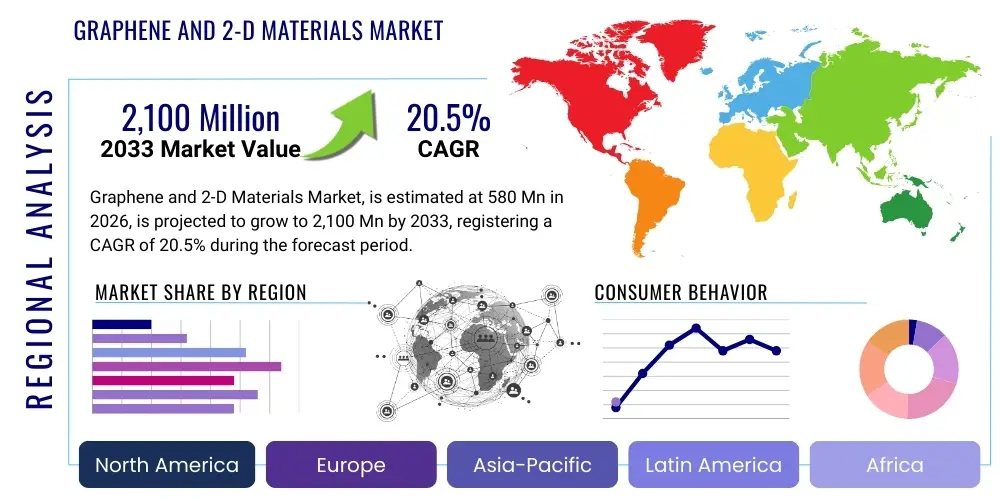

Graphene and 2-D Materials Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442510 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Graphene and 2-D Materials Market Size

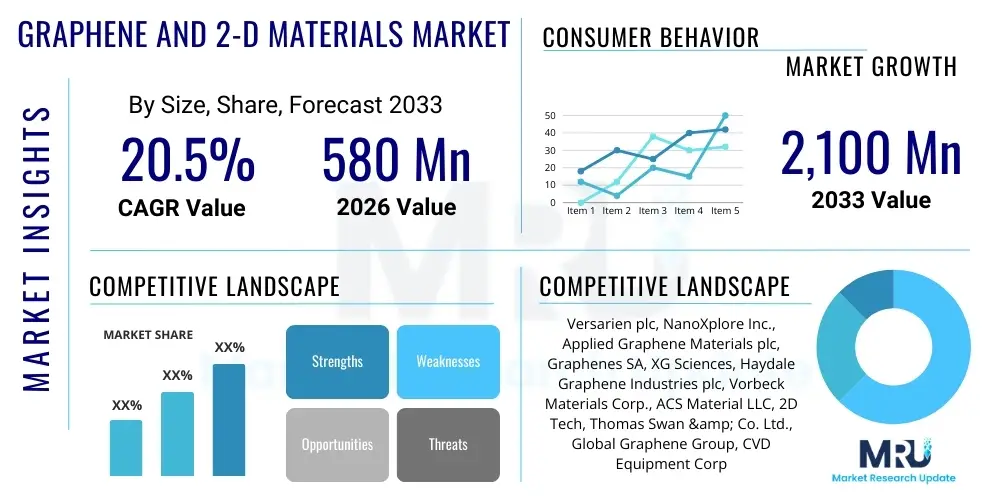

The Graphene and 2-D Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2026 and 2033. The market is estimated at USD 580 million in 2026 and is projected to reach USD 2,100 million by the end of the forecast period in 2033. This robust growth trajectory is underpinned by accelerating commercialization efforts across diverse industrial sectors, driven primarily by the exceptional mechanical, electrical, and thermal properties inherent in these advanced materials. The transition from laboratory-scale production to large-scale manufacturing techniques, such as Chemical Vapor Deposition (CVD) and various exfoliation methods, is significantly reducing production costs and broadening accessibility, thereby paving the way for widespread adoption in mainstream electronics and energy applications.

Graphene and 2-D Materials Market introduction

The Graphene and 2-D Materials Market encompasses the production, distribution, and application of atom-thin materials, principally graphene, along with other emerging two-dimensional structures like molybdenum disulfide (MoS2), hexagonal boron nitride (hBN), and tungsten diselenide (WSe2). Graphene, often dubbed a "wonder material," is a single layer of carbon atoms arranged in a hexagonal lattice, offering unparalleled electrical conductivity, mechanical strength, and thermal dissipation capabilities. These properties enable transformative applications, ranging from high-performance transistors and advanced energy storage systems, such as supercapacitors and next-generation batteries, to ultra-lightweight and exceptionally strong composite materials used in aerospace and automotive industries. The product’s versatility allows it to function as a foundational element in developing flexible electronics, highly sensitive sensors, and robust filtration membranes, addressing critical performance gaps in conventional materials.

Major applications of Graphene and 2-D materials are deeply rooted in the electronics sector, where they facilitate faster processing speeds and reduced power consumption in semiconductor devices, and in the energy sector, enhancing electrode performance in lithium-ion and solid-state batteries. The primary benefits driving market expansion include dramatically improved material strength-to-weight ratios, enhanced thermal management critical for high-density electronic packaging, and superior charge carrier mobility crucial for ultra-fast communication devices. Furthermore, their inherent biocompatibility is spurring significant uptake in the biomedical field for drug delivery systems and advanced biosensors. The market is propelled by substantial governmental funding directed toward nanotechnology research, increasing venture capital investments targeting scaling up manufacturing technologies, and the rising demand from consumer electronics manufacturers seeking thinner, lighter, and more efficient components to maintain competitive advantage.

Driving factors are heavily concentrated in materials science breakthroughs, specifically optimizing large-area deposition techniques for reliable, high-quality material synthesis necessary for industrial integration. The global shift toward sustainable and energy-efficient technologies mandates materials capable of maximizing energy conversion and storage efficiency, a niche where 2-D materials excel. Regulatory initiatives promoting lighter vehicle components for fuel efficiency, alongside increasing consumer appetite for wearable technology and smart devices requiring flexible and durable substrates, continually expand the addressable market for these revolutionary materials. Strategic partnerships between academic research institutions and industrial end-users are accelerating the technology transfer pipeline, transitioning specialized knowledge into viable commercial products, thus sustaining the long-term growth momentum of the market.

Graphene and 2-D Materials Market Executive Summary

The Graphene and 2-D Materials Market is experiencing rapid commercial maturation, moving beyond its foundational research phase into industrial implementation across key verticals such as electronics, energy, and composites. Key business trends indicate a strong focus on consolidation of manufacturing processes, particularly standardizing high-volume production methods like roll-to-roll CVD synthesis and liquid-phase exfoliation, which is essential for achieving economies of scale and reducing per-unit cost. Strategic alliances and cross-industry collaborations between materials producers and large-scale original equipment manufacturers (OEMs) are defining the commercial landscape, aiming to tailor specific material properties for specialized application requirements, such as optimizing Graphene Oxide (GO) derivatives for water purification membranes or fine-tuning Graphene Nanoplatelets (GNPs) for structural reinforcement in polymers. Investment activity is concentrated in companies demonstrating patented methods for scalable, high-purity production, signaling a shift toward product quality assurance and supply chain reliability.

Regionally, the market exhibits differential growth patterns, with the Asia Pacific (APAC) leading in terms of production volume and application integration, primarily driven by massive electronics manufacturing bases in countries like China, South Korea, and Japan, coupled with extensive government investment in nanotechnology centers. North America and Europe maintain strong leadership in high-value, specialized applications, particularly in aerospace composites, advanced biosensors, and energy storage R&D, capitalizing on established regulatory frameworks and high levels of technological sophistication. Regional trends also reflect increasing regulatory pressure for environmental sustainability, positioning 2-D materials as optimal candidates for highly efficient catalytic converters, lightweight vehicle parts, and advanced filtration systems, bolstering demand across Western economies seeking decarbonization solutions. The competitive dynamics in Europe are significantly bolstered by initiatives such as the Graphene Flagship, which promotes research coordination and commercial exploitation across the continent.

Segmentation trends highlight the dominance of Graphene Nanoplatelets (GNPs) and Graphene Oxide (GO) in terms of immediate commercial volume due to their relatively lower production cost and ease of dispersion into various matrices, making them ideal for high-volume applications like coatings, lubricants, and polymer composites. Conversely, high-purity, pristine monolayer graphene, though smaller in volume, commands premium pricing and drives innovation in the advanced electronics and photonics segments, where material defect control is paramount. The application segment is seeing the fastest growth within energy storage (batteries and supercapacitors) and composites, reflecting global infrastructure shifts toward electrification and the demand for lighter, stronger structural materials. End-user trends show the automotive and aerospace sectors rapidly increasing adoption of graphene-enhanced composites and thermal management solutions, driven by performance enhancement mandates and stringent safety standards.

AI Impact Analysis on Graphene and 2-D Materials Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Graphene/2-D Materials market frequently center on how AI can accelerate material discovery, optimize synthesis processes, and predict application performance. Key themes revolve around the potential for machine learning algorithms to sift through vast chemical parameter spaces to identify novel 2-D structures with tailored properties (e.g., specific band gaps or catalytic activity), thereby dramatically shortening the traditional R&D cycle. Users are also highly interested in AI’s role in real-time monitoring and quality control during large-scale manufacturing (like CVD), ensuring batch consistency and purity, which is a major hurdle for widespread commercial adoption. Concerns often touch upon the required data infrastructure and the expertise needed to deploy complex AI models within material science laboratories and manufacturing facilities, as well as the immediate return on investment for implementing these advanced computational tools in materials characterization.

AI's influence is profound, fundamentally transforming traditional materials science workflows by enabling high-throughput computational screening, often referred to as 'materials informatics.' Machine learning algorithms can process complex experimental data and theoretical simulations far quicker than human researchers, predicting optimal precursor concentrations, reaction temperatures, and growth durations for synthesizing high-quality 2-D materials, directly impacting production efficiency and yield. Furthermore, predictive modeling powered by neural networks is critical for simulating the performance of graphene-enhanced devices under varying operational conditions—such as stress, temperature fluctuations, and cycling stability in batteries—before costly physical prototypes are built. This capability reduces failure rates, accelerates product time-to-market, and allows companies to rapidly iterate on formulations, thereby cementing AI's role as a force multiplier for innovation in the Graphene market.

- AI accelerates the identification and design of novel 2-D material compositions and structures (Materials Informatics).

- Machine learning optimizes synthesis parameters (e.g., CVD temperature, pressure) for improved yield and quality consistency.

- AI-driven image analysis provides real-time quality control for large-area graphene film production.

- Predictive modeling simulates long-term device performance and lifetime for graphene-based electronics and batteries.

- Automated experimental platforms (robotics combined with AI) enable high-throughput screening of material properties.

- Natural Language Processing (NLP) helps researchers quickly analyze and synthesize vast bodies of published literature on 2-D materials.

DRO & Impact Forces Of Graphene and 2-D Materials Market

The Graphene and 2-D Materials market is shaped by a powerful confluence of Drivers, Restraints, and Opportunities (DRO), collectively defining its impact forces. The primary drivers are the material's superior functional properties—specifically its electrical conductivity and mechanical resilience—which are essential for next-generation performance in applications like high-frequency electronics and structurally demanding composites. Complementary to this are global energy initiatives requiring highly efficient storage solutions, where graphene significantly enhances battery density and charging speed. However, market growth is significantly restrained by the high cost of producing pristine, uniform graphene sheets on an industrial scale, particularly via techniques like CVD, coupled with lingering challenges related to material standardization and the difficulty of integrating these nano-materials into existing large-scale manufacturing infrastructures without compromising quality. Opportunities abound in emerging applications, particularly in solid-state energy storage, advanced medical diagnostics (biosensors), and large-scale water desalination membranes, offering high-growth, high-margin avenues for commercialization.

Impact forces are centered around technological maturity and regulatory harmonization. The ability of producers to transition successfully from batch processing to continuous, high-volume manufacturing remains the central competitive force; those who master scaling will capture market share. Restraints related to toxicology perception—though largely unsubstantiated through comprehensive studies—still necessitate careful regulatory navigation and public communication. The major opportunity driver is the continued miniaturization trend in consumer electronics and the increasing complexity of thermal management required in high-density devices, creating a persistent, critical demand for graphene’s unique thermal properties. Market success is heavily dependent on overcoming the high capital expenditure required for sophisticated production equipment and successfully navigating patent disputes surrounding foundational synthesis techniques, establishing a strong intellectual property portfolio as a significant barrier to entry for new competitors.

The strategic challenge for market participants is mitigating the restraint of high investment while aggressively pursuing the vast opportunity in differentiated product development. For instance, developing functionalized 2-D materials tailored precisely for drug delivery offers a path to premium pricing, justifying initial R&D costs. Simultaneously, the force of technological substitution is present; if alternative novel materials emerge that offer similar performance benefits at a fraction of the cost or with fewer integration hurdles, the competitive landscape could shift dramatically. Therefore, continuous innovation in both material synthesis efficiency and final product integration methodology is mandatory for sustained market leadership, ensuring that the unique characteristics of graphene remain economically viable and functionally superior to competing materials across core application segments.

Segmentation Analysis

The Graphene and 2-D Materials market is analyzed across several dimensions, primarily based on material type, application, and end-user industry. Segmentation by material type is crucial as it dictates the functional properties and production methodologies; this includes the distinction between high-purity monolayer graphene necessary for electronics and the more commercially mature, cost-effective derivatives like Graphene Oxide (GO) and Nanoplatelets (GNPs) used extensively in composites and coatings. Application segmentation reflects the value derived from the material, with Energy Storage (batteries and supercapacitors) and Composites currently holding the largest market shares due to high volume requirements, while the Electronics segment commands the highest price per unit due to stringent quality needs. The End-User analysis emphasizes the large-scale industrial adoption across the Automotive, Aerospace, and Healthcare sectors, driven by regulatory demands for lightweighting and efficiency improvements.

- Type:

- Monolayer Graphene

- Few-Layer Graphene

- Graphene Oxide (GO)

- Reduced Graphene Oxide (rGO)

- Graphene Nanoplatelets (GNP)

- Other 2-D Materials (hBN, MoS2, Tungsten Dichalcogenides)

- Application:

- Electronics and Semiconductors (Transistors, Displays, Flexible Electronics)

- Energy Storage (Batteries, Supercapacitors, Fuel Cells)

- Composites and Structural Materials (Plastics, Polymers, Metals)

- Coatings, Paints, and Ink

- Sensors (Biosensors, Chemical Sensors)

- Filtration and Separation

- Biomedical and Healthcare (Drug Delivery, Diagnostics)

- End-User Industry:

- Automotive

- Aerospace and Defense

- Consumer Electronics

- Healthcare and Pharmaceutical

- Industrial Manufacturing

- Energy and Power Generation

Value Chain Analysis For Graphene and 2-D Materials Market

The value chain for the Graphene and 2-D Materials Market begins with upstream analysis centered on raw material procurement, primarily high-purity carbon sources such as methane, graphite, or specialized polymer precursors, depending on the synthesis technique employed (CVD, exfoliation, or reduction). The most value-intensive step in the upstream segment involves the synthesis and production of the raw 2-D material, requiring significant capital investment in highly specialized manufacturing equipment and proprietary intellectual property for scaling processes while maintaining structural integrity and purity. Key upstream activities include the initial research and development phases focused on developing scalable synthesis methods, which determine the quality and cost profile of the final material. Efficiency in this stage, particularly in minimizing defects and maximizing yield, directly impacts profitability throughout the rest of the chain.

The midstream section involves processing, functionalization, and integration of the raw 2-D materials into intermediary products. This includes dispersing graphene into various matrices (polymers, solvents, resins) to create masterbatches, composites, or functional inks, which are then sold to downstream manufacturers. Functionalization—chemically modifying the 2-D material surface to improve dispersion or compatibility with specific matrices—adds significant value and differentiates product offerings. Testing and quality assurance, focused on measuring key parameters like layer count, lateral size, and electrical conductivity, are critical midstream activities that ensure material suitability for stringent end-use applications, bridging the gap between raw material suppliers and final product manufacturers. Failure to standardize measurement protocols at this stage remains a challenge.

The downstream analysis focuses on the final application development, product manufacturing, and distribution channels. Downstream end-users, such as battery manufacturers, aerospace composite makers, or consumer electronics firms, integrate the intermediary graphene products into their finished goods. Distribution channels are highly specialized; high-volume commodity materials like GNPs often utilize indirect channels through chemical distributors, while specialized, high-ppurity monolayer graphene for advanced semiconductor research typically relies on direct sales and technical support to ensure precise integration and performance validation. The complex nature of implementation often necessitates strong partnerships between the graphene producer and the end-user for application engineering, making the indirect channel less dominant for highly customized 2D material solutions.

Graphene and 2-D Materials Market Potential Customers

Potential customers for Graphene and 2-D materials span a wide array of high-technology and heavy industrial sectors, seeking performance enhancements that conventional materials cannot provide. The primary end-users or buyers are major multinational corporations involved in battery manufacturing (e.g., automotive Tier 1 suppliers and consumer electronics giants), polymer and composite manufacturers (aerospace and construction sectors), and sophisticated electronics component fabricators (semiconductor foundries). These customers purchase graphene derivatives either as raw powder/dispersions to enhance existing products or as integrated films for novel device creation. Their purchasing decisions are critically driven by materials performance metrics—specifically, improvements in thermal conductivity, structural strength, or electrical efficiency—rather than solely by cost, particularly in mission-critical applications like defense or medical devices.

Another significant customer segment includes academic and institutional research laboratories, particularly those focused on nanotechnology and materials science, which consume high-purity, often customized, small-volume batches for foundational research and proof-of-concept development. Beyond research, the emerging market for smart textiles and wearable technology represents a fast-growing customer base requiring flexible, conductive inks and coatings based on graphene. Ultimately, the successful commercialization of graphene relies on convincing large-scale industrial buyers of the reliability, consistency, and scalable supply of the material, necessitating stringent quality control and certification processes to meet industrial-grade requirements expected by major original equipment manufacturers (OEMs) across all potential customer verticals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 2,100 Million |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Versarien plc, NanoXplore Inc., Applied Graphene Materials plc, Graphenes SA, XG Sciences, Haydale Graphene Industries plc, Vorbeck Materials Corp., ACS Material LLC, 2D Tech, Thomas Swan & Co. Ltd., Global Graphene Group, CVD Equipment Corporation, Aixtron SE, Goodfellow Corporation, AMO GmbH, S-graphene, Grafoid Inc., Carbon Nanotechnologies Inc., Cientifica, and Angstron Materials. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Graphene and 2-D Materials Market Key Technology Landscape

The technological landscape of the Graphene and 2-D Materials market is characterized by a competitive array of synthesis methods, each targeting specific material quality and cost profiles. Chemical Vapor Deposition (CVD) remains the cornerstone technology for producing large-area, high-quality, continuous monolayer graphene films, essential for advanced electronics, flexible displays, and photonics devices. CVD offers excellent control over film thickness and uniformity but typically requires specialized, high-vacuum equipment, leading to high capital expenditure. Continuous advancements in low-temperature and roll-to-roll CVD are crucial technological trends aimed at reducing production complexity and increasing throughput necessary for mass commercialization in the semiconductor industry.

Alternatively, liquid-phase exfoliation (LPE) and chemical reduction methods, such as the modified Hummers’ method for Graphene Oxide (GO) and subsequent reduction to Reduced Graphene Oxide (rGO), dominate the production of powder and dispersion forms used in composites, batteries, and coatings. These methods are generally less expensive and more scalable than CVD for bulk material, making them dominant in high-volume, lower-purity applications. Technological focus in this domain is on developing non-toxic, environmentally friendly solvents and surfactants for LPE to improve dispersion stability and reduce environmental impact, while optimizing chemical reduction processes to enhance the electrical conductivity of rGO approaching that of pristine graphene. Further innovation involves plasma-enhanced deposition techniques and electrochemical exfoliation, offering potential breakthroughs in both quality and efficiency for specialized production needs.

Furthermore, the integration technology landscape is rapidly evolving, focusing on techniques for transferring graphene films from their growth substrate (e.g., copper foil in CVD) to the target device substrate without introducing defects or contamination. Wet transfer, dry transfer, and polymer-assisted transfer methods are constantly being refined. For composites, key technological challenges center around achieving effective, uniform dispersion of graphene particles within polymer matrices at high loading levels without causing aggregation. Novel functionalization techniques, which modify the surface chemistry of the 2-D material, are paramount for maximizing interfacial adhesion and achieving maximum performance benefits when integrated into finished products, thereby dictating success in demanding end-user applications like lightweight automotive components and high-performance sporting goods.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, fundamentally driven by its dominant position in consumer electronics and battery manufacturing, particularly in China, South Korea, and Japan. Massive governmental investment in nanotechnology research and high manufacturing capacity for intermediate graphene products (GNPs and GO) fuel regional expansion. The presence of major semiconductor foundries also ensures a high demand for high-quality monolayer graphene for advanced transistor development and flexible display integration.

- North America: North America holds a substantial share of the market, characterized by intense focus on high-value, specialized applications, particularly in the aerospace, defense, and advanced medical diagnostics sectors. The region benefits from robust venture capital funding for high-tech materials startups and strong academic-industry collaboration. Demand is concentrated in cutting-edge energy storage technologies and high-performance polymer composites for next-generation aircraft and military equipment.

- Europe: Europe represents a mature market, strongly supported by coordinated initiatives such as the Graphene Flagship, which funnels significant resources into commercializing research breakthroughs. Key adoption areas include automotive lightweighting solutions, advanced sensors for industrial monitoring, and high-performance coatings. Strict environmental regulations promote the use of 2-D materials in water purification and filtration systems, driving specialized segment growth in countries like Germany and the UK.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently represent smaller market shares but offer significant long-term growth potential, particularly in resource-heavy sectors. LATAM shows rising demand for graphene-enhanced construction materials and energy infrastructure components. MEA is focused on utilizing 2-D materials for desalination technologies and enhancing oil and gas infrastructure (e.g., anti-corrosion coatings and advanced drilling sensors), reflecting localized infrastructure development priorities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Graphene and 2-D Materials Market.- Versarien plc

- NanoXplore Inc.

- Applied Graphene Materials plc

- Graphenes SA

- XG Sciences (acquired by NanoXplore)

- Haydale Graphene Industries plc

- Vorbeck Materials Corp.

- ACS Material LLC

- 2D Tech

- Thomas Swan & Co. Ltd.

- Global Graphene Group

- CVD Equipment Corporation

- Aixtron SE

- Goodfellow Corporation

- AMO GmbH

- S-graphene

- Grafoid Inc.

- Carbon Nanotechnologies Inc.

- Cientifica

- Angstron Materials

Frequently Asked Questions

Analyze common user questions about the Graphene and 2-D Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor restraining the widespread commercialization of Graphene?

The main restraint is the challenge of cost-effective, high-volume production of high-purity, standardized 2-D materials, particularly pristine monolayer graphene, coupled with difficulties in achieving uniform dispersion and integration into complex manufacturing processes without defects.

Which application segment currently offers the highest growth potential for Graphene and 2-D Materials?

The Energy Storage segment, encompassing advanced lithium-ion batteries and supercapacitors, exhibits the highest growth potential due to graphene’s ability to significantly enhance electrode performance, cycling stability, and energy density, meeting global demands for electrification.

How is Graphene distinguished from derivatives like Graphene Oxide (GO) in the commercial market?

Pristine Graphene (Monolayer) is electrically conductive and typically used in advanced electronics, commanding a premium price. Graphene Oxide (GO) is less conductive but easier and cheaper to produce in bulk, primarily used in composites, coatings, and water filtration due to its functionalized surface and solubility.

What role does Chemical Vapor Deposition (CVD) play in the Graphene market?

CVD is the critical technology for creating large-area, continuous, high-quality graphene films on substrates, making it indispensable for advanced electronic applications like flexible displays, sensors, and high-performance semiconductors where material consistency is paramount.

Which geographic region leads the global consumption and production of Graphene?

The Asia Pacific (APAC) region leads both production capacity and consumption, fueled by its dominant global position in electronics manufacturing, extensive government support for nanotechnology, and high industrial demand from key economies like China and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager