Graphite Shell and Tubes Heat Exchangers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440920 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Graphite Shell and Tubes Heat Exchangers Market Size

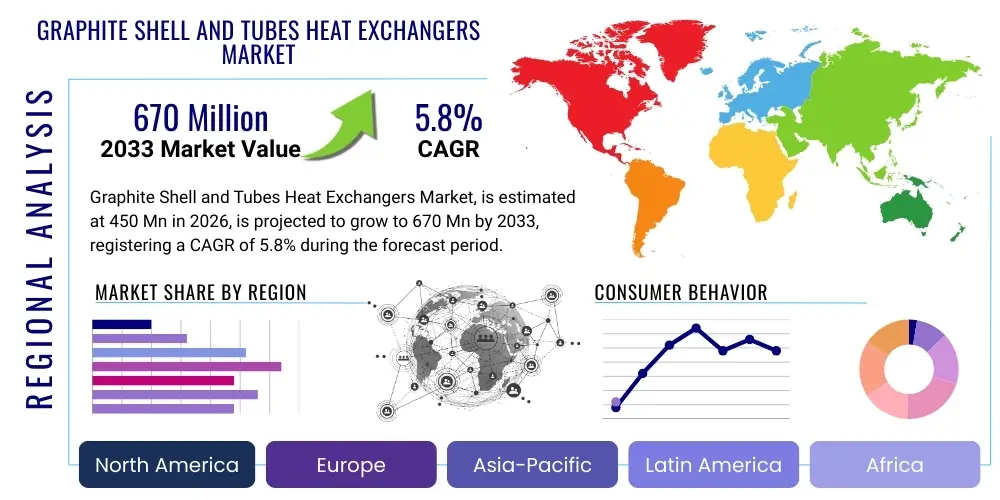

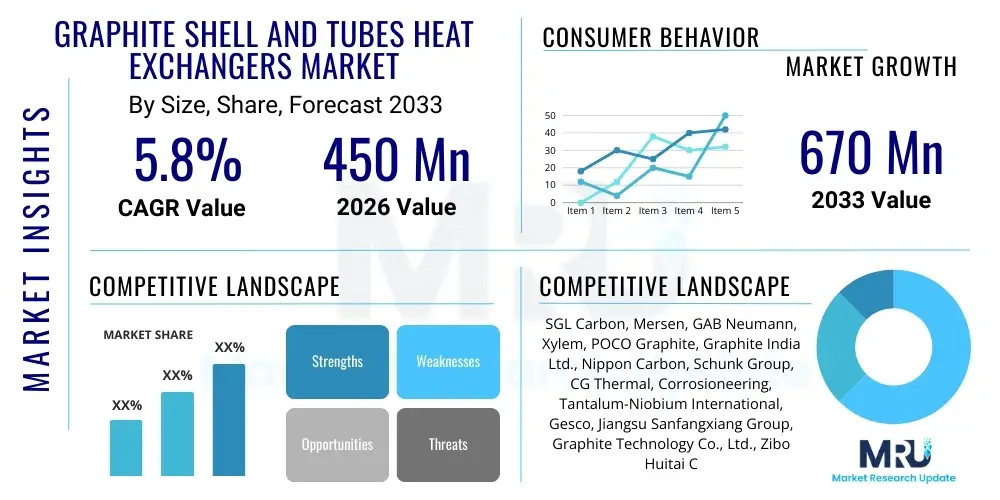

The Graphite Shell and Tubes Heat Exchangers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 670 Million by the end of the forecast period in 2033. This consistent expansion is predominantly driven by the increasing global demand for equipment capable of handling extremely corrosive chemical processes, particularly in the production of mineral acids and specialty chemicals. The inherent resistance of impermeable graphite to a vast range of aggressive media, often exceeding the capabilities of traditional high-grade metals or alloys, solidifies its critical role in sectors requiring high reliability and extended operational lifespan under harsh conditions. Market valuation is significantly influenced by fluctuating raw material prices, primarily high-purity carbon materials and phenolic resin impregnants, alongside complex fabrication techniques necessary to achieve thermal efficiency and structural integrity.

Graphite Shell and Tubes Heat Exchangers Market introduction

Graphite shell and tubes heat exchangers are critical thermal transfer devices utilized extensively in chemical processing industries where resistance to severe corrosion is paramount. These exchangers are fabricated primarily from impervious or impermeable graphite, which is carbon material treated with synthetic resins (like phenolic or PTFE) to eliminate porosity, ensuring fluid separation and mechanical strength. The fundamental design mirrors conventional shell and tube exchangers, comprising a bundle of graphite tubes housed within a graphite shell, facilitating heat transfer between two process fluids without direct contact. The superior corrosion resistance of graphite, especially against hydrochloric acid, sulfuric acid, phosphoric acid, and halogenated compounds, makes them indispensable in operations such as acid cooling, heating, condensation, and evaporation, environments where conventional metallic heat exchangers fail rapidly due to uniform or localized corrosion mechanisms.

Major applications of these specialized heat exchangers span across several high-value industrial segments. The pharmaceutical industry relies on them for sterile and non-contaminating processing, especially when dealing with aggressive solvents and reactants. The fertilizer sector uses them for handling corrosive intermediates, and perhaps most critically, the chlor-alkali industry depends on graphite exchangers for cooling and heating wet chlorine gas and concentrated brine solutions. Their benefits include exceptional chemical inertness across a broad pH range and temperature spectrum, coupled with good thermal conductivity, which, although lower than metals like copper, is efficiently leveraged through optimal design configurations (e.g., thin tube walls, high surface area bundles). The driving factors propelling market growth involve stringent environmental regulations necessitating efficient heat recovery systems, the ongoing expansion of the global chemical manufacturing base, particularly in Asian economies, and the continuous need to replace older, less efficient metallic units that pose significant maintenance liabilities in highly corrosive service.

The operational resilience of graphite heat exchangers, allowing for minimal downtime and reduced replacement frequency compared to exotic alloys, provides a strong economic incentive for long-term investment. While graphite material possesses mechanical limitations, such as brittleness and lower resistance to thermal shock compared to metals, advancements in manufacturing techniques—including improved resin formulations and composite graphite materials—are mitigating these weaknesses. Furthermore, the inherent scaling tendency is often lower in graphite compared to metallic surfaces due due to its non-metallic, smooth surface structure, contributing to sustained thermal performance over extended periods. This combination of chemical superiority and improving mechanical performance ensures that graphite shell and tube exchangers remain the preferred solution for specific, highly demanding chemical engineering applications globally.

Graphite Shell and Tubes Heat Exchangers Market Executive Summary

The Graphite Shell and Tubes Heat Exchangers Market demonstrates robust growth underpinned by significant shifts in global chemical manufacturing practices and regulatory demands for safer, more sustainable industrial processes. Key business trends indicate a strong move toward modular and compact exchanger designs, optimizing footprint efficiency within constrained plant environments. Manufacturers are increasingly focusing on vertical integration, controlling the quality and supply of raw materials (high-purity synthetic carbon) to stabilize input costs and ensure the reliability of the final impermeable product. Furthermore, strategic partnerships and acquisitions are common strategies deployed by major players to expand geographical reach, particularly into rapidly industrializing regions of Asia Pacific, and to incorporate advanced manufacturing technologies, such as improved composite graphite bonding and surface finishing techniques aimed at enhancing erosion resistance and minimizing fouling.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, driven by massive investments in chemical processing, fertilizer production, and specialized polymer manufacturing in countries like China and India. The stringent enforcement of environmental protection standards in Europe and North America drives demand for high-efficiency, non-contaminating equipment, sustaining growth in these mature markets, particularly through replacement cycles and modernization projects in the chlor-alkali and metallurgy sectors. Segment trends reveal that the use of phenolic resin-impregnated graphite exchangers holds the largest market share due to its cost-effectiveness and broad chemical compatibility, though PTFE-impregnated variants are witnessing accelerated adoption in ultra-pure or exceptionally aggressive oxidizing environments where even phenolic resins might degrade over time. The primary application segment remains chemical processing, encompassing the production of basic chemicals, specialty chemicals, and petrochemical derivatives, where these exchangers manage complex exothermic and endothermic reactions safely.

Overall, the market is characterized by a high barrier to entry due to the specialized manufacturing expertise required, encompassing precise machining, specific pressure testing protocols, and the controlled impregnation process necessary to achieve true impermeability and structural soundness. This specialization limits the number of global competitors capable of supplying high-quality, large-scale units. The immediate future suggests a heightened focus on optimizing thermal design parameters using advanced simulation tools, aiming to achieve higher heat transfer coefficients per unit volume while maintaining strict adherence to pressure vessel codes. The market’s resilience is tied directly to the steady, non-cyclical nature of demand from core chemical industries, ensuring sustained incremental expansion despite macroeconomic fluctuations, emphasizing reliability and corrosion mitigation as primary purchasing criteria over initial capital cost.

AI Impact Analysis on Graphite Shell and Tubes Heat Exchangers Market

Analysis of common user questions regarding AI's impact on the Graphite Shell and Tubes Heat Exchangers Market centers predominantly on how artificial intelligence can optimize operational efficiency, enhance predictive maintenance strategies, and accelerate material innovation. Users frequently inquire about the feasibility of AI algorithms to model complex heat transfer dynamics influenced by fouling and corrosion rates, allowing for real-time adjustments and maximizing run time between maintenance shutdowns. Another major theme is the use of machine learning in quality control during the manufacturing process, specifically identifying micro-cracks or imperfect resin impregnation within the graphite blocks or tubes, ensuring the structural integrity vital for high-pressure applications. Furthermore, there is significant user interest in how generative AI and computational material science can rapidly simulate new graphite composite formulations or modified resin systems, aiming to improve mechanical strength, thermal shock resistance, and thermal conductivity without compromising chemical inertness, traditionally a slow and expensive R&D process.

The practical application of AI in this niche market revolves around transitioning from time-based preventative maintenance to condition-based predictive maintenance. By integrating AI models with sensor data capturing pressure drop, temperature gradients, and flow rates within the exchanger, operators can predict the onset of fouling or the exacerbation of internal corrosion before catastrophic failure occurs, significantly extending the life cycle of these expensive assets. This predictive capability minimizes unexpected downtime, which is extremely costly in continuous chemical processes. Moreover, AI aids in optimizing the chemical synthesis recipes and curing cycles during the graphite impregnation phase, refining the manufacturing consistency to meet stringent international standards (e.g., ASME, PED), thereby reducing manufacturing variability and scrap rates associated with achieving high levels of impermeability required for safe operation in hazardous environments.

The long-term influence of AI extends into lifecycle management and energy optimization. AI algorithms can be trained on historical performance data from hundreds of installations to identify subtle operational anomalies invisible to human operators, leading to improvements in energy efficiency by optimizing flow rates and minimizing utility consumption (e.g., cooling water usage). By simulating the entire operational envelope, AI assists chemical plant managers in making critical capital expenditure decisions, justifying the high initial investment in graphite exchangers based on accurate, data-driven projections of enhanced reliability, reduced operational risk, and superior long-term cost of ownership when compared to less resilient alternatives. The integration of digital twins, powered by AI, promises a revolutionary approach to maintenance and operational planning within this highly specialized segment of the industrial equipment market.

- AI-driven Predictive Maintenance: Forecasts fouling rates and corrosion progression using sensor data, minimizing unplanned shutdowns.

- Manufacturing Quality Assurance: Machine learning models detect defects (micro-cracks, incomplete impregnation) during graphite processing.

- Optimized Process Control: Real-time adjustment of operational parameters (flow, temperature) to maintain peak thermal efficiency.

- Material Simulation Acceleration: Generative AI assists R&D in developing advanced, stronger composite graphite materials with enhanced thermal properties.

- Energy Efficiency Management: AI algorithms optimize utility usage based on historical and real-time performance data.

- Digital Twin Implementation: Creation of virtual models for comprehensive lifecycle monitoring and strategic capital planning.

DRO & Impact Forces Of Graphite Shell and Tubes Heat Exchangers Market

The Graphite Shell and Tubes Heat Exchangers Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the market's trajectory and profitability. The primary driving force is the imperative need for equipment that can reliably withstand highly corrosive environments typical of mineral acid production (HCl, H2SO4) and halogen chemistry, where traditional metal alloys fail prematurely or require extremely expensive, exotic material substitutes. The increasing global focus on high-purity processing in the pharmaceutical and fine chemical sectors further fuels demand, as graphite offers inert, non-contaminating surfaces. However, significant restraints impede faster growth, notably the inherent mechanical fragility of graphite, making units susceptible to damage from thermal shock, aggressive handling, or pressure spikes, leading to potentially costly repairs or replacements. Furthermore, the high initial capital expenditure compared to standard metallic exchangers presents a hurdle, especially for smaller enterprises or developing market investments where budget constraints are stringent. Nevertheless, the compelling opportunity lies in expanding applications into new, niche chemical processes requiring extreme corrosion resistance, and leveraging technological advancements, such as manufacturing high-pressure-resistant composite graphite grades, thereby overcoming traditional limitations related to operational pressure ceilings.

The impact forces within this market are substantial and often dictate competitive dynamics and customer purchasing decisions. Reliability and lifecycle cost are the dominant forces: while graphite exchangers have high initial costs, their significantly extended operational life in corrosive environments, minimizing maintenance and downtime, results in a favorable total cost of ownership (TCO) compared to continuously replacing cheaper, less robust metallic options. Regulatory influence is another critical impact force; stricter environmental and safety standards related to chemical plant integrity and containment of hazardous substances drive companies toward reliable, highly specialized equipment like graphite exchangers. Competition from specialized metallic alloys (e.g., Tantalum, Zirconium) and polymeric heat exchangers (for lower temperature/pressure applications) exerts pressure, forcing graphite manufacturers to continuously innovate their designs to maintain a competitive edge in terms of thermal efficiency and mechanical robustness. The supply chain resilience for high-purity carbon materials, influenced by energy costs and geopolitical factors, acts as an external force impacting manufacturing costs and market stability.

Addressing these dynamics requires manufacturers to focus intensely on research and development aimed at improving the material's mechanical properties, perhaps through advanced reinforcement techniques or novel resin impregnation chemistries, thereby mitigating the vulnerability to thermal stress and impact damage. Furthermore, aggressive education campaigns demonstrating the superior long-term TCO and safety benefits over conventional alternatives are essential to overcome the initial capital expenditure resistance. The market must also capitalize on regional shifts, particularly the burgeoning chemical industrial expansion across Southeast Asia and the Middle East, areas undergoing substantial capacity build-outs in chlor-alkali and fertilizer production. Successfully navigating the high cost of raw materials and the complex fabrication requirements, coupled with technological differentiation in design (e.g., improved header/baffle designs for better flow distribution and reduced erosion), will determine the market leadership structure in the forthcoming forecast period.

- Drivers:

- Increasing demand from highly corrosive chemical processing sectors (HCl, H2SO4, HNO3).

- Superior chemical inertness ensures non-contamination in pharmaceutical and food processing.

- Extended operational lifespan and reduced maintenance costs in harsh environments (Favorable Total Cost of Ownership).

- Stringent safety and environmental regulations demanding reliable process containment.

- Restraints:

- High initial capital investment compared to standard metallic heat exchangers.

- Inherent brittleness and susceptibility to mechanical shock and pressure spikes.

- Relatively lower thermal conductivity compared to premium metals (Copper, Aluminum), requiring larger surface areas.

- Complex and specialized manufacturing processes required for impermeability.

- Opportunities:

- Expansion into niche applications like specialized waste heat recovery and flue gas treatment.

- Development of advanced composite graphite materials with improved mechanical strength and pressure ratings.

- Increasing requirement for high-efficiency heat recovery systems across chemical plants.

- Geographical market expansion into rapidly industrializing regions (APAC).

Segmentation Analysis

The Graphite Shell and Tubes Heat Exchangers Market is segmented based on impregnation material type, design type, application, and end-user industry, providing a granular view of market dynamics. Segmentation by impregnation material is crucial, as the resin used directly dictates the operating temperature, pressure limits, and resistance to highly aggressive chemicals, particularly strong oxidizing agents. Phenolic resins historically dominate the market due to their excellent balance of chemical resistance, thermal stability up to approximately 200°C, and cost efficiency. However, Polytetrafluoroethylene (PTFE) and related fluoropolymer-impregnated graphite are gaining traction, especially in processes involving concentrated hydrofluoric acid or extreme temperatures, commanding a higher price point but offering unmatched chemical inertness. The market also sees segmentation based on tube-sheet design, encompassing fixed tube sheet, floating head, and U-tube configurations, each chosen based on specific thermal expansion requirements and maintenance accessibility needs in the application context.

Analyzing the market by end-user industry confirms the chemical processing segment as the largest consumer, primarily encompassing basic inorganic chemical production (acids and alkalis), followed by petrochemical and fertilizer manufacturing, where corrosion resistance against process streams containing chlorides, bromides, and sulfur compounds is non-negotiable. Furthermore, a substantial segment involves the metallurgical industry, specifically in handling pickling solutions and aggressive waste streams generated during metal refining. Segmentation by application type differentiates between condensation (e.g., solvent recovery, steam condensation), cooling (e.g., acid coolers, exothermic reaction control), heating (e.g., process stream preheating), and evaporation, with cooling applications typically demanding the highest volume of graphite exchanger installations due to the pervasive need to manage highly exothermic chemical reactions safely.

These segmentations highlight the highly specialized nature of the graphite heat exchanger market, emphasizing that procurement decisions are driven almost entirely by application-specific material compatibility rather than generalized thermal requirements. The competitive landscape within segments is often intense, particularly in the standard phenolic-impregnated sector, while the niche PTFE-impregnated segment remains highly specialized and less fragmented. Understanding the projected growth rates across these specific segments allows manufacturers to align their R&D efforts—for example, focusing on standardized modular designs for high-volume chemical cooling applications, or developing customized, high-pressure floating head designs for complex petrochemical reactor heat integration tasks—thereby strategically allocating resources to capture the most profitable sub-markets efficiently.

- By Impregnation Material:

- Phenolic Resin Impregnated Graphite

- PTFE/Fluoropolymer Impregnated Graphite

- Other Resins (e.g., Furan)

- By Design Type:

- Fixed Tube Sheet Design

- Floating Head Design

- U-Tube Bundle Design

- By Application:

- Cooling (Acid Coolers, Process Cooling)

- Heating (Preheaters, Reboilers)

- Condensation (Vapor Condensers, Solvent Recovery)

- Evaporation

- By End-User Industry:

- Chemical Processing (Inorganic Chemicals, Specialty Chemicals)

- Pharmaceutical and Fine Chemicals

- Fertilizer Production

- Metallurgy and Pickling Operations

- Petrochemical and Refining

Value Chain Analysis For Graphite Shell and Tubes Heat Exchangers Market

The value chain for Graphite Shell and Tubes Heat Exchangers is characterized by high integration and specialized processing, beginning with the upstream sourcing of high-purity carbon materials. Upstream analysis involves the procurement of synthetic raw carbon (often petroleum coke or pitch coke) which undergoes graphitization at extremely high temperatures to form the basic porous graphite structure. This is a capital-intensive process demanding strict quality control to ensure uniform porosity and density necessary for subsequent impermeabilization. Key players often maintain long-term supply agreements with specialized carbon manufacturers or engage in captive production to ensure quality consistency and cost stability, mitigating the volatility associated with basic commodity markets. The efficiency of the graphitization process directly impacts the performance characteristics, such as thermal conductivity and mechanical resilience, of the final heat exchanger product, making this stage critical to product differentiation and manufacturing cost control.

The midstream segment involves the specialized fabrication, which transforms porous graphite blocks into finished shell and tube components. This manufacturing process includes precision machining (drilling, lathing) of the shell, tubes, and tube sheets, followed by the proprietary impregnation stage, where the machined components are treated with thermosetting resins (phenolic, PTFE) under vacuum and high pressure, followed by controlled curing to achieve impermeability. This stage is proprietary and represents the highest value-add activity in the chain, requiring specialized tooling, cleanroom environments, and expert technical labor. Distribution channels are typically indirect, relying heavily on specialized engineering, procurement, and construction (EPC) firms, or highly technical distributors who possess the necessary engineering expertise to select, size, and integrate the graphite exchangers into complex chemical plant designs. Direct sales are common only for large, custom projects or key accounts involving strategic, repeat purchasers in the major chemical conglomerates.

Downstream analysis focuses on the end-users and the service lifecycle. End-users, primarily chemical, pharmaceutical, and fertilizer plants, require comprehensive technical support, including installation guidance, routine maintenance recommendations (e.g., pressure testing, cleaning procedures), and rapid availability of spare parts (e.g., replacement tubes, gaskets). The longevity and complexity of graphite exchangers necessitate strong aftermarket support; hence, service contracts and replacement parts often represent a significant portion of the total value generated over the product’s lifecycle. The flow of information and feedback from end-users regarding operational performance in specific corrosive environments is critical, directly influencing material selection and design modifications in future product generations. The entire value chain emphasizes quality, compliance with international pressure vessel codes (ASME Boiler and Pressure Vessel Code, PED), and highly specialized technical consultation, distinguishing this market significantly from commodity-level heat exchanger segments.

Graphite Shell and Tubes Heat Exchangers Market Potential Customers

Potential customers for Graphite Shell and Tubes Heat Exchangers are predominantly large-scale industrial facilities characterized by continuous operation and the necessity of handling aggressive, corrosive chemical streams. The foremost buyers are companies within the basic inorganic chemical sector, specifically those producing mineral acids such as hydrochloric acid (HCl), sulfuric acid (H2SO4), and phosphoric acid (H3PO4). In these plants, graphite exchangers are indispensable for cooling highly concentrated acid streams post-synthesis or for use in absorption towers, where metallic equipment would quickly succumb to catastrophic failure. These customers prioritize equipment reliability and minimal maintenance over initial purchase price, given the high costs associated with process downtime and environmental hazards posed by equipment failure in acid service.

Another major cohort of buyers includes companies engaged in the chlor-alkali industry, which produces essential commodities like chlorine, caustic soda, and hydrogen. Graphite heat exchangers are essential for handling wet chlorine gas (which is intensely corrosive) and cooling concentrated brine, ensuring the efficiency and safety of electrochemical processes. Furthermore, the global fertilizer industry, encompassing producers of nitrogenous and phosphatic fertilizers, constitutes a significant customer base. These operations require robust exchangers to handle corrosive intermediates like wet ammonium sulfate, high-concentration phosphoric acid intermediates, and various acidic scrubbing solutions used for emission control, where the graphite's non-metallic nature offers unmatched corrosion protection and longevity.

Finally, the pharmaceutical, fine chemical, and specialty chemical manufacturers represent a high-growth customer segment. These industries often deal with complex, multi-stage synthesis processes involving aggressive, often halogenated, solvents and reactants, frequently requiring non-contaminating surfaces to maintain product purity. Graphite exchangers are favored for their inertness and are used extensively in solvent recovery systems, reaction cooling, and purification steps. The purchasing decisions in this segment are heavily influenced by regulatory compliance (e.g., FDA requirements), ensuring the inertness of process contact materials, making graphite a critical enabler for processes involving highly sensitive or high-value chemical synthesis steps that cannot tolerate even trace metal ion contamination.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 670 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGL Carbon, Mersen, GAB Neumann, Xylem, POCO Graphite, Graphite India Ltd., Nippon Carbon, Schunk Group, CG Thermal, Corrosioneering, Tantalum-Niobium International, Gesco, Jiangsu Sanfangxiang Group, Graphite Technology Co., Ltd., Zibo Huitai Chemical Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Graphite Shell and Tubes Heat Exchangers Market Key Technology Landscape

The technology landscape for Graphite Shell and Tubes Heat Exchangers is focused on incremental improvements in material science, fabrication precision, and thermal design methodologies aimed at enhancing reliability and extending operating parameters, particularly pressure and temperature limits. A critical technological focus is on developing advanced composite graphite materials. Traditional graphite exchangers often struggle with high operational pressure due to the inherent porosity and mechanical fragility of the material structure. Innovations involve integrating high-strength carbon fibers or reinforcing structures within the graphite matrix before the impregnation stage, resulting in composites that exhibit higher burst pressure ratings and significantly improved resistance to thermal cycling and mechanical stress. These advanced materials allow graphite exchangers to compete in applications traditionally dominated by high-grade exotic metal alloys, widening the market potential beyond low-pressure acid service.

Fabrication technology remains paramount, centering on achieving perfect impermeability and high precision in machining. Advanced Computer Numerical Control (CNC) machining is essential for drilling the thousands of precise tube holes in the tube sheets and ensuring smooth fluid flow paths within the shell, minimizing erosion and maximizing heat transfer efficiency. The impregnation process utilizes sophisticated vacuum-pressure cycles and proprietary resin chemistry (including newer high-temperature, chemically inert epoxy or modified phenolic systems) to ensure zero porosity, which is critical for preventing leakage and maintaining the structural integrity necessary for chemical resistance. Furthermore, significant technological effort is dedicated to sealing technology, specifically the design and material selection of gaskets (often PTFE-based or specialized elastomers) for the tube-to-tube-sheet joints, which are critical potential failure points, particularly under differential thermal expansion between the shell and tube bundle materials.

Thermal design optimization utilizes computational fluid dynamics (CFD) and finite element analysis (FEA) to simulate complex fluid flow patterns, temperature distributions, and stress levels under various operating conditions. This enables engineers to create highly efficient, compact designs that achieve the required heat duty with the minimum necessary surface area, reducing material costs and plant footprint. Techniques like optimizing baffle spacing and configuration, modifying tube layout (e.g., triangular pitch versus square pitch), and designing sophisticated inlet/outlet nozzles to minimize local turbulence and erosion are standard practice. The integration of advanced non-destructive testing (NDT) methods, such as ultrasonic inspection and advanced pressure decay testing, further ensures the quality and long-term reliability of the exchangers, crucial for compliance with rigorous international pressure vessel standards and meeting the high reliability expectations of the demanding end-user industries.

Regional Highlights

The global Graphite Shell and Tubes Heat Exchangers market exhibits significant regional variation driven by industrial maturity, regulatory frameworks, and regional investments in chemical processing infrastructure. North America and Europe, representing mature industrial economies, are characterized by stable demand primarily focused on maintenance, replacement, and modernization cycles in established chlor-alkali, petrochemical, and pharmaceutical facilities. The emphasis in these regions is heavily placed on long-term reliability, high-efficiency designs, and adherence to strict safety and environmental standards (e.g., REACH regulations in Europe, OSHA in North America), driving demand for premium, custom-engineered graphite solutions and high-end PTFE-impregnated variants. Regulatory pressure to minimize chemical waste and maximize energy efficiency further sustains the market for specialized heat recovery units in these geographies.

Asia Pacific (APAC) stands out as the primary growth engine for the graphite heat exchanger market. Countries such as China, India, and South Korea are witnessing massive infrastructural expansion in chemical manufacturing, fertilizer production, and specialized materials industries, directly fueling the installation of new capacity. This demand surge is driven by lower operational costs and increasing local consumption of basic and specialty chemicals. While price sensitivity is higher in parts of APAC, the sheer volume of new plant construction requiring corrosion-resistant equipment positions this region to command the largest market share throughout the forecast period. Localized manufacturing bases are also emerging within APAC, seeking to serve regional demands more efficiently and compete on cost and lead time, challenging the dominance of traditional Western suppliers.

Latin America, and the Middle East and Africa (MEA), represent emerging markets with high potential, particularly in resource-rich nations investing heavily in downstream processing capabilities, such as oil refining, natural gas processing, and fertilizer production. The Middle East, in particular, is undertaking major chemical complex developments (e.g., Saudi Arabia, UAE) that require specialized corrosion control equipment to handle complex intermediate streams. However, these regions often face challenges related to project financing and reliance on imported technology, resulting in demand that can be volatile but strategically significant. The focus here is on robust, standardized designs that offer excellent performance under challenging climatic and operational conditions, supported by international EPC firms facilitating technology transfer and installation expertise in complex industrial environments.

- Asia Pacific (APAC): Dominates market growth due to extensive new investments in chemical, fertilizer, and pharmaceutical sectors in China and India. High demand for large-scale, high-capacity units.

- North America: Stable market driven by replacement cycles, stringent environmental compliance, and strong demand from the chlor-alkali and specialty chemical industries. Focus on long-term TCO.

- Europe: Mature market emphasizing technological advancements, energy efficiency, and premium graphite composites. Growth sustained by process modernization and strict regulatory requirements (e.g., Seveso Directive compliance).

- Middle East & Africa (MEA): High potential growth linked to downstream oil and gas investment, particularly in petrochemical and fertilizer manufacturing complexes requiring reliable corrosion management systems.

- Latin America: Gradual recovery and expansion, driven by mining, metallurgy, and local chemical production facilities, prioritizing cost-effective yet reliable solutions for handling aggressive process fluids.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Graphite Shell and Tubes Heat Exchangers Market.- Mersen

- SGL Carbon

- GAB Neumann GmbH

- Graphite India Ltd.

- Nippon Carbon Co., Ltd.

- CG Thermal LLC

- Schunk Group

- Xylem (previously specialized graphite operations)

- Corrosioneering Pvt. Ltd.

- Zibo Huitai Chemical Equipment Co., Ltd.

- POCO Graphite, Inc.

- Sichuan Push Group Co., Ltd.

- Jiangsu Sanfangxiang Group Co., Ltd.

- Graphite Technology Co., Ltd. (GTC)

- Tantalum-Niobium International (offering competing and complementary products)

- Carbone Lorraine (historical legacy operations now part of Mersen)

- A.W. Chesterton Company (focus on seals and components for exchangers)

- Ningbo Keli Chemical Equipment Co., Ltd.

- Hunan Kemi Chemical Industry Co., Ltd.

- Qingdao Jinnuo Chemical Equipment Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Graphite Shell and Tubes Heat Exchangers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of graphite heat exchangers over metallic exchangers?

The primary advantage is superior resistance to corrosion across a wide spectrum of highly aggressive chemicals, including concentrated mineral acids (hydrochloric, sulfuric, phosphoric) and halogenated compounds, where metallic alloys would rapidly fail, ensuring longer operational life and higher process reliability.

What are the typical pressure limitations for standard graphite shell and tubes units?

Standard impermeable graphite exchangers typically operate at lower pressures, usually under 6 to 10 bar (approximately 90 to 150 psi), due to the material's brittleness. However, new composite graphite designs are engineered to handle higher pressures, expanding their application scope into more demanding chemical processes.

Which industries are the largest consumers of graphite heat exchangers globally?

The largest consumers are the Chemical Processing Industry (particularly basic inorganic chemical production like acids and chlor-alkali), followed by the Fertilizer sector, and the Pharmaceutical and Fine Chemicals industries that require non-contaminating process equipment.

How is the impermeability of the graphite achieved in manufacturing?

Impermeability is achieved by impregnating the porous graphite material with thermosetting resins, such as phenolic resins or PTFE/fluoropolymers, under vacuum and high pressure, followed by precise curing. This process fills the natural pores, making the material non-porous and resistant to fluid penetration.

What is the future outlook for graphite heat exchangers considering new exotic metal alloys?

The outlook remains positive because even exotic metals like Tantalum and Zirconium are extremely expensive and often lack the broad chemical resistance of graphite, especially against hydrofluoric acid or concentrated HCl at elevated temperatures. Graphite maintains a specific, indispensable niche in highly specialized, aggressive chemical applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager