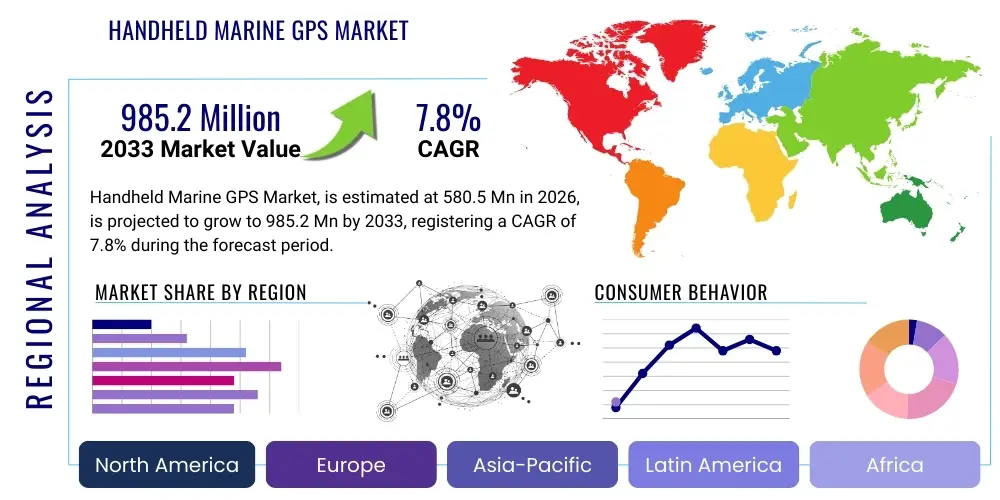

Handheld Marine GPS Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442928 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Handheld Marine GPS Market Size

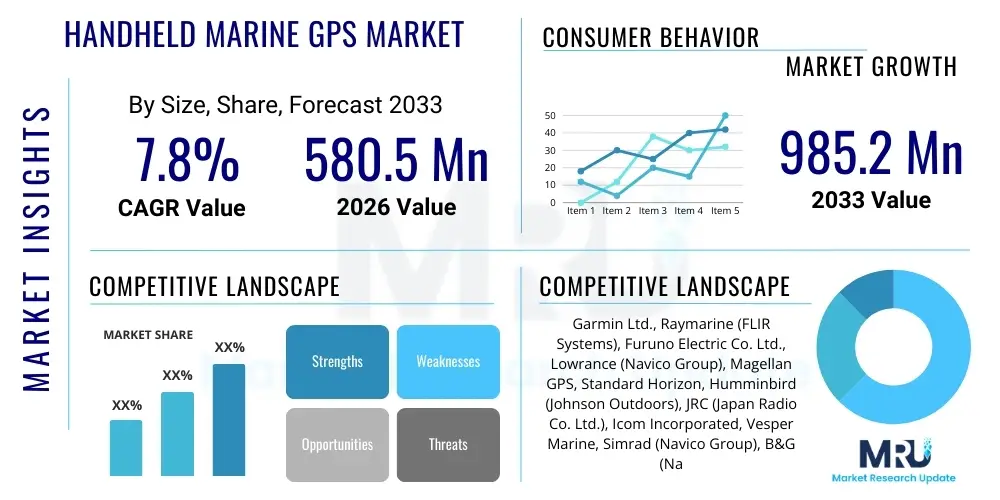

The Handheld Marine GPS Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $580.5 Million in 2026 and is projected to reach $985.2 Million by the end of the forecast period in 2033. This robust expansion is fueled by increasing demand for recreational boating, enhanced regulatory requirements for maritime safety, and continuous technological advancements improving device accuracy and battery life in rugged marine environments.

Handheld Marine GPS Market introduction

The Handheld Marine GPS Market encompasses specialized portable navigation devices designed for maritime use, providing location data, charting capabilities, and safety features for boating, fishing, and search and rescue operations. These devices integrate Global Positioning System (GPS) technology with electronic charting and often include advanced functionalities such as depth sounders, fish finders, and built-in worldwide base maps, making them indispensable tools for small craft operators and recreational users who require reliable, battery-powered navigation without reliance on fixed vessel systems. Their rugged, waterproof construction ensures durability in harsh marine conditions, distinguishing them from standard consumer GPS units.

Major applications for handheld marine GPS units span recreational activities, including sailing, kayaking, and coastal fishing, where mobility and quick deployment are paramount. Furthermore, commercial applications involve pilotage, small-scale maritime surveying, and backup navigation for vessels equipped with primary fixed systems. The inherent portability and ease of use of these devices address critical safety needs, allowing users to accurately plot courses, mark waypoints, and access emergency location services (such as MOB – Man Over Board features) even when away from the main power supply or primary navigation station. This versatility makes them a mandatory component of safety gear for numerous maritime users globally, from professional fishermen to weekend boaters.

Driving factors for market growth include the global rise in nautical tourism and recreational boating registrations, coupled with governmental mandates in several regions requiring minimum levels of portable electronic navigation capabilities for small vessels. The consistent miniaturization of electronic components, combined with improvements in satellite accuracy (utilizing augmentation systems like WAAS/EGNOS), has resulted in smaller, lighter, and more powerful units. Benefits derived from these devices include enhanced navigational precision, reduced risk of accidents, optimized fuel consumption through efficient route planning, and the ability to access critical tide and current data directly on the device interface, thereby significantly improving the overall safety and efficiency of marine operations.

Handheld Marine GPS Market Executive Summary

The Handheld Marine GPS Market exhibits strong growth momentum, primarily driven by robust business trends centered on miniaturization, integration of multi-functionality, and increased emphasis on connectivity standards. Key business strategies deployed by market leaders focus on developing ruggedized devices with superior battery longevity and intuitive user interfaces optimized for maritime environments. A significant trend involves integrating advanced sensor technology, such as barometric altimeters and digital compasses, to enhance positional accuracy and utility beyond basic GPS tracking. Furthermore, strategic partnerships between hardware manufacturers and charting service providers are crucial for ensuring up-to-date cartography, which remains a core differentiator in this competitive landscape, supporting sustained revenue generation from subscription services and map updates.

Regionally, North America and Europe dominate the market due to high levels of recreational boating participation, established maritime infrastructure, and stringent safety regulations promoting the adoption of certified navigation equipment. However, the Asia Pacific (APAC) region is poised for the fastest expansion, fueled by rising disposable incomes, growth in coastal tourism, and modernization of small commercial fishing fleets, particularly in Southeast Asia and China. These emerging markets represent substantial untapped potential, although market penetration requires localized product adaptations to address diverse charting standards and language requirements. Investment in local distribution networks is becoming increasingly critical for companies aiming to capture market share in this dynamic region, focusing on affordability without compromising essential safety features.

Segmentation analysis reveals that the recreational segment, encompassing leisure boaters and anglers, holds the largest market share, driven by high volume purchasing and frequent upgrades. However, the commercial and defense segment, which includes professional surveying and search & rescue (SAR) operations, commands higher average selling prices (ASPs) due to the need for advanced features, high durability, and integration with specialized military or professional communication systems. Functionality-wise, devices offering enhanced charting and detailed fish-finding capabilities are experiencing accelerated growth. The ongoing shift toward devices with touchscreen interfaces, replacing traditional button navigation, is a noticeable technological trend across all user segments, enhancing usability while requiring rigorous testing for waterproof reliability.

AI Impact Analysis on Handheld Marine GPS Market

User inquiries regarding AI's influence on the Handheld Marine GPS Market frequently center on concerns about automation replacing manual navigational skills, the potential for predictive analytics to enhance safety, and the necessity of improved computational efficiency for complex data processing on small, battery-powered devices. Key themes reveal user expectations for AI to provide highly customized route optimization based on real-time environmental factors, such as unpredictable weather changes, dynamic tide patterns, and localized marine traffic density. Users are also concerned about cybersecurity vulnerabilities introduced by increased connectivity, and the reliability of AI algorithms in mission-critical, high-stress maritime situations, demanding robust fail-safes and clear operational transparency in decision-making processes derived from machine learning models.

The implementation of artificial intelligence and machine learning (ML) within handheld marine GPS devices is fundamentally transforming navigational intelligence from passive mapping to active, predictive decision support. AI algorithms are instrumental in processing vast amounts of historical bathymetric data, current weather feeds, and navigational logs to generate significantly more precise and personalized route recommendations than traditional algorithms. This level of optimization minimizes human error and significantly contributes to fuel efficiency, especially beneficial for long-distance cruising or complex coastal navigation. The integration focuses on improving user experience through smart features that learn individual user preferences and automatically adjust display settings or alerts based on prevailing conditions and operational context.

Future development phases are expected to see AI-powered features move toward automated hazard identification and collision avoidance alerts, leveraging high-resolution sensor fusion (including integrated radar or sonar processing) within the handheld unit itself, rather than relying solely on external vessel systems. This enhances situational awareness, particularly in poor visibility or congested waterways. Crucially, AI is also being utilized to improve power management, optimizing processor use to extend battery life—a critical requirement for handheld emergency equipment. The deployment of lightweight, edge-based AI models capable of performing complex computations locally without constant cloud connectivity ensures reliability and speed, addressing the core safety and performance expectations of the maritime community, particularly the recreational segment seeking advanced yet simple-to-use safety augmentation.

- AI-Enhanced Route Optimization: Utilization of ML algorithms to calculate optimal paths considering real-time current, tide, and weather forecasts, reducing travel time and fuel consumption.

- Predictive Collision Avoidance: Integration of AI for processing surrounding vessel data (AIS/Radar inputs) to predict potential collision trajectories and issue timely, intelligent alerts, particularly beneficial in high-traffic zones.

- Automated Chart Correction and Mapping: Machine learning models assisting in automatically identifying discrepancies in downloaded charts based on aggregated user data and satellite imagery, speeding up map updates and accuracy.

- Smart Power Management: AI optimizing the power consumption of internal components (GPS receiver, screen brightness, processor load) based on usage patterns and environmental conditions, maximizing device longevity between charges.

- Adaptive User Interface (UI): Algorithms personalize the display layout and alert sensitivity based on the user's proficiency level, vessel type, and current navigational phase (e.g., docking vs. open sea).

- Advanced Fish Finding Analytics: AI integration in sonar functions to differentiate between species, size, and bait density, moving beyond simple depth readings to complex, predictive fish targeting.

- Natural Language Processing (NLP) for Command Inputs: Enabling voice-activated controls for setting waypoints, navigating menus, and querying localized information, crucial when hands are occupied during maritime tasks.

- Anomaly Detection in Performance: AI monitoring the internal health and signal integrity of the GPS unit, proactively alerting the user to potential hardware failures or signal jamming attempts.

DRO & Impact Forces Of Handheld Marine GPS Market

The Handheld Marine GPS Market's trajectory is primarily shaped by a confluence of powerful drivers, balanced by significant restraints, while numerous opportunities pave the way for future growth, creating dynamic impact forces. Key drivers include mandatory regulatory requirements for enhanced maritime safety across global shipping lanes and recreational zones, coupled with the persistent growth in marine tourism and water-based recreational activities. Conversely, the market faces restraints such as the relatively high initial cost of ruggedized, high-specification units compared to standard consumer electronics, and the reliance on continuous chart subscription services, which can deter casual users. Opportunities lie heavily in integrating advanced connectivity features, such as satellite communication linkages and seamless integration with smartphone ecosystems, transforming the devices from mere location trackers into comprehensive mobile maritime information hubs.

Impact forces stemming from these factors manifest prominently in product development cycles. The necessity to meet stringent Ingress Protection (IP) ratings for water and dust resistance, combined with the consumer demand for longer battery life, forces manufacturers to invest heavily in specialized materials and power-efficient processing chips. The restraint posed by high costs is partially mitigated by opportunities in emerging markets seeking reliable, entry-level devices, spurring a focus on tiered product offerings. Furthermore, the competitive impact force is intensifying as smartphone applications gain sophisticated mapping capabilities, pressuring traditional handheld GPS manufacturers to continually innovate on features exclusive to dedicated hardware, such as superior satellite acquisition speed, high-precision WAAS/EGNOS integration, and robust physical durability that phones cannot match in a marine environment.

The overall impact forces dictate a clear market direction towards hyper-specialization and safety standardization. The ongoing drive for seamless data exchange between onboard instruments (via protocols like NMEA 2000, even if handheld) and the continuous evolution of charting standards (e.g., Vector Charts vs. Raster Charts) define the technological roadmap. The restraint of signal interference or urban canyon effects in port areas pushes manufacturers toward multi-constellation GNSS (Global Navigation Satellite System) receivers (e.g., GPS, GLONASS, Galileo, BeiDou), ensuring reliable fix acquisition under challenging conditions. Ultimately, the successful market entrants will be those who can effectively balance the high consumer demand for integrated, feature-rich devices with the imperative for affordable, robust, and effortlessly usable navigational tools crucial for emergency and daily use.

- Drivers (D)

- Increasing Participation in Recreational Boating and Angling Activities Globally.

- Growing implementation of stringent maritime safety regulations mandating backup navigation and emergency positioning devices.

- Continuous technological advancements in satellite navigation systems (e.g., multi-constellation GNSS, WAAS/EGNOS augmentation) improving accuracy and reliability.

- Demand for ruggedized, high-durability electronics capable of operating in extreme marine weather conditions (IPX7/IPX8 standards compliance).

- Rising awareness among boaters regarding the critical role of portable GPS devices for Man Over Board (MOB) functions and rescue coordination.

- Restraints (R)

- High manufacturing costs associated with specialized waterproofing, high-resolution screens, and powerful processing required for accurate chart rendering.

- Intense competition from sophisticated, feature-rich marine navigation applications available on consumer smartphones and tablets.

- Perceived complexity of updating electronic charts and managing proprietary map subscription fees.

- Vulnerability to signal jamming, spoofing, or degradation, necessitating complex hardware solutions for mitigation.

- Limited battery life under continuous operation and high brightness settings, a persistent challenge for portable units.

- Opportunity (O)

- Integration with satellite communication technologies (e.g., inReach, Iridium) for enhanced off-grid connectivity, tracking, and emergency signaling.

- Development of hybrid navigation devices combining GPS functionality with traditional marine instrumentation like specialized depth sounders and advanced sonar capabilities.

- Expansion into emerging markets (APAC, Latin America) characterized by rapidly modernizing coastal communities and increasing disposable incomes for leisure activities.

- Focus on specialized professional applications, such as hydrographic surveying, maritime defense training, and commercial regulatory compliance documentation.

- Leveraging AI and machine learning for predictive route planning and sophisticated power management within compact form factors.

- Impact Forces

- Competitive Intensity: High, driven by established players (Garmin, Raymarine) and new entrants focusing on budget-friendly or highly specialized niche products.

- Technological Obsolescence: Moderate to High, due to rapid advancements in GNSS chipsets and display technology, requiring continuous product refresh cycles.

- Regulatory Influence: High, as governmental bodies frequently update safety standards (e.g., requiring higher accuracy or specific emergency features) influencing purchase decisions.

- Buyer Bargaining Power: Moderate, as standardization limits product differentiation, though feature-rich specialized units maintain pricing power.

- Substitution Threat: Moderate, primarily from sophisticated smartphone/tablet apps, compelling manufacturers to emphasize ruggedness and dedicated marine functionality not replicable on consumer devices.

- Segmentation by Product Type

- Basic Handheld GPS Units (Simple position tracking and waypoint marking)

- Handheld GPS Chartplotters (Integrate detailed electronic charting capabilities)

- Combined GPS/Sonar Units (Feature integrated depth sounding and fish-finding technology)

- Ruggedized Professional GPS (Designed for surveying, defense, and extreme environments)

- Segmentation by Application

- Recreational Boating (Sailing, Motor Boating)

- Coastal Fishing and Angling (Sport and Small-scale Commercial)

- Search and Rescue (SAR) Operations

- Professional Maritime Surveying and Hydrography

- Marine Tourism and Kayaking/Canoeing

- Defense and Maritime Security

- Segmentation by Display Type

- Monochrome Display

- Color Display (LCD, Transflective TFT)

- Touchscreen Interface

- Button/Keypad Interface

- Segmentation by Connectivity

- Standalone (Basic GPS function only)

- USB/PC Connectivity

- Wireless Connectivity (Wi-Fi, Bluetooth for map updates and data transfer)

- Satellite Communication Integrated (e.g., InReach Technology)

- Segmentation by Navigation System

- Single Constellation (GPS Only)

- Multi-Constellation GNSS (GPS, GLONASS, Galileo, BeiDou)

- Drivers: Increasing recreational boating, mandatory safety regulations, multi-constellation GNSS adoption.

- Restraints: High product cost, competition from smartphone apps, battery life limitations.

- Opportunities: Integration of satellite communication, expansion into specialized professional services, AI-enhanced features.

- Product Type (Basic GPS, Chartplotters, Combined GPS/Sonar)

- Application (Recreational, Commercial Fishing, SAR, Surveying)

- Display Type (Monochrome, Color, Touchscreen)

- Connectivity (Standalone, Wireless, Satellite Integrated)

- North America: Represents the largest and most mature market segment globally, driven by high disposable incomes, deeply embedded recreational boating culture, and stringent regulatory enforcement regarding required safety equipment on small vessels. The US, particularly the coastal states and the Great Lakes region, accounts for the highest volume of sales, with strong demand for advanced combined GPS/Sonar units tailored for fishing tournaments and leisure cruising.

- Europe: Characterized by strong market adoption, especially in Western European countries like the UK, Germany, and Scandinavia, which possess extensive coastlines and high participation in sailing and commercial maritime activities. The market here is highly competitive, focusing heavily on devices compliant with strict EU environmental standards and supporting the EGNOS augmentation system for enhanced navigation accuracy.

- Asia Pacific (APAC): Exhibits the highest growth potential (CAGR) due to rapid economic development, increasing investment in port infrastructure, and modernization of large-scale and small-scale commercial fishing fleets across China, Japan, and Southeast Asia. Market entry requires significant efforts to localize charting data and ensure competitive pricing structures to appeal to budget-conscious, yet rapidly growing, recreational and small commercial sectors.

- Latin America: A growing market influenced by coastal tourism development and resource exploration activities (e.g., Brazil, Mexico). Demand is generally focused on mid-range, durable devices suitable for rugged environmental conditions. Market growth is sensitive to economic stability and investment in local maritime infrastructure, with primary applications concentrated in local fishing and coastal patrol operations.

- Middle East and Africa (MEA): Currently holds the smallest share but shows promising growth, particularly in the UAE and Saudi Arabia due to expanding leisure marine activities and significant national investment in maritime security and coastal surveillance technologies. The region demands highly reliable units capable of operating efficiently in high-heat and dusty environments, often requiring robust support for multi-lingual interfaces.

- Garmin Ltd.

- Raymarine (FLIR Systems)

- Furuno Electric Co. Ltd.

- Lowrance (Navico Group)

- Standard Horizon

- Humminbird (Johnson Outdoors)

- JRC (Japan Radio Co. Ltd.)

- Simrad (Navico Group)

- B&G (Navico Group)

- Cobra Electronics

- Icom Incorporated

- Vesper Marine

- Magellan GPS

- Uniden

- Trimble Inc.

- Hemisphere GNSS

- Northstar

- SkyMap

- Bushnell

- Raytheon Anschütz

Segmentation Analysis

The Handheld Marine GPS Market is segmented across various dimensions, including product type, application, display technology, and key end-user groups, enabling manufacturers to tailor offerings to specific maritime needs. The foundational segmentation is based on functionality, dividing the market between basic GPS receivers, advanced chartplotters, and specialized combined units that incorporate sonar or fish-finding technology. This categorization reflects the diverse requirements of users, from simple point-to-point navigation needed by kayakers to complex bathymetric data analysis required by serious anglers and surveyors. Successful market penetration necessitates a portfolio that addresses both the high-volume, cost-sensitive recreational base and the high-value, feature-intensive professional user base.

Further analysis by application highlights the dominant share held by recreational activities, which drives volume sales and dictates trends in user interface design and connectivity features. Conversely, the commercial and governmental segments, while smaller in volume, drive innovation in durability, reliability, and encryption standards, reflecting their mission-critical operational requirements. Segmentation by display technology reveals a transition towards color, high-resolution transflective screens, offering superior readability in bright sunlight and lower power consumption compared to older monochrome or backlit LCDs, enhancing usability in open water environments where visibility is often challenging. This detailed segmentation allows manufacturers to precisely target marketing efforts and resource allocation based on identified demand pockets and technological adoption rates.

Value Chain Analysis For Handheld Marine GPS Market

The value chain for the Handheld Marine GPS Market begins with upstream activities centered on the procurement of highly specialized components, most notably GNSS chipsets, high-resolution display panels, and high-capacity, marine-grade lithium-ion batteries. Key upstream suppliers include semiconductor manufacturers (e.g., Qualcomm, Broadcom) for the critical positioning technology, and specialized electronics firms providing ruggedized housing materials and advanced waterproofing seals. Strategic relationships at this stage are crucial, as component availability and quality directly impact the final product's accuracy, reliability, and power efficiency. Research and development focused on miniaturization and integration of multi-sensor systems represent a significant investment in this upstream phase, ensuring compliance with strict environmental standards (e.g., RoHS, REACH) and performance metrics (e.g., cold start time, positional accuracy).

Midstream activities encompass the manufacturing, assembly, and software development processes. This involves designing the user interface (UI) to be intuitive and functional in high-vibration, wet environments, and developing proprietary operating systems optimized for fast chart rendering and stable performance. Quality control and rigorous testing—especially for waterproofing (IP ratings), shock resistance, and thermal tolerance—are paramount at this stage to meet the high durability expectations of marine consumers. Licensing of digital cartography (e.g., C-MAP, Navionics) from specialized data providers is a significant cost and functional requirement, often involving complex regional licensing agreements and continuous data integration to ensure users have access to the latest navigational aids and hazards.

Downstream activities involve distribution and after-sales support. The distribution channel is bifurcated into direct sales channels, primarily targeting large commercial or governmental clients, and indirect channels relying on a robust network of marine equipment retailers, specialized electronics stores, large sporting goods chains, and increasingly, e-commerce platforms focused on outdoor and nautical gear. After-sales support, including warranty services, chart updates, and technical troubleshooting, is critical for maintaining customer loyalty and brand reputation, given the safety-critical nature of the product. Manufacturers often rely on certified marine electronics technicians for complex repairs, ensuring that the service network is capable of handling highly specialized equipment maintenance efficiently.

Handheld Marine GPS Market Potential Customers

The Handheld Marine GPS Market primarily targets a diverse range of end-users who rely on accurate, portable navigation in maritime settings, segmented broadly into recreational and professional categories. The largest volume of potential customers resides in the recreational sector, encompassing private boat owners, sailors, competitive anglers, and enthusiasts engaged in smaller activities such as kayaking, jet skiing, and coastal hiking near water bodies. These buyers prioritize ease of use, integrated recreational features like fishing hot spots marking, and a reasonable price point, often purchasing these units as primary navigation for small boats or as essential backup redundancy for larger vessels, motivated significantly by personal safety and leisure enhancement.

The professional customer segment constitutes a high-value market driven by necessity and regulatory compliance. This group includes small to medium commercial fishing operators requiring accurate waypoints for optimal catch locations, maritime search and rescue (SAR) teams where precision and reliability are non-negotiable for saving lives, and professional surveyors conducting hydrographic mapping and coastal construction monitoring. These customers demand advanced features such as military-grade ruggedness, enhanced data logging capabilities, compatibility with professional charting standards (e.g., S-57/S-100), and often require devices with specific certifications to operate within regulated maritime environments, justifying a higher capital expenditure.

Furthermore, governmental and institutional buyers represent a consistent potential customer base, including naval auxiliary units, coast guards, port authorities, and environmental monitoring agencies. These organizations purchase in bulk and require highly specialized, durable units that can integrate seamlessly with existing operational platforms and communications infrastructure. Their procurement decisions are heavily influenced by factors such as long-term reliability, encrypted data capabilities, ease of fleet management, and the manufacturer's ability to provide tailored support and long product lifecycle guarantees. Marketing efforts aimed at this segment must emphasize compliance, longevity, and specialized functional integration rather than general consumer appeal.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580.5 Million |

| Market Forecast in 2033 | $985.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces | |

| Segments Covered | |

| Key Companies Covered | Garmin Ltd., Raymarine (FLIR Systems), Furuno Electric Co. Ltd., Lowrance (Navico Group), Magellan GPS, Standard Horizon, Humminbird (Johnson Outdoors), JRC (Japan Radio Co. Ltd.), Icom Incorporated, Vesper Marine, Simrad (Navico Group), B&G (Navico Group), Northstar, Uniden, Cobra Electronics, SkyMap, Bushnell, DeLorme (Garmin), Trimble Inc., Hemisphere GNSS. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Handheld Marine GPS Market Key Technology Landscape

The core technology underpinning the Handheld Marine GPS Market remains the Global Navigation Satellite System (GNSS) receiver, which has evolved significantly from single-constellation GPS to highly sensitive multi-constellation receivers capable of tracking signals from GPS, GLONASS, Galileo, and BeiDou simultaneously. This multi-constellation approach dramatically improves positional accuracy and signal availability, especially under challenging conditions like heavy cloud cover or near tall structures. Further enhancing accuracy is the widespread adoption of Satellite-Based Augmentation Systems (SBAS) such as WAAS (Wide Area Augmentation System) in North America and EGNOS (European Geostationary Navigation Overlay Service) in Europe, which provide differential correction data to refine the location fix down to sub-meter precision, crucial for safe navigation in shallow or restricted waters.

Beyond satellite reception, display technology plays a vital role. The market is increasingly dominated by transflective LCD screens, which utilize ambient light to increase visibility, thus consuming less battery power during daylight hours—a necessary feature for extended marine trips. The shift toward robust capacitive touchscreens, protected by specialized marine-grade glass, is improving user interaction, though traditional physical buttons remain essential for reliable operation when the user is wearing gloves or the device is wet. Furthermore, data processing relies on low-power, high-performance microprocessors capable of rapid, seamless rendering of vector-based electronic charts (like Navionics or C-MAP), coupled with advanced memory solutions for storing extensive chart data packages and user-generated waypoints.

Connectivity standards are becoming integral to the modern handheld unit. Bluetooth and Wi-Fi capabilities allow for wireless syncing with mobile applications for chart updates, data backups, and pairing with external sensors, such as heart rate monitors for specialized sporting applications or wireless depth transducers. A critical emerging technology is the integration of proprietary or third-party satellite communication modules (e.g., InReach by Garmin), which provides two-way text communication, weather reports, and distress signaling (SOS) capabilities far beyond the range of traditional cellular networks, transforming the handheld GPS into a comprehensive off-grid safety tool and addressing a significant safety need for offshore users.

Regional Highlights

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Handheld Marine GPS Market.Frequently Asked Questions

Analyze common user questions about the Handheld Marine GPS market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a handheld marine GPS and a standard car or hiking GPS unit?

The primary difference lies in ruggedness and functionality. Handheld marine GPS units feature superior waterproofing (high IP ratings), positive buoyancy, and utilize specialized marine charting (vector/raster) with features like tide tables, harbor information, and Man Over Board (MOB) functions, which are critical for maritime safety and navigation, unlike terrestrial GPS systems.

Which technological factors are driving the enhanced accuracy of modern handheld marine GPS devices?

Enhanced accuracy is driven by the transition to multi-constellation GNSS receivers, which simultaneously track signals from multiple satellite systems (GPS, GLONASS, Galileo, BeiDou). Furthermore, the integration of Satellite-Based Augmentation Systems (SBAS) like WAAS provides differential correction data, often achieving sub-meter positional accuracy essential for safe marine operations.

How significant is the impact of smartphone navigation apps on the dedicated handheld marine GPS market?

Smartphone apps pose a moderate substitution threat, primarily in the casual recreational segment due to their affordability. However, dedicated handheld units maintain a competitive edge due to superior battery life, extreme ruggedness, dedicated physical controls for wet environments, reliable satellite connectivity in remote areas, and the use of professional-grade, certified marine charts.

What are the key considerations when choosing a handheld GPS for offshore fishing versus coastal kayaking?

For offshore fishing, key considerations include long battery life, integrated fish-finding sonar, large high-resolution screens for detailed chart plotting, and satellite communication (e.g., InReach) for emergency use. For coastal kayaking, priority is given to lightweight design, ease of one-handed operation, basic chartplotting, and robust buoyancy features, focusing on portable safety redundancy.

What role does Artificial Intelligence (AI) play in the latest generation of handheld marine GPS systems?

AI is increasingly used to provide predictive capabilities, including optimized route planning that accounts for dynamic weather and current data, smart power management to extend operational time, and advanced algorithms for interpreting sonar data to improve fish-finding accuracy and enhance overall situational awareness for safer navigation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager