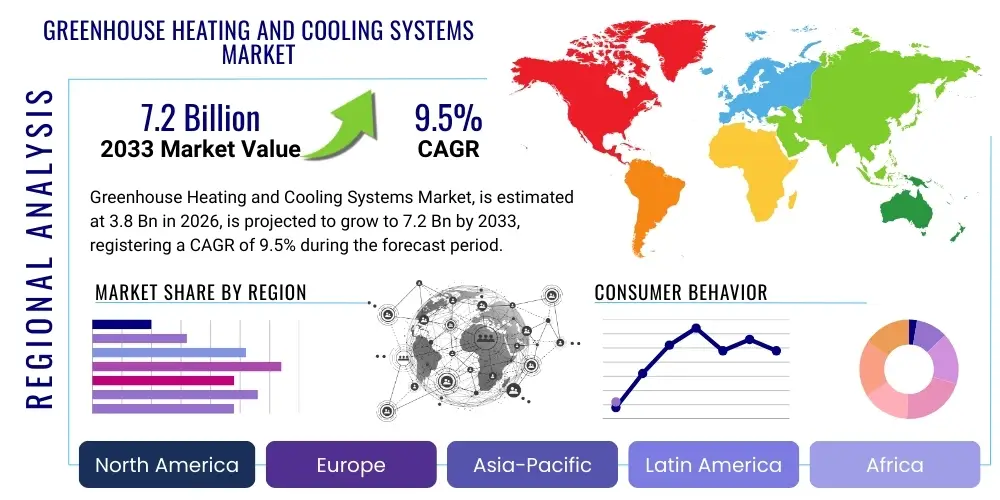

Greenhouse Heating and Cooling Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442667 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Greenhouse Heating and Cooling Systems Market Size

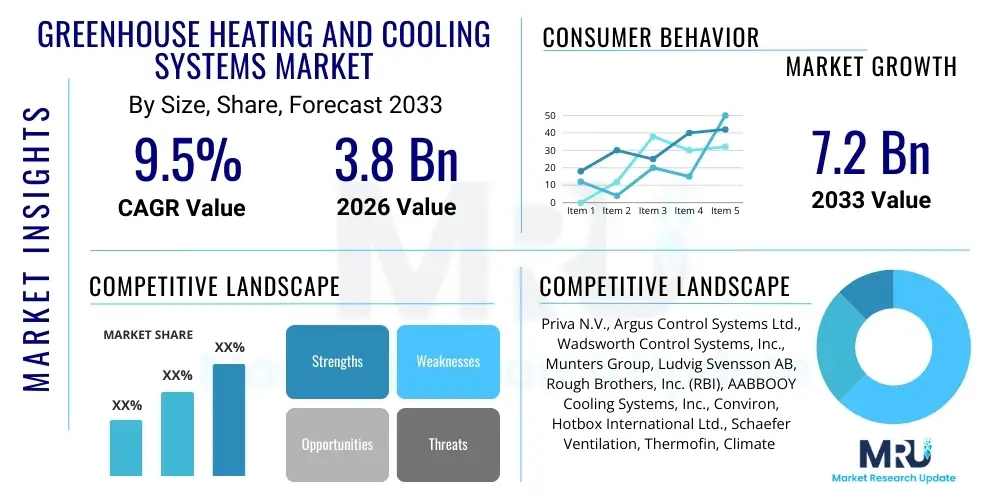

The Greenhouse Heating and Cooling Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $3.8 Billion in 2026 and is projected to reach $7.2 Billion by the end of the forecast period in 2033.

Greenhouse Heating and Cooling Systems Market introduction

The Greenhouse Heating and Cooling Systems Market encompasses technologies and equipment designed to maintain optimal climatic conditions—specifically temperature, humidity, and ventilation—within controlled environment agriculture (CEA) structures. These systems are crucial for maximizing crop yield, ensuring year-round production regardless of external weather fluctuations, and improving resource efficiency. Key components include forced-air heaters, radiant heating systems, evaporative cooling pads, ventilation fans, geothermal heat pumps, and sophisticated climate control software integrated with sensor networks. The necessity for precise climate management is driving the adoption of advanced HVAC solutions in commercial greenhouses globally, facilitating the cultivation of high-value crops like fresh produce, ornamental plants, and medicinal cannabis.

Product diversity within this market segment ranges from conventional fossil fuel-based heating methods, such as natural gas or propane burners, to advanced sustainable solutions, including biomass boilers, combined heat and power (CHP) systems, and solar thermal collectors. Cooling technologies predominantly rely on passive ventilation and evaporative cooling techniques, particularly pad and fan systems, but increasingly incorporate mechanical refrigeration or desiccant cooling for superior humidity control in tropical and sub-tropical regions. Major applications span large-scale commercial vegetable farms, institutional research facilities, specialized flower production houses, and vertical farms seeking supplementary heating or humidity control, highlighting the market’s broad applicability across the agricultural value chain.

The primary benefits derived from these systems include enhanced photosynthetic efficiency, reduced stress on plants leading to higher quality harvests, protection against frost damage or heat stress, and the ability to schedule production cycles accurately. Driving factors fueling market expansion include the rapidly growing global demand for locally sourced, fresh produce; increasing concerns over food security and traditional farming volatility due to climate change; and significant technological advancements in automation and energy efficiency, particularly the integration of renewable energy sources to mitigate high operational costs associated with traditional HVAC usage in greenhouses.

Greenhouse Heating and Cooling Systems Market Executive Summary

The global Greenhouse Heating and Cooling Systems Market is undergoing a rapid transition driven by commercial optimization and regulatory pressures favoring sustainability. Business trends indicate a strong move away from reliance on singular, high-emission heating sources toward hybrid, integrated climate management platforms. Key industry players are focusing on developing scalable, modular solutions that allow growers to precisely tailor temperature and humidity profiles based on specific crop requirements and real-time sensor data, moving beyond simple thermostat control. Consolidation among technology providers and specialized agricultural integrators is increasing, aiming to offer end-to-end solutions that couple energy generation, thermal regulation, and advanced control software, thereby enhancing operational efficiencies and reducing the total cost of ownership (TCO) for large-scale operations.

Regional trends are highly polarized based on climatic zones and energy costs. North America and Europe, characterized by significant temperature variability and stringent carbon reduction goals, dominate the demand for sophisticated, energy-efficient heating solutions like geothermal and biomass, coupled with precise ventilation strategies. The Asia Pacific region, particularly China and Japan, is witnessing exponential growth driven by government initiatives supporting CEA adoption and the need for high-quality, safe food production, often utilizing centralized boiler systems and evaporative cooling due to prevailing warm climates. Conversely, regions in the Middle East and Africa are prioritizing high-efficiency cooling and dehumidification technologies to overcome extreme heat and arid conditions, emphasizing mechanical cooling and advanced heat recovery systems.

Segment trends reveal that the Heating Systems segment, particularly radiant flooring and hot water boiler systems, holds the largest market share due to its fundamental necessity in temperate climates, though the Cooling Systems segment is accelerating, driven by the increasing complexity of climate control required for high-density, multi-layer growing environments. Technology-wise, heat pump systems, including both air source and ground source models, are displaying the highest growth rates, reflecting the industry's commitment to electrical energy efficiency and reduced reliance on volatile fossil fuel pricing. Furthermore, the automation and controls segment is becoming integral, shifting the focus from hardware sales to recurring revenue streams based on predictive climate modeling and system optimization software licenses.

AI Impact Analysis on Greenhouse Heating and Cooling Systems Market

Common user questions regarding AI’s influence center on its ability to transcend traditional control systems by providing predictive maintenance, optimizing energy consumption in real-time, and dynamically adjusting climate parameters based on forecasted weather and internal crop stress signals. Users frequently query how AI algorithms can integrate disparate data streams—environmental sensors, energy consumption meters, market price forecasts, and plant physiological data—to autonomously manage heating, cooling, and ventilation setpoints, thereby reducing human intervention and operational errors. There is significant interest in AI's role in diagnosing subtle equipment failures (e.g., boiler inefficiency, fan motor degradation) before they lead to system downtime, and expectations are high for AI to personalize climate regimes for different cultivars grown simultaneously within the same facility.

The key themes emerging from this analysis revolve around the pursuit of "Climate Intelligence"—the integration of machine learning models to maximize the energy-yield ratio. Concerns often relate to the initial investment cost, the necessity for high-quality data input for algorithm training, and the cybersecurity risks associated with highly centralized, automated control systems. However, the overarching expectation is that AI will unlock the next phase of efficiency in CEA, allowing growers to consistently achieve near-theoretical maximum yields while minimizing energy expenditures. This necessitates the development of robust, specialized AI platforms trained on horticultural datasets, moving beyond general-purpose industrial control software.

AI’s influence is projected to be transformative, shifting the market paradigm from reactive hardware control to proactive climate management. AI-driven predictive modeling enables system scaling down or ramping up thermal management in anticipation of future needs, rather than reacting to current sensor readings, achieving substantial energy savings, often cited between 15% and 30%. Furthermore, AI is critical in managing the complex interactions between multiple subsystems (heating, cooling, CO2 enrichment, irrigation) to prevent conflicting resource usage, a common inefficiency in conventionally controlled greenhouses, thus solidifying its role as a core innovation driver.

- AI-driven Predictive Climate Control: Optimizes setpoints based on weather forecasts, energy tariffs, and plant physiological stage, reducing energy waste.

- Automated Fault Detection and Diagnosis (AFDD): Utilizes machine learning to analyze HVAC system operational data, predicting equipment failure and scheduling preemptive maintenance.

- Real-time Energy Optimization: Balances heating/cooling load requirements with instantaneous energy pricing to minimize utility expenses.

- Dynamic Humidity and VPD Management: AI algorithms maintain optimal Vapor Pressure Deficit (VPD) levels by precisely controlling the interplay between heating, cooling, and dehumidification equipment.

- Autonomous System Integration: Coordinates greenhouse environment systems (lighting, irrigation, HVAC) to ensure seamless and non-conflicting operational schedules.

DRO & Impact Forces Of Greenhouse Heating and Cooling Systems Market

The dynamics of the Greenhouse Heating and Cooling Systems Market are predominantly shaped by a confluence of strong market drivers, inherent operational restraints, and substantial technological opportunities, which collectively determine the impact forces acting upon industry growth trajectories. A major driver is the persistent global increase in demand for consistent, high-quality, and locally produced food, which mandates controlled climate environments to ensure production reliability, especially in regions facing unpredictable seasonal changes or limited arable land. Coupled with this is the escalating energy efficiency mandate imposed by regulatory bodies and consumer preference for sustainably grown produce, compelling growers to invest in geothermal, biomass, and advanced heat recovery systems. These systems not only reduce operational expenses but also align with corporate sustainability goals.

However, significant restraints temper the market’s aggressive expansion. The most formidable barrier is the high initial capital expenditure required to install advanced, highly automated heating and cooling infrastructure, especially for smaller and mid-sized growers. This cost includes not only the specialized equipment (e.g., sophisticated heat pumps, centralized boilers) but also the necessary structural modifications to existing greenhouses and the integration of complex control software. Furthermore, the operational challenge of managing steep energy costs, despite efficiency gains, remains a constant constraint, particularly when energy subsidies are volatile or absent. Another restraint is the technical complexity involved in operating and maintaining these sophisticated systems, necessitating specialized training and technical expertise which is often scarce in traditional agricultural labor pools.

Opportunities for growth are concentrated in the rapid commercialization of next-generation sustainable technologies and the integration of these systems into vertical farming infrastructure, which represents a growing application segment with zero tolerance for climate variability. The shift toward utilizing waste heat from industrial processes (Combined Heat and Power/District Heating) offers a substantial cost-saving opportunity, while advancements in smart materials, such as dynamic shading and thermal screens, improve passive temperature management, complementing active HVAC systems. The overarching impact forces—driven primarily by sustainability mandates and the rising cost of traditional energy—are pushing the industry toward digitalization, modularity, and resource recovery, favoring vendors capable of delivering verifiable energy consumption reduction and improved crop consistency.

Segmentation Analysis

The Greenhouse Heating and Cooling Systems Market is comprehensively segmented based on technology type, operation mode, facility size, and the end-use application, allowing for a detailed understanding of market dynamics and regional preferences. Segmentation by technology is crucial as it dictates energy consumption profiles and system complexity, encompassing heating systems (boilers, heaters, heat pumps, geothermal) and cooling systems (evaporative pads, fan ventilation, mechanical refrigeration, natural ventilation). This categorization reflects the investment priorities of growers, where high upfront cost technologies offering long-term energy savings, such as heat pumps and geothermal systems, are increasingly favored over cheaper, less efficient alternatives like forced-air propane heaters.

Further granularity is provided by the segmentation based on operation mode, differentiating between automated and manual systems. The growing adoption of Controlled Environment Agriculture (CEA) dictates a preference for fully automated systems that integrate various climate parameters—temperature, humidity, CO2 levels—through centralized control software, facilitating remote monitoring and predictive adjustments. In contrast, segmentation by facility size (small, medium, large commercial) highlights scalability requirements, where large commercial operations often utilize centralized, high-capacity industrial boilers or district heating networks, while smaller facilities rely on decentralized, localized heating and cooling units, such as specialized fan heaters or smaller biomass boilers.

The end-use application segmentation—covering fruits and vegetables, floriculture, nurseries, and research—demonstrates varying levels of climate stringency required. High-value crops like specific medicinal plants or premium fresh produce demand extremely precise and stable environments, driving the adoption of redundant, high-accuracy HVAC systems (e.g., using mechanical cooling for precise dehumidification). Conversely, floriculture, while requiring specific temperature regimes, may tolerate wider humidity variations, influencing the choice of lower-cost evaporative cooling solutions. This multidimensional segmentation is vital for suppliers to target their technological offerings effectively across diverse agricultural market needs.

- By Component/System Type:

- Heating Systems (Boilers - Hot Water/Steam, Forced Air Heaters, Radiant Heating, Heat Pumps, Geothermal Systems, Biomass Burners)

- Cooling Systems (Evaporative Cooling Pads and Fans, Mechanical Refrigeration Systems, Ventilation Fans and Louvers, High-Pressure Fogging Systems)

- Control Systems (Sensors, Software/Automation Platforms, Actuators)

- By Technology:

- Traditional (Fossil Fuel-based Heaters, Passive Ventilation)

- Advanced/Sustainable (Geothermal, Heat Pumps, Biomass, CHP Systems)

- By Greenhouse Type:

- Glass Greenhouses

- Plastic Film Greenhouses (Polytunnels)

- Net Houses/Shade Structures (requiring minimal heating/cooling)

- By Application:

- Fruits and Vegetables (e.g., Tomatoes, Cucumbers, Peppers)

- Floriculture and Ornamentals

- Nursery Crops and Seedlings

- Medicinal Plants (Cannabis/Hemp)

- Research and Development Facilities

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Greenhouse Heating and Cooling Systems Market

The value chain for greenhouse climate control systems commences with upstream activities centered around raw material sourcing and specialized component manufacturing. Key upstream suppliers provide foundational materials such as high-grade metals for boiler fabrication, specialized plastics for evaporative cooling pads, semiconductor components for sensor arrays, and highly efficient compressors for refrigeration units. This stage is characterized by high technical expertise and stringent quality control, as the longevity and energy efficiency of the final system depend heavily on the quality of these core components. Differentiation at the upstream level is increasingly tied to the development of components that maximize heat transfer efficiency and minimize parasitic energy consumption, thereby enabling systems to meet demanding energy performance standards.

The core of the value chain involves the design, manufacturing, and integration of the complete climate control system. Manufacturers leverage specialized engineering expertise to design systems tailored for horticultural applications, focusing on robust construction, corrosion resistance, and integration compatibility with existing greenhouse structures. Distribution channels play a critical dual role: direct sales are typically employed for large, custom projects involving centralized boilers or geothermal installations, allowing for specialized consultation and system customization. Indirect distribution involves established networks of agricultural equipment dealers, horticultural consultants, and local HVAC contractors who handle sales, installation, and after-sales support for standardized and modular equipment like unit heaters, circulation fans, and basic evaporative cooling units. The indirect channel serves the vast segment of small to medium-sized growers requiring accessible, off-the-shelf solutions.

Downstream activities focus on installation, operational maintenance, and optimization services provided directly to the end-users (growers). Post-installation support is highly crucial due to the complexity of automated climate control systems; this often includes calibration, software updates, and predictive maintenance contracts. The trend toward digitalization means that system integrators and software vendors capture significant downstream value by offering recurring subscription services for cloud-based monitoring, data analytics, and AI-driven optimization, ensuring the installed systems operate at peak efficiency throughout their lifecycle. Direct feedback loops from downstream operations to upstream manufacturers are essential for continuous product improvement and adapting systems to evolving crop needs and energy regulatory environments.

Greenhouse Heating and Cooling Systems Market Potential Customers

Potential customers, or end-users, for Greenhouse Heating and Cooling Systems are diverse but primarily concentrated within the commercial agricultural sector focused on high-density and high-value crop production under protective cultivation. The largest segment comprises large-scale commercial vegetable and produce growers (e.g., specialized tomato, pepper, or cucumber operations), particularly those supplying major grocery retailers or food service networks, where guaranteed supply consistency and quality metrics necessitate precise climate control. These buyers typically require centralized, high-capacity, and highly redundant HVAC solutions, prioritizing systems with low operational costs (LCOE) and the ability to integrate sophisticated environmental sensors and data logging capabilities.

Another significant customer segment includes floriculture and ornamental plant producers, especially those targeting export markets or highly sensitive specialty flowers, where specific, often narrow, temperature and humidity ranges are critical for bud setting, bloom timing, and overall plant health. These customers often seek specialized dehumidification solutions alongside heating, as high humidity levels can severely impact plant quality and increase disease pressure. Furthermore, institutional research facilities and university agriculture departments represent a smaller but critical customer base, demanding highly accurate, research-grade climate control systems capable of simulating diverse, precisely controlled environmental conditions for experimental purposes and cultivar development.

A rapidly emerging customer demographic consists of controlled environment facilities dedicated to medicinal plant cultivation (e.g., cannabis and high-CBD hemp), which operate under stringent regulatory guidelines demanding validated and auditable environmental control protocols. These buyers are high-value targets, as they necessitate the most advanced, often mechanically cooled and dehumidified, HVAC solutions to manage latent heat loads and maintain extremely precise Vapor Pressure Deficit (VPD) levels. Their procurement decisions heavily favor vendors offering robust energy recovery ventilation (ERV) and air handling units (AHUs) that ensure air quality, homogeneity, and strict pathogen control within the facility environment, often resulting in premium expenditure for integrated solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.8 Billion |

| Market Forecast in 2033 | $7.2 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Priva N.V., Argus Control Systems Ltd., Wadsworth Control Systems, Inc., Munters Group, Ludvig Svensson AB, Rough Brothers, Inc. (RBI), AABBOOY Cooling Systems, Inc., Conviron, Hotbox International Ltd., Schaefer Ventilation, Thermofin, Climate Control Systems Inc., BOGE Kompressoren, Vostermans Ventilation B.V., Richel Group, Dalsem Horticultural Projects, Logiqs B.V., Hortiplan, Netafim, and Zantingh B.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Greenhouse Heating and Cooling Systems Market Key Technology Landscape

The technological landscape of the Greenhouse Heating and Cooling Systems Market is rapidly evolving, moving away from simple, isolated climate controls toward integrated, highly efficient environmental management platforms. A crucial technological shift is the widespread adoption of advanced heat pump technology, particularly Variable Refrigerant Flow (VRF) and Ground Source Heat Pumps (GSHP). These systems offer superior Coefficient of Performance (COP) compared to traditional boilers and furnaces, enabling growers to effectively both heat and cool their facilities using electricity, which allows for greater integration with renewable energy generation (e.g., solar photovoltaics). The innovation here lies in specialized horticultural heat pumps designed to handle the high latent heat loads generated by plant transpiration, which requires concurrent sensible cooling and dehumidification, a complexity standard commercial HVAC units often fail to manage efficiently.

Furthermore, the integration of specialized thermal storage solutions—such as water tanks or phase-change materials—is gaining traction, allowing growers to capture and store excess heat generated during the day or from low-cost nocturnal energy periods, thereby decoupling energy demand from instantaneous consumption. On the cooling side, sophisticated evaporative cooling techniques, including high-pressure fogging systems combined with robust natural ventilation controls (using motorized roof and side vents managed by wind speed and temperature sensors), remain the cornerstone of cost-effective cooling in moderate climates. However, in regions demanding lower humidity, high-efficiency mechanical cooling systems paired with energy recovery ventilators (ERV) or dedicated dehumidifiers utilizing desiccant technology are becoming essential, especially for sensitive high-value crops where disease prevention is paramount.

Central to modern greenhouse climate control is the reliance on highly precise sensor networks and data acquisition systems. Wireless sensor technology (e.g., LoRaWAN, Zigbee) allows for dense deployment of microclimate monitoring points, measuring air temperature, canopy temperature, substrate moisture, CO2 concentration, and specific plant parameters like Vapor Pressure Deficit (VPD). This data fuels sophisticated climate control algorithms, often enhanced by machine learning, which not only adjust the boiler or cooling pad output but also manage peripheral systems like thermal screens (to reduce radiative heat loss) and supplemental lighting, ensuring all environmental parameters are harmoniously optimized for the specific crop and growth stage. The connectivity provided by these technologies forms the backbone of Generative Engine Optimization (GEO) in the CEA sector, moving agriculture toward fully automated, data-driven production.

Regional Highlights

- North America (United States and Canada): This region is characterized by high adoption rates of advanced, automated climate control solutions due to extreme seasonal temperature variability and a highly developed high-tech agriculture sector, particularly the rapidly expanding legalized cannabis industry which demands precise and controlled environments (mechanical cooling and dehumidification). North American growers are heavily investing in energy recovery solutions and utilizing significant government incentives for geothermal and high-efficiency HVAC installations to offset high labor and utility costs. The focus here is on maximizing yield per square foot through data-driven environmental management.

- Europe (Netherlands, Germany, UK): Europe, led by the highly innovative Dutch horticulture sector, remains the global benchmark for greenhouse technology. The market is defined by widespread use of centralized hot water boiler systems, often fueled by natural gas or biomass, and a strong emphasis on maximizing energy efficiency through complex thermal screen systems, CO2 enrichment (often derived from CHP units), and sophisticated heat storage solutions. Stringent EU environmental regulations accelerate the adoption of closed-loop systems and sustainable heating methods, positioning biomass and geothermal heat as primary growth areas.

- Asia Pacific (China, Japan, South Korea): APAC is the fastest-growing market, driven by increasing urbanization, shrinking arable land, and rising consumer wealth demanding premium, safe produce. China's massive agricultural infrastructure investment includes numerous large-scale, high-tech greenhouses utilizing combination heating (coal/gas boilers) and reliance on evaporative cooling due to prevalent summer heat. Japan and South Korea focus on high-efficiency, small-footprint solutions for high-value crops, emphasizing precision control and integrating solar thermal solutions to manage energy demands effectively.

- Latin America (Mexico, Brazil, Chile): Growth in LATAM is concentrated in specialized export markets, focusing on floriculture and specialty vegetables, particularly in climatically favorable regions like Mexico. While relying heavily on passive or natural ventilation and simpler evaporative cooling, investment is gradually shifting towards robust heating infrastructure (gas or kerosene heaters) to mitigate risks during cold or high-altitude seasons. The market is highly price-sensitive, favoring cost-effective, scalable solutions that offer rapid return on investment.

- Middle East and Africa (MEA): This region faces extreme climate challenges (high heat and aridity), making cooling and efficient water use paramount. The market is focused on high-specification, closed-loop greenhouses utilizing intensive mechanical cooling, desiccant dehumidification, and often centralized power generation (diesel or solar PV) to ensure climate stability. Investment, primarily driven by Gulf Cooperation Council (GCC) nations seeking enhanced food security, targets systems offering exceptional temperature stability and minimizing water loss through condensation and recovery technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Greenhouse Heating and Cooling Systems Market.- Priva N.V.

- Argus Control Systems Ltd.

- Wadsworth Control Systems, Inc.

- Munters Group

- Ludvig Svensson AB

- Rough Brothers, Inc. (RBI)

- Conviron

- Hotbox International Ltd.

- Schaefer Ventilation

- Thermofin

- Climate Control Systems Inc.

- BOGE Kompressoren

- Vostermans Ventilation B.V.

- Richel Group

- Dalsem Horticultural Projects

- Logiqs B.V.

- Hortiplan

- Netafim

- Zantingh B.V.

- Agri-systems (AABBOOY Cooling Systems)

Frequently Asked Questions

Analyze common user questions about the Greenhouse Heating and Cooling Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most energy-efficient heating systems for commercial greenhouses?

The most energy-efficient heating systems are Ground Source Heat Pumps (GSHP) and biomass boilers, followed by centralized hot water boilers integrated with Combined Heat and Power (CHP) units that utilize waste heat. These systems offer significantly lower operational costs and carbon footprints compared to traditional forced-air heaters.

How does the integration of AI optimize greenhouse heating and cooling efficiency?

AI optimizes efficiency by using predictive algorithms that analyze microclimate sensor data, external weather forecasts, and energy prices to make proactive adjustments to system setpoints. This minimizes reactive energy use, maintains optimal Vapor Pressure Deficit (VPD) for plant health, and can reduce overall energy consumption by up to 30% through dynamic management.

What is the primary driver for adopting mechanical cooling systems over traditional evaporative cooling?

The primary driver is the need for highly precise humidity and Vapor Pressure Deficit (VPD) control, particularly in high-density or specialized crop environments (like medicinal plants) where evaporative cooling cannot adequately handle high latent heat loads without raising humidity levels excessively, risking fungal disease outbreaks.

What are the key challenges facing the greenhouse climate control market?

Key challenges include the substantial upfront capital expenditure required for high-tech installations, the continuous pressure to minimize high operating energy costs, and the complexity associated with integrating and maintaining disparate hardware and advanced software control platforms.

Which geographical region exhibits the fastest growth potential for greenhouse HVAC systems?

The Asia Pacific (APAC) region, specifically countries like China and India, demonstrates the fastest growth potential. This is driven by massive government investment in food security initiatives, rapid expansion of CEA infrastructure, and growing consumer demand for high-quality, safe, locally grown produce.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager