Graphite Recarburizer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441506 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Graphite Recarburizer Market Size

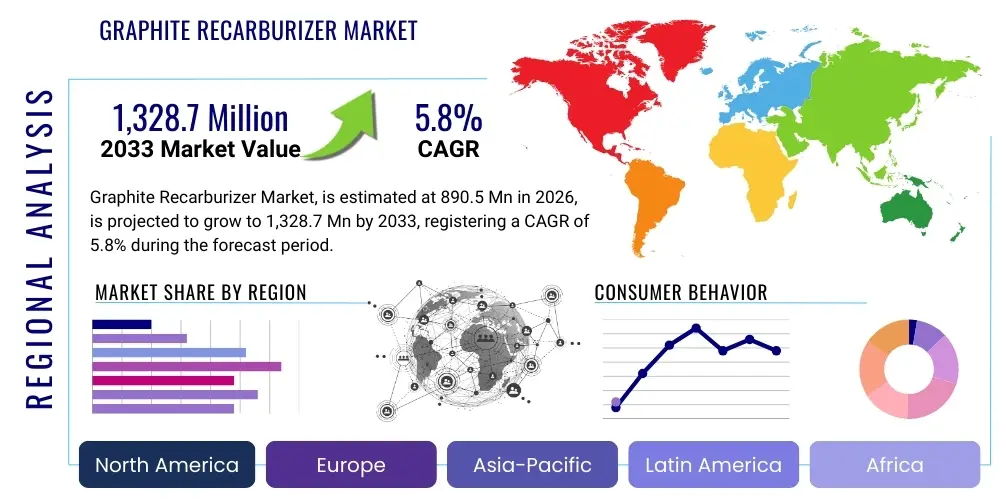

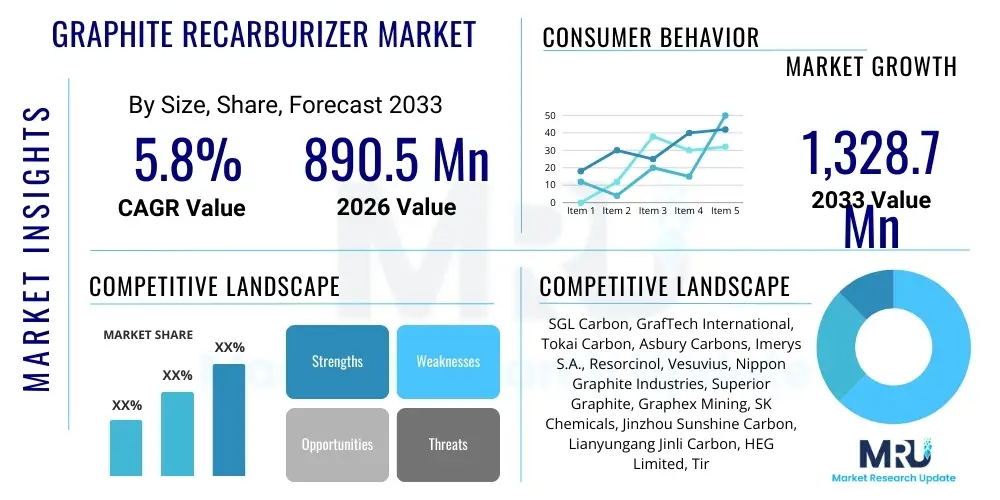

The Graphite Recarburizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 890.5 million in 2026 and is projected to reach USD 1,328.7 million by the end of the forecast period in 2033.

Graphite Recarburizer Market introduction

The Graphite Recarburizer Market encompasses the production, distribution, and consumption of high-carbon content materials primarily used in the steelmaking and foundry industries. Graphite recarburizers, also known as carburizing agents or carbon raisers, are critical additives necessary to adjust the final carbon content in molten iron and steel, ensuring the desired mechanical properties and quality of the final metal product. These materials are typically derived from calcined petroleum coke, graphitized petroleum coke, or synthetic graphite, chosen for their high carbon purity, low ash content, and high rate of dissolution, which minimizes processing time and maximizes metallurgical efficiency. The increasing global demand for high-quality, specialized alloys and the persistent reliance on scrap metal recycling in Electric Arc Furnaces (EAFs) inherently necessitates the addition of recarburizers to compensate for carbon loss during melting and refining processes, positioning this market as indispensable to global metallurgy.

The primary applications of graphite recarburizers span across various stages of metal production, including basic oxygen furnace (BOF) operations, induction furnaces, and particularly EAF steelmaking, where they are essential for slag foaming, electrode protection, and carbon restoration. Beyond traditional steel and iron casting, these materials find specialized uses in manufacturing high-strength cast iron, ductile iron, and certain types of non-ferrous alloys where precise carbon control is paramount. The benefits derived from using premium graphite recarburizers include improved metal cleanliness, reduced energy consumption through optimized melting, and a lower incidence of casting defects, thereby enhancing overall production yields and material consistency. As global infrastructure development accelerates, particularly in Asia Pacific, the foundational demand for steel and iron drives continuous growth and innovation within the recarburizer market.

Driving factors propelling this market include the global trend toward urbanization and subsequent infrastructure investments, which demand large volumes of steel. Furthermore, stringent quality control standards in end-use industries such as automotive and construction necessitate the use of high-purity recarburizers to meet specifications for tensile strength and durability. The ongoing shift in steel production methods, favoring the more environmentally efficient EAF process which heavily relies on recarburization, provides a structural boost to market growth. However, market dynamics are often moderated by fluctuations in raw material pricing, particularly petroleum coke, and the industry’s need to continually adapt to environmental regulations concerning emissions and energy usage during the graphite manufacturing process, demanding constant focus on cost efficiency and product innovation.

Graphite Recarburizer Market Executive Summary

The global Graphite Recarburizer Market is poised for stable expansion, underpinned by robust business trends emphasizing sustainability, high-purity product development, and supply chain optimization. Key industry trends highlight a rising preference for synthetic graphite recarburizers over conventional calcined coke variants, driven by the superior carbon recovery rates and lower impurity levels essential for high-specification steel production, particularly in advanced automotive and aerospace applications. Strategic mergers, acquisitions, and joint ventures focused on securing stable raw material supply (petroleum needle coke) and expanding processing capacity are prominent business strategies employed by market leaders. Furthermore, technological advancements in granulation and packaging are improving handling, reducing dust emissions, and optimizing the dissolution kinetics of recarburizers, adding significant value proposition for foundry and steel plant operators seeking improved workplace health and efficiency.

Regionally, the Asia Pacific (APAC) continues to dominate the global market, fueled by massive steel production capacity in China and India, alongside significant growth in Southeast Asian industrialization and infrastructure projects. APAC acts as both the largest consumer and the primary manufacturing hub for recarburizers, leading to competitive pricing but also demanding stricter environmental compliance locally. North America and Europe, while having lower absolute volume growth due to mature steel industries, exhibit high demand for premium, ultra-low sulfur graphite products to comply with stringent environmental standards and produce specialized, high-grade alloys. These developed regions are focusing on automation in material handling and innovative supply logistics to maintain efficiency despite higher operating costs, showcasing a trend toward specialization rather than volume expansion.

Segmentation trends indicate that the synthetic graphite recarburizer segment is experiencing the fastest growth, largely due to its high carbon content (typically >98%) and consistent quality, making it the preferred choice for sophisticated metal applications requiring precise chemical control. Application-wise, the Electric Arc Furnace (EAF) steelmaking segment remains the largest consumer, benefiting from the EAF process's reliance on carbon injection for chemical heating and slag management. Within end-user segments, the automotive sector, driven by the shift towards lighter and stronger chassis materials, continues to push demand for higher quality and consistency in cast components. The market structure thus reflects a bifurcated demand: bulk quantities of cost-effective calcined coke recarburizers for foundational steel, and specialized, high-ppurity synthetic products for critical, value-added applications across machinery and transportation.

AI Impact Analysis on Graphite Recarburizer Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Graphite Recarburizer Market primarily center on three areas: optimizing consumption rates and logistics, improving raw material quality prediction, and enhancing production efficiency within graphite manufacturing facilities. Users are keen to understand how AI-driven predictive maintenance can minimize downtime in high-temperature calcination and graphitization processes, which are energy-intensive and critical to product quality. Additionally, significant interest revolves around using machine learning algorithms to analyze complex molten metal chemistry in real-time within foundries, allowing for ultra-precise, just-in-time recarburizer additions, thereby minimizing material waste and ensuring exact metallurgical specifications are met, addressing the industry's perennial concern regarding carbon yield variability and consumption control.

The integration of AI and machine learning into the supply chain management of recarburizers promises substantial operational improvements. AI models can effectively predict fluctuations in the price and availability of raw materials like petroleum coke and natural graphite based on geopolitical, energy, and freight market data, enabling procurement teams to execute optimized hedging strategies and ensure cost stability. Furthermore, in the foundry environment, sensors integrated with molten metal analysis tools, coupled with AI processing, can calculate the precise amount, particle size, and required injection depth of the recarburizer needed to achieve the target carbon level, significantly reducing trial-and-error processes and improving batch consistency. This analytical capability transforms recarburizer usage from a reactive measure to a proactive, data-driven input, ensuring maximum utilization of high-cost, high-purity materials.

Although the manufacturing process of the graphite material itself remains largely mechanical and thermal, AI offers avenues for optimizing energy consumption, which is a major cost component. By analyzing historical temperature data, material flow rates, and furnace efficiency metrics, AI systems can fine-tune heating cycles during graphitization, leading to reduced overall energy expenditure and a smaller carbon footprint per unit of production. This technological adoption, while nascent in some segments of the recarburizer manufacturing industry, is becoming a decisive factor for large steel and foundry groups when selecting preferred suppliers, prioritizing those that demonstrate data integration capabilities and a commitment to operational excellence driven by advanced analytics and process optimization.

- AI-driven optimization of recarburizer injection rates in Electric Arc Furnaces (EAFs) to achieve superior carbon recovery.

- Predictive maintenance schedules for high-temperature graphitization kilns, reducing unexpected downtime and operational costs.

- Machine learning analysis of raw material sourcing data to forecast petroleum coke quality and price volatility.

- Improved supply chain logistics and inventory management using AI to match production capacity with variable demand from foundries.

- Enhanced quality control through image processing and sensor data analysis, ensuring uniform particle size and carbon purity of the final product.

- Development of smart recarburizer blends based on AI analysis of specific alloy requirements and thermal modeling.

DRO & Impact Forces Of Graphite Recarburizer Market

The Graphite Recarburizer Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that define its trajectory. Key drivers include the exponential growth in global steel production, particularly in emerging economies, alongside the structural shift towards EAF steelmaking, which inherently requires precise carbon addition due to the high use of scrap metal. The opportunity landscape is vast, centered on technological advancements in synthetic graphite production, which allow for customized, high-performance products catering to specialized alloy markets, and the push for 'green' recarburizers derived from bio-sources or recycled materials. However, growth is restrained by significant volatility in the cost of crucial raw materials, such as imported needle coke, and the increasing regulatory scrutiny on carbon emissions from the energy-intensive graphitization process, forcing manufacturers to invest heavily in efficiency and environmental compliance to maintain market competitiveness and operational viability.

Drivers: The persistent global urbanization trend necessitates massive infrastructure development, increasing the demand for foundational materials like steel and cast iron, directly bolstering the need for recarburizers. Foundries are increasingly focused on producing high-strength, lightweight components for the automotive sector, demanding high-purity, ultra-low sulfur recarburizers to meet stringent material specifications and achieve superior mechanical properties. The economic benefits derived from using premium recarburizers, such as reduced energy consumption during melting, improved metal quality consistency, and faster dissolution rates compared to lower-grade alternatives, further cement their essential role in efficient modern metallurgy. Furthermore, the recovery and growth in capital investment in machinery manufacturing globally, post-pandemic, contributes significantly to sustained demand.

Restraints: The primary constraint is the price instability and supply chain fragility associated with high-quality carbon sources, particularly needle coke, which is often tied to the volatile global oil and gas markets. Additionally, the energy consumption required for the graphitization process (which can reach temperatures exceeding 3000°C) results in high operating costs and significant greenhouse gas emissions, placing manufacturers under pressure to find more sustainable and cost-effective production methods. Market saturation in certain mature Western markets, coupled with intense competition from Chinese producers offering lower-cost calcined variants, limits pricing power for premium producers. Finally, the technical challenge of ensuring consistent particle size and uniform carbon recovery rate across large batches remains a limiting factor for product standardization and widespread adoption of highly specialized grades.

Opportunities: Significant growth opportunities lie in the development and scaling of synthetic graphite recarburizers tailored for specific high-performance applications, such as specialized foundry alloys and advanced powder metallurgy. The push for circular economy practices opens avenues for innovation in deriving recarburizers from recycled graphite waste or biomass, offering an environmentally friendly alternative that bypasses traditional petroleum coke reliance. Expansion into emerging markets in Southeast Asia, Africa, and Latin America, where industrialization is rapidly increasing steel and casting demand, provides new geographical revenue streams. Furthermore, integrating smart sensing and AI technologies into recarburizer usage protocols within steel plants presents a substantial opportunity for vendors to offer value-added digital services alongside their physical product, enhancing customer stickiness and operational efficiency for end-users.

Segmentation Analysis

The Graphite Recarburizer Market is meticulously segmented based on product type, application, and end-user, reflecting the diverse needs of the metallurgical industry globally. Product segmentation distinguishes between synthetic, natural, and semi-graphitized recarburizers, with synthetic grades leading in terms of growth due to their superior purity and consistency demanded by high-end applications. The heterogeneity in raw material availability and pricing means that foundries often select a mix of recarburizer types to balance cost and performance. Analyzing these segments is crucial for manufacturers to tailor their production processes and marketing strategies, ensuring they address the specific technical requirements of different steel and cast iron production methods worldwide.

Application-based segmentation highlights the distinct operational requirements of various melting processes. Electric Arc Furnaces (EAFs) constitute the largest consumption segment, utilizing recarburizers not only for carbon restoration but also for optimizing slag foaming, which is critical for thermal efficiency and furnace protection. In contrast, induction furnaces and basic oxygen furnaces (BOFs) primarily use recarburizers for precise chemical composition adjustments late in the melting cycle. This distinction mandates specialized grain sizes and dissolution rates tailored for each furnace type. Understanding the relative growth rates of these applications—particularly the increasing market share of EAF technology over BOF in many regions—is paramount for strategic capacity planning and product development focus for recarburizer producers globally.

End-user analysis demonstrates the cyclical nature of demand, heavily influenced by global construction, automotive, and machinery production cycles. The automotive sector, driven by stringent safety and efficiency standards, demands high-purity recarburizers for critical cast components. Construction and infrastructure require large volumes of standard-grade steel, driving the demand for cost-effective calcined coke recarburizers. The machinery and equipment segment, including tools and heavy engineering, requires a balance of quality and volume. These segments provide resilience to the market, as downturns in one sector (e.g., machinery) can sometimes be offset by sustained government spending on infrastructure, highlighting the market’s reliance on diversified industrial output.

- By Product Type:

- Synthetic Graphite Recarburizers

- Calcined Petroleum Coke Recarburizers (CPC)

- Graphitized Petroleum Coke Recarburizers (GPC)

- Natural Graphite Recarburizers

- Semi-Graphitized Recarburizers

- By Application:

- Electric Arc Furnace (EAF) Steelmaking

- Induction Furnace Steelmaking

- Basic Oxygen Furnace (BOF) Steelmaking

- Foundry Applications (Iron Casting)

- By End-User Industry:

- Automotive

- Construction & Infrastructure

- Machinery & Equipment

- Pipes & Fittings

- Others (Aerospace, Consumer Goods)

Value Chain Analysis For Graphite Recarburizer Market

The value chain for the Graphite Recarburizer Market begins with the highly specialized upstream analysis, focusing on the sourcing and processing of core raw materials—primarily high-quality petroleum coke (needle coke) or natural graphite. The upstream phase is characterized by energy-intensive calcination and graphitization processes, where the quality of the input material directly dictates the purity and recovery rate of the final recarburizer product. Securing long-term, stable contracts for needle coke, which is derived from the residual heavy oil of refineries, is critical and often presents a bottleneck due to supply constraints and high price volatility, demanding deep strategic partnerships between recarburizer producers and petroleum processors to mitigate risks and ensure product consistency necessary for downstream operations.

The midstream involves the manufacturing process itself, encompassing crushing, screening, grinding, and specialized thermal treatment to achieve precise particle size distribution and desired carbon content. This stage also includes quality control measures to minimize impurities like sulfur, ash, and volatile matter, which are detrimental to molten metal quality. Distribution channels are varied, incorporating direct sales models for large integrated steel mills (downstream analysis) and indirect sales through specialized industrial distributors and trading houses that cater to smaller foundries and regional metal casters. Direct sales allow for customized product specifications and technical support, while indirect channels provide wider geographical reach and logistical efficiency for standardized products across fragmented markets.

Downstream analysis centers on the utilization of recarburizers by end-users, predominantly steel mills and iron foundries, where the product is a crucial input for metallurgy. The effectiveness of the recarburizer is measured by its carbon recovery yield and dissolution speed in the molten bath. The indirect channel often involves third-party distributors who provide value-added services such as inventory management, smaller batch packaging, and local technical consultation. The overall value chain is highly sensitive to logistical costs given the bulk nature of the product, placing significant emphasis on optimizing freight and storage solutions, particularly in the rapidly growing Asia Pacific region where vast distances and varied infrastructure present constant logistical challenges.

Graphite Recarburizer Market Potential Customers

Potential customers for the Graphite Recarburizer Market are fundamentally defined by the structure and demands of the global metallurgical industry, encompassing entities that require precise carbon content adjustment in molten ferrous metals. The primary and largest customer segment consists of large-scale integrated steel producers operating Electric Arc Furnaces (EAFs) and Basic Oxygen Furnaces (BOFs). EAF operators are particularly dependent, as they process high volumes of steel scrap and require constant carbon compensation and slag foaming agents. These customers demand large volumes, often secured through long-term contracts, prioritizing consistent quality, low impurities (especially sulfur), and reliable bulk delivery logistics to maintain continuous high-volume production schedules.

The second major group includes independent and captive foundries specialized in producing various types of cast iron, including gray iron, ductile iron, and malleable iron castings. These end-users, spanning the automotive, heavy machinery, and pipe manufacturing sectors, often require higher-purity synthetic or graphitized recarburizers to achieve specific microstructure characteristics and mechanical properties in their final products, demanding granular quality control and flexibility in particle size. This segment places a premium on technical support and customized material specifications, as their production runs are often smaller and more specialized than those of mass steel producers, requiring tailored solutions to minimize casting defects.

A growing niche segment of customers includes specialty alloy producers and powder metallurgy companies. These operations, focusing on high-value, low-volume applications for sectors like aerospace and medical devices, require ultra-high-purity recarburizers, sometimes tailored to nanoscale or specific mesh sizes. These customers are less price-sensitive and more focused on absolute purity (>99% carbon) and verifiable trace element analysis. Thus, the potential customer base is highly diversified, ranging from massive, cost-sensitive commodity producers to highly specialized, quality-driven niche manufacturers, necessitating a broad product portfolio from market suppliers to maximize reach and market penetration across the entire metallurgical ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 890.5 Million |

| Market Forecast in 2033 | USD 1,328.7 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGL Carbon, GrafTech International, Tokai Carbon, Asbury Carbons, Imerys S.A., Resorcinol, Vesuvius, Nippon Graphite Industries, Superior Graphite, Graphex Mining, SK Chemicals, Jinzhou Sunshine Carbon, Lianyungang Jinli Carbon, HEG Limited, Tirupati Carbons, OMC Carbon. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Graphite Recarburizer Market Key Technology Landscape

The technological landscape of the Graphite Recarburizer Market is characterized by continuous refinement in thermal processing and raw material preparation, aiming for higher purity, lower sulfur content, and improved dissolution kinetics. A central technological focus is the optimization of the graphitization process, which involves high-temperature thermal treatment (up to 3000°C) to convert amorphous carbon materials into crystalline graphite structure. Innovations in furnace design, particularly the shift toward Acheson or electric resistance furnaces with enhanced insulation and atmospheric control, are crucial for reducing energy consumption and maintaining precise temperature profiles, thereby ensuring consistent product quality while mitigating the high operational costs associated with electricity usage in this highly demanding thermal process.

Another pivotal technological area involves advanced material handling and particle engineering. Manufacturers are increasingly utilizing sophisticated crushing and milling equipment, often incorporating air classification systems, to achieve tightly controlled particle size distributions (PSDs). A consistent and optimized PSD is vital because it directly influences the dissolution rate of the recarburizer in molten metal; finely sized particles dissolve rapidly but increase handling challenges, whereas coarser particles require longer integration time. Technological efforts are concentrated on producing highly dense, low-dust granules that offer the best balance between rapid recovery yield and ease of handling and injection, which is a major factor in reducing environmental impact within the foundry environment.

Furthermore, there is a burgeoning interest in process technologies related to alternative raw materials. As environmental pressures mount, research and development are accelerating in using biomass-derived carbon sources, recycled electrode scraps, and specialized coal tars as precursors for recarburizer production. While these materials often present technical challenges regarding high ash content or non-uniformity, advanced purification and chemical activation techniques are being developed to render them viable, cost-effective, and sustainable substitutes for traditional petroleum coke. The successful scaling of these alternative feedstock technologies will significantly reshape the upstream supply chain and enhance the market's overall resilience against geopolitical risks affecting traditional oil-derived carbon sources, representing a key area of technological differentiation.

Regional Highlights

Regional dynamics are critical to understanding the consumption and production patterns in the Graphite Recarburizer Market, reflecting the distribution of global steelmaking and foundry capacity.

- Asia Pacific (APAC): Dominates the global market, accounting for the largest share in both consumption and production. This dominance is driven primarily by China and India, which are global hubs for steel manufacturing, rapid infrastructure development, and automotive production. The region exhibits high demand for both cost-effective CPC and high-purity synthetic grades, sustained by continuous urbanization and industrialization projects.

- North America: Characterized by a mature steel industry with a high concentration of Electric Arc Furnaces (EAFs). Demand is stable, focusing predominantly on premium, ultra-low sulfur synthetic recarburizers to meet stringent environmental regulations and high-quality specifications for aerospace and high-end automotive parts. Innovation in efficient injection systems is a regional priority.

- Europe: Similar to North America, Europe maintains a stable but mature market, prioritizing sustainability and high-performance products. Strict EU environmental policies drive demand toward graphitized and synthetic products derived from high-quality sources, emphasizing product traceability and consistent quality for specialized machinery and tooling applications.

- Latin America (LATAM): Exhibits moderate growth, primarily centered in Brazil and Mexico, driven by localized automotive manufacturing and domestic infrastructure needs. The market tends to favor cost-efficiency, utilizing a mix of domestic and imported recarburizers, but gradually adopting higher-grade materials as industrial quality standards improve.

- Middle East and Africa (MEA): Represents the smallest market share but shows promising growth potential, particularly in the Gulf Cooperation Council (GCC) states due to planned industrial diversification and large-scale construction projects requiring foundational steel and specialized castings. The region relies heavily on imports and focuses on competitive pricing strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Graphite Recarburizer Market.- SGL Carbon SE

- GrafTech International Ltd.

- Tokai Carbon Co., Ltd.

- Asbury Carbons Inc.

- Imerys S.A.

- Vesuvius plc

- Nippon Graphite Industries, Ltd.

- Superior Graphite Co.

- HEG Limited

- Lianyungang Jinli Carbon Co., Ltd.

- Jinzhou Sunshine Carbon Co., Ltd.

- Tirupati Carbons & Chemicals Pvt. Ltd.

- Graphex Mining Limited

- OMC Carbon Group

- SK Chemicals Co., Ltd.

- Ruitian Carbon Co., Ltd.

- Dalian Bright Carbon Co., Ltd.

- Resorcinol Carbon Co.

- Dura-Bar (A Charter Manufacturing Company)

- Shandong Kenuo Carbon Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Graphite Recarburizer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Synthetic and Graphitized Petroleum Coke (GPC) Recarburizers?

Synthetic graphite recarburizers are typically made from graphitized petroleum coke (GPC) which undergoes high-temperature thermal treatment (>2500°C) to achieve a crystalline structure, resulting in carbon content often exceeding 98.5% and extremely low sulfur levels, making them ideal for high-specification alloys where purity is paramount.

How does the shift toward Electric Arc Furnace (EAF) steelmaking influence the demand for recarburizers?

The increasing adoption of EAF technology significantly boosts recarburizer demand because EAFs primarily rely on recycled scrap steel, which is inherently lower in carbon than pig iron. Recarburizers are essential to restore the necessary carbon content and are crucial for creating slag foam, which improves thermal efficiency and protects the furnace electrodes, driving volume consumption.

What are the key factors driving the price volatility of graphite recarburizers?

Price volatility is primarily driven by fluctuations in the cost and availability of upstream raw materials, particularly high-quality needle coke, which is a refined derivative of petroleum and is thus subject to the dynamics of the global oil and gas markets. Energy costs associated with the extremely high-temperature graphitization process also contribute significantly to the final product cost.

Which geographical region holds the largest market share for Graphite Recarburizers?

The Asia Pacific (APAC) region currently holds the largest market share, fueled by the vast steel production capacity and rapid industrialization, particularly in China and India. APAC dominates both the manufacturing and consumption sides of the global recarburizer market due to sustained infrastructure and automotive industry growth.

What is the importance of particle size distribution (PSD) in high-quality recarburizer selection?

Particle Size Distribution (PSD) is critical as it dictates the dissolution rate and carbon recovery efficiency. Foundries typically require precise, narrow PSD ranges—smaller particles for rapid dissolution in induction furnaces and specialized blends for EAF injection systems—to ensure uniform carbon absorption and minimize material waste and dust generation during handling.

Are there environmentally friendly or sustainable alternatives emerging in the recarburizer market?

Yes, significant research focuses on developing sustainable alternatives, including bio-based carbon sources derived from processed agricultural waste and the utilization of recycled graphite electrode remnants. These sustainable options aim to reduce reliance on petroleum-derived coke and lower the overall carbon footprint of metallurgical processes.

How do impurities like sulfur affect the performance and application of recarburizers?

High levels of impurities, especially sulfur, are detrimental to metal quality, leading to embrittlement, porosity, and reduced mechanical strength, particularly in high-grade steel and ductile iron. Consequently, the demand for ultra-low sulfur synthetic recarburizers is increasing, especially for critical automotive and specialized alloy applications.

What role does automation play in the future consumption of graphite recarburizers?

Automation, particularly through integrated sensor technology and AI-driven control systems, allows foundries to achieve precise, real-time dosing of recarburizers. This minimizes over-consumption, improves carbon yield consistency, and ensures tighter control over alloy chemistry, enhancing operational efficiency and lowering material costs for end-users.

How do manufacturers ensure the consistency and quality of synthetic graphite recarburizers?

Consistency is ensured through rigorous quality control processes starting from raw material selection (high-grade needle coke), followed by stringent monitoring of the thermal profile during graphitization, and final inspection using advanced analysis techniques like X-ray diffraction (XRD) and particle size analysis to confirm purity and crystalline structure.

What is the primary function of recarburizers beyond simply raising the carbon content in steelmaking?

Beyond carbon restoration, recarburizers play a vital role in EAF operations by acting as a fuel source and slag foaming agent. Carbon injected into the slag layer reacts to produce CO gas, which creates a foamy slag blanket, improving heat transfer efficiency, reducing energy consumption, and minimizing damage to the furnace refractories and electrodes.

In which end-user segment is the demand for high-purity synthetic recarburizers most pronounced?

The automotive industry exhibits the most pronounced demand for high-purity synthetic recarburizers. This is driven by the need to produce lighter, stronger, and defect-free cast components (e.g., engine blocks, transmission parts) that meet stringent safety and performance standards requiring extremely precise control over metallurgical structure and minimal sulfur contamination.

What regulatory constraints primarily impact the production of graphite recarburizers globally?

Key regulatory constraints revolve around environmental protection, specifically concerning air quality and energy consumption. Regulations restrict sulfur dioxide (SO2) and nitrogen oxide (NOx) emissions from high-temperature processing, requiring manufacturers to invest in costly flue gas treatment and implement energy-efficient technologies to comply with global environmental standards.

How does the value chain address logistical challenges for bulk recarburizer supply?

The value chain addresses logistical challenges through a combination of strategic regional warehousing, optimized bulk packaging solutions (like large sacks or silo deliveries), and reliance on efficient multimodal transport. For international markets, suppliers often partner with specialized logistics providers to manage customs and ensure timely delivery, crucial due to the product’s high weight-to-value ratio.

What emerging technologies might disrupt the traditional recarburizer market in the next decade?

Potential disruptive technologies include advanced continuous graphitization processes that significantly lower energy consumption, the commercial scaling of high-quality bio-coke derivatives as a stable alternative feedstock, and the widespread adoption of AI-driven optimization software that mandates ultra-precise, potentially smaller-volume usage, reducing overall material consumption per ton of metal.

What is the difference in performance metrics between Calcined Petroleum Coke (CPC) and Graphitized Petroleum Coke (GPC) recarburizers?

CPC is cost-effective with lower carbon purity (typically 96-98%) and higher residual sulfur/ash, suitable for standard steel applications. GPC is produced via further high-temperature processing, offering higher carbon content (>98.5%) and faster dissolution kinetics due to its crystalline structure, making it superior for high-end casting requiring rapid and efficient carbon absorption.

How do global economic cycles, particularly in construction, affect recarburizer demand?

Global economic cycles, especially sustained growth in construction and infrastructure, directly translate into higher demand for foundational steel and cast iron, which are the primary output of the metallurgical industries. This cyclical demand creates corresponding spikes in the need for standard and high-volume recarburizers, linking market health closely to GDP and capital expenditure trends.

Why is low sulfur content so important in recarburizers for ductile iron production?

Ductile iron production is highly sensitive to sulfur, as sulfur counteracts the effect of magnesium inoculants necessary to form spherical graphite nodules, which define ductile iron’s mechanical properties. Therefore, ultra-low sulfur recarburizers are mandatory to ensure the successful formation of ductile structures and prevent the degradation of material strength and elongation characteristics.

Beyond raw material costs, what major operational costs challenge recarburizer manufacturers?

The most significant operational challenges stem from massive energy costs associated with the graphitization process, which requires continuous electrical power at extremely high temperatures. Additionally, the maintenance and replacement of specialized refractory materials within the kilns and furnaces represent substantial, recurring capital expenditure.

What strategic role do key suppliers play in the market?

Key suppliers like SGL Carbon, GrafTech, and Tokai Carbon play a strategic role by investing heavily in R&D to develop proprietary high-purity grades, maintaining global supply chains, and offering specialized technical support. Their financial stability and capacity ensure reliable supply for major integrated steel producers, minimizing operational risks for large-scale customers.

How is the market addressing the issue of dust emissions during recarburizer handling?

Manufacturers are addressing dust emissions by improving granulation technology to produce denser, less friable particles, applying specialized anti-dust coatings, and offering products in specific, optimized packaging formats. Foundries are also implementing automated pneumatic injection systems that significantly reduce airborne dust exposure during the material transfer process.

What is the forecast growth rate for the synthetic recarburizer segment compared to the overall market?

The synthetic recarburizer segment is generally forecast to grow at a rate slightly higher than the overall market CAGR (e.g., 6.5% vs. 5.8%). This accelerated growth is due to the rising global demand for higher-specification alloys and increasing regulatory pressure, which favor the superior purity and consistent performance offered by synthetic products.

What competitive advantages do Chinese manufacturers hold in the recarburizer market?

Chinese manufacturers often hold a competitive advantage due to large-scale production capacities, lower average labor costs, and significant government support, allowing them to offer cost-effective calcined petroleum coke (CPC) and standard graphitized variants at highly competitive prices in the global bulk commodity market.

How does the quality of petroleum coke feedstock impact the final recarburizer grade?

The quality of petroleum coke feedstock, particularly its initial sulfur and metal impurity content, directly determines the maximum purity achievable in the final recarburizer. High-quality needle coke is mandatory for producing ultra-high-purity synthetic graphite recarburizers used in critical applications, as impurities cannot be entirely eliminated during thermal processing.

What is the expected long-term impact of digitalization on recarburizer procurement and usage?

Digitalization will lead to more strategic, data-driven procurement based on predictive models that anticipate commodity price shifts and supply bottlenecks. In usage, digital tools will integrate recarburizer dosing into smart foundry management systems, optimizing inventory, consumption, and ensuring tighter control over final product chemistry.

What is the difference between recarburization and inoculation in foundry practices?

Recarburization is the primary process of adding carbon raisers (recarburizers) to molten metal to meet the target carbon percentage. Inoculation, however, is a secondary treatment involving the addition of specific alloying elements (inoculants) just before pouring, designed to influence the crystallization process and achieve desired microstructural characteristics, such as the formation of graphite flakes or nodules.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager