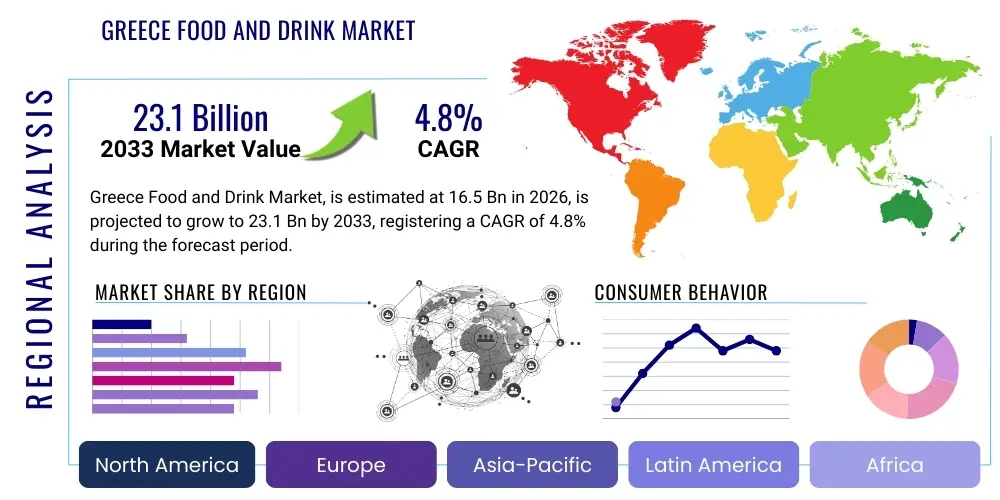

Greece Food and Drink Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443498 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Greece Food and Drink Market Size

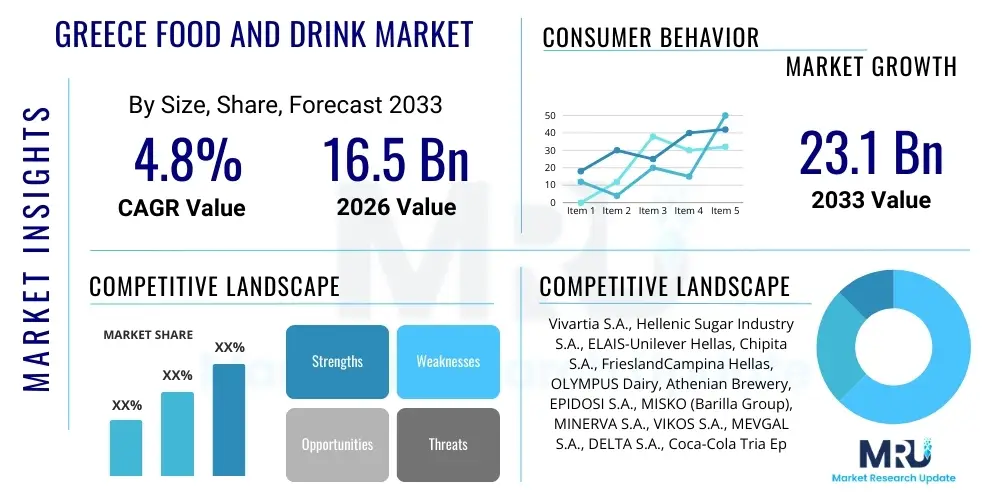

The Greece Food and Drink Market is projected to grow at a Compound Annual Growth Rate (CAGR) of [4.8%] between 2026 and 2033. The market is estimated at [USD 16.5 Billion] in 2026 and is projected to reach [USD 23.1 Billion] by the end of the forecast period in 2033.

Greece Food and Drink Market introduction

The Greece Food and Drink Market is characterized by a strong foundation rooted in the globally recognized Mediterranean diet, combined with increasing modernization across production and distribution channels. This market encompasses a vast array of products, ranging from essential staples like olive oil, dairy, and fresh produce to high-value processed foods, alcoholic beverages (notably wine and ouzo), and non-alcoholic drinks. Major applications include household consumption, sophisticated HoReCa (Hotel, Restaurant, and Catering) sectors heavily influenced by robust tourism, and an expanding export segment leveraging the 'Made in Greece' premium brand identity.

The core benefit derived from this market lies in the perceived high quality, nutritional value, and authenticity associated with Greek products, which appeal strongly to both domestic consumers and international markets seeking healthier alternatives. Driving factors include sustained growth in the tourism industry, which exponentially increases demand for local food service provision; a rising domestic focus on premiumization and organic food consumption; and the ongoing penetration of international retail formats and e-commerce platforms facilitating broader consumer access. Furthermore, EU common agricultural policies and regional development funds play a significant role in supporting agricultural modernization and enhancing production efficiencies, underpinning overall market resilience and expansion.

Product categories dominating the market include fresh fruits and vegetables, robust meat and fish processing industries, and a highly competitive dairy sector, particularly yogurt and cheese. The increasing disposable income, coupled with shifts toward convenience foods driven by urbanization and changing lifestyle dynamics, necessitates continuous product innovation from local producers. Despite economic fluctuations, the intrinsic demand for food and drink, especially high-quality Mediterranean staples, ensures continuous, albeit modulated, market growth throughout the forecast period.

Greece Food and Drink Market Executive Summary

The Greece Food and Drink Market is experiencing a transformative phase, moving towards enhanced technological integration, sustainability, and export orientation. Business trends highlight a significant consolidation among key producers, alongside aggressive investment in digitalization of supply chains to optimize logistics and minimize waste. Local companies are increasingly focusing on niche, high-margin products such as gourmet olive oils, specialized organic produce, and regional Protected Designation of Origin (PDO) items to differentiate themselves from global competitors. Furthermore, there is a clear trend towards fortified and functional foods catering to an aging population and health-conscious youth, demanding transparency in sourcing and production methods.

Regionally, the market dynamics are heavily influenced by population density and tourism inflow. Urban centers like Athens and Thessaloniki drive demand for convenience, international cuisine, and organized retail formats, while island regions and tourist hotspots exhibit seasonal spikes, predominantly driving the HoReCa segment and demand for locally sourced ingredients. Specific agricultural regions, such as Crete for olives and certain mainland areas for dairy, maintain their prominence as production hubs, heavily supported by specialized governmental incentives aimed at preserving agricultural heritage and maximizing yield through sustainable practices. Export growth, particularly within the European Union and emerging Asian markets, continues to be a cornerstone of the market's macroeconomic contribution.

Segment trends underscore the robust performance of the non-alcoholic beverages sector, fueled by demand for functional drinks and bottled water, and the steady resilience of the dairy segment. Distribution channels are undergoing evolution, with e-commerce witnessing accelerated adoption, especially post-2020, challenging the traditional dominance of large supermarket chains. The meat and poultry segment faces increased scrutiny regarding sourcing and ethical farming, prompting producers to invest in advanced traceability systems. Overall, the market is defined by a dual structure: preserving high-quality traditional production while simultaneously adopting modern industrial standards and addressing contemporary consumer demands for health, convenience, and ethical sourcing.

AI Impact Analysis on Greece Food and Drink Market

Common user inquiries regarding AI's influence in the Greece Food and Drink Market primarily revolve around optimizing agricultural productivity, enhancing supply chain transparency, improving food safety protocols, and personalized consumer engagement. Users frequently ask how AI can address labor shortages in farming, whether predictive analytics can minimize inventory waste in retail, and how machine learning might authenticate the origin and quality of premium products like olive oil and feta cheese to combat counterfeiting. The central themes are efficiency gains, traceability improvements necessary for high-value exports, and leveraging data for targeted marketing of specialized regional products, while concerns focus on the high implementation cost for small and medium-sized enterprises (SMEs) prevalent in the Greek agricultural sector.

- AI-driven Precision Agriculture: Optimization of irrigation, fertilization, and pest control through real-time data analysis to maximize yields of key Greek crops (olives, grapes).

- Enhanced Supply Chain Visibility: Use of machine learning algorithms to predict demand fluctuations, optimize logistics routes, and reduce spoilage rates from farm to retail shelf.

- Quality Control and Authenticity: Deployment of AI vision systems for automated sorting, grading of produce, and verifying the Protected Designation of Origin (PDO) status of specific Greek foods.

- Personalized Consumer Experience: AI recommendation engines utilized by e-commerce platforms and retail apps to offer tailored Greek food and beverage selections based on dietary restrictions and preferences.

- Predictive Maintenance in Processing: Implementation of sensors and AI models in food processing plants to foresee equipment failure, minimizing downtime and maintaining high safety standards.

- Labor Efficiency: Use of robotics and automated systems, guided by AI, to address seasonal labor requirements in harvesting and packaging operations.

DRO & Impact Forces Of Greece Food and Drink Market

The Greece Food and Drink Market is powerfully shaped by strong external and internal forces, including pivotal growth drivers like the relentless expansion of the tourism sector, which fundamentally underpins demand for domestic HoReCa services and localized food experiences. Furthermore, the global trend towards healthier eating and the widespread recognition of the Mediterranean diet provide a substantial advantage, driving international demand and premium pricing for high-quality Greek staples. However, the market faces significant restraints, primarily stemming from high energy costs, fragmented supply chains often characterized by small-scale producers, and the persistent challenge of capital access for necessary technological upgrades and infrastructure modernization. These constraints inhibit economies of scale and often make Greek products less price-competitive in global commodity markets.

Opportunities abound in leveraging Greece’s vast agricultural biodiversity to develop novel, high-value functional foods and niche organic products that cater to specialized dietary needs. Significant growth pathways exist in digitizing the distribution ecosystem, utilizing e-commerce and direct-to-consumer models to bypass traditional, sometimes inefficient, wholesale channels. Moreover, strategic investment in sustainable farming and ‘circular economy’ initiatives offers chances to reduce environmental impact, comply with stricter EU environmental mandates, and enhance brand reputation, appealing directly to environmentally conscious global consumers. The regulatory environment, although strict (EU standards), presents an opportunity for certified producers to guarantee safety and quality, acting as a competitive barrier against non-compliant international imports.

The key impact forces operational within this market include technological disruption, manifesting in smart farming and advanced processing automation; regulatory shifts, particularly changes in EU agricultural subsidies and labeling laws; and macroeconomic volatility, influencing consumer spending and commodity prices. Geopolitical stability and international trade agreements dictate access to export markets, while demographic changes—both domestic aging and immigration patterns—affect labor availability and local consumption profiles. These forces collectively necessitate continuous adaptation, requiring Greek businesses to invest in resilient supply chain solutions and adopt a proactive stance toward innovation to sustain long-term profitability.

Segmentation Analysis

The Greece Food and Drink Market is extensively segmented based on key criteria including the type of product consumed, the nature of the processing required, and the channels through which these products reach the consumer. The primary product segment differentiates between fresh products (unprocessed fruits, vegetables, meat) and processed/packaged foods, reflecting the varying degrees of industrial activity involved. Furthermore, segmentation by distribution channel is crucial, distinguishing between organized retail (supermarkets, hypermarkets), HoReCa (hospitality), and the rapidly growing digital channels (e-commerce). This segmentation offers granular insights into consumer preferences and identifies areas of high growth potential, particularly within high-margin specialty items and health-focused categories.

- Product Type:

- Dairy Products (Yogurt, Cheese, Milk)

- Bakery and Confectionery

- Meat, Poultry, and Seafood

- Fruits and Vegetables (Fresh and Processed)

- Oils and Fats (Olive Oil, Sunflower Oil)

- Beverages (Alcoholic, Non-Alcoholic, Juices)

- Processed and Packaged Foods (Ready-to-Eat, Canned Goods)

- Snacks and Cereals

- Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores and Traditional Grocery Stores

- HORECA (Hotels, Restaurants, Cafes)

- E-commerce and Online Retail

- Specialty Food Stores

- Nature:

- Conventional

- Organic

Value Chain Analysis For Greece Food and Drink Market

The value chain for the Greece Food and Drink Market begins with the Upstream Analysis, which focuses on the sourcing of raw materials. This stage is dominated by small-to-medium sized agricultural holdings (SMEs) for fresh produce and livestock, alongside specialized firms providing seeds, feed, fertilizers, and agricultural technology. The critical challenge in this stage is the consolidation of fragmented input providers to achieve volume consistency and quality standardization necessary for large-scale processing and export. Investment in primary processing (e.g., grain mills, basic dairy processing) is vital here, linking raw material quality directly to final product specifications mandated by EU regulations.

Midstream activities encompass the intensive processing, manufacturing, and packaging of food and drink items. This involves large-scale dairy plants, advanced bottling facilities for water and beverages, and sophisticated packaging technologies to extend shelf life and ensure traceability. Distribution channels, both direct and indirect, represent the key conduit to the market. Direct channels involve farm-to-table models and local farmers' markets, catering to niche, quality-conscious segments. Indirect channels are far more dominant, relying heavily on third-party logistics (3PL) providers to move products from centralized processing hubs to organized retail (supermarkets) and the vast network of HoReCa establishments, particularly concentrated in tourist areas.

Downstream analysis centers on retail, consumption, and export. The market is primarily served by major domestic and international supermarket chains which dictate pricing and promotional strategies. Exports play an increasing role, utilizing specialized distributors and agents focused on penetrating key international markets, particularly in Europe, North America, and increasingly Asia, driven by the strong brand equity of the Mediterranean diet. Effective value chain management requires robust cold chain infrastructure and seamless coordination between producers and retailers, aiming to minimize post-harvest losses and maximize consumer satisfaction across diverse distribution points.

Greece Food and Drink Market Potential Customers

Potential customers for the Greece Food and Drink Market are highly diverse, spanning various demographics and international boundaries. Domestically, end-users include individual households prioritizing traditional Greek dietary staples (e.g., olive oil, yogurt, pulses), institutional buyers (schools, hospitals, public services), and critically, the burgeoning HoReCa sector which demands large volumes of high-quality ingredients to service the massive influx of tourists. These professional buyers often seek reliable, certified local suppliers capable of fulfilling large, consistent orders while adhering to stringent food safety and quality standards.

Internationally, the primary buyers are importers, retailers (both mainstream and specialty ethnic stores), and foodservice distributors in countries with significant Greek diaspora or strong interest in Mediterranean cuisine. Key regions include Germany, the UK, the US, and increasingly, countries in the Middle East and East Asia seeking gourmet and health-oriented food products. The market also targets specific segments, such as health-conscious consumers interested in organic and functional foods, and gourmet shoppers willing to pay a premium for PDO-certified regional delicacies, such as specific cheeses or wines.

The evolving customer base also includes digital consumers utilizing e-commerce platforms for convenience, especially younger demographics in urban centers who seek ready-to-eat meals and specialty packaged goods. This shift necessitates that producers and retailers invest in digital storefronts and efficient last-mile delivery capabilities. Ultimately, the market must satisfy the dual demand for affordable, high-volume staples for the mass market and niche, high-value authenticated products for the premium and export segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | [USD 16.5 Billion] |

| Market Forecast in 2033 | [USD 23.1 Billion] |

| Growth Rate | [4.8% (CAGR)] |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vivartia S.A., Hellenic Sugar Industry S.A., ELAIS-Unilever Hellas, Chipita S.A., FrieslandCampina Hellas, OLYMPUS Dairy, Athenian Brewery, EPIDOSI S.A., MISKO (Barilla Group), MINERVA S.A., VIKOS S.A., MEVGAL S.A., DELTA S.A., Coca-Cola Tria Epsilon, AGROVIM S.A., Loulis Food Ingredients, Hellenic Dairies S.A., TERRA VERDE S.A., Tsantalis Vineyards, G. B. KALLAS S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Greece Food and Drink Market Key Technology Landscape

The technological landscape of the Greece Food and Drink Market is rapidly evolving, driven by the need for increased efficiency, compliance with stringent EU food safety regulations, and improved export competitiveness. A key technological focus is the adoption of Precision Agriculture methodologies, utilizing IoT sensors, drones, and satellite imagery. These tools allow Greek farmers, particularly those cultivating high-value crops like olives and grapes, to monitor soil health, water needs, and pest infestations in real-time, thereby optimizing resource use and ensuring consistent, high-quality yields while reducing environmental impact. This shift is critical for small-to-medium enterprises (SMEs) to meet global demand for sustainably sourced products.

In the processing and manufacturing sector, investments are heavily centered on automation and advanced quality control systems. Modern Greek food processing plants are integrating technologies such as advanced robotics for packaging and sorting, and sophisticated Supervisory Control and Data Acquisition (SCADA) systems to maintain precise temperature and hygiene standards throughout production runs. Furthermore, high-pressure processing (HPP) and modified atmosphere packaging (MAP) technologies are gaining traction, especially for fresh-cut produce and prepared meals, extending shelf life and preserving nutritional integrity without heavy reliance on chemical preservatives, a key consumer preference.

Traceability and supply chain integrity are also major technological imperatives. Blockchain technology is emerging as a critical tool, particularly for premium export products like olive oil and honey, allowing consumers and regulators to verify the entire journey of the product from farm origin to final point of sale. Digital transformation extends to the consumer interface via e-commerce platforms, utilizing sophisticated warehouse management systems (WMS) and route optimization software to ensure rapid and accurate delivery, crucial for maintaining the quality of perishable goods in Greece’s geographically challenging terrain. The integration of these various technologies is fundamental to transitioning the market into a globally competitive, modernized food production system.

Regional Highlights

- Attica Region: This region, encompassing Athens, serves as the primary consumption hub and the largest organized retail market in Greece. It dictates trends in convenience food, imported luxury goods, and specialized organic markets. It is the central logistical node for both imports and domestically processed goods, characterized by high population density and sophisticated distribution networks.

- Central Macedonia (Thessaloniki): A vital agricultural and industrial region, Central Macedonia is a significant production hub for grains, meat, and dairy (e.g., Olympus). It acts as a gateway to the Balkan markets, driving substantial export activities and focusing heavily on large-scale food processing and packaged goods manufacturing.

- Crete: Recognized globally for its high-quality olive oil and specialized dairy products, Crete is a major producer of PDO-certified goods. Its regional market is highly influenced by tourism, leading to increased demand for locally sourced, premium HoReCa ingredients and traditional Cretan diet staples.

- Peloponnese: Critical for fruit, vegetable, and wine production, the Peloponnese region emphasizes viticulture and citrus farming. The regional market structure supports cooperatives focused on maximizing export volumes and maintaining rigorous quality control for fresh and mildly processed goods.

- Ionian and Aegean Islands: These regions are characterized by extreme seasonal consumption spikes driven entirely by international tourism. Their market structure prioritizes speed and volume in logistics, with a strong preference for localized, authentic food and beverage experiences offered through restaurants and specialized local taverns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Greece Food and Drink Market.- Vivartia S.A.

- Hellenic Sugar Industry S.A.

- ELAIS-Unilever Hellas

- Chipita S.A. (Mondelēz International)

- FrieslandCampina Hellas

- OLYMPUS Dairy

- Athenian Brewery S.A.

- EPIDOSI S.A.

- MISKO (Barilla Group)

- MINERVA S.A.

- VIKOS S.A. (Water & Beverages)

- MEVGAL S.A.

- DELTA S.A. (Dairy Products)

- Coca-Cola Tria Epsilon (3E)

- AGROVIM S.A. (Olive Oil)

- Loulis Food Ingredients S.A.

- Hellenic Dairies S.A.

- TERRA VERDE S.A.

- Tsantalis Vineyards S.A.

- G. B. KALLAS S.A. (Meat Processing)

- P.G. NIKAS S.A.

- HEINEKEN N.V. (via Athenian Brewery)

- Karakostas S.A.

- Kolios S.A.

- ION S.A. (Confectionery)

- NESTLE Hellas S.A.

- KRONOS S.A.

- Hatzidaki Winery

- EVGA S.A.

- MALLIA S.A.

Frequently Asked Questions

Analyze common user questions about the Greece Food and Drink market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current growth trajectory of the Greece Food and Drink Market?

The Greek Food and Drink Market is projected for stable growth, anchored by the resilience of domestic demand, strong export performance particularly for PDO products, and sustained high consumption rates driven by the booming tourism sector, estimating a CAGR of [4.8%] through 2033.

Which specific segments are driving innovation in the Greek food sector?

Innovation is primarily driven by the organic and functional foods segment, focused on health, alongside the beverages sector integrating natural ingredients and low-sugar alternatives. The use of advanced processing and traceability technologies is also central to competitive innovation, especially for export-oriented high-value items like olive oil and dairy.

How does the tourism industry impact the demand for Greek food and drink products?

Tourism profoundly boosts the HoReCa segment, creating massive seasonal demand peaks for locally sourced ingredients, ready-to-serve meals, and traditional Greek beverages. This sector not only increases domestic consumption volumes but also acts as a vital showcase for Greek products to international consumers, subsequently fueling export demand.

What are the primary regulatory challenges facing Greek food producers?

Greek producers must strictly adhere to the rigorous food safety, labeling, and environmental standards mandated by the European Union. While compliance ensures quality and market access, it imposes significant operational costs, particularly regarding hygiene protocols, traceability documentation, and meeting specific environmental sustainability targets.

What role does e-commerce play in the distribution of food and drink in Greece?

E-commerce is an accelerating distribution channel, especially in urban areas, enabling consumers to access a wider range of specialty and international goods. For local producers, it offers a crucial direct-to-consumer pathway, reducing reliance on traditional supermarket chains and facilitating the export of premium Greek products globally.

The Greece Food and Drink Market remains a dynamic sector, deeply integrated with the nation's culture, economy, and global brand identity. The confluence of traditional, high-quality production methods with modern technological integration presents a compelling landscape for future investment and sustained growth.

The market's reliance on agriculture means that technological advancements such as smart irrigation and climate monitoring are becoming indispensable tools for mitigating risks associated with climate change and ensuring harvest consistency. Furthermore, the commitment of Greek companies to enhancing product transparency and securing international certifications reinforces the market's reputation for authenticity and safety, a critical competitive differentiator in high-value foreign markets. Addressing the challenge of fragmentation through cooperative models and vertical integration remains crucial for unlocking greater economies of scale and maximizing export profitability.

Looking ahead, geopolitical stability in the wider European region and the strength of the Eurozone will significantly influence purchasing power and export routes. Strategic efforts to diversify product offerings beyond core staples, focusing on plant-based alternatives and fortified health foods, will allow Greek producers to capture emerging global dietary trends. The continuous modernization of logistics infrastructure, particularly cold chain capabilities across the islands and remote areas, is essential for maintaining product quality and supporting the growth trajectory of both domestic retail and international trade.

Finally, governmental and EU funding support remains pivotal for the market's long-term health, providing necessary capital for research, development, and infrastructure projects. This support is instrumental in helping SMEs adopt expensive but necessary technologies, ensuring that the entire value chain, from small farm to large processor, can compete effectively on the global stage while preserving the unique, high-quality character of Greek food and beverages.

In conclusion, the Greece Food and Drink Market is poised for resilience and growth, driven by fundamental consumer preferences for quality and authenticity, optimized by increasing technological adoption, and supported by a robust tourism ecosystem.

Further analysis of the technological adoption rate reveals that while large enterprises are quick to implement ERP systems for inventory and supply chain management, smaller family-owned agricultural businesses face steeper learning curves and higher upfront costs for digitization. Bridging this technological gap through targeted subsidies and educational programs is a recognized priority for sectorial organizations. Successful technology diffusion is not just about adopting new machinery but about fundamentally changing data management and decision-making processes, leading to higher accountability and efficiency across the board.

The sustainability agenda, heavily influenced by EU policy, is driving packaging innovation, pushing companies away from single-use plastics towards recyclable, biodegradable, or minimal packaging solutions. Consumers, particularly the younger Greek demographic, are increasingly aware of ecological footprints, pressuring brands to implement verifiable sustainable practices throughout their operations, from water usage on the farm to waste disposal at the factory. This focus on environmental, social, and governance (ESG) factors is transforming marketing strategies and procurement decisions within the industry.

Lastly, the competitive intensity is high, characterized by strong international brands competing with highly localized Greek companies. The local companies often leverage their strong heritage and regional certifications (PDO/PGI) as core competitive advantages against lower-cost imports. Continuous investment in branding and marketing that emphasizes the unique cultural value and nutritional superiority of Greek products is paramount for maintaining market share, especially in saturated categories like dairy and olive oil.

The market also benefits from specialized labor skills, particularly in traditional fermentation, cheese making, and high-quality confectionery, skills which are crucial for maintaining the authenticity of premium items. However, attracting and retaining younger talent in primary agriculture remains a challenge, necessitating automation solutions that complement rather than replace skilled manual labor. Educational institutions and industry bodies are collaborating to create specialized training programs focused on agri-tech and modern food processing techniques.

Specific micro-trends include the rapid growth of non-alcoholic craft beverages, reflecting a moderation trend among consumers. Furthermore, the increasing acceptance of alternative protein sources, though nascent, suggests future diversification away from traditional meat and dairy dominance. Producers who proactively engage in product diversification and ethical sourcing will be best positioned to capitalize on future consumer shifts in both domestic and export markets, ensuring that the Greece Food and Drink Market continues its upward trajectory in value and volume throughout the forecast period.

The strong euro and international monetary policies also play a non-negligible role, impacting the cost of imported raw materials (e.g., grains not produced sufficiently domestically) and affecting the price competitiveness of Greek exports in markets utilizing different currencies. Financial planning and hedging strategies are essential business requirements for manufacturers heavily involved in international trade.

In the distribution sphere, the ongoing power struggle between large multinational retail chains and smaller, independent local stores is central. While organized retail offers unparalleled reach and efficiency, small stores maintain personalized customer relationships and often specialize in regional, artisan products, contributing significantly to the cultural fabric of Greek consumption. Hybrid distribution models, combining the efficiency of large logistics centers with the curated experience of specialty shops, are likely to define the future retail landscape.

The resilience of the agricultural sector, supported by significant EU Common Agricultural Policy (CAP) funds, acts as a stabilizer against volatile weather patterns and global commodity price shocks. These subsidies enable crucial capital expenditures, such as irrigation system upgrades and machinery purchases, which are vital for enhancing agricultural productivity and climate resilience across Greek farming communities.

The report underscores that sustainable success in the Greece Food and Drink Market necessitates a holistic approach that integrates technological modernity with cultural preservation, ensuring that the unique heritage and quality of Greek food remain competitive differentiators in the complex global food supply chain.

The focus on health and wellness extends significantly beyond just organic food to include low-sodium, low-fat, and sugar-free formulations across categories like dairy, beverages, and packaged snacks. Manufacturers are responding by reformulating classic Greek recipes and introducing entirely new product lines that align with strict contemporary health criteria, often leveraging the natural health benefits intrinsic to Mediterranean ingredients. This commitment to 'better-for-you' products is essential for capturing market share among younger, health-conscious urban consumers.

Finally, the market’s inherent structural challenges—such as the prevalence of small land plots and difficulties in collective bargaining power—require continued political and industry-led initiatives to promote cooperative farming models. These models help small farmers achieve the scale needed to supply major retailers and export markets efficiently, ensuring that the economic benefits of market growth are distributed more widely across the agricultural community.

The continuous optimization of processing yields through advanced analytics is another area gaining traction, helping reduce operational waste and improving overall resource utilization, particularly important in resource-scarce environments. This optimization translates directly into cost savings and improves the competitive positioning of Greek processed food in high-volume markets.

Investment in R&D, often in partnership with Greek universities and research institutes, is focused on bio-prospecting for unique indigenous ingredients with functional properties, further enhancing the specialty and premium identity of Greek food products globally. This strategic focus ensures sustained differentiation and protects against commoditization.

This comprehensive analysis confirms that the Greece Food and Drink Market is navigating global challenges with strategic investments in technology, quality, and sustainability, solidifying its position as a robust and essential sector of the national economy.

The increasing digitalization of customer service and B2B ordering systems within the HoReCa segment streamlines interactions between producers, distributors, and hotels/restaurants, leading to faster fulfillment and reduced administrative errors, which is crucial during peak tourist seasons. Specialized software for menu planning and inventory tracking, integrated with producer logistics, is enhancing operational efficiency across the food service value chain.

Furthermore, the wine industry segment specifically benefits from technological advancements in viniculture, including remote sensing and precision fermentation controls, enabling producers to consistently craft high-quality wines that meet sophisticated international palates. This elevates Greek wine from a local curiosity to a globally competitive premium product, contributing significantly to the high-value beverage export portfolio.

Overall, the market is characterized by a high degree of integration with broader European economic and regulatory frameworks, demanding sophistication in compliance and operational execution. Success hinges on agile responses to consumer demands for health, convenience, and transparency, underpinned by robust technological infrastructure and unwavering commitment to the quality inherent in the Mediterranean tradition.

The report provides a deep-dive into the market structure, identifying key opportunities arising from tourism and export, while also highlighting the imperative to overcome structural constraints related to logistics and agricultural fragmentation through targeted technological adoption and cooperative enterprise models. The outlook remains optimistic, provided investments in sustainability and digitalization are maintained consistently across the sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager