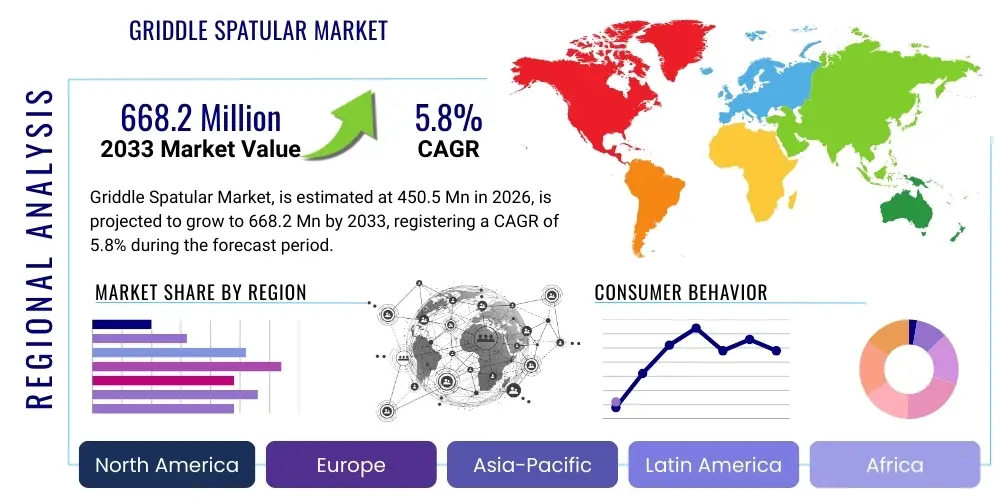

Griddle Spatular Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442027 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Griddle Spatular Market Size

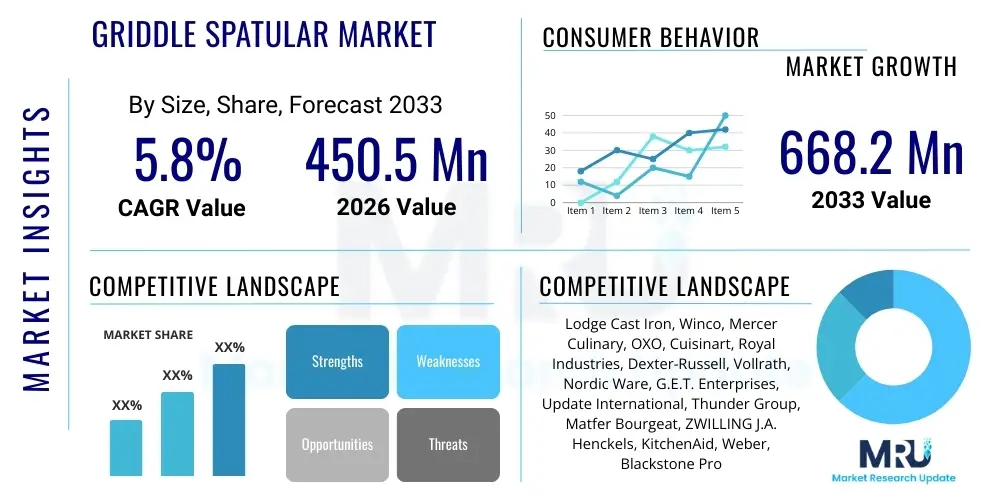

The Griddle Spatular Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 668.2 Million by the end of the forecast period in 2033.

Griddle Spatular Market introduction

The Griddle Spatular Market encompasses the production, distribution, and sale of specialized flat cooking utensils designed primarily for use on flat-top grills and griddles. These tools are engineered for high-heat environments, offering superior scraping, flipping, and chopping capabilities crucial for commercial kitchens, food trucks, and residential outdoor cooking enthusiasts. The market is characterized by a strong emphasis on material science, particularly the utilization of high-grade stainless steel to ensure longevity, corrosion resistance, and compliance with stringent food safety standards.

Griddle spatulas are essential instruments in modern culinary preparation, distinguished from standard kitchen spatulas by their robust construction, often featuring beveled edges for effective scraping and ergonomic handles for extended use. Major applications span quick-service restaurants, fine dining establishments utilizing specific griddle techniques, and the rapidly expanding segment of home outdoor grilling and recreational vehicle (RV) cooking. The primary benefit of these tools lies in enhancing efficiency and consistency in cooking, especially when preparing large volumes of food such as burgers, pancakes, cheesesteaks, and stir-fries.

Driving factors for market expansion include the global proliferation of street food culture and food service industries, which heavily rely on griddle cooking efficiency. Furthermore, the rising consumer interest in outdoor cooking, coupled with the introduction of sophisticated residential griddle systems and accessories, is significantly boosting demand. Innovations in handle materials, such as heat-resistant composites and ergonomic designs aimed at reducing chef fatigue, also contribute positively to market dynamics, solidifying the griddle spatular as a non-negotiable tool for professional and amateur cooks alike.

Griddle Spatular Market Executive Summary

The Griddle Spatular Market is poised for sustained growth, driven primarily by robust expansion in the global commercial food service sector and increasing adoption of outdoor recreational cooking appliances. Business trends indicate a strong shift towards premium, specialized tools, where manufacturers are focusing on superior material composition—specifically 420 or 304 grade stainless steel—to cater to the stringent durability demands of high-volume commercial users. Key market players are leveraging strategic partnerships with professional chefs and culinary schools to influence purchasing decisions and validate product design, emphasizing attributes like heat resistance, balance, and specialized blade profiles (e.g., hamburger turners, choppers, slotted spatulas).

Regionally, North America continues to dominate the market share, largely due to a deeply ingrained culture of barbecue, outdoor grilling, and a highly developed quick-service restaurant (QSR) infrastructure. However, the Asia Pacific (APAC) region presents the highest growth potential, fueled by rapid urbanization, increasing disposable incomes, and the modernization of traditional cooking techniques in countries like China and India, where flat-top cooking is gaining momentum. Europe also shows steady growth, particularly in professional kitchen equipment renewal and the rising popularity of food truck businesses across major metropolitan areas.

Segment trends highlight the Stainless Steel material segment as the dominant category due to its unparalleled performance in high-temperature commercial settings. The Commercial Application segment remains the largest revenue generator, although the Residential segment is experiencing faster proportional growth, driven by product customization and aesthetically pleasing designs targeted at the home consumer. E-commerce channels are rapidly gaining traction, offering consumers direct access to niche, specialized tools and detailed product comparisons, bypassing traditional wholesale distribution models and enabling smaller, specialized manufacturers to compete effectively on a global scale.

AI Impact Analysis on Griddle Spatular Market

User queries regarding the impact of Artificial Intelligence (AI) on the Griddle Spatular Market typically revolve around manufacturing optimization, supply chain efficiency, and the development of "smart" cooking accessories. Key themes include whether AI can predict demand fluctuations for specific tool types (e.g., offset vs. straight spatulas), how automation can reduce manufacturing defects and material waste in steel fabrication, and the potential for AI integration into related kitchen systems, such as smart griddles that could suggest the optimal tool for a cooking task. Consumers and B2B buyers are less concerned about the tool itself becoming "smart" and more interested in how AI can make the overall procurement process cheaper, faster, and more reliable, ensuring timely delivery of high-quality, durable equipment necessary for continuous commercial operation.

While the griddle spatula itself remains a relatively low-tech, mechanical instrument, AI profoundly influences the supporting ecosystem. In manufacturing, machine learning algorithms are utilized for predictive maintenance of stamping and grinding machinery, minimizing downtime and ensuring continuous production of precisely cut blades. Furthermore, AI-powered quality control systems employing vision technology can rapidly identify minute imperfections in material finish or handle assembly, drastically improving product consistency before distribution. This operational enhancement directly translates to higher product reliability, a critical factor for commercial buyers whose reputation depends on equipment durability.

In the supply chain, AI algorithms optimize inventory management based on real-time sales data across diverse geographical regions, accurately forecasting seasonal spikes in demand related to outdoor cooking trends or commercial kitchen upgrade cycles. This advanced forecasting capability reduces warehousing costs and minimizes stockouts, ensuring that specialized tools are available when professional chefs and retail consumers require them. Ultimately, AI enhances the overall efficiency and responsiveness of the griddle spatular market without directly altering the fundamental functionality of the product itself, thereby securing high-quality supply at competitive prices.

- AI optimizes factory floor efficiency through predictive maintenance of stamping and forging equipment.

- Machine learning algorithms enhance quality control, identifying micro-defects in stainless steel finishing and handle attachment.

- AI-driven supply chain management improves demand forecasting for seasonal and regional requirements, minimizing logistical delays.

- Generative AI assists in ergonomic design refinement by simulating user fatigue based on handle geometry and weight distribution.

- Automated warehousing and sorting systems, powered by AI, streamline the distribution of specialized spatula variants to global retailers.

DRO & Impact Forces Of Griddle Spatular Market

The dynamics of the Griddle Spatular Market are governed by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that shape strategic decision-making for manufacturers and distributors. A primary driver is the accelerating expansion of the global food service industry, particularly the proliferation of quick-service restaurants, food trucks, and institutional catering operations that rely heavily on high-volume griddle cooking techniques. This commercial demand necessitates the continuous procurement of durable, specialized spatulas designed to withstand aggressive daily usage and extreme thermal conditions. Complementing this, the increasing consumer adoption of high-end residential outdoor griddles and cooking stations provides a significant impetus for market growth, creating a new segment focused on aesthetic appeal and ergonomic comfort alongside commercial-grade performance.

However, the market faces notable restraints, chiefly related to the volatility of raw material costs, particularly stainless steel (chromium and nickel alloys). Fluctuations in global commodity markets directly impact manufacturing overheads, compelling companies to either absorb costs, impacting profitability, or pass them on to consumers, potentially suppressing demand in the price-sensitive residential segment. Additionally, the proliferation of low-cost, inferior quality generic tools, primarily from regions with lower manufacturing standards, poses a constant competitive challenge, leading to downward pressure on pricing for entry-level products. Furthermore, the inherent simplicity of the product means intellectual property protection is challenging, often resulting in rapid market entry by competitors.

Opportunities for growth are abundant, particularly in the realm of specialized product development, focusing on tools designed for specific culinary tasks, such as dedicated smash burger spatulas or oversized scraper choppers for industrial use. Manufacturers can capitalize on the growing demand for sustainable and hygienic options by utilizing anti-microbial coatings or incorporating recycled materials in handle components. Moreover, geographic expansion into rapidly developing economies in Africa and parts of Southeast Asia, where modern culinary practices are evolving, represents a substantial long-term opportunity. The overarching impact forces include stricter global food safety regulations, which favor high-quality, seamless stainless steel tools that are easy to clean and sanitize, thereby pushing cheaper, less durable plastic or composite alternatives out of commercial use.

Segmentation Analysis

The Griddle Spatular Market is systematically segmented based on material composition, handle type, application scope, and distribution channel, providing a granular view of market dynamics and consumer preferences across different usage environments. Segmentation is critical for manufacturers to tailor product lines and marketing strategies, recognizing the distinct needs of a high-volume commercial kitchen versus a recreational home griller. The fundamental distinction often lies in the required durability, where commercial users prioritize high-gauge stainless steel blades and heat-resistant, securely attached handles, while residential consumers might also consider aesthetic features, specialized color coding, and composite grip materials for comfort.

The analysis reveals that the Material segment is dominated by metal alloys, driven by performance requirements, while the Application segment clearly delineates the market into the higher-revenue, stringent Commercial sector and the faster-growing, diverse Residential sector. Understanding these segments allows market participants to optimize their supply chain. For example, products destined for the Commercial segment are often procured through B2B wholesalers and institutional suppliers, whereas Residential sales are increasingly channeled through large-scale retail chains and direct-to-consumer e-commerce platforms, requiring different packaging and logistics solutions. This multifaceted segmentation framework is essential for accurately forecasting demand and identifying underserved niche markets, such as specialized spatulas for Hibachi style cooking or bespoke tools for high-end artisan bakeries utilizing flat-top ovens.

- By Material:

- Stainless Steel (304 Grade, 420 Grade)

- High-Carbon Steel

- Composite Materials

- Silicone/Nylon (Edge protection and specialty use)

- By Blade Type:

- Solid (Flipping and turning)

- Slotted/Perforated (Draining grease)

- Scraper/Chopper (Beveled edge)

- Offset Spatulas

- By Handle Material:

- Wood (Ergonomic, aesthetic)

- High-Temperature Plastic/Polypropylene

- Metal/Stainless Steel

- Composite/Rubberized Grip

- By Application:

- Commercial (Restaurants, Food Trucks, Institutional)

- Residential (Home Use, Outdoor Grilling)

- By Sales Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Department Stores, Specialty Kitchen Stores)

- Wholesale/Distribution (Institutional Suppliers)

Value Chain Analysis For Griddle Spatular Market

The value chain for the Griddle Spatular Market commences with Upstream Analysis, involving the procurement of raw materials, primarily high-grade stainless steel coils or sheets, along with various materials for handles such as specialized plastics, rubberized grips, or hardwoods. Suppliers of these primary materials, often large-scale metal refineries and chemical companies, hold moderate bargaining power due to global commodity price volatility and the specialized nature of food-grade steel requirements. The core manufacturing process involves precision cutting, stamping, forging, grinding, and polishing of the blade, followed by the attachment and secure fastening of the handle components. Efficiency in this stage, driven by lean manufacturing principles and automation, is paramount to maintaining competitive pricing, as the product has relatively standardized performance criteria.

The midstream of the value chain focuses on distribution channels, which are bifurcated between direct and indirect methods. Indirect distribution remains dominant for high-volume commercial sales, utilizing specialized B2B kitchen equipment wholesalers and institutional suppliers who manage large inventories and offer procurement services to restaurants and catering businesses. These distributors often require bulk packaging and adhere to strict commercial quality standards. In contrast, the residential market relies heavily on major retailers, department stores, and increasingly, direct sales through e-commerce platforms. The shift toward online sales (Direct Channel) streamlines the process, bypassing traditional intermediaries and enabling manufacturers to gain higher margins while offering detailed product information directly to the end-user.

Downstream analysis centers on the final consumption points. Commercial kitchens prioritize utility, durability, and compliance, driving sales of standardized, heavy-duty models. Residential consumers, conversely, are influenced by branding, ergonomic features, and design aesthetics, leading to a higher demand for specialized sets and tools with unique handle materials. Effective branding, comprehensive after-sales support (though limited for this low-cost item), and responsive logistics are crucial elements at this end of the chain, ensuring consumer satisfaction and repeat purchases. The performance of the spatular in its end-use environment—measured by longevity and scraping efficiency—ultimately validates the quality throughout the entire upstream and midstream process.

Griddle Spatular Market Potential Customers

Potential customers for griddle spatulas span a broad range of food preparation environments, categorizing primarily into professional commercial users and domestic residential consumers. The largest and most consistently demanding segment consists of commercial kitchens, including quick-service restaurant chains (QSRs) like burger establishments and sandwich shops, institutional cafeterias (schools, hospitals, corporate dining), and mobile food vendors (food trucks, concession stands). These professional entities represent bulk buyers who require robust, certified tools capable of continuous daily operation under intense heat and rigorous cleaning cycles. Their purchasing decisions are driven by durability, ergonomic design to minimize staff fatigue, and compliance with health and safety standards, often favoring products with NSF certification or similar endorsements.

The second major category involves the rapidly expanding residential market, comprising individuals who own and operate home griddles, outdoor flat-top grills, or specialized cooking appliances. This customer base is characterized by higher sensitivity to brand reputation and aesthetic features, seeking spatulas that offer a comfortable grip, appealing design, and often come bundled in specialized sets with complementary accessories like scrapers and tongs. This segment also includes culinary enthusiasts and professional home cooks who invest in high-quality tools that mirror professional-grade performance. Marketing efforts targeted at this group often focus on ease of use, material quality storytelling, and instructional content related to achieving optimal cooking results.

A burgeoning niche customer segment includes specialized culinary schools and vocational training centers, which procure sets of griddle spatulas for student training purposes, ensuring exposure to industry-standard equipment. Furthermore, equipment rental companies and large event caterers represent transient high-volume customers who require temporary stock for large functions. Understanding the diverse usage patterns—from the aggressive scraping techniques employed in a diner kitchen to the delicate flipping required in a residential breakfast setting—allows manufacturers to effectively segment their product offerings and maximize penetration across all viable end-user groups, solidifying the market’s reliance on these essential tools.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 668.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lodge Cast Iron, Winco, Mercer Culinary, OXO, Cuisinart, Royal Industries, Dexter-Russell, Vollrath, Nordic Ware, G.E.T. Enterprises, Update International, Thunder Group, Matfer Bourgeat, ZWILLING J.A. Henckels, KitchenAid, Weber, Blackstone Products, Traeger, Camp Chef, Starfrit |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Griddle Spatular Market Key Technology Landscape

The technology landscape for the Griddle Spatular Market is primarily centered on advanced material science and manufacturing precision, rather than electronics or digital integration. A core technological focus is the metallurgical process required to produce high-performance stainless steel blades, often involving heat treatment and tempering to achieve the optimal balance between flexibility for flipping and rigidity for scraping and chopping. Manufacturers increasingly rely on specialized grades of stainless steel, such as 420 J2, known for its superior edge retention and hardness, or 304, prized for its exceptional corrosion resistance, particularly important in high-salt commercial cooking environments and frequent dishwasher cycles. Precision laser cutting and CNC machining are essential technologies ensuring standardized blade geometry and perfect alignment, minimizing inconsistencies that could lead to premature failure in professional settings.

A second major technological area involves handle design and assembly technology. Given the critical requirement for hygiene and safety, advanced thermoplastic injection molding techniques are utilized to produce seamless, highly durable handles from high-temperature resistant polypropylene or nylon. The critical challenge is the secure mechanical or chemical bonding of the metal blade tang to the handle material to prevent separation, a common failure point in inferior products. Many leading companies employ specialized rivet systems or overmolding technology to create a watertight, sanitary seal, thereby reducing bacterial harboring risks and extending product lifespan. Furthermore, material scientists are continuously innovating with composite materials that offer superior heat insulation and tactile grip, improving user comfort during prolonged use.

Beyond the product itself, the technological landscape includes the adoption of automated inspection systems during manufacturing, often utilizing digital vision systems and sensors to verify material thickness, curvature, and finish consistency against rigorous quality benchmarks. These technologies ensure mass-produced spatulas meet the stringent tolerances demanded by commercial buyers. Emerging technologies also include the use of sophisticated simulation software (Finite Element Analysis) to test stress points and thermal resistance during the design phase, allowing manufacturers to optimize the structural integrity of the tools before physical prototyping, leading to faster product development cycles and reduced material waste in the initial stages of production.

Regional Highlights

The geographic distribution of the Griddle Spatular Market reveals distinct consumption patterns and growth trajectories across major global regions, reflecting cultural cooking preferences and economic development levels.

- North America: This region holds the largest market share, characterized by a mature and highly developed food service industry, including massive fast-food chains and a deeply entrenched culture of outdoor grilling and professional flat-top cooking. The demand here is focused on high-durability, heavy-gauge stainless steel spatulas, often required in large quantities for commercial operations. The US market, in particular, drives innovation in specialized tools like smash burger press spatulas and scraper choppers, reflecting the diversity of flat-top culinary applications.

- Europe: The European market shows stable, sustained growth, driven primarily by the modernization of professional kitchens and the expansion of casual dining formats across countries like Germany, France, and the UK. While quality and design aesthetics are important, adherence to specific regional food contact material regulations (e.g., EU regulations) is paramount, necessitating detailed material documentation from manufacturers.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region. This explosive growth is fueled by rising urbanization, increasing consumer spending on dining out, and the widespread adoption of modern cooking equipment in rapidly developing economies such as China, India, and Southeast Asia. The demand is diverse, ranging from affordable, high-volume tools for street food vendors to premium, specialized tools for high-end hotel kitchens.

- Latin America (LATAM): Growth in LATAM is moderate but steady, linked to the expansion of regional restaurant chains and the growing popularity of food preparation techniques that utilize high-heat griddles. Market penetration is often challenging due to economic variability and competition from locally produced, lower-cost alternatives, but opportunities exist in catering to the rising middle-class segment demanding better quality.

- Middle East and Africa (MEA): The MEA region represents an emerging market, with demand concentrated in commercial kitchens within rapidly growing hospitality sectors (hotels and luxury resorts) in the UAE and Saudi Arabia. Infrastructure development and tourism growth are key drivers, demanding imported, high-quality professional tools compliant with international standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Griddle Spatular Market.- Lodge Cast Iron

- Winco

- Mercer Culinary

- OXO

- Cuisinart

- Royal Industries

- Dexter-Russell

- Vollrath

- Nordic Ware

- G.E.T. Enterprises

- Update International

- Thunder Group

- Matfer Bourgeat

- ZWILLING J.A. Henckels

- KitchenAid

- Weber

- Blackstone Products

- Traeger

- Camp Chef

- Starfrit

Frequently Asked Questions

Analyze common user questions about the Griddle Spatular market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a commercial and residential griddle spatula?

Commercial griddle spatulas are engineered for extreme durability, often featuring thicker, higher-gauge stainless steel blades and seamless, high-heat resistant handles to endure heavy use, continuous heat exposure, and industrial dishwashing cycles, prioritizing longevity and NSF compliance over aesthetics. Residential models typically focus on ergonomic comfort, aesthetic design, specialized features, and may use lighter materials suitable for less rigorous, intermittent home use.

Which material offers the best performance and durability for griddle spatulas?

High-grade stainless steel, specifically 304 or 420 J2 alloys, is universally recognized as offering the best balance of corrosion resistance, strength, and edge retention necessary for professional griddling. While 304 stainless steel excels in hygiene and corrosion defense, 420 J2 stainless steel often provides superior hardness for scraping and chopping actions, making it ideal for scraper and chopper spatula variants.

How are environmental sustainability trends influencing griddle spatula manufacturing?

Sustainability influences are primarily seen in handle construction, with manufacturers increasingly exploring recycled and sustainably sourced materials, such as certified hardwoods or recycled plastics, to reduce their environmental footprint. Additionally, the focus on producing highly durable, long-lasting stainless steel tools reduces the frequency of replacement, which inherently contributes to resource conservation and waste reduction over the product lifecycle, appealing to eco-conscious commercial buyers.

What role does the e-commerce channel play in market growth for griddle spatulas?

E-commerce platforms are critical growth drivers, especially for the residential and small business segments, offering vast product variety, detailed user reviews, and comparative pricing unavailable through traditional wholesale channels. Online sales enable specialized tool manufacturers to reach a global consumer base directly, facilitating targeted marketing of unique and niche spatula designs and accessories, accelerating market penetration beyond regional distribution limitations.

What key design features should commercial buyers look for to ensure hygiene and safety?

Commercial buyers should prioritize spatulas featuring seamless construction between the blade and handle to eliminate crevices where food particles and bacteria can accumulate. Look for fully sealed handles, often achieved through overmolding or secure riveting with watertight integrity, along with materials that are certified by food safety organizations like NSF International, ensuring easy and effective sanitation compliance in professional kitchen environments.

This report segment extensively details the Griddle Spatular Market's structure, growth drivers, key technological inputs, and major regional dynamics. The market's resilience is intrinsically tied to the enduring demand from the quick-service restaurant (QSR) sector, which mandates consistent, high-quality, and reliable cooking instruments. Specialized tool designs, particularly those focused on ergonomic efficiency and enhanced scraping capabilities, are critical differentiators in the highly competitive commercial space. The increasing adoption of outdoor griddling in residential settings is broadening the consumer base, demanding a fusion of commercial-grade performance with residential aesthetic appeal. Manufacturers are investing heavily in advanced forging and stamping techniques to optimize the durability of stainless steel blades, which remains the cornerstone of product quality. Regional expansion into the APAC corridor promises substantial future growth, driven by rapid urbanization and the proliferation of modernized food preparation facilities. The market exhibits characteristics of a mature industry with continuous incremental innovations centered on material science and ergonomic improvements rather than revolutionary technological shifts. The rigorous adherence to food safety standards across North America and Europe continues to impose high barriers to entry for low-quality manufacturers, reinforcing the market leadership of established brands known for reliable, certified products.

The strategic landscape is marked by continuous efforts to optimize supply chain robustness, minimizing vulnerability to global commodity price fluctuations affecting steel and specialized handle composites. Manufacturers are keenly focused on vertical integration or strong supplier relationships to secure stable material costs. Furthermore, product specialization, evidenced by the development of tools specifically designed for tasks such as smash burgers, flat-top steak preparation, or dedicated grill cleaning, allows companies to capture niche market value and command premium pricing. The penetration of e-commerce is forcing traditional wholesale distributors to evolve their models, offering enhanced logistics and tailored inventory management services to compete with direct-to-consumer online channels. Future growth will also be catalyzed by the widespread replacement cycles in aging commercial kitchens and the continuous rise of global tourism, which directly fuels the hotel and restaurant equipment procurement sector, where durable griddle spatulas are considered indispensable assets.

In summary, the Griddle Spatular Market remains fundamentally robust, supported by consistent demand across diverse global culinary landscapes. While not a high-technology sector, the reliance on precision engineering, material science excellence, and stringent quality control protocols ensures its essential role in both professional and recreational cooking environments. Key competitive factors include brand reputation, material certification, and the ability to efficiently manage complex global supply chains. The forecasted growth rate validates the sustained necessity of these specialized tools, positioning the market for steady expansion through the forecast period, contingent upon successful navigation of raw material price volatility and adherence to evolving international food safety standards, which favor robust stainless steel construction over cheaper alternatives.

Further analysis of the competitive environment indicates that mergers and acquisitions are infrequent but often strategic, aimed at gaining patented handle technologies or securing strong distribution networks in key geographical areas. Smaller, innovative players often introduce niche products targeting specific culinary sub-sectors before being acquired by larger established firms seeking to diversify their commercial product portfolio. Intellectual property protection, particularly regarding unique blade profiles and patented handle ergonomics, serves as a soft barrier to market entry. The focus on providing comprehensive tool sets, often combining spatulas with scrapers, tongs, and oil dispensers, enhances perceived consumer value, particularly in the residential segment, driving higher average transaction values. The long-term stability of this market is assured by the fundamental and irreplaceable nature of the griddle as a core cooking surface in high-volume food preparation, making the specialized spatula a perennial necessity.

The technological evolution, while subtle, is significant for manufacturing efficiency. Automation, particularly in the final grinding and polishing stages of the stainless steel blade, is crucial for achieving the required mirror finish or specific surface texture, which minimizes food sticking and enhances sanitation. Investment in energy-efficient machinery for heat treatment processes also represents a growing trend, aligning manufacturing practices with corporate sustainability goals. The integration of digital inventory tracking, utilizing RFID tags on bulk shipments to commercial clients, enhances supply chain transparency and reduces loss, thereby optimizing the logistical efficiency for distributors. These operational enhancements, driven by subtle technological adoptions, underpin the ability of manufacturers to maintain high-quality standards while controlling costs in a price-sensitive commodity market segment.

Regarding regional market dynamics, the dominance of North America is reinforced by continuous product innovation tailored to the specific demands of American cuisine and cooking styles, particularly the prevalence of flat-top and propane griddling systems. Conversely, the high growth projection for APAC reflects not just population size, but also the rapid shift from traditional cooking vessels to modern, westernized kitchen equipment in commercial settings. European markets are characterized by a focus on aesthetic quality and premium finishes, catering to a highly discerning professional chef community that often favors tools from established European utensil manufacturers known for heritage and precision craftsmanship. Successfully competing globally requires manufacturers to maintain flexible production lines capable of switching between high-volume, standardized commercial products and lower-volume, specialized, design-intensive residential models to meet heterogeneous regional demand profiles.

The role of regulatory compliance cannot be overstated, particularly for manufacturers targeting commercial sales. Certifications from organizations such as NSF, FDA, and European food contact safety bodies are essential prerequisites for market entry into major established regions. This regulatory landscape compels consistent investment in material traceability and strict adherence to manufacturing protocols. The demand for seamless, non-porous handles and high corrosion resistance is directly linked to regulatory pressures favoring tools that minimize cross-contamination risk and ensure ease of cleaning in industrial dishwashers. This regulatory environment acts as a natural consolidation force, favoring large, established manufacturers who can afford the compliance costs and rigorous testing protocols required to maintain professional market access.

Finally, the future trajectory of the Griddle Spatular Market will be shaped by how effectively manufacturers respond to the blurring lines between commercial and residential product demands. As home users adopt higher-end griddles, their expectations for professional-grade durability and performance increase, driving demand for premium products previously exclusive to the commercial sphere. This convergence provides opportunities for product line simplification and increased production scale for high-quality items. Success in the coming years will depend on market players’ ability to innovate subtly, optimize manufacturing processes through technology, and strategically manage distribution to capture growth across all key application segments, maintaining the spatula's status as an indispensable utensil in the global kitchen equipment ecosystem.

The cumulative effect of increased specialization, regulatory compliance demands, and efficient supply chain management solidifies the Griddle Spatular Market's growth outlook. Product differentiation is increasingly achieved through ergonomic engineering, focusing on weight balance and handle texture to improve user control and reduce wrist strain, a major concern in high-volume professional kitchens. Companies that successfully leverage user-centric design principles, backed by advanced materials science, are positioned for market share gains. The market's character, defined by its reliance on traditional, reliable manufacturing processes integrated with modern quality control and logistics technology, ensures its vital contribution to the broader culinary tools industry. The ongoing globalization of food culture and the continuous expansion of the hospitality sector worldwide will provide the foundational demand necessary for the market to achieve its forecasted valuation by 2033.

The competitive differentiation also stems from the integration of specialized functions. For instance, some manufacturers have introduced spatulas with integrated measurement markings or unique blade flexibility profiles optimized for thin foods, showcasing how subtle modifications can capture highly specific professional sub-segments. Marketing strategies frequently emphasize the heritage and precision of the tools, often tying the product narrative to professional chefs and culinary excellence. This approach is particularly effective in the premium segment, where buyers equate higher cost with superior craftsmanship and longevity. Furthermore, the after-market accessory sector, including specialized storage cases and cleaning tools designed specifically for griddle spatulas, contributes supplementary revenue and enhances overall brand loyalty, solidifying the ecosystem around the core product.

In conclusion, the market analysis reinforces the projected positive CAGR, driven by underlying structural demand from the commercial food industry and accelerating interest in home griddling. While raw material cost pressures and intense competition necessitate operational efficiency, opportunities in design innovation, material quality, and strategic regional expansion—especially in fast-growing APAC markets—are abundant. The market's stability and consistent growth trajectory make it an attractive segment within the broader kitchenware industry, characterized by predictable demand cycles and a continuous focus on optimizing mechanical performance through material science and precision engineering. This foundational strength ensures the griddle spatula remains a critical component in the global cooking tool kit for the foreseeable future, driving sustained market value.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager