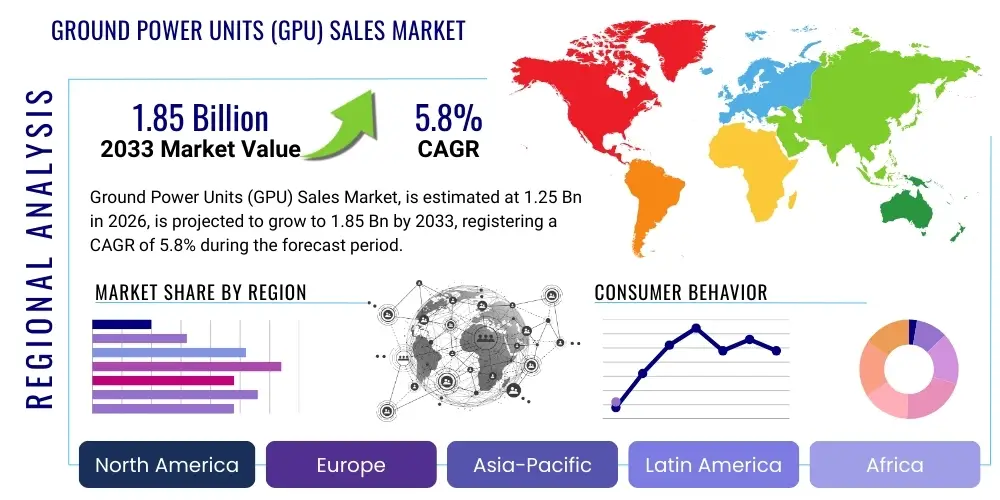

Ground Power Units (GPU) Sales Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441459 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Ground Power Units (GPU) Sales Market Size

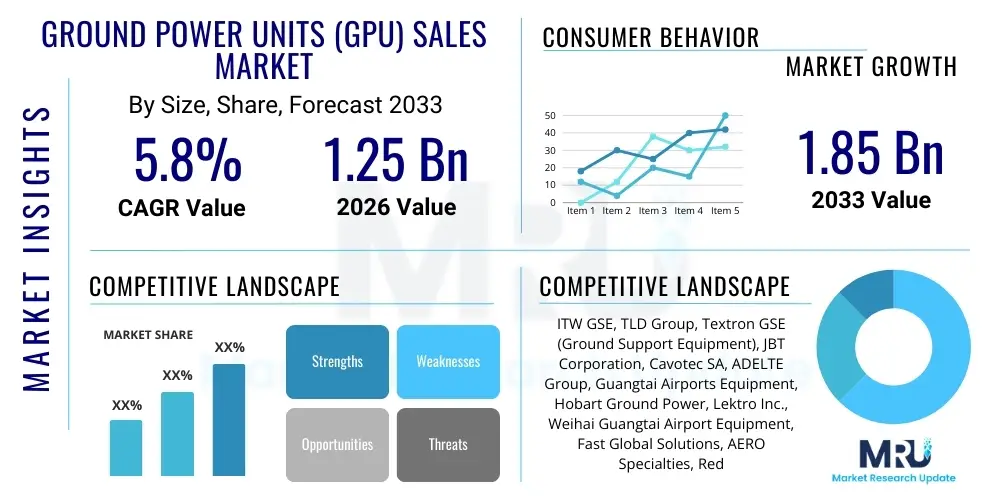

The Ground Power Units (GPU) Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Ground Power Units (GPU) Sales Market introduction

The Ground Power Units (GPU) Sales Market encompasses the manufacturing, distribution, and utilization of specialized equipment designed to supply electrical power to aircraft while they are parked on the ground, ensuring necessary operational functions without running the aircraft’s engines. This equipment is critical for pre-flight checks, maintenance procedures, passenger comfort systems (like heating and air conditioning), and general power requirements during turnaround times. GPUs are essential components of airport ground support equipment (GSE) infrastructure, driving efficiency and significantly reducing carbon emissions and noise pollution typically associated with auxiliary power unit (APU) usage. The fundamental product segmentation includes mobile GPUs, which are typically trailer-mounted or self-propelled, and fixed GPUs, often integrated into passenger boarding bridges or centralized underground power systems. Market growth is primarily stimulated by global investments in new airport infrastructure, fleet modernization, and increasing regulatory pressure to adopt cleaner, more sustainable ground operations, particularly the shift toward electric and static GPU solutions.

Ground Power Units are sophisticated power conversion systems that take facility power (AC) and convert it to the precise voltage and frequency (usually 400 Hz AC or 28V DC) required by modern aircraft. The product landscape has diversified significantly, moving away from traditional diesel-powered GPUs towards electric and hybrid models, reflecting a broader industry commitment to sustainability. Major applications span commercial aviation (international, regional, and low-cost carriers), military bases, and specialized air cargo operations. Beyond core electricity supply, contemporary GPUs often incorporate smart monitoring features, remote diagnostics, and energy management capabilities, making them integral to optimized gate management systems. The demand profile is highly correlated with air traffic volumes, new aircraft deliveries, and the global expansion of air travel routes, particularly in emerging economies where new airports are being constructed rapidly to handle escalating passenger demand.

The primary benefits derived from utilizing modern GPUs include substantial reductions in operational expenditure (OpEx) for airlines, primarily through minimizing reliance on expensive jet fuel consumed by onboard Auxiliary Power Units (APUs). Furthermore, the integration of solid-state GPUs enhances reliability and reduces maintenance costs compared to older rotating machinery. Key driving factors include stringent environmental regulations enforced by bodies like the International Civil Aviation Organization (ICAO) and local environmental agencies, pushing airports towards electrification. The continuous modernization of aircraft fleets, necessitating stable and high-quality power inputs for advanced avionics, also mandates the adoption of high-precision GPUs. The shift towards gate electrification, wherein fixed power solutions replace mobile units, represents a significant structural change propelling market demand for stationary, robust, and technologically advanced power systems capable of handling rapid aircraft turnarounds efficiently and safely.

Ground Power Units (GPU) Sales Market Executive Summary

The Ground Power Units (GPU) Sales Market is undergoing a rapid transition driven by technological innovation and strict environmental mandates. Business trends indicate a strong shift towards solid-state and electric GPUs, displacing diesel-powered units, fueled by global airport modernization projects focused on achieving net-zero emissions goals. Major industry players are focusing on developing integrated gate solutions that combine GPUs with pre-conditioned air (PCA) systems and charging infrastructure for electric GSE fleets, creating comprehensive energy management hubs at the apron. Geographically, Asia Pacific is dominating the market growth landscape due to massive airport construction and expansion efforts in China, India, and Southeast Asia, while North America and Europe lead in technological adoption, driven by stringent regulatory timelines for fleet electrification and noise reduction. Segment-wise, the fixed GPU category, particularly solid-state models, is experiencing the highest growth rate, reflecting the long-term infrastructure investments by major airports aiming for improved operational reliability and energy efficiency compared to flexible mobile units.

Key business imperatives driving market activity involve strategic mergers and acquisitions aimed at consolidating specialized technology providers and achieving economies of scale in manufacturing. Manufacturers are increasingly offering service agreements and maintenance packages alongside equipment sales, creating recurring revenue streams and improving customer loyalty. The competitive environment is characterized by intense focus on power quality assurance, minimized harmonic distortion, and maximizing system uptime, critical requirements for sensitive aircraft electronics. Furthermore, the commercial aviation segment remains the largest consumer, but military and specialized defense aviation platforms require highly ruggedized and customized mobile GPUs, representing a lucrative, high-margin niche. Supply chain resilience, particularly concerning the sourcing of high-performance semiconductors and battery components for electric models, is becoming a critical determinant of market success and timely project delivery, necessitating vertical integration or secure strategic partnerships among major vendors.

Regional trends reveal differentiated market maturity levels; established markets in Western Europe and North America prioritize replacement and upgrade cycles, focusing on smart grid integration and energy recovery systems. Conversely, emerging markets in Latin America, the Middle East, and Africa are primarily focused on initial deployment for newly built or rapidly expanding airport facilities, prioritizing cost-effectiveness and durability in harsh climatic conditions. The rapid digitalization of airport operations is fostering demand for 'smart GPUs' equipped with Internet of Things (IoT) sensors, enabling predictive maintenance and seamless integration with Airport Collaborative Decision Making (A-CDM) platforms. This integration not only optimizes power usage but also contributes significantly to quicker and more predictable aircraft turnaround times, which is a major performance indicator for airlines and airport authorities globally. The transition toward modular designs is also gaining traction, allowing for easier scaling and servicing of the units throughout their lifecycle.

AI Impact Analysis on Ground Power Units (GPU) Sales Market

User inquiries regarding AI's influence on the Ground Power Units (GPU) market frequently revolve around predictive maintenance capabilities, optimal energy distribution, and the role of machine learning in smart gate management systems. Users are keenly interested in how AI algorithms can predict GPU component failure based on real-time operational data (temperature, load cycles, voltage fluctuations), thereby minimizing unscheduled downtime which is highly detrimental to airport operations. A second major theme concerns AI's ability to optimize energy consumption by dynamically adjusting power output based on aircraft specific needs and scheduled gate times, integrating seamlessly with airport energy grids and peak-load management strategies. Expectations center on AI transforming GPUs from simple power sources into intelligent, self-monitoring assets that contribute directly to efficiency gains and improved turnaround predictability, enhancing both the lifespan of the equipment and the overall sustainability performance of the airport infrastructure.

- AI-driven predictive maintenance forecasts component degradation, minimizing GPU failures and maximizing equipment uptime through scheduled interventions.

- Machine learning algorithms optimize power allocation across multiple gates, balancing electrical load demands and reducing overall airport energy costs.

- Integration of AI with Airport Operational Database (AODB) systems allows GPUs to auto-adjust power profiles based on real-time aircraft type and service requirements.

- Advanced diagnostics utilizing neural networks analyze historical fault data to identify recurring operational issues and suggest hardware or software improvements.

- AI enhances cybersecurity protocols within smart GPU networks, protecting sensitive operational data and preventing unauthorized access to critical infrastructure.

- Optimization of battery charging cycles in mobile electric GPUs, extending battery life and improving fleet availability through intelligent charging schedules.

- Use of deep learning for analyzing environmental sensor data, optimizing GPU cooling systems performance based on ambient temperature and humidity, thus increasing efficiency.

DRO & Impact Forces Of Ground Power Units (GPU) Sales Market

The GPU Sales Market is fundamentally driven by global aviation traffic recovery and substantial investments in airport decarbonization strategies, making the transition to electric and solid-state units inevitable. However, high initial capital expenditure (CAPEX) associated with these advanced units, coupled with infrastructural challenges in upgrading existing airport electrical grids, acts as a significant restraint. Opportunities are abundant in the development of modular, smart grid-compatible GPUs and establishing robust service and maintenance contracts across emerging markets. The market dynamics are highly impacted by strict government environmental policies mandating reduced reliance on fossil fuels in ground operations, compelling airlines and airports toward greener alternatives, ensuring stable, long-term demand growth, but simultaneously presenting immediate implementation challenges due to standardization requirements.

Drivers: The primary growth drivers stem from the accelerated global focus on sustainable airport operations and the increasing stringency of noise and emission regulations. Airports worldwide are committing to net-zero targets, necessitating the phase-out of traditional diesel GPUs in favor of quiet, zero-emission electric and solid-state models. Furthermore, the sustained recovery and projected growth in commercial air traffic, especially post-pandemic, require continuous investment in ground support equipment capable of handling higher frequency and faster turnarounds. Technological advancements, particularly in solid-state power conversion systems, offer superior power quality, essential for the sophisticated avionics systems of modern aircraft like the Boeing 787 and Airbus A350, driving replacement demand. The mandatory integration of GPUs at the gate, replacing the often-inefficient use of aircraft APUs, provides significant cost savings for airlines in jet fuel expenses, reinforcing the economic rationale for GPU adoption.

Restraints: Significant restraints primarily revolve around the substantial initial investment costs required for deploying advanced solid-state GPUs and the necessary, often complex, electrical infrastructure upgrades at older airport facilities. Integrating high-power electrical equipment places considerable strain on existing airport power grids, frequently requiring costly modifications to substations and cabling, which can slow down deployment timelines. Furthermore, the lack of standardization across different aircraft types and regional electrical systems creates complexity for manufacturers and airport operators, requiring highly configurable solutions. In emerging markets, budget constraints often lead to the preferential purchase of cheaper, diesel-powered mobile units despite long-term sustainability goals, hindering the mass adoption of electric alternatives. Finally, the long procurement cycles inherent in large airport infrastructure projects pose a challenge to rapid market expansion and technological adoption.

Opportunities: Key opportunities lie in the burgeoning demand for centralized power systems (CPS) and modular GPU designs that facilitate easier scaling and maintenance. The convergence of GPUs with other gate equipment, such as PCA and electric vehicle charging points, creates opportunities for integrated smart gate solutions managed by sophisticated energy management software. The expansion of airport infrastructure in Asia Pacific, the Middle East, and Latin America represents untapped greenfield markets ready for immediate deployment of the latest electric and solid-state technologies. Moreover, the development of specialized military and defense applications requiring robust, high-mobility, and reliable power sources offers a niche market opportunity. The increasing trend of offering GPUs as a service (GPUaaS) or under long-term leasing models mitigates the high initial CAPEX barrier for airport operators, potentially accelerating the transition to advanced units and generating sustainable service revenue for vendors.

Segmentation Analysis

The Ground Power Units (GPU) Sales Market is segmented primarily based on Power Type (Diesel/Engine-driven, Electric/Battery-powered, and Solid-State), Configuration (Mobile and Fixed/Static), Application (Commercial Aviation, Military Aviation, General Aviation), and Output Frequency (400 Hz AC and 28V DC). The segmentation reflects the diverse operational environments and varying power needs across the aviation ecosystem. The Solid-State segment, characterized by high efficiency, low maintenance, and superior power quality, is projected to dominate the market share growth, driven by its suitability for modern, sensitive aircraft systems. Geographically, the market analysis is crucial for understanding regional infrastructure development priorities, with distinct demand patterns observable between technologically mature Western markets and rapidly expanding emerging economies.

The segmentation by Configuration, distinguishing between Mobile and Fixed GPUs, is critical to understanding the underlying infrastructure investment patterns of airports. Fixed GPUs, often integrated into passenger boarding bridges or under the ramp, are associated with long-term, high-efficiency gate management strategies and represent permanent infrastructure upgrades. They offer consistent power quality and minimize ramp congestion, making them highly desirable for high-throughput gates. Mobile GPUs, traditionally diesel but increasingly electric, offer flexibility and are essential for remote stands, maintenance hangars, and airports with limited fixed infrastructure. However, the environmental pressure is rapidly diminishing the mobile diesel share in favor of electric mobility, especially in major hubs prioritizing zero-emission ramp operations. The shift towards electrification impacts both mobile and fixed units, influencing the entire market trajectory.

Analyzing the segmentation by Power Type reveals the core technological transition occurring in the industry. Solid-State GPUs are replacing traditional rotating (diesel and older engine-driven) units due to their reliability, smaller footprint, and ability to provide highly precise power output regardless of load fluctuations. Solid-state technology minimizes wear parts and eliminates emissions at the source. Electric GPUs (battery-powered mobile units) are bridging the gap where fixed power access is impractical, offering zero local emissions mobility, addressing the environmental concerns associated with diesel mobility. Commercial aviation remains the dominant application segment, driven by the sheer volume of aircraft movements and regulatory focus on airport sustainability, requiring robust, scalable GPU solutions tailored for large passenger jets.

- Power Type: Diesel/Engine-driven GPUs, Electric/Battery-powered GPUs, Solid-State GPUs, Hybrid GPUs

- Configuration: Mobile GPUs (Trailer-mounted, Self-propelled), Fixed GPUs (PBB Integrated, Stand-Alone Pedestal)

- Application: Commercial Aviation (Major Airports, Regional Airports), Military Aviation, General Aviation/FBOs

- Output Frequency: 400 Hz AC, 28V DC, 270V DC (Emerging Military Standard)

- Region: North America, Europe, Asia Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA)

Value Chain Analysis For Ground Power Units (GPU) Sales Market

The Ground Power Units (GPU) value chain begins with specialized upstream suppliers providing critical components such as high-performance semiconductors, power electronics (rectifiers, inverters), highly durable cabling, and custom-designed transformers. For electric and solid-state units, the quality and cost of key components, especially IGBT modules and specialized control software, significantly influence the final product efficiency and price point. Manufacturers (OEMs) then undertake complex assembly, integrating these components into ruggedized enclosures, followed by rigorous testing to ensure compliance with stringent aviation power quality standards (e.g., ISO 6858). The highly technical nature of GPUs necessitates specialized engineering expertise at the manufacturing stage. This stage is followed by distribution through a mix of direct sales channels, catering to major airport authorities and defense ministries, and indirect channels involving specialized airport ground support equipment (GSE) distributors and authorized third-party system integrators who handle localized installation and after-sales support, particularly in highly fragmented regional markets.

The downstream analysis focuses on the end-user adoption and post-sale service lifecycle. End-users, primarily airport operators, airlines, military logistics commands, and FBOs (Fixed Base Operators), demand long-term reliability and minimal total cost of ownership (TCO). Installation and commissioning, often complex due to integration with existing gate infrastructure and electrical grids, are handled either by the OEM's technical team or certified local partners. Post-sales services, including scheduled maintenance, repair, and parts supply, represent a crucial revenue stream and a core determinant of customer satisfaction. The efficiency of the service network is paramount, as GPU failures directly impact aircraft turnaround times and potentially disrupt flight schedules. The shift towards smart, connected GPUs allows vendors to offer predictive maintenance contracts, leveraging IoT data collected from installed units, enhancing service quality, and optimizing spare parts management, thereby strengthening the downstream relationship.

Distribution channels in the GPU market are highly strategic. Direct sales channels are preferred for high-value, bespoke projects, such as major airport terminal expansions or military procurements, where close collaboration between the airport engineering department and the manufacturer is necessary to ensure precise specification adherence. Indirect channels, utilizing regional distributors and system integrators, are essential for penetrating smaller airports, regional carriers, and FBO markets. These partners often bundle the GPU sales with other GSE, offering complete ramp equipment packages. Furthermore, leasing and rental companies play an increasing role, particularly for mobile units, providing flexibility to airports and airlines that prefer operational expenditure models over large capital investments. The choice of channel is heavily dependent on the complexity of the unit, the regulatory environment of the region, and the established relationships between the vendor and the aviation authority, necessitating a hybrid distribution strategy for global coverage and market penetration.

Ground Power Units (GPU) Sales Market Potential Customers

The primary purchasers of Ground Power Units are organizations involved in aircraft handling and maintenance across the entire spectrum of aviation operations. Commercial airport authorities and governmental bodies responsible for civil airport infrastructure constitute the largest customer segment, as they invest in fixed GPU systems integrated into gates and centralized power infrastructure as part of long-term capital projects. Airlines, particularly large international carriers and regional operators, are also direct customers for mobile GPU units (both electric and diesel, though increasingly electric) to equip their maintenance bases and for use at remote or older gates lacking fixed power access. These customers prioritize equipment reliability, adherence to stringent safety certifications, and low maintenance requirements to ensure efficient and punctual flight operations, directly impacting their profitability and on-time performance metrics.

A significant niche customer base exists within the defense and military aviation sectors. Military airbases and naval aviation commands require highly ruggedized, specialized mobile GPUs capable of operating under extreme environmental conditions and providing specialized DC power outputs (e.g., 270V DC) for military aircraft. These procurements are often high-value contracts characterized by strict security and compliance standards, prioritizing operational robustness and rapid deployability over initial cost. Furthermore, Fixed Base Operators (FBOs) serving General Aviation (GA) and private jets represent an increasingly important customer segment. As the fleet of private and corporate jets grows globally, FBOs require compact, high-quality, and often aesthetically refined GPUs to provide premium service to their high-net-worth clientele, focusing on noise reduction and rapid service delivery during private jet turnarounds.

Other potential customers include global Ground Handling Service Providers (GHSPs), who manage ramp operations for multiple airlines at various airports and therefore purchase and operate large fleets of mobile GPUs, both electric and diesel. Their purchasing decisions are highly sensitive to equipment lifespan, ease of maintenance, and the total cost of ownership across their geographically diverse operations. Additionally, major aircraft Maintenance, Repair, and Overhaul (MRO) facilities represent a steady demand source for fixed and mobile GPUs used extensively within hangars to power aircraft systems during lengthy maintenance checks and refurbishment processes. These facilities require units capable of continuous, high-load operation for extended periods, necessitating industrial-grade reliability and advanced thermal management features within the power electronics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ITW GSE, TLD Group, Textron GSE (Ground Support Equipment), JBT Corporation, Cavotec SA, ADELTE Group, Guangtai Airports Equipment, Hobart Ground Power, Lektro Inc., Weihai Guangtai Airport Equipment, Fast Global Solutions, AERO Specialties, Red Box International, Tronair Inc., Siemens AG, Sinepower, Power Force Technologies, Rheinmetall MAN Military Vehicles, Guinault SA, S POWER |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ground Power Units (GPU) Sales Market Key Technology Landscape

The contemporary technology landscape of the Ground Power Units market is fundamentally dominated by solid-state power conversion technology, which utilizes advanced semiconductor components, typically Insulated Gate Bipolar Transistors (IGBTs), to achieve highly efficient and stable AC-to-AC or AC-to-DC power conversion. Solid-state GPUs offer substantial improvements in power quality, characterized by low total harmonic distortion (THD) and rapid voltage regulation, critical parameters for protecting sensitive aircraft electronic systems. These units are significantly more compact, quieter, and require less maintenance compared to older rotary or engine-driven converters, driving the long-term infrastructure investment trend. Additionally, the development of modular and redundant power modules within solid-state GPUs ensures maximum operational reliability; if one module fails, the remaining modules can often sustain the required load, thereby minimizing downtime and enhancing gate utilization efficiency, a key metric for airport performance.

Beyond core power electronics, the integration of smart technologies, often referred to as IoT (Internet of Things) and sophisticated control systems, is redefining the functionality of modern GPUs. New units are equipped with embedded microprocessors, remote monitoring capabilities, and standardized communication protocols (like Ethernet or CAN bus) that allow seamless integration into the airport's centralized Asset Management Systems (AMS) and Gate Management Systems (GMS). This connectivity enables real-time performance tracking, remote fault diagnostics, and automated data logging related to power usage, aiding in accurate billing and energy management. Furthermore, advancements in thermal management, using highly efficient liquid cooling or specialized heat sink designs, are crucial for maintaining the performance and lifespan of the power electronics, particularly in high-ambient temperature environments common in the Middle East and Asia Pacific regions.

A parallel significant technological shift is occurring in mobility and energy storage, specifically impacting mobile GPU segments. The rapid evolution of high-density lithium-ion and lithium-polymer battery technologies is making battery-powered electric GPUs (eGPUs) a viable, high-performance alternative to traditional diesel units. These eGPUs offer instantaneous torque and rapid recharging capabilities, coupled with sophisticated Battery Management Systems (BMS) that maximize battery life and operational safety. In the fixed GPU sector, the adoption of centralized power systems (CPS) is gaining traction, where power conversion occurs at a single, centralized facility and power is distributed via underground cables to multiple gates, reducing the need for individual converters at every stand and improving overall energy efficiency across the apron. This approach requires advanced power distribution network management and robust safety cut-off mechanisms, representing the future direction for large, modern airport facilities striving for maximized operational centralization and minimized ramp clutter.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, primarily fueled by massive infrastructure investments in aviation across China, India, and Southeast Asia (Vietnam, Indonesia). The region is characterized by numerous greenfield airport projects and significant capacity expansion at existing hubs, necessitating large-scale procurement of both fixed and mobile GPU systems. While cost remains a factor, the increasing awareness and governmental pressure regarding air quality, particularly in densely populated urban centers, are accelerating the adoption of electric and solid-state GPUs for new installations, positioning the region as the primary demand engine over the forecast period.

- North America: North America represents a mature, high-value market focused heavily on replacement cycles and technological upgrades. Demand is driven by aging infrastructure modernization initiatives and strict regulatory compliance regarding emissions and noise reduction, particularly at major coastal hubs. The market exhibits high readiness for advanced solid-state and integrated gate systems (GPU/PCA combined units) due to robust capital availability and a strong focus on maximizing operational efficiencies and integrating smart airport technologies (IoT, AI) into ramp management processes.

- Europe: Europe is characterized by stringent environmental mandates (e.g., EU Green Deal) that have actively pushed airports towards full ramp electrification and the mandatory use of fixed power at gates. This region leads in the adoption of centralized power systems and highly efficient solid-state technology. Market growth is stable, primarily driven by the need to replace existing older equipment to meet updated power quality standards required by newer aircraft and the continuous push toward reducing carbon footprints across the entire airport operation value chain.

- Middle East and Africa (MEA): The Middle East market is driven by the expansion of major international transit hubs (UAE, Qatar, Saudi Arabia) undertaking massive long-term airport development projects. These projects prioritize state-of-the-art infrastructure, leading to strong demand for fixed, high-capacity solid-state GPUs designed to withstand extremely high ambient temperatures. Africa's market remains fragmented, with demand concentrated in major gateway airports, often preferring robust, reliable diesel units due to intermittent electrical grid stability, although major hubs are beginning the transition to fixed electric solutions.

- Latin America (LATAM): LATAM is an emerging market characterized by gradual infrastructure improvement and rising air traffic volumes. Market penetration for advanced GPUs is moderate, with a mix of new fixed installations at modernized airports and continued reliance on mobile, predominantly diesel-powered units at regional facilities. The region offers significant long-term potential as governmental and private investments in aviation infrastructure continue to grow, focusing on reducing fuel consumption and integrating cleaner ground operations as airports mature.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ground Power Units (GPU) Sales Market.- ITW GSE

- TLD Group

- Textron GSE (Ground Support Equipment)

- JBT Corporation

- Cavotec SA

- ADELTE Group

- Guangtai Airports Equipment

- Hobart Ground Power

- Lektro Inc.

- Weihai Guangtai Airport Equipment

- Fast Global Solutions

- AERO Specialties

- Red Box International

- Tronair Inc.

- Siemens AG

- Sinepower

- Power Force Technologies

- Rheinmetall MAN Military Vehicles

- Guinault SA

- S POWER

Frequently Asked Questions

Analyze common user questions about the Ground Power Units (GPU) Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Solid-State GPUs over traditional diesel units?

The primary factor driving the shift is the stringent global environmental regulations mandating the reduction of carbon emissions and noise pollution at airports. Solid-State GPUs offer zero local emissions, superior power quality essential for modern aircraft, and significantly lower long-term maintenance costs compared to their diesel counterparts, enhancing overall operational efficiency and sustainability efforts.

How do Ground Power Units contribute to cost savings for airlines and airport operators?

GPUs reduce costs primarily by minimizing the use of the aircraft’s Auxiliary Power Unit (APU). Utilizing a GPU, especially a fixed electric or solid-state unit, consumes cheaper grid electricity instead of expensive jet fuel required to run the APU, leading to substantial savings in fuel expenditure and reduced wear and tear on the aircraft’s onboard systems, extending engine life.

Which geographical region is expected to exhibit the highest growth rate in the GPU Sales Market?

The Asia Pacific (APAC) region is forecasted to achieve the highest growth rate. This acceleration is attributed to massive ongoing investments in new airport infrastructure development, capacity expansions in countries like China and India, and increasing air traffic demand requiring immediate and scalable ground support equipment procurement, particularly advanced electric models.

What are the key differences between Fixed GPUs and Mobile GPUs, and which configuration dominates new installations?

Fixed GPUs are permanently installed infrastructure, often integrated into passenger boarding bridges, offering consistent, high-quality power and minimizing ramp clutter. Mobile GPUs, typically trailer-mounted or self-propelled, offer flexibility for remote stands. New installations, especially at major international gates, are increasingly dominated by Fixed Solid-State GPUs due to their reliability and contribution to integrated smart gate management systems.

What role does technology like IoT and AI play in the next generation of GPU systems?

IoT and AI are crucial for transforming GPUs into intelligent assets. IoT sensors enable real-time performance monitoring and data transmission, while AI algorithms leverage this data for predictive maintenance, anticipating potential component failures. AI also optimizes energy consumption by dynamically balancing the load and integrating the GPU seamlessly with the airport's centralized energy grid management system, improving reliability and operational efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager