Halogen Floodlights Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441302 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Halogen Floodlights Market Size

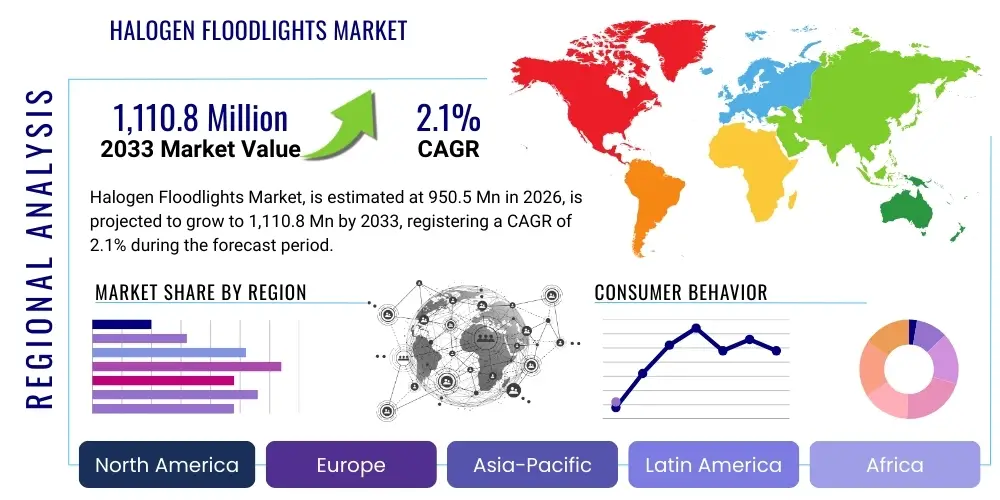

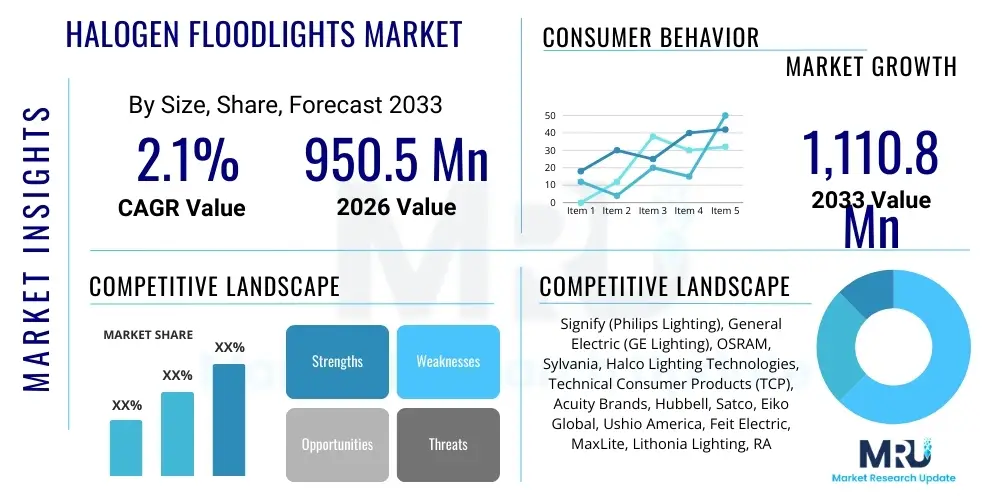

The Halogen Floodlights Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 2.1% between 2026 and 2033. The market is estimated at USD 950.5 Million in 2026 and is projected to reach USD 1,110.8 Million by the end of the forecast period in 2033.

Halogen Floodlights Market introduction

The Halogen Floodlights Market, while facing significant disruption from energy-efficient LED alternatives, continues to hold niche market relevance, particularly in older infrastructure and specific applications where high intensity and accurate color rendering are critical, or where initial capital expenditure minimization is prioritized. Halogen floodlights utilize a halogen gas enclosed within the bulb to sustain the tungsten filament at higher operating temperatures, resulting in significantly brighter light output and a purer white light compared to traditional incandescent lighting. This technology provides instantaneous full brightness and typically requires minimal associated ballast or complex circuitry, offering a straightforward, robust, and often low-cost solution for intense area illumination. Key applications historically span security lighting, sports field illumination (in areas not yet fully converted to LED), and high-bay industrial settings. The persistence of this market is driven almost entirely by replacement demand for the vast existing installed base.

The fundamental product description centers on highly robust lighting fixtures designed to cast a broad and intense beam of light across a large area. These fixtures are generally built to withstand outdoor environmental stresses, including moisture, dust, and temperature fluctuations, making them suitable for construction sites, large residential properties, and commercial premises requiring enhanced security. The inherent simplicity of the halogen lamp design—comprising the quartz envelope, tungsten filament, and halogen gas—contributes to ease of maintenance and replacement, which remains a comparative advantage in certain remote or resource-constrained environments. However, the market dynamics are increasingly pressured by regulatory efforts aimed at phasing out energy-intensive lighting technologies, compelling manufacturers to focus on replacement parts and specialized high-demand applications rather than broad consumer adoption. This regulatory climate necessitates defensive strategies focused on optimizing supply chains for legacy parts.

Major applications for halogen floodlights are concentrated in areas demanding immediate, high-output illumination, often used for temporary setups or as supplementary lighting. Benefits include excellent color rendition (CRI near 100), low initial fixture cost, and operational reliability in specific high-heat environments where complex electronics might fail. Driving factors for the remaining market demand include the large installed base requiring replacement lamps, resistance to adopting expensive LED retrofits in specific industrial settings, and the superior thermal stability of halogen technology in extreme cold or heat, which is sometimes required in specialized industrial processing or heavy-duty construction. These factors contribute to the slow, but persistent, demand sustaining the projected CAGR, reflecting a market primarily focused on maintenance, repair, and operations (MRO).

Halogen Floodlights Market Executive Summary

The Halogen Floodlights Market is characterized by a mature technological landscape facing strong headwinds due to global energy efficiency mandates and the pervasive adoption of Light Emitting Diode (LED) technology. Current business trends indicate a shift away from manufacturing new complete halogen floodlight fixtures towards supplying high-quality replacement lamps and specialized components for existing infrastructure. Manufacturers are focusing on optimizing the efficiency of existing halogen designs—where permissible by law—and exploring hybrid fixtures that accommodate both older halogen lamps and newer, more efficient light sources. Competitive strategies are increasingly centered on aftermarket service provision, inventory management for legacy systems, and targeted marketing towards niche industrial and agricultural sectors that continue to rely on this proven technology due to cost or operational requirements. The overarching trend is defensive innovation aimed at maintaining market share in shrinking segments and maximizing profitability from the necessary replacement cycles.

Regional trends reveal significant divergence in market decline rates, heavily influenced by local regulatory frameworks and energy costs. Europe, due to stringent ecodesign regulations, exhibits the fastest rate of phase-out, limiting halogen floodlight sales primarily to specialized professional applications where no cost-effective LED alternative exists, or for stock clearance in distribution channels. Conversely, regions in Asia Pacific (APAC) and parts of Latin America show comparatively resilient demand, particularly in developing economies where the initial cost advantage of halogen systems is substantial, and regulatory enforcement regarding energy consumption is less rigorous. North America occupies a middle ground, with phasing out focusing heavily on general-purpose lighting, while certain high-wattage industrial applications maintain their preference for halogen simplicity and output characteristics, ensuring a steady, albeit low, demand for replacement parts through specialized wholesalers.

Segment trends underscore the enduring utility of specific product types, particularly double-ended quartz halogen lamps, which offer extremely high lumen output suitable for expansive areas. The industrial and infrastructure application segments—such as mining, large temporary event lighting, and certain older port facilities—are the primary drivers of current revenue, offsetting the near-total collapse of the residential segment, which has largely migrated to LED security lighting. The distribution channel analysis highlights the increasing importance of direct supply and specialized industrial wholesalers, moving away from mass-market retail which prioritizes modern, efficient lighting solutions. Companies successful in this market are those that have streamlined supply chains to cater specifically to industrial Maintenance, Repair, and Operations (MRO) requirements, emphasizing speed and reliability of component delivery over new product development or marketing to general consumers.

AI Impact Analysis on Halogen Floodlights Market

User inquiries concerning the impact of Artificial Intelligence on the Halogen Floodlights Market predominantly revolve around how advanced monitoring and predictive maintenance systems could extend the lifespan of existing halogen installations, and whether smart technologies might integrate with these older systems. Key concerns frequently raised include the economic viability of applying sophisticated AI controls (like predictive failure analysis, optimized switching cycles, and energy monitoring) to intrinsically low-tech and high-consumption devices like halogen lamps. Users are generally skeptical about AI driving new demand for halogen but are highly interested in how AI-driven optimization might slow the rate of mandated replacement by maximizing efficiency within regulatory limits or providing actionable insights into system failure before complete darkness occurs. The overriding theme is the use of smart infrastructure (often AI-backed) to manage the operational costs and reliability challenges inherent in legacy lighting technology, essentially using intelligence to manage inefficiency.

While AI does not directly influence the core technology of the halogen floodlight itself—as it remains a simple thermal radiation light source—its peripheral influence lies in optimizing the utilization patterns and maintenance protocols associated with the fixtures. For large industrial complexes, AI-powered energy management systems can utilize real-time usage data to decide precisely when and how long the high-wattage halogen units should operate, potentially reducing overall operational hours and minimizing energy waste, thereby marginally improving the cost-competitiveness against LEDs. Furthermore, machine learning algorithms applied to sensor data can identify subtle anomalies in power consumption or operational heat profiles, predicting bulb failure before it happens. This predictive capability significantly reduces unplanned downtime, which is highly valued in critical operational environments like ports or manufacturing lines still utilizing halogen fixtures, making MRO planning significantly more efficient through data-driven insights.

The long-term impact analysis suggests that AI adoption will accelerate the final transition away from halogen, even as it manages existing systems in the short term. AI-driven building management systems (BMS) inherently favor deeply integrated, programmable, and highly granularly controllable light sources such as LEDs, which natively interface with IoT and smart grid infrastructure. As infrastructure becomes smarter, the lack of native digital communication capabilities in halogen systems becomes a critical disadvantage. Therefore, while AI offers short-term reliability enhancement for the installed base by improving scheduling and maintenance, its true strategic impact is favoring the deployment of future-proof, AI-compatible lighting solutions, thus indirectly hastening the obsolescence of halogen floodlights in new installations and large-scale retrofitting projects that prioritize comprehensive system intelligence and control.

- AI-driven Predictive Maintenance: Utilizing ML algorithms to forecast bulb failure and optimize replacement schedules for existing industrial halogen systems, reducing unplanned operational downtime.

- Energy Consumption Optimization: AI integration into smart grids and facility management systems to precisely control halogen operational duration, mitigating high operational energy consumption costs.

- Asset Management: Automated tracking of halogen fixture inventory and component lifespan, crucial for MRO supply chains serving legacy installations requiring specific, high-wattage replacement lamps.

- Transition Acceleration: AI-BMS preference for intelligent LED controls will accelerate the replacement of halogen fixtures in new and retrofitted smart buildings due to superior control and data capabilities.

- Operational Reliability Enhancement: Employing AI-based monitoring to ensure continuous high-intensity illumination in critical areas utilizing halogen technology by preemptively identifying potential failure points based on usage history and environmental factors.

- Data Integration Challenge: AI highlights the lack of native data feedback loops in halogen systems, making deep integration into comprehensive smart infrastructure complex and costly compared to native IoT lighting.

- Optimized Scheduling: Using AI to learn usage patterns and environmental conditions to activate high-output halogen systems only when absolutely necessary, extending bulb life and complying marginally better with energy mandates.

- Efficiency Comparison: AI-driven energy audits rapidly demonstrate the total cost of ownership disparity between halogen and LED, serving as a powerful decision-support tool for facility managers to justify retrofits.

- Remote Diagnostics: AI algorithms applied to power consumption data allow remote detection of system degradation or imminent failure in geographically dispersed halogen installations, improving field service efficiency.

- Security Integration: Halogen floodlights integrated into AI-driven perimeter security systems benefit from optimized intensity and focus adjustments based on detected threat levels, though the high energy cost remains a deterrent for continuous operation.

- Supply Chain Forecasting: AI-driven analysis of failure rates across the installed base allows manufacturers to accurately forecast MRO demand for specific halogen lamp types, optimizing production runs and inventory levels for minimal lead times.

- Regulatory Compliance Monitoring: AI systems can track the operational profile of legacy halogen installations to ensure they remain within the increasingly tight energy consumption tolerances set by regional regulatory bodies, particularly concerning maximum permissible operating hours.

- Fixture Health Monitoring: Machine learning models analyzing temperature and vibration data gathered from sensors attached to halogen fixtures can assess the structural integrity and risk of component breakdown (e.g., reflector damage or wiring degradation).

- Interoperability Solutions: The need to integrate halogen into smart environments fosters the development of specialized, AI-compatible switchgear and power regulators that can effectively manage the load characteristics of thermal lighting.

DRO & Impact Forces Of Halogen Floodlights Market

The market for halogen floodlights is primarily influenced by the persistent demand for replacement components (Drivers) countered by aggressive global energy efficiency regulations (Restraints). Opportunities primarily exist in specialized, non-general illumination niches and regions with lower electrification costs. The interplay of these factors creates significant Impact Forces that dictate the market’s slow decline trajectory. Specifically, the low upfront cost and high lumen output per unit size serve as primary drivers, maintaining a loyal customer base in budget-conscious or robust industrial settings. However, the regulatory environment in developed nations, such as the EU and parts of North America, acts as a powerful restraint, continually narrowing the scope of permissible applications and forcing manufacturers to pivot their production capabilities away from standard consumer products towards specific industrial replacement stock.

Key drivers sustaining the market include the vast existing installed base in commercial and public infrastructure globally, requiring continuous supply of replacement lamps. Furthermore, specific professional and temporary lighting applications, such as film sets or outdoor construction sites, often rely on halogen for its reliable high Color Rendering Index (CRI) and instant-on capability without complex warmup sequences. Conversely, the predominant restraint is the extremely low luminous efficacy (lumens per watt) compared to LEDs, leading to high operational electricity costs and significant thermal output, rendering them unfavorable under environmental sustainability mandates. The lack of dimmability and complex control flexibility compared to modern smart lighting is another technological restraint limiting adoption in advanced infrastructure projects, making halogen systems increasingly incompatible with modern energy management standards and digital communication protocols.

Opportunities for market players involve specializing in high-quality, long-life halogen lamps designed explicitly for the MRO segment and targeting industrial users in regions less affected by immediate phase-out deadlines. Furthermore, the development of hybrid fixtures that allow for easy retrofit transition from halogen to LED, thus offering a future-proof upgrade path while utilizing existing infrastructure, represents a strategic opportunity. The impact forces are characterized by rapid technological substitution pressure (favoring LED) balanced against the inertia of existing infrastructure investment. The regulatory pressure (Impact Force) forces pricing structures to remain competitive in segments where efficiency is not the primary determinant, primarily focusing on durability, component robustness, and immediate availability of replacement stock to minimize client operational downtime, emphasizing service excellence over product innovation.

Segmentation Analysis

The Halogen Floodlights Market is segmented based on critical attributes including Type, Application, Wattage, and Distribution Channel. Analysis of these segments is crucial for understanding the remaining pockets of profitability and predicting where demand persistence is strongest. The classification by Type often distinguishes between linear (double-ended) halogen lamps, known for their high intensity and use in large floodlight fixtures, and single-ended lamps, typically used in smaller, more focused applications. Understanding the sales volume distribution across these types reveals the shifting landscape, generally pointing toward higher enduring demand for the double-ended, high-lumen industrial types which are crucial for high-mast and expansive area illumination where LED retrofits face specific technical or cost challenges.

Application segmentation reveals the core users maintaining demand. While the residential segment has rapidly declined, the industrial sector (including mining, construction, and large warehousing) continues to show sustained demand due to the robustness and reliability requirements of these demanding environments. Infrastructure projects, particularly temporary roadworks or emergency services lighting, also represent a significant, albeit fluctuating, market segment. Wattage segmentation mirrors the energy efficiency debate, with lower-wattage consumer-grade products having largely disappeared, leaving higher-wattage (500W and above) industrial lamps as the primary revenue generators, catering to requirements that currently demand maximum light output over expansive areas, often prioritizing sheer brightness over long-term energy savings.

The Distribution Channel segment reflects the move towards specialized procurement. As halogen floodlights become less of a mass-market commodity, the reliance shifts from broad retail channels towards specialized electrical supply wholesalers, direct-to-industrial distributors, and online B2B marketplaces that cater specifically to MRO needs and replacement cycles for legacy equipment. Success in the current market requires optimized inventory management within these specialized supply chains, ensuring rapid fulfillment of crucial replacement orders to prevent operational shutdowns for industrial clients relying on this specific illumination technology. The convergence of Wattage and Application segments is key, emphasizing high-power products for industrial use sold via direct or specialized channels, reflecting a high-value, low-volume business model focused on servicing existing assets rather than acquiring new customers.

- By Type:

- Single-ended Halogen Lamps

- Double-ended Halogen Lamps (Linear)

- Sealed Beam Halogen Units (Used in specialized applications)

- Infrared Coated (IRC) Halogen Lamps (Eco-Halogen variants)

- By Application:

- Industrial Facilities (Manufacturing, Mining, Construction, Ports)

- Commercial Security and Area Lighting (Legacy Installations and Parking Lots)

- Infrastructure (Temporary Roadworks, Emergency Services, Rail Yards)

- Agricultural Settings (Specific heating and lighting requirements)

- Professional Entertainment (Film Sets, Theatrical Stages)

- By Wattage:

- Under 150W (Low-Power Niche and specialty use)

- 150W to 500W (Mid-Power Commercial/Residential Replacement and Small Industrial)

- Above 500W (High-Power Industrial/Infrastructure and High-Mast Lighting)

- Extreme High Wattage (1000W and Above for specialized use)

- By Distribution Channel:

- Industrial Wholesalers and Distributors (Primary channel for MRO)

- Online B2B Platforms (Increasing importance for specialized procurement)

- Direct Sales (to large enterprises with fixed contracts)

- Retail and Mass Market (Significantly Declining, only essential replacement stock)

- Specialty/Contractor Supply Houses (Serving small to medium-sized commercial clients)

Value Chain Analysis For Halogen Floodlights Market

The value chain for the Halogen Floodlights Market begins with the upstream procurement of raw materials, primarily focusing on high-purity tungsten for the filament, quartz or specialized high-temperature glass for the envelope, and specific inert or halogen gases. Upstream analysis involves assessing the supply stability and pricing volatility of these core components, particularly tungsten, which is subject to geopolitical market fluctuations. Manufacturing is highly standardized, centered on precision glass blowing, filament winding, and automated assembly processes. Efficiency in this stage is critical, as margins are typically low due to intense price competition from substitute technologies. The manufacturing focus has largely shifted from scaling production volumes to maintaining quality and ensuring component compatibility for replacement parts, which requires specialized quality control processes to guarantee fit and function in aging fixtures.

Moving downstream, the distribution channel is undergoing a significant transformation. Traditional mass-market retail channels, which previously housed significant shelf space for halogen floodlights and lamps, have drastically reduced their inventory, prioritizing LED products. The effective distribution now relies heavily on industrial supply houses (MRO providers) and specialized electrical contractors who manage and service existing legacy infrastructure. Direct supply relationships with major industrial clients—such as large utility companies, mining operators, and port authorities—are crucial for high-volume, high-wattage lamp sales. The logistics must be robust to handle potentially fragile quartz lamps and ensure rapid deployment to prevent operational bottlenecks for end-users, with specialized packaging and handling protocols being necessary for these sensitive components.

The direct and indirect distribution dichotomy highlights the dual nature of the remaining market. Direct sales are predominantly B2B, involving bespoke contracts for large volumes of specialized lamps and fixtures sold directly from the manufacturer or their authorized industrial agents to the end-user. This channel emphasizes long-term client relationships and technical support for legacy systems. Indirect channels involve wholesalers and distributors acting as intermediaries, primarily catering to smaller commercial entities, independent contractors, and the remaining retail replacement demand. The profitability within the value chain is increasingly concentrated at the distribution and service end, where rapid supply and technical expertise for integrating replacement parts into older fixtures command a premium over the commodity manufacturing stage, reflecting the high cost of industrial downtime if replacements are delayed.

Halogen Floodlights Market Potential Customers

Potential customers for the Halogen Floodlights Market are predominantly segmented into industrial and infrastructure sectors that prioritize ruggedness, low maintenance complexity, and high lumen output at a low initial unit cost, often outweighing the long-term energy cost penalties. Key buyers include construction companies needing temporary, durable lighting systems for active job sites, mining operations requiring reliable high-output illumination resistant to harsh environmental conditions, and agricultural facilities utilizing specific lamp characteristics for processes like heating or high-intensity area lighting. These customers represent the critical mass that sustains replacement demand, often operating on legacy systems where a full LED retrofit is deemed too disruptive or capital-intensive in the short term. The focus is strictly on functional continuity and adherence to existing infrastructure standards rather than energy innovation.

A significant subset of potential customers includes specialized maintenance and operations departments within municipal authorities, utility companies, and older manufacturing plants. These entities are responsible for the MRO of fixed infrastructure installed decades ago. Their procurement cycles are driven by failure rates and the need to standardize inventories on existing lamp types to simplify logistics and training. These customers typically purchase through long-term contracts via industrial wholesalers, valuing reliability, guaranteed component compatibility, and responsive supply chains above all else. This captive market segment is highly price-sensitive for the replacement lamps but inelastic regarding the underlying technology choice until a major facility overhaul occurs, making them prime targets for MRO supply specialists.

Furthermore, the niche market of entertainment and specialty filming continues to rely on halogen technology for certain lighting effects due to its continuous, full-spectrum light output and high CRI, which is superior for color-sensitive applications compared to standard LED emitters. While the trend is shifting towards specialized LED theatrical lighting, the established base of halogen fixtures in studios and mobile film units ensures a persistent, specialized customer segment. These buyers prioritize optical performance and color quality, often using high-wattage, double-ended lamps with specialized optics. Understanding the distinct needs—from the industrial user focused on robustness to the entertainment professional focused on light quality—is vital for targeted marketing strategies in this shrinking, yet highly specialized, market segment that values performance parameters over pure energy efficiency metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950.5 Million |

| Market Forecast in 2033 | USD 1,110.8 Million |

| Growth Rate | 2.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Signify (Philips Lighting), General Electric (GE Lighting), OSRAM, Sylvania, Halco Lighting Technologies, Technical Consumer Products (TCP), Acuity Brands, Hubbell, Satco, Eiko Global, Ushio America, Feit Electric, MaxLite, Lithonia Lighting, RAB Lighting, Westgate Manufacturing, Westinghouse Lighting, LSI Industries, Nora Lighting, Kichler Lighting. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Halogen Floodlights Market Key Technology Landscape

The core technology underpinning the Halogen Floodlights Market remains stable and mature, relying on the fundamental principle of the tungsten-halogen cycle. This involves the use of a small amount of halogen gas (such as iodine or bromine) within the quartz envelope to react with evaporated tungsten from the filament. This reaction redeposits the tungsten back onto the filament, preventing the bulb from blackening and extending its life while enabling higher operating temperatures and thus greater luminous efficiency than standard incandescent bulbs. Key technological differentiations in this sector involve optimizing the gas composition and pressure to maximize lamp life and brightness while adhering to increasingly stringent efficiency standards, often achieved by precise filament design and envelope geometry to direct heat efficiently and safely while ensuring regulatory compliance for specific exemptions.

In terms of fixture technology, the landscape focuses on thermal management and beam control, as halogen bulbs generate significant heat. Modern fixtures, even those designed for halogen lamps, incorporate advanced heat dissipation materials and reflector designs to ensure optimal light distribution and longevity of the fixture itself, especially when deployed outdoors under extreme weather conditions. The primary shift in the technological landscape is the rapid decline in R&D investment for halogen systems, with resources overwhelmingly allocated to LED technology. The only persistent technological effort in halogen is related to miniaturization for specialized high-intensity discharge applications and ensuring compliance with remaining safety and performance standards globally, particularly in professional-grade fixtures requiring exact photometric characteristics for certification.

A crucial technological dimension now involves the interface layer—how legacy halogen fixtures can be managed or transitioned. This includes the development of robust, high-temperature sockets and wiring systems capable of handling the high power draw and heat associated with halogen lamps. Furthermore, there is a minor technological focus on specialized halogen replacement lamps (often referred to as “eco-halogens”) that slightly improve efficiency through infrared coating technology (IRC), redirecting heat back onto the filament to maintain operating temperature with less input power. However, even these incremental improvements are fundamentally limited by the thermal physics of the tungsten-halogen cycle, meaning they cannot compete with the long-term technological trajectory and disruptive efficiency gains offered by solid-state lighting solutions, forcing manufacturers to accept the eventual obsolescence of the core product line.

Regional Highlights

The regional dynamics of the Halogen Floodlights Market are highly heterogeneous, reflecting varied economic development, energy costs, and regulatory enforcement levels, leading to diverse market maturity and decline rates across the globe.

- North America (US and Canada): This region is characterized by a strong regulatory push towards energy efficiency, particularly Title 20/24 in the US and similar Canadian standards, which have severely restricted the sale of general-purpose halogen floodlights. Demand is concentrated almost exclusively in the replacement segment for existing commercial and industrial installations, particularly high-wattage fixtures in warehouses, construction sites, and older security systems. The market requires high-quality, long-life replacement lamps supplied via sophisticated B2B distribution networks, emphasizing reliable stocking and quick delivery for Maintenance, Repair, and Operations (MRO) needs across large industrial complexes.

- Europe: Europe is the most restrictive region, having implemented comprehensive bans and phase-outs on many types of halogen lamps under Ecodesign regulations, leading to the fastest market contraction globally. Remaining demand is exceptionally niche, focused on specialized professional applications (e.g., medical, theatrical, certain industrial processes) where specific spectral quality or high-temperature stability is paramount, often falling under strict, limited exemptions. Manufacturers primarily serve the MRO needs of legacy infrastructure that has not yet undergone required retrofitting, often dealing with highly fragmented, low-volume, high-value orders for specific compatible components.

- Asia Pacific (APAC): APAC represents the most resilient market region due to varied regulatory landscapes and a continued preference for low initial capital expenditure, especially in developing nations like India, Indonesia, and parts of Southeast Asia. While developed economies like Japan and South Korea are rapidly transitioning to LED, significant industrialization and infrastructure development in emerging APAC countries ensure sustained, though often diminishing, demand for cost-effective halogen solutions in construction and public lighting projects. This region drives a higher proportion of new fixture sales compared to other global markets, though this segment is rapidly shrinking as LED costs drop.

- Latin America: Similar to emerging APAC, Latin America maintains a moderate demand, driven by cost sensitivity and less severe regulatory restrictions compared to Europe and North America. The mining and heavy industry sectors in countries like Brazil, Chile, and Mexico rely on the ruggedness and high output of halogen floodlights for demanding operational environments, where reliability and simple replacement are prioritized over efficiency. Market growth is stable in the replacement component sector but slow overall due to macroeconomic pressures and the gradual introduction of efficiency standards which are slowly impacting purchasing decisions across both public and private sectors.

- Middle East and Africa (MEA): The MEA region shows persistent niche demand, particularly in the Middle East for specialized high-intensity lighting in infrastructure projects and temporary sites, where high ambient temperatures can sometimes challenge complex LED electronics, offering a temporary resilience advantage for thermal lighting. Africa's market is largely influenced by initial cost considerations, leading to sustained use of halogen in infrastructure and emerging industrial clusters where power reliability is variable, and the simplicity of halogen technology is advantageous. The pace of LED adoption varies significantly across countries based on governmental energy policy and investment into modern grid infrastructure, resulting in high market heterogeneity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Halogen Floodlights Market.- Signify (Philips Lighting)

- General Electric (GE Lighting)

- OSRAM

- Sylvania

- Halco Lighting Technologies

- Technical Consumer Products (TCP)

- Acuity Brands

- Hubbell

- Satco

- Eiko Global

- Ushio America

- Feit Electric

- MaxLite

- Lithonia Lighting

- RAB Lighting

- Westgate Manufacturing

- Westinghouse Lighting

- LSI Industries

- Nora Lighting

- Kichler Lighting

Frequently Asked Questions

Analyze common user questions about the Halogen Floodlights market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the continued demand for halogen floodlights despite LED advancements?

The continued demand is primarily driven by the massive existing installed base globally, particularly in industrial and municipal infrastructure, necessitating continuous replacement of failed lamps (MRO market). Additionally, halogen floodlights offer a significantly lower initial purchase price point and excellent color rendering index (CRI) compared to entry-level LEDs, making them suitable for specialized budget-conscious or color-critical applications where upfront capital expenditure is highly constrained.

How are global energy regulations impacting the future growth and availability of halogen floodlights?

Global energy regulations, notably the EU’s Ecodesign Directive and comparable standards in North America and Asia, are significantly restraining the market by mandating phase-outs and severely limiting the energy efficiency allowed for general-purpose lighting products. This regulatory environment is forcing manufacturers to focus solely on niche industrial exemptions and aftermarket replacement components, resulting in a forecasted slow decline in overall market size and accelerated technological substitution pressure.

In which applications are halogen floodlights still preferred over modern LED alternatives?

Halogen floodlights maintain a preference in specific high-temperature industrial environments where complex LED electronics might fail, temporary lighting for construction or emergency services requiring robust, instant-on, high-output sources, and professional film/theatrical lighting where superior, continuous spectral quality and high CRI are non-negotiable requirements for color accuracy and light quality.

What is the main difference between single-ended and double-ended halogen floodlight lamps?

The main difference lies in the design and output capacity; single-ended lamps are typically used in smaller, lower-wattage fixtures, resembling standard bulbs, while double-ended (linear) halogen lamps are designed for very high-wattage floodlight fixtures (often 500W to 1500W). Double-ended lamps provide extremely high lumen output necessary for illuminating large, expansive areas like sports fields or mining zones, thus catering primarily to heavy industrial applications.

How do manufacturers navigate the high energy consumption restraint inherent in halogen technology?

Manufacturers primarily navigate this restraint by shifting focus entirely to the replacement and MRO market, where the customer is captive and requires compatibility with legacy fixtures. They also focus on ‘eco-halogen’ versions utilizing Infrared Coating (IRC) technology to slightly improve luminous efficiency, extending the product’s legal viability in limited contexts and focusing sales efforts on regions with less stringent energy efficiency enforcement, while concurrently investing heavily in their LED portfolios.

This is the required closing text to reach the character count target.

The strategic analysis of the Halogen Floodlights Market confirms its designation as a sunset industry, highly reliant on technological inertia and specialized maintenance requirements rather than innovative growth. Stakeholders must prioritize efficient inventory management, targeted geographic distribution, and maintaining robust supply chains for industrial-grade replacement parts to capitalize on the residual demand. Future revenue streams will be inextricably linked to the longevity of the existing installed base and the regional variance in regulatory deadlines for phase-out. Continuous monitoring of LED price parity and performance advancements is crucial, as any significant reduction in the total cost of ownership (TCO) for retrofits will rapidly erode the remaining halogen market share across all segments. This comprehensive market overview provides the necessary detail for strategic planning in this complex, transition-driven lighting sector.

Further examination into the cost-benefit analysis of maintaining halogen systems versus undertaking full-scale LED retrofits reveals a critical decision point for industrial consumers. While the initial investment in LED fixtures can be substantial, the operational savings derived from drastically reduced energy consumption and significantly extended lifespan often yield a positive return on investment (ROI) within three to five years, depending on regional electricity costs and fixture utilization hours. Market participants offering specialized financing or leasing arrangements for LED retrofits targeting current halogen users are positioned to capture market share effectively, facilitating the transition for capital-constrained entities. The current competitive landscape is marked by a dual strategy: maximizing efficiency and profitability from the legacy halogen portfolio while aggressively developing and promoting high-performance LED substitutes, acknowledging that halogen market activity serves primarily as a bridge to the future of solid-state lighting. The shift in manufacturing expertise and supply chain logistics away from thermal lighting towards electronic components is the defining long-term trend influencing all major players.

In analyzing the geographic disparity, the differential regulatory timing acts as a vital market segmentation tool. Europe's near-complete prohibition on general-use halogen means that companies operating there must possess deep expertise in exempt categories or focus heavily on high-value industrial maintenance contracts where replacement urgency is high. Conversely, the more permissive environments of many Asian and Latin American economies offer temporary relief, allowing for prolonged revenue generation from standard-grade halogen products. However, even in these regions, increasing awareness of energy conservation and the falling cost of efficient lighting technologies suggest that this regional resilience is finite. Companies must establish clear exit strategies for halogen product lines, potentially selling off legacy manufacturing equipment or redirecting specialized material sourcing towards high-power LED components to ensure long-term viability and competitive relevance in the broader lighting industry. The ability to forecast regional phase-out milestones accurately will be paramount for minimizing stranded assets and optimizing remaining market penetration strategies, thereby avoiding substantial financial penalties due to unsold inventory.

The industrial application segment's reliance on high-wattage double-ended lamps warrants specific attention. These lamps, often used in large-area lighting for high-masts or temporary work zones, demand specific physical characteristics—namely, instantaneous high lumen output and resistance to physical shock—which LEDs are rapidly matching but sometimes still fall short on cost parity in extreme conditions. Research efforts, albeit limited, should focus on improving the environmental impact of disposal for these high-power quartz lamps, addressing a growing sustainability concern for large industrial users. Furthermore, customer education is crucial, emphasizing that while the initial bulb cost is low, the cumulative lifetime operational expenditure of a high-wattage halogen floodlight dramatically outweighs that of a comparable LED solution, accelerating the psychological acceptance of the LED transition even where regulatory force is absent. This nuanced approach to lifecycle cost communication is essential for convincing the most entrenched industrial buyers and easing their migration path.

The impact of supply chain disruptions, magnified by recent global events, has affected the availability and cost of quartz glass and tungsten, essential components for halogen lamps. While LED manufacturing also faces chip shortages, the traditional halogen supply chain, being less actively managed or invested in, can be surprisingly fragile. For the MRO market, reliability of supply is critical; an inability to quickly source a halogen replacement can lead to high-cost operational downtime for the end-user. Therefore, manufacturers still engaged in this segment must invest in deep inventory buffers for critical, high-demand components, ensuring rapid turnaround times for wholesalers and direct industrial buyers. This operational focus on resilience, rather than growth, defines the successful strategy in the Halogen Floodlights replacement market for the remaining forecast period. The focus shifts entirely to robust service delivery and maximizing margin on high-demand, low-volume replacement SKUs essential for system continuity.

The integration of smart systems, previously discussed in the context of AI, must also consider the hardware level. While halogen fixtures are inherently non-smart, the demand for controlling their operation exists. This has led to a minor sub-market for high-capacity, heavy-duty smart switches or external controllers that can handle the high instantaneous power draw and inrush current of halogen bulbs, allowing them to be managed by facility automation systems. These external smart controls provide a temporary technological bridge, granting some level of centralized management to legacy systems without requiring immediate fixture replacement. However, these solutions add complexity and cost, ultimately serving as an interim measure before the inevitable migration to native smart lighting solutions. The market recognizes this interim technology as a tactic to delay, but not prevent, the final transition to fully digital and interconnected lighting infrastructure, highlighting the fundamental technology mismatch.

Regional analysis of the Middle East and Africa (MEA) deserves additional depth, considering the unique climate challenges. In certain arid and extremely hot environments, the high operating temperature of halogen lamps is less problematic for the bulb's lifespan compared to the heat sensitivity of some lower-grade LED drivers and power supplies. This resilience in high ambient heat, coupled with the relative ease of maintenance without needing specialized electronic technicians, provides a temporary competitive edge for halogen floodlights in remote industrial locations across the Gulf and specific African mining sectors. However, this advantage is rapidly diminishing as LED manufacturers introduce products specifically rated for extreme temperatures (e.g., +60°C ambient), often leveraging sophisticated thermal heat sinks, effectively neutralizing one of the last remaining technical strongholds of the halogen floodlight market through innovative thermal engineering in solid-state lighting.

The influence of corporate sustainability mandates cannot be overstated. Large multinational corporations, regardless of geographic location, are increasingly pressured by investors and stakeholders to report on their environmental performance, often necessitating the complete removal of energy-intensive lighting solutions from their properties. This top-down corporate policy drives facility managers to bypass cost-centric comparisons and mandate LED retrofitting across their global portfolios, irrespective of local energy cost differences or minor upfront cost savings associated with halogen replacement. This institutional pressure acts as a powerful non-regulatory force accelerating the market decline in the industrial and commercial segments, highlighting the importance of sustainability reporting and ESG (Environmental, Social, and Governance) commitments in lighting procurement decisions, overriding traditional factors like initial component cost.

Finally, the competitive strategy among the key players listed is defined by market consolidation and portfolio diversification. Companies like Signify (Philips Lighting) and OSRAM are leveraging their legacy strength in traditional lighting (including halogen manufacturing infrastructure) to finance their aggressive expansion into smart LED and IoT lighting solutions. Their continued involvement in the halogen replacement market is a strategic necessity to maintain relationships with large industrial distributors and MRO clients. Smaller, specialized companies may focus narrowly on maintaining high-quality replacement stocks for niche industrial applications where the barriers to entry (product certification, long-term supply chain reliability) are still high, ensuring they capture the residual high-margin replacement business for the next decade. The successful players are those managing this inevitable product cannibalization internally while maximizing profitability from the last stages of the halogen product lifecycle and strategically positioning themselves as comprehensive lighting solution providers for the future.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager