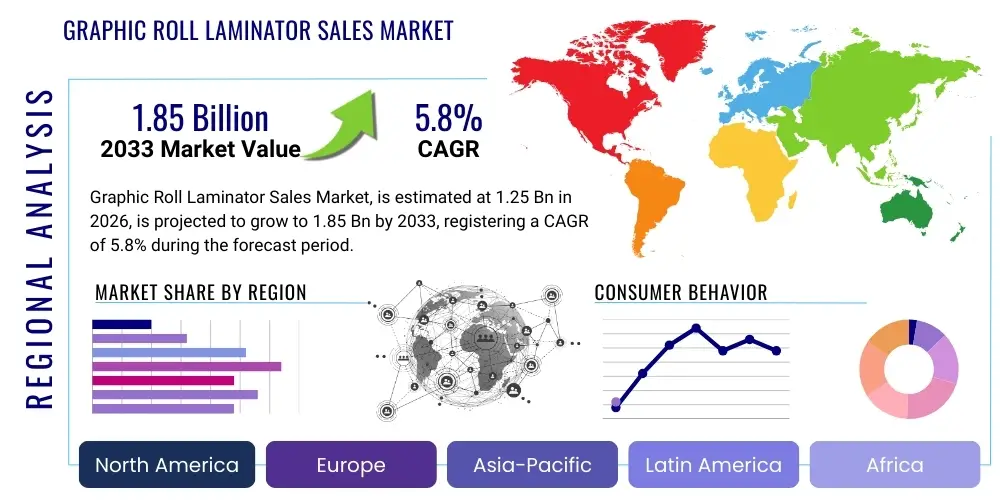

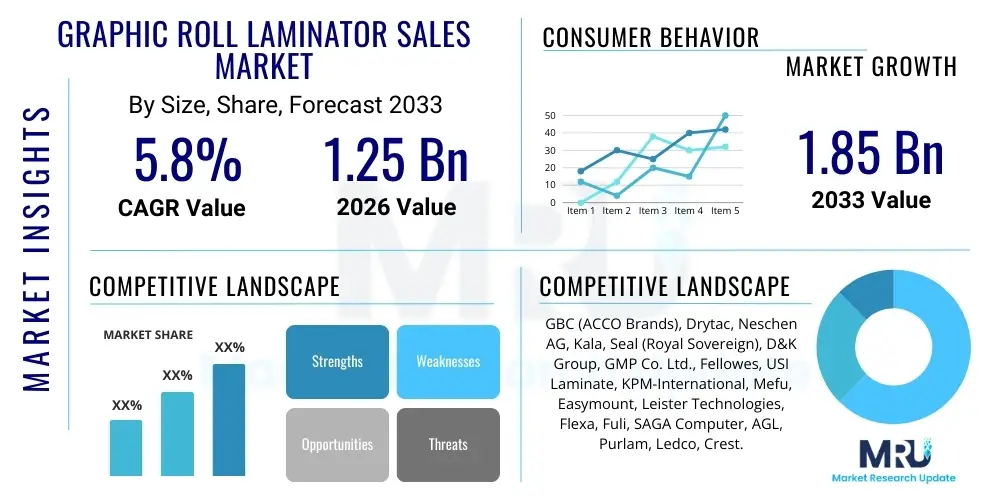

Graphic Roll Laminator Sales Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443131 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Graphic Roll Laminator Sales Market Size

The Graphic Roll Laminator Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.85 Billion by the end of the forecast period in 2033.

Graphic Roll Laminator Sales Market introduction

Graphic roll laminators are sophisticated industrial and commercial devices designed to apply protective film, typically polypropylene, vinyl, or polyester, to printed media in a continuous rolling process. These machines are fundamentally crucial within the wide-format printing industry, serving applications ranging from large-scale signage, vehicle wraps, retail point-of-sale displays, architectural graphics, and durable fine art reproductions. The primary function is to enhance the longevity, aesthetic quality, and physical resilience of the graphic output, protecting it from abrasion, moisture, UV degradation, and chemical exposure. Modern roll laminators feature advanced capabilities such as automated trimming, high-speed operation, and precise tension control, facilitating efficient workflow management and superior output quality necessary for demanding commercial environments.

The product portfolio within this market spans various categories, including cold laminators, hot laminators, and dual-purpose hybrid systems. Cold laminators are preferred for pressure-sensitive applications, particularly where heat could damage sensitive substrates or inks, such as digital prints utilizing solvent, UV-cured, or latex inks. Hot laminators, conversely, utilize thermal activation for films requiring heat bonding, often resulting in highly durable and rigid encapsulation. The major applications driving sales include the burgeoning digital signage market requiring durable overlays, the expansive field of fleet graphics and vehicle wrapping which necessitates high-tack protective films, and the interior decor sector utilizing wall murals and floor graphics that require robust wear layers and anti-slip certifications. The versatility of modern laminating films allows for matte, gloss, satin, and specialty textured finishes, further driving application diversity.

The continued expansion of the digital printing ecosystem, coupled with increasing demand for personalized and short-run graphic applications, acts as a pivotal driver for the Graphic Roll Laminator Sales Market. Benefits derived from utilizing these systems include significantly extended graphic lifespan, enhanced color vibrancy, structural rigidity improvement, and cost-effective production scaling. The driving factors are intrinsically linked to the macroeconomic trends favoring visually impactful advertising and protective requirements in high-traffic commercial settings, coupled with technological refinements that have made the operation of these large machines more accessible and efficient for medium-sized printing operations. Furthermore, the increasing complexity of graphic output, such as layered or textured media, demands the precision offered by high-end roll laminating solutions.

Graphic Roll Laminator Sales Market Executive Summary

The Graphic Roll Laminator Sales Market is poised for stable expansion, underpinned by significant shifts in business trends focusing on automation, efficiency, and material innovation. Key business trends include the strong convergence toward hybrid laminators capable of handling both thermal and pressure-sensitive films, allowing print service providers (PSPs) enhanced flexibility and reduced capital expenditure requirements. Furthermore, manufacturers are prioritizing the integration of IoT capabilities and sophisticated control software to facilitate remote diagnostics, predictive maintenance, and optimized material usage, thereby reducing waste and improving overall equipment effectiveness (OEE). The market is moving away from purely mechanical systems toward sophisticated electro-mechanical platforms, demanding higher levels of software integration for seamless production management.

Regionally, the Asia Pacific (APAC) market is exhibiting the fastest growth trajectory, driven by massive infrastructure projects, rapid urbanization, and the corresponding surge in demand for commercial and retail signage in countries like China and India. This high growth is supported by increasing foreign direct investment into regional printing hubs and a growing middle class that fuels consumer advertising spending. North America and Europe, while mature markets, are experiencing a steady replacement cycle, focusing on upgrading older equipment with high-speed, wide-format laminators that accommodate the increasingly large digital printing platforms. The European market, in particular, is emphasizing environmental compliance, favoring manufacturers that integrate energy-saving features and compatibility with sustainable film alternatives, often leading to premium pricing for compliance-ready equipment.

In terms of segment trends, the wide-format (>60 inches) segment maintains market dominance, reflecting the industry's shift towards producing large-scale indoor and outdoor graphics, particularly for building wraps and transportation advertising. Within technology segmentation, cold lamination systems continue to hold a larger share due to the proliferation of heat-sensitive digital inks (latex and UV), though the thermal segment remains essential for durable floor graphics and specific industrial applications requiring maximum adhesion and rigidity. The end-user segment is increasingly diversified, moving beyond traditional commercial printers to include in-house corporate marketing departments, educational institutions, and specialized architectural film installers. This diversification emphasizes the need for user-friendly, smaller-footprint laminators capable of professional-grade output with minimal specialized training.

AI Impact Analysis on Graphic Roll Laminator Sales Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Graphic Roll Laminator domain predominantly revolve around questions of predictive maintenance, automated quality control, and optimized throughput planning. Users frequently ask: "How can AI reduce material waste during lamination?" and "Will AI integration require significant retraining of existing staff?" or "What specific data points can AI analyze to predict machine failure?" The core theme synthesized from these concerns is the expectation that AI should transition laminators from reactive maintenance schedules and manual error checking to highly proactive, self-optimizing finishing systems. Concerns center on the high cost of retrofitting older machinery, the complexities of implementing data security protocols for proprietary production metrics, and the practical reliability of AI algorithms in interpreting the complex visual and physical characteristics of laminated materials, especially concerning fault detection like microscopic bubbling, silvering, or misregistration.

The consensus expectation is that AI will primarily enhance efficiency and material utilization, thereby substantially improving the overall return on investment (ROI) for advanced laminating equipment. For instance, sophisticated machine vision systems leveraging deep learning models can monitor the lamination process in real-time, instantly detecting microscopic defects that human operators might miss, automatically adjusting pressure or speed parameters to correct issues before significant material loss occurs. Furthermore, AI-driven scheduling tools can analyze incoming job queues, film inventory, and machine performance histories to determine the optimal sequence for production runs, minimizing energy consumption, reducing changeover times, and ensuring that optimal temperature stabilization is achieved just in time for the next job, consequently reducing standby power usage.

While AI does not directly influence the core mechanical function of bonding film to substrate, its influence on ancillary processes is transformational. Predictive analytics, using data streamed from various machine sensors (e.g., thermal mapping, roller alignment sensors, motor load metrics), allow AI algorithms to forecast potential component failure—such as roller bearing wear, fluid leakage, or heating element degradation—weeks in advance. This capability drastically reduces unscheduled downtime, a critical factor for high-volume commercial printers operating under tight deadlines. The integration of AI also supports the development of fully autonomous lamination workflows, where the system automatically recognizes the material type (via RFID or barcode scanning), loads the corresponding machine profile, and executes the job with minimal manual intervention, catering specifically to the rising demand for 'lights-out' manufacturing processes in the finishing sector.

- AI-driven Predictive Maintenance: Forecasting component failure using sensor data streams (temperature, pressure, motor load) to minimize unscheduled and costly downtime.

- Automated Quality Control (AQC): Real-time microscopic defect detection (bubbling, warping, silvering) using high-resolution computer vision and immediate process parameter adjustment to correct flaws.

- Optimized Workflow Scheduling: Using complex algorithms to sequence lamination jobs based on film type, width, and heating requirements for maximum throughput and minimum material changeover waste.

- Material Recognition Systems: Automated identification of substrate and film types (via digital reading or weight analysis) for instantaneous loading of optimal, pre-calibrated machine settings.

- Energy Consumption Optimization: AI management of heating cycles and standby motor loads based on predictive modeling of workflow demands, aligning consumption with real-time need.

- Operator Assistance Systems: Providing intelligent, step-by-step troubleshooting recommendations and contextual guidance to reduce reliance on highly skilled, specialized technical staff and speed up basic maintenance tasks.

- Waste Reduction Algorithms: Analyzing trim waste patterns and adjusting initial material feed position automatically to optimize film usage across multiple jobs.

DRO & Impact Forces Of Graphic Roll Laminator Sales Market

The market dynamics are governed by robust driving forces centered on the proliferation of wide-format digital printing and the indispensable requirement for graphic durability, particularly in outdoor and high-traffic applications. The primary drivers include the expanding use of high-quality visual communications in retail and advertising, the increasing complexity of regulatory standards mandating floor graphic slip resistance (e.g., UL 410 standards), and the continuous innovation in printing technologies that necessitate specialized protective overlays. These drivers are compelling print service providers globally to invest in faster, wider, and more versatile laminating equipment to keep pace with production demands and client specifications for resilience against mechanical abrasion, UV exposure, and moisture ingress. The market is constantly influenced by the necessity of enhancing printed graphics’ aesthetic appeal and tactile properties through specialized finishes, thereby increasing the perceived value and justifying higher service pricing.

Conversely, significant restraints hinder growth potential, primarily revolving around the substantial initial capital expenditure required for purchasing high-end industrial laminators, which presents a steep financial barrier to entry for smaller printing shops and start-ups. Furthermore, the inherent environmental challenge associated with disposing of large volumes of non-biodegradable lamination films poses a long-term sustainability constraint, prompting intense scrutiny from regulatory bodies and end-users who prefer recyclable alternatives, even if they currently possess limited performance characteristics. Economic volatility, particularly impacting global construction and advertising spending (which often dictate demand for large graphics), can lead to deferred or canceled investment decisions in new finishing equipment. Operational challenges, such as the persistent shortage of highly skilled technicians capable of maintaining and troubleshooting complex, automated electromechanical systems, also act as a structural restraint in several emerging markets and even mature regions grappling with workforce demographic shifts.

The market presents compelling opportunities anchored in technological advancement, geographic expansion, and material science innovation. The crucial development of eco-friendly, recyclable, or thinner films presents a major avenue for sustainable market growth, effectively addressing the critical environmental restraint and meeting rising consumer demand for corporate responsibility. Furthermore, opportunities exist in penetrating niche application markets such as flexible electronics protection (requiring precise, low-heat lamination), specialized biomedical labeling, and high-security government applications requiring highly durable and tamper-evident films. The proliferation of digital textile printing, while typically utilizing different fixing methods, creates potential auxiliary demands for specific types of heat-activated graphic stabilizers or protective overlays for non-traditional substrates. The overall impact forces compel manufacturers to prioritize automation and material efficiency, ensuring that equipment is user-friendly, highly reliable, and capable of precisely processing the next generation of specialized, lightweight substrates and high-performance films.

- Drivers: Growing demand for highly durable outdoor signage and large-format architectural graphics; expansion of global wide-format digital printing infrastructure; necessity for specialized protection (UV, chemical, scratch) in vehicle wraps and floor graphics; rising adoption of high-impact visual merchandising in retail.

- Restraints: High initial capital investment cost for industrial machines coupled with significant installation requirements; intrinsic environmental concerns regarding the disposal of polymer-based plastic film waste; volatility in raw material (polymer and silicone) prices impacting production costs; structural shortage of skilled maintenance labor in many geographic markets.

- Opportunities: Rapid development and increasing commercial adoption of sustainable, bio-based and recyclable lamination films; untapped growth potential in emerging economies (e.g., Southeast Asia, Africa, Eastern Europe); accelerated integration of smart factory protocols (IoT and Industry 4.0) into laminating workflows; expansion into high-specification security and industrial protective lamination applications.

- Impact Forces: Intense global competitive pressure forcing continuous reduction in equipment manufacturing costs; increasingly stringent regulatory requirements concerning material fire retardancy, chemical composition, and floor graphic slip resistance certifications; rapid technological obsolescence necessitating frequent equipment upgrades to maintain competitive edge; localized or global supply chain disruptions affecting the availability of specialized components like precision rollers and complex electronic control boards.

Segmentation Analysis

The Graphic Roll Laminator Sales Market is meticulously segmented based on Laminator Type, Roller Width, Technology, and End-User Application, providing a multi-dimensional view of market dynamics and specialized demands required across the finishing sector. Segmentation by Laminator Type—Cold, Hot, and Hybrid—is critical, reflecting the fundamental operational mechanism and suitability for various ink and substrate combinations. Cold laminators utilize pressure-sensitive adhesives and dominate the digital printing sector due to their compatibility with heat-sensitive outputs, requiring sophisticated pressure and alignment systems. Thermal (Hot) laminators are sought after for maximum durability and rigidity, often in industrial settings or for heavy-duty applications like ID cards or rigid displays. Hybrid machines, combining both capabilities, are gaining significant traction due to their operational flexibility, reducing the need for multiple specialized equipment setups and offering a superior ROI for versatile print shops serving diversified client needs.

The Roller Width segmentation, spanning Standard (up to 40 inches, catering to small offices and standard posters), Medium (40 to 60 inches, popular for small sign shops), and Wide-Format (>60 inches, industrial production standard), dictates the equipment's primary market focus and scale of investment. The Wide-Format segment remains the largest and fastest-growing, reflecting the industry standard for producing vehicle wraps, building banners, and large display graphics required in modern advertising campaigns. Advances in high-speed, continuous lamination for wide-format media, particularly minimizing material stretching and warping across long runs, are crucial differentiators among leading manufacturers. The Technology Feature segmentation further refines market offerings by examining automation levels, such as automatic trimming systems, advanced heat assistance for better cold film adhesion, and sophisticated tension control mechanisms that are vital for precision.

The End-User segmentation provides insight into consumption patterns, distinguishing between high-volume Commercial Print Service Providers (PSPs), specialized Sign and Display Manufacturers, decentralized in-house corporate marketing departments, and institutional buyers like educational facilities. PSPs are the largest consumer segment, driving demand for heavy-duty, 24/7 operational capability. Architectural firms utilizing graphic films for glass or walls represent a growing niche segment requiring extreme precision for long, detailed applications. Understanding these segments is vital for manufacturers to tailor product development, pricing strategies, and distribution channels effectively. The diverse requirements across different end-user groups, from high-volume, continuous production needs of global PSPs to the intermittent, high-quality demands of educational and archival use, necessitate a highly varied product offering and robust, tiered technical support infrastructure.

- By Laminator Type:

- Cold Laminators (Pressure-Sensitive)

- Hot (Thermal) Laminators

- Hybrid Laminators (Combining Cold and Heat-Assist capabilities)

- By Roller Width:

- Standard Format (Up to 40 inches width, typically office and small format)

- Medium Format (40 to 60 inches width, mid-range commercial use)

- Wide Format (Above 60 inches width, industrial signage and vehicle wraps)

- By Technology Feature:

- Automatic Trimming and Slitting Systems

- Heat Assist Systems (for cold laminators)

- Advanced Pneumatic/Hydraulic Tension Control

- High-Speed Continuous Feed Systems

- Mounting and Encapsulating Capabilities

- By End-User Application:

- Commercial Print Service Providers (PSPs) and Graphic Houses

- Sign and Display Manufacturing (including P.O.P. and Banner production)

- In-House Corporate & Government Reprographics Departments

- Educational and Archival Institutions (for preservation)

- Specialty/Industrial Graphics (e.g., floor graphics, architectural films)

Value Chain Analysis For Graphic Roll Laminator Sales Market

The value chain for the Graphic Roll Laminator Sales Market initiates with upstream activities encompassing raw material sourcing and highly specialized component manufacturing. Key primary inputs include high-precision ground steel for the main rollers, advanced polymer and silicone compounds for non-stick roller coatings, complex electronic control systems (PLCs, servo-motor controllers), and high-efficiency heating elements and temperature sensors. Suppliers in this segment, often specializing in high-tolerance machining and robust electronic assemblies, exert a moderate-to-high influence over the overall equipment production costs and, crucially, the long-term quality consistency of the lamination process. Critical upstream success factors include securing stable supplies of specialized, high-temperature resistant silicone and maintaining rigorous quality control over roller concentricity and alignment, which is paramount for achieving flawless, bubble-free lamination results on wide-format media without distortion or curling.

Moving downstream, the chain involves manufacturing, assembly, and highly specialized distribution. Leading original equipment manufacturers (OEMs) focus heavily on modular design, ensuring ease of maintenance, and achieving compliance with stringent global safety and electrical standards (e.g., CE, UL, RoHS). Distribution channels are highly critical in this capital equipment market segment due to the size, weight, and installation complexity of the machinery. The primary channels include direct sales forces for addressing major global printing accounts and handling bespoke factory installations, specialized regional distributors who assume responsibility for complex installation logistics, extensive technical training, and essential after-sales servicing, and, to a lesser extent, industrial e-commerce platforms for lower-cost, standard-format desktop models. The necessity for expert installation and calibration of wide-format systems mandates strong, enduring technical partnerships between OEMs and certified local distributors, ensuring comprehensive regional support that builds long-term customer loyalty and drives repeat equipment sales.

The final stage involves direct interaction with end-users and the management of post-sales activities. Direct sales are predominantly utilized for large industrial contracts where equipment customization, complex financing packages, and integrated workflow solutions are required by high-volume producers. Indirect channels, facilitated through authorized dealers and value-added resellers (VARs), are highly favored for reaching small-to-medium enterprises (SMEs) and localized print shops, leveraging the dealer's existing regional client base, local technical knowledge, and logistical infrastructure. Aftermarket support, including the continuous sale of highly specific spare parts (suchg as specialized silicone rollers, cutting blades, and heating fuses) and ongoing preventative service contracts, represents a significant and stable recurring revenue stream for both manufacturers and distributors, simultaneously serving as a crucial differentiator among competitors based on service response time and technical expertise. Optimization of this value chain hinges critically on efficient global logistics for heavy machinery and maintaining globally accessible service networks capable of quick response times.

Graphic Roll Laminator Sales Market Potential Customers

The target market for graphic roll laminators is diverse yet concentrated primarily within the expansive visual communications and industrial printing sectors, demanding both high-volume throughput and specialized graphic protection. The largest and most consistently prominent customer segment comprises Commercial Print Service Providers (PSPs), ranging from local quick-print shops handling daily posters to vast, multinational digital printing factories executing global advertising campaigns. These entities utilize roll laminators as an indispensable, non-negotiable component of their finishing workflow to produce high volumes of outdoor banners, durable posters, trade show graphics, and specialized promotional materials that fundamentally require protection against environmental wear, handling damage, and UV fading. Their capital purchasing decisions are driven by key performance indicators such as maximum throughput speed, maximum width capacity, automation features (like auto-trimming), and the machine's ability to consistently handle highly specialized applications like anti-graffiti protective films or regulated slip-resistant floor graphic materials.

A rapidly expanding and highly demanding customer base includes specialized Sign and Display Manufacturers, as well as highly skilled Vehicle Wrap Installers and Fleet Graphic Production Houses. These businesses require roll laminators that can consistently achieve flawless, bubble-free application of intricate graphic overlays onto flexible and rigid substrates, often demanding high-tack, low-temperature cold lamination capabilities to prevent distortion of heat-sensitive vinyl films. Consistency, repeatable precision, and reliable tension control are absolutely critical for these users, as flaws introduced during the lamination process directly translate to costly graphic failure, installation complications, and client dissatisfaction. Furthermore, architectural and interior design firms purchasing laminators for bespoke wall coverings, specialized protective window films, and durable fine art reproductions represent a high-value, niche segment emphasizing exceptional precision, color fidelity maintenance, and surface texture compatibility over high-volume output.

Beyond the core commercial printing industry, significant future potential lies within large corporate in-house reprographics departments, government institutions (especially military and public safety sectors requiring highly durable ID cards, archival maps, and security documents), and major educational facilities. While the volume demands from these institutional buyers may be lower than those of global commercial PSPs, their requirement for immediate, internal, secure, and professional lamination capabilities justifies investment in reliable, mid-range hybrid systems. Manufacturers often strategically target these institutional and government buyers by emphasizing ease of use, superior operator safety features, minimal operational noise, and a reduced physical footprint, thereby broadening the market beyond traditional printing specialists and focusing on departmental autonomy and operational security.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GBC (ACCO Brands), Drytac, Neschen AG, Kala, Seal (Royal Sovereign), D&K Group, GMP Co. Ltd., Fellowes, USI Laminate, KPM-International, Mefu, Easymount, Leister Technologies, Flexa, Fuli, SAGA Computer, AGL, Purlam, Ledco, Crest. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Graphic Roll Laminator Sales Market Key Technology Landscape

The technological landscape of the Graphic Roll Laminator market is characterized by a strong and continuous emphasis on achieving extreme precision mechanics, seamless integrated digital controls, and significant advancements in thermal and pressure management systems. The core technology revolves around highly engineered silicone or specialized rubber rollers that must maintain exceptionally uniform pressure and consistent temperature across the entire media width, which is fundamentally crucial for eliminating operational flaws like silvering, bubbling, and achieving perfect, consistent adhesion on massive wide-format prints. Modern industrial systems employ sophisticated, often digitally controlled, pneumatic or hydraulic pressure systems coupled with precise electronic control units (ECUs) to allow operators to fine-tune roller pressure parameters based dynamically on the substrate thickness, film density, and exact material composition. This crucial capability maximizes material compatibility and drastically minimizes production waste in high-volume environments.

The rapid development and integration of automated features represent the most significant technological trend impacting new equipment sales. This includes the implementation of advanced integrated cutting and trimming units that operate inline with the lamination process, which can drastically reduce post-production labor and processing time. Furthermore, sophisticated substrate handling systems, such such as automated material loading and synchronized take-up mechanisms utilizing continuous tension feedback loops (often regulated by load cells), ensure absolutely wrinkle-free output even when operating at industrial high speeds, commonly reaching up to 30 feet per minute for the largest models. Heat assist technology in cold laminators—where the rollers are gently pre-warmed to a controlled temperature—is rapidly becoming a standard feature, significantly enhancing the flow characteristics of the pressure-sensitive adhesive for better initial bonding, particularly critical in large production facilities where ambient temperature and humidity fluctuate significantly throughout the day.

The future technological trajectory is decisively moving toward enhanced digital connectivity, comprehensive data management, and the implementation of machine learning, perfectly aligning with global Industry 4.0 standards. The integration of numerous sensors and IoT modules is enabling real-time performance monitoring, automated calibration adjustments, and remote diagnostics by manufacturers or third-party service providers. Manufacturers are investing substantial research and development capital into creating intuitive, touch-screen user interfaces that are capable of storing and instantly recalling thousands of pre-set material and film profiles, thereby enabling rapid and error-free job changeovers and minimizing reliance on manual data entry or highly specialized operator knowledge. This holistic digital transformation is not only dramatically improving production efficiency and quality control but is also providing print service providers with granular, actionable data for accurate tracking of operational costs, material consumption rates, and overall equipment effectiveness (OEE).

Regional Highlights

The global Graphic Roll Laminator Sales Market exhibits distinct regional consumption and growth profiles, heavily influenced by local economic development stages, the maturity of digital printing adoption rates, and governmental investment in commercial and public infrastructure projects. North America and Europe currently represent the most established and technologically mature markets, characterized by high penetration rates of sophisticated, high-speed, wide-format equipment. Growth in these regions is primarily driven by essential replacement cycles, where older, legacy mechanical machines are systematically upgraded to newer, IoT-enabled hybrid systems offering superior energy efficiency, higher operational precision, and seamless integration with complex digital front ends (DFEs), which are all necessary to maintain a competitive edge in mature printing markets. The established presence of major print manufacturing, large format signage production, and high-volume advertising hubs sustains steady, predictable demand, particularly for large-scale outdoor media and specialized fleet graphics that require durable protection.

The Asia Pacific (APAC) region is decisively forecasted to demonstrate the highest Compound Annual Growth Rate during the entire forecast period, establishing it as the primary engine of global market expansion. This accelerated expansion is largely attributable to rapid industrialization, massive and continuous investments in large-scale infrastructure development (leading to significant demand for construction site graphics, safety signage, and municipal promotional materials), and the rapid expansion of the burgeoning retail and exhibition sector driving sophisticated visual merchandising needs. Major economies like China and India, in particular, are seeing massive influxes of investment into their domestic printing ecosystems, leading to high adoption rates of advanced, high-volume standard and wide-format laminators. Local manufacturers in APAC are also increasingly sophisticated and cost-competitive, offering tailored solutions that effectively cater to regional price sensitivities and diverse operational requirements, often incorporating necessary features like robust dust protection and simplified maintenance protocols.

Latin America, the Middle East, and Africa (MEA) collectively constitute emerging markets that offer substantial long-term growth potential, albeit from a lower baseline. Growth in these regions is characterized by significant initial investment waves and the gradual establishment of centralized, large-scale printing operations designed to serve national or regional areas. Factors such as recovering commodity prices and increased infrastructural funding in Latin America, coupled with extensive commercial development and major international events in MEA (e.g., world expos, sporting events), are consistently stimulating commercial printing investments. However, market penetration remains currently constrained by persistent logistical challenges, often higher costs associated with equipment imports (due to tariffs or freight), and a relative lack of established, highly specialized technical support infrastructure compared to mature markets, requiring global vendors to develop robust, highly simple-to-maintain equipment and localized training programs to ensure market success.

- North America: Mature replacement market; high capital expenditure driven by technology upgrade cycles; significant demand for automated, high-speed hybrid laminators for commercial graphics and highly specialized industrial films.

- Europe: Strong focus on sustainability and regulatory compliance (e.g., REACH standards); premium preference for durable, certified lamination films and high-energy-efficient equipment, often emphasizing reduced operational noise.

- Asia Pacific (APAC): Highest growth region globally; powered by massive infrastructure spending, rapid urbanization, and exponential expansion of the domestic printing industry in key economies like China, India, and Indonesia; characterized by increasing adoption of industrial wide-format systems.

- Latin America: Emerging foundational market characterized by foundational investment in localized digital printing capacity; current demand heavily concentrated in the advertising, signage, and packaging sectors in major economies such as Brazil and Mexico.

- Middle East & Africa (MEA): Growth tied specifically to major commercial, tourism, and construction projects; focus on procuring robust, reliable equipment suitable for extreme climatic conditions and capable of extended, high-duty cycles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Graphic Roll Laminator Sales Market.- GBC (ACCO Brands)

- Drytac

- Neschen AG

- Kala

- Seal (Royal Sovereign)

- D&K Group

- GMP Co. Ltd.

- Fellowes

- USI Laminate

- KPM-International

- Mefu

- Easymount

- Leister Technologies

- Flexa

- Fuli

- SAGA Computer

- AGL

- Purlam

- Ledco

- Crest

Frequently Asked Questions

What is the difference between cold and hot graphic roll laminators, and which is dominating the market?

Cold roll laminators utilize pressure-sensitive adhesives (PSAs) and high mechanical pressure from rubber rollers to bond the film to the substrate without using significant heat. These systems are essential for handling heat-sensitive materials, such as many digital prints produced utilizing solvent, latex, or UV inks, as thermal exposure can cause catastrophic damage to the ink or substrate. Cold lamination generally offers faster processing speeds and a reduced energy footprint, making them highly popular in the rapidly expanding wide-format digital graphics sector. Hot, or thermal, laminators use precisely heated rollers to activate specialized heat-sensitive films, resulting in a more rigid, highly durable, and permanent seal often suitable for demanding industrial use. Currently, the Cold Laminator segment holds a larger market share in terms of unit sales volume within the graphic arts sector due to the widespread adoption of digital printing technologies that necessitate heat-free finishing. However, Hybrid systems, which offer both cold and heat-assist capabilities within a single frame, are rapidly gaining significant traction as they provide print shops with superior flexibility, effectively allowing them to serve highly varied applications with a single capital investment, thus prioritizing operational efficiency and maximum material compatibility.

How is the demand for environmentally friendly lamination films impacting equipment sales?

The increasing regulatory pressure and stringent corporate sustainability mandates are profoundly driving innovation in both film chemistry and laminator design, significantly impacting equipment sales dynamics. End-users, particularly large retail brands, global corporations, and government procurement agencies, are actively prioritizing materials that are easily recyclable, derived from bio-based feedstocks, or manufactured with significantly reduced volatile organic compounds (VOCs). This essential market shift is creating a pronounced demand for laminators specifically capable of consistently handling these newer, specialized film formulations, which often require extremely precise temperature and pressure calibration to achieve optimal bonding compared to traditional, more forgiving polyester or PVC films. Consequently, equipment manufacturers are intensively incorporating advanced sensor technology, often coupled with AI, and sophisticated closed-loop control systems into their latest roll laminators to ensure repeatable, high-quality results with these environmentally sensitive materials. Companies investing in new laminators are actively seeking certifications and integrated features that explicitly validate the equipment's full compatibility with sustainable films, viewing this specialized capability as a critical key differentiator and a necessary future-proofing measure against rapidly evolving global environmental standards and consumer expectations.

What are the key technological advancements driving growth in the wide-format laminator segment?

The wide-format laminator segment (machines with roller widths exceeding 60 inches) is experiencing robust growth fueled by several critical technological advancements primarily focused on enhancing automation, increasing maximum throughput speed, and achieving enhanced material precision handling. A critical advancement is the integration of highly sophisticated automatic trimming and slitting systems that accurately cut the film and graphic inline, immediately following the lamination process, which entirely eliminates the need for separate manual cutting stations and drastically accelerates overall workflow efficiency. Secondly, sophisticated auto-feed, continuous web monitoring, and automated take-up roller mechanisms, controlled by powerful servo-motors and continuous tension feedback loops, actively prevent material skewing, undesirable wrinkling, and bubbling, which are notorious quality issues when processing very large or thin substrates at high industrial speeds. This ensures consistently flawless output, which is absolutely essential for high-value, non-reworkable applications like permanent fleet graphics and large architectural wall murals. Thirdly, the deep adoption of Industry 4.0 principles, including integrated software for remote job management, predictive remote diagnostic capabilities via the Internet of Things (IoT), and ultra-precise roller heating systems (Heat Assist) for improved cold film adhesion, are collectively elevating the industrial reliability and operational transparency of these capital-intensive machines, ultimately justifying their significant price points.

What role does machine maintenance and lifespan play in purchasing decisions for graphic roll laminators?

Machine maintenance requirements, reliability metrics, and expected operational lifespan are pivotal, high-priority factors that heavily influence purchasing decisions in the graphic roll laminator market, frequently outweighing initial capital cost considerations for high-volume commercial users. Buyers prioritize equipment known for exceptionally high reliability, robustness, and minimal unscheduled downtime, as any unexpected interruption in the critical finishing line can halt an entire printing operation, potentially leading to costly production delays, financial penalties, and client dissatisfaction. Manufacturers who successfully offer robust, long-term service contracts, guarantee readily available inventories of spare parts (especially high-wear components like specialized silicone rollers, cutting blades, and heating sensors), and provide comprehensive preventative maintenance schedules gain a significant and sustained competitive advantage. The focus across the industry is rapidly shifting towards machines equipped with advanced predictive maintenance sensors and diagnostic tools, often utilizing AI and machine learning, which actively alert operators or service technicians to potential issues before a component reaches a critical failure point. Furthermore, the inherent longevity of the equipment is essential; a high-end laminator is a major capital investment typically amortized over a 7 to 10-year operational period. Therefore, systems robustly designed with modular components for easy field servicing and utilizing highly durable construction materials are strongly valued, ensuring the total cost of ownership (TCO) remains maximally favorable over the machine's extended operational life and providing maximum sustainable return on investment for the print service provider.

Which regional market offers the highest growth potential for graphic roll laminator sales, and why?

The Asia Pacific (APAC) region currently offers the highest and most dynamic growth potential for the Graphic Roll Laminator Sales Market globally. This accelerated growth trajectory is primarily fueled by unprecedented rates of rapid urbanization and continuous industrial expansion, resulting in massive infrastructural and commercial construction projects across key developing nations like China, India, and Indonesia. This sustained construction boom directly translates to an escalating, sustained demand for robust, weather-resistant outdoor signage, critical safety graphics, and diverse promotional materials, all of which mandatorily require high-quality, durable lamination. Concurrently, the region is undergoing rapid technological penetration of advanced digital printing technologies, systematically replacing older, less efficient analog printing methods, which in turn necessitates significant and immediate investment in complementary high-speed finishing equipment such as wide-format roll laminators. Furthermore, local government initiatives that actively support manufacturing growth and the continuous expansion of the retail and exhibition sectors further stimulate demand significantly. While North America and Europe remain established, high-value markets based mainly on replacement demand, APAC's substantial underlying market size, combined with the accelerating rate of new printing capacity installation, firmly positions it as the clear regional leader in terms of projected CAGR and overall volume growth throughout the forecast period, primarily driven by the collective expansion of both the domestic printing industry and dramatically increasing regional advertising expenditure budgets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager