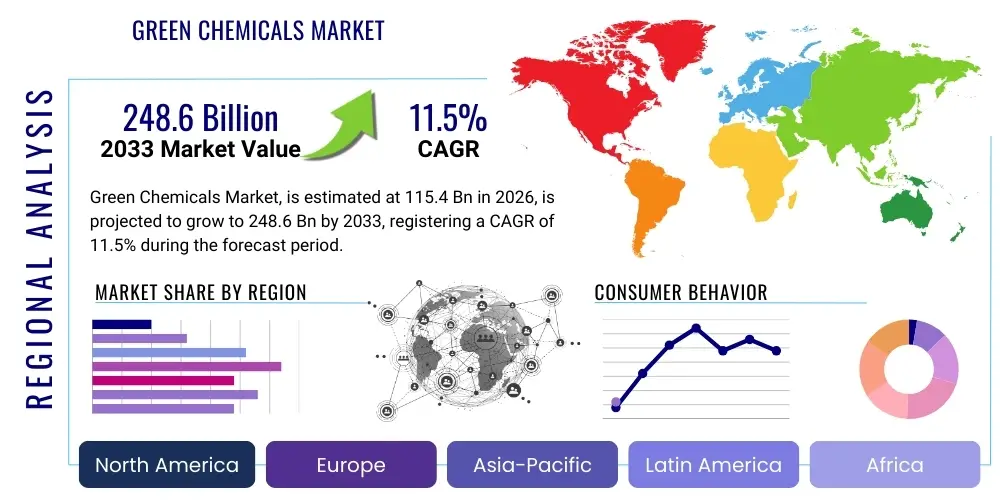

Green Chemicals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443503 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Green Chemicals Market Size

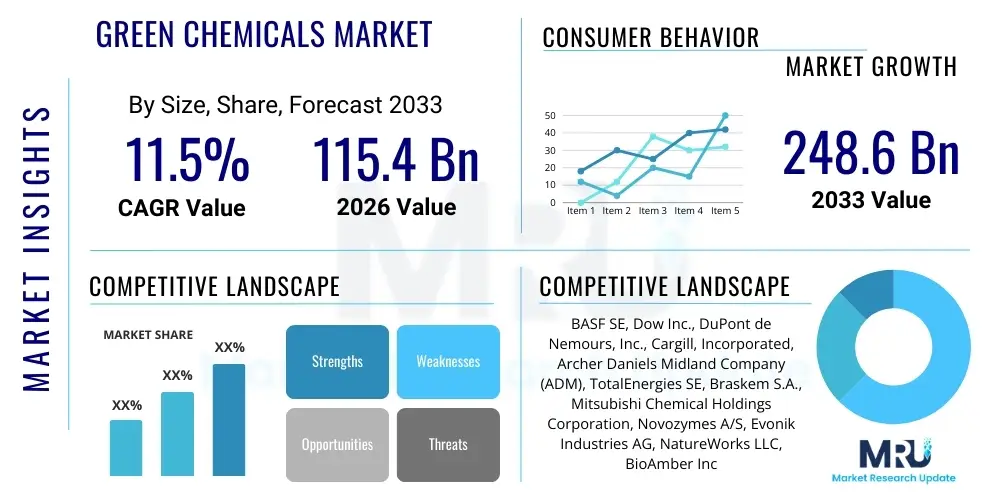

The Green Chemicals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 115.4 Billion in 2026 and is projected to reach USD 248.6 Billion by the end of the forecast period in 2033.

Green Chemicals Market introduction

The Green Chemicals Market encompasses chemical products and processes designed to reduce or eliminate the use and generation of hazardous substances, aligning with the principles of green chemistry and sustainable development goals. This sector includes bio-based chemicals, renewable chemicals derived from biomass, and environmentally friendly processes used in the production of solvents, polymers, and platform chemicals. The fundamental objective is the creation of products that minimize environmental impact across their entire lifecycle, from feedstock sourcing to disposal. Key product categories involve bio-alcohols, bio-polymers, bio-solvents, and specialized biochemicals used extensively across diverse industries, significantly improving sustainability metrics in manufacturing.

Major applications of green chemicals span packaging, textiles, automotive components, construction materials, and household cleaning products. For instance, bio-plastics derived from renewable sources are replacing petroleum-based polymers in packaging, while bio-lubricants are gaining traction in industrial machinery and automotive sectors due to their reduced toxicity and rapid biodegradability. The inherent benefits include lower carbon footprints, reduced dependence on fossil fuels, minimized toxic waste generation, and improved occupational safety standards in manufacturing facilities. These benefits are increasingly prioritized by corporations seeking to meet stringent Environmental, Social, and Governance (ESG) criteria and achieve net-zero emission targets.

The market is driven primarily by escalating regulatory pressures worldwide, particularly in the European Union and North America, mandating sustainable practices and chemical risk reduction. Concurrently, heightened consumer awareness regarding the environmental impact of conventional products fuels demand for eco-friendly alternatives. Furthermore, significant technological advancements in industrial biotechnology, such as fermentation processes and enzyme catalysis, are improving the cost-competitiveness and scalability of bio-based chemical production, making them viable substitutes for conventional petrochemicals. Supportive governmental policies, including subsidies and tax incentives for bio-refineries, further accelerate market expansion and foster innovation within the green chemicals ecosystem.

Green Chemicals Market Executive Summary

The Green Chemicals Market is characterized by robust growth, propelled by the global shift towards circular economy models and mandatory sustainability reporting. Current business trends indicate a significant acceleration in strategic partnerships between traditional chemical giants and specialized biotech firms to secure sustainable feedstock supply and integrate novel bio-processing technologies. Investment in R&D is heavily skewed towards developing high-performance, cost-effective bio-polymers and bio-solvents capable of matching or exceeding the performance metrics of conventional fossil fuel derivatives. Mergers and acquisitions focusing on vertical integration, securing upstream bio-mass processing capabilities, and expanding downstream application expertise are defining the competitive landscape.

Regionally, Europe maintains its leadership position due to pioneering regulatory frameworks like REACH and the Green Deal, which actively stimulate demand and production innovation. North America follows closely, driven by governmental support (e.g., USDA BioPreferred Program) and substantial private sector investment in corn-to-chemical conversion facilities. Asia Pacific, particularly China and India, is emerging as the fastest-growing region, fueled by rapid industrialization, increasing governmental focus on air and water pollution control, and the growing establishment of large-scale bio-refinery complexes aiming for self-sufficiency in sustainable materials. Latin America and MEA are seeing moderate growth, primarily centered around bio-fuel production integrated with nascent biochemical manufacturing.

Segmentation analysis highlights bio-polymers as the dominant product segment, primarily due to their extensive use in packaging, agriculture, and textiles, driven by the urgency to mitigate plastic waste. The feedstock segment is predominantly ruled by starch and sugar, though cellulosic biomass is rapidly gaining traction as technological barriers related to non-food sources diminish. In terms of application, the packaging and automotive sectors are the primary consumers, demonstrating a high willingness to pay a premium for materials that enhance their environmental profiles. Future growth is anticipated to be particularly strong in niche segments such as high-performance bio-lubricants and specialized bio-surfactants, reflecting advanced material substitution trends across industrial operations.

AI Impact Analysis on Green Chemicals Market

Users frequently inquire how Artificial Intelligence (AI) and Machine Learning (ML) can accelerate the notoriously complex and resource-intensive process of developing and scaling up sustainable chemical processes. Common questions revolve around AI’s ability to optimize biocatalysis, predict molecular properties for novel bio-based materials, and enhance the efficiency of industrial fermentation and separation technologies. There is significant concern and expectation regarding whether AI can dramatically reduce the time-to-market and lower the production costs of green chemicals, which traditionally struggle to compete solely on price with established petrochemical routes. Furthermore, users are keenly interested in AI’s role in managing complex, geographically dispersed bio-mass supply chains and ensuring the quality control and standardization required for high-volume bio-product manufacturing. The overarching theme is utilizing AI to overcome the economic and technical bottlenecks inherent in scaling sustainable chemistry.

AI’s influence is profound in optimizing reaction pathways and feedstock utilization. ML algorithms are increasingly used to screen thousands of potential catalysts and enzymes much faster than traditional laboratory methods, identifying optimal biocatalytic systems for complex synthesis. This drastically cuts down the experimental time needed for process development. Moreover, predictive modeling helps chemical engineers anticipate and manage variability in bio-mass feedstock composition, adjusting reaction conditions dynamically to maintain consistent output quality. This capability is crucial for achieving industrial scalability and ensuring the reliability of green chemical supply chains, which often depend on variable agricultural inputs.

In manufacturing, AI-driven process control systems are deployed in bio-refineries to monitor real-time fermentation metrics (such as pH, temperature, and nutrient concentration). These systems use deep learning models to predict potential deviations and automatically optimize operational parameters, thereby maximizing yield and reducing energy consumption. This level of precision minimizes waste generation, aligns perfectly with green chemistry principles, and significantly improves the overall economic viability of sustainable manufacturing. Furthermore, AI tools are essential for lifecycle assessment (LCA), providing granular data on environmental impact and helping companies make informed decisions regarding the most sustainable sourcing and production routes.

- AI accelerates the discovery and optimization of novel biocatalysts and enzymes for green chemical synthesis.

- Machine Learning models predict optimal reaction conditions, improving yield and purity in fermentation processes.

- Predictive maintenance and anomaly detection minimize downtime and optimize energy efficiency in bio-refinery operations.

- AI enhances feedstock supply chain resilience by forecasting availability and managing quality variability in bio-mass inputs.

- Advanced data analytics facilitate comprehensive Lifecycle Assessments (LCA), ensuring full compliance and transparency regarding environmental footprint.

DRO & Impact Forces Of Green Chemicals Market

The trajectory of the Green Chemicals Market is governed by a dynamic interplay of powerful drivers, structural restraints, and evolving opportunities, all subject to significant impact forces from regulatory and consumer spheres. The primary driving force is the global imperative for sustainability, reinforced by national commitments to decarbonization and net-zero targets, compelling industries to transition away from fossil-fuel dependence. Regulatory frameworks, particularly carbon taxes and plastic bans, create a financially compelling environment for green alternatives. However, this momentum is counterbalanced by significant restraints, chiefly the higher production cost of many bio-based chemicals compared to mature, mass-produced petrochemical equivalents, creating competitive price parity challenges. Additionally, the complex logistics of establishing consistent, large-scale, sustainable biomass supply chains present operational hurdles that require massive infrastructural investment.

Opportunities in the market center around utilizing non-food cellulosic feedstock, which addresses concerns related to competition with food crops and offers a potentially cheaper raw material source. The development of high-performance, drop-in green chemicals—those that can replace conventional chemicals without requiring substantial modifications to existing manufacturing infrastructure—represents a high-growth opportunity. Furthermore, the burgeoning demand for specialized green chemicals in emerging high-tech sectors like electronics and aerospace, where performance and sustainability are both critical, opens lucrative niche markets. Successfully leveraging these opportunities requires continuous innovation in processing technologies and establishing robust intellectual property portfolios around novel bio-synthetic routes.

Impact forces are heavily concentrated in two areas: governmental policy and consumer sentiment. Stricter environmental policies (e.g., mandates for recycled content or biodegradable packaging) act as an amplifying force, immediately boosting demand regardless of short-term cost implications. Conversely, shifts in global commodity prices for crude oil can act as a dampening force; when oil prices drop significantly, the cost differential between fossil-based and green chemicals widens, posing an immediate competitive threat to sustainable alternatives. Consumer preference for ethical and sustainable brands, often quantified through purchasing behavior and willingness to pay a premium for certified green products, exerts a consistent upward pressure, compelling brand owners to integrate green chemicals into their product formulations to maintain market relevance and brand equity.

Segmentation Analysis

The Green Chemicals Market is comprehensively segmented across product type, application, and feedstock source, offering a granular view of specific growth pockets and technological adoption trends. Product segmentation is critical as it highlights the maturation level and market dominance of different chemical classes, ranging from basic platform chemicals to highly specialized performance materials. Feedstock segmentation defines the sustainability profile of the market, distinguishing between first-generation, food-based sources (like starch and sugar) and more environmentally preferred second- and third-generation sources (like cellulosic biomass and algae). Application segmentation reveals end-user industry commitment and substitution readiness, indicating where regulatory pressure and consumer demand are most acutely felt.

Bio-based polymers (e.g., PLA, PHA, and bio-PE) constitute the largest and most dynamic product segment, driven by the global imperative to reduce plastic pollution and improve end-of-life options for packaging materials. Bio-alcohols, particularly bio-ethanol and bio-butanol, remain crucial components, primarily serving the fuel blending and solvent markets. Analyzing these segments demonstrates a clear trend: the market is moving beyond bulk commodity chemicals toward specialized, high-value functional ingredients derived through bio-processing. This specialization requires higher capital investment but yields better profit margins and stronger competitive differentiation.

The evolution of feedstock sourcing towards non-food resources is a defining long-term trend. While starch and sugar derivatives currently dominate due to established supply chains and conversion technologies, significant R&D is directed towards leveraging agricultural waste, municipal solid waste, and dedicated energy crops. This shift is vital for addressing the ethical challenges and volatility associated with food-based raw materials. Understanding this segmentation is essential for manufacturers planning long-term supply resilience and for investors evaluating sustainable investment opportunities based on feedstock security and conversion efficiency.

- By Product Type:

- Bio-alcohols (Bioethanol, Biobutanol, Bio-glycols)

- Bio-polymers (PLA, PHAs, Bio-PET, Bio-PE, Bio-PU)

- Bio-solvents and Bio-lubricants

- Bio-organic Acids (Lactic Acid, Succinic Acid, Citric Acid)

- Platform Chemicals (C3, C4, C5, and C6 chemicals)

- By Application:

- Packaging

- Automotive and Transportation

- Construction

- Textiles and Apparel

- Agriculture (Bio-pesticides, Bio-fertilizers)

- Consumer Goods (Personal Care, Detergents)

- Pharmaceuticals and Healthcare

- By Feedstock:

- Starch and Sugar

- Cellulosic Biomass

- Vegetable Oils and Fats

- Animal Fats

- Algae

- Industrial Waste Streams

Value Chain Analysis For Green Chemicals Market

The value chain for the Green Chemicals Market is complex, involving multiple specialized stages starting from sustainable feedstock sourcing through to final consumer distribution. The upstream segment involves the cultivation, harvesting, and pre-treatment of biomass, whether it be agricultural waste, dedicated energy crops, or specialized oilseeds. Efficiency in this stage is paramount, focusing on optimizing yields and minimizing transportation costs associated with bulky biomass. Key players in the upstream include specialized agricultural companies and large bio-refinery operators who manage the initial conversion of raw biomass into usable sugars or oils, often requiring sophisticated mechanical and thermal processing.

The midstream is the core chemical conversion stage, where bio-refineries employ advanced industrial biotechnology techniques—primarily fermentation, enzymatic catalysis, or chemo-catalysis—to transform platform chemicals into desired green products like bio-polymers, bio-solvents, or organic acids. This stage requires significant capital expenditure in bioreactors and purification equipment. Direct distribution often involves large contracts with major industrial consumers (B2B), such as automotive manufacturers or large packaging converters, who integrate these green materials into their production processes. Indirect distribution, though less common for bulk chemicals, occurs when specialized bio-ingredients are sold through chemical distributors to smaller companies in the cosmetics or cleaning products sectors.

The downstream segment encompasses the manufacturing of final products and their distribution to end-users. This stage involves complex formulation and compounding, such as blending bio-polymers with additives to achieve specific material properties. Major downstream players include multinational consumer goods companies (CPGs) and specialized product manufacturers who market the sustainability advantages of their products to consumers. Transparency and traceability throughout the entire value chain, facilitated by certifications and digital tracking, are becoming crucial for demonstrating the verifiable "green" credentials of the final product to increasingly discerning regulators and consumers.

Green Chemicals Market Potential Customers

The primary purchasers and end-users of green chemicals span a diverse array of industrial sectors, driven by regulatory compliance, corporate sustainability mandates, and consumer pull. The packaging industry constitutes the largest immediate market, seeking bio-plastics (like PLA and PHA) to replace conventional, non-biodegradable polymers in bottles, films, and containers. Major fast-moving consumer goods (FMCG) companies, including beverage producers and food packagers, are heavy consumers, utilizing green chemicals to enhance their environmental, social, and governance (ESG) performance and appeal to eco-conscious consumers.

The automotive and construction sectors represent high-volume, long-term growth markets. Automotive manufacturers are increasingly demanding bio-based polyurethanes, composite materials, and interior components to reduce vehicle weight, improve fuel efficiency, and decrease their manufacturing carbon footprint. In construction, demand focuses on sustainable insulation materials, bio-adhesives, and bio-lubricants used in machinery and material processing. These industrial customers typically require large volumes, stringent quality standards, and verifiable LCA data supporting the sustainability claims of the chemicals.

Furthermore, specialized industries like personal care and pharmaceuticals are rapidly increasing their adoption of high-purity, bio-derived solvents, surfactants, and specialized ingredients. Cosmetic formulators are seeking plant-derived emollients and performance enhancers to meet 'clean label' demands, while the pharmaceutical industry uses specific bio-solvents to reduce toxicity in drug manufacturing processes. These customers are often willing to pay a substantial premium for materials offering superior performance combined with low toxicity and validated renewable origins, solidifying their role as high-value end-users within the green chemicals ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.4 Billion |

| Market Forecast in 2033 | USD 248.6 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Inc., DuPont de Nemours, Inc., Cargill, Incorporated, Archer Daniels Midland Company (ADM), TotalEnergies SE, Braskem S.A., Mitsubishi Chemical Holdings Corporation, Novozymes A/S, Evonik Industries AG, NatureWorks LLC, BioAmber Inc., Genomatica, Corbion N.V., GFBiochemicals Ltd., Gevo, Inc., Renewable Energy Group, Inc., Solvay S.A., Croda International Plc, DSM-Firmenich. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Green Chemicals Market Key Technology Landscape

The technological landscape of the Green Chemicals Market is rapidly evolving, moving beyond traditional chemical synthesis to embrace sophisticated biotechnological pathways and highly efficient separation methods. A primary technological focus is on industrial white biotechnology, specifically utilizing genetically engineered microorganisms (e.g., yeast, bacteria, or algae) in large-scale fermentation processes to produce chemicals like bio-succinic acid, lactic acid, and various monomers for bio-polymers. Advances in metabolic engineering and synthetic biology are enabling scientists to design microbial strains that can efficiently convert complex, non-food biomass (cellulosic material) into high-value chemicals with high yields and minimal byproducts. This bio-catalysis approach is inherently greener, operating under mild conditions (lower temperature and pressure) compared to high-energy petrochemical processes.

Another critical area of innovation is focused on enhancing feedstock flexibility and pre-treatment methods. Developing cost-effective and environmentally benign technologies for breaking down complex lignocellulosic biomass (agricultural waste, wood residues) into fermentable sugars is crucial for reducing dependency on food crops and achieving economic scalability. Technologies such as catalytic pyrolysis, supercritical fluid extraction, and advanced enzymatic hydrolysis are being refined to improve sugar yields while minimizing energy inputs and solvent usage. Furthermore, the integration of continuous processing technologies, replacing traditional batch operations in bio-refineries, is driving down operational costs and improving overall resource efficiency, making bio-based chemicals more competitive with conventional alternatives.

Downstream separation and purification also represent significant technological bottlenecks and opportunities. Separating target chemicals from the complex fermentation broth often requires substantial energy input. Therefore, novel separation technologies like membrane filtration, sophisticated chromatography, and specialized solvent extraction systems are being developed and optimized to achieve high purity levels efficiently. Furthermore, advancements in chemical engineering involve integrating bio-refinery complexes with existing conventional chemical plants, enabling hybrid processes that utilize both fossil and bio-derived intermediates. This integrated approach allows companies to gradually phase in bio-based feedstocks, minimizing disruption and capital expenditure, and significantly boosting the scalability and commercial viability of green chemical production.

Regional Highlights

Regional dynamics heavily influence the Green Chemicals Market, dictated by varying regulatory environments, resource availability, and the maturity of industrial biotechnology infrastructure. Europe, led by countries such as Germany, the Netherlands, and Scandinavia, maintains its market dominance and innovative edge. This is primarily due to the European Union’s ambitious regulatory policies, including the Green Deal, which provides a strong institutional framework and financial support for sustainable chemistry. European chemical companies are at the forefront of bio-polymer and bio-solvent development, driven by strict mandates on plastic usage and carbon emissions. Investment flows strongly into sustainable industrial parks and integrated bio-refinery clusters, establishing Europe as a hub for commercial-scale, high-value green chemical production.

North America, particularly the United States, represents a robust and rapidly expanding market, benefiting from vast agricultural resources (especially corn and soy) that underpin the first-generation bio-chemical industry. Government initiatives like the USDA BioPreferred program provide a stable regulatory pull, while significant private investment, particularly in the Midwest, accelerates the transition toward advanced biofuels and biochemicals. The region excels in developing novel enzymatic and microbial conversion technologies, with key companies focusing on scaling up production of drop-in bio-based platform chemicals that seamlessly integrate into existing supply chains. Canada also contributes significantly through its strong forest products sector, providing abundant cellulosic feedstock potential.

The Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This acceleration is driven by rapid economic growth, large populations demanding sustainable packaging, and urgent governmental responses to severe environmental degradation, particularly in China and India. While still reliant on international technology, domestic capacity building is swift, with massive investments poured into new bio-refinery construction. Japan and South Korea, possessing advanced technological capabilities, are focusing on high-end bio-materials and specialized chemical applications, contrasting with the high-volume commodity bio-chemical production seen in China. Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions, where growth is closely tied to agricultural resource availability (sugarcane in Brazil) and national strategies aimed at economic diversification away from traditional fossil fuels.

- North America (US & Canada): Strongest market for bio-fuels and established bio-refining infrastructure; driven by federal mandates and high adoption rates in packaging and consumer goods.

- Europe (Germany, Netherlands, UK): Market leader driven by stringent environmental regulations (EU Green Deal, REACH); focus on specialized bio-polymers and sustainable solvents.

- Asia Pacific (China, India, Japan): Fastest-growing region due to escalating industrialization, governmental pollution control, and massive investment in new bio-manufacturing capacity.

- Latin America (Brazil): Significant market due to abundant sugarcane feedstock, making it a global leader in bio-ethanol and bio-based polyethylene (Bio-PE) production.

- Middle East & Africa (MEA): Emerging market exploring integration of bio-refining as part of broader economic diversification strategies, focusing initially on specialized bio-fuel components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Green Chemicals Market.- BASF SE

- Dow Inc.

- DuPont de Nemours, Inc.

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- TotalEnergies SE

- Braskem S.A.

- Mitsubishi Chemical Holdings Corporation

- Novozymes A/S

- Evonik Industries AG

- NatureWorks LLC

- BioAmber Inc.

- Genomatica

- Corbion N.V.

- GFBiochemicals Ltd.

- Gevo, Inc.

- Renewable Energy Group, Inc.

- Solvay S.A.

- Croda International Plc

- DSM-Firmenich

Frequently Asked Questions

Analyze common user questions about the Green Chemicals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between green chemicals and traditional petrochemicals?

Green chemicals are derived predominantly from renewable resources like biomass (plants, algae, waste streams) and are manufactured using processes designed to minimize environmental hazard and maximize energy efficiency, resulting in a significantly reduced carbon footprint compared to petrochemicals derived from fossil fuels.

Are green chemicals currently cost-competitive with conventional alternatives?

While some mature green chemicals (like bio-ethanol) are competitive, many specialized bio-based chemicals currently face higher production costs due to required technological investments and complex, non-standardized biomass supply chains. However, continuous R&D and scaling efforts are rapidly narrowing this cost gap, especially as carbon taxes internalize the environmental cost of petrochemicals.

Which green chemical product type is experiencing the highest growth in demand?

Bio-polymers, particularly Polylactic Acid (PLA) and Polyhydroxyalkanoates (PHAs), are experiencing the highest demand growth, driven by stringent global regulations aimed at reducing single-use plastic pollution and increasing consumer preference for biodegradable and compostable packaging solutions across food and retail sectors.

How do global oil price fluctuations affect the Green Chemicals Market?

Fluctuations in crude oil prices directly impact the production cost of petrochemicals. When oil prices drop sharply, the economic incentive to switch to often more expensive green alternatives diminishes. Conversely, high, volatile oil prices strengthen the competitive position and market penetration rate of green chemicals.

What is the significance of cellulosic biomass as a feedstock for green chemicals?

Cellulosic biomass (agricultural and forest residues) is crucial because it does not compete with the food chain (non-food-based), offering a more sustainable and politically acceptable raw material source. Technological breakthroughs in converting cellulose efficiently are key to achieving mass production scalability and lowering overall feedstock costs for the industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager