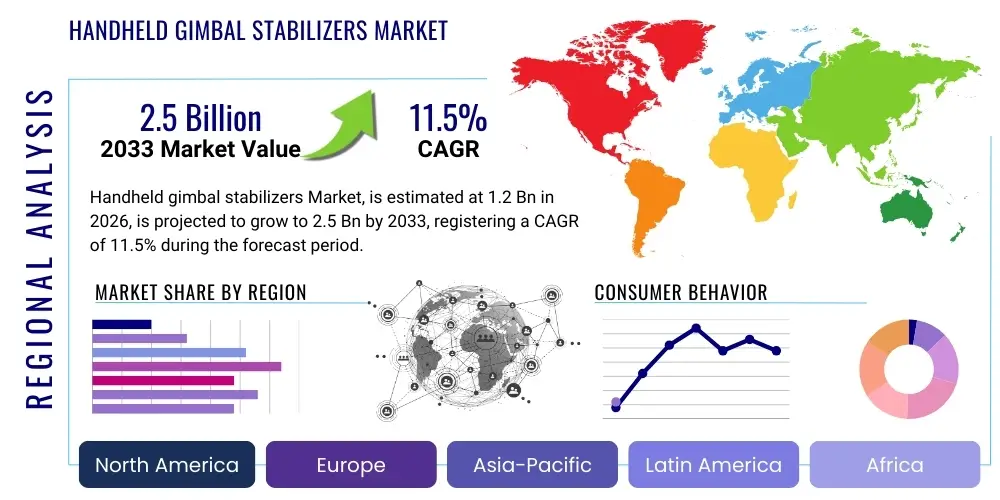

Handheld gimbal stabilizers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441037 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Handheld gimbal stabilizers Market Size

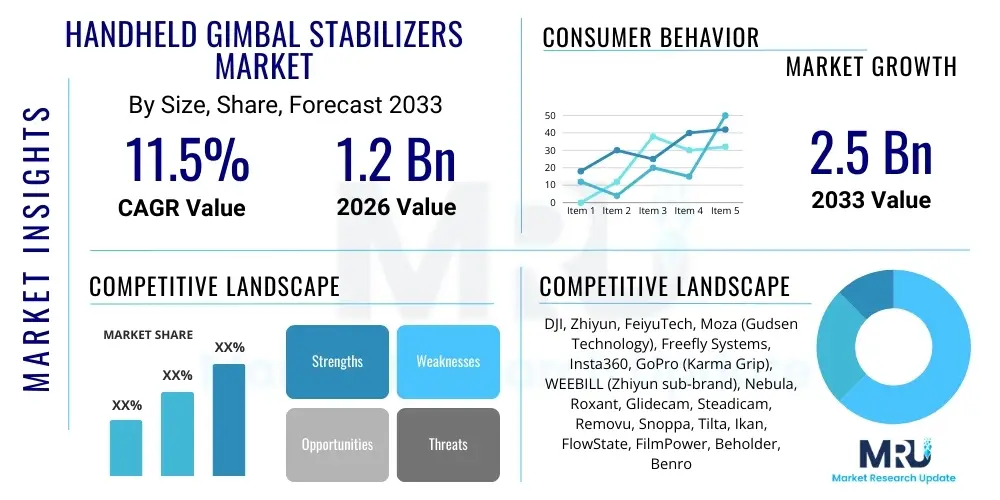

The Handheld gimbal stabilizers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for high-quality, professional-grade video content across various digital platforms, alongside the continuous advancement in stabilization technology making devices more compact, affordable, and accessible to a wider consumer base including hobbyists and social media influencers.

Handheld gimbal stabilizers Market introduction

Handheld gimbal stabilizers are electromechanical devices designed to steady cameras or smartphones along multiple axes (typically three) using advanced sensors, motors, and processors. Their primary function is to counteract unwanted motion, such as handshake or walking vibration, thereby producing smooth, stable, and cinematic footage regardless of the operator's movement. These devices have transitioned from being niche tools for professional cinematographers to essential accessories for modern content creators, reflecting a broader democratization of high-fidelity video production capabilities. The core technology relies on Inertial Measurement Units (IMUs) and brushless motors that rapidly adjust the camera position in real-time, ensuring the camera payload remains level and focused on the intended subject.

Major applications of handheld gimbals span professional filmmaking, live streaming, vlogging, travel documentation, real estate virtual tours, and even specialized industrial inspections requiring smooth video capture from difficult angles. The versatility of modern gimbals—which now accommodate everything from lightweight smartphones to heavy mirrorless camera setups—positions them as indispensable tools in the digital content ecosystem. They significantly reduce post-production stabilization requirements and enhance the visual quality of output, meeting the increasingly stringent quality expectations of online audiences and broadcast standards. Furthermore, the integration of advanced features such as automatic tracking, motion time-lapse, and panoramic shots expands their functional utility far beyond simple stabilization.

The market benefits from several powerful driving factors, notably the global proliferation of high-resolution video consumption (4K and beyond), the explosive growth of platforms like TikTok, YouTube, and Instagram Reels necessitating daily content uploads, and the corresponding desire among content creators to differentiate themselves through superior video quality. Technological miniaturization and improved battery life, coupled with fierce competition among manufacturers leading to competitive pricing strategies, further accelerate market adoption. These factors collectively establish a robust foundation for sustained growth in the handheld gimbal stabilizers sector across all major geographical regions.

Handheld gimbal stabilizers Market Executive Summary

The Handheld gimbal stabilizers market is characterized by rapid innovation, intense technological competition, and significant growth fueled by the digital media revolution. Key business trends include the shift towards lighter, more powerful brushless motors, improved payload capacities to handle heavier professional camera setups, and the increasing reliance on software features like AI-powered tracking and intelligent shooting modes to simplify complex cinematography. Furthermore, strategic alliances between gimbal manufacturers and smartphone ecosystem providers are becoming crucial, aiming to provide seamless hardware-software integration for the vast mobile content creator demographic. Sustainability and modularity are emerging design focuses, allowing users to upgrade components rather than replace entire units, appealing to both cost-conscious consumers and environmental sustainability advocates.

Regionally, Asia Pacific (APAC) stands out as the dominant growth region, primarily due to its massive manufacturing base, significant concentration of mobile-first content consumers, and the rapid adoption of social commerce and short-form video formats, particularly in countries like China, India, and South Korea. North America and Europe, while slower in terms of raw volume growth compared to APAC, maintain leadership in the premium segment, showing high demand for sophisticated, high-payload gimbals used in professional indie and commercial filmmaking. Latin America and the Middle East & Africa (MEA) represent emerging markets, with increasing internet penetration and rising social media usage driving initial adoption, particularly in the entry-level smartphone gimbal segment, indicating strong long-term potential for expansion.

Segment trends reveal a pronounced shift toward 3-axis gimbals due to their superior stabilization capabilities across pitch, yaw, and roll axes, making them the industry standard for professional results. The application segment is dominated by smartphone gimbals, reflecting the sheer volume of mobile content created globally, though the DSLR/Mirrorless segment is vital for revenue generation due to the higher price points of these heavy-duty stabilizers. The end-user structure shows continuous growth in the hobbyist/vlogger category, emphasizing the need for user-friendly interfaces and robust mobile connectivity. Overall, the market remains dynamic, heavily influenced by the speed of technological convergence between camera hardware and stabilization algorithms.

AI Impact Analysis on Handheld gimbal stabilizers Market

User queries regarding AI's influence on handheld gimbals frequently center on topics such as the efficacy of predictive tracking, whether AI can completely replace manual control, and how intelligent algorithms contribute to cinematic quality without requiring expert skill. Users often express concerns about the accuracy and speed of automatic subject lock, especially in chaotic environments, and how AI might enable entirely new filming perspectives or automate previously complex camera movements. The general expectation is that AI will enhance usability, reduce the required skill ceiling for advanced shots, and integrate gimbals more deeply into the smart device ecosystem by providing autonomous operational capabilities, thereby maximizing efficiency for solo content creators.

The integration of Artificial Intelligence and machine learning models into handheld gimbal firmware represents a paradigm shift, moving the devices beyond passive stabilization toward active, intelligent cinematography tools. AI algorithms are now crucial for advanced features such as predictive movement analysis, where the system anticipates the subject's trajectory and adjusts motor responses milliseconds before the movement occurs, resulting in exceptionally smooth and seemingly anticipatory camera work. Furthermore, sophisticated image recognition models enable highly accurate and persistent subject tracking, distinguishing human figures, animals, or specific objects even when temporarily obscured by obstacles. This capability drastically improves the efficiency of single-person operations, automating the role of a dedicated camera operator.

Moreover, AI is being leveraged to introduce 'smart filming modes' that automatically apply cinematic rules, such as the rule of thirds or dynamic pan speeds appropriate for the scene context, based on real-time analysis of depth, light, and subject activity. This democratization of high-level production techniques is making professional-looking footage accessible to amateur users. The future of AI in gimbals involves deep learning models that optimize battery usage, motor torque, and stabilization parameters specific to the attached camera model and lens, leading to unparalleled efficiency and performance optimization tailored to the hardware configuration, thereby solidifying AI's role as a core competitive differentiator.

- AI-Powered Predictive Stabilization: Utilizing machine learning to forecast camera shake and subject trajectory for proactive counter-motion.

- Intelligent Subject Tracking: Highly accurate, persistent object and human recognition that maintains focus lock even with minor obstructions or complex movements.

- Automated Cinematic Modes: Algorithms that apply professional framing and movement techniques based on real-time scene analysis (e.g., Dolly Zoom, Hyperlapse pathfinding).

- Optimized Power Management: AI routines that fine-tune motor power output and responsiveness based on payload weight and stabilization requirements, extending battery life.

- Gesture and Voice Control: Machine vision recognition enabling hands-free control and initiating predefined complex shots.

DRO & Impact Forces Of Handheld gimbal stabilizers Market

The market for handheld gimbal stabilizers is driven primarily by the astronomical rise in global content creation, the increasing technical demands of consumers for 4K and 8K video resolution, and the accessibility afforded by continuous product development. Counterbalancing this growth are significant restraints, notably the relatively steep initial investment required for high-end professional units and the technical complexity or learning curve associated with mastering multi-axis operation and advanced firmware settings. Opportunities are abundant, focusing on industrial applications, integrating AR/VR capabilities into stabilization platforms, and creating specialized, ultra-lightweight designs optimized for niche markets like drone filmmaking or extreme sports documentation. These forces—Drivers, Restraints, and Opportunities—collectively dictate the pace and direction of technological innovation and market penetration.

Key drivers include the pervasive trend of digitization across all sectors, making video the preferred medium for communication, marketing, and entertainment. The affordability and quality of smartphone cameras have created a massive base of aspiring content creators who immediately seek stabilization tools to enhance their mobile footage. Additionally, the rapid update cycles of flagship cameras (DSLRs and mirrorless) necessitate frequent gimbal upgrades to handle heavier bodies and lenses, sustaining replacement demand in the professional segment. The driving impact is further amplified by the competitive race among manufacturers to offer unique, proprietary software features, such as seamless integration with phone camera APIs and complex motion-control applications, attracting users looking for specialized tools.

Restraints primarily revolve around market saturation in the entry-level segment, leading to price erosion, and the persistent challenge of device compatibility—ensuring a gimbal works flawlessly with the constantly evolving specifications of dozens of camera models and smartphone operating systems. The weight and bulkiness of some professional 3-axis setups remain a constraint for run-and-gun filmmakers who prioritize portability. However, immense opportunities lie in vertical market expansion: specialized gimbals designed for medical imaging, security surveillance (especially perimeter tracking and low-light environments), and integration into mixed reality production pipelines. The greatest opportunity lies in further miniaturization while maintaining high payload capacity, solving the inherent trade-off between portability and stabilization power.

DRO & Impact Forces Summary:

- Drivers: Exponential growth of digital content creation; democratization of filmmaking tools; rising adoption of 4K/8K technologies; continuous product innovation leading to improved battery life and compactness.

- Restraints: High initial cost for professional-grade equipment; steep learning curve for mastering advanced motion features; challenges in ensuring universal camera and smartphone compatibility; intense price competition in the entry-level segment.

- Opportunities: Expansion into industrial and enterprise applications (e.g., inspections, security); integration with augmented and virtual reality filming ecosystems; development of specialized, weather-resistant gimbals for niche outdoor markets; modular design focused on future proofing.

- Impact Forces: High bargaining power of buyers due to numerous alternatives (both software stabilization and alternative hardware); moderate threat of substitutes (on-board camera stabilization is improving); high intensity of competitive rivalry among major brands (Zhiyun, DJI, FeiyuTech, etc.); moderate barrier to entry for new entrants due to high R&D costs for motor/algorithm development.

Segmentation Analysis

The Handheld gimbal stabilizers market is meticulously segmented across key dimensions, including the number of stabilization axes, the intended application/payload size, and the primary end-user demographic. This segmentation is crucial for manufacturers to tailor product development and marketing efforts precisely, targeting specific needs ranging from the ultra-portable solutions required by amateur vloggers to the heavy-duty precision demanded by professional cinema crews. Analyzing these segments reveals shifting consumer preferences, particularly the convergence of features between smartphone and mirrorless gimbals, where high-end mobile stabilizers are beginning to incorporate features previously reserved for larger cinema tools, reflecting the increasing capability of mobile camera systems.

- By Axis Type:

- 3-Axis Gimbals: Providing stability across pan, tilt, and roll (dominant segment).

- 2-Axis Gimbals: Stabilizing across two primary axes, usually for budget or ultra-lightweight applications.

- Single-Axis (Roll): Primarily used for simple panning support, increasingly rare.

- By Application/Payload:

- Smartphone Gimbals (Lightweight Payload): Designed exclusively for mobile devices.

- Action Camera Gimbals: Ruggedized units for GoPro and similar cameras.

- DSLR and Mirrorless Camera Gimbals (Medium-to-Heavy Payload): Professional and prosumer stabilizers supporting interchangeable lens systems.

- Cinema Camera Gimbals (Heavy Payload): Specialized units for high-end cinematic cameras.

- By End-User:

- Professional Filmmakers and Commercial Production Houses

- Hobbyists and Amateur Content Creators (Vloggers, Streamers)

- Enterprise and Industrial Users (Security, Inspection, Real Estate)

- By Distribution Channel:

- Online Sales (E-commerce Platforms, Direct-to-Consumer Websites)

- Offline Sales (Specialty Electronics Stores, Camera Retailers)

Value Chain Analysis For Handheld gimbal stabilizers Market

The value chain for handheld gimbal stabilizers begins with upstream activities focused on procuring highly specialized components, followed by complex manufacturing and assembly, and culminates in a sophisticated distribution network connecting producers to global end-users. Upstream analysis highlights the critical reliance on suppliers for high-precision components, including brushless DC motors (crucial for smooth, silent operation), high-sensitivity Inertial Measurement Units (IMUs) composed of gyroscopes and accelerometers, and proprietary chipsets optimized for stabilization algorithms. The intellectual property associated with these core components, particularly the sensor fusion and motor control algorithms, represents significant value capture points, leading major manufacturers to often vertically integrate or secure exclusive supply agreements for crucial parts.

Manufacturing involves complex assembly, calibration, and rigorous quality control, particularly for balancing the motorized axes to handle dynamic loads. This phase also includes the essential process of software integration, where the proprietary firmware, critical for stabilization performance and feature enablement (like tracking and time-lapse modes), is loaded and tested. Downstream activities are dominated by efficient distribution channels. The market utilizes both direct distribution (selling through proprietary online stores, allowing for greater margin control and direct customer feedback) and indirect distribution, leveraging global e-commerce giants and specialized camera equipment retailers. Specialty retailers often provide necessary pre-purchase consultation and after-sales support, especially for high-end professional gimbals requiring detailed setup knowledge.

The distribution landscape shows a strong preference for online channels, driven by the tech-savvy nature of the target audience and the global reach required to serve decentralized content creators. Direct sales offer manufacturers greater control over branding and pricing, while partnerships with large electronics distributors (indirect channels) ensure widespread geographical availability and efficient logistics, crucial for rapidly capturing market share in emerging regions. Ultimately, efficient synchronization between precise component sourcing (upstream) and responsive, high-volume distribution (downstream) is necessary to maintain competitiveness in this fast-moving consumer electronics sector.

Handheld gimbal stabilizers Market Potential Customers

Potential customers for the Handheld gimbal stabilizers market represent a broad spectrum of digital media producers, ranging from highly paid commercial cinematographers using the devices for feature films and advertisements to everyday consumers capturing family memories. The primary segmentation of end-users involves professional production users and prosumer/hobbyist users. Professional filmmakers and video production houses prioritize payload capacity, precision, build quality, and integration with advanced camera control systems (e.g., focus pulling and zoom control), viewing gimbals as essential capital equipment that enhances their production value and efficiency on set, particularly in demanding, fast-paced shooting scenarios.

The largest volume segment comprises hobbyists, travel bloggers, social media influencers, and casual videographers. These consumers prioritize ease of use, portability (especially smartphone gimbals), fast setup, and smart features like automated tracking and intuitive mobile application control. For this group, the gimbal acts as an extension of their smartphone or entry-level camera, allowing them to instantly upgrade the quality of their daily content without needing extensive technical training or complex balancing procedures. The market successfully caters to this group by offering highly affordable, lightweight, and connectivity-focused solutions that remove barriers to entry for smooth footage capture.

Beyond traditional media creation, there is a growing segment of enterprise and industrial buyers. This includes real estate agencies using gimbals for immersive property tours, security firms requiring stable footage from mobile surveillance units, construction companies performing site inspections, and specialized educational institutions creating training videos. For these institutional buyers, durability, reliability, long operational battery life, and often, resistance to adverse weather conditions are the critical purchase criteria, emphasizing utility and robust performance over purely aesthetic features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DJI, Zhiyun, FeiyuTech, Moza (Gudsen Technology), Freefly Systems, Insta360, GoPro (Karma Grip), WEEBILL (Zhiyun sub-brand), Nebula, Roxant, Glidecam, Steadicam, Removu, Snoppa, Tilta, Ikan, FlowState, FilmPower, Beholder, Benro |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Handheld gimbal stabilizers Market Key Technology Landscape

The technological landscape of the handheld gimbal stabilizer market is defined by continuous evolution in three critical areas: electromechanical systems, sensory technology, and sophisticated software algorithms. Core to stabilization performance are Brushless Direct Current (BLDC) motors, which offer high torque density, energy efficiency, and silent operation, crucial for video recording environments. Recent advancements focus on enhancing motor responsiveness and minimizing latency, allowing gimbals to react faster to sudden movements. Furthermore, modular battery systems and optimized power delivery circuits are extending operational life, addressing a long-standing constraint for professional users engaged in all-day filming schedules. The push for ultra-light materials like carbon fiber also dictates design innovation, reducing operator fatigue without sacrificing structural integrity or payload capacity.

Sensory technology is the 'intelligence' layer of the gimbal, primarily relying on highly sensitive Inertial Measurement Units (IMUs) that combine gyroscopes (measuring angular velocity) and accelerometers (measuring linear acceleration). Modern stabilization systems employ advanced Sensor Fusion techniques, blending data from multiple internal and external sensors (including magnetometers and encoders) to achieve hyper-accurate determination of the camera's orientation in three-dimensional space. This sensory precision feeds into proprietary algorithms, which are the most valuable technological assets of leading companies. These algorithms include PID (Proportional-Integral-Derivative) controllers finely tuned for motor response and specialized filters designed to isolate intentional camera movements from accidental jitters, translating raw sensor data into exceptionally fluid output.

Finally, connectivity and software integration constitute a rapidly growing area of technological focus. The transition towards seamless wireless control via Bluetooth Low Energy (BLE) and Wi-Fi allows gimbals to communicate effectively with cameras and smartphones, enabling remote operation, parameter adjustments, and firmware updates. Critically, the development of intelligent tracking algorithms, often leveraging AI and machine vision, allows the gimbal to automate complex camera movements and subject tracking, enhancing the user experience. The future technological trajectory is geared towards tighter integration with mobile platforms through optimized APIs and the use of adaptive stabilization profiles that automatically adjust based on detected shooting conditions or attached lens profile, ensuring optimal performance out-of-the-box.

Regional Highlights

Geographical market dynamics reveal distinct patterns of adoption and revenue generation, heavily influenced by regional content creation trends, disposable income, and manufacturing concentration. Asia Pacific (APAC) currently dominates the market both in terms of production volume and consumer adoption, driven by countries like China, where major manufacturers are based, and by the enormous, rapidly expanding demographic of mobile content creators in Southeast Asia and India. APAC’s market is characterized by high demand for mid-range and entry-level smartphone gimbals, capitalizing on the mobile-first internet consumption pattern.

North America holds a significant revenue share, primarily driven by the professional and high-end consumer segment. The region exhibits high spending power and a mature market of professional filmmakers, independent studios, and leading media production companies that require high-payload, technologically advanced stabilizers with extensive accessory support. Technological uptake is rapid in North America, with consumers frequently adopting the latest iterations of flagship gimbals featuring advanced AI tracking and sophisticated electronic follow-focus systems, placing emphasis on performance and reliability.

Europe represents a crucial market characterized by stringent quality demands and a strong prosumer base. Countries like Germany, the UK, and France show steady demand, particularly within the wedding videography, documentary filmmaking, and corporate video production sectors. The European market values build quality, ergonomic design, and long-term support. While not matching APAC’s volume, Europe remains highly profitable due to a preference for premium, feature-rich gimbals that offer precise control and durability for intensive use cases.

- Asia Pacific (APAC): Market leader in volume and manufacturing; driven by smartphone gimbal adoption, especially in China, India, and Korea; high growth rate fueled by social media penetration.

- North America: Leading region for high-end professional equipment adoption; strong demand from film and television industries; focus on advanced features and heavy payload capacity.

- Europe: Mature prosumer market with high standards for quality and ergonomics; strong presence in niche markets like documentary and corporate video production.

- Latin America (LATAM): Emerging high-growth market, adoption accelerating due to increasing internet access and burgeoning local influencer culture; initial demand focused on affordable, accessible models.

- Middle East & Africa (MEA): Nascent market showing potential, particularly in the UAE and Saudi Arabia due to high digital infrastructure investment and a focus on high-quality luxury content production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Handheld gimbal stabilizers Market.- DJI

- Zhiyun

- FeiyuTech

- Moza (Gudsen Technology)

- Freefly Systems

- Insta360

- GoPro (Karma Grip)

- WEEBILL (Zhiyun sub-brand)

- Nebula

- Roxant

- Glidecam

- Steadicam (Tiffen)

- Removu

- Snoppa

- Tilta

- Ikan

- FlowState

- FilmPower

- Beholder

- Benro

Frequently Asked Questions

Analyze common user questions about the Handheld gimbal stabilizers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Handheld gimbal stabilizers Market?

The Handheld gimbal stabilizers Market is projected to grow at a strong CAGR of 11.5% during the forecast period spanning from 2026 to 2033, driven primarily by the global demand for high-quality video content.

Which segment dominates the market in terms of end-use application?

The smartphone gimbal segment currently dominates the market in terms of volume of units sold due to the expansive global base of mobile content creators, vloggers, and social media influencers seeking easy, portable stabilization solutions.

How is Artificial Intelligence (AI) impacting gimbal technology?

AI significantly enhances gimbal performance through predictive stabilization algorithms, highly accurate subject tracking, and automated cinematic modes, reducing the learning curve and enabling professional-grade results for solo operators.

Which geographical region holds the largest market share for manufacturing and volume adoption?

Asia Pacific (APAC) leads the market, primarily due to the concentration of key manufacturing facilities in countries like China and the rapid, widespread adoption of mobile gimbals among the region's massive content creator demographic.

What are the primary factors restraining market growth despite high demand?

Market growth is primarily restrained by the high initial cost associated with advanced, professional 3-axis gimbals and the technical complexity related to achieving perfect balancing and mastering proprietary firmware features.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Handheld Gimbal Stabilizers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Smartphones, DSLRs, Cinema Cameras, Action Cameras, Underwater Cameras), By Application (Commercial, Personal), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- 3-Axis Handheld Gimbal Stabilizers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (2-Axis 3-Axis Handheld Gimbal Stabilizer, 3-Axis 3-Axis Handheld Gimbal Stabilizer, Other), By Application (Filmmaking, Extreme Sports, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager