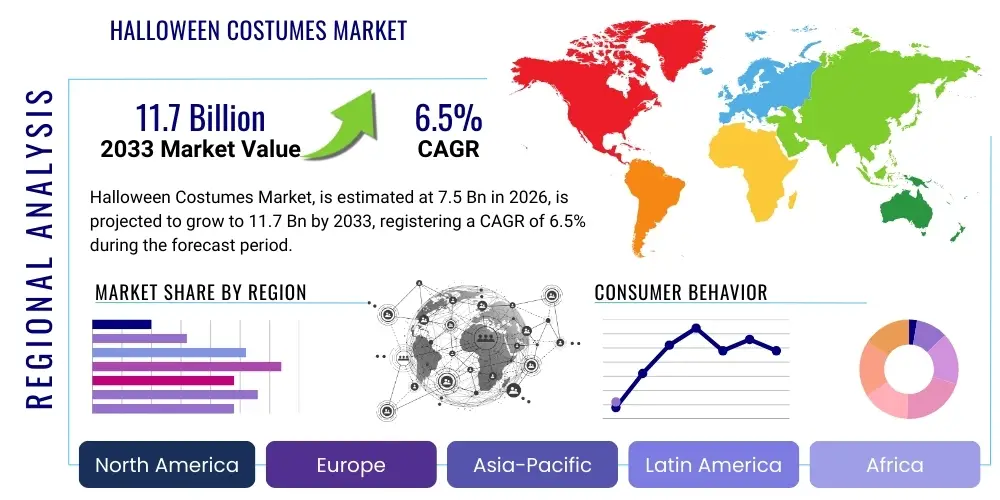

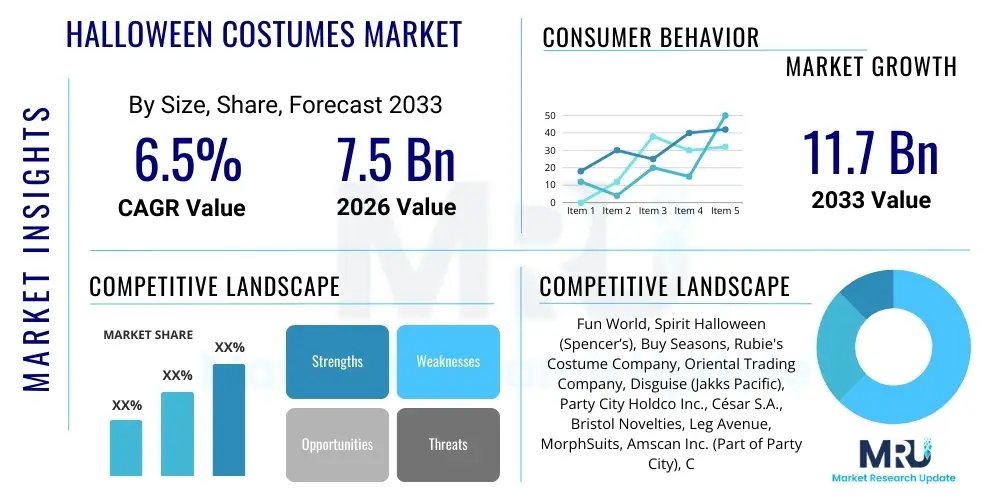

Halloween Costumes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441891 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Halloween Costumes Market Size

The Halloween Costumes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 11.7 Billion by the end of the forecast period in 2033. This robust expansion is fueled by increasing participation rates in Halloween festivities across Western and increasingly Asian markets, heightened disposable income allowing for higher quality or multiple costume purchases, and the strong influence of social media trends which necessitate visually compelling and unique outfits for online sharing and content creation. The market scope includes not only traditional garments but also accessories, makeup kits, masks, and temporary decorations integral to the overall consumer experience.

Halloween Costumes Market introduction

The Halloween Costumes Market encompasses the design, manufacturing, distribution, and sale of apparel, accessories, and ancillary products worn specifically for Halloween celebrations, trick-or-treating, costume parties, and related thematic events. Products range from generic seasonal attire and pre-packaged character costumes to highly specialized, custom-made professional garments, catering to diverse age groups including infants, children, teenagers, adults, and increasingly, pets. Major applications center around personal entertainment and participation in cultural events, alongside commercial uses such as themed retail displays, corporate events, and entertainment industry needs. The primary benefits derived by consumers include self-expression, social interaction enhancement, and creative outlet provision, driving market participation significantly.

The primary driving factors sustaining market growth include the rising commercialization of global holidays, the expansion of pop culture franchises providing new character inspirations annually, and the continuous innovation in costume materials, such as sustainable fabrics and smart textiles featuring LED integration or interactive elements. Furthermore, the global proliferation of e-commerce platforms has drastically improved accessibility and variety for consumers, enabling niche and specialized costume manufacturers to reach broader international audiences. Despite the seasonal nature of sales, strategic marketing campaigns commencing as early as late summer help sustain consumer interest and influence purchasing decisions toward premium options.

Halloween Costumes Market Executive Summary

The Halloween Costumes Market Executive Summary highlights a strong upward trajectory driven by significant shifts in consumer behavior toward personalized and high-quality experiential purchases. Key business trends include the consolidation of large costume retailers acquiring smaller, specialized accessory manufacturers, and the pronounced shift towards online direct-to-consumer (DTC) models leveraging influencer marketing to promote specific styles and licensed characters. Regionally, North America remains the dominant revenue generator due to deep cultural roots of the holiday, while the Asia Pacific region, particularly countries like China and Japan, exhibits the fastest growth rate, fueled by the adoption of Western holiday traditions and the strength of the cosplay culture intersecting with Halloween demand. Segment trends indicate robust growth in the adult demographic, specifically for high-end, detailed, and historically accurate costumes, alongside the remarkable expansion of the pet costume segment, reflecting the increasing humanization of domestic animals in consumer spending patterns. Sustainability and ethical sourcing are emerging segment considerations, influencing the manufacturing processes and material choices of forward-thinking market participants.

AI Impact Analysis on Halloween Costumes Market

User queries regarding the impact of Artificial Intelligence (AI) on the Halloween Costumes Market primarily revolve around three key areas: personalized costume design generation, optimizing supply chain logistics for highly seasonal demand, and enhancing the consumer shopping experience through virtual try-ons and trend forecasting. Consumers are keen to know if AI can generate novel, copyright-free costume ideas based on their preferences or current micro-trends, moving beyond traditional licensed characters. Manufacturers, conversely, are focused on utilizing AI for predicting viral costume demands months in advance, allowing for optimized inventory management and mitigating the risks associated with highly unpredictable seasonal retail. Additionally, there is significant interest in how AI algorithms can power advanced recommendation engines, matching costumes and coordinating accessories across vast online inventories, thereby increasing average transaction value and customer satisfaction.

The implementation of AI algorithms dramatically enhances the design phase by analyzing social media data, search trends, and previous year sales data to accurately forecast which specific characters, memes, or historical themes will dominate the upcoming season. This predictive capability minimizes waste associated with overproduction of unpopular items and ensures critical inventory alignment for high-demand items, addressing the core challenge of extreme seasonality. Furthermore, AI-driven tools are being integrated into the consumer interface, offering features like generative design prompts where users describe an idea and the AI outputs a design concept, or sophisticated chatbots that guide users through complex custom sizing and material selection processes. This digital transformation improves speed-to-market and enhances customization options, positioning key market players competitively.

- AI-driven trend forecasting minimizes inventory risk by accurately predicting viral costume popularity months in advance.

- Generative AI tools assist designers in creating novel, personalized, and non-licensed costume concepts rapidly.

- Optimized supply chain and logistics management via AI ensures efficient distribution during the peak selling window (September-October).

- Virtual Try-On (VTO) experiences powered by AI and AR technologies reduce return rates for online costume purchases.

- Personalized marketing and recommendation engines powered by machine learning increase conversion rates and basket size.

- Automated quality control systems using computer vision ensure manufacturing standards are met for complex costume components.

DRO & Impact Forces Of Halloween Costumes Market

The dynamics of the Halloween Costumes Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping industry profitability and expansion. Key drivers include the massive global influence of social media platforms (e.g., TikTok, Instagram) that amplify visibility and demand for unique costumes, alongside the relentless production of new, popular content (movies, streaming series, video games) that provides fresh character inspiration annually. However, the market faces significant restraints, primarily the extreme seasonality of sales, which requires high capital investment for inventory that must be liquidated within a tight window, coupled with persistent challenges related to intellectual property infringement and the proliferation of low-quality counterfeit goods. Opportunities abound in the burgeoning demand for sustainable and ethically produced costumes, the expansion into adjacent global markets currently underserved by specialized costume retailers, and the integration of technology, such as augmented reality (AR) experiences and customizable 3D-printed accessories, to enhance consumer engagement.

The impact forces are particularly intense surrounding price sensitivity and intellectual property (IP) management. Consumers often seek affordable options for single-use items, pressuring manufacturers to utilize lower-cost materials, yet simultaneous demand exists for high-quality, licensed replica costumes, necessitating a dual strategy catering to both budget and premium segments. The regulatory environment concerning fire safety standards and chemical content in textiles, especially for children's costumes, acts as a constant external pressure point, compelling adherence to stringent manufacturing protocols. Overall, the market thrives on rapid response to cultural trends, demanding highly agile supply chains that can pivot quickly to capitalize on unexpected viral demands, making logistics and forecasting capabilities paramount impact forces.

Segmentation Analysis

The Halloween Costumes Market is meticulously segmented based on product type, end-user, material, and distribution channel to address the diverse needs of a highly seasonal and trend-driven consumer base. This detailed segmentation allows manufacturers and retailers to tailor their marketing strategies, inventory management, and product development efforts effectively. The segmentation by end-user, specifically distinguishing between adults, children, and pets, is crucial as each group exhibits unique purchasing drivers: children prioritize licensed characters and ease of wear, adults prioritize uniqueness and detail, and pet owners focus on comfort and novelty. Analyzing these segments reveals varying price elasticity and quality expectations across the market landscape.

Further granularity is achieved through segmentation by product type, differentiating between full costumes (pre-packaged kits), accessories (wigs, masks, specialized props), and related items (makeup, temporary tattoos). This categorization is essential for distribution channel planning; for instance, mass merchants typically stock a high volume of full, pre-packaged costumes, while specialty stores focus heavily on high-margin accessories and customizable components. Material segmentation, including polyester, cotton, vinyl, and innovative sustainable fabrics, is gaining prominence, reflecting growing consumer awareness regarding environmental impact and safety standards, particularly concerning flammable materials.

Understanding these cross-segment dynamics is vital for market positioning. A company specializing in sustainable, high-end adult costumes distributed primarily through online DTC channels requires entirely different operational and marketing infrastructure than a mass-market manufacturer of polyester children's costumes sold through big-box retail. The shift toward experience-based consumption also boosts the accessory segment, as consumers increasingly prefer creating unique looks by combining various components rather than relying solely on off-the-rack outfits, driving higher Average Selling Prices (ASPs) in the specialized accessory category.

- By Product Type:

- Full Costumes (Pre-packaged Kits)

- Accessories (Masks, Wigs, Hats, Props)

- Specialty Makeup & SFX

- Footwear and Hosiery

- Costume Components (Individual Pieces)

- By End-User:

- Adults (18+ Years)

- High-End/Licensed Replicas

- Budget/Mass Market

- Children (0-17 Years)

- Infant/Toddler

- Pre-teen

- Pets (Dogs, Cats, Others)

- Commercial/Professional (Theatres, Events)

- Adults (18+ Years)

- By Material:

- Synthetic Fabrics (Polyester, Nylon, Spandex)

- Natural Fabrics (Cotton, Wool)

- Sustainable/Recycled Materials

- Plastic and Vinyl

- Foam and Latex

- By Distribution Channel:

- Online Retail (E-commerce Platforms, DTC Websites)

- Mass Merchants and Hypermarkets (Walmart, Target)

- Specialty Costume Stores (Seasonal Pop-ups, Year-round Retailers)

- Department Stores

Value Chain Analysis For Halloween Costumes Market

The value chain of the Halloween Costumes Market begins with extensive Upstream Analysis, focusing on the procurement of raw materials, which primarily include synthetic textiles (polyester and nylon), plastics, latex, and specialized components like LEDs and electronic circuitry for interactive costumes. Key upstream activities involve sourcing materials from textile mills, chemical suppliers, and specialized component manufacturers, often concentrated in Asia Pacific regions, particularly China and Vietnam, due to cost efficiencies in manufacturing and labor. The efficiency of this stage is highly dependent on managing seasonal price volatility in raw materials and ensuring compliance with international safety and flammability standards, particularly pertinent for children’s wear.

Midstream activities encompass design and manufacturing. Design involves trend forecasting, intellectual property licensing negotiations, pattern creation, and sample production. Manufacturing processes range from basic cut-and-sew operations for mass-market items to specialized 3D printing and detailed craftsmanship for premium collector costumes. The subsequent Downstream Analysis focuses on distribution and retail. Given the highly concentrated selling period (Q3 and early Q4), efficient logistics are paramount. Products move through various Distribution Channels, including large-scale centralized wholesalers, direct sales to mass merchants, and specialized e-commerce fulfillment centers.

Distribution channels are broadly categorized as Direct and Indirect. Direct distribution includes manufacturers selling via their own brand websites (DTC), which offers higher control over branding and pricing. Indirect channels involve sales through traditional brick-and-mortar Specialty Costume Stores (seasonal and permanent), Mass Merchants, and major third-party E-commerce platforms (like Amazon or specialized marketplaces). The shift towards online retail heavily favors platforms with robust logistical capabilities that can handle rapid, high-volume shipping, significantly impacting the margins and inventory strategies of all participants in the value chain. Effective inventory management and robust reverse logistics for returns management are crucial given the high post-season markdown risks inherent in this market.

Halloween Costumes Market Potential Customers

The primary End-User/Buyers of Halloween costume products are exceptionally diverse, segmented across various demographic and psychographic groups, ranging from nuclear families buying for children's trick-or-treating to young adults participating in elaborate themed parties, and even commercial entities requiring uniforms or displays. Families with children represent a consistently reliable segment, driving demand for licensed characters, safety-compliant materials, and easy-to-wear designs, typically purchasing through mass merchants or large online retailers due to convenience and price consciousness. This demographic is less price-sensitive for in-demand licensed characters but requires durability and high safety ratings.

The Adult segment constitutes the highest growth potential and revenue per purchase, further stratified into casual participants and enthusiasts (e.g., Cosplayers, convention-goers). Casual adult buyers often seek trendy, ironic, or easily recognizable costumes, purchasing primarily in the last weeks of October. Enthusiasts, however, often plan months in advance, investing heavily in high-quality, complex, or custom components, utilizing specialized online vendors and craft suppliers. This segment is less price sensitive and seeks authenticity and superior material quality, driving innovation in the premium accessory and specialized makeup sub-segments.

In addition to consumer segments, commercial customers form a significant, albeit smaller, segment. These include entertainment venues, theme parks, professional theatre companies, corporate entities hosting seasonal events, and even marketing agencies requiring bespoke promotional costumes. These buyers prioritize customizability, durability (due to repeated professional use), bulk ordering capabilities, and specialized features (e.g., fire-resistant materials, professional-grade comfort). The rapidly growing Pet Costume segment targets pet owners who view their animals as part of the family, prioritizing comfort and novelty, typically purchasing through major pet supply retailers and increasingly through general e-commerce platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 11.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fun World, Spirit Halloween (Spencer’s), Buy Seasons, Rubie's Costume Company, Oriental Trading Company, Disguise (Jakks Pacific), Party City Holdco Inc., César S.A., Bristol Novelties, Leg Avenue, MorphSuits, Amscan Inc. (Part of Party City), Costumes USA, California Costume Collections, Mask-arade, Tipsy Elves, Smiffy’s, Chasing Fireflies, Halloweencostumes.com, Elope Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Halloween Costumes Market Key Technology Landscape

The Key Technology Landscape in the Halloween Costumes Market is rapidly evolving beyond traditional textile manufacturing, increasingly incorporating digital and advanced manufacturing techniques to meet consumer demand for novelty, realism, and personalization. Advanced manufacturing technologies, such as 3D Printing and Additive Manufacturing, are instrumental in the production of highly detailed, customized masks, complex armor components, and unique props that are difficult or cost-prohibitive to create using conventional injection molding. This technology enables rapid prototyping and small-batch production, crucial for capitalizing on fleeting viral trends.

Digital technologies are fundamentally transforming the retail experience. Augmented Reality (AR) and Virtual Reality (VR) platforms are being integrated to offer Virtual Try-On (VTO) features, allowing online shoppers to visualize how a costume or accessory looks on them using a smartphone or webcam, thereby mitigating the primary barrier of online costume purchasing—uncertainty regarding fit and appearance. Furthermore, manufacturers are experimenting with Smart Textiles and wearable technology, incorporating small, flexible LED arrays, responsive sound chips, and micro-sensors into costumes, creating interactive experiences. These 'smart costumes' are high-margin products that appeal to the tech-savvy adult and enthusiast demographic.

E-commerce infrastructure itself represents a crucial technology layer. Advanced AI-driven recommendation systems, coupled with sophisticated supply chain management software (SCM), ensure that the highly volatile demand cycle of the industry is managed effectively. The use of robust cybersecurity protocols is also becoming paramount, especially as more transactions shift online and companies handle vast amounts of personal consumer data related to design preferences and purchasing history. The convergence of material science (eco-friendly and bio-degradable polymers) and digital interactivity is defining the next generation of competitive advantages in this niche sector.

Regional Highlights

- North America: North America, led predominantly by the United States and Canada, remains the largest and most mature market for Halloween Costumes globally, driven by deep-rooted cultural tradition, high average spending per participant, and aggressive year-round retail promotion. The market here is characterized by high demand for licensed pop culture costumes, premium quality adult outfits, and a rapidly expanding segment dedicated to pet costumes. Retail dominance is shared between dedicated seasonal pop-up stores (like Spirit Halloween) and major mass merchants (like Walmart and Target), with e-commerce accounting for over 50% of purchases, emphasizing the criticality of speedy fulfillment during the peak season.

- Europe: The European market shows steady, though generally lower, per capita spending compared to North America, but exhibits high growth rates driven by the increasing commercial adoption of Halloween festivities, particularly in the UK, Ireland, and increasingly Germany. Demand is diversified, encompassing traditional gothic and horror themes alongside international pop culture trends. Regulatory compliance related to textile flammability standards (such as CE marking requirements) is a crucial operational factor for manufacturers serving this region. The market is fragmented, with strong local players complementing large international retailers.

- Asia Pacific (APAC): The APAC region is the fastest-growing market segment, primarily influenced by countries like Japan (Cosplay culture blending with seasonal events), Australia, and emerging urban centers in China and South Korea. Growth is fueled by rising disposable incomes and the increasing integration of Western cultural holidays, particularly among the youth demographic. Unlike the Western market, APAC demand is often sustained throughout the year due to consistent demand from the convention and themed entertainment industries, diversifying the revenue stream beyond the single seasonal spike. Local customization of global trends is a significant characteristic here.

- Latin America (LATAM): The LATAM market is characterized by emerging interest in Halloween, often blending with traditional local holiday celebrations (like Day of the Dead in Mexico). While spending is currently lower than in mature markets, the large youth population and rapidly expanding middle class in countries like Brazil and Mexico present significant long-term growth potential. Manufacturers often need to adapt product lines to local preferences and socio-economic realities, emphasizing budget-friendly options distributed through traditional retail channels and regional online platforms.

- Middle East and Africa (MEA): The MEA region is the smallest but exhibits selective growth, primarily concentrated in expatriate communities and major metropolitan hubs (Dubai, Abu Dhabi, and parts of South Africa) where Western cultural influence is higher. The market demand is highly specialized and often skewed toward adult parties and themed corporate events rather than traditional family trick-or-treating. Distribution is heavily reliant on high-end specialty stores and premium international e-commerce channels, necessitating sophisticated supply chain logistics to overcome geographical and regulatory hurdles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Halloween Costumes Market.- Rubie's Costume Company

- Spirit Halloween (owned by Spencer's)

- Party City Holdco Inc.

- Disguise (a subsidiary of Jakks Pacific)

- Fun World

- California Costume Collections

- Oriental Trading Company

- Amscan Inc. (Part of Party City)

- Leg Avenue

- MorphSuits

- Smiffy’s

- Buy Seasons

- Bristol Novelties

- César S.A.

- Tipsy Elves

- Halloweencostumes.com (a subsidiary of Fun.com)

- Elope Inc.

- Forum Novelties

- InCharacter Costumes

- Chasing Fireflies

Frequently Asked Questions

Analyze common user questions about the Halloween Costumes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current growth driver for the premium segment of the Halloween Costumes Market?

The premium segment growth is primarily driven by the 'Experience Economy' and social media influence. Adults are increasingly investing in high-quality, detailed, and licensed replica costumes to create unique, viral-worthy content and enhance participation in specialized events and parties. Demand for intricate special effects makeup and advanced costume accessories also boosts premium spending, shifting focus from single-use items to collector-grade garments.

How is sustainability affecting material sourcing and manufacturing in the costume industry?

Sustainability is compelling manufacturers to prioritize recycled polyester (rPET), organic cotton, and biodegradable materials to reduce environmental impact. Consumers, particularly younger generations, are seeking ethically sourced and durable costumes, pressuring key players to improve transparency in their supply chains. This trend is leading to the development of higher-cost, specialized sustainable lines, often marketed through DTC channels emphasizing eco-friendly certifications.

What role does intellectual property (IP) licensing play in determining market leaders?

IP licensing is critical for market leadership, as licensed costumes based on current hit movies, television shows, and video games consistently generate the highest sales volume, especially in the children's segment. Companies that secure exclusive or highly desirable IP rights gain a significant competitive advantage, allowing them to dominate retail shelf space and command premium pricing, cementing their position against generic or unlicensed competitors.

What are the primary logistical challenges faced by the Halloween Costumes Market?

The central logistical challenge is the market's extreme seasonality; approximately 80% of annual sales occur in the four weeks leading up to October 31st. This requires massive, rapid inventory deployment, necessitating highly sophisticated predictive analytics for demand forecasting, extensive temporary warehousing capacity, and efficient last-mile delivery systems capable of handling unexpected spikes in online orders without failure.

How are technology integrations like AR/VR changing the costume purchasing experience?

Augmented Reality (AR) and Virtual Try-On (VTO) applications are fundamentally changing the online shopping experience by allowing customers to digitally superimpose costumes onto themselves before purchasing. This technology significantly reduces consumer anxiety regarding fit, style, and visual appeal, leading to lower return rates, higher conversion rates, and increased customer confidence in buying complex or premium costumes sight unseen.

The Halloween Costumes Market is characterized by intense cyclical demand, heavily influenced by global media consumption, consumer disposable income, and the increasing sophistication of e-commerce platforms. The transition toward customized experiences and the adoption of cutting-edge manufacturing technologies, such as 3D printing for specialized accessories, are reshaping the competitive landscape. Market stability is ensured by the unwavering cultural importance of Halloween in key regions, while future growth is largely dependent on successful expansion into emerging international markets and the strategic integration of sustainable supply chain practices. Analyzing market dynamics reveals a sector that is highly responsive to fleeting trends but anchored by consistent demand for quality, novelty, and strong emotional resonance with consumers across all age brackets. The continuous evolution of popular culture requires market players to maintain unparalleled agility in design and production, ensuring they capitalize on the short window of opportunity each year. Furthermore, the expansion of commercial applications, extending beyond consumer use to include entertainment and marketing sectors, provides a reliable counterbalance to the inherent volatility of seasonal retail. Strategic investments in warehousing automation and demand sensing technologies are imperative for maintaining profitability in this high-risk, high-reward retail segment.

Future projections indicate a diversification of revenue streams, moving beyond traditional apparel to encompass specialized makeup kits, interactive props, and licensed pet merchandise, thereby broadening the market definition. Key competitors are focusing on vertical integration and acquiring complementary technology firms to secure proprietary advantages in personalization and virtual engagement. Licensing agreements will become more valuable and contested, driving up the cost of securing rights to the most popular characters, thus reinforcing the dominance of established players with deep financial resources. The pressure to innovate on the material front is also escalating, spurred by environmental regulatory shifts and consumer preference, making research and development into eco-friendly polymers and recycled fabrics a critical competitive battleground for the long term. Overall market health relies on maintaining the balance between meeting mass-market price expectations and fulfilling the growing demand for bespoke, premium-grade products. This necessitates a highly segmented approach to marketing, distribution, and product lifecycle management.

The strategic imperatives for companies operating in this market include mastering cross-channel inventory synchronization, leveraging social media platforms for real-time trend identification, and rapidly transitioning concepts from design studio to global fulfillment centers. Successful adaptation to digital retail requires robust investment in user experience and data analytics, ensuring that personalized recommendations and sizing guides are accurate and engaging. Regional expansion strategies must be localized, recognizing that the definition and celebration of Halloween vary significantly across continents, requiring culturally sensitive product lines and localized marketing campaigns. Furthermore, mitigating the risks associated with global supply chain disruptions, especially concerning raw material tariffs and geopolitical instability, is paramount for securing steady, profitable operations during the critical sales months. The long-term outlook remains positive, conditional upon sustained innovation in both product offering and operational efficiency to navigate the unique challenges posed by extreme seasonality and trend volatility.

The adult demographic continues to exhibit complex purchasing behaviors, often seeking costumes that offer satire, commentary, or a highly detailed historical look, driving strong growth in the specialized accessory and customization services sector. The ability of major retailers to offer rental options, particularly for high-cost, professional-grade costumes, is an emerging trend designed to capture budget-conscious adult consumers who still desire quality without the long-term commitment of ownership. This shift towards a circular economy model within the costume market introduces new operational complexities, requiring investment in cleaning, refurbishment, and inventory tracking technologies designed for rental cycles rather than one-time sales. The competitive environment is also intensified by the participation of independent artisans and creators utilizing platforms like Etsy, which cater to niche, handmade, and highly unique costume needs, forcing larger corporations to enhance their customization offerings to compete at the micro-segment level. This bifurcation between mass-market affordability and bespoke exclusivity defines much of the strategic planning in the current market environment.

A crucial factor influencing the market is the continuous evolution of digital consumption patterns. The rise of short-form video content platforms (e.g., TikTok, Reels) has drastically shortened the lifecycle of viral trends. A costume concept can go from obscure to globally sought-after in a matter of days, demanding unprecedented speed in design replication, sourcing, and distribution. Companies that possess vertically integrated supply chains or strong, flexible manufacturing partnerships are best positioned to capitalize on these micro-trends. Furthermore, the integration of gaming and virtual world elements into physical products, such as limited-edition costumes tied to in-game unlocks or virtual merchandise, represents a synergistic opportunity to engage younger, digitally native consumers. The focus is increasingly moving toward providing a comprehensive, multi-platform experience rather than just selling a physical garment, encompassing digital assets, social sharing features, and interactive elements. These technological shifts necessitate specialized skill sets in AI-driven pattern making and rapid digital prototyping within the manufacturing units.

The regulatory framework governing consumer safety remains a persistent challenge, particularly concerning fire safety standards for fabrics, chemical contents in makeup, and choking hazards in small accessories, especially for items targeted at children. Compliance with disparate international standards (e.g., EU regulations vs. US CPSC standards) necessitates sophisticated quality control processes and material traceability systems, often increasing manufacturing costs. Companies demonstrating a commitment to high safety standards and transparent material sourcing gain significant trust and brand equity, particularly among family consumers. Furthermore, labor practices within the primarily Asian manufacturing hubs are under increased scrutiny, driving demand for ethical sourcing verification and sustainable factory audits. This complexity in global compliance adds significant overhead but is essential for maintaining access to premium Western markets. As the market matures, consolidation through mergers and acquisitions is expected to continue, allowing large entities to leverage economies of scale in both IP procurement and global compliance management, further tightening the competitive pressure on smaller, independent costume suppliers.

The implementation of dynamic pricing models, supported by machine learning algorithms that analyze real-time inventory levels, competitor pricing, and historical sales velocity, is increasingly prevalent among major online retailers. This enables retailers to maximize revenue during the narrow peak sales window and efficiently liquidate excess stock during the post-holiday period, mitigating the inherent risks of obsolescence. Operational excellence in logistics extends beyond mere speed; it now includes advanced packaging solutions designed to minimize shipping damage for complex items and eco-friendly packaging materials that align with sustainability goals. The ability to handle peak season demand without overwhelming customer service channels is also a key differentiator, requiring investment in AI-powered chatbots and automated return processing systems. These factors collectively underscore the shift of the Halloween Costumes Market from a simple apparel business to a highly data-driven, technologically managed seasonal retail sector.

Furthermore, the segmentation analysis reveals that the 'Accessories' category, encompassing wigs, masks, prop weapons, and specialized SFX components, is outpacing the growth rate of full packaged costumes. This is attributed to the consumer desire for personalization and the trend of combining low-cost base garments with high-quality, impactful accessories to create a unique look. This trend demands flexibility from manufacturers to produce a wide variety of specialized components rather than relying on standard kits. The demand for customizable options has also fueled the growth of third-party marketplaces and small, artisan businesses specializing in niche prop production, often utilizing advanced technologies like resin casting and complex mold making. Retailers are strategically allocating more floor and virtual space to accessories, recognizing their higher margin potential and their role in driving overall transaction value during the peak season. The convergence of cosplay enthusiasm and mainstream Halloween participation continues to elevate the aesthetic and material standards expected across all accessory sub-segments.

In terms of distribution, the emergence of hybrid retail models, combining pop-up seasonal stores with robust click-and-collect capabilities, is proving highly effective in North America. These models leverage the instantaneous availability of brick-and-mortar stores for last-minute shoppers while streamlining inventory management through online ordering, providing a hedge against the volatility of shipping timelines. Investment in geo-location marketing is becoming standard practice, alerting local consumers to stock availability and unique in-store promotions, maximizing foot traffic during the crucial final two weeks of October. As consumers become more discerning about quality, the necessity of seeing and feeling certain products, particularly those related to fit and texture, maintains the relevance of physical retail presence, even as e-commerce dominates transaction volume. The symbiotic relationship between online personalization and physical retail validation is a defining feature of the current market distribution strategy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager