Guitar Electric Box Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442436 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Guitar Electric Box Market Size

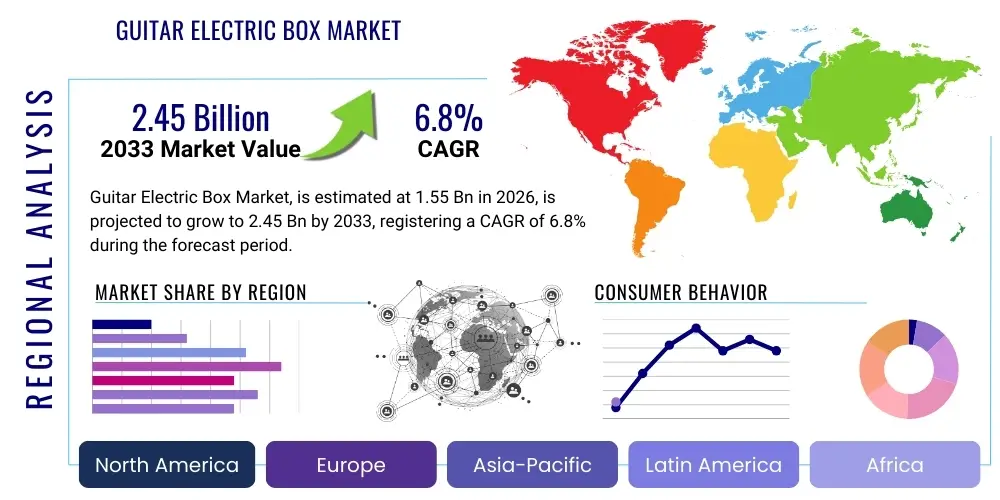

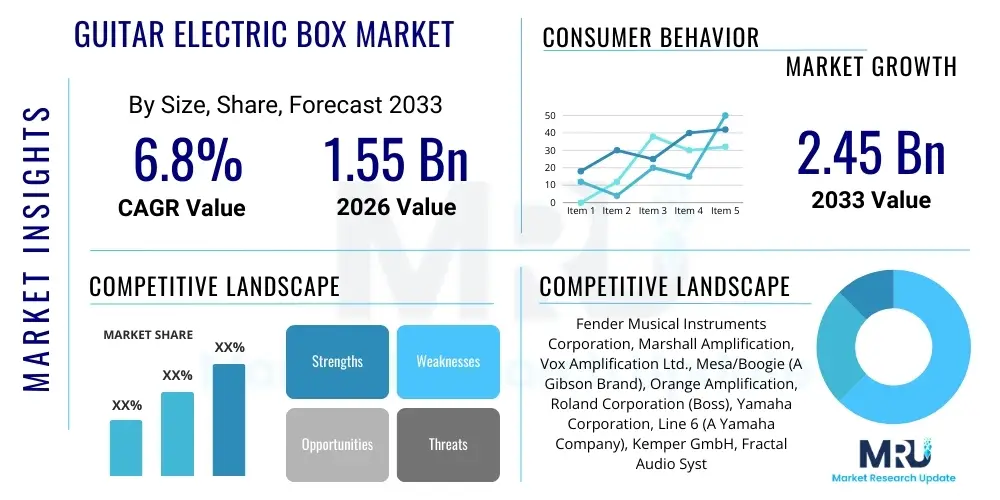

The Guitar Electric Box Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.55 billion in 2026 and is projected to reach USD 2.45 billion by the end of the forecast period in 2033.

Guitar Electric Box Market introduction

The Guitar Electric Box Market encompasses the global trade and utilization of specialized enclosures and components designed to house the electronics, speakers, and cabinetry necessary for amplifying and modifying the sound produced by electric guitars. These products, often categorized as speaker cabinets, amplifier heads, combo amplifiers, and specialized pedal enclosures, are crucial components in the signal chain for musicians across professional and amateur segments. The primary function of these electric boxes is not just amplification but also tone shaping, providing unique sonic characteristics derived from material science, acoustic design, and electronic circuitry.

Product descriptions range significantly, from vintage-style wooden cabinets utilizing specific speaker types (e.g., Celestion, Jensen) and open-back designs, to modern, highly portable digital modeling enclosures with integrated effects processing units. Major applications include live musical performances in small and large venues, professional recording studios, home practice setups, and music education institutions. The versatility of modern electric boxes, particularly those incorporating advanced digital signal processing (DSP), allows them to simulate numerous classic amplifier tones, significantly broadening their appeal and utility across various genres, including rock, jazz, blues, metal, and pop.

The benefits driving market growth include the continuous evolution of professional music production standards, increasing disposable income spent on musical instruments in developing economies, and the sustained popularity of amplified guitar music globally. Technological advancements focused on miniaturization, power efficiency, and connectivity—such as Bluetooth integration and USB recording capabilities—are making high-quality tone accessible to a wider demographic. Furthermore, the enduring demand for premium, handcrafted tube amplifiers ensures a stable high-end segment, complementing the rapid growth seen in the budget-friendly and technologically advanced digital segments.

Guitar Electric Box Market Executive Summary

The Guitar Electric Box Market is experiencing robust expansion driven by convergence between traditional analog circuitry and cutting-edge digital modeling technologies. Business trends indicate a strong focus on direct-to-consumer (D2C) sales models, facilitated by e-commerce platforms and digital marketing, allowing niche boutique manufacturers to compete effectively with established industry giants. Key strategic shifts include increased investment in R&D to develop lightweight, high-output Class D amplifiers and sophisticated software algorithms that accurately mimic the nonlinear behavior of vacuum tubes. Sustainability is also emerging as a factor, with some manufacturers exploring eco-friendly cabinet materials and modular designs for easier repair and upgrades.

Regionally, North America and Europe maintain dominance due to high concentration of professional musicians, established music cultures, and robust retail infrastructure, though the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, primarily fueled by rising youth engagement in music, urbanization, and expanding access to affordable instruments in China, India, and Southeast Asia. Regulatory environments, particularly concerning electronic waste and restricted substances (like RoHS compliance), influence manufacturing processes globally. Segmentation trends show a polarization: premium tube amplifiers maintain their value proposition in the professional recording sector, while solid-state and digital modeling combo amplifiers are capturing the largest volume share in the intermediate and beginner segments, appealing to users seeking versatility and convenience in smaller packages.

The market faces challenges related to component shortages, particularly semiconductors critical for digital units, and intense pricing pressure in the entry-level segment due to mass production capabilities in emerging markets. However, opportunities abound in specialized markets, such as high-gain metal amplification and acoustic amplification solutions. Successful market participants are those who effectively manage supply chain resilience while simultaneously offering compelling user experiences through software updates, cloud integration for preset sharing, and enhanced portability features. The overall outlook suggests a healthy, competitive market where innovation in tone fidelity and user interface design will dictate leadership positions.

AI Impact Analysis on Guitar Electric Box Market

Common user questions regarding AI's impact on the Guitar Electric Box Market often revolve around two main themes: Will AI replace traditional amplifier technology, and how can AI enhance the sound modeling process? Users frequently express concerns about the loss of analog warmth and authenticity, contrasting it with the perceived convenience and perfect replication offered by AI-driven algorithms. Key expectations include personalized tone profiles generated automatically based on playing style, intelligent noise reduction, and AI-assisted mixing features integrated directly into amplifier or cabinet electronics. Users are primarily interested in whether AI can move beyond simple digital modeling to truly emulate the dynamic, reactive nature of analog circuitry and speaker breakup under varying load conditions, offering a tool that simplifies complex sound engineering without sacrificing artistic control or sonic quality.

The core influence of Artificial Intelligence currently manifests primarily in advanced Digital Signal Processing (DSP) used in high-end modeling amplifiers and effects pedals, which simulate complex analog circuits. AI/Machine Learning (ML) algorithms are being trained on vast datasets of recorded amplifier tones, capturing nuances that traditional physical modeling equations often miss, such as tube compression dynamics and speaker cabinet resonance at different volumes. This capability enables manufacturers to offer unprecedented tonal versatility and accuracy in compact, reliable units, challenging the dominance of physical tube amplifiers in many non-boutique segments. Furthermore, AI contributes to optimizing amplifier design by analyzing material vibrations and acoustic coupling within cabinet enclosures, streamlining the prototyping process and enhancing acoustic performance.

In the near future, the application of AI is expected to extend into automated calibration and impedance matching between different components (e.g., guitar pickups, effects, amplifier inputs, and speaker outputs), ensuring optimal signal flow and tone fidelity regardless of the setup. AI also offers significant potential in personalized sound creation, where algorithms could analyze a musician's existing library of music and suggest or automatically generate new tonal presets tailored to specific compositions or playing techniques. This integration shifts the value proposition of the electric box from a passive amplifying device to an active, intelligent tone-shaping partner, requiring increased software development expertise from market incumbents.

- Enhanced tonal modeling accuracy through Neural Networks replicating complex tube behavior.

- Development of personalized, adaptive tone presets based on user playing style and music genre.

- AI-driven optimization of speaker cabinet acoustic design and material selection.

- Intelligent noise suppression and feedback mitigation algorithms integrated into combo units.

- Automated impedance and gain staging matching for seamless integration of diverse gear.

- Predictive maintenance analytics for early detection of component failure in electronic circuits.

- Integration of cloud-based AI services for sharing and downloading verified, curated tone profiles.

DRO & Impact Forces Of Guitar Electric Box Market

The Guitar Electric Box Market dynamics are shaped by a complex interplay of drivers, restraints, opportunities, and overall market impact forces. Key drivers include the global expansion of music streaming and digital content creation, necessitating high-quality recording setups for independent artists, and the increasing sophistication and affordability of digital modeling technology, making premium sounds accessible to entry-level musicians. However, the market is restrained by the high upfront cost and maintenance associated with professional-grade tube amplifiers, along with supply chain vulnerabilities related to specialized components like vacuum tubes and specific speaker magnets. Opportunities lie in catering to the niche vintage reissue market, expanding into emerging markets like Southeast Asia and Latin America, and developing highly portable, battery-powered solutions for buskers and mobile performers. These forces collectively propel market growth while demanding continuous innovation in manufacturing and distribution strategies.

Drivers: A primary driver is the accelerating trend toward professional audio quality in home studios, amplified by the pandemic-driven shift towards remote work and content creation. Musicians are investing heavily in reliable, studio-grade amplification solutions that offer both physical presence (cabinets) and versatile connectivity (direct recording outputs). Furthermore, technological breakthroughs in solid-state and digital amplification have drastically reduced the size and weight of powerful amplifiers without compromising wattage or fidelity. This portability factor is critical for touring musicians and hobbyists alike, driving replacement cycles for older, heavier gear. The enduring appeal of specific, iconic guitar tones across generations sustains the market for both genuine vintage units and high-fidelity digital replicas, ensuring consumer spending remains strong across income brackets.

Restraints: Significant restraints include the volatility of the global electronics supply chain, which impacts the production of digital circuit boards and DSP chips necessary for modeling amplifiers. For traditional tube amplifiers, the diminishing global supply of high-quality vacuum tubes and the specialized labor required for their construction and maintenance present long-term cost challenges. Furthermore, market saturation in established regions (North America and Western Europe) leads to intense competition and pricing pressure, particularly in the mid-range combo amplifier segment. Counterfeit products, especially digital tone modeling software and cheap cabinet knock-offs, also erode legitimate sales and harm brand reputation, complicating intellectual property protection.

Opportunities: Major opportunities exist in developing specialized solutions for emerging musical genres, such as extended-range guitars (7 and 8 strings) which require cabinets tuned for lower frequencies, and providing robust, weather-resistant solutions for outdoor performance and festival circuits. The environmental movement presents an opportunity for manufacturers to innovate using sustainable, lightweight composite materials for cabinets, reducing transport costs and carbon footprint, appealing to environmentally conscious consumers. Moreover, the integration of advanced networking and IoT capabilities, allowing for remote diagnostics, automated firmware updates, and subscription services for tone packs, represents a fertile area for generating recurring revenue streams and enhancing customer engagement.

Impact Forces: The overarching impact force is the shift from purely analog consumption to a hybrid digital-analog ecosystem. This technological convergence increases the total addressable market by attracting tech-savvy users, but simultaneously raises the barrier to entry for small, traditional analog manufacturers who lack software development resources. Economic forces, such as fluctuating material costs (wood, metals, rare earth magnets), directly impact manufacturing margins. Socio-cultural impact forces, primarily the influence of celebrity guitarists and online gear reviewers (influencers), continue to heavily sway purchasing decisions, demanding that brands maintain strong digital marketing presence and product visibility on platforms like YouTube and Instagram. Regulatory impact forces, particularly trade tariffs and safety certifications (CE, UL), dictate international pricing and market access, requiring sophisticated global compliance management from large vendors.

Segmentation Analysis

The Guitar Electric Box Market is fundamentally segmented across several dimensions, primarily based on the underlying technology (e.g., Tube vs. Solid-State vs. Digital Modeling), the physical format (e.g., Combo vs. Head & Cabinet), and the core application (e.g., Practice vs. Professional Touring). Analyzing these segments provides critical insights into consumer preferences and investment areas for manufacturers. The Tube Amplifier segment, though smaller in volume, holds significant value due to its premium pricing and enduring professional demand, driven by the unique harmonic richness and responsiveness that digital units strive to replicate. Conversely, the Digital Modeling segment dominates in unit volume and growth rate, capitalizing on versatility, portability, and price accessibility. Understanding the distinct requirements of each end-user group—from the bedroom enthusiast needing low-wattage combo amps to the touring professional requiring high-powered, road-ready stacks—is essential for targeted product development and market penetration strategies.

Segmentation by format reveals that Combo Amplifiers remain the most popular choice for general use due to their integrated, all-in-one design, minimizing setup complexity. The Head and Cabinet configuration, however, offers superior flexibility, allowing users to mix and match different heads (the electronic core) with various cabinets (the acoustic element), appealing strongly to tone purists and studio engineers who require granular control over their sound texture and projection characteristics. Further differentiation occurs based on wattage and output class, where low-wattage (<15W) amps cater to the practice and small studio market, and high-wattage (>50W) units satisfy the demands of large stages and high-volume genres like metal. The rising prominence of powered cabinet speakers designed specifically for use with dedicated digital modelers (e.g., Kemper, Fractal) represents a new, high-growth sub-segment blurring the lines between traditional amplification and PA systems.

- By Type:

- Tube Amplifiers

- Solid-State Amplifiers

- Digital Modeling Amplifiers

- Hybrid Amplifiers

- By Format:

- Combo Amplifiers

- Head and Cabinet (Stack)

- Powered Speakers/Cabinets (for Profilers)

- By Wattage:

- Low Wattage (Under 15W)

- Medium Wattage (15W - 50W)

- High Wattage (Above 50W)

- By Application:

- Professional Recording

- Live Performance (Small Venue)

- Live Performance (Large Venue/Stadium)

- Home Practice/Hobbyist

- Educational Institutions

Value Chain Analysis For Guitar Electric Box Market

The value chain for the Guitar Electric Box Market is multi-layered, beginning with the procurement of specialized raw materials and extending through complex manufacturing processes, distribution, and final user adoption. The upstream activities involve sourcing critical components such as specific types of wood (e.g., Baltic birch plywood for cabinets), rare earth magnets for speaker drivers, high-reliability electronic components (capacitors, transformers), and, crucially, vacuum tubes (for tube amps). For digital boxes, the upstream dependency on semiconductor manufacturers and specialized DSP chip providers is paramount. Efficiency and ethical sourcing in this stage directly impact final product cost and reliability, requiring strong supplier relationship management and quality control protocols to ensure consistency in tonal performance, a non-negotiable factor for end-users.

Manufacturing involves several distinct stages: cabinet construction (cutting, gluing, Tolex application), speaker driver assembly (including cone and voice coil manufacturing), and chassis assembly (circuit board population, wiring, and soldering). Differentiation is high during this phase, with boutique manufacturers emphasizing meticulous hand-wiring and specialized components for superior sonic fidelity, while mass-market brands focus on automated assembly and cost optimization. The transition from manufacturing to distribution is mediated by established distribution channels, either through large international distributors or directly to regional retailers. Brand reputation and perceived quality dictate which distribution model is chosen, with high-end brands often preferring exclusive dealership networks to maintain pricing integrity and customer experience.

Downstream activities center on sales, service, and user engagement. Direct channels, increasingly prominent, include manufacturers selling via their own websites or dedicated online marketplaces, offering better margins and direct customer feedback loops. Indirect channels involve traditional brick-and-mortar music stores, which remain vital for hands-on testing and demonstration, essential activities for guitar gear purchases. Post-sale support, including warranty service, availability of specialized repair parts (especially tubes and transformers), and continuous software updates for digital products, forms a critical part of the value proposition. The ultimate value delivery is realized when the end-user (musician, producer) integrates the electric box into their creative workflow, justifying the investment based on tone, reliability, and professional utility.

Guitar Electric Box Market Potential Customers

Potential customers for the Guitar Electric Box Market are highly diversified, ranging from professional, full-time touring musicians and studio engineers to casual hobbyists and beginners learning the instrument. The professional segment demands maximum reliability, impeccable tone fidelity, and robust road-worthiness, often prioritizing high-end tube stacks or sophisticated, redundant digital profiling systems. These buyers represent a high-value segment, less price-sensitive and more brand-loyal to manufacturers known for legacy and quality craftsmanship (e.g., Marshall, Fender, Vox, Mesa/Boogie). Studio engineers seek versatile, isolated cabinets and specialized recording amplifiers (e.g., low-wattage heads with reactive load boxes) that integrate seamlessly into complex recording chains.

The largest volume segment comprises amateur musicians and hobbyists, who prioritize affordability, convenience, and versatility. This group drives demand for solid-state and digital modeling combo amplifiers, which offer a multitude of tones and effects in a single, budget-friendly unit suitable for home practice or small jams. Portability and features like headphone outputs and auxiliary inputs are key purchasing criteria for this demographic. Educational institutions and music schools also represent institutional buyers, requiring durable, easy-to-use combo amps for teaching environments, focusing on resilience and simple operation rather than high-fidelity nuance. Furthermore, the rising population of acoustic guitar players requiring specialized acoustic amplifiers—often featuring tailored EQ, anti-feedback controls, and microphone inputs—constitutes a growing niche end-user segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 billion |

| Market Forecast in 2033 | USD 2.45 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fender Musical Instruments Corporation, Marshall Amplification, Vox Amplification Ltd., Mesa/Boogie (A Gibson Brand), Orange Amplification, Roland Corporation (Boss), Yamaha Corporation, Line 6 (A Yamaha Company), Kemper GmbH, Fractal Audio Systems, Blackstar Amplification, Peavey Electronics Corporation, Hughes & Kettner, Egnater Amplification, Supro USA, Matchless Amplifiers, Dr. Z Amplification, Soldano Custom Amplification, Diezel Amplification, Two-Rock Amplifiers |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Guitar Electric Box Market Key Technology Landscape

The technology landscape of the Guitar Electric Box Market is characterized by a dual focus: preserving and refining classic analog tube technology while aggressively advancing digital signal processing (DSP) and associated software. In the analog realm, innovation centers on optimized power supply designs, use of advanced transformer winding techniques for enhanced frequency response, and Class A/B circuit refinement to maximize headroom and dynamic response while reducing noise floor. New developments include reactive load boxes and integrated attenuation technologies, which allow users to achieve desirable "cranked amp" tones at safe, reduced volume levels, addressing a major constraint of high-wattage tube amps for home and studio use. The materials science applied to cabinet construction, including specialized porting and internal baffling, continues to evolve to maximize acoustic projection and minimize standing waves.

The digital domain is defined by sophisticated modeling algorithms, often leveraging Neural Networks and machine learning (AI), to create increasingly accurate digital twins of classic analog circuits. Manufacturers are moving beyond simple static modeling to dynamic profiling and capture technology, allowing users to clone the exact sound characteristics of any physical amplifier and cabinet combination. Key technological trends include enhanced connectivity via USB-C for high-resolution audio recording directly to computers, integrated Bluetooth for playback of backing tracks, and robust proprietary software ecosystems for firmware management and preset sharing. Furthermore, the development of lightweight, high-power Class D amplifier modules has revolutionized portability, allowing compact units to deliver performance traditionally requiring bulky Class A/B counterparts, substantially reducing weight across both solid-state and digital platforms.

A critical area of technological convergence is the development of impulse response (IR) technology for cabinet simulation. IRs provide precise digital snapshots of the acoustic characteristics of speaker cabinets, microphones, and room ambiance, offering unparalleled realism when using direct recording outputs. The market is witnessing a race among manufacturers to offer vast, high-quality IR libraries and proprietary file formats, making cabinet emulation a standard feature in modern digital units. Overall, successful technologies emphasize integration—combining amplification, effects processing, power attenuation, and recording interfaces into unified, user-friendly packages that appeal to the modern musician seeking versatility without compromising on tone quality or professional reliability.

Regional Highlights

The market performance and growth dynamics of the Guitar Electric Box Market vary significantly across geographical regions, influenced by cultural affinity for amplified music, economic factors, and regional manufacturing capabilities. North America, encompassing the United States and Canada, remains the largest revenue generator globally, characterized by a highly mature market, a dense concentration of professional touring musicians, established music production infrastructure (Nashville, Los Angeles, New York), and strong brand loyalty towards legacy manufacturers like Fender and Marshall. Demand in this region is balanced between the premium, high-end tube segment and advanced digital modeling systems, sustained by a robust consumer willingness to invest in quality gear and frequent gear upgrades catalyzed by online review culture.

Europe, particularly the UK, Germany, and Scandinavia, represents another major market stronghold, driven by strong historical roots in rock music and a thriving independent music scene. European consumers show a preference for niche, boutique, high-quality amplification manufactured within the continent (e.g., Orange, Vox, Diezel), emphasizing craftsmanship and unique sonic characteristics. Regulatory standards, such as those related to electronic waste and material sourcing, heavily influence product design and manufacturing in this region. The European market exhibits steady, stable growth, focusing on replacement cycles and the persistent demand for reliable, versatile equipment suitable for both small club gigs and large festival stages.

Asia Pacific (APAC) stands out as the fastest-growing region, presenting the most significant long-term expansion opportunity. This growth is predominantly fueled by rapid economic development, increasing penetration of Western music culture among the large youth population, and expanding musical education institutions in countries like China, India, South Korea, and Japan. While Japan maintains a strong, mature market focused on quality and niche boutique products, emerging economies are driving demand for mass-market, affordably priced solid-state and digital combo amplifiers, often manufactured regionally. Investment in local distribution networks and culturally tailored product lines is crucial for capitalizing on the volume potential of the APAC market.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but are projected to see accelerated growth, driven by improving economic stability and a growing appreciation for local and international music performances. LATAM markets, including Brazil and Mexico, are characterized by a high sensitivity to pricing, making affordability a key factor, though a passionate, dedicated core of musicians seeks high-quality imported gear. Logistical challenges, import tariffs, and limited local retail infrastructure present operational hurdles in both LATAM and MEA, necessitating careful strategic planning for market entry and distribution efficiency. The MEA region shows emerging demand linked to large cultural events and increasing disposable income in urban centers, focusing primarily on high-volume professional audio equipment for venues and studios.

- North America: Highest revenue share; mature market; strong demand for both premium analog and high-end digital; high influence of professional music industry and gear reviewers.

- Europe: Second largest market; preference for boutique and handcrafted amplifiers; stable growth rates; stringent regulatory environment impacting design.

- Asia Pacific (APAC): Fastest-growing region; high demand for affordable, versatile digital units; growth centered in China, India, and Southeast Asia; increasing local manufacturing presence.

- Latin America (LATAM): Growing market potential; high price sensitivity; focus on entry-level and mid-range products; logistical and tariff complexities.

- Middle East and Africa (MEA): Nascent growth driven by venue development and professional audio infrastructure investment; specialized demand for robust, reliable touring equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Guitar Electric Box Market.- Fender Musical Instruments Corporation

- Marshall Amplification

- Vox Amplification Ltd.

- Mesa/Boogie (A Gibson Brand)

- Orange Amplification

- Roland Corporation (Boss)

- Yamaha Corporation

- Line 6 (A Yamaha Company)

- Kemper GmbH

- Fractal Audio Systems

- Blackstar Amplification

- Peavey Electronics Corporation

- Hughes & Kettner

- Egnater Amplification

- Supro USA

- Matchless Amplifiers

- Dr. Z Amplification

- Soldano Custom Amplification

- Diezel Amplification

- Two-Rock Amplifiers

Frequently Asked Questions

Analyze common user questions about the Guitar Electric Box market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the shift from Tube to Digital Modeling amplifiers?

The shift is primarily driven by the need for versatility, portability, and accurate tonal replication at lower volumes. Digital modeling offers hundreds of tones, integrated effects, and direct recording capability in a lighter, more reliable, and often less expensive package than traditional tube amplifiers, appealing strongly to modern home studio users and touring musicians seeking reduced gear weight.

How significant is the role of Impulse Response (IR) technology in modern guitar cabinets?

IR technology is highly significant as it provides hyper-realistic digital simulations of microphone placement, speaker characteristics, and room acoustics. This allows digital modelers and direct recording units to achieve studio-quality cabinet sounds without requiring a physical cabinet and microphone, revolutionizing quiet practice, recording, and fly-in gig setups.

Which geographical region exhibits the highest growth potential for the Guitar Electric Box Market?

The Asia Pacific (APAC) region, particularly driven by emerging economies like China and India, shows the highest growth potential. This is attributed to increasing youth participation in music, rising disposable incomes, and greater exposure to international music trends, leading to strong demand for entry-level and mid-range electric amplification solutions.

What is the main challenge faced by manufacturers of traditional tube amplifiers?

The main challenge is the diminishing, volatile supply chain for high-quality vacuum tubes and specialized transformers, coupled with the high cost of skilled labor required for point-to-point wiring and maintenance. This constrains high-volume production and drives up the price point relative to digitally produced alternatives.

Are sustainability practices influencing the design of new electric guitar boxes?

Yes, sustainability is an emerging influence. Manufacturers are increasingly exploring eco-friendly and lightweight cabinet materials (e.g., sustainable woods, composites) to reduce environmental impact and lower transportation costs, appealing to environmentally conscious consumers and meeting stricter regulatory guidelines in regions like Europe.

How do solid-state amplifiers compare to tube amplifiers in terms of market positioning?

Solid-state amplifiers typically occupy the entry-level and intermediate market segments, favored for their reliability, lower maintenance, and consistent performance at high volumes. While tube amplifiers dominate the high-end professional and boutique segments due to their unique harmonic complexity and touch sensitivity, solid-state units provide greater value and durability for beginner and practice applications.

What is the difference between a combo amplifier and a head and cabinet setup?

A combo amplifier integrates the amplifier head (electronics) and the speaker cabinet into a single, portable unit, offering convenience. A head and cabinet setup separates the components, allowing musicians the flexibility to interchange different amp heads with various speaker cabinets, optimizing tone for specific applications or acoustic environments, often preferred by professional touring musicians.

What role does power rating (wattage) play in purchasing decisions for electric boxes?

Wattage determines the maximum clean volume and headroom available. Low-wattage amps (under 15W) are ideal for home use and recording where volume constraints are present, allowing the player to achieve saturated tones at manageable levels. High-wattage amps (50W+) are necessary for live performance in large, unmic’d venues or for maintaining clean tones with heavy drumming, though digital attenuation technologies are reducing the emphasis on extremely high wattage.

How is AI being utilized to enhance the sound quality of digital modeling units?

AI, specifically machine learning and neural networks, is used to train algorithms on vast datasets of vintage and modern amplifier tones. This allows digital units to capture and replicate the complex, non-linear dynamics and harmonic interactions of analog components with higher accuracy than traditional mathematical modeling, resulting in more realistic and dynamic digital sounds.

What are the key technological advancements expected in speaker cabinet design?

Future advancements focus on optimized acoustic materials, specialized internal baffling to improve bass response and reduce internal reflections, and the integration of powered speaker technology specifically designed to handle the full frequency spectrum output of digital profilers (Full Range Flat Response or FRFR), moving away from traditional guitar speakers’ limited frequency range.

Which end-user segment is most resistant to adopting digital modeling technology?

The high-end professional recording studio and boutique enthusiast segments tend to be the most resistant, often prioritizing the tactile responsiveness, tube compression characteristics, and unique sonic imperfections inherent to expensive, hand-wired analog tube amplifiers, viewing digital modeling as a tool for convenience rather than ultimate tone purity.

How does the value chain in the Guitar Electric Box market differ for boutique vs. mass-market products?

Boutique products emphasize upstream sourcing of premium, often rare, components (specific tubes, high-tolerance transformers) and rely on specialized, highly skilled manual assembly. Mass-market products prioritize automated assembly, standardized components, and optimized distribution logistics to achieve cost efficiency and high-volume output.

What impact have direct-to-consumer (D2C) channels had on the market?

D2C channels have lowered the barriers to entry for smaller, niche manufacturers, allowing them to bypass traditional retail margins and offer competitive pricing. This model also provides manufacturers with direct customer feedback, faster iteration cycles, and greater control over brand messaging and customer experience.

Are there specialized electric boxes designed for acoustic guitars, and how do they differ?

Yes, acoustic amplifiers are specialized electric boxes designed for acoustic instruments. They differ significantly by featuring flat frequency response, high headroom, built-in anti-feedback technology, and often include dedicated inputs for microphones and complex EQ controls to manage the nuances of acoustic resonance, focusing on clarity rather than harmonic saturation.

What role do global trade regulations, such as tariffs, play in the market?

Global trade regulations and tariffs directly affect the cost of importing raw materials (like specialized wood or electronic components) and finished goods between regions (e.g., US to Europe, or China to US). These regulations introduce cost volatility and require manufacturers to localize production or adjust pricing strategies frequently to maintain competitiveness in international markets.

What is the significance of the base year (2025) and historical period (2019-2024) in the market report?

The historical period analyzes past growth trends, component supply changes, and major product launches, setting the context for current market valuation. The base year (2025) provides the stabilized reference point from which the forecasted growth rate (CAGR 6.8% until 2033) and future projections are calculated, integrating the most recent market data and recovery trends.

How are manufacturers addressing the issue of amplifier volume for home recording environments?

Manufacturers are addressing high volume via two methods: producing low-wattage tube amplifiers (<15W) that achieve saturation at lower volumes, and integrating advanced features like power attenuation, built-in reactive load boxes, and direct USB recording outputs into higher-wattage units, enabling silent recording or practice without sacrificing tone quality.

What is the general trend in cabinet material usage?

The general trend remains the use of high-quality plywoods, primarily Baltic birch, for professional-grade cabinets due to its density and resonance characteristics. However, there is a growing trend towards lighter weight composite materials, especially in digital and solid-state cabinets, to enhance portability and reduce shipping costs, appealing to the gigging musician.

How important are software updates for the competitive position of digital electric boxes?

Software updates are extremely important; they enable digital manufacturers to introduce new features, fix bugs, enhance modeling accuracy, and launch new amplifier or effect models post-purchase. This continuous improvement strategy enhances product longevity and value, serving as a critical differentiator against competitors and driving customer loyalty in the digital segment.

Beyond music performance, what other applications drive the demand for electric boxes?

Secondary applications include professional audio testing and measurement, sound effect design for film and gaming, and educational purposes in music technology programs. These applications require the sonic flexibility and reliable signal path provided by high-quality electric boxes, particularly the modeling and profiling units.

What is a hybrid amplifier and where does it fit into the segmentation?

A hybrid amplifier typically combines a tube preamp section with a solid-state or digital power amp section, aiming to capture the tonal warmth and harmonic richness of tubes while benefiting from the reliability and efficiency of solid-state technology. They occupy the mid-range segment, offering a balance of tone characteristics and maintenance ease.

Which specific technology is critical for the portability revolution in high-power amplifiers?

Class D amplifier technology is critical. Class D circuits are significantly more energy-efficient and generate less heat than traditional Class A/B circuits, allowing manufacturers to house powerful, high-wattage amplifiers in extremely small, lightweight enclosures, dramatically improving the portability of professional-grade heads.

How does the increasing trend of music education globally affect the market demand?

Increased global music education, particularly in emerging markets, drives high-volume demand for reliable, user-friendly, and affordable combo amplifiers. Educational institutions serve as key initial purchase points, introducing new players to established brands and creating a stable pipeline for future upgrade cycles.

What is the main concern regarding intellectual property in the digital modeling segment?

The main concern involves the precise digital replication ("profiling" or "capturing") of proprietary analog circuits and unique amplifier tones. Manufacturers of classic tube amplifiers are highly protective of their sound signatures, leading to complex legal and ethical debates around digital ownership and replication within the modeling technology segment.

In the context of the supply chain, which component is currently posing the greatest vulnerability?

For digital electric boxes, semiconductors (DSP chips) used in modeling circuitry are the greatest vulnerability due to global supply shortages and allocation issues. For traditional analog boxes, the supply of high-quality vacuum tubes remains a persistent, long-term vulnerability due to specialized, limited production sources globally.

What is the projected long-term market trajectory: Analog dominance or Digital convergence?

The projected long-term trajectory is strong digital convergence. While the high-end analog segment will persist due to niche professional demand, the majority of volume growth and market innovation will occur in hybrid and full-digital platforms, driven by features like AI modeling, cloud connectivity, and enhanced portability that appeal to the mass market.

How do economic factors specifically influence the boutique amplifier segment?

The boutique segment, dealing with luxury, high-value goods, is highly sensitive to consumer disposable income and economic stability. During economic downturns, purchases of these non-essential, expensive items tend to decline sharply, although the core enthusiast collector base often provides a baseline level of resilient demand.

What differentiates a reactive load box from a simple power attenuator?

A simple attenuator reduces volume by absorbing power, potentially altering the amplifier's feel. A reactive load box actively simulates the complex, non-linear electrical impedance of a real speaker, allowing the tube amplifier to operate under ideal load conditions, ensuring the tone and feel remain accurate, even when recording silently or running through digital cabinet simulations.

Why is the quality of wood material important for cabinet construction?

The quality and type of wood (e.g., dense Baltic birch plywood vs. particleboard) significantly impacts the cabinet's resonance, projection, and structural integrity. High-quality wood minimizes unwanted vibrations and frequency absorption, ensuring the speaker's tone is faithfully reproduced and projected, contributing directly to the overall sonic signature.

Beyond amplification, what integrated features are increasingly demanded by consumers in electric boxes?

Consumers increasingly demand integrated features such as USB audio interfaces for direct recording, headphone outputs for silent practice, auxiliary inputs for jamming along to tracks, built-in loopers, and proprietary effects modeling engines, transforming the amplifier into a comprehensive all-in-one practice and recording solution.

In the regional analysis, what is the key difference between the UK and German markets?

The UK market shows a strong historical affinity for legacy British brands (e.g., Marshall, Vox, Orange) and a focus on rock and metal tones. The German market, while appreciative of these, often shows a greater technical appreciation for precision engineering, resulting in higher demand for brands known for clean, high-headroom tones and innovative technical design (e.g., Hughes & Kettner, Diezel).

How do manufacturers ensure product reliability for professional touring musicians?

Reliability is ensured through rigorous quality control, using military-grade components, designing robust chassis and corner protection, and offering dual redundancy features (especially in digital systems). Road-worthiness is a major factor in the high-end segment, justifying the premium pricing for durable, dependable gear that can withstand frequent transport and varying climates.

What is the expected long-term impact of AI on customer service and maintenance for electric boxes?

AI is expected to enable predictive maintenance, alerting users to potential component failures (e.g., failing tubes, degrading capacitors) before they occur. It will also power advanced diagnostic tools, allowing technicians to remotely analyze amplifier performance based on uploaded data logs, streamlining warranty claims and repair processes globally.

Why is the ability to share and download tone presets important for digital amplifier market growth?

The ability to share and download presets fosters a strong user community, leveraging the creative input of thousands of users. This feature adds tremendous value by offering instant access to celebrity tones or professionally curated sounds, driving adoption among users who prioritize quick, high-quality sonic results without deep technical knowledge.

What role does aesthetic design play in purchasing decisions within this market?

Aesthetic design is highly important, particularly in the boutique and legacy segments. The visual appeal (e.g., Tolex color, grille cloth design, knob style) contributes to the emotional connection and desirability of the product, serving as a powerful secondary differentiator after tone, especially for brands with strong visual identities like Vox or Orange.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager