Google Workspace Productivity Tools Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443252 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Google Workspace Productivity Tools Market Size

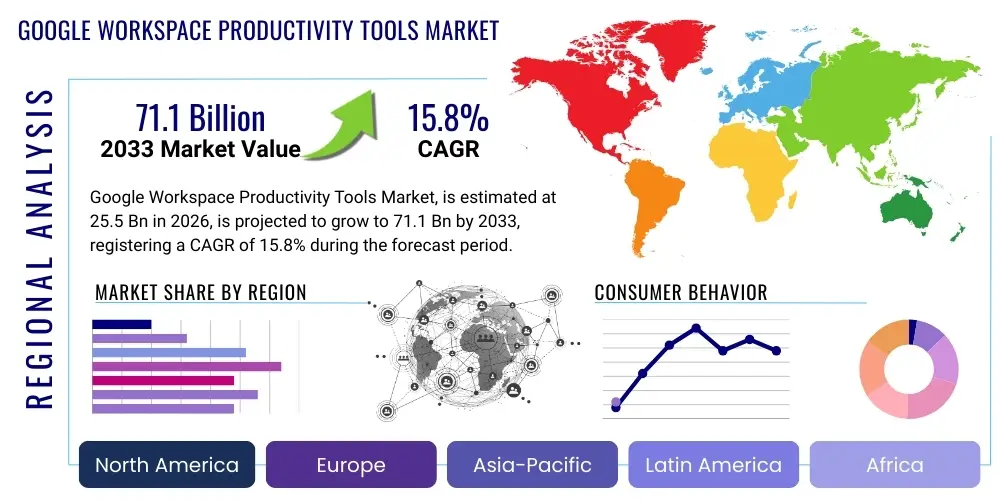

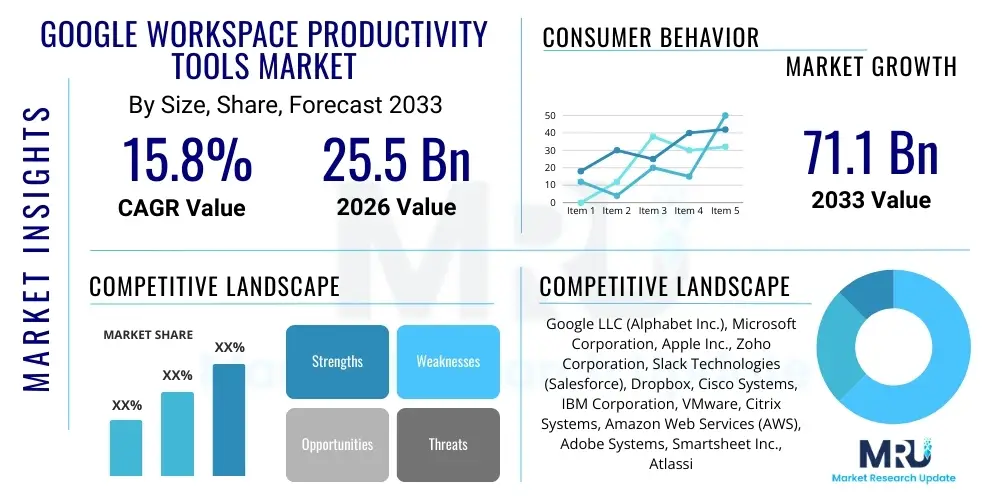

The Google Workspace Productivity Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $25.5 Billion USD in 2026 and is projected to reach $71.1 Billion USD by the end of the forecast period in 2033.

Google Workspace Productivity Tools Market introduction

The Google Workspace Productivity Tools Market encompasses the comprehensive suite of cloud-native applications designed to facilitate collaboration, communication, and content creation for businesses, educational institutions, and individual users globally. This robust ecosystem, fundamentally rooted in the Software-as-a-Service (SaaS) delivery model, includes widely recognized, continuously updated applications such as Gmail for enterprise communication, Docs, Sheets, and Slides for content creation, Google Drive for secure, unified file storage, and Meet and Chat for real-time video conferencing and instant messaging. The core product definition emphasizes its seamless integration across diverse operating systems and mobile devices, coupled with a fundamental commitment to real-time co-editing and synchronous workflow management, which collectively positions it as a foundational infrastructure element for the modern, geographically dispersed workforce. Its inherent scalability is a critical market differentiator, capable of addressing the complex needs of large, heavily regulated multinational corporations requiring granular administrative control and advanced security protocols, while simultaneously offering cost-effective, straightforward solutions tailored for the operational requirements of Small and Medium Enterprises (SMEs) seeking rapid deployment and minimized IT overhead. The architectural foundation is built upon Google’s global cloud network, ensuring high availability and performance across all geographic markets, cementing its status as a leading contender in the enterprise software segment.

Major applications of Google Workspace extend significantly beyond basic office functionalities to sophisticated operational and strategic business requirements, covering areas such as project management through integrated task tracking, advanced data analysis utilizing specialized functions and extensions within Sheets, and the facilitation of unified internal and external communication strategies. Organizations routinely leverage the integrated platform for high-stakes collaborative document creation, complex financial modeling, conducting large-scale, secure virtual meetings, and maintaining stringent data governance over centralized file repositories in Google Drive. A key differentiator and market driving factor is the commitment to interoperability and an open ecosystem, highlighted by robust Application Programming Interfaces (APIs) and the thriving Google Workspace Marketplace, which enables extensive customization and integration with thousands of specialized third-party business applications. This flexibility effectively minimizes technological fragmentation and enables enterprises to construct a powerful, interconnected digital workspace that is highly optimized for sector-specific compliance and workflow needs. The suite’s capacity for rapid iteration and deployment of new features, particularly those based on Artificial Intelligence, ensures that users consistently benefit from cutting-edge tools designed to maximize organizational efficiency and throughput, reinforcing the platform's long-term value proposition.

The principal driving factors fueling the accelerated expansion of this market are deeply rooted in the structural shifts affecting global commerce, most prominently the lasting adoption of hybrid and fully remote working models, which necessitate highly reliable, cloud-based collaboration platforms that guarantee secure data accessibility regardless of user location. The decisive competitive advantage is currently being secured through continuous technological enhancement of the suite with advanced Artificial Intelligence (AI) and Machine Learning (ML) features, including the native integration of generative AI capabilities to automate cognitive tasks, summarize complex data sets, and assist in content creation, thereby elevating human productivity. The tangible benefits derived by organizational users encompass enhanced employee productivity stemming from unparalleled real-time collaboration, substantial reduction in Capital Expenditure (CapEx) associated with traditional licensed software, and significantly improved data security and rigorous compliance management features inherent to Google’s hyperscale cloud infrastructure. Furthermore, the aggressive investment in security features like zero-trust architectures and the competitive dynamic spurred by the rivalry with other major players, notably Microsoft 365, mandate continuous innovation, ensuring high market momentum and a sustained period of double-digit growth throughout the forecast period. The comprehensive ecosystem approach, including ancillary tools like AppSheet for custom application development, solidifies the platform's attractiveness across diverse industry verticals.

Google Workspace Productivity Tools Market Executive Summary

The Google Workspace Productivity Tools Market is currently navigating a highly dynamic growth trajectory, primarily fueled by the profound integration of advanced generative Artificial Intelligence (Gemini), which is rapidly transforming foundational business trends towards predictive and automated workflow management. This technological infusion is driving unprecedented demand for the platform’s premium tiers, where automation and intelligence translate directly into quantifiable efficiency gains for large organizations. Business trends are further characterized by a decisive enterprise pivot toward unified SaaS platforms, seeking to consolidate fragmented software spending and minimize integration complexities. This market imperative is forcing service providers to focus intensely on interoperability, offering seamless integration not only internally across the Workspace suite but but also externally with mission-critical third-party enterprise resource planning (ERP) and customer relationship management (CRM) systems. Security remains a top-tier business priority, with enterprises requiring features beyond standard encryption, focusing on advanced e-discovery, immutable logging, and granular data sovereignty controls, particularly in regulated industries like finance and healthcare, defining the current high-stakes competitive environment.

Regional trends indicate a clear hierarchy in market maturity and adoption rates. North America and Western Europe maintain their position as dominant revenue generators, characterized by sophisticated enterprise IT environments and the highest per-user consumption of advanced features. These regions lead in the early deployment of AI-powered tools and specialized industry solutions, reflecting higher digital maturity and established cloud migration frameworks. Conversely, the Asia Pacific (APAC) region is strategically positioned as the critical growth engine for the next five to seven years, projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by the rapid digital transformation occurring among vast populations of SMEs, high rates of mobile device adoption, and government mandates promoting cloud services across public sectors, particularly in rapidly urbanizing and industrialized economies. Latin America and the Middle East & Africa (MEA) represent significant opportunities for expansion, capitalizing on infrastructure modernization projects and increasing demand for remote collaboration capabilities among resource-intensive sectors such as energy and mining, typically preferring the agile, subscription-based TCO model offered by Google Workspace.

Segmentation trends reveal substantial growth across both the Large Enterprise and the Education sectors. Large Enterprises are increasingly migrating from competing legacy systems, attracted by the total cost of ownership benefits, continuous innovation in AI, and the promise of a truly integrated, security-first ecosystem. The Education sector’s high adoption rates, historically supported by subsidized or free tiers, continue to act as a crucial pipeline, fostering future generations of business professionals who are already proficient in the Workspace platform, thus ensuring long-term user stickiness. Application-wise, Communication & Collaboration segments (Meet, Chat) show persistent growth tied to hybrid work mandates, while the Content Creation & Document Management segment (Docs, Drive) is undergoing rapid transformation due to AI features that fundamentally redefine how content is generated, edited, and governed. Pricing model trends are moving towards value-based subscriptions, with premium tiers providing differentiated access to high-value features such as enhanced security, compliance auditing tools (Google Vault), and exclusive AI functionalities, allowing Google to monetize advanced capabilities and maximize Average Revenue Per User (ARPU) within the competitive SaaS landscape.

AI Impact Analysis on Google Workspace Productivity Tools Market

Analysis of high-frequency user search queries and organizational technology audits related to AI integration in Google Workspace reveals a keen focus on maximizing operational efficiencies and managing the associated compliance and ethical risks. Users are predominantly asking how the integrated Gemini models can perform complex cognitive tasks, such as generating detailed marketing copy based on brief bullet points, analyzing vast datasets in Sheets to identify trends and create actionable reports, and automating the summarization of lengthy email chains or multi-hour video conference transcripts in Meet. The underlying anticipation is that these AI capabilities will effectively eliminate up to 30% of time spent on routine administrative tasks, redirecting employee focus toward strategic initiatives and higher-value activities. Consequently, organizations are actively seeking benchmark data to quantify the immediate Return on Investment (ROI) derived from AI productivity features, driving the demand for advanced analytics tools that measure task completion acceleration and document processing efficiency within the Workspace environment. This sustained pressure for demonstrable efficiency gains is accelerating the adoption cycle of premium AI-enabled subscription tiers across the corporate client base.

A secondary, yet equally critical, cluster of user concern centers on data governance, proprietary information protection, and the responsible deployment of AI. Common inquiries frequently address how Google ensures that enterprise data utilized by the Gemini model remains isolated and confidential, not used for training publicly available models, and fully compliant with international privacy laws, including the rigorous requirements of GDPR and specific sector regulations like HIPAA. Furthermore, a substantial societal concern reflected in user dialogue is the fear of job roles becoming redundant, particularly those involving foundational writing, data entry, and meeting transcription. Google’s proactive market strategy addresses this by framing AI as a "co-pilot" or "augmentative tool," emphasizing that the technology is designed to enhance human capability and decision-making rather than fully replacing human judgment. This strategic narrative is vital for maintaining high user adoption rates and mitigating organizational resistance to disruptive technological change, particularly in industries with complex regulatory oversight and established workflow procedures that require human verification.

The strategic deployment of AI features within Google Workspace is fundamentally reshaping the competitive landscape, creating a technological arms race where superior AI performance and integration depth are the primary differentiators against established competitors. Google's continuous refinement of specialized AI models for unique functions—such as Smart Compose in Gmail, customized formula suggestions in Sheets, and automated security monitoring via AI-powered threat detection—ensures a tightly integrated and cohesive user experience that competitors struggle to replicate with fragmented third-party solutions. This depth of integration is crucial for Generative Engine Optimization (GEO), ensuring that Google's products consistently provide the most relevant, context-aware, and intelligent answers within the workflow itself, minimizing the need for users to switch context to external tools. Therefore, the long-term market success of Google Workspace hinges directly on its ability to deliver intelligent, ethical, and seamlessly integrated AI functionalities that consistently exceed end-user expectations for both productivity and data integrity, further solidifying its ecosystem lock-in for enterprise clients demanding future-proof solutions.

- Generative AI for Content Creation: Automated drafting of complex emails, instant summarization of large reports, and rapid generation of presentation narratives and initial slide frameworks (Slides).

- Predictive Workflow Augmentation: AI-driven suggestions for optimizing meeting schedules, intelligent prioritization of incoming communications (Gmail), and proactive organization/tagging of files in Drive based on content and context.

- Enhanced Security and Compliance: Utilization of AI for sophisticated real-time threat detection, identification of suspicious login anomalies, and automated enforcement of organization-wide Data Loss Prevention (DLP) policies.

- Automation of Repetitive Tasks: Substantial reduction of manual data entry through intelligent recognition and extraction in Sheets and automated categorization and archiving of digital assets and communications.

- Impact on User Training and Adoption: Necessitates the development of specialized training modules focused on advanced prompting techniques and ethical AI use to maximize the utility of co-pilot features.

- Competitive Differentiation: AI capabilities serve as the primary strategic battleground against rival platforms, driving intensified research and development spending focused on performance, integration, and trustworthiness.

- Custom Application Development: AI integration with AppSheet allows for intelligent automation within custom-built, low-code departmental applications, expanding productivity beyond the core tools.

- Data Analysis Acceleration: AI assists in transforming raw data into visual insights in Sheets and Data Studio, bypassing manual formula creation and complex analysis steps, democratizing data accessibility.

DRO & Impact Forces Of Google Workspace Productivity Tools Market

The fundamental market dynamics are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), which together dictate the velocity and direction of expansion and form the resulting Impact Forces. The primary and most potent drivers include the global, non-reversible mandate for organizational cloud migration and comprehensive digital transformation initiatives across virtually all industry verticals, propelled by the urgent need for operational scalability and capital expenditure minimization. This momentum is intrinsically linked to the pervasive and persistent shift towards flexible, geographically dispersed, and hybrid work models, which are functionally dependent on robust, real-time, cross-platform collaboration tools like those offered by Google Workspace. Furthermore, the systematic and continuous introduction of cutting-edge Artificial Intelligence (AI) into the core product suite acts as a powerful catalyst, driving replacement cycles and attracting new enterprise clients seeking technological superiority and measurable productivity enhancements through automation and predictive analytics capabilities.

Significant restraints challenging the market's seamless expansion revolve critically around legal and regulatory frameworks, particularly the increasing global scrutiny over data sovereignty, privacy, and residency requirements (e.g., specific regional mandates in Germany, Russia, or China). Adherence to complex regulations like GDPR (Europe) and CCPA (California) requires massive administrative overhead and highly localized infrastructure investments, complicating international deployment strategies for large multinational corporations. A second major restraint is the deep historical market penetration and customer loyalty commanded by established competitors, most notably Microsoft 365. Overcoming this inertia requires Google Workspace to not only demonstrate technical superiority but also offer compelling economic incentives, highly streamlined migration pathways, and superior integration capabilities with legacy enterprise systems that are often optimized for competitor platforms, requiring sustained investment in compatibility layers and integration middleware.

Conversely, vast opportunities for unprecedented expansion arise from two primary vectors: the verticalization of the productivity suite and geographical market penetration. The opportunity to develop and offer highly specialized, industry-specific productivity solutions—complete with compliant templates, specialized workflows, and sector-specific AI models tailored for finance, healthcare, or government—represents a massive untapped revenue stream beyond the general-purpose offerings. Geographically, the accelerated digitization of Small and Medium Enterprises (SMEs) in emerging economies across the Asia Pacific (APAC) and Latin America offers a greenfield opportunity for massive subscription volume growth, as these entities often leapfrog legacy IT systems directly to cloud-native solutions. The combined effect of these DRO elements generates formidable Impact Forces, compelling Google to focus capital investment heavily on compliance guarantees, advanced security certifications, superior AI integration, and targeted regional partnerships. This intensification of competition simultaneously benefits the consumer by ensuring rapid product cycles, continuous feature upgrades, and pressure on pricing structures across the entire enterprise productivity market, solidifying the market’s trajectory toward intelligent, platform-based ecosystems over standalone applications.

Segmentation Analysis

The Google Workspace Productivity Tools Market undergoes rigorous segmentation analysis to facilitate precise strategic planning, enabling vendors and investors to accurately gauge demand elasticity and allocate resources effectively across differing user requirements. The market is fundamentally segmented based on core dimensions including Deployment Mode, Enterprise Size, Application Type, and key End-User Industry verticals, providing a high-resolution view of adoption patterns. The segmentation by Deployment Mode, distinguishing between pure Cloud-based and emerging Hybrid models, is crucial for addressing organizations with strict on-premise data requirements or those undergoing phased cloud migration strategies. Furthermore, the segmentation by Enterprise Size remains pivotal, as the administrative complexity, security needs, and pricing sensitivity of Large Enterprises (requiring premium features like Google Vault and advanced IAM) contrast sharply with the basic, scalable needs of SMEs that prioritize low TCO and ease of deployment, driving fundamentally different go-to-market strategies.

Segmentation based on Application Type dissects the functionality demand, highlighting which specific components of the Workspace suite are experiencing the highest growth. The Communication & Collaboration segment, encompassing tools like Google Meet, Chat, and Calendar, often experiences demand spikes commensurate with changes in global remote work policies and the need for seamless, persistent communication channels. Conversely, the Content Creation & Document Management segment (Docs, Sheets, Slides, Drive) is undergoing disruptive growth driven by the introduction of generative AI, which transforms the speed and quality of content generation, thus increasing the perceived value and utilization rate of these core applications. Understanding these functional demands is essential for product development prioritization and feature rollout sequencing. The integration of administrative tools and low-code platforms (AppSheet) into the Enterprise Productivity & Administration segment reflects the growing need for internal IT teams to manage and customize the environment effectively.

Finally, the segmentation by End-User Industry provides critical vertical-specific insights, recognizing that different industries possess unique regulatory, security, and functional needs. The Banking, Financial Services, and Insurance (BFSI) sector, for instance, drives demand for the most stringent security and audit trail features, while the Education sector requires robust capacity for mass user management and accessibility features. The IT and Telecom sectors, typically early adopters, drive the demand for advanced API integrations and developer tools. Monitoring adoption rates across these diverse industries enables Google to tailor its marketing messages, develop industry-specific compliance certifications, and prioritize partnerships that specialize in vertical solutions, ensuring that the full potential of the Workspace platform is realized across the entire enterprise client spectrum, maximizing market penetration and long-term subscription renewal rates globally.

- Deployment Mode: Cloud-based, Hybrid

- Enterprise Size: Small and Medium Enterprises (SMEs), Large Enterprises

- Application Type: Communication & Collaboration (Gmail, Meet, Chat, Calendar), Content Creation & Document Management (Docs, Sheets, Slides, Drive, Keep), Enterprise Productivity & Administration (Admin Console, Vault, AppSheet, Endpoint Management)

- End-User Industry: IT and Telecom, Banking, Financial Services and Insurance (BFSI), Retail and E-commerce, Healthcare, Education, Government and Public Sector, Manufacturing, Others

Value Chain Analysis For Google Workspace Productivity Tools Market

The Value Chain for the Google Workspace Productivity Tools Market commences with highly capital-intensive upstream activities, focusing predominantly on the development and maintenance of the hyperscale cloud infrastructure, which forms the core competitive advantage. Upstream analysis involves Google's continuous, multi-billion-dollar investment in its global network of interconnected data centers, advanced proprietary hardware (including custom Tensor Processing Units - TPUs for AI acceleration), and foundational software layers. Key activities here include ensuring massive computational capacity, implementing redundant systems for high availability, and conducting continuous R&D into cutting-edge technologies like quantum computing and advanced networking protocols. The successful execution of these upstream functions is paramount, as they directly dictate the speed, reliability, and security of the downstream SaaS offering. Furthermore, the sourcing and training of specialized talent—AI researchers, security engineers, and large-scale infrastructure architects—is a vital input, establishing significant economic barriers to entry for potential new competitors.

The midstream segment of the value chain is dedicated to product development, integration, and ecosystem management. This crucial stage involves the cyclical refinement and updating of all core applications (e.g., integrating Gemini into Docs and Sheets), ensuring seamless data flow between applications, and developing robust security features embedded within the code. Distribution channels operate within this midstream phase, determining how the product reaches the diverse global customer base. Google employs a dual-channel strategy: Direct sales teams handle large, strategic, and often custom deployment agreements with multinational enterprises, ensuring high-touch implementation and consultation services. Simultaneously, the indirect channel, comprising a vast network of Authorized Google Workspace Resellers, Value-Added Resellers (VARs), and Managed Service Providers (MSPs), is vital for mass market penetration, serving the complex installation, customization, and continuous support needs of SMEs and localized businesses that require regional language expertise and localized billing flexibility. Effective channel management, including partner certification and incentive programs, is critical for maximizing market reach and scaling support services efficiently.

The downstream activities focus exclusively on user adoption, service delivery, and post-sales support, directly influencing customer satisfaction, retention rates, and ultimately, subscription renewals. Downstream processes include providing multi-tiered technical support (ranging from self-service knowledge bases to dedicated enterprise technical account managers), facilitating secure data migration from legacy platforms, and offering comprehensive user training modules focused on maximizing efficiency with AI-enabled features. Successful downstream execution requires a deep understanding of customer workflows to ensure optimal platform integration and minimal operational disruption during deployment. Furthermore, the continuous collection and analysis of user feedback at this stage are critical inputs for the upstream R&D cycle, enabling Google to quickly adapt and refine its feature set based on real-world enterprise needs and competitive performance benchmarks. The high stickiness inherent in deeply integrated enterprise productivity suites reinforces the importance of stellar downstream service delivery for ensuring long-term revenue stability and customer lifetime value (CLTV).

Google Workspace Productivity Tools Market Potential Customers

Potential customers for the Google Workspace Productivity Tools Market are defined by organizations exhibiting a strong strategic imperative for digital transformation, seeking to replace outdated, costly legacy systems with agile, cloud-native platforms, and prioritizing high collaboration and mobility for their employees. This demographic spans across all geographical regions and organizational scales, yet is unified by the desire for reduced Total Cost of Ownership (TCO) delivered through subscription models, platform flexibility, and inherent security features built upon Google’s global cloud infrastructure. Key customer segments prioritize unified communication, require stringent compliance capabilities (e.g., data residency control), and value an open API ecosystem that supports extensive integration with existing custom or third-party business applications, making the platform highly attractive to organizations with complex IT environments and diverse departmental needs.

Targeted buyer personas within these potential organizations are highly specialized. They include Chief Information Officers (CIOs) and Chief Technology Officers (CTOs) whose decisions are governed by IT security metrics, platform reliability (guaranteed uptime SLAs), and the financial mandate to consolidate software vendors and move from CapEx to OpEx models. Departmental managers and Chief Operating Officers (COOs) are motivated by immediate productivity gains, seamless team collaboration capabilities, and user-friendly interfaces that minimize the need for extensive training and support calls. The Education and SME sectors, in contrast, often prioritize immediate accessibility, ease of administrative scalability for large user numbers, and highly competitive pricing points. These diverse needs necessitate Google’s tiered subscription offering, from basic individual plans to highly governed Enterprise Plus packages, ensuring comprehensive coverage across the entire spectrum of organizational requirements and budget constraints.

Current market expansion efforts are strategically focused on organizations that have been historically reliant on competing on-premise or desktop-based suites, presenting a significant migration opportunity driven by the superior AI functionality and collaboration tools now offered by Workspace. Specifically, sectors like Healthcare and Government are exhibiting accelerated adoption trends, moving beyond initial skepticism concerning cloud security, now driven by the necessity for secure remote patient care coordination, distance learning platforms, and efficient citizen services delivery. Any enterprise seeking to modernize its communication stack (e.g., replacing aging PBX systems with Google Voice and Meet), or aiming to empower a highly mobile sales force with secure, integrated document access via Drive, represents a high-potential customer. The long-term customer value is secured through the platform’s continuous innovation, ensuring that the technology investment remains relevant against rapidly evolving competitive threats and technological standards, securing future revenue streams through sustained subscription loyalty.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $25.5 Billion USD |

| Market Forecast in 2033 | $71.1 Billion USD |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Google LLC (Alphabet Inc.), Microsoft Corporation, Apple Inc., Zoho Corporation, Slack Technologies (Salesforce), Dropbox, Cisco Systems, IBM Corporation, VMware, Citrix Systems, Amazon Web Services (AWS), Adobe Systems, Smartsheet Inc., Atlassian Corporation, Proofpoint. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Google Workspace Productivity Tools Market Key Technology Landscape

The core technological landscape enabling the functionality and competitive edge of the Google Workspace Productivity Tools Market is built upon Google’s proprietary hyperscale cloud computing infrastructure, leveraging globally distributed data centers and advanced, high-speed fiber-optic networks. This foundational technology ensures unparalleled global performance, minimal application latency, and industry-leading resilience required for real-time collaborative tasks such as simultaneous co-editing in Docs and high-definition video conferencing via Meet. Critical components include the specialized hardware, such as Tensor Processing Units (TPUs), specifically optimized for the intensive machine learning workloads that underpin AI features, alongside sophisticated load balancing and container orchestration systems (like Kubernetes). This advanced infrastructure is essential not only for delivery speed but also for meeting stringent enterprise Service Level Agreements (SLAs) regarding uptime and data processing capability across geographically dispersed user populations, guaranteeing a consistent and reliable professional environment.

A second defining technological characteristic is the ubiquitous deployment of Artificial Intelligence and Large Language Models (LLMs), notably the powerful Gemini suite, natively integrated across all Workspace applications. This AI layer fundamentally transforms user interaction by providing predictive text suggestions, advanced conversational search across Drive content, intelligent meeting transcription and summarization, and sophisticated data visualization recommendations within Sheets. The technology leverages vast amounts of anonymized data and deep learning algorithms to continuously enhance contextual awareness, moving the tools beyond simple automation to genuine workflow augmentation. Furthermore, AI is crucial for fortifying the platform’s security posture, utilizing machine learning algorithms for real-time anomaly detection, zero-day threat identification, and automating responses to potential phishing and malware attacks, elevating the security baseline significantly above traditional, signature-based protection methods, addressing the critical needs of regulated sectors like BFSI and Healthcare.

Complementing the AI and infrastructure layers, the technology landscape features robust security and governance architecture, emphasizing a Zero Trust security model where access verification is required from every user, device, and request, regardless of location. This is coupled with advanced Identity and Access Management (IAM) tools, comprehensive Data Loss Prevention (DLP) capabilities, and the functionality of Google Vault for e-discovery, archival, and compliance auditing. Moreover, the adoption of modern progressive web application (PWA) development standards ensures platform-agnostic, responsive design, allowing for seamless transition and consistent user experience across desktop browsers, dedicated mobile applications, and ChromeOS devices. This multi-layered, integrated technological approach—combining hyperscale infrastructure, deep AI integration, and enterprise-grade security—ensures that Google Workspace remains at the forefront of the competitive productivity software market, offering future-proof solutions capable of handling the evolving complexities of the digital enterprise.

Regional Highlights

- North America: Maintains its status as the largest revenue contributor and the most technologically mature market. Dominance is characterized by high enterprise cloud spending, rapid deployment of advanced, AI-integrated premium tiers, and a high concentration of tech-forward multinational corporations. This region drives innovation, particularly in security and compliance features demanded by highly regulated US industries.

- Europe: Exhibits strong, steady growth, with adoption heavily influenced by regulatory strictures, primarily GDPR and the push for data sovereignty. Western European countries (Germany, UK, France) are key markets, requiring Google to invest heavily in local data centers and specialized governance tools to ensure regional compliance, particularly within the public sector and financial services.

- Asia Pacific (APAC): The fastest-growing region globally, characterized by explosive growth in subscription volumes from SMEs in emerging economies (India, Southeast Asia) and large-scale government digitization projects. Market penetration relies heavily on mobile-first solutions and scalable, affordable pricing structures that cater to rapidly growing, diverse local markets.

- Latin America (LATAM): A high-potential emerging market, driven by governmental and educational institutions seeking cost-effective cloud solutions to modernize outdated IT infrastructure. Growth is focused on flexible consumption models and addressing unique connectivity challenges prevalent in the region, with significant uptake in Brazil and Mexico.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) states, fueled by ambitious national digital transformation strategies (e.g., UAE Vision 2030). Market dynamics are influenced by geopolitical stability and demand for high-security, sovereign cloud solutions tailored to critical national infrastructure and government services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Google Workspace Productivity Tools Market.- Google LLC (Alphabet Inc.)

- Microsoft Corporation

- Apple Inc.

- Zoho Corporation

- Slack Technologies (Salesforce)

- Dropbox

- Cisco Systems

- IBM Corporation

- VMware

- Citrix Systems

- Amazon Web Services (AWS)

- Adobe Systems

- Smartsheet Inc.

- Atlassian Corporation

- Proofpoint

Frequently Asked Questions

Analyze common user questions about the Google Workspace Productivity Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Google Workspace Market between 2026 and 2033?

The Google Workspace Productivity Tools Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 15.8% during the forecast period from 2026 to 2033, driven by continuous AI integration and the global shift towards hybrid work environments, pushing the total market valuation toward $71.1 Billion USD.

How is Generative AI fundamentally changing the Google Workspace offering?

Generative AI, specifically through the integration of Gemini (formerly Duet AI), is transforming Workspace from a passive toolset into an active productivity co-pilot, automating complex cognitive tasks such as document drafting, data summarization, meeting note creation, and enhancing real-time security intelligence across the entire suite of collaborative applications.

Which geographical region is expected to show the highest growth rate in Google Workspace adoption?

The Asia Pacific (APAC) region is forecasted to demonstrate the fastest growth rate in adoption, fueled by aggressive digital transformation initiatives across Small and Medium Enterprises (SMEs) and rapid increases in cloud service penetration across key emerging economies like India and Southeast Asia, seeking scalable and affordable solutions.

What are the primary restraints impacting the expansion of the Google Workspace Market?

The most significant market restraints include the increasingly stringent global requirements for data sovereignty and privacy compliance (e.g., complex GDPR mandates), creating administrative overhead for multinational organizations, and the pervasive competitive pressure exerted by highly integrated rival platforms such as Microsoft 365.

Which specific segments within the End-User Industry are driving the adoption of premium Workspace tiers?

The Banking, Financial Services, and Insurance (BFSI) sector, along with Large Enterprises in the highly regulated Healthcare and IT industries, are significantly driving the adoption of premium Enterprise Plus tiers, primarily due to their critical need for advanced security features, comprehensive governance controls, e-discovery tools (Vault), and compliance auditing capabilities.

How does Google Workspace address data security and compliance concerns for large organizations?

Google Workspace addresses these concerns through robust, modern zero-trust security architectures, dedicated data sovereignty controls provided via the Google Cloud platform, and embedded enterprise-grade compliance features including automated Data Loss Prevention (DLP) and immutable data retention policies necessary for regulatory adherence.

What role do indirect channels play in the distribution of Google Workspace?

Indirect channels, encompassing a global network of Value-Added Resellers (VARs) and Managed Service Providers (MSPs), are absolutely critical for scaling market reach, particularly within the Small and Medium Enterprise (SME) segment, by providing essential localized support, customized deployment, migration expertise, and flexible regional billing options.

How is the market leveraging the integration of AppSheet within the Workspace ecosystem?

The integration of AppSheet democratizes application development by enabling non-technical personnel (citizen developers) to create custom, low-code/no-code business process applications directly integrated with their data in Sheets and Drive, significantly enhancing departmental agility and automating niche, internal workflows without reliance on centralized IT development resources.

What is the primary driving factor for the market shift toward cloud-native productivity tools?

The predominant driving factor is the organizational necessity to effectively and securely support flexible, hybrid work models, requiring platforms that offer unparalleled scalability, universal accessibility, and robust security architecture to facilitate seamless real-time collaboration across any device or geographical boundary.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager