Graphics Card Dock Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442904 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Graphics Card Dock Market Size

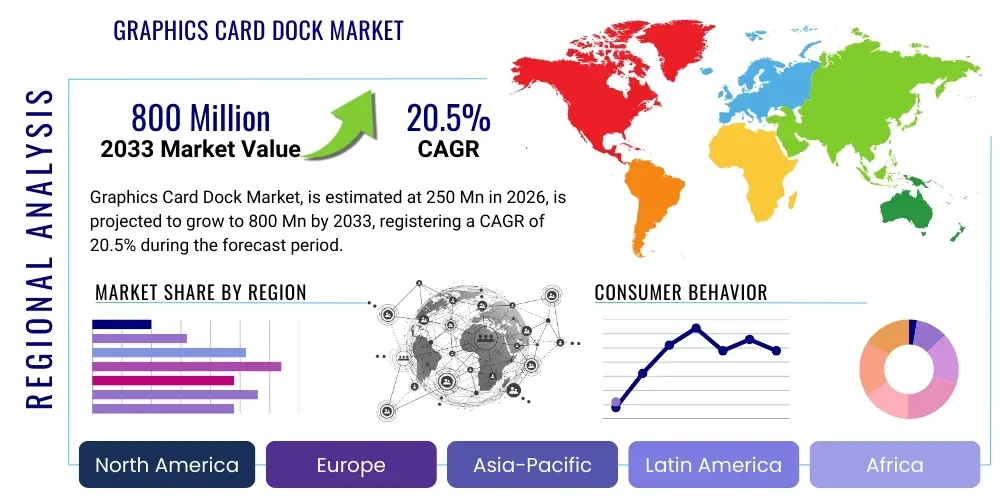

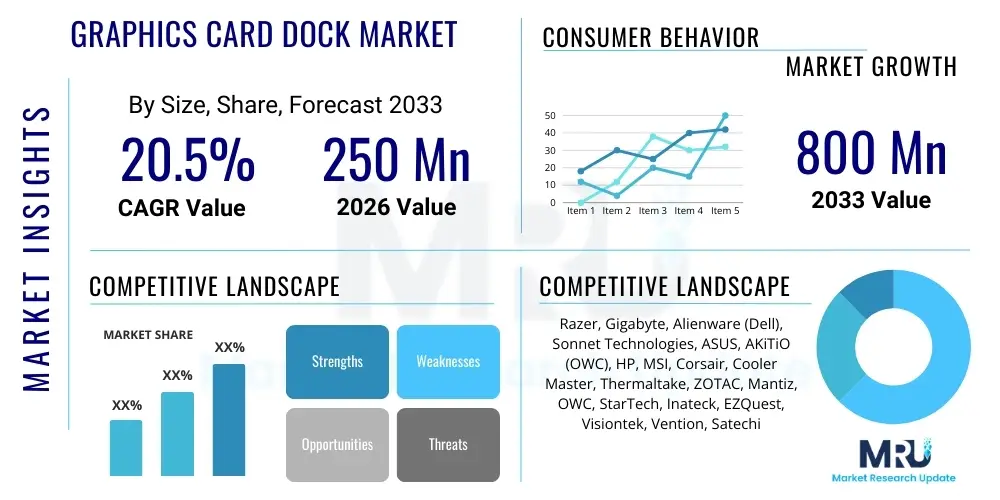

The Graphics Card Dock Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2026 and 2033. The market is estimated at $250 Million in 2026 and is projected to reach $800 Million by the end of the forecast period in 2033.

Graphics Card Dock Market introduction

The Graphics Card Dock Market encompasses external enclosures designed to house dedicated desktop graphics processing units (GPUs), connecting them to host devices, primarily laptops or small-form-factor PCs, via high-speed interfaces like Thunderbolt or USB 4.0. These external GPU (eGPU) solutions address the growing computational demands of modern applications, offering a pathway to upgrade graphics performance without requiring internal modifications to the host system. The primary product description centers around maximizing portability and maintaining high processing power, enabling thin-and-light notebooks to handle intensive tasks such as 4K gaming, professional video editing, 3D rendering, and complex machine learning computations that standard integrated graphics cannot support.

Major applications of graphics card docks span across several high-growth sectors. In the consumer electronics space, they are crucial for transforming mainstream laptops into powerful gaming rigs, providing desktop-class framerates and graphical fidelity. Within professional environments, eGPUs are essential tools for creative professionals utilizing Adobe Creative Cloud, DaVinci Resolve, or Autodesk suites, where GPU acceleration significantly reduces rendering times. Furthermore, the burgeoning field of data science and artificial intelligence utilizes these docks to connect high-VRAM GPUs for localized model training and inference tasks, offering flexibility and cost efficiency compared to dedicated desktop workstations or cloud computing subscriptions.

The market benefits significantly from several driving factors, including the increasing penetration of ultra-thin laptops lacking dedicated graphics, the continuous performance improvement of high-end GPUs, and the standardization and widespread adoption of high-bandwidth connectivity protocols like Thunderbolt 4. These docks provide a vital upgrade path, extending the useful life of existing hardware while enabling users to adopt the latest GPU technology immediately upon release. This modularity, combined with the escalating demand for immersive virtual reality (VR) and augmented reality (AR) content, cements the Graphics Card Dock Market as a critical component in the modern computing ecosystem, fostering both flexibility and specialized performance capabilities.

Graphics Card Dock Market Executive Summary

The Graphics Card Dock Market is poised for substantial growth, driven primarily by evolving business trends centered on remote work, content creation, and mobile high-performance computing (HPC). Business trends indicate a strong enterprise pivot towards modular IT solutions, where professional users require the portability of a laptop for travel coupled with the immense processing power of a dedicated workstation when docked. Segment trends highlight a rapid shift towards Thunderbolt 4 compatible docks, offering superior bandwidth and power delivery, alongside increasing demand from the hardcore gaming segment focused on maximizing resolution and frame rates. Furthermore, the convergence of AI development with consumer hardware accelerates the adoption of high-end eGPUs specifically for localized AI inferencing, creating a premium sub-segment within the market.

Regional trends indicate North America and Europe maintaining dominance due to high disposable income, sophisticated technological infrastructure, and the large installed base of high-performance laptops and gaming enthusiasts. However, the Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by expanding esports industries, burgeoning populations of professional content creators, and government investments in digital infrastructure, particularly in countries like China, South Korea, and India. The regional expansion is also characterized by strategic partnerships between dock manufacturers and local hardware distributors to ensure supply chain efficiency and competitive pricing structures.

In summary, the market's trajectory is defined by its ability to bridge the gap between portability and performance. Key strategic imperatives for market participants include focusing on enhanced thermal management systems, seamless plug-and-play functionality across different operating systems (Windows and macOS), and integration of advanced power supply units (PSUs) capable of reliably supporting the most power-hungry, next-generation GPUs. Sustained growth hinges on the continuous evolution of connectivity standards, making eGPUs an increasingly viable and effortless computing augmentation solution for a diverse global user base spanning both consumer and professional demographics.

AI Impact Analysis on Graphics Card Dock Market

User inquiries regarding AI's impact on the Graphics Card Dock Market frequently revolve around whether eGPUs can effectively handle complex machine learning models, the latency introduced during AI processing via external interfaces, and the feasibility of using eGPUs for decentralized AI development compared to cloud services. Users are highly concerned about the performance delta between internal desktop GPUs and externally connected eGPUs when running resource-intensive AI frameworks like TensorFlow or PyTorch. The consensus expectation is that AI acceleration will not only drive demand for more powerful GPUs but also necessitate docks with minimal latency, superior cooling, and high power delivery capabilities to support sustained AI training workloads effectively. The key themes include performance validation for deep learning, optimization of high-speed data transfer (Thunderbolt), and the potential for eGPUs to democratize access to powerful AI hardware for individual researchers and small development teams.

The profound impact of artificial intelligence is fundamentally reshaping the market landscape for graphics card docks, transforming them from primarily gaming accessories into critical tools for computational workloads. AI training, particularly deep learning models, requires substantial parallel processing capabilities, making high-end GPUs indispensable. As AI application development moves increasingly to edge devices and localized training environments, the convenience and flexibility offered by an eGPU enclosure become highly attractive. This shifts the target audience segmentation to include data scientists and machine learning engineers who need modular, transportable processing power, thereby expanding the total addressable market beyond traditional consumer and content creation sectors.

Furthermore, the integration of AI-specific features in modern GPUs, such as dedicated Tensor Cores, necessitates that eGPUs maintain absolute compatibility and bandwidth integrity to leverage these specialized processing units optimally. Manufacturers are responding by engineering docks that prioritize cooling efficiency and stability under heavy, continuous AI load—conditions often more demanding than even peak gaming usage. This specialization is fostering innovation in proprietary connection management software designed to minimize communication overhead and maximize throughput for large data sets, ensuring that the external GPU performs nearly identically to an internally mounted counterpart, thus solidifying the eGPU's role as a viable, scalable, and affordable solution for local AI development and deployment.

- Increased demand for high-VRAM, professional-grade GPUs for deep learning models.

- Drives innovation in minimizing latency through optimized Thunderbolt 4 and USB 4.0 implementations.

- Expands the eGPU customer base to include data scientists, AI researchers, and developers.

- Necessitates improved thermal solutions and higher wattage Power Supply Units (PSUs) in dock designs.

- Facilitates decentralized and localized AI model training and inference at the edge.

- Potential for specialized eGPU docks optimized solely for AI accelerator cards (e.g., specific Nvidia/AMD professional lineups).

DRO & Impact Forces Of Graphics Card Dock Market

The dynamics of the Graphics Card Dock Market are dictated by a balanced interplay of drivers (D), restraints (R), opportunities (O), and potent impact forces. The primary driver is the widespread consumer and professional adoption of ultra-portable laptops that inherently lack the thermal capacity and physical space for high-performance discrete GPUs. These users demand uncompromising performance for graphic-intensive tasks such as high-refresh-rate gaming, 4K video editing, and advanced 3D modeling, making eGPUs a necessary augmentation. Simultaneously, the accelerating rate of GPU innovation, where performance generationally outstrips previous iterations, encourages the adoption of modular solutions that allow users to upgrade only the GPU component without replacing the entire host system, fostering cost-efficiency and sustainability.

However, significant restraints temper this growth. The most critical constraint remains the high initial investment required, encompassing the cost of the dock itself and the discrete GPU, often placing the total expenditure comparable to or exceeding a dedicated mid-range gaming desktop. Furthermore, complexity in software setup, driver compatibility issues across different operating systems (especially macOS updates), and the inherent performance overhead (latency) introduced by the external connectivity standard, though minimal with Thunderbolt 4, still represent hurdles for mainstream, less technically proficient users. The maximum achievable bandwidth, while rapidly improving, still limits the performance potential of the highest-end GPUs compared to internal PCIe connections.

Opportunities for market expansion are abundant, particularly with the transition to the universal and superior bandwidth of USB 4.0 and Thunderbolt 4, which mitigates previous performance bottlenecks and enhances cross-device compatibility. The expanding professional market, fueled by the gig economy and remote work, provides a fertile ground for high-end dock adoption by graphic designers, architects, and VFX artists who require seamless transitions between mobile productivity and stationary power. The chief impact forces include the strategic pricing and aggressive marketing of dock solutions by major PC OEMs (like Razer and Dell/Alienware) and the continuous evolution of GPU thermal designs, which require dock manufacturers to constantly innovate their cooling and power delivery infrastructure to remain relevant and reliable for next-generation hardware.

Segmentation Analysis

The Graphics Card Dock Market is fundamentally segmented based on the connectivity technology employed, the specific application for which the dock is intended, and the type of end-user utilizing the solution. Analyzing these segments provides crucial insight into consumer behavior and technological adoption patterns across different market demographics. The Type segmentation, categorized by interface standards such as Thunderbolt 3, Thunderbolt 4, and the emerging USB 4.0, highlights the continuous shift towards higher bandwidth, faster charging, and greater compatibility. The Application segment differentiates consumer needs, separating high-end gamers who prioritize minimal latency and maximum frame rates from professional users focused on sustained, stable rendering performance.

Further granularity in segmentation reveals distinct value propositions for different buyer groups. The End-User segmentation clearly delineates the purchasing motivations of individual consumers, who are often driven by gaming or casual content creation, versus enterprises and academic institutions, which procure these units for centralized hardware management, specific R&D projects, and modular computational labs. The market is increasingly seeing specialization, where dock designs are optimized for specific GPU lengths and power consumption requirements, offering tailored solutions rather than a one-size-fits-all approach. This detailed segmentation allows manufacturers to target marketing and product development efforts more precisely, addressing niche requirements within the professional, gaming, and data science communities effectively.

- Type (Connectivity Standard):

- Thunderbolt 3

- Thunderbolt 4

- USB 4.0

- Proprietary/Legacy Connections

- Application:

- Gaming and Entertainment

- Professional Workstations (CAD, Video Editing, 3D Rendering)

- Data Science and AI Acceleration

- General Consumer Enhancement

- End-User:

- Individual Consumers/Enthusiasts

- Enterprises and Small-to-Medium Businesses (SMBs)

- Academic and Research Institutions

- E-sports and Gaming Cafés

- GPU Compatibility:

- Full-Length GPUs

- Half-Length GPUs

- Single Slot/Dual Slot/Triple Slot Designs

Value Chain Analysis For Graphics Card Dock Market

The Value Chain for the Graphics Card Dock Market begins with the upstream analysis, focusing heavily on the suppliers of critical components. This phase involves the procurement of high-speed connectivity chipsets (primarily Intel’s Thunderbolt controllers or certified USB-IF compliant controllers), specialized power supply units (PSUs) capable of delivering 500W to 1000W of stable power, and custom thermal management components (fans, heat sinks, and chassis materials). Raw material procurement is highly sensitive to geopolitical stability and supply chain consistency, as components like complex circuit boards and high-gauge cabling are essential. Key upstream suppliers include major semiconductor manufacturers, specialized PSU vendors, and enclosure fabrication specialists who dictate the initial cost structure and quality baseline of the final product.

The midstream process involves assembly, manufacturing, and dock design. This phase is where core value is added through sophisticated engineering, including optimizing the internal layout for efficient airflow, designing robust and reliable communication paths (PCB design), and integrating user-friendly features such as additional USB hubs, Ethernet ports, and display outputs. Direct distribution channels often involve high-volume retailers, specialized electronics stores, and direct-to-consumer (DTC) sales through proprietary brand websites (e.g., Razer, Sonnet). Indirect distribution channels leverage large e-commerce platforms (Amazon, Newegg) and global technology distributors who manage logistics and inventory across regional markets. The choice between direct and indirect distribution channels significantly influences pricing strategies and market reach, with DTC channels allowing for higher margin capture and better control over customer experience.

The downstream analysis focuses on the end-user interaction, integration, and post-sales support. For enterprise clients, the downstream component includes large-scale IT procurement, system integration services, and robust technical support to ensure fleet compatibility and uptime. For individual consumers, the success of the product heavily relies on ease of installation (plug-and-play), software driver stability, and the ability to seamlessly switch between mobile and docked operations. Continuous firmware updates and strong community support for troubleshooting common GPU compatibility issues are crucial downstream value adds. This phase ultimately determines brand loyalty and repeat purchases, particularly as GPU standards evolve rapidly, requiring proactive manufacturer support to maintain compatibility with new generations of graphics cards.

Graphics Card Dock Market Potential Customers

Potential customers for the Graphics Card Dock Market fall into several distinct categories, united by the need for high computational power married with high portability. The largest segment remains the individual consumer, specifically the enthusiastic PC gamer utilizing a thin or ultra-portable laptop who desires desktop-caliber frame rates and graphical settings without sacrificing mobility. This customer values performance upgrades, investment protection (only replacing the GPU), and ease of use. They are highly responsive to marketing emphasizing low latency, high bandwidth, and aesthetic design, often choosing products from gaming-focused brands like Razer and Alienware.

Another rapidly expanding segment consists of professional content creators and creative agencies. These users, including video editors, motion graphics artists, and architects running software like Revit or Maya, require massive GPU acceleration to handle 4K/8K rendering, complex simulations, and real-time visualization. For this B2B segment, reliability, professional certification, extended warranties, and support for professional-grade GPUs (e.g., NVIDIA RTX A-series or AMD Radeon Pro) are paramount. They view the eGPU dock as an essential workflow accelerator, enabling high-power tasks to be executed effectively on standardized corporate laptops.

Finally, emerging potential customers include small-to-medium enterprises (SMBs) engaged in data science, academic institutions setting up modular labs for computer vision or AI research, and specialized users who require compute flexibility. These buyers are motivated by the cost-effectiveness of sharing expensive GPUs among multiple users or the necessity of having transportable AI/ML training environments. Their purchase decisions are driven by technical specifications such as PSU wattage, connectivity standards (Thunderbolt 4 performance guarantee), and thermal efficiency to ensure stability during long, uninterrupted computational sessions, emphasizing the utility and versatility of the eGPU solution as a core infrastructure component.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million |

| Market Forecast in 2033 | $800 Million |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Razer, Gigabyte, Alienware (Dell), Sonnet Technologies, ASUS, AKiTiO (OWC), HP, MSI, Corsair, Cooler Master, Thermaltake, ZOTAC, Mantiz, OWC, StarTech, Inateck, EZQuest, Visiontek, Vention, Satechi |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Graphics Card Dock Market Key Technology Landscape

The technological core of the Graphics Card Dock Market relies fundamentally on high-speed serial data transfer protocols, which have undergone significant evolution to support the immense bandwidth required by modern GPUs. Thunderbolt technology, particularly Thunderbolt 4, stands as the dominant interface, offering 40 Gbps bidirectional bandwidth, which is critical for minimizing the latency and data throughput bottlenecks between the discrete GPU and the host CPU. This interface also provides simultaneous power delivery (up to 100W for laptop charging) and high-resolution display connectivity, consolidating the docking station functionality with raw graphical processing power. Manufacturers are continually investing in proprietary software stacks to optimize driver compatibility and resource allocation, ensuring that the external GPU performs as close to native internal speed as technologically possible, a key performance differentiator in the competitive landscape.

Thermal management and power supply unit (PSU) technology represent another critical area of innovation. As high-end GPUs increasingly demand 300W to 450W or more, graphics card docks must incorporate robust, high-efficiency PSUs (often 80 PLUS certified) and sophisticated cooling solutions that can manage extreme heat generated during sustained high-load operations like long gaming sessions or complex rendering tasks. The trend is moving towards larger enclosures capable of housing triple-slot graphics cards and integrating advanced liquid or hybrid cooling options, particularly in premium market segments. Engineering challenges focus on compacting this high-wattage power and cooling infrastructure while maintaining a sleek, desktop-friendly form factor, pushing material science and airflow dynamics to their limits.

Looking forward, the adoption of USB 4.0, which shares many underlying specifications with Thunderbolt 4, is set to democratize the technology, potentially making eGPUs accessible to a wider range of non-Intel/non-certified host devices. Furthermore, advances in PCIe technology (moving toward PCIe 5.0) will necessitate that future docking standards, or proprietary solutions, find ways to accommodate even higher bandwidth requirements, potentially through multi-lane aggregation or novel optical interconnect technologies, although these remain largely in the research and development phase. The successful market proliferation of graphics card docks is intrinsically linked to the continuous technological refinement of these core components—high-speed controllers, stable power delivery, and superior thermal design—which collectively define the user experience and overall performance fidelity.

Regional Highlights

- North America: This region holds a commanding market share, characterized by high consumer spending on premium technology, a massive installed base of professional workstations and gaming systems, and the early adoption of high-speed connectivity standards like Thunderbolt 4. The presence of major technology hubs and a large professional creative industry (Hollywood, Silicon Valley) drives consistent demand for high-performance eGPU solutions for video editing, 3D animation, and localized data science research. Marketing efforts here emphasize raw performance, brand recognition, and advanced features.

- Europe: The European market demonstrates strong growth, particularly in Western European countries (Germany, UK, France), driven by robust PC gaming communities and a strong focus on high-quality manufacturing and professional applications. Regulatory initiatives promoting energy efficiency also influence purchasing decisions, favoring eGPUs that allow users to utilize energy-efficient laptops for day-to-day tasks while reserving high power draw for specific computational workloads. Germany, with its dense engineering and IT sector, is a key driver for enterprise adoption.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by the explosive growth of the esports industry, the large population of mobile gamers, and the rapid expansion of content creation platforms across China, Japan, and South Korea. Increased urbanization and rising middle-class disposable income enable greater investment in consumer electronics upgrades. Local manufacturers are gaining traction, often offering more budget-conscious solutions, which expands the market to a broader consumer base than the high-end focus seen in North America.

- Latin America (LATAM): This region is an emerging market, currently characterized by price sensitivity but exhibiting increasing demand for computing upgrades. eGPUs appeal here as a more economical long-term investment compared to frequent replacement of entire computing systems. Adoption is focused heavily on consumer gaming, though infrastructure constraints relating to reliable, high-speed internet and power stability can sometimes pose localized challenges to high-end eGPU usage.

- Middle East and Africa (MEA): Market penetration is currently limited but growing in technologically advanced Gulf Cooperation Council (GCC) countries. The demand is concentrated in professional sectors (architecture, oil and gas simulation) and premium consumer segments. The market relies heavily on imported units and is often influenced by global pricing and distribution logistics, presenting opportunities for specialized distributors focused on high-end niche products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Graphics Card Dock Market.- Razer

- Gigabyte

- Alienware (Dell)

- Sonnet Technologies

- ASUS

- AKiTiO (OWC)

- HP

- MSI

- Corsair

- Cooler Master

- Thermaltake

- ZOTAC

- Mantiz

- OWC

- StarTech

- Inateck

- EZQuest

- Visiontek

- Vention

- Satechi

Frequently Asked Questions

Analyze common user questions about the Graphics Card Dock market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using a Graphics Card Dock (eGPU)?

The primary benefit is enabling high-performance graphics processing—essential for 4K gaming, VR, and professional rendering—on ultra-portable or small-form-factor laptops that lack internal dedicated GPUs. It provides a modular, upgradeable performance boost while retaining portability.

Which connectivity standard provides the best performance for eGPUs?

Thunderbolt 4 currently offers the best standardized performance for eGPUs, providing 40 Gbps of bidirectional bandwidth and efficient power delivery, minimizing the performance loss (latency) compared to a directly integrated desktop GPU.

Is there a significant performance loss when using an eGPU compared to a desktop GPU?

While some performance overhead (typically 10-20% depending on the GPU and task) is inherent due to the Thunderbolt interface, modern standards like Thunderbolt 4 have significantly narrowed this gap, especially for high-resolution (4K) and GPU-bound workloads where the external connection's speed is less of a limiting factor.

Are Graphics Card Docks compatible with both Windows and macOS systems?

Yes, most modern Graphics Card Docks are designed for compatibility with both Windows PCs (especially those with Thunderbolt 3/4) and macOS devices, although specific GPU models (especially NVIDIA) may have limited or complex driver support on macOS.

What are the key technical specifications to consider when purchasing an eGPU dock?

Buyers must prioritize the connectivity standard (Thunderbolt 4 recommended), the wattage of the built-in Power Supply Unit (PSU) to ensure it supports the desired GPU, and the physical dimensions (slot count and length) to guarantee the compatibility of the chosen graphics card.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager