Hand-Soldering Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443442 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Hand-Soldering Equipment Market Size

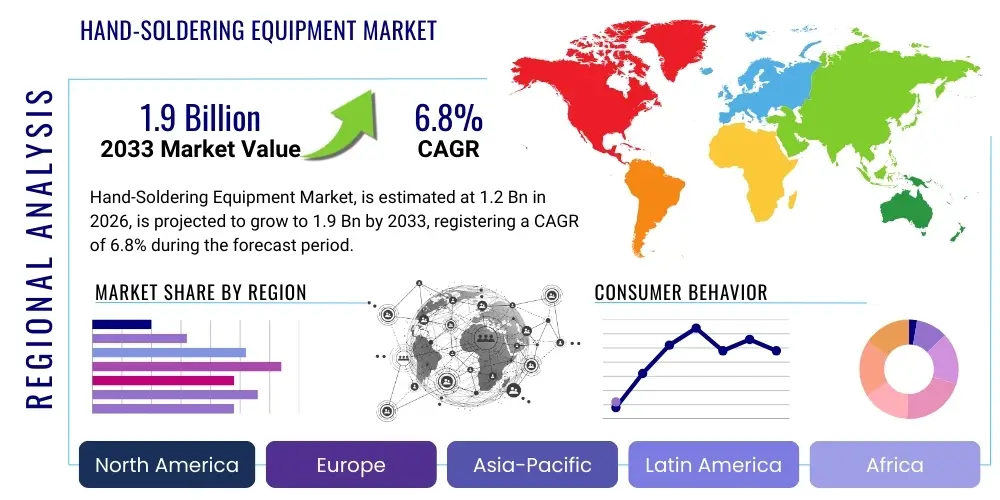

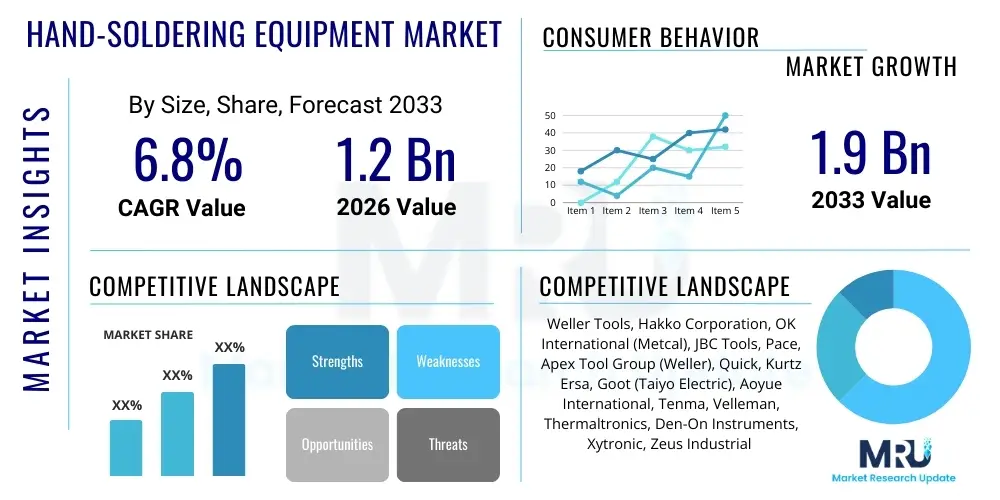

The Hand-Soldering Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033. This consistent expansion is directly linked to the burgeoning global electronics manufacturing sector, particularly the rapid adoption of consumer electronics, increased complexity in automotive electronic control units (ECUs), and the pervasive demand for reliable repair and rework solutions across various industries. The stability and precision offered by modern hand-soldering equipment are critical for quality assurance in high-reliability applications, driving sustained investment in high-end stations and tools.

Hand-Soldering Equipment Market introduction

The Hand-Soldering Equipment Market encompasses a wide range of devices and tools used manually to join electronic components onto printed circuit boards (PCBs) or to repair existing solder joints. This category primarily includes soldering irons, soldering stations (temperature-controlled units), specialized tweezers, hot air rework stations, fume extraction systems, and associated consumables like tips and solder wire. These tools are indispensable across the electronics value chain, facilitating everything from prototype development and low-volume assembly to intricate repair work in fields requiring high precision and reliability.

Major applications for hand-soldering equipment span critical sectors such as Consumer Electronics Manufacturing (smartphones, wearables), Automotive Electronics (ADAS, infotainment systems), Aerospace and Defense (avionics repair, robust component attachment), Medical Devices (diagnostic equipment assembly), and Telecommunications infrastructure (5G equipment deployment and maintenance). The primary benefits of using advanced hand-soldering equipment include enhanced temperature stability, crucial for handling sensitive components and lead-free solders, improved ergonomic design reducing operator fatigue, and integrated safety features like precise thermal control and effective fume extraction. Furthermore, modern equipment often incorporates digital interfaces and connectivity options, allowing for process control and compliance tracking, which is essential in regulated environments.

Key driving factors propelling market growth include the relentless trend toward miniaturization of electronic components, demanding highly precise and controllable soldering tools, the global shift towards lead-free soldering processes (necessitating higher temperature stability), and the increasing volume and complexity of electronic waste requiring professional rework and repair rather than immediate replacement. The integration of high-performance microprocessors and fine-pitch components requires specialized tips and highly responsive heating elements, continuously pushing manufacturers to innovate in thermal recovery speed and accuracy, thereby stimulating replacement cycles and market expansion. The proliferation of IoT devices and industrial automation systems further amplifies the need for robust, reliable connections, making hand-soldering a foundational skill supported by sophisticated equipment.

Hand-Soldering Equipment Market Executive Summary

The Hand-Soldering Equipment Market is experiencing dynamic business trends characterized by a strong emphasis on automation compatibility, thermal performance, and compliance with strict environmental regulations, particularly the Restriction of Hazardous Substances (RoHS) Directive requiring lead-free processes. Key segments like high-power soldering stations and integrated rework systems are seeing rapid adoption driven by the demands of complex multi-layer PCBs found in modern computing and communication equipment. Manufacturers are focusing heavily on developing smart soldering tools equipped with digital process control and traceability features, addressing the Industry 4.0 requirements for data logging and quality assurance. The competitive landscape is defined by established global players leveraging proprietary heating technology and expanding their training and support services to capture specialized markets.

Regionally, Asia Pacific (APAC) stands as the dominant force in the market, primarily due to the concentration of global Electronic Manufacturing Services (EMS) providers and Original Equipment Manufacturers (OEMs) in countries such as China, South Korea, Taiwan, and Vietnam. This region is not only the largest consumer but also the primary manufacturing base for a vast array of electronic goods, translating into massive demand for both high-volume assembly tools and specialized rework stations. North America and Europe, while having lower production volumes compared to APAC, exhibit high demand for premium, technologically advanced equipment utilized in high-reliability applications like defense, aerospace, and advanced medical diagnostics, driven by stringent quality standards and robust R&D activities. The regulatory environment concerning health and safety, particularly regarding mandated fume extraction, is also a significant driver influencing equipment purchasing decisions in these mature markets.

Segment trends highlight the shift from basic analog soldering irons to sophisticated digital soldering stations offering multi-channel capabilities and interchangeable tools (e.g., hot air, desoldering guns). The 'Temperature Controlled' equipment segment is experiencing explosive growth due to its necessity in lead-free soldering, preventing component damage, and ensuring joint quality conformity. Furthermore, the market for integrated soldering and fume extraction systems is rising sharply, driven by increasing awareness and regulatory enforcement related to operator health. Within the application segmentation, the telecommunications and automotive sectors are projected to show the highest compound growth, reflecting the global rollout of 5G infrastructure and the transition to electric vehicles, both heavily reliant on complex and densely packed electronic assemblies that frequently require manual precision work.

AI Impact Analysis on Hand-Soldering Equipment Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the hand-soldering domain primarily revolve around three core themes: Quality Assurance (How can AI verify manual solder joint quality?), Process Optimization (Can AI recommend optimal temperature profiles for different components and solders?), and Training/Ergonomics (How can AI assist operators and reduce skill dependence?). Users are keenly interested in solutions that bridge the gap between human precision and automated consistency, addressing concerns about the subjectivity inherent in manual quality inspection and the high cost of training skilled personnel. Expectations are focused on AI-powered vision systems that provide real-time feedback on technique, automated parameter adjustments for soldering stations based on component data, and predictive maintenance algorithms for prolonging equipment lifespan and minimizing downtime, thereby enhancing overall operational efficiency and consistency in production environments.

The most immediate and impactful application of AI is in augmenting quality control processes. AI-driven vision systems, utilizing machine learning models trained on vast datasets of acceptable and defective solder joints (e.g., cold joints, bridges, insufficient fillets), are being integrated into manual workstations. These systems can provide instantaneous, objective feedback to the operator, flagging potential defects immediately after the joint is made, thus allowing for on-the-spot corrections and dramatically reducing the need for costly and time-consuming downstream inspection. This shift moves quality checking from an end-of-line process to an in-process mechanism, which is critical for maintaining high yields in complex rework tasks.

Beyond quality monitoring, AI is beginning to influence process parameter management and predictive maintenance. Advanced soldering stations connected to enterprise resource planning (ERP) systems can utilize AI algorithms to analyze component specifications, PCB material, and solder type, automatically suggesting or adjusting the optimal tip temperature and dwell time, especially in environments handling mixed-technology boards. Furthermore, AI analyzes operational data—such as heating element usage, tip wear patterns, and temperature overshoot frequency—to predict component failure in the soldering equipment itself. This allows maintenance teams to schedule proactive replacements, preventing unexpected failures on the production floor and maximizing the utilization rates of high-value soldering and rework systems, providing a significant return on investment for high-throughput users.

- AI-powered Vision Systems: Real-time, objective solder joint quality inspection and feedback for operators.

- Process Parameter Optimization: Automated adjustment of tip temperature and dwell time based on material and component inputs, maximizing joint reliability.

- Predictive Maintenance: Analyzing equipment usage data to forecast failure of heating elements or controllers, ensuring minimal operational downtime.

- Skill Augmentation and Training: Providing guided assistance and scoring techniques to novice operators, accelerating the learning curve for complex manual tasks.

- Inventory Management: Using usage metrics to predict consumption rates of soldering tips, flux, and other consumables, optimizing supply chain efficiency.

DRO & Impact Forces Of Hand-Soldering Equipment Market

The market is primarily driven by the continuous miniaturization of electronic components, necessitating highly precise tools, and the widespread adoption of lead-free soldering, which demands superior thermal control. Opportunities are vast, stemming from the integration of hand-soldering equipment into Industry 4.0 frameworks, emphasizing connectivity and data logging for quality assurance, especially in highly regulated sectors like aerospace and medical devices. However, the market faces restraints, chiefly the high initial capital expenditure required for advanced, multi-channel rework stations, and a persistent global shortage of highly skilled electronics technicians proficient in micro-soldering and complex rework procedures, making ROI justification challenging for smaller enterprises. The impact forces are currently skewed towards positive drivers, where technological necessity and quality compliance demands outweigh the restraining factors, propelling steady investment in sophisticated equipment essential for modern electronics assembly and repair.

Drivers: The global proliferation of consumer electronics, alongside the massive build-out of 5G infrastructure, mandates the continuous assembly and maintenance of high-density PCBs, which often require precise manual intervention where automation is either impractical or too costly, particularly during prototype stages and complex rework. Furthermore, the automotive sector's rapid transition towards Electric Vehicles (EVs) and sophisticated Advanced Driver-Assistance Systems (ADAS) integrates substantial amounts of highly reliable electronic content. These critical components require meticulous manual soldering and rework capabilities, driving demand for premium, certified hand-soldering equipment that can maintain precise thermal profiles necessary for stringent automotive safety standards. Additionally, increasing environmental and occupational safety regulations globally necessitate the integration of highly efficient fume extraction systems and equipment certified for lead-free solder use, boosting demand for newer, compliant models.

Restraints: A significant restraint is the elevated initial acquisition cost of high-end, digital soldering and rework stations, which can represent a substantial barrier to entry for small-to-medium enterprises (SMEs) and independent repair shops. These advanced systems, while offering superior performance, require a higher upfront investment compared to traditional analog irons. Another critical constraint is the ongoing difficulty in recruiting and retaining personnel skilled in micro-soldering techniques. The specialized dexterity and technical knowledge required for working with increasingly smaller surface mount devices (SMDs) and fine-pitch components are scarce, forcing companies to invest heavily in training, which sometimes leads to an over-reliance on automated selective soldering systems, thereby marginally reducing the overall potential growth rate of the hand-soldering equipment market.

Opportunities: The greatest opportunities lie in the emerging markets of Southeast Asia and Latin America, which are rapidly developing electronics manufacturing ecosystems, leading to new centers of demand for basic and intermediate-level soldering equipment. Strategically, integrating equipment with IoT capabilities, allowing for cloud-based monitoring of usage, maintenance, and process parameters (GEO optimization), presents a significant avenue for market expansion among large EMS providers seeking centralized control over global operations. Furthermore, the increasing complexity and high cost of finished electronic goods incentivize repair over replacement. This focus on long-term sustainability and repairability is creating a robust, growing market segment for professional rework and repair equipment across specialized service centers in all major global regions, offering manufacturers a niche for highly specialized, high-margin products.

Segmentation Analysis

The Hand-Soldering Equipment Market is meticulously segmented based on Equipment Type, Application, and End-User, reflecting the diverse operational requirements across the electronics assembly and maintenance landscape. Segmentation by Type is crucial as it differentiates basic tools (soldering irons) from sophisticated integrated systems (rework stations), directly correlating with price points and the complexity of tasks they can handle. Application segmentation clarifies demand drivers stemming from specific end-use industries—like telecommunications versus medical devices—each characterized by distinct reliability and regulatory standards. The End-User analysis separates mass production environments (EMS providers) from specialized repair facilities (service centers) and small-scale operations (DIY/hobbyists), allowing manufacturers to tailor product features, distribution strategies, and pricing structures effectively. This detailed segmentation provides actionable insights into high-growth areas, particularly those demanding multi-channel digital rework systems capable of managing complex thermal profiles.

- By Equipment Type:

- Soldering Stations (Digital vs. Analog)

- Soldering Irons (Fixed temperature vs. Variable temperature)

- Rework Stations (Hot Air Rework Stations, Infrared Rework Stations)

- Desoldering Tools (Vacuum Desoldering Pumps, Desoldering Guns)

- Fume Extraction Systems

- Associated Accessories (Tips, Nozzles, Stands, Flux Dispensers)

- By Application:

- Through-Hole Technology (THT) Soldering

- Surface Mount Technology (SMT) Rework and Repair

- Fine-Pitch Component Soldering

- High-Power/Heavy Duty Soldering

- By End-User:

- Electronics Manufacturing Services (EMS)

- Original Equipment Manufacturers (OEMs)

- Repair and Service Centers

- R&D Laboratories and Educational Institutions

- Aerospace and Defense

- Automotive Electronics

- Hobbyists and DIY Users

Value Chain Analysis For Hand-Soldering Equipment Market

The value chain for hand-soldering equipment begins with the Upstream Analysis, focusing on the sourcing of specialized raw materials, primarily high-purity copper, specialized alloys (for tips and heating elements), advanced ceramic materials (for rapid heating technology), and polymers for ergonomic handles and station casings. Key upstream activities include securing reliable suppliers for high-precision components, such as temperature sensors (thermocouples) and microcontrollers necessary for digital stations. The manufacturing stage is capital-intensive, requiring high-precision machining, vacuum coating techniques (for tip longevity), and rigorous calibration and testing procedures to ensure thermal accuracy and compliance with global safety standards (e.g., ESD safe certification). Optimization at this stage focuses on achieving economies of scale in the production of heating cartridges and standard station bodies while maintaining strict quality control over proprietary heating technology, which is a major competitive differentiator.

The distribution channel is multifaceted, relying heavily on both direct and indirect routes. Direct sales are often utilized for high-value, customizable rework systems sold directly to large global EMS providers or specialized aerospace/defense contractors, where technical support, training, and long-term service contracts are critical components of the sale. Conversely, the majority of standard soldering stations, basic irons, and consumable supplies (tips, filters) are sold through robust Indirect distribution networks, including authorized electronics component distributors (e.g., Digi-Key, Mouser), industrial supply houses, and, increasingly, specialized e-commerce platforms. This indirect channel offers wider market reach, efficient inventory management, and localized customer support, catering particularly to SMEs, repair shops, and hobbyist markets. The selection of the channel often dictates pricing strategies, with direct sales focusing on relationship management and technical solution delivery, while indirect sales prioritize volume and speed.

The Downstream Analysis involves the integration of the equipment into the final operational environment of End-Users. For large EMS providers, hand-soldering equipment acts as a critical bottleneck tool for specialized assembly or post-reflow correction. Success downstream is measured by the equipment's compatibility with existing production environments, its reliability under continuous operation, and the availability of specialized consumables. The end-users, comprising large OEMs, smaller repair centers, and R&D labs, utilize this equipment to ensure product functionality, longevity, and quality compliance. The value added at this stage includes comprehensive technical training provided by the manufacturer or distributor, software updates for digital stations, and rapid supply of replacement parts, ensuring minimal disruption to the customer's production or repair workflow. Effective feedback loops from downstream users are vital for manufacturers to iteratively improve tip design, ergonomic features, and software functionalities, driving future product innovation.

Hand-Soldering Equipment Market Potential Customers

The primary customers for advanced hand-soldering equipment are large Electronic Manufacturing Services (EMS) providers, such as Foxconn and Flex, which require high volumes of reliable, standardized equipment for both primary assembly lines and dedicated rework zones. These customers prioritize equipment featuring robust digital temperature control, multi-channel capabilities to handle diverse tasks simultaneously, and full traceability/data logging functions essential for ISO compliance and large-scale quality management. The automotive electronics sector, encompassing both major car manufacturers and their Tier 1 suppliers (e.g., Continental, Bosch), represents a rapidly growing and highly demanding customer base, requiring certified equipment capable of handling high-power components and operating under stringent quality requirements mandated by industry standards like IATF 16949 for ensuring product safety and longevity in harsh environments.

Another significant customer segment includes dedicated third-party Repair and Service Centers, ranging from specialized smartphone and laptop repair facilities to sophisticated industrial equipment maintenance depots. These customers demand highly ergonomic, versatile rework stations that can perform intricate micro-soldering tasks, often involving components on densely packed multi-layer boards that are challenging to access. The complexity of these repairs means that the equipment must offer exceptional thermal recovery, a wide array of specialized tips, and highly effective localized fume extraction to protect the technician. Furthermore, government and defense agencies, along with specialized aerospace maintenance depots, form a high-value customer group that requires equipment meeting extreme reliability specifications (e.g., MIL-SPEC standards), often necessitating proprietary, custom-designed soldering tools and consumables that can handle high-temperature and extreme-reliability applications.

Finally, the academic and research community, including R&D laboratories, technical universities, and vocational training centers, constitutes a foundational customer segment. These institutions purchase equipment for prototyping, hands-on training, and low-volume experimental assembly. Their purchasing decisions are often driven by a balance of cost-effectiveness, durability, and features that support educational outcomes, such as clear temperature displays and user-friendly interfaces. The increasing popularity of DIY electronics, fueled by platforms like Arduino and Raspberry Pi, has also boosted demand for accessible, entry-level to mid-range soldering irons and stations through e-commerce channels, creating a mass-market opportunity often catered to by budget-conscious manufacturers and local distributors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Weller Tools, Hakko Corporation, OK International (Metcal), JBC Tools, Pace, Apex Tool Group (Weller), Quick, Kurtz Ersa, Goot (Taiyo Electric), Aoyue International, Tenma, Velleman, Thermaltronics, Den-On Instruments, Xytronic, Zeus Industrial Products, SolderStar, Pioneer, ATTEN, Antex. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hand-Soldering Equipment Market Key Technology Landscape

The technological evolution within the hand-soldering equipment market is fundamentally driven by the need for faster thermal recovery, precise temperature stability required for lead-free solders (which operate at higher temperatures), and enhanced safety features, particularly Electrostatic Discharge (ESD) protection and sophisticated fume management. The core technological advancement lies in heating element design. Modern high-performance soldering stations predominantly utilize proprietary induction heating technology or highly efficient ceramic heating elements combined with integrated thermocouples placed directly at the tip of the element. Induction heating provides near-instantaneous heat transfer and exceptional power recovery, crucial when soldering to high thermal mass components or ground planes, maintaining the required temperature profile without overshoot, thus preventing damage to sensitive components.

Connectivity and digital control represent another major technological thrust (AEO focus on Industry 4.0 integration). Advanced soldering stations are now equipped with microprocessors and digital screens, allowing operators to preset specific temperature profiles, lock temperature settings to ensure compliance, and often connect via USB or Ethernet to centralized production management systems. This connectivity enables automatic data logging of operational parameters, including actual tip temperature, duration of soldering time, and power usage, fulfilling the growing regulatory requirements for traceability in high-reliability applications like medical and aerospace electronics. Furthermore, many systems now feature integrated smart interfaces that manage multiple tools (iron, hot air gun, desoldering tweezers) from a single base unit, optimizing bench space and workflow efficiency.

A critical technology component mandated by increasing health and safety awareness is the advanced integrated fume extraction system. Manufacturers are developing high-efficiency particulate air (HEPA) and activated carbon filtration systems that are either integrated directly into the soldering station or designed as bench-top units with highly localized extraction nozzles. These systems are crucial for removing solder smoke, which contains harmful particulates and gaseous flux residues. Technological improvements focus on increasing filter lifespan, reducing operational noise levels, and ensuring compliance with occupational health standards (OSHA, COSHH). Finally, the continuous innovation in soldering tip metallurgy and geometry—such as iron-plated copper cores—is extending tip life and improving thermal performance, directly reducing operational costs and maintaining quality during high-volume manual rework tasks.

Regional Highlights

The regional market landscape for hand-soldering equipment is dominated by Asia Pacific (APAC), which accounts for the largest market share globally. This supremacy is attributable to the region being the epicenter of global electronics manufacturing, housing major EMS companies and a large concentration of consumer electronics, IT hardware, and automotive electronics production facilities in countries like China, Japan, South Korea, and Taiwan. The robust infrastructure investment in 5G networks across APAC further fuels demand for sophisticated rework and assembly equipment. Market growth in this region is also characterized by a high volume demand for mid-range and high-end soldering stations necessary to maintain high production throughput and quality standards required by international clients, ensuring APAC remains the fastest growing market throughout the forecast period due to continuous expansion of electronics assembly capacity.

North America maintains a strong position, particularly in the demand for highly specialized and premium-priced hand-soldering equipment. Demand here is less focused on mass production volumes and more on R&D, military/defense applications, medical device manufacturing, and high-reliability aerospace electronics. These sectors require equipment that adheres to extremely rigorous quality specifications (e.g., J-STD certifications) and offers advanced features like data logging, precise thermal profiles, and calibration traceability. The stringent regulatory environment and the presence of leading technological innovators ensure continued investment in the latest generation of smart, connected soldering and rework stations, often driving global innovation in areas like induction heating and integrated safety features like advanced ESD protection.

Europe represents a mature and highly quality-conscious market, where demand is primarily driven by adherence to strict environmental and occupational health regulations (e.g., RoHS, REACH, COSHH). European end-users, concentrated in automotive electronics, high-end industrial control systems, and precision engineering, prioritize integrated safety features, such as mandatory, high-efficiency fume extraction systems. Germany, the UK, and France are key markets, characterized by high adoption rates of premium, reliable, and ergonomically designed equipment, essential for meeting high labor standards and maintaining consistency in complex manufacturing and repair processes. The push for sustainability and the extended lifecycle of industrial machinery also contribute to a strong demand for sophisticated rework equipment that supports long-term maintenance and component-level repair.

- Asia Pacific (APAC): Dominates the market due to concentrated electronics manufacturing (EMS/OEM), rapid 5G deployment, and mass production volumes.

- North America: Focuses on high-reliability sectors (Aerospace, Defense, Medical Devices) demanding premium, traceable, and technologically advanced equipment.

- Europe: Driven by strict occupational health standards (fume extraction mandate) and high-quality demands in automotive and industrial control systems.

- Latin America & MEA: Emerging markets showing steady growth, driven by increasing localized electronics assembly and the need for standardized repair infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hand-Soldering Equipment Market.- Weller Tools (Apex Tool Group)

- Hakko Corporation

- JBC Tools

- OK International (Metcal)

- Pace Inc.

- Kurtz Ersa GmbH

- Goot (Taiyo Electric Ind. Co., Ltd.)

- Quick Intelligent Equipment Co., Ltd.

- Thermaltronics

- Aoyue International Co., Ltd.

- Den-On Instruments

- Xytronic Industries Co., Ltd.

- Velleman Group

- Tenma

- SolderStar Ltd.

- ATTEN Technology Co., Ltd.

- ZEUS Industrial Products, Inc.

- Esico Triton

- Antex (Electronics) Ltd.

- Pioneer Equipment

Frequently Asked Questions

Analyze common user questions about the Hand-Soldering Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of high-end soldering stations?

The primary driver is the widespread industry shift towards mandatory lead-free soldering processes, which require exceptionally precise and stable thermal control (high wattage and fast recovery) to achieve reliable joints at higher melting temperatures without damaging increasingly miniaturized components. High-end stations provide the necessary thermal efficiency and control accuracy for compliance and quality.

How is the integration of Industry 4.0 influencing the design of modern hand-soldering equipment?

Industry 4.0 integration mandates features such as digital connectivity (Ethernet/USB), data logging, and process traceability. Modern soldering stations are designed with microprocessors that record critical operational parameters (temperature, power, usage time) for centralized quality auditing and manufacturing compliance, enabling seamless integration into automated production ecosystems.

Which geographic region exhibits the highest growth potential for hand-soldering equipment and why?

The Asia Pacific (APAC) region, particularly emerging markets like Vietnam, India, and Malaysia, shows the highest growth potential. This is attributed to the continuous expansion of local and international electronics manufacturing bases relocating or expanding within the region, coupled with substantial governmental and private investment in telecommunications and consumer electronics infrastructure.

What is the biggest restraint impacting the market growth of sophisticated rework stations?

The most significant restraint is the high initial capital expenditure required for advanced, multi-channel rework and hot air stations, alongside the pervasive global shortage of highly trained micro-soldering technicians capable of operating and maximizing the complex capabilities of these specialized systems effectively.

Is fume extraction equipment a mandatory requirement for soldering operations globally?

While not universally mandated in every country, localized, high-efficiency fume extraction systems are increasingly mandatory or strongly recommended in highly regulated regions like North America and Europe (under OSHA and COSHH regulations) due to health and safety concerns related to airborne particulates and gaseous flux residues emitted during the soldering process.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager