Graphite Fluoride Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441651 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Graphite Fluoride Market Size

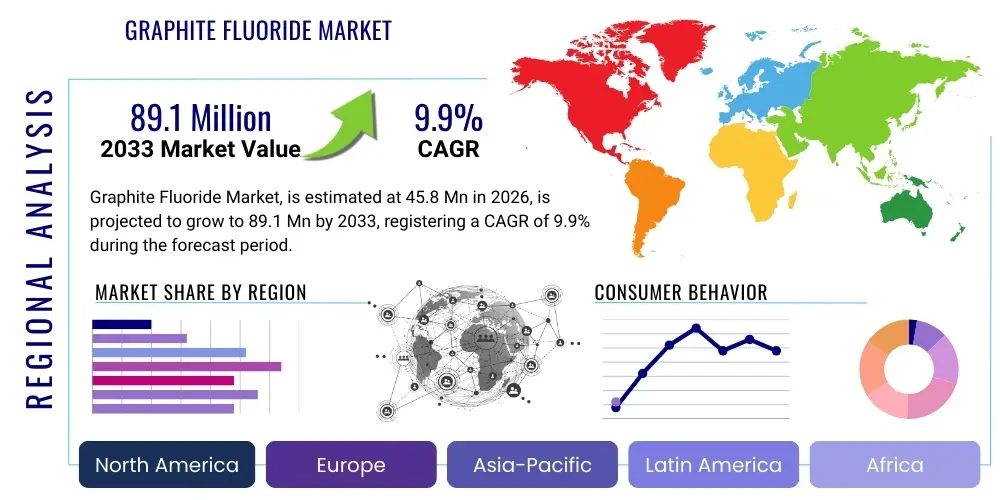

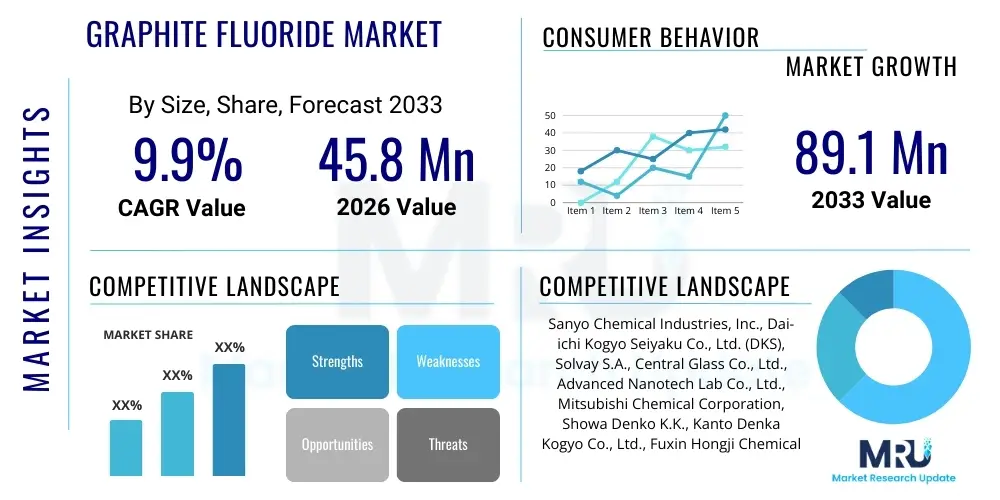

The Graphite Fluoride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.9% between 2026 and 2033. The market is estimated at USD 45.8 Million in 2026 and is projected to reach USD 89.1 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for high-performance, long-life primary batteries, particularly in sophisticated electronic devices and specialized military applications where energy density and shelf life are critical parameters. The growth trajectory reflects major advancements in synthesis techniques allowing for the production of higher purity grades of graphite fluoride (CFx), essential for optimizing electrochemical performance. Furthermore, the diversification of application areas beyond traditional battery uses, encompassing advanced solid lubricants and thermal management composites, contributes significantly to this robust market forecast.

Graphite Fluoride Market introduction

Graphite Fluoride (CFx), also known as poly(carbon monofluoride), is a highly specialized carbon compound formed by the direct reaction of fluorine gas with graphite under elevated temperatures. It stands out in the materials science landscape due to its unique combination of properties: extreme thermal stability, low surface energy, exceptional chemical inertness, and high theoretical energy density when utilized as a cathode material in lithium primary batteries. Graphite fluoride is synthesized in various stoichiometric ratios (typically ranging from CF0.5 to CF1.2), with the specific ratio influencing its electrochemical potential and thermal behavior. This versatility makes it indispensable in sectors demanding peak performance and reliability, where standard materials cannot meet the stringent operational requirements.

The product's primary applications span high-end lithium batteries, specifically Li/(CFx) cells, which are favored for use in implantable medical devices, critical defense systems, deep-well drilling instruments, and smart utility meters due to their unparalleled energy density and extremely long shelf life, often exceeding ten years. Beyond electrochemistry, CFx functions as an exceptional solid lubricant in harsh environments, such as aerospace bearings and high-temperature machinery, reducing friction and wear where oil-based lubricants fail. Moreover, its hydrophobic nature and thermal properties are exploited in protective coatings and specialized composite materials requiring enhanced surface durability and heat dissipation. The inherent stability of CFx ensures functional reliability across wide temperature ranges, providing a significant competitive advantage over conventional materials in demanding industrial and military settings.

Driving factors underpinning the market expansion include the miniaturization trend across the electronics industry, requiring smaller yet more powerful energy sources, and the exponential growth in Industrial Internet of Things (IIoT) sensors and smart grid infrastructure, all dependent on durable, maintenance-free primary power. Furthermore, technological advancements leading to lower-cost and more environmentally sustainable fluorination processes are expected to improve market accessibility and widen the potential application base. The ongoing research into utilizing graphite fluoride derivatives in next-generation solid-state batteries also represents a major long-term driver for sustained market growth. These factors collectively establish CFx as a crucial, high-value material in the global specialty chemicals sector, positioning the market for aggressive revenue generation throughout the forecast period.

Graphite Fluoride Market Executive Summary

The Graphite Fluoride market is undergoing a significant transformation, characterized by robust demand in the high-performance battery sector and increasing technological sophistication in material synthesis. Current business trends indicate a strong focus on vertical integration among key players, securing the supply chain for high-purity graphite and fluorine precursors, which are essential for producing optimal CFx grades for electrochemical applications. Mergers and acquisitions are concentrating expertise in specialized fluorination techniques, aiming to reduce production costs and standardize material quality. Furthermore, substantial R&D investments are channeled towards developing surface-modified CFx materials and exploring alternative production methodologies, such as plasma fluorination, to enhance safety profiles and improve specific energy capacity, addressing the demanding requirements of aerospace and medical sectors.

Regionally, the Asia Pacific (APAC) area, spearheaded by China, Japan, and South Korea, maintains dominance both in manufacturing capacity and consumption, primarily driven by the massive electronics and battery production ecosystems resident in these nations. South Korea and Japan, in particular, lead in the application of high-grade CFx in advanced smart devices and medical electronics. North America and Europe are crucial markets defined by stringent regulatory environments but exhibit high demand from niche, high-value sectors such as defense, aerospace, and advanced energy storage research. These regions prioritize material provenance and sustainability, often favoring suppliers who demonstrate closed-loop fluorine handling and minimized environmental impact throughout the material lifecycle. The strategic regional competition centers on establishing resilient supply lines and achieving superior product differentiation through purity and consistency.

Segment-wise, the battery application category, specifically Li/(CFx) primary cells, remains the dominant revenue generator, fueled by increasing deployments of autonomous sensors and long-life metering systems. Within this segment, the demand for higher purity and controlled particle size distribution (PSD) CFx materials is accelerating, reflecting the shift towards more compact and powerful battery designs. Simultaneously, the solid lubricants segment is experiencing healthy growth, particularly in high-temperature industrial equipment and automotive components where conventional lubricants fail due to extreme operational conditions. Future segment trends are expected to favor materials tailored for specific battery chemistries, including those designed for high-rate pulse discharge applications and ultra-low temperature performance, ensuring sustained segmentation growth across diverse end-use verticals.

AI Impact Analysis on Graphite Fluoride Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Graphite Fluoride Market frequently center on three critical themes: optimizing complex chemical synthesis processes, enhancing supply chain resilience, and accelerating the discovery of novel CFx derivatives with superior performance characteristics. Users are particularly concerned about how AI-driven predictive modeling can minimize variability in the highly sensitive fluorination reaction, which is paramount for achieving the consistent purity levels required for high-end primary batteries. Expectations are high that AI will lead to the creation of 'digital twins' of production lines, allowing for real-time adjustments and minimizing high-cost material waste. Furthermore, demand exists for AI algorithms capable of analyzing vast datasets from electrochemical testing, rapidly iterating on potential material formulations to meet future energy density and safety mandates, thus drastically shortening the traditional R&D cycle in this highly specialized materials sector.

- AI-driven predictive modeling optimizes fluorination parameters (temperature, pressure, gas flow) to maximize yield and material consistency.

- Machine learning algorithms enhance quality control by analyzing spectral data (e.g., XPS, XRD) for real-time defect detection and purity assurance.

- AI facilitates supply chain optimization, predicting demand fluctuations for precursor materials (graphite, fluorine) and mitigating geopolitical risks associated with sourcing.

- Accelerated material informatics utilizes AI to simulate and discover novel CFx structures and composites optimized for solid-state battery applications.

- AI supports predictive maintenance of specialized high-temperature reactors, minimizing downtime and increasing operational safety in hazardous synthesis environments.

DRO & Impact Forces Of Graphite Fluoride Market

The dynamics of the Graphite Fluoride market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the critical Impact Forces determining market trajectory. Key drivers include the ever-increasing global reliance on maintenance-free, long-life primary power sources for critical infrastructure, such as remote monitoring systems, smart meters, and specialized military and aerospace equipment where battery replacement is impractical or prohibitively expensive. The inherent high energy density and longevity of Li/(CFx) batteries position them uniquely to service these demanding applications. Additionally, the growing awareness regarding the benefits of CFx as an advanced solid lubricant in extreme conditions, replacing conventional, less stable alternatives, further propels demand across heavy industry and automotive sectors, particularly in components exposed to high temperatures and pressures.

However, significant restraints temper the market's growth potential. The production of graphite fluoride involves the use of highly corrosive and toxic fluorine gas, necessitating extremely specialized and expensive manufacturing facilities, contributing to high production costs that limit broader commercial adoption. Furthermore, strict regulatory hurdles surrounding the handling, transport, and disposal of fluorine compounds create significant operational and compliance burdens for manufacturers. Supply chain volatility, especially concerning the sourcing of high-purity synthetic graphite, which is a critical precursor, also poses a constraint, potentially leading to price fluctuations and material scarcity, thus complicating long-term procurement strategies for downstream users. These high barriers to entry and operational costs restrict the market primarily to specialized, high-margin applications.

Opportunities for exponential growth are concentrated in the rapid innovation within next-generation battery technology and material science. The utilization of graphite fluoride as a cathode component in advanced solid-state battery architectures is a significant potential growth avenue, offering solutions to improve safety and energy storage capacity beyond current lithium-ion limitations. Moreover, the increasing adoption of CFx in medical implantable devices, where biocompatibility and unparalleled reliability are paramount, provides a high-value niche market opportunity. The development of advanced, surface-modified graphite fluoride composites for thermal management and high-performance friction materials represents a further avenue for diversification, moving beyond electrochemistry into critical structural and functional component applications. Successful navigation of the restraints through process innovation will be critical to capitalizing on these major market opportunities.

Segmentation Analysis

The Graphite Fluoride market is meticulously segmented based on Type, Application, and Grade, reflecting the diverse requirements of end-user industries and the chemical variations inherent in the product. The segmentation by Type primarily differentiates between the material's stoichiometric ratio, namely Monofluoride (CF)n and Subfluoride (C2F)n or lower ratios, each possessing distinct electrochemical properties and surface energy levels. Monofluoride exhibits a higher energy density and is preferentially used in standard long-life primary batteries, whereas lower fluorination ratios are sometimes explored for enhanced discharge rates or specialized lubrication blends. This distinction allows manufacturers to tailor the material properties precisely to specific performance mandates, ensuring optimal product integration.

Segmentation by Application is critical, dominated by the Battery sector (primarily lithium/CFx cells), followed by Solid Lubricants, and Specialized Additives/Coatings. The battery segment is further subdivided based on the end-use device, such as utility metering, medical implants, or military electronics, each imposing unique requirements on energy output and longevity. Conversely, the solid lubricants segment focuses on particle size, thermal stability, and low friction coefficient, serving industrial machinery, aerospace components, and automotive systems operating under extreme stress. The precise specification requirements across these diverse applications necessitate specialized production lines and rigorous quality assurance protocols to maintain consistency.

Finally, segmentation by Grade—often defined by purity level and particle size distribution (PSD)—is becoming increasingly vital. High-purity, ultra-fine CFx grades are mandated for advanced medical and defense applications where electrochemical performance must be flawless and predictable. Standard industrial grades, typically utilized in general lubrication and industrial coatings, have less stringent requirements regarding trace impurities and surface morphology. The market trend indicates a rapid shift towards the higher-purity segment, driven by manufacturers seeking incremental performance gains in highly competitive, sensitive electronic devices. Analyzing these segments provides a clear map of supply and demand dynamics, guiding strategic investment in capacity expansion and product development.

- Type:

- Monofluoride Graphite ((CF)n)

- Subfluoride Graphite (e.g., (C2F)n)

- Mixed Fluorination Grades

- Application:

- Primary Lithium Batteries (Li/(CFx) cells)

- Utility Metering (Smart Meters)

- Medical Devices (Implantable, Monitoring)

- Military and Aerospace Electronics

- IoT and Sensor Networks

- Solid Lubricants

- Industrial Machinery and Bearings

- Aerospace and Defense Components

- Automotive High-Temperature Parts

- Chemical Additives and Coatings

- Thermal Management Materials

- Primary Lithium Batteries (Li/(CFx) cells)

- Grade:

- High Purity Grade (99.5%+)

- Industrial Grade

- Standard Grade

Value Chain Analysis For Graphite Fluoride Market

The value chain for the Graphite Fluoride Market initiates with the upstream procurement of essential raw materials, primarily high-purity graphite (natural flake or synthetic highly-ordered pyrolytic graphite) and elemental fluorine gas. The quality and consistency of the graphite precursor directly dictate the final electrochemical performance of the CFx product, making sourcing and purification of this input material a critical activity. The production of elemental fluorine is an energy-intensive and hazardous process, leading to high barriers to entry for new market participants and concentrating power among a few specialized chemical suppliers. Upstream complexity is a major determinant of production cost and subsequent market price, requiring robust contractual agreements and rigorous quality validation processes to ensure material suitability for specialized applications like medical batteries.

The midstream segment involves the specialized chemical synthesis, predominantly through direct fluorination in custom-designed, corrosion-resistant reactors under precise thermal conditions. This conversion process is the core value-add stage, where graphite is transformed into poly(carbon monofluoride) with specific stoichiometry, particle size, and surface characteristics. Manufacturing complexity requires continuous optimization of reactor design, temperature control, and gas handling to minimize impurity introduction and maximize the desired fluorination ratio, directly impacting the final material's energy density. Leading manufacturers invest heavily in proprietary processing techniques and particle modification technologies (e.g., surface coating, milling) to enhance material homogeneity and functional safety, driving competitive advantage in the high-purity segment.

Downstream activities include the integration of CFx into final products. For batteries, this involves formulation, cathode preparation, and cell assembly by specialized battery manufacturers catering to niche markets (e.g., medical device OEMs or defense contractors). For lubricants, CFx powder is blended with oils or greases, or incorporated into polymer matrices for dry lubrication applications. Distribution channels are highly specialized: direct sales dominate the high-volume battery and aerospace segments, ensuring stringent quality control and proprietary knowledge transfer between supplier and end-user. Indirect distribution, leveraging specialty chemical distributors, is more common for industrial-grade solid lubricants and general chemical additives, requiring expertise in hazardous materials handling and just-in-time logistics. The high-stakes nature of end-applications necessitates tight collaboration across all value chain stages, emphasizing traceability and performance verification.

Graphite Fluoride Market Potential Customers

The potential customer base for the Graphite Fluoride market is highly specialized and technologically demanding, characterized by organizations requiring reliable, high-energy-density power sources or superior performance in extreme mechanical environments. Primary customers are leading manufacturers of specialized lithium primary batteries, particularly those focusing on Li/(CFx) chemistry, which is crucial for applications where maintenance is either impossible or extremely expensive. These include companies supplying smart utility meters, which require multi-year operational lifetimes without battery replacement, and Original Equipment Manufacturers (OEMs) of implantable medical devices (such as pacemakers and neurostimulators), where battery failure is catastrophic and mandates the highest levels of material reliability and purity.

A secondary, yet rapidly growing, customer segment includes the aerospace, defense, and oil & gas exploration industries. Within aerospace and defense, CFx is utilized in power packs for specialized military electronics and missiles, valued for its stability across wide temperature and pressure ranges, ensuring mission critical functionality. Oil & gas companies utilize CFx as a solid lubricant in downhole drilling equipment and sensors, operating deep underground in high-temperature, high-pressure environments where conventional lubricants break down rapidly. These customers prioritize thermal stability, chemical inertness, and resistance to harsh environmental degradation, often demanding customized particle sizes and specific material grades for optimal integration into complex mechanical systems.

Furthermore, specialty chemical formulators and advanced materials companies constitute another significant customer base. These organizations purchase CFx primarily for incorporation into high-performance protective coatings, thermal interface materials, and polymer composites requiring enhanced friction reduction or improved hydrophobicity. The trend towards miniaturization and greater efficiency in electronics cooling systems is driving demand for CFx-based thermal management solutions. These diverse customer needs—ranging from life-critical medical devices to high-stress industrial machinery—underscore the strategic importance of CFx as a specialty material, requiring suppliers to maintain robust R&D capabilities and tailored technical support across varied application domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Million |

| Market Forecast in 2033 | USD 89.1 Million |

| Growth Rate | 9.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sanyo Chemical Industries, Inc., Dai-ichi Kogyo Seiyaku Co., Ltd. (DKS), Solvay S.A., Central Glass Co., Ltd., Advanced Nanotech Lab Co., Ltd., Mitsubishi Chemical Corporation, Showa Denko K.K., Kanto Denka Kogyo Co., Ltd., Fuxin Hongji Chemical Co., Ltd., Nanografi Nano Technology, Time Nano, Graphene Laboratories Inc., ACS Material LLC, Alfa Aesar (Thermo Fisher Scientific), XFNANO, Chemetall (BASF Group), Zibo Nanma Chemical Co., Ltd., Hefei Kaier Nano Material Co., Ltd., American Elements, and Talga Resources Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Graphite Fluoride Market Key Technology Landscape

The technological landscape of the Graphite Fluoride market is dominated by advancements in synthesis methods aimed at achieving higher purity, better control over the stoichiometry (CFx ratio), and optimized particle morphology, which are critical determinants of electrochemical performance. The primary and most widely utilized manufacturing technique remains Direct Fluorination, where elemental fluorine gas reacts with graphite under controlled thermal conditions, typically in rotating kilns or fluidized bed reactors. Recent innovations focus on enhancing reactor design and process controls to ensure uniform fluorination across the entire batch, minimizing undesirable side reactions and maximizing the C:F ratio closer to unity (CF1.0) without compromising the crystalline structure. Controlling the reaction rate and temperature profile is paramount, as slight deviations can lead to materials unsuitable for high-performance battery cathodes, driving significant intellectual property protection around specific temperature-time protocols.

A crucial area of technological development involves surface modification and functionalization techniques. Pure Graphite Fluoride often suffers from poor electronic conductivity, which necessitates mixing it with conductive additives (like carbon black) in battery formulations. Advanced techniques such as plasma treatment, chemical vapor deposition (CVD), and proprietary surface doping are being explored to enhance the intrinsic conductivity of the CFx particle surface while maintaining the high energy density potential of the bulk material. Furthermore, researchers are employing micronization and nano-sizing techniques, including sophisticated jet milling and controlled precipitation, to achieve uniform particle size distribution (PSD). Optimized PSD reduces internal resistance within the battery cell and improves electrode packing density, leading directly to increased capacity and longer cycle life in specialized primary cells designed for high-rate pulsed applications, such as automatic external defibrillators or military transmitters.

Emerging technologies also include the investigation of alternative, potentially safer fluorination routes, such as liquid-phase or electrochemical methods, although these are currently less mature than gas-phase fluorination for industrial scale. Simultaneously, analytical technology plays a vital role; the use of advanced characterization tools like X-ray Photoelectron Spectroscopy (XPS), X-ray Diffraction (XRD), and Raman spectroscopy is essential for accurately confirming the chemical environment, degree of fluorination, and presence of impurities (such as C-O bonds or residual fluorine). Technological innovation in the Graphite Fluoride sector is intrinsically linked to precision manufacturing, where the combination of finely tuned chemical processing, advanced particle engineering, and rigorous analytical verification determines the material’s fitness for sensitive, high-reliability end-use applications.

Regional Highlights

The global Graphite Fluoride market exhibits distinct regional dynamics driven by manufacturing concentration, regulatory frameworks, and sector-specific demand patterns. Asia Pacific (APAC) holds the largest market share and is expected to maintain the highest growth rate throughout the forecast period. This dominance is intrinsically linked to the region’s massive electronics manufacturing base, particularly in South Korea, Japan, and China, which are global leaders in producing consumer electronics, smart meters, and specialized component batteries. Japan, in particular, has historically been a hub for high-quality CFx synthesis and battery cell integration, housing several key global manufacturers. The robust expansion of IoT devices and smart infrastructure deployment across rapidly developing Asian economies fuels the continuous, high-volume demand for reliable primary Li/(CFx) power sources, establishing APAC as the indispensable center of both supply and consumption.

North America represents a high-value, niche market, driven primarily by demand from the defense, aerospace, and advanced medical device sectors. The United States government and its contractors are major consumers of high-purity CFx for long-life batteries used in military communications, surveillance equipment, and specialized defense systems where reliability under extreme conditions is non-negotiable. Furthermore, North America houses leading biomedical device manufacturers who rely on the ultra-reliability and long shelf life of CFx batteries for implantable devices like pacemakers and neurological stimulators. The market here is characterized by high price tolerance but stringent quality assurance requirements and often mandates domestic sourcing or secure supply lines, encouraging localized, high-tech manufacturing capacity dedicated to advanced material grades.

Europe constitutes a mature, sophisticated market with a strong focus on industrial machinery, automotive component manufacturing, and sustainable energy transition. While Europe’s consumption of CFx in high-end solid lubricants for precision industrial machinery is substantial, demand is increasingly shaped by regulatory pressures and the European Green Deal initiatives. There is a growing research interest in utilizing CFx in next-generation sustainable battery technologies, though current market absorption remains lower than APAC. European manufacturers face heightened environmental scrutiny regarding fluorine handling and waste management, pushing regional suppliers toward process innovations that minimize environmental footprint. Latin America and the Middle East & Africa (MEA) represent emerging markets, with demand primarily concentrated in specialized applications such as remote oil and gas monitoring sensors and developing smart grid infrastructure projects, relying heavily on imported, high-performance CFx materials.

- Asia Pacific (APAC): Dominates market share due to large-scale electronics manufacturing (Japan, South Korea, China); highest growth driven by IoT, smart meters, and consumer electronics adoption.

- North America: High-value market segment driven by stringent demand from aerospace, defense (mission-critical power systems), and implantable medical device industries; strong emphasis on quality and domestic supply security.

- Europe: Stable market focused on industrial lubricants and specialized machinery; increasing regulatory emphasis on sustainable battery components and advanced material research aligning with EU environmental standards.

- Latin America and MEA: Emerging demand primarily in resource extraction (oil/gas sensors) and nascent smart utility infrastructure projects requiring imported, specialized power sources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Graphite Fluoride Market.- Sanyo Chemical Industries, Inc.

- Dai-ichi Kogyo Seiyaku Co., Ltd. (DKS)

- Solvay S.A.

- Central Glass Co., Ltd.

- Advanced Nanotech Lab Co., Ltd.

- Mitsubishi Chemical Corporation

- Showa Denko K.K.

- Kanto Denka Kogyo Co., Ltd.

- Fuxin Hongji Chemical Co., Ltd.

- Nanografi Nano Technology

- Time Nano

- Graphene Laboratories Inc.

- ACS Material LLC

- Alfa Aesar (Thermo Fisher Scientific)

- XFNANO

- Chemetall (BASF Group)

- Zibo Nanma Chemical Co., Ltd.

- Hefei Kaier Nano Material Co., Ltd.

- American Elements

- Talga Resources Ltd.

Frequently Asked Questions

Analyze common user questions about the Graphite Fluoride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving the demand for Graphite Fluoride?

The dominant application driving demand for Graphite Fluoride (CFx) is its use as the high-energy cathode material in Li/(CFx) primary lithium batteries. These batteries are valued for their exceptional energy density, wide operating temperature range, and extremely long shelf life, making them essential for smart meters, medical implants, and critical defense systems.

Why is high purity critical for Graphite Fluoride materials?

High purity is paramount, especially for electrochemical applications, because impurities (like residual graphite or carbon-oxygen bonds) severely degrade the battery's performance characteristics, reducing capacity, increasing self-discharge rates, and potentially compromising the safety and reliability required for life-critical or mission-critical devices.

What are the main restraints impacting the growth of the CFx market?

The primary restraints include the high production cost, which stems from the specialized equipment needed for safely handling highly corrosive elemental fluorine gas, and the stringent regulatory complexities associated with manufacturing and transporting hazardous fluorine-based chemical products globally.

How is the Graphite Fluoride market leveraging solid-state battery technology?

The market sees significant opportunity in solid-state battery development, where CFx derivatives can potentially be utilized to create all-solid-state cells. Researchers are investigating CFx to improve interfacial stability, enhance energy density, and address safety concerns inherent in liquid electrolyte systems, positioning it as a key future component.

Which geographical region dominates the consumption and production of Graphite Fluoride?

The Asia Pacific (APAC) region, specifically countries like Japan, South Korea, and China, currently dominates both the production and consumption of Graphite Fluoride, driven by the immense manufacturing volume of advanced electronics, IoT sensors, and high-performance battery systems within the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager