Grilling Wood Chips Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442773 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Grilling Wood Chips Market Size

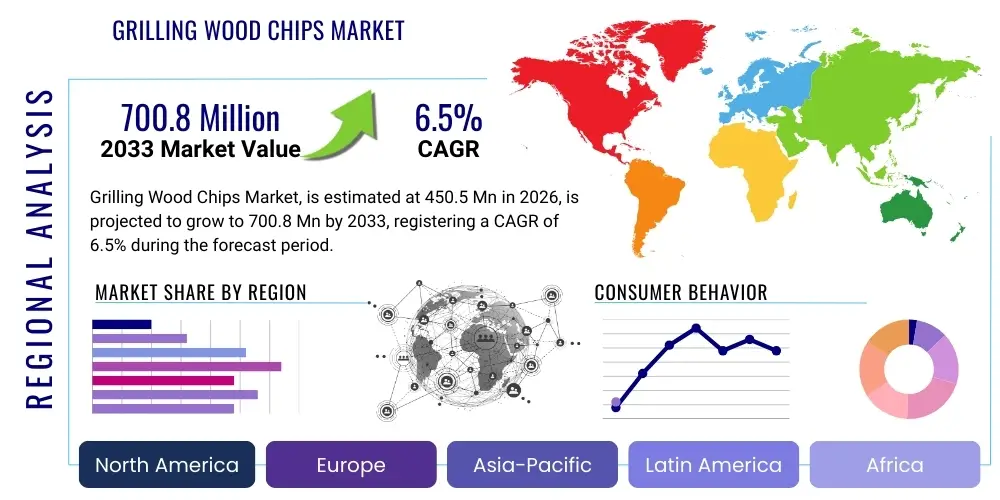

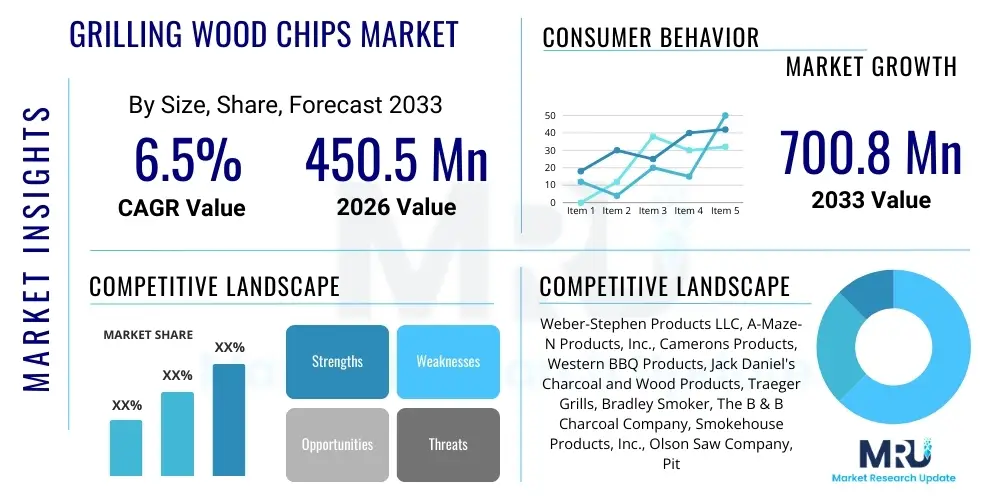

The Grilling Wood Chips Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 700.8 Million by the end of the forecast period in 2033.

Grilling Wood Chips Market introduction

The Grilling Wood Chips Market encompasses the production, distribution, and sale of small pieces of natural, untreated wood specifically designed to be used in grilling, smoking, and barbecuing processes to impart distinct flavors to food. These chips, derived from various hardwoods and fruitwoods such as hickory, mesquite, cherry, and apple, are essential components for achieving authentic smoke flavor profiles, particularly in gas or electric grills where natural smoke generation is otherwise limited. The primary application spans residential outdoor cooking, professional catering, and specialized commercial food preparation where controlled, nuanced smoke infusion is critical to the culinary outcome.

Key benefits driving market adoption include the ability to easily customize flavor intensity and profile, the relatively low cost compared to logs or chunks, and the convenience they offer for shorter smoking sessions. The rising global popularity of barbecue culture, coupled with increasing consumer interest in gourmet cooking and food experimentation at home, serves as a fundamental market driver. Furthermore, the accessibility of a wide variety of exotic and specialty wood types encourages repeat purchases and market expansion, positioning grilling wood chips as a staple accessory in the outdoor cooking industry.

The continuous innovation within the market focuses on flavor blends, sustainable sourcing practices, and enhanced product presentations, such as pre-soaked or quickly combustible varieties. Major market participants are actively engaged in educating consumers about proper usage and pairing specific wood flavors with different types of meat or vegetables, thereby maximizing the product's value proposition. This focus on culinary education and product differentiation ensures sustained demand, especially as global consumer spending on outdoor leisure and home entertainment increases.

Grilling Wood Chips Market Executive Summary

The Grilling Wood Chips Market is characterized by robust growth, propelled primarily by shifting consumer preferences towards authentic, smoky flavor profiles and the expanding popularity of sophisticated outdoor culinary experiences. Business trends indicate a strong move toward premiumization, where consumers are increasingly willing to pay higher prices for sustainably sourced, unique wood varieties, and branded blends that guarantee consistent quality and specific flavor outcomes. Manufacturers are responding by focusing on advanced kiln-drying processes and utilizing environmentally responsible raw material procurement, often seeking third-party certifications to enhance brand reputation and meet ethical consumer demands. The competitive landscape is fragmented, featuring numerous specialized regional producers alongside large established outdoor cooking brands.

Regionally, North America maintains market dominance due to its established and culturally ingrained barbecue tradition, high disposable income, and massive installed base of grills and smokers. However, the Asia Pacific and European markets are exhibiting the highest growth rates, driven by the Westernization of culinary practices and increasing penetration of specialized grilling equipment. European consumers show a growing preference for woods derived from native European species, while APAC markets are rapidly adopting convenience-oriented packaging and unique flavor mixes suitable for regional cuisine adaptations. Regulatory trends concerning forestry management and wood treatment standards are becoming increasingly critical, influencing sourcing strategies across all geographical regions.

Segmentation trends highlight the dominance of classic wood types (Hickory, Mesquite) but reveal significant uptake in fruit woods (Apple, Peach) for lighter protein smoking. The distribution channel is undergoing a transformation, with e-commerce experiencing accelerated growth, largely driven by younger consumers seeking specific, sometimes niche, wood chip varieties that may not be available in standard brick-and-mortar retail locations. Commercial application growth remains steady, anchored by quick-service restaurants and steakhouses that utilize controlled smoking techniques to standardize menu offerings and enhance food flavor presentation.

AI Impact Analysis on Grilling Wood Chips Market

Analysis of user inquiries related to AI and the grilling wood chips market reveals key themes centered on supply chain optimization, flavor profile prediction, and integration into smart grilling systems. Users frequently question how AI algorithms can predict optimal harvest timing for specific wood species to ensure consistent moisture and quality, minimizing defects that affect smoke flavor. There is significant interest in how machine learning could be applied to analyze consumer feedback data (e.g., social media mentions, review sentiment) to rapidly identify emerging flavor trends and recommend innovative wood blends, thus streamlining product development and inventory management for specialty retailers. Furthermore, consumers anticipate AI integration into next-generation smart smokers, enabling systems to recommend the precise type and quantity of wood chips required based on meat type, weight, desired doneness, and ambient temperature conditions.

The primary concern users express is the potential for AI-driven automation to dilute the artisanal, traditional nature of barbecue and smoking. However, expectations lean heavily towards using AI as an enhancement tool, particularly in logistics and quality control. AI’s ability to forecast demand for specific wood types based on seasonality and regional grilling events promises to significantly reduce waste and improve the freshness of inventory across the supply chain. For manufacturers, computer vision systems combined with AI are expected to standardize wood chip sizing and eliminate impurities more effectively than manual inspection, leading to a higher quality product delivered to the end consumer.

In retail and marketing, generative AI is impacting content creation by personalizing advertisements and pairing wood chips with recipe suggestions based on individual consumer purchasing history and dietary preferences. This hyper-personalization improves conversion rates and enhances the perceived value of premium wood chip products. Overall, the consensus view is that AI will not replace the fundamental act of grilling but will serve as a powerful data analysis tool, ensuring product quality, optimizing distribution, and making sophisticated smoking techniques more accessible to the novice backyard chef.

- AI optimizes wood sourcing by predicting quality based on climatic data.

- Machine learning algorithms forecast regional flavor trends, guiding new product development.

- Integrated AI in smart grills recommends precise wood chip pairings and quantities for specific recipes.

- Computer vision systems enhance quality control, ensuring uniformity in chip size and reducing impurities.

- Generative AI personalizes marketing content, matching specific wood chips to consumer cooking habits.

- Predictive analytics minimizes supply chain waste and optimizes inventory levels across retail channels.

DRO & Impact Forces Of Grilling Wood Chips Market

The dynamics of the Grilling Wood Chips Market are shaped by a powerful interplay of Driving forces (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces influencing future growth trajectories. The primary driving force is the global surge in interest in outdoor cooking and gourmet food preparation, particularly spurred by demographic shifts favoring home entertainment and premium experiences. Opportunities arise significantly from product diversification, including the introduction of specialty wood blends, pellet/chip hybrid products, and sustainable, certified sourcing practices that appeal to environmentally conscious consumers. However, market expansion is constrained by regulatory restrictions on forestry practices in various jurisdictions and fluctuating raw material costs, alongside growing competition from alternative smoking methods such as wood pellets and liquid smoke products.

The key impact forces are centered on sustainability and consumer education. Consumer demand for traceable, ethically harvested wood chips is forcing manufacturers to invest heavily in supply chain transparency and certification programs (e.g., FSC certified woods). This emphasis on sustainability acts both as a restraint (higher sourcing costs) and a driver (enhanced brand loyalty and premium pricing power). Moreover, the increasing complexity of flavor options necessitates extensive consumer education initiatives—through online tutorials, packaging information, and point-of-sale displays—to ensure proper product use and maximize customer satisfaction, thereby converting first-time buyers into loyal users of specific wood types.

The market faces external impact from the general economic climate, as grilling accessories are often considered discretionary purchases. However, the persistent trend towards high-quality, authentic food experiences mitigates cyclical economic downturns to some extent. Innovation in packaging, particularly the move towards nitrogen-flushed, vacuum-sealed bags to maintain moisture content and freshness, is another critical force impacting perceived product quality and shelf life. Overcoming the restraint of inconsistent raw material quality through advanced drying and processing technologies represents a major competitive advantage for leading market players focused on consistent flavor delivery.

Segmentation Analysis

The Grilling Wood Chips Market is comprehensively segmented based on several key parameters, including the Type of Wood, Application (End-User), and Distribution Channel. This granular segmentation allows manufacturers and retailers to tailor their offerings to specific consumer needs, ranging from professional chefs requiring specific smoke density and flavor profiles to casual backyard grillers seeking convenience and versatility. The segmentation by wood type, which includes species like Hickory, Mesquite, Oak, and various fruit woods, is paramount as flavor is the core product attribute, with each segment catering to different protein types and culinary traditions. For instance, Mesquite often dominates in Southwestern US markets, while fruitwoods are popular for poultry and seafood globally.

Segmentation by Application differentiates between residential use, which accounts for the largest volume but features high seasonality, and commercial use (restaurants, food processors), which demands higher quality consistency and bulk packaging. Commercial users typically prioritize cost-efficiency and reliable supply chains, whereas residential users prioritize convenience and flavor novelty. The growing trend of year-round indoor smoking appliances, while not yet dominant, is beginning to blur the lines between traditional seasonal residential purchasing and continuous commercial demand.

The Distribution Channel segmentation, spanning online retail, specialized outdoor stores, large format retailers (supermarkets, hypermarkets), and specialty BBQ shops, is critical for market access. The shift toward e-commerce provides significant opportunities for niche manufacturers to bypass traditional retail gatekeepers and offer specialized, premium wood types directly to a global audience. Conversely, mass retailers remain essential for high-volume, standard wood chip offerings, benefiting from high foot traffic and immediate consumer accessibility.

- By Wood Type:

- Hickory

- Mesquite

- Oak

- Apple

- Cherry

- Alder

- Pecan

- Specialty/Blended Woods (e.g., Maple, Bourbon Barrel Oak)

- By Application:

- Residential/Household Use

- Commercial Use (Restaurants, Catering, Food Processing)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Direct-to-Consumer Websites)

- Offline Retail

- Supermarkets and Hypermarkets

- Specialty BBQ Stores

- Hardware and Home Improvement Stores

Value Chain Analysis For Grilling Wood Chips Market

The value chain for grilling wood chips begins with rigorous upstream analysis focused on sustainable sourcing and raw material acquisition. This initial stage involves forestry companies, sawmills, and specialized wood processors who must ensure the wood feedstock is free of chemicals, pesticides, and excessive moisture. Quality control here is crucial, as the chemical composition of the wood directly dictates the flavor profile and burn consistency. Key activities include responsible harvesting, specialized seasoning (natural air drying or accelerated kiln drying), and cutting the wood into uniform chip sizes suitable for grilling applications. The sustainability of this upstream process is increasingly monitored by consumers and regulatory bodies, influencing supplier selection and pricing dynamics.

The midstream phase involves the core manufacturing process: chipping, cleaning (removing bark or debris), screening for size uniformity, and advanced drying methods to achieve the optimal low moisture content (typically below 10-15%) necessary for clean, consistent smoke generation. Following processing, packaging becomes a critical value-add step. This involves high-barrier packaging materials, sometimes with nitrogen flushing, to preserve the wood's aromatic oils and prevent moisture absorption, ensuring long shelf life and consistent product quality for the downstream segment. Effective logistics are essential in this stage to minimize transport costs for a relatively bulky, low-density product.

Downstream analysis focuses on distribution channels, which include direct and indirect sales. Indirect channels rely heavily on major retailers, large distributors, and specialized outdoor cooking wholesale networks that facilitate market penetration across broad geographic areas. Direct channels, typically via e-commerce or dedicated brand outlets, allow manufacturers to capture higher margins, manage brand presentation, and receive immediate consumer feedback. Potential customers (end-users) include both enthusiastic home grillers seeking unique flavors and commercial entities requiring reliable, high-volume supplies. Success in the downstream market hinges on effective merchandising, clear flavor descriptions, and leveraging digital platforms for product education and recipe dissemination.

Grilling Wood Chips Market Potential Customers

The primary segment of potential customers for grilling wood chips is the vast population of home grilling enthusiasts, ranging from casual weekend barbecuers to dedicated amateur pitmasters. These consumers are typically interested in elevating their outdoor cooking quality, experimenting with different flavor pairings, and achieving results comparable to professional smokers. This segment is characterized by high seasonality in purchasing, strong responsiveness to new flavor introductions, and a willingness to invest in premium accessories that enhance their leisure activities. Marketing efforts directed at this group emphasize ease of use, flavor quality, and specific pairing recommendations (e.g., Applewood for pork shoulder, Hickory for beef ribs).

A second, highly valuable segment comprises professional end-users, including commercial restaurants, catering companies specializing in smoked meats, and industrial food processors that incorporate smoked flavor into packaged goods. These buyers prioritize bulk purchasing options, guaranteed supply consistency, precise moisture control, and certifications ensuring the wood is food-safe and untreated. For this segment, the buying decision is often driven by operational efficiency, standardized product flavor, and minimizing the risk of contamination or off-flavors that could compromise commercial kitchen output. Long-term supply contracts and specialized commercial packaging are common requirements for servicing this industrial clientele.

Finally, a growing niche market includes original equipment manufacturers (OEMs) of grills and smokers who often purchase wood chips in bulk to include starter packs with new unit sales. This acts as an initial touchpoint, introducing new grill owners to the concept of smoking. Additionally, specialty food retailers and gourmet grocery stores that curate high-end food ingredients represent crucial buyers seeking differentiated, artisanal, and ethically sourced wood chips to appeal to their sophisticated customer base. Engaging with professional competition BBQ teams also serves as a strong marketing channel, as their endorsements significantly influence consumer purchasing behavior.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 700.8 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Weber-Stephen Products LLC, A-Maze-N Products, Inc., Camerons Products, Western BBQ Products, Jack Daniel's Charcoal and Wood Products, Traeger Grills, Bradley Smoker, The B & B Charcoal Company, Smokehouse Products, Inc., Olson Saw Company, Pit Boss Grills (Dansons, Inc.), Char-Broil, Kingsford Products Company, Cookshack Inc., Masterbuilt, Fire & Flavor, J&R Manufacturing, Smokey Mountain Cooker, Maine Grilling Woods, and Flavor Smoke. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grilling Wood Chips Market Key Technology Landscape

The technology landscape within the Grilling Wood Chips Market is primarily centered on enhancing wood preparation consistency, safety, and shelf-life optimization rather than fundamentally changing the product itself. A critical technology is advanced kiln drying, which utilizes controlled temperature and humidity schedules to reduce the wood's moisture content to precise, low levels. This process is superior to traditional air drying as it significantly reduces drying time, guarantees uniform moisture content across batches, and, crucially, sterilizes the wood by eliminating potential pests, mold spores, and pathogens, ensuring a food-safe product ready for smoking. Consistency in moisture content is paramount because it directly impacts the rate of smoke generation and the resulting flavor profile.

Another significant technological advancement lies in precision machining and screening systems. Modern wood chippers and grinders are calibrated to produce chips of highly uniform size and thickness, which is essential for predictable burn rates and even smoke distribution in different types of grills and smokers. Automated screening systems utilize vibrating meshes or optical sorting (increasingly supported by AI) to remove oversized fragments, fine sawdust, and foreign debris, thereby maximizing the usable product quality and preventing unwanted bitter or acrid flavors that result from burning impurities. This level of precision is particularly important for commercial customers requiring reliable performance.

Furthermore, technology plays a vital role in packaging and preservation. Manufacturers increasingly employ high-barrier films and modified atmosphere packaging (MAP), specifically nitrogen flushing, to seal the wood chips. This technology displaces oxygen, preventing oxidation of the wood’s volatile aromatic compounds, which are responsible for the smoke flavor. This significantly extends the shelf life of the product, preserving its freshness and potency until it reaches the end-user. Continuous innovation in this area is focused on biodegradable or recyclable high-barrier materials to align with global sustainability goals without compromising product integrity.

Regional Highlights

- North America: This region holds the largest market share due to its deeply entrenched barbecue culture, high adoption rates of specialized smoking equipment, and significant consumer disposable income allocated to outdoor leisure. The U.S. market, specifically, drives demand for classic flavors like Hickory and Mesquite, with a high concentration of competitive BBQ events and professional culinary interest boosting the commercial segment. Canada also contributes significantly, though demand is concentrated during the summer months. Innovation often centers around premium, specialty wood blends derived from local sources.

- Europe: Europe is the fastest-growing region, characterized by a rapid increase in the popularity of American-style smoking techniques, particularly in Germany, the UK, and Scandinavia. Consumers are highly focused on sustainability and organic sourcing, leading to a preference for locally or ethically certified woods. The market sees strong growth in specialty retail stores offering niche smoking accessories. Regulatory complexity related to wood importation and treatment standards represents a key regional dynamic.

- Asia Pacific (APAC): The APAC market is emerging, driven by increasing Western influence in culinary trends and rising urbanization leading to higher disposable incomes. Countries like Australia, Japan, and South Korea are showing accelerated adoption. Demand here is characterized by smaller-format packaging and a growing interest in milder flavors like Cherry and Applewood, which complement traditional Asian cooking methods. E-commerce penetration is critical for market access in this fragmented region.

- Latin America (LATAM): Growth in LATAM is driven by established grilling traditions, particularly in Brazil and Argentina, though often utilizing traditional charcoal methods. The wood chip segment is expanding as consumers seek enhanced flavor complexity beyond standard charcoal. Economic volatility remains a restraint, pushing consumers toward value-oriented standard wood types rather than premium specialty imports.

- Middle East and Africa (MEA): This region represents the smallest segment, though growth is evident, particularly in the GCC countries, fueled by expatriate populations and high-end hospitality sectors incorporating smoking techniques. The environmental conditions (high heat, low humidity) necessitate robust, high-quality packaging to maintain product integrity during storage and distribution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grilling Wood Chips Market.- Weber-Stephen Products LLC

- A-Maze-N Products, Inc.

- Camerons Products

- Western BBQ Products

- Jack Daniel's Charcoal and Wood Products

- Traeger Grills

- Bradley Smoker

- The B & B Charcoal Company

- Smokehouse Products, Inc.

- Olson Saw Company

- Pit Boss Grills (Dansons, Inc.)

- Char-Broil

- Kingsford Products Company

- Cookshack Inc.

- Masterbuilt

- Fire & Flavor

- J&R Manufacturing

- Smokey Mountain Cooker

- Maine Grilling Woods

- Flavor Smoke

Frequently Asked Questions

Analyze common user questions about the Grilling Wood Chips market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most popular wood chip flavors for grilling and smoking?

The most popular flavors globally are Hickory and Mesquite, known for their strong, traditional smoke flavor ideal for beef and pork. Fruit woods like Apple and Cherry are also highly favored for their milder, sweeter smoke, which is excellent for poultry, fish, and vegetables.

How do I properly prepare wood chips for use in a grill or smoker?

Wood chips should generally be soaked in water or another liquid (like beer or wine) for 30 minutes to an hour before use. Soaking helps them smolder slowly instead of igniting immediately, ensuring a steady, long-lasting smoke output for optimal flavor infusion.

What is the primary difference between grilling wood chips and wood pellets?

Wood chips are irregularly shaped pieces of raw wood, primarily used in gas or charcoal grills and water smokers, requiring soaking. Wood pellets are compressed sawdust used specifically in pellet smokers, offering consistent heat and smoke without requiring pre-soaking.

Are sustainably sourced grilling wood chips readily available in the market?

Yes, sustainability is a growing market focus. Many leading brands now offer chips certified by organizations like the Forest Stewardship Council (FSC), ensuring the wood is harvested using responsible and sustainable forestry management practices.

Which distribution channel exhibits the fastest growth for grilling wood chips?

The online retail and e-commerce channel is experiencing the fastest growth, primarily because it allows consumers easy access to a wider variety of specialized flavors, bulk options, and premium wood chip brands not typically stocked in traditional brick-and-mortar stores.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager