneuverability in tight spaces, and compliance with increasingly common Low-Speed Vehicle (LSV) regulations—are key driving factors propelling market expansion well beyond its traditional confines and cementing its role as a versatile asset in modern infrastructure management and neighborhood transportation.

Golf Carts Market Executive Summary

The Golf Carts Market is experiencing a phase of dynamic growth, largely characterized by the decisive technological migration toward advanced electric platforms. Current business trends reflect an intense competitive landscape where differentiation is achieved primarily through technological integration, particularly the incorporation of high-density lithium-ion batteries which offer superior performance metrics over legacy lead-acid systems. Market players are strategically focused on developing connected cart solutions, featuring integrated telematics, GPS navigation, and advanced fleet management software. These sophisticated systems appeal strongly to commercial operators seeking optimized asset utilization, predictive maintenance schedules, and enhanced security features, thereby transforming the cart from a simple vehicle into a managed, networked asset vital for efficient operations across sprawling facilities and complex logistics environments.

Regional dynamics illustrate a concentrated demand in mature markets alongside explosive potential in emerging economies. North America maintains its leadership position, underpinned by a highly developed infrastructure for golf and a robust culture of personal recreational vehicle ownership within planned communities. This region demonstrates high early adoption rates for premium, technologically advanced models. Conversely, the Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR), driven by significant government investment in tourism infrastructure, rapid urbanization leading to larger university and corporate campuses, and rising discretionary income allowing for increased recreational spending and private vehicle purchases. European growth, while steady, is distinctly shaped by strict sustainability targets and regulatory environments that favor quiet, electric vehicles for use in sensitive ecological areas and historical urban centers, pushing innovation in zero-emission utility applications and localized transport solutions.

Analysis of market segmentation reveals the unequivocal ascendance of the electric golf cart segment, which is projected to dominate market share and revenue generation throughout the forecast period due to favorable environmental policies and operational cost savings. Furthermore, the application segment shows a pronounced diversification: the fastest expansion is occurring within the Commercial & Institutional sector, surpassing the growth rate of traditional golf course applications. This pivot necessitates the manufacturing of more rugged, customizable utility models capable of handling heavier payloads and longer operating hours. Within the power source category, the shift from lead-acid to lithium-ion batteries is accelerating rapidly, establishing new industry standards for durability, weight reduction, and efficiency, fundamentally altering manufacturer supply chain strategies and competitive positioning to meet the increasing demand for high-performance electric propulsion.

AI Impact Analysis on Golf Carts Market

User inquiries regarding AI's influence predominantly center on the feasibility and safety of fully autonomous golf cart operation within dynamic environments, the cost-effectiveness of implementing AI-driven predictive maintenance for large rental fleets, and how smart navigation systems can improve the flow and safety on crowded golf courses or industrial complexes. Users are highly interested in the long-term return on investment (ROI) derived from AI tools that minimize downtime and optimize energy consumption, viewing AI not just as a high-end feature, but as an essential management solution for modernizing fleet operations and enhancing overall efficiency and safety standards.

The integration of Artificial Intelligence (AI) and machine learning (ML) is fundamentally transforming the operational and design paradigm of the Golf Carts Market, evolving these vehicles into highly sophisticated, intelligent assets. The primary application of AI currently lies in advanced fleet telematics and predictive maintenance systems crucial for large commercial operators such as resorts and university campuses. AI algorithms process massive datasets—including vehicle location, battery health, motor temperature, and operational cycles—to accurately forecast potential mechanical failures or suboptimal performance patterns. This capability allows fleet managers to schedule maintenance proactively during low-demand periods, ensuring near-perfect operational readiness, dramatically reducing unexpected breakdowns, and optimizing the longevity of high-value components, thereby significantly lowering the total cost of ownership (TCO) and improving service continuity.

Beyond maintenance, AI is indispensable in the development of sophisticated navigation and safety protocols essential for the eventual deployment of autonomous vehicles. Utilizing sensor fusion—combining data from LiDAR, radar, and high-resolution cameras—AI-powered systems interpret complex, real-time environments to perform tasks such as precision docking, intelligent speed control based on pedestrian proximity, and dynamic route optimization that bypasses congestion or hazardous areas. While full autonomy is still under regulatory review, these technologies enable robust Advanced Driver Assistance Systems (ADAS), including automatic emergency braking and dynamic stability control, which enhance safety standards, particularly for utility carts navigating industrial environments or multi-passenger shuttles transporting guests. The strategic deployment of AI also extends into enhancing the user experience and optimizing energy management. ML models analyze terrain, payload, and driving habits to fine-tune the power delivery of electric motors, ensuring the most efficient use of battery charge. For end-users, this translates to improved range accuracy and consistent performance.

- Implementation of Predictive Maintenance Systems: AI monitors component wear and usage patterns across the fleet to schedule maintenance optimally, substantially maximizing asset uptime and significantly reducing unscheduled service costs.

- Autonomous Navigation and Route Optimization: ML algorithms enable complex pathfinding, collision avoidance, and semi-autonomous driving features, optimizing transport efficiency in extensive resort environments or industrial complexes.

- Enhanced Safety and Obstacle Detection: Computer vision and sensor fusion systems utilize AI to accurately identify and classify obstacles, pedestrians, and potential hazards, leading to highly responsive automatic emergency braking and improved vehicle security.

- Dynamic Battery and Energy Management: AI optimizes charging cycles and discharge rates based on terrain analysis and forecasted usage, significantly extending the operational life and effective range of lithium-ion battery packs.

- Personalized User Experience: AI systems learn and adapt to driver and passenger preferences regarding speed profiles, environmental control, and connectivity settings, providing a customized and seamless transport experience.

- Geofencing and Fleet Control: AI enables highly accurate geo-fencing capabilities, allowing commercial operators to restrict vehicle access to predefined zones and automatically adjust operational parameters, such as speed limits, in sensitive areas, enhancing safety and compliance.

DRO & Impact Forces Of Golf Carts Market

The market trajectory for Golf Carts is fundamentally determined by a confluence of Drivers, Restraints, and Opportunities (DRO), which exert significant Impact Forces on industry growth and product development. A primary driver is the accelerating global mandate for environmental sustainability, pushing for the retirement of gasoline-powered fleets in favor of zero-emission electric alternatives. This shift is strongly supported by technological advances in lithium-ion battery technology, which have significantly mitigated previous concerns regarding range anxiety and long recharge times. Coupled with this is the robust demographic factor of increasing populations of affluent retirees, particularly in North America and Europe, which fuels sustained demand for comfortable, safe, and easily accessible Low-Speed Vehicles (LSVs) for localized mobility within planned residential and recreational communities, establishing a stable customer base for personal use.

Conversely, market expansion faces notable constraints that temper growth rates, especially in price-sensitive regions. The most significant constraint is the higher initial capital expenditure required for advanced electric golf carts, particularly those integrating premium lithium-ion technology and sophisticated digital features, compared to established gasoline models. This cost disparity acts as a financial barrier for small-scale golf course operators or individual consumers with budget limitations, even if the total cost of ownership (TCO) proves more favorable over the long term. Furthermore, the fragmented and often inconsistent regulatory landscape across different municipalities and nations regarding the classification and operational limits of LSVs on public thoroughfares creates market complexity and limits the widespread commercial and personal utility of these vehicles outside controlled environments, slowing the adoption of neighborhood electric vehicles (NEVs).

Opportunities for exponential growth are heavily concentrated in strategic market diversification and accelerated technology adoption. The most lucrative opportunity lies in capturing the surging demand from non-traditional utility sectors, including complex logistics operations, large manufacturing plant transportation, and specialized grounds maintenance where electric UTVs offer superior indoor operation capabilities and quieter performance than traditional utility vehicles. Product innovation focused on autonomous capabilities (driven by AI), modular designs for rapid reconfiguration, and the adoption of advanced, lightweight composite materials to improve durability and reduce curb weight will serve as critical impact forces. Furthermore, the commercial viability of solar-assist charging solutions presents a significant avenue for improving sustainability and extending operational efficiency in geographically isolated or remote application areas, mitigating dependence on fixed charging infrastructure and further displacing combustion engine dependency.

Segmentation Analysis

The Golf Carts Market is intricately segmented across several critical axes, including power source, primary application, and seating capacity, providing a granular view of market dynamics and enabling manufacturers to strategically tailor product development and target specific consumer needs. The segmentation by power source is perhaps the most defining factor, encompassing electric (sub-segmented into lead-acid and lithium-ion), gasoline, and hybrid/solar models. The electric segment dictates the industry’s technological direction, with lithium-ion representing the future standard due to superior performance, safety, and rapid charging capabilities, making it the highest growth sub-segment.

Application segmentation categorizes the market by end-user environment, clearly illustrating the shift away from reliance solely on the golfing sector. While golf courses remain a stable, necessary core segment for manufacturers, the fastest and most significant expansion is currently being recorded in the Commercial & Institutional segment. This includes high-demand sectors such as hospitality (resorts, theme parks), large educational campuses, and industrial facilities (factories, warehouses), requiring rugged, high-payload utility vehicles designed for continuous, specialized operation and low maintenance. The Personal Use segment, encompassing buyers in gated communities, demands vehicles that emphasize aesthetics, comfort, and advanced features for neighborhood transportation.

Furthermore, segmentation by seating capacity helps manufacturers accurately address specific fleet operational needs. The 2-seater configuration remains the industry standard for traditional golf play and basic utility transport. However, the rapidly growing necessity for efficient personnel transport in commercial and institutional settings is fueling a surge in demand for 4-seater and particularly 6-seater and above models. These multi-passenger carts are essential for shuttle services in resorts and airports, demonstrating a shift in focus toward high-density, low-speed public transit solutions. Understanding these capacity requirements is essential for optimizing vehicle stability, battery power requirements, and overall chassis design robustness.

- By Power Source

- Electric Golf Carts

- Lead-Acid Battery Type

- Lithium-Ion Battery Type (Fastest Growth, Superior TCO)

- Gasoline Golf Carts (Shrinking Market Share, Primarily Utility)

- Solar Golf Carts (Hybrid Integration for Range Extension)

- Electric Golf Carts

- By Application

- Golf Courses (Stable Core Market)

- Commercial & Institutional Use

- Resorts & Hospitality (High Demand for Passenger Shuttles)

- Airports & Transit Centers (Logistics and Staff Movement)

- Universities & Campuses (Security and Maintenance Fleets)

- Industrial & Logistics Facilities (Fastest Commercial Growth, Utility Carts)

- Personal Use (Gated Communities & Recreation, Focus on Customization)

- By Seating Capacity

- 2-Seater (Standard Golf Play and Small Utility)

- 4-Seater (Neighborhood & Small Resort Shuttle)

- 6-Seater and Above (Multi-passenger and Heavy Utility Transport)

- By Ownership

- Fleet Ownership/Rental (Commercial Focus, Demand for Telematics)

- Individual Ownership (Personal Use Focus, Demand for Luxury Features)

Value Chain Analysis For Golf Carts Market

The value chain of the Golf Carts Market is characterized by specialized sourcing and complex assembly processes, commencing with upstream activities centered on the procurement of high-specification components, which increasingly dictate final product performance and cost. Critical upstream inputs include advanced lithium-ion battery cells and packs, high-efficiency AC electric motors, sophisticated electronic control units (ECUs), and lightweight structural materials like aluminum chassis components. Suppliers must adhere to stringent quality and safety standards, especially concerning battery thermal management systems. Efficiency in managing these upstream relationships, particularly securing stable, high-volume, cost-effective battery supply, is paramount for Original Equipment Manufacturers (OEMs) to maintain competitive pricing and stable production volumes, mitigating volatility in critical raw material markets and ensuring a reliable component stream for advanced models.

Midstream activities encompass the core manufacturing processes, including research and development, design, and final vehicle assembly. Leading Original Equipment Manufacturers (OEMs) differentiate themselves at this stage through robust product engineering innovation, focusing on modular designs that facilitate easier customization and repair, integration of advanced safety features, and aesthetic design improvements tailored for specific regional markets (e.g., luxury resort models vs. rugged utility vehicles). Manufacturing practices increasingly incorporate advanced automation and lean principles to optimize assembly lines, reduce labor costs, and maintain high consistency in production quality, especially as regulatory requirements for Low-Speed Vehicles (LSVs) become more complex and standardized globally. This phase is critical for integrating the digital and mechanical components, ensuring seamless functionality of telematics and power management systems.

The downstream segment involves distribution, sales, and comprehensive after-sales support. Distribution channels are typically bifurcated: direct sales channels efficiently handle large volume commercial fleet orders (e.g., selling 100+ carts directly to a major resort chain or university), while indirect sales rely heavily on a network of certified independent dealers who manage retail sales, customization services, and local after-sales maintenance for individual consumers and smaller corporate buyers. After-sales service forms a crucial part of the value proposition, particularly for rental fleets where minimizing vehicle downtime is non-negotiable. Providing rapid access to genuine spare parts, specialized technical support, and advanced diagnostics tools significantly enhances customer loyalty, reinforces the manufacturer's brand reputation for long-term reliability, and ensures fleet managers can maintain high utilization rates.

Golf Carts Market Potential Customers

The core potential customer base for golf carts has strategically expanded beyond the conventional leisure industry to encompass a diverse range of institutional and private buyers seeking efficient, localized mobility solutions. Historically and presently, golf course owners and operators constitute the foundation of the demand structure, driven by the cyclical need to update or expand their rental fleets every 3 to 5 years. These buyers prioritize features such as extreme durability, seamless integration of GPS fleet management technology for operational control, reliable performance on varied terrain, and low noise operation to maintain the quality of the golfing experience, resulting in significant recurring B2B orders often governed by long-term service contracts.

The most rapidly expanding demographic of potential customers is the Commercial and Institutional sector. This includes large multinational corporations utilizing carts within expansive manufacturing complexes for internal transport of personnel and equipment (often demanding specialized utility modifications like tow packages or customized cargo beds), major airport authorities requiring high-capacity shuttle services and baggage handlers, and extensive healthcare or educational campuses utilizing low-speed vehicles for security, maintenance, and facility management. These institutional buyers focus intensely on quantifiable metrics such as operational efficiency, maximal payload capacity, and lowest total cost of ownership (TCO), making vehicles with high-performance battery systems and AI-enabled predictive maintenance capabilities highly attractive, justifiable capital investments.

Finally, the individual private buyer market, particularly within North America and specific European luxury resort areas, represents substantial growth potential. Consumers residing in gated, master-planned, or retirement communities increasingly rely on golf carts as their primary, preferred mode of local transportation. This segment of the market places a high value on vehicle aesthetics, comfort features (premium seating, built-in coolers, infotainment), enhanced safety specifications (headlights, turn signals, seatbelts required for street legality), and extensive personalization options. These consumers often view the golf cart as an extension of their lifestyle rather than just a utility vehicle, driving significant demand for high-end, customizable, neighborhood electric vehicle (NEV) models that blur the line between a traditional cart and a small car.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Club Car, EZ-GO, Yamaha Golf-Car Company, Garia, Cushman, Star EV, Textron Specialized Vehicles, Columbia ParCar, Polaris Inc., Tomberlin, Bintelli Electric Vehicles, Moke America, Melex, HDK Electric Vehicles, LvTong, Xiamen Dalle Electric Car Co., Ltd., Marshell Green Power, Cruise Car, Kandi Technologies Group Inc., Taylor-Dunn, Jiangsu Excellence Sports Equipment Co., Ltd., Tropos Motors, Viking Carts, Global Electric Motorcars (GEM). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Golf Carts Market Key Technology Landscape

The Golf Carts Market is undergoing a significant technology-led transformation, moving beyond simple battery-and-motor operation towards digitally integrated, high-performance electric vehicles. The most pivotal advancement is the near-universal migration from antiquated lead-acid batteries to sophisticated lithium-ion (Li-ion) power packs. This shift is non-negotiable for market leadership, as Li-ion technology offers dramatic improvements in energy density, reducing the required battery weight while simultaneously extending vehicle range and minimizing charging time, often cutting it by half compared to lead-acid counterparts. Furthermore, Li-ion systems provide consistent power output throughout the discharge cycle and boast a superior cycle life, which translates directly into lower maintenance costs and a significantly better return on investment for commercial fleet operators, fundamentally changing the economics of fleet ownership.

Digital connectivity and advanced telematics systems are rapidly becoming standard features, forming the second major pillar of technological progress. Manufacturers are integrating full-service telemetry units that allow for remote monitoring, diagnostics, and over-the-air software updates. For golf courses, these systems enable real-time tracking, speed control via geofencing (preventing carts from entering prohibited areas), and integrated GPS mapping that enhances the player experience by providing yardage and course tips. For utility applications, these connected features allow fleet managers to monitor utilization rates, optimize logistics routes, enforce operational security through remote disabling, and instantly locate vehicles, all of which are crucial for maximizing asset utilization and ensuring efficiency across large, complex facility footprints.

Future technological development is focused on enhancing safety, sustainability, and autonomous capabilities. Sensor technology, including LiDAR, radar, and high-resolution cameras, is being miniaturized and integrated to enable sophisticated Advanced Driver Assistance Systems (ADAS), such as predictive path planning, adaptive cruise control, and advanced collision avoidance, essential steps toward low-speed autonomy and compliance with stringent public road safety standards for NEVs. Furthermore, material science innovation is contributing to the adoption of lighter, more durable composite materials for vehicle bodies and chassis, improving energy efficiency and corrosion resistance in varied climates. The incorporation of regenerative braking systems is another key development, capturing kinetic energy during deceleration and feeding it back to the battery, which substantially extends operational range, particularly beneficial in hilly terrains and intensive stop-and-go commercial environments.

Regional Highlights

The global Golf Carts Market demonstrates distinct regional characteristics defined by varied levels of market maturity, regulatory environments, and consumer applications. North America stands as the largest and most mature market, accounting for the highest revenue share globally. This dominance is attributed to several structural factors: the region possesses the world’s highest density of golf courses, substantial consumer disposable income allocated to recreational vehicles, and a strong cultural acceptance of Low-Speed Vehicles (LSVs) as primary local transport, particularly in sunbelt retirement communities. Consequently, North American consumers demand high-specification carts featuring premium comforts, advanced digital integrations, and lithium-ion power, driving innovation in the luxury and high-performance segments and maintaining a steady cycle of fleet replacement and technological upgrades.

The Asia Pacific (APAC) region is projected to register the most aggressive growth rate throughout the forecast period, transitioning rapidly from an emerging market to a global powerhouse. This acceleration is supported by enormous government and private sector investment in tourism infrastructure, including the construction of mega-resorts, theme parks, and sprawling residential cities in China, Japan, and Southeast Asia. The increasing urbanization and industrial development across APAC countries also create immense demand for electric utility vehicles in internal logistics, staff transport, and large-scale maintenance operations. Local manufacturing hubs are expanding rapidly in this region, often focusing on cost-effective electric models suitable for high-volume commercial fleet purchases, though the demand for luxury imported models is also strong in developed markets like Japan and South Korea due to rising affluence.

Europe represents a crucial, albeit mature, market segment where growth is less volume-driven and more focused on sustainable utility and niche applications. Stringent European Union emission standards and strong municipal pressure to limit noise and pollution in urban and heritage areas heavily favor the adoption of electric golf carts for municipal services, resort transport, and industrial campuses. Demand is particularly robust in Western European countries like the UK, France, and Spain, which possess highly developed hospitality sectors. The European market prioritizes certifications, superior durability, and compliance with specific road safety regulations, leading manufacturers to focus on highly reliable and aesthetically pleasing electric LSVs designed for maximum operational longevity and versatile use across diverse institutional and urban settings.

- North America (Dominant Market Share): Established recreational and residential LSV culture; leads technological adoption of lithium-ion and advanced telematics; highest volume of golf course fleet replacement cycles; strong focus on premium, feature-rich models.

- Europe (Mature and Regulatory-Driven): Market expansion constrained by size but boosted by strict environmental policies; high demand for specialized electric utility carts and luxury resort vehicles; intense focus on vehicle reliability, energy efficiency, and regulatory compliance.

- Asia Pacific (Fastest Growing Region): Rapid infrastructure development in hospitality and manufacturing; rising middle-class disposable income supporting personal purchases; significant opportunity for localized, high-volume production and industrial vehicle sales.

- Latin America (Emerging Potential): Growth trajectory tied to developing tourism sectors, particularly in resort heavy nations; gradual but consistent shift toward electric models, with price sensitivity remaining a key factor; increasing demand for utility carts in mining and agriculture.

- Middle East and Africa (Niche High-Value Market): Demand heavily concentrated in high-end luxury resorts (UAE, Saudi Arabia) and large infrastructure projects; operational requirements demand vehicles with specialized durability, advanced battery management, and effective cooling systems to withstand extreme climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Golf Carts Market.- Club Car (An Ingersoll Rand Brand)

- EZ-GO (A Textron Specialized Vehicles Brand)

- Yamaha Golf-Car Company

- Garia

- Cushman (A Textron Specialized Vehicles Brand)

- Star EV

- Columbia ParCar Corp.

- Polaris Inc.

- Tomberlin

- Bintelli Electric Vehicles

- Moke America

- Melex

- HDK Electric Vehicles

- LvTong

- Xiamen Dalle Electric Car Co., Ltd.

- Marshell Green Power

- Cruise Car

- Kandi Technologies Group Inc.

- Taylor-Dunn

- Jiangsu Excellence Sports Equipment Co., Ltd.

- Tropos Motors

- Viking Carts

- Global Electric Motorcars (GEM)

Frequently Asked Questions

Analyze common user questions about the Golf Carts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards electric golf carts, specifically lithium-ion technology?

The primary drivers are global environmental regulations promoting zero-emission vehicles, combined with the superior operational advantages of lithium-ion (Li-ion) batteries, which offer extended range, faster recharging times, reduced vehicle weight, and a significantly longer lifespan compared to traditional lead-acid batteries, leading to lower total ownership costs.

How significant is the commercial application segment compared to traditional golf course use in terms of market growth?

While golf courses remain a stable revenue source, the Commercial and Institutional segment—encompassing resorts, universities, airports, and industrial logistics—is projected to be the fastest-growing application market, driven by the demand for versatile, high-capacity utility electric vehicles for specialized internal transportation needs.

What key technological advancements are fundamentally impacting the design and functionality of modern golf carts?

Key advancements include the ubiquitous adoption of high-efficiency lithium-ion power sources, the integration of advanced telematics and GPS for comprehensive fleet management, and the early stages of integrating AI-powered features for predictive maintenance and advanced safety/collision avoidance systems (ADAS).

Which geographical region offers the highest growth potential for golf cart manufacturers seeking market expansion?

The Asia Pacific (APAC) region is anticipated to demonstrate the highest Compound Annual Growth Rate (CAGR) due to massive infrastructural investments in tourism, the proliferation of new residential communities, rising consumer affluence, and expanding local manufacturing capabilities in countries like China and India.

Are golf carts capable of operating on public roads, and what regulatory requirements must they meet?

Many modern electric golf carts are designed to meet specifications for Low-Speed Vehicles (LSVs) or Neighborhood Electric Vehicles (NEVs). To operate legally on public roads with posted speed limits typically under 35 mph, they must comply with federal and state safety standards, including requirements for headlamps, turn signals, mirrors, windshields, seatbelts, and vehicle identification numbers (VINs).

How does AI contribute to reducing the operational costs of golf cart fleets?

AI significantly reduces operational costs through predictive maintenance systems that analyze real-time performance data to identify and address potential component failures before they cause costly downtime, optimizing service schedules and extending the lifespan of critical, high-value components, especially batteries and motors.

What are the main financial constraints affecting market growth?

The primary financial constraint is the higher initial procurement cost of technologically advanced electric golf carts, particularly those utilizing lithium-ion batteries and integrated digital features, which creates an adoption barrier for cost-sensitive buyers despite the long-term operational savings.

What role do solar power systems play in the Golf Carts Market?

Solar power is increasingly used as a hybrid technology, primarily through roof-mounted panels that offer trickle charging capabilities. This extends the effective operational range, reduces reliance on grid charging, and enhances the sustainability profile of the vehicles, particularly in resort and maintenance applications where carts operate outdoors for long periods.

How are manufacturers addressing the demand for vehicle customization in the personal use segment?

Manufacturers are employing modular designs and offering extensive customization options, including specialized body kits, high-end upholstery, custom paint jobs, lifted suspensions, and integrated entertainment systems, treating the golf cart as a personalized neighborhood electric vehicle tailored to individual lifestyle and aesthetic preferences.

What is the competitive advantage of lithium-ion over lead-acid batteries for golf cart applications?

The competitive advantage of lithium-ion batteries is rooted in their maintenance-free nature, significantly lighter weight (improving energy efficiency), faster charging capability, and a deeper discharge cycle tolerance, resulting in greater power consistency and a longer useful life, directly enhancing the cart’s performance and reducing fleet maintenance labor.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Micro Electric Vehicles Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Golf Carts and Micro Cars, Quadricycles), By Application (Commercial, Residential, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Electric Microcars Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Golf Carts and Micro Cars, Quadricycles), By Application (Commercial, Residential), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager