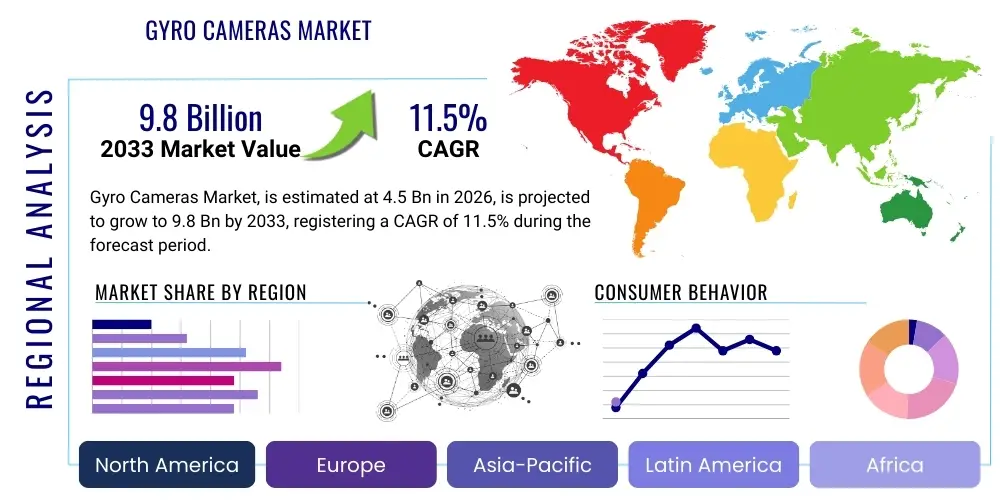

Gyro Cameras Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442328 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Gyro Cameras Market Size

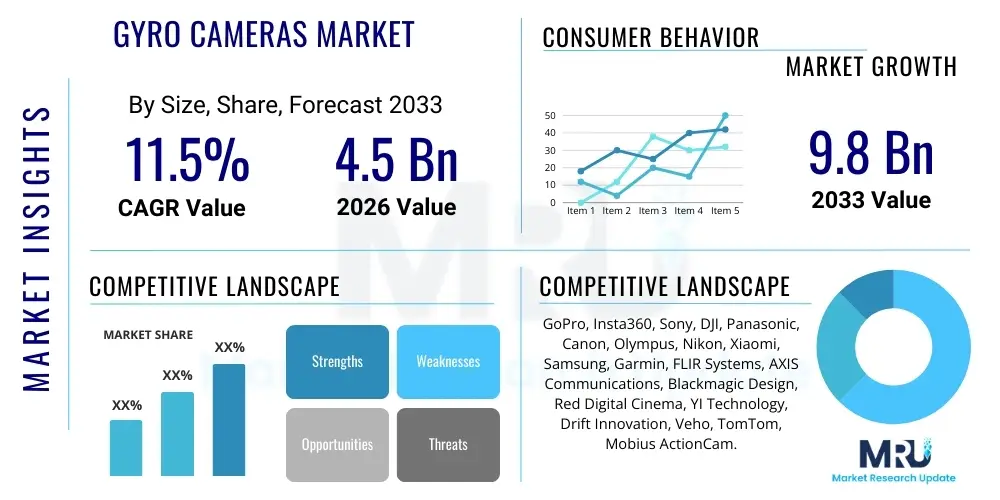

The Gyro Cameras Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 9.8 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the increasing demand for ultra-smooth, professional-grade video content across various sectors, including action sports, cinematography, and autonomous systems. The continuous miniaturization of sophisticated Inertial Measurement Units (IMUs) and advances in sensor fusion algorithms are key technological enablers propelling market expansion.

The stabilization capabilities offered by gyro cameras, which effectively counteract translational and rotational movements, are becoming standard requirements for high-definition video capture, particularly in dynamic environments. Traditional image stabilization methods are often insufficient to meet the quality benchmarks set by modern streaming platforms and professional media production houses. Therefore, dedicated gyro cameras or devices integrating advanced gyro sensors are seeing accelerated adoption, driving significant value generation across the consumer electronics and professional equipment segments globally.

Gyro Cameras Market introduction

Gyro cameras, also known as stabilized cameras, are advanced imaging systems that incorporate gyroscopic sensors, accelerometers, and magnetometers (collectively known as Inertial Measurement Units or IMUs) to detect and compensate for camera shake and movement in real-time. This sophisticated integration allows the camera to capture exceptionally stable and smooth footage, even under highly volatile conditions such as extreme sports, aerial filming, or automotive testing. The core product provides electronic image stabilization (EIS) enhanced by precise motion data, offering superior performance compared to purely optical stabilization systems, especially across all three rotational axes (pitch, yaw, and roll).

The major applications of gyro cameras span a wide range of industries, including action photography and videography, where they are integral to documenting activities like surfing, skiing, and mountain biking. Furthermore, they are extensively used in professional cinematography for drone filming and handheld shots requiring cinematic smoothness. In the industrial sector, gyro cameras are crucial for inspection tasks involving robots or remotely operated vehicles (ROVs) operating in unstable environments, ensuring data clarity and accuracy. The automotive industry employs these cameras for testing and for integrated Advanced Driver Assistance Systems (ADAS), where stable visuals are non-negotiable for object recognition and navigation.

The primary benefits derived from using gyro cameras include achieving unparalleled video quality free from jitter and motion blur, reducing the need for costly and cumbersome external gimbals, and enabling creators to capture high-impact footage in situations previously deemed impossible. Driving factors for this market include the pervasive rise of social media and video streaming platforms demanding high-resolution, professional content, coupled with the decreasing cost and size of IMU technology. Furthermore, the expanding use of drones and unmanned aerial vehicles (UAVs) in commercial applications mandates highly stable imaging systems, providing a significant structural driver for market growth across various vertical markets.

Gyro Cameras Market Executive Summary

The Gyro Cameras Market is characterized by vigorous growth, largely propelled by escalating consumer and commercial requirements for superior image stabilization in mobile and action capture scenarios. Business trends indicate a strong move toward integrating sophisticated 6-axis stabilization systems directly into smaller form factors, challenging the traditional market share of mechanical gimbal devices. Key industry players are focusing heavily on developing proprietary sensor fusion algorithms and optimizing power consumption to extend recording times, recognizing that usability and endurance are critical differentiators in competitive environments. Strategic partnerships between sensor manufacturers and camera OEMs are defining the pace of technological innovation, particularly concerning low-light performance and 4K/8K resolution stabilization.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by its robust consumer electronics manufacturing ecosystem and the high adoption rate of action cameras among a young, tech-savvy population in countries like China, India, and South Korea. North America and Europe, while mature, maintain market leadership in terms of revenue contribution, primarily due to high expenditure on professional-grade filmmaking equipment and advanced automotive applications. The integration of gyro cameras into autonomous vehicle sensor suites and high-end security systems in these regions further solidifies their significant market share, focusing on industrial and enterprise-level stabilization solutions rather than purely consumer-grade products.

Segment trends demonstrate that the action camera segment holds the largest market share by volume, benefiting from the widespread popularity of adventure tourism and sports documentation. However, the professional and commercial cinematography segment is projected to exhibit the highest growth rate, driven by demand for cinematic quality across virtual reality (VR), augmented reality (AR), and cinematic drone platforms. Furthermore, segmentation by technology reveals a shifting preference towards electronic image stabilization integrated with sophisticated gyro hardware (Hybrid Stabilization), offering a balance between cost, weight, and performance, signaling a fundamental change in how camera stabilization is implemented across various product lines.

AI Impact Analysis on Gyro Cameras Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can surpass traditional stabilization methods in gyro cameras, specifically asking about real-time predictive movement correction and automated post-processing improvements. Common concerns revolve around whether AI algorithms can distinguish between intentional camera movements (like panning or tilting) and unwanted jitters, thus maintaining the filmmaker’s creative intent while delivering maximum smoothness. Expectations center on AI enhancing sensor fusion accuracy, enabling seamless integration of visual data with IMU data, and streamlining the stabilization workflow for both amateur users and high-end professional production, particularly for dynamic, unpredictable subjects.

The integration of AI fundamentally transforms how gyro cameras interpret and respond to motion data. Instead of relying solely on raw angular velocity readings from the gyroscope, AI algorithms use deep learning models trained on vast datasets of video footage to recognize specific movement patterns. This predictive stabilization allows the camera to anticipate upcoming shakes or jerks before they fully manifest, enabling proactive compensation rather than reactive correction. This results in an unprecedented level of smoothness, especially in high-speed or complex motion scenarios where traditional proportional-integral-derivative (PID) controllers struggle to adapt quickly enough to varying conditions.

Moreover, AI extends the utility of gyro cameras far beyond mere stabilization. Machine learning models are now being deployed in post-processing tools to automatically calibrate, deskew, and frame footage based on the camera’s movement metadata (the gyro data log). This dramatically reduces the time and technical expertise required for professional editing, turning moderately shaky footage into perfectly stable cinematic shots with a single click. AI also facilitates smart feature integration, such as subject tracking and automatic compositional adjustments, optimizing the captured image based on context and detected elements within the frame, driving significant value for professional content creators seeking efficient, high-quality output.

- Enhanced Predictive Stabilization: AI models anticipate motion before it occurs, ensuring smoother output than reactive systems.

- Intelligent Sensor Fusion: Machine learning optimizes the blending of visual data (Optical Flow) and IMU data for superior accuracy.

- Automated Post-Production: AI analyzes gyro metadata to streamline editing, correcting warping and rolling shutter effects automatically.

- Contextual Stabilization: Algorithms differentiate between intended movement (panning) and unintended shake, preserving creative decisions.

- Subject Tracking and Framing: AI uses gyro data alongside visual input to maintain optimal framing of moving subjects consistently.

- Power Optimization: AI manages IMU sampling rates dynamically, conserving battery life without compromising performance stability.

DRO & Impact Forces Of Gyro Cameras Market

The Gyro Cameras Market is fundamentally driven by the proliferation of 4K and 8K video standards, which make stabilization flaws highly noticeable, necessitating advanced stabilization solutions. The exponential growth in content creation, particularly user-generated content (UGC) and professional action sports documentation, fuels constant demand for rugged, high-performance, and easily operable gyro cameras. Opportunities are abundant in the integration of gyro technology into emerging fields such as VR/360-degree cameras, requiring seamless, distortion-free motion capture, and in industrial inspection where image clarity under difficult operational conditions is mission-critical. However, restraints include the relatively higher initial cost compared to conventional cameras, dependence on advanced battery technology to power both the camera and sophisticated IMUs, and the ongoing challenge of miniaturizing the complex hardware without compromising image sensor quality, thereby creating a push-pull dynamic within the market.

Key drivers center around the shift from casual photography to professional videography among general consumers and the increased adoption of drones and aerial platforms across commercial sectors like construction, agriculture, and infrastructure monitoring. The ability of gyro cameras to capture stable footage while maneuvering quickly in three dimensions provides an inherent advantage over non-stabilized systems, directly contributing to greater operational efficiency and safety in these applications. Furthermore, the rising awareness among consumers regarding the superior quality of stabilized footage, largely influenced by high-quality content available on platforms like YouTube and TikTok, reinforces purchasing decisions toward advanced gyro-equipped devices, maintaining upward momentum for market volume and value.

Impact forces currently shaping the market include high competition from integrated solutions (e.g., smartphones with advanced EIS/OIS) which serve the entry-level market, requiring dedicated gyro camera manufacturers to focus on niche high-performance segments like professional filmmaking and industrial robotics. The rapid pace of sensor technology development means product lifecycles are relatively short, forcing companies to invest heavily in continuous R&D to maintain relevance. Regulatory environments concerning drone usage and privacy also indirectly affect the market, influencing the design and application scope of aerial gyro cameras. Successfully navigating these forces—specifically balancing high performance with cost-effectiveness and maximizing battery efficiency—will dictate market leadership over the forecast period.

Segmentation Analysis

The Gyro Cameras Market segmentation provides a granular view of diverse product applications and end-user adoption patterns, crucial for targeted marketing and strategic investment planning. The market is primarily segmented based on Type (Action Cameras, Professional Cameras, Dash Cams, and Industrial Cameras), Technology (Mechanical, Electronic, and Hybrid Stabilization), and End-User (Consumer, Media & Entertainment, Automotive, Industrial, and Military & Defense). This structure helps distinguish high-volume consumer segments, which prioritize portability and ease of use, from high-value industrial segments, which focus on ruggedness, precision, and data logging capabilities. Geographic segmentation further divides the market, reflecting differences in consumer spending power, regulatory environments, and the concentration of manufacturing hubs across major regions.

The segmentation by Type is critical, with Action Cameras dominating volume sales due to the demand for stabilized capture in extreme sports and travel vlogging. Conversely, Professional Cameras, used in cinema and broadcasting, drive the highest average selling prices (ASPs) due to their advanced sensor sizes and integration capabilities with high-end production environments. The Technology segmentation highlights the trend toward Hybrid Stabilization, which combines the corrective movements of a mechanical gimbal (Optical Image Stabilization - OIS) with the software correction of electronic sensors (EIS/Gyro), offering the best performance trade-off for high-resolution video capture. Understanding these dynamics is essential for market participants seeking to optimize their product portfolios and penetrate the most lucrative market niches effectively.

Analysis of the End-User segment reveals that the Media & Entertainment industry represents a core revenue stream, relying on gyro cameras for immersive content creation, cinematic drone shots, and virtual production environments. The Automotive segment is poised for rapid expansion, driven by the mandatory integration of reliable vision systems for ADAS and autonomous driving features, requiring highly stable cameras capable of performing under vibration and varying lighting conditions. The Industrial segment, encompassing surveillance, inspection, and robotics, demands specialized, rugged gyro camera systems that offer reliability and integration with complex machinery, ensuring stable video feeds for critical monitoring operations and diagnostic tasks in harsh environments.

- By Type:

- Action Cameras

- Professional Cameras/Cinematography Cameras

- Automotive Cameras (Dash Cams, ADAS Integration)

- Industrial/Surveillance Cameras

- By Technology:

- Electronic Image Stabilization (EIS) with Gyro

- Optical Image Stabilization (OIS) with Gyro

- Hybrid Stabilization (Combining Mechanical and Electronic)

- By Resolution:

- HD (720p, 1080p)

- 4K UHD

- 8K and Above

- By End-User:

- Consumer (Travel, Vlogging)

- Media & Entertainment (Filmmaking, Broadcasting)

- Automotive (Testing, Autonomous Vehicles)

- Industrial & Robotics (Inspection, Monitoring)

- Military & Defense

Value Chain Analysis For Gyro Cameras Market

The value chain for the Gyro Cameras Market is intricate, beginning with the upstream supply of highly specialized components, followed by complex assembly, and concluding with diverse distribution channels reaching both mass-market consumers and highly specialized industrial clients. Upstream analysis focuses heavily on the procurement of critical components, including high-resolution image sensors (CMOS/CCD), advanced Inertial Measurement Units (IMUs) incorporating 6-axis or 9-axis gyroscopes and accelerometers, and sophisticated semiconductor chipsets necessary for real-time processing and sensor fusion. Suppliers of these core technologies, often specialized semiconductor firms, hold significant leverage, as the quality and performance of the final camera product are directly dependent on the precision and integration capabilities of these fundamental components. Strategic sourcing, intellectual property surrounding sensor fusion algorithms, and the ability to secure a consistent supply of cutting-edge IMUs are paramount for camera manufacturers to maintain a competitive edge.

The midstream phase involves manufacturing and assembly, where camera OEMs integrate the sensors, lenses, and processing units into the final product. This stage requires high levels of precision engineering to ensure proper alignment and mechanical durability, especially for action cameras designed for harsh environments. Downstream activities involve reaching the end-user through highly differentiated distribution channels. For consumer-grade action cameras, indirect distribution channels like large e-commerce platforms (Amazon, Alibaba) and major consumer electronics retailers dominate, necessitating strong brand marketing and optimized logistics. The success of this channel relies heavily on large-scale promotional campaigns and competitive pricing strategies to capture volume sales.

Conversely, professional and industrial gyro cameras often rely on direct distribution or specialized indirect channels, such as authorized industrial equipment distributors, system integrators, and specialized B2B sales forces. This approach ensures that complex equipment is sold alongside necessary technical support, calibration services, and integration advice tailored to specific industry needs (e.g., aerospace, marine, or cinema production houses). Direct sales allow manufacturers to gather immediate feedback for product iteration and maintain high margins on high-value products. The efficiency of the entire value chain hinges on seamless collaboration between specialized component suppliers, technology innovators (especially software developers for stabilization algorithms), and robust logistics networks capable of handling global distribution.

Gyro Cameras Market Potential Customers

The Gyro Cameras Market serves a broad spectrum of potential customers, ranging from individual consumers and amateur enthusiasts to large, multi-national corporations and government agencies, each seeking superior motion stability for their imaging requirements. The largest volume segment comprises individual consumers and content creators, including professional and semi-professional vloggers, travel enthusiasts, and action sports athletes, who require rugged, easy-to-use, and highly stabilized cameras for documenting dynamic experiences. These buyers prioritize features such as portability, robust battery life, waterproofing, and seamless connectivity for immediate sharing, driving significant demand for action camera models integrated with proprietary stabilization technology. Furthermore, families and casual users increasingly adopt dash cams with gyro stabilization to ensure forensic quality video evidence in automotive incidents, representing a consistently growing segment of the consumer base.

On the enterprise and professional side, the Media & Entertainment industry constitutes a core customer base. Film production companies, television broadcasters, and specialized drone cinematography firms rely heavily on high-end gyro cameras integrated into professional cinema rigs and stabilized drone platforms to capture Hollywood-standard, smooth footage for major productions, virtual reality experiences, and live broadcasting events. These professional buyers prioritize sensor size, dynamic range, data logging capabilities (logging precise gyro metadata for post-production stabilization), and compatibility with professional editing software. Their procurement decisions are driven by the need for image quality that meets stringent industry benchmarks and the ability to integrate camera systems into existing complex workflows.

Critical industrial and government sectors represent the highest value, specialized customer segment. This includes major automotive OEMs utilizing cameras for R&D, testing vehicle stability, and incorporating sensor arrays into Level 3 and Level 4 autonomous driving systems, where motion fidelity is a functional safety requirement. Military and defense agencies employ gyro cameras for surveillance, reconnaissance, and target acquisition systems mounted on vehicles, aircraft, or soldier gear, demanding extreme ruggedization and reliable performance under severe environmental stress. Additionally, companies involved in infrastructure inspection (pipelines, wind turbines, bridges) utilize gyro cameras on ROVs and UAVs to capture stable diagnostic imagery, ensuring reliable data collection for preventative maintenance and safety compliance, demonstrating the indispensable nature of stabilized imaging in mission-critical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 9.8 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GoPro, Insta360, Sony, DJI, Panasonic, Canon, Olympus, Nikon, Xiaomi, Samsung, Garmin, FLIR Systems, AXIS Communications, Blackmagic Design, Red Digital Cinema, YI Technology, Drift Innovation, Veho, TomTom, Mobius ActionCam. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gyro Cameras Market Key Technology Landscape

The technology landscape of the Gyro Cameras Market is rapidly evolving, driven primarily by advancements in miniature MEMS (Micro-Electro-Mechanical Systems) sensors and powerful computational hardware capable of executing complex stabilization algorithms in real-time. The core enabling technology is the Inertial Measurement Unit (IMU), typically comprising 3-axis gyroscopes and 3-axis accelerometers (6-axis sensing), or sometimes including a magnetometer for full 9-axis spatial orientation tracking. These IMUs are becoming smaller, more precise, and significantly less expensive, which allows manufacturers to embed them directly into compact camera bodies without major cost or size penalties. The quality of stabilization is directly proportional to the sampling rate and accuracy of these IMUs, leading to continuous investment in developing low-noise, high-frequency sensing components that can reliably capture the subtle vibrations and rapid movements characteristic of high-impact action scenarios.

Beyond the hardware, the computational layer, often referred to as sensor fusion technology, is equally critical. Sensor fusion algorithms merge the high-frequency inertial data from the gyro with visual data (e.g., optical flow analysis) captured by the image sensor. This hybridization ensures that stabilization is both responsive (due to gyro data) and contextually aware (due to visual data). Leading market players are developing proprietary algorithms—often incorporating AI and machine learning techniques—to enhance this fusion process, reducing common artifacts such as the "jello effect" (rolling shutter distortion) and lens warping that often plague pure EIS systems. Furthermore, the capacity to log the precise gyro metadata alongside the video file is becoming a standard feature, allowing users access to extremely powerful post-processing stabilization tools that can correct movements with pixel-level precision, offering a level of control previously only available with expensive external mechanical gimbals.

The future technology trajectory points toward improved battery efficiency and further integration of stabilization with high-resolution capture (4K and 8K). Managing the massive data throughput generated by both high-resolution sensors and high-frequency IMUs requires specialized processors (DSPs or dedicated ASICs). Manufacturers are also focusing on optimizing the power consumption of both the sensor array and the processor to meet consumer demands for longer filming times. Additionally, there is a push for tighter integration between gyro stabilization and optical elements, leveraging micro-OIS systems that physically adjust lens components based on gyro input, creating a truly seamless hybrid system that offers professional-grade stability without any noticeable cropping or loss of field of view, thereby pushing the boundaries of what integrated cameras can achieve in dynamic shooting environments.

Regional Highlights

- North America (NA): North America maintains a leading position in the Gyro Cameras Market in terms of overall revenue, characterized by high disposable income, early adoption of high-resolution professional cinematic equipment, and significant military and industrial applications. The region is a primary hub for specialized software development, particularly for post-processing tools utilizing gyro metadata. Demand is driven by the robust media and entertainment industry (Hollywood, Silicon Valley tech firms), which utilizes gyro cameras extensively in drone filmmaking, virtual production, and autonomous vehicle R&D. The competitive landscape is mature, focusing on high-end, premium-priced devices and sophisticated B2B solutions for aerospace and critical infrastructure inspection, ensuring sustained, high-value growth.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period, fueled by its status as a global manufacturing center for consumer electronics and the explosive growth in consumer usage across emerging economies. Countries like China, Japan, and South Korea are leaders in IMU component manufacturing and camera assembly, benefiting from lower production costs and strong supply chain integration. The market here is volume-driven, with massive demand for affordable action cameras and integrated gyro stabilization in smartphones and dash cams. Rapid urbanization, increasing infrastructure projects, and the rise of local content creators across India and Southeast Asia provide strong underlying momentum for mass-market adoption and continued expansion.

- Europe: Europe represents a significant and technologically discerning market, particularly strong in professional cinematography, high-end automotive R&D (Germany), and aerial photography services. European consumers emphasize product quality, durability, and compliance with stringent technical standards. The region shows strong demand for industrial applications, notably in infrastructure inspection using drones equipped with highly stabilized cameras, and in environmental monitoring. Government procurement for security and surveillance applications, coupled with a robust outdoor and adventure sports culture, ensures steady demand, focusing heavily on premium brands known for precision engineering and advanced stabilization reliability.

- Latin America (LATAM): The LATAM market is characterized by emerging growth and increasing penetration rates, albeit starting from a smaller base compared to established regions. Key demand drivers include expanding tourism, growing social media adoption, and increasing investment in professional security and surveillance infrastructure. Economic factors often lead to greater price sensitivity, favoring budget-friendly action camera models. Brazil and Mexico are the primary markets, showing increasing adoption of dashboard cameras and consumer-grade stabilization technology, supported by regional economic improvements and greater access to global consumer electronics supply chains.

- Middle East and Africa (MEA): The MEA market is strategically important due to significant government spending on security and defense, massive infrastructure development projects, and a growing professional filmmaking industry (especially in the UAE and Saudi Arabia). The demand is highly segmented, with high-end requirements in the oil and gas sector for remote inspection (ROVs) driving industrial gyro camera sales, while consumer demand is accelerating due to rising connectivity and disposable incomes. The market requires specialized products capable of withstanding extreme temperatures and harsh environmental conditions typical of the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gyro Cameras Market.- GoPro

- Insta360

- Sony Corporation

- DJI (Dà-Jiāng Innovations)

- Panasonic Corporation

- Canon Inc.

- Olympus Corporation

- Nikon Corporation

- Xiaomi Corporation

- Samsung Electronics Co., Ltd.

- Garmin Ltd.

- FLIR Systems (Teledyne FLIR)

- AXIS Communications AB

- Blackmagic Design Pty. Ltd.

- Red Digital Cinema

- YI Technology

- Drift Innovation

- Veho Global Group

- TomTom International BV

- Mobius ActionCam

Frequently Asked Questions

Analyze common user questions about the Gyro Cameras market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between Gyro Stabilization (EIS) and Optical Image Stabilization (OIS)?

Gyro Stabilization (Electronic Image Stabilization, or EIS) primarily uses data from internal gyroscopes to digitally shift the image sensor’s output to counteract detected movement, often resulting in slight cropping. Optical Image Stabilization (OIS) uses gyro data to physically shift the lens elements or the sensor module, correcting the light path before it hits the sensor, which generally preserves the field of view but involves mechanical components.

Which segment of the Gyro Cameras Market is experiencing the fastest growth?

The professional and commercial cinematography segment is currently experiencing the fastest growth rate, driven by the increasing need for high-fidelity, stabilized 4K and 8K footage for cinematic drone applications, virtual reality content creation, and high-end broadcasting, demanding specialized, high-cost gyro systems.

How is AI influencing the performance of next-generation Gyro Cameras?

AI is being utilized to implement predictive stabilization, where algorithms anticipate camera movements based on trained data, offering proactive correction superior to reactive traditional gyro systems. AI also enhances sensor fusion and automates complex post-production stabilization adjustments using logged gyro metadata.

What are the key restraint factors affecting the adoption of high-end Gyro Cameras?

The primary restraints are the high initial investment cost associated with professional-grade gyro-stabilized equipment and the ongoing challenge of achieving long battery life, as the high sampling rates required by IMUs and the intense processing demands consume significant power resources.

What is the significance of logging gyro metadata in modern cameras?

Logging gyro metadata allows users, especially professionals, to apply precise, highly detailed stabilization corrections in post-production software (e.g., ReelSteady or Gyroflow). This capability enables the recovery of otherwise unusable footage by leveraging the exact movement data recorded by the camera's internal sensors, offering maximum control and quality optimization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager