Google Business View Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442949 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Google Business View Market Size

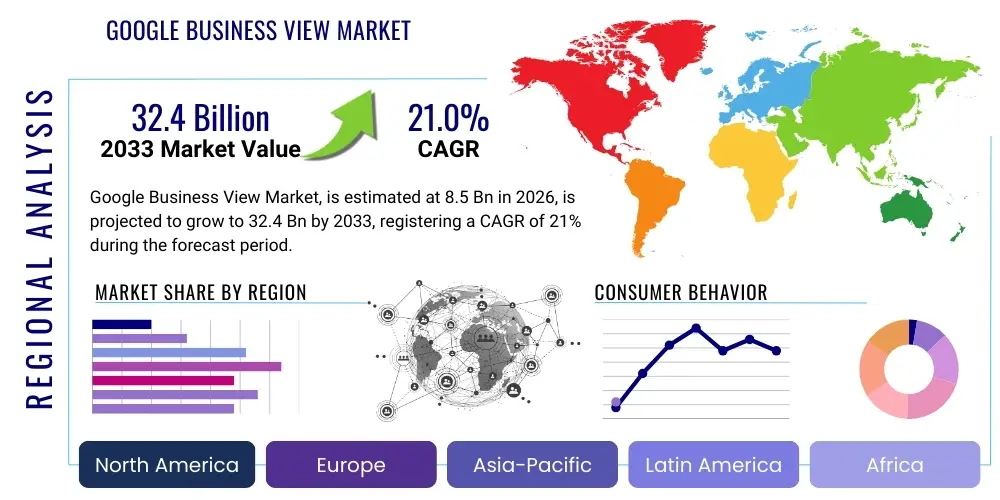

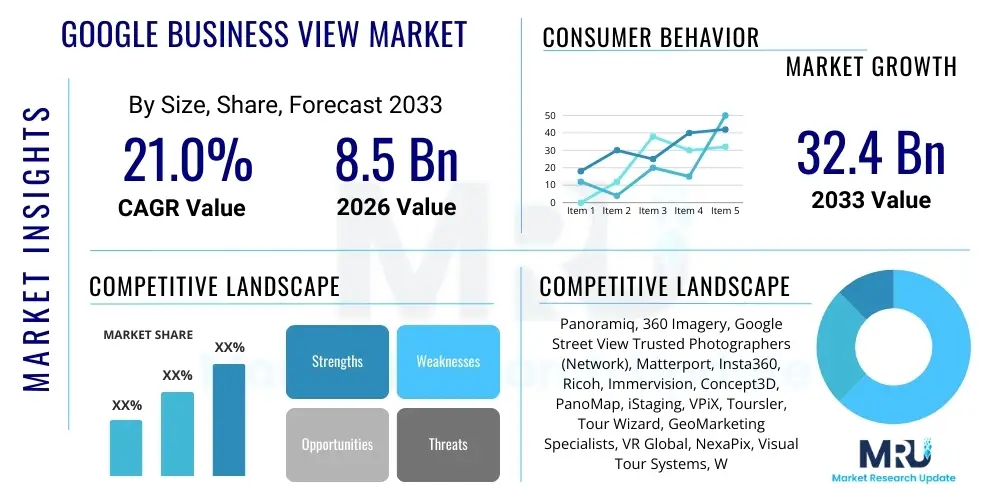

The Google Business View Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.0% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $32.4 Billion by the end of the forecast period in 2033. This substantial growth trajectory is attributed to the increasing digitalization of small and medium-sized enterprises (SMEs), coupled with the rising consumer demand for immersive and transparent pre-visit experiences across key sectors like retail, hospitality, and real estate. The strategic integration of high-definition 360-degree imagery directly into Google Search, Maps, and Street View significantly enhances online visibility and conversion rates for local businesses globally, solidifying its essential role in modern location-based marketing strategies.

Google Business View Market introduction

The Google Business View Market, fundamentally driven by the need for enhanced digital presence and consumer trust, encompasses services related to creating, managing, and optimizing high-quality 360-degree virtual tours and professional imagery for businesses listed on Google platforms. This service transforms standard Google My Business listings into highly engaging visual assets, enabling potential customers to virtually explore interiors, check ambiance, and review facilities before visiting physical locations. The core product offering involves utilizing specialized spherical cameras and proprietary stitching software to produce seamless, interactive walkthroughs that are published directly onto the Google ecosystem, drastically improving search engine result page (SERP) visibility and organic traffic.

Major applications of Google Business View span various commercial sectors where physical location and customer experience are critical determinants of success. The hospitality sector, including hotels, restaurants, and resorts, leverages these views to showcase amenities and accommodations, significantly boosting booking confidence. Similarly, the real estate market utilizes virtual tours to provide remote property viewings, accelerating the decision-making cycle for buyers and renters. Furthermore, retail outlets, fitness centers, automotive dealerships, and educational institutions employ this technology to differentiate themselves in competitive digital landscapes by offering transparent, reliable visual information, thereby reducing reliance on static text descriptions or low-quality user-submitted photos.

The primary benefits driving market expansion include measurable improvements in local search rankings, increased click-through rates (CTRs) to business websites, and significant enhancements in time spent viewing a listing. Businesses with high-quality virtual tours often experience a substantial increase in customer engagement and location queries. Key driving factors underpinning this growth involve the ubiquitous adoption of smartphones and high-speed internet access globally, which facilitates the smooth consumption of rich media content. Moreover, Google’s continuous promotion and integration of immersive features within its mapping and search interfaces inherently drive demand for professional, standardized virtual content, positioning Google Business View as an indispensable tool for geo-marketing efficiency and effectiveness.

Google Business View Market Executive Summary

The Google Business View Market is poised for robust expansion, reflecting a confluence of accelerating digital transformation and heightened consumer expectations for rich, interactive location data. Current business trends indicate a strong move toward professionalization, where high-volume, standardized content creation, often facilitated by certified partner networks, is becoming the norm. Small and medium enterprises (SMEs), realizing the tangible return on investment (ROI) from superior visual listings, are increasingly allocating marketing budgets toward high-quality virtual content services. Furthermore, there is a distinct trend of integrating Google Business Views with broader digital marketing campaigns, including social media promotion and website embedding, maximizing the utility of the captured spatial data beyond the Google platform itself. Strategic partnerships between established digital marketing agencies and specialized 360-degree photographers are also driving market efficiency and service scalability.

Regionally, the market exhibits differential growth rates heavily correlated with internet penetration, commercial density, and the maturity of local search ecosystems. North America and Europe currently represent the largest revenue pools, driven by early adoption, sophisticated digital infrastructures, and a high concentration of multinational corporate clients demanding unified global virtual visibility strategies. However, the Asia Pacific (APAC) region is forecasted to demonstrate the highest CAGR, primarily fueled by rapid urbanization, explosive growth in e-commerce, and massive proliferation of local businesses in emerging economies like India and Southeast Asia. Governments and tourism boards in APAC are also increasingly utilizing Business View capabilities for promoting cultural landmarks and regional tourist attractions, injecting further capital into the market infrastructure.

Segment trends highlight the critical importance of service complexity and integration. The 360-Degree Virtual Tours segment remains the foundational revenue generator, yet specialized services such as Point of Interest (POI) tagging, advanced data analytics tied to tour engagement metrics, and integration with augmented reality (AR) features are emerging as high-growth sub-segments. Application-wise, the Real Estate and Hospitality sectors continue to dominate expenditure, given their reliance on showcasing physical spaces. Furthermore, the market is segmenting by quality tier, with premium services offering advanced virtual reality (VR) compatibility and high-resolution, time-stamped views, catering to luxury brands and large corporate entities requiring maximum visual fidelity and technological sophistication.

AI Impact Analysis on Google Business View Market

User queries regarding the influence of Artificial Intelligence (AI) on the Google Business View Market frequently center on automation, content standardization, and predictive insights. Common questions analyze whether AI will automate the entire process of virtual tour creation, reducing the need for human photographers, or if it will primarily serve to enhance existing services through better data processing and customer personalization. Key concerns revolve around the future labor market for certified photographers, the ability of AI to interpret spatial aesthetics, and the integration of AI-driven tools for generating dynamic, personalized tour routes based on user behavior and intent. Users anticipate that AI could streamline content moderation, improve image stitching accuracy, and, most significantly, provide sophisticated analytics regarding tour efficacy and visitor demographic profiles.

The consensus drawn from user expectations suggests that AI will act as a powerful augmentative force rather than a disruptive replacement. Businesses expect AI to optimize the visual content capture process, using algorithms to guide optimal camera positioning and lighting adjustments automatically, ensuring consistency across disparate locations. Furthermore, AI is anticipated to play a crucial role in enhancing accessibility by automatically generating audio descriptions or language translations for virtual tours. Predictive analytics, powered by machine learning, will allow businesses to correlate tour engagement data with conversion metrics, refining location presentation strategies in real-time. This focus on automation of labor-intensive tasks and sophisticated data analysis ensures AI significantly elevates the quality and effectiveness of Google Business View services, driving value for both service providers and end-user businesses.

- AI-driven automated stitching and image correction significantly enhance the quality and efficiency of 360-degree photo processing, minimizing post-production time.

- Machine Learning (ML) algorithms analyze user interaction within virtual tours to generate predictive insights on customer interest points and navigation patterns.

- Natural Language Processing (NLP) facilitates the automatic generation of descriptive tags, POI markers, and accessible content descriptions for enhanced SEO value within the tour.

- AI assists in content moderation and compliance checks, ensuring all published imagery adheres to Google's strict visual guidelines and quality standards globally.

- Computer Vision enables automatic recognition of assets and inventory within commercial spaces (e.g., recognizing specific car models in a dealership tour), enhancing product linkage.

- Future implementation includes AI assistance in dynamic tour generation, tailoring the virtual path shown to a user based on their previous search history and demonstrated preferences.

DRO & Impact Forces Of Google Business View Market

The dynamics of the Google Business View Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's Impact Forces. Strong drivers center around the measurable ROI derived from enhanced local search visibility and increased foot traffic, compelling businesses to invest in high-quality visual content. The continuous evolution of Google’s search algorithms, prioritizing immersive, data-rich content, acts as a perpetual market stimulus, forcing commercial entities to adapt their digital marketing strategies. These powerful growth forces are underpinned by the global trend toward experiential marketing, where consumers demand transparency and detailed visual context before making purchasing decisions or physically visiting a location. Consequently, the proven ability of Google Business View to bridge the gap between digital presence and physical reality is a paramount market accelerator.

Despite robust growth potential, the market faces significant restraints, primarily revolving around the initial setup costs and the perception of complexity associated with professional 360-degree photography services. While the long-term ROI is compelling, capital expenditure for highly specialized photographic equipment and the certified labor required for high-volume shoots can be prohibitive for very small businesses with limited marketing budgets. Furthermore, market fragmentation, characterized by inconsistencies in pricing structures and quality standards among non-certified or independent providers, poses a risk of diluting the overall perceived value of professional Business View services. Another substantial restraint is the necessity for physical access to the business premises, which can be challenging during unforeseen events, regulatory restrictions, or for businesses operating in highly secure environments.

Conversely, significant opportunities exist in expanding service offerings to specialized, niche segments and integrating advanced digital capabilities. The opportunity to bundle Business View services with other complementary digital marketing products, such as social media management, website development, and spatial data analytics dashboards, provides avenues for substantial revenue diversification for service providers. Furthermore, the integration of virtual tours with Augmented Reality (AR) applications, allowing users to overlay digital information onto the physical space viewed virtually, represents a next-generation growth vector. Lastly, targeting underserved sectors like logistics facilities, governmental buildings, and large industrial plants, which have growing needs for internal visualization for operational purposes, offers substantial, untapped market potential, positioning certified professionals to leverage their expertise beyond conventional retail applications.

- Drivers: Increased consumer demand for immersive, pre-visit digital experiences and visual transparency.

- Drivers: Direct correlation between high-quality virtual tours and significant improvements in local SEO rankings and engagement metrics.

- Restraints: High initial investment costs for professional photography equipment and certified personnel.

- Restraints: Standardization challenges and quality control issues across a globally decentralized network of service providers.

- Opportunity: Expansion into niche commercial sectors and public infrastructure projects requiring internal visualization for operational planning and security.

- Opportunity: Integration of advanced features like AR/VR compatibility and advanced spatial analytics into standard Business View packages.

- Impact Force: Google’s proprietary algorithm updates that continuously favor rich, interactive content, sustaining mandatory business investment.

- Impact Force: The necessity for businesses to maintain a superior digital footprint to compete effectively against digitally native and well-resourced competitors.

Segmentation Analysis

The Google Business View Market is systematically segmented based on Type of Service, Application (End-User Industry), and Geographic Region, facilitating detailed analysis of growth drivers and competitive positioning within specific market niches. Segmentation by service type differentiates the market based on the complexity and technical sophistication of the visual output, ranging from foundational static imagery packages to complex, fully integrated 360-degree virtual walkthroughs. Understanding these segments is crucial for providers to tailor service bundles that meet varying budgetary and technological requirements of diverse client bases, ensuring maximum market penetration across different enterprise sizes.

The segmentation by Application provides crucial insight into where the highest demand and expenditure originate. While certain sectors like Hospitality and Real Estate are mature, demonstrating consistent, high-volume demand, emerging applications in areas like Healthcare and Industrial Manufacturing are exhibiting accelerated growth, driven by needs for virtual patient navigation and remote facility inspection, respectively. Analyzing these segmentations allows stakeholders to identify fast-growing verticals, allocate marketing resources efficiently, and develop industry-specific solutions, such as specialized POI tagging for hospital departments or detailed machine labeling for factory floors, thereby maximizing specialized value proposition.

- By Type:

- 360-Degree Virtual Tours

- High-Quality Static Imagery Packages

- Video Integration Services (Short-form internal walkthroughs)

- POI Tagging and Custom Navigation Features

- By Application (End-User Industry):

- Hospitality (Hotels, Restaurants, Tourism)

- Real Estate and Property Management

- Retail and E-commerce Integration

- Automotive Dealerships and Services

- Education and Institutional Campuses

- Healthcare and Medical Facilities

- Fitness and Recreation Centers

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises and Multinational Corporations (MNCs)

Value Chain Analysis For Google Business View Market

The value chain for the Google Business View Market begins with upstream activities focused on technology development and equipment manufacturing, involving producers of high-resolution 360-degree cameras, stabilization gear, and sophisticated image stitching software. Key players in this stage include specialized camera manufacturers and software developers who establish the quality ceiling and technical specifications for the entire ecosystem. The quality of the input technology directly dictates the final output fidelity and the efficiency of the capturing process. Innovation upstream, particularly in areas like light field technology and instantaneous stitching, is critical for reducing production costs and increasing the scalability of services offered downstream.

Midstream processes constitute the core service delivery, primarily dominated by certified 360-degree photography professionals and specialized digital marketing agencies. This stage involves the labor-intensive activities of content capture, post-processing (including geo-tagging, quality assurance, and moderation compliance), and the physical uploading of the virtual tour data to Google’s centralized Street View infrastructure. Direct channels in this market involve businesses contracting certified photographers directly via the official Google Street View Trusted program, prioritizing expertise and guaranteed quality. Indirect channels, which are growing significantly, involve large digital agencies or marketing platforms that bundle Business View services with a comprehensive suite of digital offerings, acting as intermediaries to manage the entire process for their client base, often leveraging proprietary workflow management tools to maintain consistency across large campaigns.

Downstream activities are focused on distribution, monetization, and consumption. The primary distribution channel is Google’s ecosystem itself (Search, Maps, My Business), which ensures ubiquitous reach and integration into consumer workflows. Monetization occurs through the service fees charged by the photographers or agencies to the businesses. The end-users of the product are the consumers who interact with the tours, leading to conversion, while the ultimate customers are the businesses benefiting from the enhanced visibility and engagement. The success downstream is measured by the analytical tools integrated with the service, tracking views, engagement duration, and correlation with physical location visits, ensuring the service provides quantifiable marketing intelligence back to the end-user business.

Google Business View Market Potential Customers

Potential customers for Google Business View services are overwhelmingly comprised of end-users whose business model relies heavily on physical location, visual appeal, and customer trust established prior to arrival. The primary buyers are categorized across sectors such as Hospitality, which includes independent and chain hotels, fine dining restaurants, and event venues; Real Estate, encompassing commercial and residential developers, leasing agents, and property managers; and high-traffic Retail environments, ranging from flagship stores and shopping malls to specialized boutique retailers. These sectors share the common necessity of providing a compelling, accurate, and visually rich digital preview of their physical assets to influence customer decision-making processes significantly, making the Business View solution an essential component of their location intelligence strategy.

Beyond these conventional segments, emerging potential customers include institutional bodies and specialized service providers. Educational institutions, such as universities and private schools, utilize virtual tours extensively to attract remote students and facilitate campus navigation for visitors. Healthcare facilities, including large hospitals and specialized clinics, are adopting these services to demystify complex medical environments, reduce patient anxiety, and improve internal wayfinding, a crucial aspect of patient experience. Furthermore, public sector organizations and municipalities use Business View to showcase libraries, parks, and other civic assets, promoting local community engagement and tourism. The breadth of potential customers is continually expanding as virtually any entity with a physical location recognizes the strategic imperative of converting online interest into actual physical footfall through transparency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $32.4 Billion |

| Growth Rate | 21.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Panoramiq, 360 Imagery, Google Street View Trusted Photographers (Network), Matterport, Insta360, Ricoh, Immervision, Concept3D, PanoMap, iStaging, VPiX, Toursler, Tour Wizard, GeoMarketing Specialists, VR Global, NexaPix, Visual Tour Systems, Walkinto, Real Tour Vision, VRTUOZ |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Google Business View Market Key Technology Landscape

The technological foundation of the Google Business View Market relies heavily on specialized hardware and sophisticated software infrastructure designed for spatial capture and processing. At the core are professional-grade 360-degree cameras, often equipped with multiple lenses and advanced sensor technology, crucial for capturing full spherical high-resolution images rapidly and consistently. Key technological advancements in this area include enhanced low-light performance, immediate in-camera stitching capabilities, and specialized GPS/IMU (Inertial Measurement Unit) integration to accurately map the spatial location of each captured panorama. The adoption of advanced computational photography techniques is driving the ability to produce HDR (High Dynamic Range) imagery, ensuring visual fidelity even in challenging lighting conditions, which is essential for showcasing intricate commercial interiors.

The processing and integration phase is highly dependent on proprietary and third-party stitching software, which performs complex image alignment, perspective correction, and color balancing to create a seamless virtual environment. Critical technology here involves computer vision algorithms that detect and mask moving objects or people to ensure privacy compliance and maintain image quality consistency throughout the tour path. Furthermore, the market leverages cloud-based platforms for high-volume data storage, quality control workflows, and direct integration APIs (Application Programming Interfaces) with Google Street View infrastructure. These APIs enable seamless submission, approval, and publishing of the finished virtual tours, minimizing latency and maximizing time-to-market for the final visualization product.

Beyond capture and processing, the market landscape is increasingly characterized by interactive display and analytics technologies. This includes the integration of tours with standard web browsers through WebGL, ensuring accessibility across various devices, and specific optimizations for mobile viewing, including VR headset compatibility (e.g., Google Cardboard or Meta Quest platforms). Analytical tools, often utilizing machine learning, track user heatmaps, navigation paths, and dwell times within the virtual environment, providing quantitative metrics on customer engagement. This data feedback loop, powered by sophisticated tracking scripts and reporting dashboards, transforms the Business View from a simple visual asset into a powerful, data-driven marketing intelligence tool, informing future content strategy and physical space optimization decisions for the end client.

Regional Highlights

The geographical distribution of the Google Business View Market highlights significant regional disparities in adoption maturity, regulatory environment, and technological infrastructure, all of which influence market growth and investment strategies. North America, specifically the United States, represents the largest and most mature market, characterized by high commercial density, advanced digital marketing sophistication, and robust competition among service providers. Businesses in this region quickly recognized the necessity of leveraging Google's platform for localized search dominance, leading to high investment in professional virtual content. The region’s advanced IT infrastructure facilitates the swift creation, management, and consumption of high-bandwidth 360-degree imagery, setting the benchmark for service quality and application innovation, particularly in major metropolitan areas like New York, Los Angeles, and Toronto.

Europe follows closely, driven by stringent consumer protection laws that encourage business transparency and a highly fragmented local business landscape requiring strong digital differentiation. Western European countries, including Germany, the UK, and France, exhibit high adoption rates, particularly within the tourism and luxury retail sectors. Central and Eastern Europe are rapidly catching up, supported by increasing internet penetration and modernization of local business digital infrastructures. The key distinction in the European market is the emphasis on multilingual support and adherence to diverse data privacy regulations (like GDPR), influencing how service providers manage and process spatial data captured within commercial premises.

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR) due to several powerful demographic and economic shifts. Rapid urbanization, massive growth in the SME sector across economies like India, China, and Southeast Asia, and a vast, mobile-first consumer base are key accelerators. While infrastructure challenges exist in certain remote areas, major commercial hubs are experiencing exponential demand for localized digital visibility. The Middle East and Africa (MEA), while currently smaller, are demonstrating promising growth, primarily concentrated in tourism-centric nations (UAE, Saudi Arabia) and resource-rich economies focusing on infrastructure development. These regions present substantial opportunities for certified providers capable of scaling operations quickly to meet burgeoning commercial needs.

- North America: Market leader due to early adoption, high digital maturity, and strong integration of Business View into standard local SEO strategies.

- Europe: High growth fueled by strong regulatory support for consumer transparency and high demand from hospitality and premium retail sectors.

- Asia Pacific (APAC): Expected fastest growth rate, driven by rapid SME digitization, high mobile penetration, and urbanization across emerging markets.

- Latin America: Characterized by fragmented but growing demand, primarily concentrated in large commercial centers (e.g., Brazil, Mexico) utilizing Business View for tourism promotion.

- Middle East: High-value, project-based demand focused on showcasing major real estate developments, luxury hotels, and government initiatives (e.g., UAE Vision 2030).

- China: Unique market dynamics requiring integration with domestic mapping and search platforms, often through specialized localized service providers.

- Germany: Focus on industrial applications, showcasing manufacturing facilities and quality control processes to B2B clients.

- Japan: High technological sophistication, driving demand for advanced features like high-resolution imagery and intricate navigation paths for complex retail spaces.

- India: Mass market adoption driven by millions of SMEs entering the digital ecosystem for the first time, seeking affordable visual marketing solutions.

- UK: Strong demand from the financial and corporate services sectors, showcasing office interiors and professional environments for recruitment and branding purposes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Google Business View Market, encompassing photography networks, technology providers, and large digital agencies leveraging this service.- Panoramiq (Specialized 360 Imagery Provider)

- 360 Imagery (Global Network of Certified Professionals)

- Matterport (Technology and Platform Provider, often integrated with Street View)

- Insta360 (Key Hardware Manufacturer for 360 Cameras)

- Ricoh (Hardware Manufacturer, noted for Theta series)

- Concept3D (Provider of immersive map and virtual tour technology)

- VPiX (Virtual Tour Software and Hosting Solutions)

- Tour Wizard (Specialized Virtual Tour Software)

- GeoMarketing Specialists Inc.

- VR Global Solutions

- NexaPix Professional Photography

- Visual Tour Systems

- Walkinto Platforms

- Real Tour Vision (RTV)

- iStaging Corp. (AR/VR solutions for real estate)

- Virtual Exposure Experts

- PanoMap Services

- Toursler Agency

- VRTUOZ Solutions

- 360 Visibility Group

Frequently Asked Questions

Analyze common user questions about the Google Business View market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Google Business View and how does it enhance local SEO?

Google Business View, now fully integrated into Google Street View, is a service that publishes high-quality, 360-degree interactive virtual tours of a business’s interior directly onto Google Maps and Search. It significantly enhances local Search Engine Optimization (SEO) by increasing the completeness and richness of the Google My Business profile, which Google algorithms prioritize. Businesses with these tours experience higher visibility in local search results (the 'local pack'), increased click-through rates, and a verified boost in consumer trust and physical visits, thereby accelerating conversion from search query to location arrival.

What are the typical costs associated with commissioning a Google Business View virtual tour?

The costs for commissioning a Google Business View tour are highly variable and depend primarily on the physical size of the business location, the complexity of the shoot (e.g., number of specific Points of Interest needed), and the provider's pricing structure. Costs are generally quoted as a one-time setup fee, covering photography, processing, stitching, and publishing. While a small retail shop might pay a few hundred dollars, large facilities like resorts or multi-story buildings can require investments in the thousands. It is a capital expenditure, as hosting on Google is free and the tour generally remains active indefinitely, requiring updates only upon major structural changes.

How long does it take for a virtual tour to appear live on Google Maps?

The process of going live typically involves three phases: the physical photography session, which usually takes a few hours to a full day depending on size; post-production processing and quality assurance, which can range from 2 to 7 business days; and finally, Google's internal review and publishing process. In most cases, a professionally captured and submitted tour will appear live and searchable across Google platforms within 10 to 14 business days from the date of the shoot. Expedited services may reduce this timeline, but adherence to Google's strict quality control standards is paramount for successful publication.

Can virtual tours be embedded outside of Google's ecosystem, such as on a company website?

Yes, Google Business View tours are designed for wide utility and can be easily embedded directly onto a company's official website, social media platforms, or property listing services. Google provides simple, standardized HTML embed codes, similar to those used for embedding YouTube videos. This capability is a significant value proposition, allowing businesses to maximize the reach of their single visual asset across multiple digital marketing channels, providing a consistent, immersive experience regardless of the platform the customer uses to engage with the brand.

Is ongoing maintenance required for a Google Business View tour?

The primary Google Business View asset does not require mandatory ongoing maintenance unless the business undergoes substantial physical renovations, layout changes, or relocates. The tour is a snapshot in time. However, best practice suggests refreshing the tour every 2 to 3 years, or immediately following significant seasonal changes (e.g., major holiday decorations) or structural updates, to maintain accuracy and visual relevance for customers. Service providers often offer discounted re-shoot packages or incremental update services for minor changes, ensuring the business listing remains fully accurate and highly engaging.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager