Gravel Spreader Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441881 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Gravel Spreader Market Size

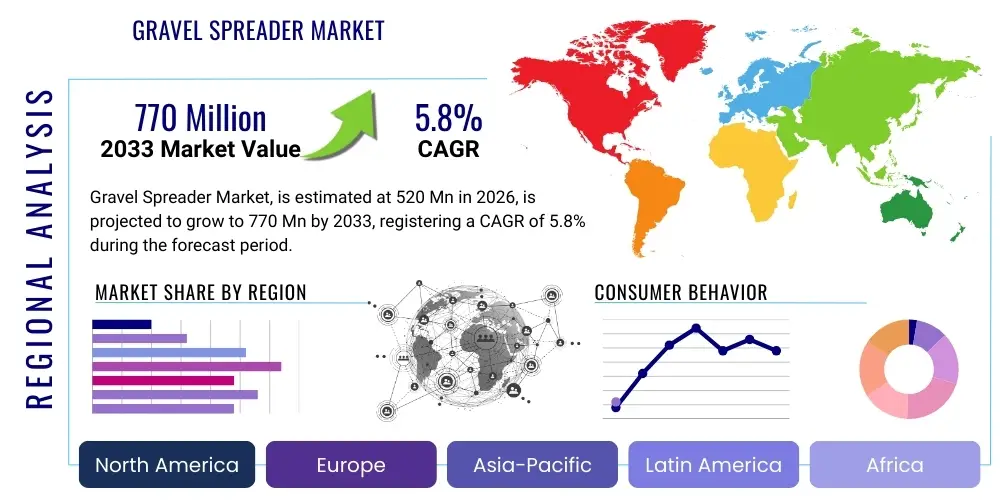

The Gravel Spreader Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $520 Million USD in 2026 and is projected to reach $770 Million USD by the end of the forecast period in 2033. This consistent expansion is primarily fueled by increasing global infrastructure investments, particularly in emerging economies where rural road networks require continuous maintenance and development. The demand for efficient, high-capacity spreading equipment capable of handling various aggregate materials, including gravel, sand, and salt, drives technological advancements and market penetration across diverse applications.

Gravel Spreader Market introduction

The Gravel Spreader Market encompasses the manufacturing, distribution, and utilization of mechanized equipment designed to uniformly distribute aggregate materials such as crushed stone, gravel, sand, and salt over a surface. These specialized machines are critical components in maintaining infrastructure integrity and ensuring public safety, particularly in road construction, pavement patching, shoulder maintenance, and winter road treatments. Gravel spreaders range from small, utility-vehicle-mounted units used for landscaping and minor repairs to large, heavy-duty truck-mounted systems employed in high-volume public works projects and mining operations. The product description centers on robust construction, variable material flow control, and compatibility with various prime movers (trucks, skid steers, tractors) to enhance operational flexibility and material efficiency.

Major applications for gravel spreaders span several vital economic sectors. In civil engineering, they are indispensable for road construction and maintenance, including resurfacing unpaved roads and applying shoulder material to prevent erosion. In agriculture, specialized spreaders are sometimes utilized for field preparation requiring uniform distribution of certain amendments or aggregates. Furthermore, the capacity of these machines to handle abrasive and non-abrasive materials makes them highly valuable in the mining and forestry sectors for maintaining access roads and ensuring stable operating conditions. The primary benefit derived from these devices is the substantial reduction in manual labor required for material handling and the achievement of highly precise, consistent application rates, which minimizes material waste and ensures optimal surface quality.

Driving factors propelling market growth include escalating government investments in transportation infrastructure globally, particularly focused on improving last-mile connectivity and rehabilitating aging roadway systems in developed nations. The increasing adoption of precision agriculture techniques, though a niche segment, also contributes to demand for specialized, controlled-application spreaders. Furthermore, the necessity for robust winter maintenance programs in regions experiencing heavy snowfall mandates the procurement of dual-purpose spreaders capable of handling both gravel/sand for traction and de-icing chemicals. Regulatory compliance concerning road safety and environmental runoff management further encourages the use of advanced spreading technologies that offer precise control over material output.

Gravel Spreader Market Executive Summary

The Gravel Spreader Market is characterized by steady technological evolution, transitioning towards more automated, fuel-efficient, and multi-functional equipment. Business trends indicate a strong move toward hydraulic-driven systems offering superior reliability and variable speed control compared to traditional PTO or chain-driven mechanisms. Key players are increasingly focusing on telematics and integrated controls to provide real-time monitoring of application rates and GPS-based material tracking, enhancing operational transparency and efficiency for end-users like municipal governments and large construction contractors. Mergers, acquisitions, and strategic partnerships, particularly concerning smaller specialized manufacturers, are common strategies employed by market leaders to expand product portfolios and penetrate niche regional markets, especially in Asia Pacific and Latin America, where infrastructure build-out is accelerating rapidly.

Regional trends reveal North America and Europe as mature markets driven primarily by equipment replacement cycles, stringent environmental regulations requiring controlled spreading, and sophisticated winter maintenance requirements. The adoption rate of advanced features like V-box hopper systems and specialized anti-corrosion coatings is highest in these regions. Conversely, the Asia Pacific (APAC) region is poised for the highest growth rate, propelled by massive governmental initiatives focused on rural road development in countries like India and China, alongside significant construction activities linked to urbanization and industrial zones. Latin America and the Middle East & Africa (MEA) present burgeoning opportunities, contingent upon stable political environments and consistent funding for public works projects. The demand in these areas often leans towards rugged, high-capacity, and easy-to-maintain units.

Segment trends highlight the growing preference for truck-mounted spreaders due to their high volume capacity and suitability for large-scale municipal or highway applications. Within the application segment, road construction and maintenance remain the dominant consumers, though the landscaping segment shows accelerating demand for smaller, more maneuverable tailgate and tow-behind units suitable for commercial properties and residential developments. The capacity segmentation reflects a market polarization: high-volume, continuous operation demands large capacity units (over 2000 lbs), while specialized, precision-work requires smaller, controlled-output equipment. Furthermore, material versatility, allowing the spreader to handle dry granular materials, wet aggregates, and brine solutions, is becoming a key differentiating factor across all segments.

AI Impact Analysis on Gravel Spreader Market

User inquiries regarding AI's impact on the Gravel Spreader Market frequently center on autonomous spreading capabilities, predictive maintenance for equipment uptime, and optimization of material usage based on real-time environmental data. Users are concerned about the complexity and cost associated with integrating sophisticated AI control systems into rugged, traditional machinery, but they express high expectations for improved operational efficiency, especially regarding minimizing material waste (a major operating expense) and achieving unparalleled uniformity in spreading across varied terrains. Key themes revolve around machine learning algorithms governing variable rate technology (VRT), using sensor data to adjust spreader output instantly based on road surface conditions, vehicle speed, and weather predictions. Furthermore, digital twin technology and advanced diagnostics powered by AI are anticipated to transform maintenance scheduling, moving from calendar-based checks to predictive fault detection, thereby maximizing the lifespan and utilization of the spreading fleet.

- AI integration facilitates Variable Rate Technology (VRT), optimizing material application density based on GPS mapping and real-time road condition sensing.

- Machine learning algorithms enhance preventative maintenance schedules by analyzing vibration, temperature, and usage patterns, significantly reducing unexpected downtime.

- Autonomous operation capabilities, guided by AI-powered navigation and obstacle detection, are emerging for closed environments (e.g., large construction sites or mining roads).

- Telematics systems powered by AI interpret vast datasets to generate efficiency reports, optimizing fleet routing and fuel consumption during spreading operations.

- AI-driven image recognition tools can assess the uniformity of spread material post-application, providing immediate feedback for calibration and quality control.

DRO & Impact Forces Of Gravel Spreader Market

The Gravel Spreader Market is significantly influenced by a dynamic interplay of growth drivers, constraining factors, and emerging opportunities, all subjected to measurable impact forces. Drivers predominantly include escalating global government spending on civil infrastructure renewal and expansion, particularly the rehabilitation of secondary and tertiary road networks in developing economies. The mandatory requirement for effective winter road maintenance in high-latitude regions acts as a robust seasonal driver for multi-purpose spreaders. Furthermore, technological advancements leading to greater precision, such as improved hydraulic systems and integrated control interfaces, incentivize equipment upgrades among commercial and municipal fleet operators, seeking efficiency gains and reduced material wastage. These positive forces collectively provide a strong upward trajectory for market expansion, particularly in segments focused on precision and capacity.

Restraints, however, pose challenges to this growth trajectory. High initial capital investment required for heavy-duty, advanced spreading equipment can be prohibitive for smaller municipal governments or independent contractors, particularly in cost-sensitive markets. Regulatory hurdles concerning permissible aggregate loads on public roads and fluctuating material costs (gravel, sand, salt) introduce operational volatility and budgetary constraints for end-users. Additionally, the market's reliance on specific cyclical industries, such as construction and mining, means economic downturns can lead to postponed equipment purchasing decisions, creating periodic market stagnation. The complexity of integrating sophisticated control electronics into rugged machinery also necessitates specialized maintenance training, which can be a limiting factor in remote or under-resourced operational environments.

Opportunities are largely concentrated around the proliferation of smart city initiatives, which require infrastructure maintenance equipment to be digitally enabled and highly efficient, driving demand for IoT-integrated spreaders. The growing acceptance of private-public partnerships (PPPs) in infrastructure development opens new avenues for large-scale equipment procurement through leasing or service contracts. Geographically, expansion into untapped rural markets across Southeast Asia and Africa, where basic road networks are under development, presents substantial long-term growth potential. Impact forces, such as the increasing global focus on sustainability, pressure manufacturers to develop spreaders that minimize material contamination and are highly fuel-efficient, influencing design changes towards lightweight materials and optimized engine integration. Regulatory impact focuses on emissions standards for the prime movers and safety standards for spreader operation.

Segmentation Analysis

The Gravel Spreader Market is comprehensively segmented based on Type, Capacity, Application, and Operation Mechanism, allowing for a detailed analysis of specialized demand patterns across various end-user profiles. This segmentation helps identify specific technological trends and geographical market concentrations. The Type segmentation, differentiating between tailgate, tow-behind, and mounted spreaders, reflects the varying scales and mobility requirements of tasks, from small commercial landscaping to major highway maintenance. Capacity segmentation dictates the operational scale, with large units serving high-volume municipal needs and small units catering to precision and maneuverability requirements. Application segments delineate the primary end-use sector, confirming road maintenance as the core revenue generator while recognizing the growing potential in agriculture and specialized civil engineering projects.

The market analysis reveals that the Truck-Mounted segment (a sub-category of Type) is expected to maintain its dominance due to its high volume capacity and suitability for large-scale operations required by Department of Transportation (DOT) agencies. However, the Tow-Behind segment is demonstrating robust growth, driven by its versatility and lower entry cost, making it attractive to smaller contractors and farmers who utilize existing machinery (tractors or trucks) as prime movers. From an operational perspective, hydraulic-driven systems are rapidly replacing mechanically driven units across all segments, attributed to their superior torque, consistent flow rate, and reduced maintenance complexity. This shift represents a crucial technological pivot impacting manufacturer investment and competitive strategies across the segmentation landscape.

- By Type:

- Tailgate Spreaders

- Tow-Behind Spreaders (Pull-Type)

- Mounted Spreaders

- Truck-Mounted

- Skid Steer/Loader Mounted

- Tractor Mounted

- By Capacity:

- Small Capacity (Below 500 lbs)

- Medium Capacity (500 lbs – 2,000 lbs)

- Large Capacity (Above 2,000 lbs)

- By Application:

- Road Construction & Maintenance (Primary Highways, Rural Roads)

- Landscaping & Commercial Property Maintenance

- Agriculture & Farm Infrastructure

- Mining & Forestry Access Road Maintenance

- By Operation Mechanism:

- Hydraulic Driven

- Mechanical (PTO/Chain) Driven

- Electric Driven

Value Chain Analysis For Gravel Spreader Market

The value chain for the Gravel Spreader Market begins with upstream activities, primarily involving the procurement of raw materials such as high-grade steel, specialized plastics for hoppers (especially in lighter models), hydraulic components (pumps, motors, valves), and advanced electronic controls. Key upstream suppliers include steel mills, hydraulic systems manufacturers, and specialized electronics firms providing sensor technology and GPS integration. Manufacturers focus on design, fabrication, assembly, and quality testing, emphasizing ruggedness, corrosion resistance, and precision engineering. Vertical integration, where major manufacturers produce their own hydraulic components or specialized chassis, is rare but provides a competitive edge in quality control and supply chain resilience. Manufacturers heavily invest in R&D to incorporate anti-corrosion materials and VRT (Variable Rate Technology) capabilities.

The distribution channel represents a critical mid-stream phase, encompassing both direct and indirect routes. Direct distribution is common for high-volume, custom-built truck-mounted units sold directly to government agencies (municipalities, state DOTs) or major industrial clients (mining companies). This approach allows for direct negotiation, tailored specifications, and bundled service contracts. Indirect distribution relies heavily on an established network of heavy equipment dealers, farm machinery retailers, and specialized construction rental companies. These intermediaries provide local sales, financing options, maintenance services, and spare parts availability, crucial for market reach, especially for smaller and medium-sized tailgate and tow-behind spreaders.

Downstream activities involve the final end-user application, operation, and subsequent maintenance and disposal. The efficiency of the downstream segment is highly dependent on effective operator training provided by distributors or manufacturers, ensuring the equipment is used optimally to minimize material waste and maximize lifespan. Post-sales service, including the availability of proprietary spare parts and specialized technical support for electronic and hydraulic systems, is a significant factor in brand loyalty and repeat purchases. The movement towards telematics and predictive maintenance is streamlining downstream operations, allowing operators to proactively manage equipment health and schedule servicing before major failures occur, thereby increasing overall fleet utilization rates across construction and municipal sectors.

Gravel Spreader Market Potential Customers

Potential customers for gravel spreaders are broadly categorized into public sector entities responsible for infrastructure management and private commercial enterprises engaged in construction, agriculture, or specialized maintenance services. Public sector bodies, including federal, state, and municipal Departments of Transportation (DOTs), Public Works Departments, and military bases, constitute the largest customer base. These entities require high-capacity, heavy-duty spreaders for maintaining large road networks, especially focusing on applications like shoulder maintenance, chip sealing, and high-volume winter control. Procurement cycles are often driven by governmental budget allocations, infrastructure spending packages, and fleet replacement schedules mandated by safety and emissions standards.

The private commercial sector represents a diverse customer base, including large construction and civil engineering firms that require spreaders for site preparation, temporary road building, and materials handling on massive projects. Furthermore, commercial landscaping companies and property management firms specializing in large campuses, industrial parks, or retail centers purchase smaller, more maneuverable units (tailgate or skid steer mounted) primarily for detailed pavement patching, gravel path maintenance, and commercial snow/ice control during winter months. Agricultural operators, particularly those managing large farms or complex field layouts, occasionally use specialized versions for the uniform application of soil conditioners or fertilizer aggregates, though this segment often overlaps with general farm equipment usage.

A third crucial customer group consists of mining, quarrying, and forestry companies. These heavy industrial users require extremely robust spreaders to maintain private access roads that endure constant heavy vehicle traffic and harsh environmental conditions. The equipment purchased by this segment is typically focused on maximum durability, high payload capacity, and resistance to abrasive materials. Rental equipment companies also act as key buyers, acquiring a broad fleet of spreaders to serve contractors and municipalities needing equipment for short-term projects or supplementing their existing fleets during peak operational periods, such as major road construction seasons or severe winter events. Manufacturers must tailor their sales strategies to address the varying needs of these groups, ranging from long-term government contracts to rapid, short-cycle sales through dealer networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $520 Million USD |

| Market Forecast in 2033 | $770 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henderson Products, Inc., The Boss Snowplow (a division of The Toro Company), Meyer Products LLC, Western Products (a division of Douglas Dynamics), Fisher Engineering (a division of Douglas Dynamics), Swenson Spreader LLC, Flink Company, Highway Equipment Company (Hi-Way), Epoke A/S, Crafco Inc., Everest Equipment Co., Monroe Truck Equipment, Kahlbacher Machinery GmbH, Aebi Schmidt Group, SnowEx (a division of Trynex International), Buyers Products Company, SaltDogg, Tarrant Manufacturing Co., Viking-Cives Inc., Wausau Equipment Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gravel Spreader Market Key Technology Landscape

The technological landscape of the Gravel Spreader Market is increasingly focused on achieving precision, durability, and operational intelligence, moving away from purely mechanical systems. Advanced hydraulics represent a foundational technology, offering superior power transmission, smoother control, and higher reliability than older mechanical drive systems. The shift allows for seamless integration with electronic controls. Furthermore, materials science plays a crucial role; manufacturers are utilizing high-strength, lightweight materials like specialized alloys and engineered polymers in hopper construction to minimize overall equipment weight, thereby increasing payload capacity and reducing fuel consumption of the prime mover. Anti-corrosion treatments, including specialized powder coatings and stainless steel components, are essential innovations driven by the need to resist the abrasive nature of gravel and the corrosive effects of winter road salts (chlorides).

The most transformative technology influencing this market is the adoption of Variable Rate Technology (VRT) coupled with integrated GPS and telematics systems. VRT allows operators to precisely control the volume and spread pattern of aggregate materials based on pre-programmed maps or real-time sensor inputs related to vehicle speed and road geometry. This is vital for maximizing material efficiency, especially in expensive operations like chip sealing or controlled salt application. Telematics provides fleet managers with remote diagnostics, material usage reports, and geo-fencing capabilities, significantly improving asset management and optimizing logistical planning across large operational areas. These digital tools enhance accountability and ensure regulatory compliance regarding material application standards.

Furthermore, innovations in control systems are making spreaders easier to operate and calibrate. Modern control interfaces are typically color touchscreen displays housed within the cab, offering intuitive access to complex functions, diagnostic feedback, and calibration settings. These systems are often standardized to integrate seamlessly with existing vehicle data buses (like CAN bus) and allow for quick adjustments between different materials (e.g., dry gravel, damp sand, or pre-wetted salt). The ongoing research into automation and semi-autonomous spreading capabilities, utilizing LIDAR and computer vision to maintain precise distances and patterns without constant human correction, signifies the future direction of technology, promising enhanced safety and unparalleled accuracy, particularly in environments like tunnels or challenging road terrain.

Regional Highlights

- North America: This region holds a dominant market share, driven primarily by the stringent requirements of winter road maintenance in the U.S. and Canada, necessitating robust, dual-purpose spreaders capable of handling both de-icing chemicals and traction materials like sand/gravel. The U.S. infrastructure spending initiatives, particularly focused on repairing aging state and county roads, ensure a consistent demand for replacement equipment and technological upgrades (e.g., GPS-enabled VRT spreaders). Key demand drivers include high adoption rates of large-capacity truck-mounted and specialized skid steer spreaders for commercial snow removal contractors and public works agencies. The regulatory environment favors high safety standards and advanced telematics integration.

- Europe: Characterized by a highly sophisticated market focused on environmental efficiency and precision spreading. European governments, especially in Nordic and Central European nations, prioritize minimizing salt and aggregate runoff, driving demand for highly calibrated spreaders with wet/dry spreading capabilities and advanced electronic controls. Germany, the UK, and Scandinavia are technological hubs, witnessing early adoption of electric-driven systems and sustainable material application techniques. The emphasis here is on quality, longevity, and low emissions from associated vehicle fleets.

- Asia Pacific (APAC): Expected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid urbanization, industrial expansion, and extensive national programs dedicated to rural road infrastructure development (e.g., India's Bharatmala Project and China's continued infrastructure push). While price sensitivity remains a factor, the sheer volume of construction activity dictates a high demand for basic, rugged, high-capacity tow-behind and truck-mounted spreaders. Manufacturers are strategically partnering with local distributors to establish assembly and service centers to cater to this fast-growing, diverse regional demand.

- Latin America: Market growth is moderate but significant, focused mainly on mining access roads and critical arterial routes. Brazil and Mexico represent the largest markets, where demand is cyclical, tied to commodity prices influencing mining investment and government spending stability. Customers in this region prioritize durability and ease of mechanical repair, often favoring robust, less technologically complex equipment over high-end integrated systems.

- Middle East and Africa (MEA): This region offers emerging opportunities linked to large-scale construction projects (e.g., smart city developments in the GCC nations) and resource extraction industries. Demand in the Middle East is specialized, focusing on dust control and road base preparation in arid environments, while Africa's demand centers on basic infrastructure development for logistics and resource transportation. The MEA market is heavily dependent on imported equipment, making local service support a critical differentiator for global vendors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gravel Spreader Market.- Henderson Products, Inc.

- The Boss Snowplow (a division of The Toro Company)

- Meyer Products LLC

- Western Products (a division of Douglas Dynamics)

- Fisher Engineering (a division of Douglas Dynamics)

- Swenson Spreader LLC

- Flink Company

- Highway Equipment Company (Hi-Way)

- Epoke A/S

- Crafco Inc.

- Everest Equipment Co.

- Monroe Truck Equipment

- Kahlbacher Machinery GmbH

- Aebi Schmidt Group

- SnowEx (a division of Trynex International)

- Buyers Products Company

- SaltDogg

- Tarrant Manufacturing Co.

- Viking-Cives Inc.

- Wausau Equipment Company

Frequently Asked Questions

Analyze common user questions about the Gravel Spreader market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the demand for advanced gravel spreaders with VRT technology?

Demand is driven by the necessity for reduced material waste, increased operational efficiency, and stringent environmental regulations requiring precise control over aggregate and salt application. VRT (Variable Rate Technology) ensures optimal material density, lowering long-term operating costs for municipal and commercial users.

Which segment of the Gravel Spreader Market is expected to witness the highest growth rate through 2033?

The Asia Pacific (APAC) region is projected to experience the highest growth rate, fueled by substantial government investments in rural road connectivity and urban infrastructure expansion across high-growth economies like India and China, necessitating vast amounts of maintenance equipment.

What is the primary difference between hydraulic-driven and mechanical-driven gravel spreaders in terms of performance?

Hydraulic-driven spreaders offer superior control over material flow, constant torque independent of engine speed, and higher reliability with fewer moving parts susceptible to corrosion compared to traditional mechanical (PTO or chain) driven systems, leading to more uniform spreading results.

How is AI impacting the maintenance and operational uptime of gravel spreader fleets?

AI impacts uptime through predictive maintenance analysis, utilizing sensor data to forecast potential component failures (e.g., in hydraulics or bearings) before they occur. This transition from reactive to proactive servicing significantly reduces unexpected downtime and increases overall fleet utilization.

What are the key application areas for large-capacity, truck-mounted gravel spreaders?

Large-capacity, truck-mounted spreaders are primarily used for high-volume public works, including highway shoulder maintenance, extensive chip sealing projects on state and county roads, and heavy-duty winter road control operations managed by governmental Departments of Transportation (DOTs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager