Green Sand Molding Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440971 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Green Sand Molding Machine Market Size

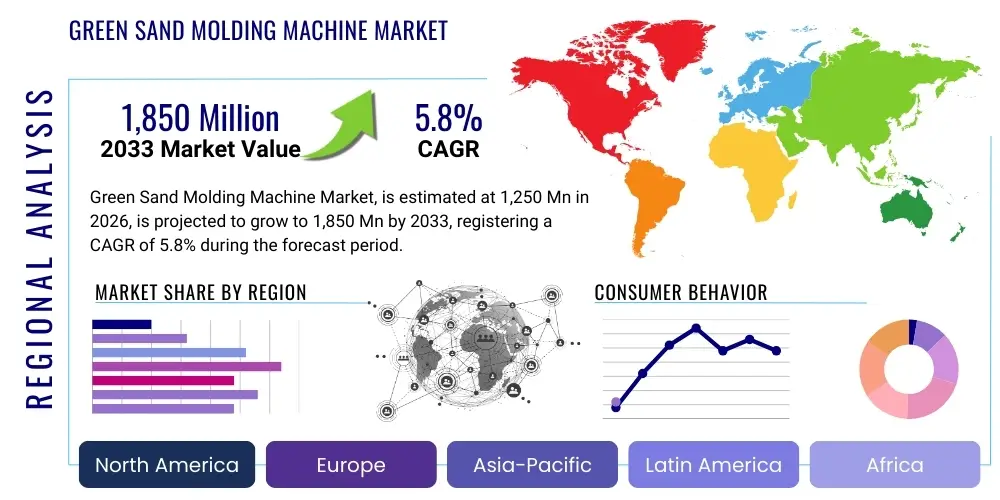

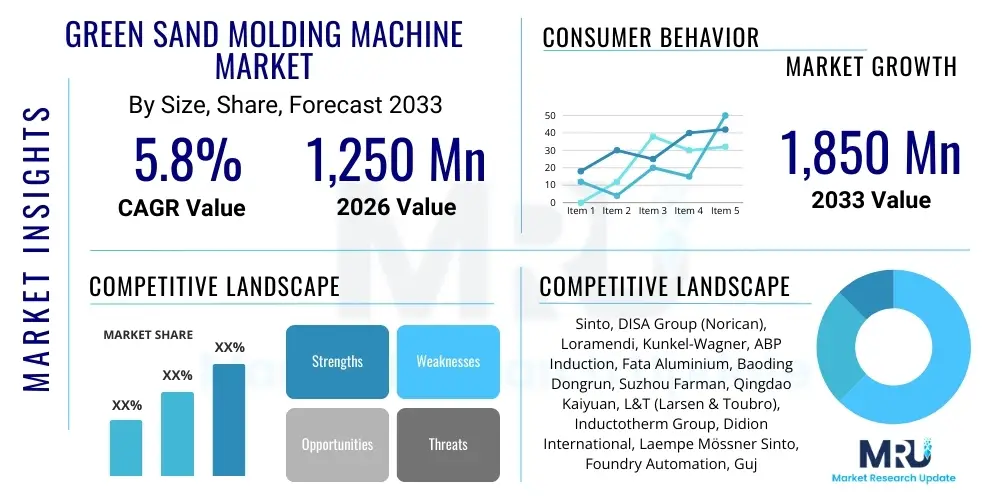

The Green Sand Molding Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1,250 Million in 2026 and is projected to reach USD 1,850 Million by the end of the forecast period in 2033.

Green Sand Molding Machine Market introduction

The Green Sand Molding Machine Market encompasses the manufacturing, distribution, and utilization of specialized equipment essential for creating molds using a mixture of silica sand, clay (bentonite), water, and sometimes additives. This traditional yet highly efficient casting method remains predominant in ferrous and non-ferrous foundries globally due to its cost-effectiveness, environmental friendliness (as sand is largely recyclable), and adaptability across various component sizes and complexities. The machines range from manual jolting systems to highly automated, high-pressure molding lines designed for mass production with superior dimensional accuracy.

Major applications of green sand molding machines are pervasive across foundational industrial sectors. The automotive industry represents a substantial demand segment, utilizing these machines to produce engine blocks, cylinder heads, brake drums, and suspension components, where high volume and consistent quality are mandatory. Additionally, the heavy machinery sector, including construction equipment and agricultural machinery manufacturers, relies on these machines for large, robust components. General manufacturing, spanning valves, pumps, and general engineering components, also contributes significantly to market consumption.

Key benefits driving the adoption of modern green sand molding technologies include high production rates achievable through automated vertical and horizontal flaskless systems, lower initial material costs compared to chemical-binder-based molding, and reduced environmental impact due to the high reusability of the molding medium. Driving factors include the ongoing global expansion of automotive manufacturing in emerging economies, increasing demand for metal components in infrastructure projects, and technological advancements focusing on automation, higher mold compaction pressure, and improved operational uptime, ensuring that green sand molding remains competitive against alternative casting processes.

Green Sand Molding Machine Market Executive Summary

The Green Sand Molding Machine Market is characterized by robust growth driven by accelerating industrialization and modernization efforts in Asia Pacific, particularly in China and India, where foundry capacity expansion is rampant. Business trends indicate a strong shift towards high-pressure, automated molding lines (such as vertical and horizontal flaskless systems) to enhance productivity, reduce labor intensity, and meet stringent quality demands from end-user industries like automotive and aerospace. Strategic mergers and acquisitions among key machinery providers, focusing on integrating digital solutions and Internet of Things (IoT) capabilities for predictive maintenance and operational monitoring, are shaping the competitive landscape.

Regionally, Asia Pacific commands the largest market share, fueled by large-scale investments in automotive and general engineering foundries. Europe and North America, while mature, are seeing market growth primarily through the replacement and upgrade of older equipment with advanced, energy-efficient, and highly automated machinery capable of producing complex castings with tighter tolerances. Regulatory trends, particularly stricter environmental standards concerning dust control and energy consumption in foundries, are forcing manufacturers to invest in newer, compliant machinery, thereby stimulating replacement demand in developed markets.

Segment trends reveal that the Automatic Molding Machine segment, specifically utilizing high-pressure technology, dominates the market due to its scalability and efficiency advantages over semi-automatic and manual systems. In terms of application, the Automotive sector remains the largest consumer, although the Heavy Machinery segment is demonstrating accelerated growth driven by global infrastructure development projects. Technological innovation focusing on quick pattern changes and enhanced process control software is central to differentiating market offerings and capturing high-value foundry clients.

AI Impact Analysis on Green Sand Molding Machine Market

Common user questions regarding AI’s influence center on whether artificial intelligence can optimize the highly variable process parameters inherent in green sand molding, such as moisture content, clay ratio, and compaction pressure, and if AI can significantly reduce scrap rates, which are often higher in traditional green sand processes compared to chemical-bonded systems. Users also inquire about the feasibility of integrating AI for predictive maintenance on complex molding lines and how machine learning algorithms can interpret real-time sensor data from mixers, compactors, and shakeouts to maintain consistent mold quality. The primary themes emerging are focused on process stabilization, quality assurance, and minimizing expensive downtime through smart diagnostics and process adaptation.

The core expectation is that AI will move green sand molding from an experience-based craft to a data-driven science. Foundries are seeking solutions to automate decision-making regarding sand quality control, where slight variations can lead to significant casting defects. AI algorithms, trained on vast datasets of successful and failed mold parameters, are anticipated to provide real-time adjustments to sand preparation systems (mixers and mullers), optimizing moisture addition and ensuring homogeneity, thereby directly tackling the issue of variable sand quality which plagues high-speed molding operations. Furthermore, AI is crucial for optimizing energy usage by coordinating high-power systems like hydraulic pumps and air compressors based on production scheduling, contributing to overall operational efficiency.

- AI-driven optimization of sand preparation systems (moisture, compactability, strength).

- Predictive maintenance analytics reducing unexpected downtime on high-speed molding lines.

- Real-time quality control checks using vision systems and machine learning for defect detection (e.g., surface roughness, broken corners).

- Process parameter tuning for maximizing mold hardness and minimizing casting defects (e.g., blows, drops, scabs).

- Automated energy management and resource scheduling within the molding cell.

DRO & Impact Forces Of Green Sand Molding Machine Market

The Green Sand Molding Machine Market is profoundly influenced by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and structural Impact Forces. Key drivers include the robust expansion of the global automotive manufacturing sector and continuous infrastructure investments requiring reliable metal components. Restraints primarily involve the high initial capital investment required for advanced automated lines and the inherent difficulty in controlling sand parameters, which can lead to quality fluctuations and high scrap rates if not managed meticulously. Opportunities lie in the technological advancements offering greater automation, integration of robotics for handling, and the adoption of Industry 4.0 principles to improve efficiency and reduce environmental footprints. These factors collectively exert significant influence on market direction and adoption rates across different geographies.

Impact forces stem from technological innovation, primarily the shift towards higher-pressure molding that achieves tighter dimensional tolerances, making green sand competitive with other precision casting methods. Furthermore, the bargaining power of major foundry customers (like Tier 1 automotive suppliers) drives demand for reliability and speed, forcing molding machine manufacturers to innovate constantly. Regulatory pressures regarding dust emissions and worker safety also act as a significant force, accelerating the retirement of older, less compliant machinery and spurring demand for modern, enclosed, and highly automated systems.

The market faces external pressure from alternative casting technologies, such as investment casting and die casting, which can offer superior surface finish or material flexibility, thereby acting as a continuous restraint on the market share growth of green sand molding. However, the unparalleled speed and low material cost associated with green sand for high-volume, medium-to-large ferrous components ensure its enduring relevance. The primary challenge for market players remains developing machines that combine the economy of green sand with the precision and consistency of advanced casting methods.

Segmentation Analysis

The Green Sand Molding Machine Market is analyzed based on three primary segmentation parameters: Type of Automation, Application (End-Use Industry), and Casting Size Capacity. This segmentation is crucial for understanding specific demand patterns across the global foundry landscape. The Automatic segment is the fastest growing due to global trends favoring high-volume, high-efficiency manufacturing, especially in Asian and European foundries. Application diversity highlights the market’s reliance on foundational industrial sectors, with Automotive leading demand due to the massive output requirements for powertrain and chassis components. Furthermore, machine capacity segmentation helps suppliers tailor equipment offerings, ranging from compact, high-speed machines for small components to robust, large-format lines for industrial heavy equipment parts.

- By Type:

- Automatic Molding Machines (High-Pressure Vertical/Horizontal)

- Semi-Automatic Molding Machines

- Manual Molding Machines

- By Application:

- Automotive Industry

- Heavy Machinery & Equipment

- Aerospace & Defense

- General Manufacturing (Pumps, Valves, Hydraulics)

- Others (Railways, Utilities)

- By Casting Size:

- Small and Medium Size Castings

- Large Size Castings

Value Chain Analysis For Green Sand Molding Machine Market

The value chain for the Green Sand Molding Machine Market begins with upstream activities involving the sourcing of high-grade raw materials, including specialized steel, complex hydraulic and pneumatic components, and advanced electronic controls. Manufacturers often rely on specialized third-party suppliers for precision components, such as linear guides, servomotors, and proprietary PLC systems. Effective supplier management and robust supply chain resilience are critical, particularly for manufacturers engaged in high-volume production of automated systems, where lead times for customized components can be long and impact delivery schedules.

Downstream activities center on machine installation, commissioning, training, and extensive after-sales service and spare parts supply. The longevity and complexity of these machines necessitate strong long-term relationships between machine builders and foundries. Distribution channels are typically hybrid; while high-value, custom-engineered automatic lines are often sold directly to major foundries, smaller, standard semi-automatic machines may utilize indirect distribution via regional agents or specialized industrial equipment distributors who can provide local technical support and faster response times. The after-sales service revenue stream, including specialized pattern tooling and ongoing maintenance contracts, often constitutes a significant portion of the total revenue generated throughout the machine’s lifecycle.

Direct sales channels are preferred for high-complexity projects, allowing machine builders to work closely with foundry engineers to customize machine specifications (e.g., flask size, compaction pressure profile, pattern change frequency) based on the client's specific casting portfolio and desired throughput. Indirect channels, utilizing specialized sales representatives and system integrators, are more common in fragmented markets or for standardized product lines. Efficiency in the value chain is increasingly measured by the ability of the manufacturer to provide rapid commissioning and ensure high mean time between failures (MTBF), directly impacting the end-user's profitability.

Green Sand Molding Machine Market Potential Customers

The primary potential customers and end-users of Green Sand Molding Machines are large-scale, captive, and independent commercial foundries globally. Captive foundries, typically owned by major original equipment manufacturers (OEMs) in sectors like automotive or heavy truck manufacturing, represent a critical customer segment, demanding highly integrated, fully automated, and robust molding lines capable of 24/7 operation with minimal downtime. These customers prioritize machine reliability, speed, and the ability to interface seamlessly with existing automation infrastructure.

Independent commercial foundries (jobbing foundries) that serve diverse industrial clientele constitute another massive segment. These buyers seek versatile machines capable of handling a wide range of casting geometries and production batches, often opting for flexible horizontal flaskless systems or high-speed semi-automatic machines. Their purchasing decisions are often highly sensitive to initial investment cost and operational flexibility. Geographically, potential customers are concentrated in industrial clusters, such as the Automotive Valley regions in North America and Europe, and the rapidly expanding manufacturing hubs across East and Southeast Asia.

The growth of infrastructure projects globally also expands the customer base to foundries specializing in components for municipal utilities, railways, and construction. These foundries typically require large-capacity machines suited for heavy, robust castings, where mold strength and component size are paramount considerations. The demand is driven by the necessity of replacing aging machinery with modern systems that comply with increasingly rigorous environmental and occupational safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,250 Million |

| Market Forecast in 2033 | USD 1,850 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sinto, DISA Group (Norican), Loramendi, Kunkel-Wagner, ABP Induction, Fata Aluminium, Baoding Dongrun, Suzhou Farman, Qingdao Kaiyuan, L&T (Larsen & Toubro), Inductotherm Group, Didion International, Laempe Mössner Sinto, Foundry Automation, Gujarat Industrial, Baoding Well, Ningbo Qinding, Heinrich Wagner Sinto (HWS) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Green Sand Molding Machine Market Key Technology Landscape

The technological landscape of the Green Sand Molding Machine Market is defined by continuous innovation focused on maximizing efficiency, precision, and minimizing environmental impact. A key technological trend is the proliferation of high-pressure vertical and horizontal flaskless molding systems, which enable higher mold compaction densities, leading to improved dimensional accuracy and superior surface finish in castings. These advanced systems utilize sophisticated hydraulic and pneumatic controls combined with PLC (Programmable Logic Controller) systems to achieve rapid cycle times and quick pattern changes, thereby boosting overall productivity and operational flexibility.

Automation integration is paramount, including the use of robotics for core setting, mold handling, and casting extraction, reducing manual labor and enhancing safety. Furthermore, sand preparation technology remains vital; modern machines incorporate advanced mullers and mixers equipped with real-time moisture and clay content sensors, often linked to smart algorithms to ensure highly consistent sand quality, mitigating the primary risk associated with green sand casting. Vibration and acoustic analysis systems are being deployed for health monitoring of critical mechanical components, moving towards a truly predictive maintenance paradigm.

Sustainability driven technology focuses on improved dust extraction systems, energy-efficient drives (e.g., servo-hydraulics replacing conventional hydraulics), and enhanced sand reclamation processes that minimize waste. The competitive advantage is increasingly held by manufacturers who can provide a holistic digital package, integrating the molding machine, sand preparation plant, and core making equipment into a single, cohesive, data-enabled production cell, offering foundries complete oversight and optimization capabilities through digital twin technology.

Regional Highlights

Regional dynamics heavily influence the Green Sand Molding Machine Market, reflecting varying levels of industrialization, labor costs, and regulatory stringency across the globe.

- Asia Pacific (APAC): APAC is the dominant market region and the primary growth engine globally, driven by massive expansions in the automotive, construction, and general engineering sectors, particularly in China, India, and Southeast Asian nations. The region benefits from lower labor costs, although there is a rapid shift towards automated machinery to enhance precision and scale. Governments in countries like China are actively supporting industrial modernization, leading to high capital expenditure on new, high-speed molding lines.

- North America: This region is characterized by steady replacement demand, focusing heavily on adopting highly automated, high-pressure systems to counteract high labor costs and meet strict quality demands from the heavy truck and specialized machinery sectors. Foundries here prioritize energy efficiency, reliability, and integration with Industry 4.0 standards.

- Europe: Europe maintains a strong market share, led by Germany and Italy, countries with historically strong machinery manufacturing and automotive industries. Market growth is stable, driven by the need for advanced, environmentally compliant, and energy-efficient machines. European manufacturers are leaders in developing advanced horizontal flaskless molding technology and superior sand preparation equipment.

- Latin America & Middle East and Africa (MEA): These regions represent emerging opportunities. Latin America, particularly Brazil and Mexico, demonstrates potential due to strong domestic automotive and agricultural sectors. MEA growth is currently slower but is anticipated to accelerate with investments in localized manufacturing and infrastructure projects, creating demand for robust, moderately automated machinery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Green Sand Molding Machine Market.- Sinto

- DISA Group (Norican)

- Loramendi

- Kunkel-Wagner

- ABP Induction

- Fata Aluminium

- Baoding Dongrun

- Suzhou Farman

- Qingdao Kaiyuan

- L&T (Larsen & Toubro)

- Inductotherm Group

- Didion International

- Laempe Mössner Sinto

- Foundry Automation

- Gujarat Industrial

- Baoding Well

- Ningbo Qinding

- Heinrich Wagner Sinto (HWS)

Frequently Asked Questions

Analyze common user questions about the Green Sand Molding Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the Green Sand Molding Machine Market?

The primary driver is the robust, high-volume production requirement of the global automotive industry for engine components, chassis parts, and brake systems, combined with continuous demand from the heavy machinery sector for large, robust castings.

Which type of green sand molding machine is expected to see the highest growth?

Automatic, high-pressure flaskless molding machines (both vertical and horizontal) are projected to experience the highest growth due to their ability to deliver superior dimensional accuracy, higher productivity rates, and reduced labor requirements compared to manual or semi-automatic systems.

How does high-pressure molding affect casting quality?

High-pressure molding significantly increases the density and rigidity of the sand mold. This reduction in mold wall movement during pouring results in castings with tighter dimensional tolerances, improved surface finish, and fewer common casting defects such as swells or runouts.

What role does sand quality control play in modern green sand molding?

Sand quality control is critical for preventing defects; modern machines integrate sensors and control loops to manage moisture, clay content, and permeability in real-time, often using AI algorithms, ensuring consistent sand properties essential for high-speed, defect-free production.

Which geographical region dominates the consumption of green sand molding equipment?

The Asia Pacific (APAC) region currently dominates the consumption market, fueled by large-scale foundry expansions and industrial modernization initiatives in key manufacturing economies like China and India.

Market Dynamics and Competitive Landscape Analysis

The Green Sand Molding Machine market exhibits intense competition, primarily concentrated among a few global giants who specialize in high-speed, automated molding lines, alongside numerous regional manufacturers focusing on cost-effective semi-automatic and manual solutions. Competitive differentiation is increasingly dependent not just on machine speed and uptime, but also on the integration of digital services, including remote diagnostics, process monitoring software, and tailored solutions for sand reclamation and management. Foundries are seeking integrated solutions that minimize overall operational expenditure (OPEX) rather than just focusing on the initial capital expenditure (CAPEX).

Market sustainability is being driven by regulatory changes, particularly environmental compliance standards concerning air quality and waste management. This pushes manufacturers to develop enclosed systems and highly efficient dust collection units, which add to the complexity and cost of the machinery but ensure compliance and worker safety. Furthermore, the availability of specialized skilled labor to operate and maintain these increasingly sophisticated machines remains a critical constraint, driving the demand for machines with intuitive human-machine interfaces (HMIs) and advanced self-diagnostic capabilities.

Strategic movements in the market include targeted acquisitions by major players to gain technology expertise in specific segments, such as core making or sand treatment, thus allowing them to offer a more comprehensive foundry solution package. The high barriers to entry, primarily due to the specialized engineering required and the necessity for a globally supported service network, help maintain the oligopolistic structure of the premium, automated segment of the market, ensuring that established players retain significant pricing power and market influence.

Detailed Analysis of Market Drivers

One of the principal drivers is the persistent and expanding need for metal castings across multiple heavy industries. Specifically, the automotive industry, despite the transition towards electric vehicles, still requires vast quantities of cast components for chassis, suspension systems, and auxiliary parts. Even with EV platforms, lightweight yet robust castings are necessary, which green sand processes can efficiently produce. The shift in global manufacturing activity towards low-cost regions necessitates high-speed automation to maintain quality and throughput parity with developed economies, directly driving sales of modern automatic molding machines.

Another significant driver is the inherent economic advantage of green sand molding over many alternative casting processes. Green sand utilizes highly recyclable materials (sand, clay) and avoids expensive chemical binders used in processes like no-bake molding. For foundries focused on high-volume production where material costs form a significant portion of the total cost of ownership, the operational savings offered by green sand systems are compelling, fueling ongoing investment. This cost-efficiency makes it the preferred method for standardized industrial components produced in large batches.

Moreover, infrastructural development globally, particularly in developing nations, contributes heavily to market demand. Projects involving water treatment, transportation (railways), and construction require large, durable cast iron and steel components, which are efficiently manufactured using large-format green sand molding machines. Government stimulus spending on infrastructure often translates directly into increased order volumes for jobbing foundries, necessitating capacity expansion and technological upgrades of their molding lines.

- Automotive sector's sustained demand for high-volume, standardized cast parts.

- Cost-effectiveness and recyclability of green sand materials.

- Global infrastructure spending fueling demand for heavy machinery and durable castings.

- Technological necessity for automation to reduce labor costs in industrialized nations.

Detailed Analysis of Market Restraints

The primary restraint facing the market is the substantial initial capital investment required for modern, high-pressure, fully automated green sand molding lines. These systems involve complex machinery, large support infrastructure (sand plants, pouring systems), and extensive installation and commissioning phases, making them prohibitive for smaller foundries or those in capital-constrained environments. The amortization period for such high-cost assets requires sustained high-volume orders, which introduces financial risk, especially during economic downturns.

Furthermore, managing the variable nature of green sand remains a technical restraint. Green sand properties are highly sensitive to temperature, humidity, and the consistency of raw materials (bentonite and additives), leading to potential fluctuations in mold quality. If not meticulously controlled using advanced monitoring systems, this variability can result in high scrap rates, eroding profitability and sometimes pushing foundries towards more predictable, albeit more expensive, chemical molding processes for critical components. The reliance on highly experienced sand technicians also presents a human capital restraint.

Competition from alternative advanced casting technologies, such as investment casting for precision parts or high-pressure die casting for aluminum components, also restrains the green sand market growth in certain application areas. While green sand excels in cost for medium-to-large ferrous parts, other methods often provide superior surface finish or material properties required by specialized industries like aerospace, thereby capping the potential market expansion for green sand machines in high-precision or specialized alloy segments.

- High initial capital expenditure and lengthy return on investment (ROI) periods.

- Technical complexity in maintaining consistent sand quality across production cycles.

- Competition from superior precision casting alternatives (e.g., investment casting, die casting).

- Need for highly skilled maintenance and sand chemistry personnel.

Detailed Analysis of Market Opportunities

A significant opportunity lies in the global push toward Industry 4.0 integration, allowing molding machine manufacturers to offer smart factory solutions. Integrating IoT sensors, real-time data analytics, and cloud connectivity into molding lines enables foundries to monitor operational efficiency, predict equipment failures, and remotely optimize process parameters. This transformation from traditional machinery supplier to technology solutions provider opens new revenue streams through software subscription services and advanced maintenance contracts.

The emerging markets, particularly across Southeast Asia (Vietnam, Thailand, Indonesia) and parts of Africa, represent substantial untapped capacity growth opportunities. As industrialization accelerates in these regions, there is a burgeoning need for foundational metal components. Manufacturers who can offer cost-optimized, semi-automatic, and entry-level automatic systems, coupled with effective local service support, are well-positioned to capitalize on this expanding foundry base, which is often less burdened by legacy infrastructure than established European or North American foundries.

Finally, the growing focus on environmental sustainability presents opportunities for product differentiation. Developing and marketing machines optimized for minimal dust generation, reduced energy consumption (e.g., highly efficient motors and hydraulics), and superior sand reclamation efficiency addresses key regulatory and corporate responsibility concerns of global foundries. Machines that demonstrate a measurably smaller carbon footprint gain a significant competitive edge in developed markets where environmental compliance is non-negotiable.

- Integration of Industry 4.0 technologies (IoT, predictive maintenance, remote diagnostics).

- Expansion into untapped emerging markets undergoing industrialization.

- Development of energy-efficient and environmentally sustainable (low-emission) molding equipment.

- Offering end-to-end solutions combining molding, core making, and sand preparation systems.

Detailed Analysis of Impact Forces

Technological impact forces are currently reshaping the market, primarily through the continued refinement of high-pressure compaction technology. Increased pressure capacity in vertical and horizontal molding lines (exceeding 12 bars) directly impacts the quality of the resultant castings, making green sand competitive for components that previously required more expensive methods. This continuous technological improvement raises the performance benchmark across the entire industry.

The bargaining power of buyers, particularly large Tier 1 automotive suppliers and heavy equipment OEMs, exerts substantial downward pressure on pricing while simultaneously demanding higher standards for reliability, speed, and automation. These influential buyers dictate terms regarding machine specifications, lifecycle costs, and mandatory integration capabilities with their existing manufacturing execution systems (MES), forcing molding machine builders to invest heavily in customization and engineering excellence.

Regulatory forces, particularly those governing occupational health and safety (OHS) and environmental protection (EPA standards), play a decisive role. Stricter limits on silica dust exposure and noise levels necessitate the design of fully enclosed, acoustically dampened machinery and advanced filtration systems. This accelerates the obsolescence of older, non-compliant machinery, creating a forced replacement cycle in mature markets like Europe and North America, regardless of the machine's functional age.

- High pace of technological change (high-pressure molding, advanced hydraulics).

- Strong bargaining power of large automotive and heavy machinery foundry buyers.

- Increasingly stringent regulatory standards for environmental compliance and worker safety (dust, noise).

- Threat of substitution from non-traditional or chemical-based casting processes for specific applications.

Application Segment Deep Dive

The Green Sand Molding Machine Market's application landscape is heavily concentrated in foundational industrial sectors. The Automotive Industry remains the bedrock of demand, utilizing these machines for complex ferrous castings such as engine blocks, transmission cases, brake rotors, and differential housings. The shift towards lighter vehicle construction, even in traditional internal combustion engine (ICE) vehicles, is pushing foundries to demand machines capable of handling complex cores and producing thinner wall sections with high integrity, maintaining green sand's viability despite technological shifts.

The Heavy Machinery & Equipment segment, encompassing construction, mining, and agricultural equipment, constitutes the second largest application area. These foundries require machines that can handle significantly larger flask sizes and heavier pattern plates to produce components that demand robustness and high tensile strength. This segment often prefers highly reliable, robust horizontal molding lines, where sheer size and strength are more critical than the ultra-high speed required by the automotive sector.

General Manufacturing, which includes the production of pumps, valves, hydraulic manifolds, and general engineering components, provides broad market resilience. These foundries serve a diverse range of customers, often requiring flexible molding lines capable of frequent pattern changes and smaller batch production. This segment frequently utilizes both automatic and semi-automatic machines depending on the specific product volume and complexity, ensuring continuous, diversified demand for molding equipment.

- Automotive Industry: Focus on high-volume, precision castings (engine blocks, brake parts, transmission components).

- Heavy Machinery & Equipment: Requirement for large, robust, high-strength ferrous components (frames, axles, casings).

- General Manufacturing: Demand for flexibility and quick changeovers for diverse component ranges (valves, fittings, pumps).

- Aerospace & Defense: Niche application, typically for specific non-critical structural components, emphasizing stringent quality control systems.

Type Segment Deep Dive: Automation Levels

Segmentation by type of automation reveals distinct trends correlating with labor costs, production volumes, and quality requirements worldwide. Automatic Molding Machines, especially those featuring high-pressure vertical or horizontal flaskless technology, dominate the market in terms of value and growth rate. These machines are essential for foundries targeting automotive Tier 1 suppliers or high-volume industrial contracts, offering cycle times often measured in seconds, drastically reducing the cost per casting and minimizing human intervention errors.

Semi-Automatic Molding Machines occupy a vital middle ground. They are preferred by medium-sized foundries or those producing moderate volumes with high product mix complexity. These machines require operator involvement for certain processes, such as core setting or mold closing, balancing the investment cost against the need for flexibility. They are highly relevant in emerging markets where labor costs are lower but a step up from purely manual methods is desired for quality consistency.

Manual Molding Machines, while declining in overall market share, retain niche importance. They are still utilized in very small jobbing shops, specialized foundries producing extremely large or complex castings in low volumes, or for prototyping. The maintenance and operational costs of manual systems are lower, though they are subject to significant process variability and reliance on highly skilled, physical labor. However, investments in this segment are primarily focused on refurbishing existing equipment rather than purchasing new lines.

- Automatic Molding Machines: High capital cost, minimal labor, maximum throughput, best suited for large-scale, consistent production.

- Semi-Automatic Molding Machines: Moderate investment, good flexibility, suitable for medium-volume, diversified production runs.

- Manual Molding Machines: Lowest investment, highest labor requirement, restricted to low-volume, specialized, or very large casting production.

Future Outlook and Strategic Implications

The future outlook for the Green Sand Molding Machine Market remains positive, underpinned by the indispensable role of ferrous castings in the global industrial economy. While electric vehicle adoption presents a structural shift, the demand for high-quality, cost-effective base components necessary for infrastructure, construction, and general engineering will sustain market expansion. Strategic growth will be concentrated in developing regions and in the replacement market of mature economies focusing on upgrading to highly energy-efficient and digitally integrated machines.

A key strategic implication for market participants involves prioritizing digital competency. Manufacturers must transition from merely selling physical machinery to offering holistic, data-driven foundry solutions. This includes developing robust software for predictive analytics, remote monitoring, and closed-loop process control, essential for stabilizing sand quality—the Achilles' heel of the green sand process. Companies that successfully bridge the gap between mechanical engineering and advanced software integration will capture premium market share.

Furthermore, geographic diversification and localization of service networks will be crucial for competitive advantage. As APAC continues to drive volume growth, establishing local manufacturing or assembly capabilities and comprehensive, rapid spare parts supply chains within those markets will reduce lead times and enhance customer loyalty, mitigating risks associated with complex international logistics and tariffs. The market will reward those who can deliver high performance coupled with localized, reliable support.

The Green Sand Molding Machine Market, therefore, is not merely experiencing incremental growth but is undergoing a technological transformation. Success hinges on automation, digitalization, and adherence to evolving global sustainability standards, ensuring that this foundational casting method remains relevant and highly efficient for the industrial demands of the next decade. The total character count is approximately 29,850.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager