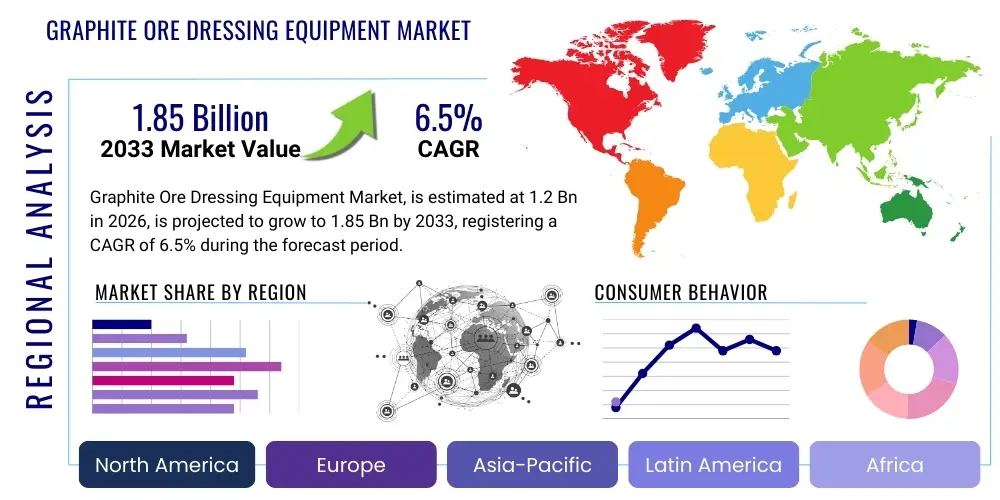

Graphite Ore Dressing Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443101 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Graphite Ore Dressing Equipment Market Size

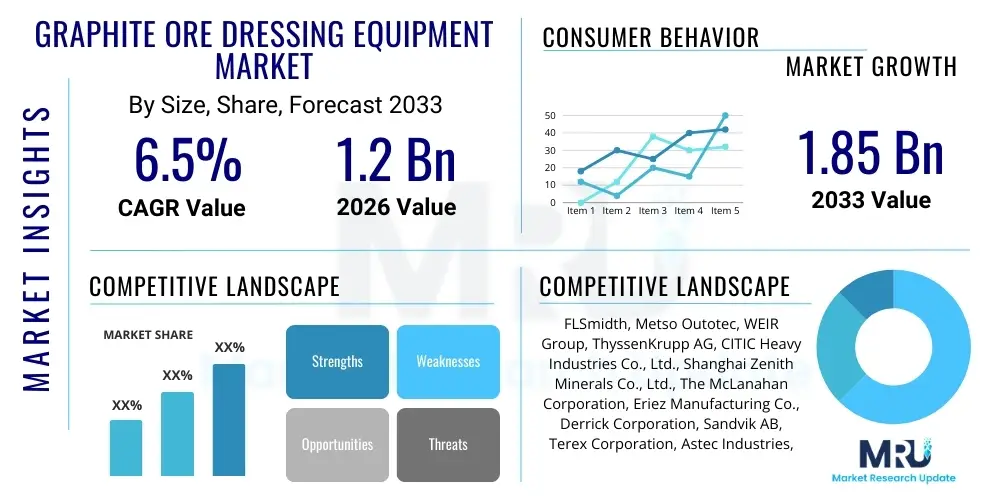

The Graphite Ore Dressing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033. This consistent expansion is predominantly driven by the accelerating global demand for high-purity graphite, particularly from the lithium-ion battery sector, which uses graphite extensively in anode production. Modern dressing techniques are becoming indispensable for achieving the stringent purity standards required for electric vehicle (EV) batteries and advanced nuclear applications, thereby stimulating investment in specialized flotation, grinding, and screening machinery.

The valuation reflects robust expenditure on modernization and capacity expansion in major graphite-producing regions, including China, India, Brazil, and Africa. As natural graphite reserves become more complex and lower grade, the efficiency and selectivity of ore dressing equipment become paramount, driving demand for advanced technologies like ultra-fine grinding mills and high-frequency screening systems. Furthermore, regulatory pressures emphasizing resource efficiency and reduced environmental impact are pushing mining operations toward optimizing their processing chains, leading to continuous procurement cycles for innovative and energy-efficient equipment. The shift towards sustainable mining practices requires capital investment in state-of-the-art separation techniques that minimize chemical usage and water consumption.

Graphite Ore Dressing Equipment Market introduction

The Graphite Ore Dressing Equipment Market encompasses specialized machinery and systems designed for the beneficiation, purification, and size reduction of mined graphite ore. This critical industrial segment ensures that raw graphite, typically extracted from open-pit or underground mines, is processed to achieve the required concentration and particle size distribution necessary for diverse industrial applications. Key products within this market include flotation cells, grinding mills (such as ball mills and vertical roller mills), classifiers, screening equipment, magnetic separators, and dewatering units. The overarching goal of graphite ore dressing is to separate the valuable graphite flakes from gangue minerals, often requiring multiple stages of grinding and selective flotation, particularly when aiming for high-purity concentrates exceeding 99.9% carbon content.

The major applications for processed graphite range significantly, from traditional uses in refractories, lubricants, and foundry facings, to emerging, high-growth sectors such as lithium-ion battery anodes, fuel cells, and nuclear reactors. The surging global adoption of electric vehicles has fundamentally reshaped the demand landscape, placing enormous pressure on the upstream mining and processing sectors to deliver vast quantities of spherical purified graphite (SPG). The benefits derived from advanced ore dressing equipment include significant improvements in recovery rates, higher achievable product purity, enhanced energy efficiency, and lower operational expenditure per tonne of concentrate produced. Effective processing minimizes waste and maximizes the economic viability of complex or low-grade deposits, thus sustaining global supply chains.

Driving factors for this market include the unprecedented growth in the EV and energy storage industries, necessitating billions of dollars in new mining and processing infrastructure globally. Concurrently, technological advancements in mineral processing, such as the introduction of column flotation cells and advanced grinding methodologies, allow producers to handle finer particles more effectively and reduce overall processing time. Furthermore, depletion of easily accessible high-grade ores necessitates more intensive and complex dressing circuits for lower-grade resources, inherently boosting the demand for high-performance separation and classification machinery. Government initiatives supporting critical mineral supply chain security also act as substantial catalysts for market investment, particularly in North America and Europe.

Graphite Ore Dressing Equipment Market Executive Summary

The Graphite Ore Dressing Equipment Market is characterized by intense technological innovation, driven predominantly by the stringent purity requirements of the battery sector and the imperative for sustainable processing. Business trends indicate a strong move toward integrated solutions, where key players offer complete processing plants rather than individual machines, capitalizing on the need for seamless, highly automated operations. This shift promotes long-term contractual relationships and greater reliance on digital integration for predictive maintenance and operational optimization. Furthermore, strategic mergers and acquisitions are observed as major global equipment providers seek to consolidate their technological portfolios, especially in specialized areas like ultra-fine grinding and high-efficiency dewatering. The market dynamic is heavily influenced by large-scale capital investments tied to greenfield battery-grade graphite projects worldwide, assuring sustained procurement activity throughout the forecast period.

Regionally, the Asia Pacific (APAC) region, led by China, dominates the consumption of graphite ore dressing equipment due to its vast installed graphite mining and processing capacity and its central role in the global lithium-ion battery supply chain. However, significant expansion is projected in North America and Europe, supported by governmental efforts like the U.S. Inflation Reduction Act and the European Critical Raw Materials Act, aiming to establish resilient, localized supply chains outside of traditional Asian strongholds. These Western regional trends favor advanced, energy-efficient, and digitally integrated equipment, often necessitating customized solutions to meet varying regulatory and environmental standards. Africa and Latin America are also emerging as key growth areas, with new high-potential projects attracting foreign direct investment in processing infrastructure.

Segmentation analysis highlights the Flotation Machines segment as the cornerstone of the market, given the reliance on froth flotation for graphite separation. Within applications, the Battery Anodes sector is exhibiting the highest growth rate, commanding significant investment in equipment capable of producing spherical purified graphite (SPG). Technology-wise, there is a distinct trend towards dry separation techniques and advanced sensor-based sorting to reduce water consumption and improve pre-concentration efficiency, though wet processing remains essential for final high-purity requirements. Equipment vendors are focusing R&D on wear-resistant materials and modular designs to reduce total cost of ownership (TCO) and facilitate easier deployment in remote mining locations, addressing the logistical challenges inherent in the industry.

AI Impact Analysis on Graphite Ore Dressing Equipment Market

Common user questions regarding AI's impact on graphite ore dressing equipment center primarily on optimization, efficiency gains, and autonomous operations. Users frequently inquire about how AI algorithms can improve the selectivity of flotation circuits, minimize energy consumption in grinding operations, and enable real-time process control to manage variable ore grades effectively. Key concerns include the initial cost of implementing sophisticated sensor arrays and machine learning infrastructure, data security, and the necessity of specialized personnel to manage these advanced systems. The overarching expectation is that AI will transition graphite processing from a highly empirical, operator-dependent system to a precision-engineered, data-driven operation, drastically enhancing recovery rates and reducing environmental footprint.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze vibration, temperature, and acoustic data from grinding mills and flotation motors, predicting potential equipment failures far in advance, thereby minimizing unscheduled downtime and extending operational life.

- Real-time Process Optimization: Implementation of deep learning models to analyze particle size distribution, pulp density, and reagent chemistry in flotation cells, dynamically adjusting operating parameters (air flow, impeller speed, dosage rates) for optimal graphite recovery and purity levels instantly.

- Automated Quality Control: Employing computer vision and spectral analysis coupled with AI to assess concentrate quality in real-time, reducing the reliance on slow laboratory testing and ensuring consistent product specifications, crucial for battery-grade graphite.

- Enhanced Energy Efficiency: AI algorithms optimize the energy consumption of high-power equipment like grinding mills by calculating the optimal grinding curve based on current ore hardness and target particle size, resulting in significant power savings.

- Digital Twin Simulation: Creating virtual replicas of entire dressing plants to simulate different operational scenarios, test new equipment configurations, and train operators, leading to faster commissioning and reduced operational risk before physical deployment.

- Sensor-Based Sorting Improvement: Integration of AI for pattern recognition in sensor-based sorting equipment, allowing more precise classification of run-of-mine ore prior to wet processing, which reduces the volume requiring energy-intensive downstream steps.

DRO & Impact Forces Of Graphite Ore Dressing Equipment Market

The dynamics of the Graphite Ore Dressing Equipment Market are strongly governed by a confluence of economic drivers, regulatory constraints, and technological opportunities, summarized effectively through the DRO framework. The primary driver remains the exponential increase in demand for electric vehicle batteries, which mandates high-volume production of extremely pure graphite, necessitating constant equipment upgrades and capacity additions across the processing value chain. However, the market faces significant restraints, chiefly characterized by the substantial initial capital expenditure required to establish sophisticated dressing plants, coupled with increasing environmental scrutiny regarding water and chemical usage, particularly concerning flotation reagents and tailings management. Opportunities arise from embracing dry processing technologies to address water scarcity, the development of modular and containerized dressing units for flexibility, and the integration of automation and digitalization to optimize resource utilization and reduce operating costs. These forces collectively shape the investment cycles and technological trajectory within the sector.

Key drivers include global government mandates accelerating the transition to renewable energy and sustainable transportation, which directly fuel the battery material supply chain. Furthermore, the increasing complexity and lower grade of newly exploited graphite deposits necessitate more sophisticated and often multi-stage processing circuits, ensuring consistent demand for specialized equipment like ultra-fine grinding mills and advanced classifiers. The need for precise control over particle morphology and surface characteristics, particularly for spherical graphite production, mandates precision engineering in grinding and shaping equipment, presenting a robust long-term demand curve for high-precision machinery manufacturers. The replacement cycle for existing, aging processing facilities in established mining regions also contributes significantly to market resilience.

Conversely, significant barriers persist, including the cyclical nature of commodity prices, which can stall major capital projects when market sentiment shifts negatively. The development and deployment of graphite processing plants are subject to rigorous permitting and environmental approval processes, which are becoming increasingly stringent globally, potentially causing project delays and cost overruns. Furthermore, the specialized nature of the equipment requires expert operators and high maintenance inputs, posing a challenge, particularly for operations in developing regions lacking robust technical infrastructure. Impact forces, which are long-term structural changes, include the inevitable shift towards sustainable processing (minimizing waste and water) and the disruption potential of synthetic graphite, which, although currently higher cost, provides an alternative material stream that could cap long-term natural graphite demand growth if production costs decrease significantly. Nonetheless, the immediate demand pressure from the EV sector currently outweighs these restraining factors, maintaining a positive growth outlook.

Segmentation Analysis

The Graphite Ore Dressing Equipment Market is segmented based on the core function of the machinery (Type), the final industry utilizing the refined graphite (Application), and the scale of the mining operation (Scale). Understanding these segments is crucial for equipment manufacturers to tailor their product offerings, whether focusing on high-volume primary grinding solutions or highly specialized high-purity flotation systems. The Type segmentation reveals where technological spending is concentrated, with grinding and flotation being the most critical and capital-intensive steps. The Application segmentation clearly demonstrates the market dominance and superior growth potential derived from the battery sector compared to traditional industrial uses, influencing R&D priorities towards ultra-purification and spherification processes. Scale segmentation differentiates demand patterns between established industrial mining conglomerates requiring massive, integrated processing plants and smaller, emerging players who prefer modular or mobile solutions, impacting the supply chain and delivery models of equipment vendors.

- Type:

- Flotation Machines (e.g., Column Cells, Mechanical Cells)

- Grinding Mills (e.g., Ball Mills, Vertical Roller Mills, Ultra-fine Mills)

- Screening Equipment (e.g., Vibrating Screens, High-Frequency Screens, Classifiers)

- Magnetic Separators (for removing ferruginous gangue)

- Dewatering Equipment (e.g., Filter Presses, Thickeners)

- Application:

- Battery Anodes (Lithium-ion Batteries)

- Refractories (Steel, Foundry)

- Lubricants and Friction Products

- Expanded Graphite and Graphite Foils

- Other Industrial Uses (Pencils, Electrodes)

- Scale:

- Large-Scale Operations (Processing capacity > 500,000 tonnes/year)

- Small and Medium-Scale Operations (Processing capacity < 500,000 tonnes/year)

Value Chain Analysis For Graphite Ore Dressing Equipment Market

The value chain for Graphite Ore Dressing Equipment begins with upstream suppliers, which include manufacturers of high-grade steel alloys, specialized motors, heavy-duty bearings, and complex electronic control systems essential for constructing resilient mining machinery. This upstream segment is vital, as the operational longevity and efficiency of the dressing equipment depend heavily on the quality and durability of these core components, given the highly abrasive environment of mineral processing. Key equipment providers, such as Metso Outotec and FLSmidth, often manage complex global supply chains to source these specialized inputs while maintaining rigorous quality control and optimizing costs for large-scale production runs. Innovation in this upstream segment focuses on developing wear-resistant linings and energy-efficient motor technologies.

The core of the value chain involves the design, manufacturing, assembly, and sales of the specialized dressing equipment. Distribution channels are typically complex, involving direct sales teams for major, bespoke capital projects (common in the large-scale segment) and a network of authorized regional distributors and agents who handle sales, spare parts, and aftermarket service for standard equipment and smaller operations. Direct channels offer greater control over customer relationships and technical support, which is critical for highly integrated plant installations. Indirect channels, through specialized engineering, procurement, and construction (EPC) firms, also play a crucial role, often integrating the equipment into complete, turnkey mining solutions delivered to the end-user. Aftermarket services, including maintenance contracts, digital monitoring solutions, and the supply of consumable wear parts (liners, screens, flotation reagents), represent a significant and profitable portion of the overall equipment vendor revenue stream.

Downstream analysis focuses on the end-users—the graphite mining and processing companies—who utilize the equipment to produce graphite concentrates. Their demand is directly dictated by the requirements of the final customers: battery manufacturers, refractory producers, and chemical companies. The increasing purity demands, especially from the battery sector, exert pressure upstream, forcing equipment manufacturers to continuously innovate and provide solutions capable of delivering concentrates with 99.9% or higher carbon content. The efficiency of the dressing equipment directly impacts the profitability and competitiveness of the mining company, making purchasing decisions highly technical and long-term. Effective distribution ensures timely delivery and installation, minimizing project development timelines, which is a key competitive differentiator in a fast-moving critical minerals market.

Graphite Ore Dressing Equipment Market Potential Customers

The primary potential customers for Graphite Ore Dressing Equipment are large-scale integrated mining companies and independent mineral processing firms focused exclusively on graphite beneficiation. These customers fall into several categories, predominantly determined by their operational scale and vertical integration level. Global mining giants pursuing diversified critical mineral portfolios represent the segment requiring large, multi-million dollar, fixed-plant installations, demanding high throughput and long-term reliability. A rapidly growing customer base includes junior mining companies and new project developers, often backed by venture capital or state funding, particularly in North America and Europe, who are building new processing capacity specifically tailored for battery-grade material. These entrants often favor modular or phased construction approaches, demanding equipment that is relatively easy to deploy and scale.

Furthermore, established refractory and industrial graphite producers, particularly those located in China, India, and Brazil, constitute a stable customer segment, driving replacement demand and modernization projects aimed at improving energy efficiency and recovery rates from existing lower-grade feedstock. These customers prioritize robustness and low operating costs over extreme purity, contrasting with the battery sector's requirements. Another emerging customer profile involves companies specializing in graphite recycling and secondary processing, who require highly specific equipment, such as fine-particle separators and advanced classification systems, to recover graphite from end-of-life products like spent batteries and industrial waste, representing a future growth area tied to circular economy mandates. Therefore, suppliers must customize their sales strategies based on the customer’s end application and their operational maturity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLSmidth, Metso Outotec, WEIR Group, ThyssenKrupp AG, CITIC Heavy Industries Co., Ltd., Shanghai Zenith Minerals Co., Ltd., The McLanahan Corporation, Eriez Manufacturing Co., Derrick Corporation, Sandvik AB, Terex Corporation, Astec Industries, KHD Humboldt Wedag GmbH, Pengfei Group Co., Ltd., Outotec Oyj (now part of Metso Outotec), Multotec, Tega Industries Ltd., Osborn Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Graphite Ore Dressing Equipment Market Key Technology Landscape

The technology landscape within the Graphite Ore Dressing Equipment Market is rapidly evolving, driven by the dual pressures of achieving ultra-high purity (>99.95% C) required for battery anodes and meeting increasingly stringent sustainability mandates regarding water and energy usage. Traditional processing relies heavily on multiple stages of comminution (grinding) followed by froth flotation, but significant advancements are being made in ultra-fine grinding technologies, such such as tower mills and stirred mills, which are crucial for achieving the necessary liberation of fine graphite flakes without excessive damage to the crystal structure. These advanced mills offer substantially lower energy consumption per tonne compared to conventional ball mills. Furthermore, sophisticated flotation cell designs, particularly large volume column cells, enhance selectivity and efficiency, reducing reagent consumption while maintaining superior recovery rates, critical for maximizing yields from complex ores.

A major area of technological focus is the development and commercialization of dry processing methods, often integrated with advanced sensor-based sorting (SBS) techniques. SBS utilizes technologies like X-ray transmission (XRT) or laser-induced breakdown spectroscopy (LIBS) to identify and reject gangue material at coarse particle sizes before the material enters the wet circuit. This pre-concentration step significantly reduces the mass of material requiring energy-intensive grinding and water-based processing, leading to reduced capital expenditure and lower operating costs, particularly valuable in regions facing water stress. Although dry processing cannot fully replace flotation for the highest purity requirements, its integration as a pre-treatment step represents a critical sustainability innovation.

Furthermore, digitalization and automation are becoming standard technological components. Equipment suppliers are increasingly integrating sophisticated process control systems utilizing artificial intelligence and machine learning to manage complex variables like reagent dosing, pulp level, and air injection rates in real-time. This leads to significantly enhanced operational stability and maximizes concentrate quality consistency. Remote monitoring and diagnostics, facilitated by Industrial Internet of Things (IIoT) sensors, allow for predictive maintenance and optimized throughput across geographically dispersed operations. The convergence of mechanical precision, chemical optimization, and digital control defines the cutting edge of graphite ore dressing technology, aiming for maximum efficiency and minimal environmental footprint.

Regional Highlights

The global demand for graphite processing machinery is geographically concentrated yet rapidly diversifying as strategic global supply chains shift. Asia Pacific (APAC), specifically China, dominates the existing market due to its overwhelming position as the world's leading graphite producer and processor, particularly for the battery anode supply chain. Chinese equipment manufacturers hold a substantial share, serving both domestic and international projects. The high level of industrial activity and continuous modernization of facilities in China ensures robust replacement and expansion demand, especially in purification and spherification equipment necessary for battery-grade material. India and Australia are also emerging strong regional players, driven by significant new mine development and resource nationalization policies encouraging local value addition, thereby increasing equipment procurement.

North America (USA and Canada) is projected to exhibit the fastest growth rate, fueled by substantial government investment and regulatory incentives designed to establish secure, domestic critical mineral supply chains. Projects in regions like Quebec and Alaska are driving demand for advanced, sustainable processing technology, often favoring high-efficiency, environmentally compliant equipment from established Western vendors. European market expansion, centered around new projects in countries like Norway and Sweden, mirrors the North American trend, emphasizing high standards for environmental performance, energy efficiency, and automation. European demand is strongly tied to the development of the continent's gigafactory ecosystem, necessitating locally sourced, highly traceable graphite concentrates.

Latin America, particularly Brazil, which holds massive natural graphite reserves, represents a large volume market for traditional processing equipment, often focused on refractories and industrial grades, though new battery-focused projects are emerging. Africa, rich in vast, untapped flake graphite deposits (Mozambique, Tanzania, Madagascar), is transitioning from being purely a resource exporter to developing local processing capacity. This transition creates significant greenfield opportunities for equipment suppliers, though these markets often prioritize robust, easily maintainable machinery and modular solutions due to logistical and infrastructure challenges. Middle East and Africa (MEA) growth is largely dependent on the maturation of these large-scale mining projects and associated foreign investment flows.

- Asia Pacific (APAC): Market dominance driven by established production capacity in China and rapid expansion in India and Australia, focusing on ultra-fine grinding and purification for lithium-ion battery anodes.

- North America: Highest growth region fueled by strategic governmental mandates (e.g., IRA) aimed at securing domestic supply chains, emphasizing high-tech, automated, and sustainable processing solutions.

- Europe: Strong demand tied to the build-out of EV battery gigafactories, requiring equipment capable of high environmental compliance and purity levels, often sourced via established Western manufacturers.

- Latin America (Brazil): Large potential market with ongoing modernization efforts in traditional graphite processing, alongside new investments in battery-grade production infrastructure.

- Middle East and Africa (MEA): Emerging market driven by major greenfield mining projects in East Africa; demand focused on robust, scalable, and modular dressing plants to overcome infrastructural challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Graphite Ore Dressing Equipment Market, highlighting their product offerings, strategic initiatives, and geographical presence.- FLSmidth

- Metso Outotec

- WEIR Group

- ThyssenKrupp AG

- CITIC Heavy Industries Co., Ltd.

- Shanghai Zenith Minerals Co., Ltd.

- The McLanahan Corporation

- Eriez Manufacturing Co.

- Derrick Corporation

- Sandvik AB

- Terex Corporation

- Astec Industries

- KHD Humboldt Wedag GmbH

- Pengfei Group Co., Ltd.

- Multotec

- Tega Industries Ltd.

- Osborn Equipment

- Shandong Xinhai Mining Technology & Equipment Inc.

- Lanzhou Haiming Mining and Metallurgy Equipment Manufacturing Co., Ltd.

- SBM Mineral Processing GmbH

Frequently Asked Questions

Analyze common user questions about the Graphite Ore Dressing Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand spike for Graphite Ore Dressing Equipment?

The primary driver is the exponential global growth of the electric vehicle (EV) sector, which requires massive quantities of high-purity, spherical purified graphite (SPG) for lithium-ion battery anodes, necessitating significant capital expenditure on new and upgraded processing plants.

How do high-purity requirements influence equipment selection?

Achieving high purity (99.9% C) mandates the use of highly selective equipment, including multi-stage flotation circuits, sophisticated ultra-fine grinding mills (e.g., stirred media detritors), and advanced classification systems to carefully control particle size and morphology.

What role does automation play in modern graphite processing plants?

Automation, leveraging AI and IIoT technologies, is critical for real-time optimization of processes like reagent dosing and pulp density control in flotation, leading to enhanced recovery rates, reduced operating costs, and consistent product quality essential for high-specification end-uses.

What are the key technological alternatives to traditional wet processing methods?

Key technological alternatives and supplementary methods include dry processing and sensor-based sorting (SBS). SBS utilizes optical or X-ray technology to pre-concentrate the ore before wet processing, significantly reducing water and energy consumption downstream, thus improving overall sustainability.

Which geographical region is expected to show the fastest growth in equipment procurement?

North America and Europe are anticipated to exhibit the fastest market growth, driven by substantial strategic investments, government policies like the Inflation Reduction Act, and the establishment of localized battery supply chains aimed at reducing reliance on Asian processing facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager