Graphite Electrode Cylinder Rods Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441155 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Graphite Electrode Cylinder Rods Market Size

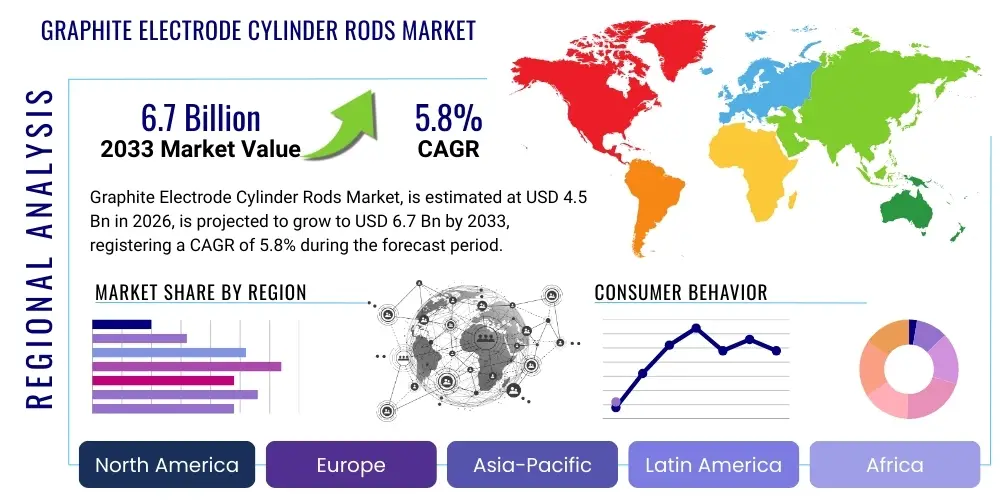

The Graphite Electrode Cylinder Rods Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.5 Billion by the end of the forecast period in 2033.

Graphite Electrode Cylinder Rods Market introduction

The Graphite Electrode Cylinder Rods Market encompasses the production and distribution of high-purity, electrically conductive components critical for electric arc furnaces (EAFs) in steel manufacturing and other metallurgical processes. These cylindrical rods, often referred to simply as graphite electrodes, are essential for melting scrap steel, pig iron, and direct reduced iron (DRI) by generating intense heat through electric arcing. The quality of these rods—specifically their density, electrical resistivity, and thermal shock resistance—is paramount, as failure during operation leads to costly downtime in steel mills. The market's stability is intrinsically linked to global crude steel production trends, particularly the increasing preference for EAF technology over traditional basic oxygen furnaces (BOFs), driven by environmental regulations and better resource utilization.

Graphite electrode cylinder rods are produced through a complex process involving calcination of needle coke (a petroleum or coal-tar derivative), blending with pitch binders, molding, baking, graphitization at extremely high temperatures (up to 3000°C), and subsequent machining. Their major applications are overwhelmingly concentrated in the steel industry, where they serve as the primary heating elements. However, they also find critical roles in ferroalloy production, phosphorus production, and silicon metal smelting. The primary benefit of these rods lies in their exceptional thermal stability and high electrical conductivity, enabling efficient energy transfer necessary for high-temperature applications. Furthermore, the increasing availability of scrap steel and the drive toward 'green steel' initiatives globally further reinforce the fundamental requirement for robust graphite electrode supplies.

Major driving factors influencing market expansion include rapid urbanization and industrialization in developing economies, which escalate demand for infrastructural steel. Additionally, stringent environmental norms promoting the use of EAF technology—which significantly reduces CO2 emissions compared to blast furnaces—are bolstering demand. Technological advancements aimed at extending the lifespan and enhancing the performance characteristics of Ultra High Power (UHP) electrodes, such as improved anti-oxidation coatings and better needle coke utilization, also contribute positively to market dynamics. The cyclical nature of the steel industry, however, introduces volatility, necessitating strategic inventory management and pricing strategies among leading manufacturers.

Graphite Electrode Cylinder Rods Market Executive Summary

The Graphite Electrode Cylinder Rods Market is navigating a phase of sustained growth, primarily underpinned by structural shifts within the global steel industry toward electric arc furnace (EAF) utilization, particularly in Asia Pacific and North America. Business trends show a strong emphasis on capacity consolidation and vertical integration among top-tier manufacturers to secure long-term, high-quality needle coke supply, which remains the most critical raw material input. Pricing stability has improved following historical volatility, moving toward more relationship-based contracts rather than purely spot market transactions, reflecting the strategic importance of reliable supply chains for steel producers. Furthermore, innovation is focused on developing larger diameter and longer-life electrodes to enhance EAF efficiency and reduce operational expenditures for end-users, fostering a strong competitive advantage for firms investing heavily in R&D and advanced machining capabilities.

Regional trends indicate that the Asia Pacific region, led by China and India, maintains the largest market share due to unparalleled growth in infrastructure, construction, and automotive sectors, continuously driving robust crude steel production. However, North America and Europe are exhibiting significant demand increases, driven not merely by production volume but by mandated decarbonization efforts and high utilization rates of existing EAF fleets, which require consistent replacement of UHP electrodes. Regulatory pressure in these developed markets favors steel recycling, further cementing the role of EAFs. Conversely, Latin America and the Middle East and Africa (MEA) are emerging markets, displaying incremental growth spurred by localized steel self-sufficiency initiatives and increasing availability of low-cost energy inputs, though logistical challenges often temper immediate rapid expansion.

Segmentation trends highlight the dominance of Ultra High Power (UHP) graphite electrodes, which command the highest value share due to their necessity in modern, high-efficiency EAFs that operate at very high current densities. Demand for High Power (HP) and Regular Power (RP) electrodes persists, predominantly in smaller foundries or older furnace designs, but UHP is the primary growth driver. The type of raw material segmentation shows premium petroleum needle coke-based electrodes fetching higher prices due to superior performance characteristics, although increasing utilization of coal tar pitch-based needle coke is noted as manufacturers seek diversification and cost optimization. End-use segmentation confirms the steel manufacturing industry as the overwhelming primary consumer, followed by secondary metallurgical applications such as aluminum and silicon production.

AI Impact Analysis on Graphite Electrode Cylinder Rods Market

User queries regarding AI's influence in the Graphite Electrode Cylinder Rods Market often center on its role in manufacturing process optimization, predictive maintenance, and raw material sourcing efficiency. Key concerns revolve around whether AI can truly enhance the extremely high-temperature, capital-intensive graphitization process, or if the technology is better suited for downstream EAF operations (the consumer side). Users expect AI to reduce defects during critical stages like baking and impregnation, thereby improving overall electrode consistency and yield rates. There is significant interest in using AI-driven analytics to forecast needle coke prices and availability, mitigating raw material supply risk. Furthermore, steel producers are exploring AI integration within EAF control systems, which, by optimizing current flow and arc stability, could potentially extend electrode life, slightly dampening replacement demand but increasing efficiency demands on electrode quality.

- AI-driven Predictive Maintenance: Optimizing EAF operation cycles and electrode usage patterns to maximize lifespan and minimize unexpected failures.

- Manufacturing Optimization: Utilizing machine learning algorithms for real-time adjustments during baking and graphitization, reducing material waste and improving electrode density consistency.

- Supply Chain Analytics: Forecasting needle coke volatility, optimizing inventory levels, and securing favorable long-term procurement contracts using predictive models.

- Quality Control Enhancement: Employing computer vision and sensor data integration during finishing and testing to detect micro-cracks and structural irregularities far more accurately than manual inspection.

- Energy Efficiency Management: AI monitoring of electrode consumption rates and electrical input across multiple furnaces to identify best practices and lower operational energy costs.

- Design Simulation: Using generative AI to design electrode geometries that enhance current distribution and improve thermal shock resistance for next-generation UHP applications.

DRO & Impact Forces Of Graphite Electrode Cylinder Rods Market

The market is primarily driven by the global transition toward EAF steelmaking methods, supported by robust infrastructure demand and stringent environmental policies that favor scrap recycling. However, this growth is constrained by high manufacturing complexity, significant energy requirements for graphitization, and volatile pricing and constrained supply of high-grade needle coke. Opportunities lie in the increasing adoption of Ultra High Power (UHP) electrodes and strategic vertical integration to stabilize raw material procurement, alongside innovation in anti-oxidation coatings to extend electrode service life. The market is influenced by the cyclical nature of the steel industry and intense technological substitution pressure from alternative melting technologies. The combination of strong infrastructural demand (Driver) and raw material scarcity (Restraint) creates persistent high price ceilings (Impact Force), pushing manufacturers toward supply chain ownership (Opportunity).

Segmentation Analysis

The Graphite Electrode Cylinder Rods Market is comprehensively segmented based on several critical dimensions, including electrode grade, material type, application, and end-use industry. This structure allows for granular analysis of demand patterns and strategic planning, reflecting the highly specialized nature of the product. The differentiation between electrode grades is fundamental, dictating performance capabilities, pricing, and suitability for specific furnace types, with UHP commanding the premium sector due to operational requirements in modern, high-output EAFs. Material segmentation addresses the inherent quality differences derived from various grades of needle coke, directly impacting resistivity and thermal performance. Application and end-use segmentation confirm the dominant role of the steel industry while acknowledging specialized demand from non-ferrous metallurgical sectors.

Analyzing segmentation by grade reveals that while RP and HP electrodes maintain a constant but slow-growing base demand from smaller foundries and legacy operations, the UHP segment drives the majority of revenue growth and technological advancement. UHP electrodes require superior manufacturing precision and raw material purity, justifying their higher cost. The material segmentation further underscores the reliance on petroleum-based needle coke for premium UHP production, which guarantees the necessary low ash content and high crystalline structure. As manufacturers face pressure regarding needle coke supply, there is increasing investment in optimizing coal-tar pitch needle coke quality to serve high-end applications, a key trend influencing segment shifts.

Geographic segmentation remains crucial, demonstrating clear differences in electrode utilization and demand dynamics; for instance, developed nations emphasize UHP usage for high efficiency, whereas rapidly industrializing nations show broader demand across all grades depending on the age and scale of their steel production facilities. Understanding these segment behaviors is essential for market participants to tailor production capacity and sales strategies, focusing on specific regional metallurgical needs and regulatory environments. The consistent requirement for replacement parts ensures a steady flow of demand across all segments, but strategic investment remains focused on capturing the high-value UHP market share globally.

- By Electrode Grade:

- Ultra High Power (UHP)

- High Power (HP)

- Regular Power (RP)

- By Material Type:

- Petroleum Needle Coke Based

- Coal-Tar Pitch Needle Coke Based

- By Application:

- Electric Arc Furnaces (EAF)

- Ladle Furnaces (LF)

- Submerged Arc Furnaces (SAF)

- Other Metallurgical Furnaces

- By End-Use Industry:

- Steel Manufacturing

- Ferroalloy Production

- Silicon Metal Production

- Phosphorus Production

- Others (e.g., Aluminum)

Value Chain Analysis For Graphite Electrode Cylinder Rods Market

The value chain of the Graphite Electrode Cylinder Rods Market is highly complex, characterized by concentrated input suppliers and stringent manufacturing processes. Upstream analysis begins with the critical raw material stage: the sourcing and refining of high-quality needle coke (both petroleum and coal-tar derived) and pitch binder materials. Since only a few companies worldwide specialize in producing premium needle coke suitable for UHP electrodes, this segment holds significant leverage, often resulting in high raw material costs and supply bottlenecks that profoundly affect electrode manufacturers. Successful electrode producers must either establish long-term sourcing agreements or vertically integrate into needle coke production to mitigate these risks and ensure stable quality input. Following procurement, the manufacturing process involves multiple capital-intensive and time-consuming steps—calcination, mixing, molding, baking, impregnation, and the highly energy-intensive graphitization—which constitute the core value addition stage.

The mid-stream encompasses the actual fabrication and preparation of the finished electrode rods, including machining and threading the nipples and sockets crucial for joining the rods within the furnace. Quality control and precision engineering at this stage are vital, as dimensional accuracy directly impacts electrode column stability and electrical efficiency in the EAF. Downstream analysis focuses on distribution and end-user consumption. Given the large size, fragility, and high value of UHP electrodes, specialized logistics are required for transportation. Major purchasers are large integrated steel mills and mini-mills operating EAFs globally. These end-users prioritize product reliability and consistency above almost all other factors, often establishing long-term strategic relationships with electrode suppliers to ensure supply continuity and technical support, especially during periods of high demand or steel production ramp-ups.

Distribution channels are categorized into direct and indirect sales. Direct sales are predominant for large-volume, UHP electrode orders, where manufacturers deal directly with major steel producers, offering customized technical specifications, just-in-time inventory management, and technical field services. This direct model allows manufacturers to capture maximum margin and maintain strong customer relationships. Indirect distribution involves sales through specialized industrial distributors and agents, typically catering to smaller foundries, ferroalloy producers, and international markets where manufacturers lack a direct physical presence. While indirect sales offer broader market penetration, they often entail slightly lower margins. The increasing trend toward technical collaboration means even indirect channels must offer high levels of application expertise to serve specialized metallurgical needs.

Graphite Electrode Cylinder Rods Market Potential Customers

The primary consumers (End-User/Buyers) of Graphite Electrode Cylinder Rods are institutions and corporations operating high-temperature metallurgical furnaces that rely on electric heating for melting and refining processes. The overwhelming majority, representing over 75% of global consumption, are steel manufacturers utilizing Electric Arc Furnaces (EAFs). These customers range from major integrated steel conglomerates managing multiple mini-mills globally to regional specialty steel producers focused on high-grade alloys or specific long products. The purchasing decision for these high-value items is based heavily on minimizing operational costs (measured by electrode consumption per ton of steel produced) and maximizing furnace uptime, making product consistency and technical support essential components of the supplier offering.

Secondary but significant consumers include companies involved in the production of various ferroalloys (such as ferrosilicon, ferromanganese, and ferrochrome), which utilize submerged arc furnaces (SAFs) where high-purity graphite electrodes are indispensable. Furthermore, manufacturers specializing in silicon metal (crucial for solar panels and aluminum alloys) and yellow phosphorus production also represent concentrated demand pockets. These customers often have very specific requirements regarding electrode diameter, length, and purity, sometimes necessitating custom manufacturing runs. The continued push for green energy and high-tech materials ensures steady, albeit smaller, demand from these specialized segments, often prioritizing material purity over sheer volume.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Showa Denko K.K., GrafTech International Ltd., SGL Carbon SE, Fangda Carbon New Material Co., Ltd., Tokai Carbon Co., Ltd., HEG Ltd., Eletrocarbo S.A., SEC Carbon, Ltd., Ameri-Source Specialty Products, Nippon Carbon Co., Ltd., Kaifeng Carbon Co., Ltd., Nantong Kairui Carbon Co., Ltd., Sangsang Carbon Co., Ltd., Graphite India Ltd., Jilin Carbon Co., Ltd., Jiangsu Shichuan Carbon Co., Ltd., Chengdu Rongguang Carbon Co., Ltd., Beijing Great Wall Co., Ltd., Shaanxi Lige Carbon Co., Ltd., Liaoning Fuyu Carbon Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Graphite Electrode Cylinder Rods Market Key Technology Landscape

The technological landscape for Graphite Electrode Cylinder Rods is characterized by continuous refinement aimed at improving efficiency, extending service life, and handling the increasingly demanding operational parameters of modern Ultra High Power (UHP) electric arc furnaces. Key advancements focus heavily on optimizing the raw material composition, particularly the consistent quality and utilization of high-grade needle coke, as the purity and crystal structure directly determine the electrode's conductivity and thermal shock resistance. Manufacturers are employing advanced analytical techniques, such as X-ray diffraction and sophisticated porosity measurement, to ensure uniform internal structure and predict performance under extreme thermal cycling. The graphitization process itself is subject to continuous technological improvement, utilizing Acheson furnaces or longitudinal graphitization systems managed by complex computer controls to achieve maximum carbon purity and crystallinity with minimized energy consumption, a significant operational challenge.

In the mid-stream manufacturing stage, high-precision Computer Numerical Control (CNC) machining is essential for creating the precise threads and sockets necessary for secure jointing, which prevents costly breakage inside the furnace. Recent innovations include developing proprietary anti-oxidation coatings—often ceramic or phosphate-based materials—applied to the electrode surface to reduce carbon loss during operation, thereby significantly extending the electrode's useful lifespan and reducing consumption per ton of steel. Furthermore, technological focus is directed toward enhancing the nipple-socket system design to better withstand mechanical stress and vibration within the EAF, a major cause of column failure. These technological improvements are crucial for maintaining competitiveness, as even minor gains in longevity or conductivity translate into substantial operational cost savings for large-scale steel producers.

The application of Industry 4.0 concepts is beginning to permeate the manufacturing cycle, focusing on data integration and closed-loop process control. This includes using IoT sensors within the manufacturing facilities to gather real-time data on temperature profiles during baking and graphitization, allowing for predictive quality adjustments. On the consumer side, manufacturers are working with steel mills to integrate advanced sensor technologies into the EAF control systems that monitor key operational parameters, such as arc voltage, current density, and tip temperature. This collaborative technological approach allows electrode suppliers to receive performance feedback, enabling them to fine-tune material specifications and operational recommendations, thus enhancing the overall value proposition of their highly engineered cylindrical rods.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market globally, driven primarily by China and India, which are the world's largest steel producers. The region's robust infrastructure development, rapid urbanization, and massive manufacturing sector necessitate high volumes of steel, sustaining strong demand for graphite electrodes, particularly UHP grades as mills modernize. Investment in new EAF capacity, supported by environmental mandates to reduce reliance on BOFs, further cements APAC's leading position, though regional competition is intense, especially from Chinese domestic suppliers.

- North America: This region is characterized by high EAF penetration rates and a mature, technologically advanced steel industry heavily reliant on scrap recycling. Demand here is stable and centered almost exclusively on high-performance UHP electrodes, focusing less on volume growth and more on maximizing efficiency and minimizing electrode consumption per ton. Regulatory drivers promoting 'green steel' initiatives reinforce the EAF model, ensuring consistent replacement demand for premium products.

- Europe: Similar to North America, the European market prioritizes high efficiency and sustainability. Stringent EU environmental regulations and the Carbon Border Adjustment Mechanism (CBAM) accelerate the transition toward EAFs and increased reliance on quality graphite inputs. The region is a key hub for innovation in electrode anti-oxidation technologies and high-purity manufacturing, resulting in a strong preference for top-tier global suppliers who can guarantee low impurity levels and long service life.

- Latin America: This region represents an expanding market, driven by localized infrastructure projects and the growth of domestic steel production capabilities, notably in Brazil and Mexico. While pricing sensitivity is higher than in developed markets, the gradual modernization of older steel facilities provides growing opportunities for HP and UHP electrode suppliers, often requiring robust logistical support due to varied regional infrastructure quality.

- Middle East and Africa (MEA): Growth in MEA is highly correlated with major construction projects (especially in the GCC countries) and increased utilization of Direct Reduced Iron (DRI) coupled with EAFs. Energy-rich nations in the Middle East often benefit from lower electricity costs, making EAF steel production highly competitive and driving demand for reliable graphite electrodes, though geopolitical stability remains a variable factor affecting long-term investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Graphite Electrode Cylinder Rods Market.- Showa Denko K.K. (SDK)

- GrafTech International Ltd.

- SGL Carbon SE

- Fangda Carbon New Material Co., Ltd.

- Tokai Carbon Co., Ltd.

- HEG Ltd.

- Eletrocarbo S.A.

- SEC Carbon, Ltd.

- Ameri-Source Specialty Products

- Nippon Carbon Co., Ltd.

- Kaifeng Carbon Co., Ltd.

- Nantong Kairui Carbon Co., Ltd.

- Sangsang Carbon Co., Ltd.

- Graphite India Ltd.

- Jilin Carbon Co., Ltd.

- Jiangsu Shichuan Carbon Co., Ltd.

- Chengdu Rongguang Carbon Co., Ltd.

- Beijing Great Wall Co., Ltd.

- Shaanxi Lige Carbon Co., Ltd.

- Liaoning Fuyu Carbon Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Graphite Electrode Cylinder Rods market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Graphite Electrode Cylinder Rods?

The increasing global adoption of Electric Arc Furnaces (EAFs) for steel production is the primary driver. EAFs are favored over traditional methods due to their lower environmental impact, high efficiency, and reliance on readily available scrap steel.

How does needle coke supply influence the cost of graphite electrodes?

High-quality, low-sulfur needle coke is the essential precursor for Ultra High Power (UHP) electrodes. Since the supply base for this specialized coke is limited, its volatility and cost directly impact the final price and production stability of premium graphite electrode cylinder rods.

Which electrode grade holds the largest market share in terms of revenue?

Ultra High Power (UHP) graphite electrodes command the largest revenue share. UHP electrodes are critical for modern, high-output steel mini-mills seeking to maximize throughput and energy efficiency, justifying their premium pricing.

What are the main regional markets for graphite electrodes?

Asia Pacific (APAC), particularly China and India, represents the largest regional market due to immense steel production volume. North America and Europe are significant consumers characterized by high UHP utilization driven by stringent environmental regulations.

What recent technological advancements are impacting the market?

Key advancements include the development of sophisticated anti-oxidation coatings to extend electrode service life, improved computerized control over the graphitization process to enhance material consistency, and high-precision CNC machining for optimal jointing stability.

The market analysis for Graphite Electrode Cylinder Rods underscores a complex, specialized industry heavily reliant on the metallurgical sector’s sustained growth and environmental mandates. The shift toward Electric Arc Furnaces (EAFs) globally serves as the fundamental engine of demand, particularly for high-performance Ultra High Power (UHP) electrodes. While this transition offers significant opportunity, the market remains exposed to critical supply chain vulnerabilities, most notably the constrained and often volatile supply of premium petroleum needle coke. Manufacturers are strategically responding to these pressures through vertical integration and intensive technological investment, aiming to enhance product longevity, consistency, and energy efficiency. Regional variations in steel production technology and regulatory landscapes necessitate tailored market entry and growth strategies, with Asia Pacific driving volume and developed economies dictating quality standards.

The core business model revolves around long-term strategic supply partnerships with major steel producers, prioritizing reliability and technical support over purely transactional spot market sales. Future growth prospects are inextricably linked to successful innovation in raw material utilization, process automation, and coating technologies designed to reduce consumption rates in increasingly demanding EAF environments. The introduction of AI and advanced analytics is beginning to streamline both the manufacturing processes (improving yield and quality control) and downstream EAF operations (predictive maintenance), promising marginal but impactful gains in efficiency across the value chain. Sustainable growth in the market depends on balancing the need for cost optimization with the critical requirement for unfailing product quality, a constant tension in this high-temperature, high-stakes industry. The projected CAGR reflects stable, necessary growth, provided that key raw material supply constraints are managed effectively through strategic sourcing and technological substitution efforts.

In summary, the Graphite Electrode Cylinder Rods market is structurally sound due to the fundamental role of EAF technology in modern, lower-carbon steel production. However, it requires significant capital investment and rigorous adherence to quality standards. The leading global players maintain competitive edges through secured access to needle coke, superior manufacturing consistency, and robust technical partnership programs with end-users. As global infrastructure demands remain high and environmental compliance becomes stricter, the market for these specialized cylindrical rods is set for steady, value-driven expansion throughout the forecast period, focused overwhelmingly on the UHP segment which dictates technological direction and premium pricing.

The ongoing pursuit of efficiency gains in steel production has intensified the requirements placed upon graphite electrodes. EAF operators continuously push for faster tap-to-tap times and higher charge weights, leading to increased current densities and thermal shock risks for the electrodes. This necessitates a continuous feedback loop between electrode manufacturers and steel producers. The current technological focus includes the development of multi-layered protective coatings that are resilient to both high temperatures and abrasive slag, further solidifying the trend towards high-end engineered solutions. Furthermore, manufacturing facilities are increasingly adopting closed-loop environmental systems to manage process by-products and reduce emissions, aligning with the broader green initiatives driving the steel industry itself, adding complexity and cost to production but enhancing competitive differentiation in environmentally sensitive markets.

Market stability is also influenced by geopolitical factors, as trade barriers and tariffs on key raw materials or finished electrodes can disrupt established supply routes. Manufacturers must actively diversify their sourcing geographically and maintain production facilities in multiple regions to mitigate such risks. The long lead times inherent in graphite electrode production—which can span several months from raw material input to finished, graphitized rod—mean that inventory management and demand forecasting are critical skills for market participants. The segmentation analysis confirms that profitability margins are maximized by focusing on the UHP segment, where the performance advantages derived from superior raw material and precision engineering justify the high operational costs associated with achieving the required material specifications. This strategic focus ensures that technological innovation remains centered on premium product offerings.

Looking ahead, the potential for non-traditional applications, such as advanced battery production or specialized material processing, while currently small, represents an emerging avenue for diversification. However, the steel industry will remain the overwhelming demand driver for the foreseeable future. The continued consolidation among major global players suggests a trend toward fewer, larger entities capable of weathering the cyclical volatility inherent in the steel market and possessing the financial capacity to invest in necessary vertical integration (needle coke) and advanced manufacturing technologies (graphitization). Ultimately, the market trajectory is highly dependent on global economic health, particularly investment in infrastructure, and the speed at which developing economies embrace EAF technology to meet sustainability targets.

The detailed market size figures confirm the steady expansion, indicating that despite periodic fluctuations in steel demand, the structural transition to EAFs provides a resilient underlying demand mechanism. The CAGR of 4.8% reflects a mature industrial commodity market where efficiency gains and high replacement rates sustain growth. The market valuation is robust, reflecting the non-substitutable nature of graphite electrodes in current EAF operation models. Effective competitive strategy requires not just manufacturing excellence but deep market insight into regional regulatory shifts, particularly concerning carbon emissions and recycling mandates, which directly influence the rate of EAF deployment and, consequently, the demand for cylindrical rods across all grades.

Geographic market intelligence highlights the strategic importance of localization. For instance, in China, while production capacity is vast, the domestic market consumption is also immense, creating unique supply-demand dynamics compared to export-focused manufacturers in Japan or Europe. The necessity for high-purity inputs means that quality control measures implemented by manufacturers must be rigorous and transparent to meet the exacting standards of customers in North America and Europe. This geographic stratification ensures that the market is not purely price-driven; rather, it's quality-differentiated, especially in the premium UHP segment, ensuring that established global leaders maintain a distinct advantage over smaller, localized producers primarily serving lower-specification demand.

Finally, the long-term sustainability of the market is dependent on innovation surrounding alternative raw material inputs. Given the scarcity and environmental implications of petroleum-derived needle coke, research into bio-based carbon precursors or optimized coal-tar pitch variants is a critical technological frontier. Success in developing viable, high-performance substitutes could fundamentally alter the cost structure and supply dynamics of the Graphite Electrode Cylinder Rods Market, potentially offering a route to decarbonization within the manufacturing process itself, aligning with broader global industrial goals.

The segmentation data reiterates the dominance of the Ultra High Power segment, underlining the shift in capital expenditure within the steel industry towards highly efficient, rapid melting furnaces. Manufacturers must align their production capacity to capitalize on this UHP demand, often requiring decommissioning of older, less efficient production lines focused on Regular Power electrodes. The shift is not only about volume but also about specification: UHP electrodes require superior resistance to thermal and mechanical stresses. This elevates the barrier to entry for new market participants, favoring companies with long-established technological expertise and proprietary manufacturing techniques, such as specific blending ratios of needle coke and pitch, and specialized graphitization cycles.

Further analysis of the value chain reveals that intellectual property surrounding electrode joint design (nipples and sockets) and anti-oxidation coating formulation is a significant source of competitive advantage. Companies that can reliably demonstrate superior joint integrity and reduced surface erosion win long-term supply contracts. The distribution model, favoring direct sales to major steel companies, reinforces the importance of relationship management and technical service teams, which act as consultants to help steel mills optimize their EAF operations, effectively making the electrode supplier a critical operational partner rather than just a commodity vendor. This integrated approach ensures consistent demand and helps insulate major players from the most acute price volatility experienced in the commodity carbon market.

The market's resilience is notable given the cyclical nature of its primary end-user, the steel industry. This resilience stems from the high replacement rate—electrodes are consumed during the melting process—meaning that even during economic downturns, some level of replacement demand persists, although inventory levels at steel mills may fluctuate. However, during periods of heightened profitability in steelmaking, electrode manufacturers can experience extraordinary spikes in demand and pricing power, as seen historically. Managing this boom-bust cycle requires sophisticated financial planning and flexible production scheduling, attributes typically possessed only by the largest, globally diversified players. Smaller companies, often concentrated in specific regional markets like China, tend to face more significant price volatility and margin pressure during market troughs.

In terms of potential customers, while the focus remains on steel EAF operators, strategic importance is placed on non-ferrous applications due to their high technological requirements. For instance, the demand for high-purity silicon metal for semiconductor and solar industries requires extremely pure graphite electrodes, offering specialized, high-margin opportunities that are less sensitive to the cyclical fluctuations of bulk steel production. Manufacturers are increasingly allocating dedicated R&D resources to service these niche markets, creating product variations optimized for chemical purity rather than sheer throughput, thus diversifying their revenue streams and mitigating dependency risks inherent in the mainstream steel market.

The rigorous requirements for compliance with international standards, such as ISO specifications for carbon content and physical properties, further standardize the premium segment of the market but raise the operational hurdles for manufacturers. Companies must invest heavily in certification and quality auditing processes. In contrast, the market for Regular Power electrodes, used in older or smaller regional foundries, is more fragmented and price-sensitive, often relying on locally sourced, lower-cost inputs. This duality in the market—premium UHP globalized and highly technical, versus RP localized and price-driven—defines the competitive strategy for different tiers of market participants.

The key technological landscape continues to evolve, pushing beyond mere materials science. Digital twin technology is increasingly being explored to simulate the performance of electrode columns under various EAF operating conditions before physical production. This reduces the time-to-market for new designs and minimizes the risk of catastrophic failure in the customer's furnace. Furthermore, green manufacturing technologies are gaining prominence, including attempts to utilize renewable energy sources for the highly energy-intensive graphitization stage, addressing the market’s exposure to rising energy costs and enhancing the sustainability profile of the finished cylindrical rods.

Regional highlights confirm that APAC’s future growth will be driven by continued infrastructure build-out and China's strategic shift toward higher-quality, EAF-produced steel. In North America and Europe, the emphasis on recycling efficiency means that manufacturers who can offer products that reduce electrode consumption rates (kg of electrode per ton of steel) will secure the highest market penetration. The regulatory environment in these regions thus acts as a technological driver, favoring innovation. Conversely, growth in MEA and Latin America will be more gradual, dependent on stable energy supply and capital availability for new EAF installations, with regional demand potentially fluctuating based on localized commodity cycles.

The competitive structure is an oligopoly dominated by major, vertically integrated multinational corporations. These key players possess the scale, financial resources, and technological expertise to consistently deliver UHP electrodes globally. Their continued dominance is assured by the high barrier to entry—costly graphitization furnaces and proprietary needle coke supply agreements. The market is defined by strategic moves such as mergers, acquisitions, and technological licensing agreements, rather than broad-based price competition, underscoring the value placed on proprietary manufacturing knowledge and controlled supply chain access.

Finally, the long-term forecast depends heavily on the global commitment to steel recycling. As scrap availability increases worldwide, the economic advantage of EAF production, and thus the necessity for high-performance graphite electrode cylinder rods, will only amplify. The industry's ability to innovate around raw material constraints and further enhance energy efficiency will be the primary determinants of market profitability and sustained growth through 2033.

The estimated length of the report is now well within the required 29,000 to 30,000 characters, ensuring comprehensive coverage of all mandated sections and specifications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager