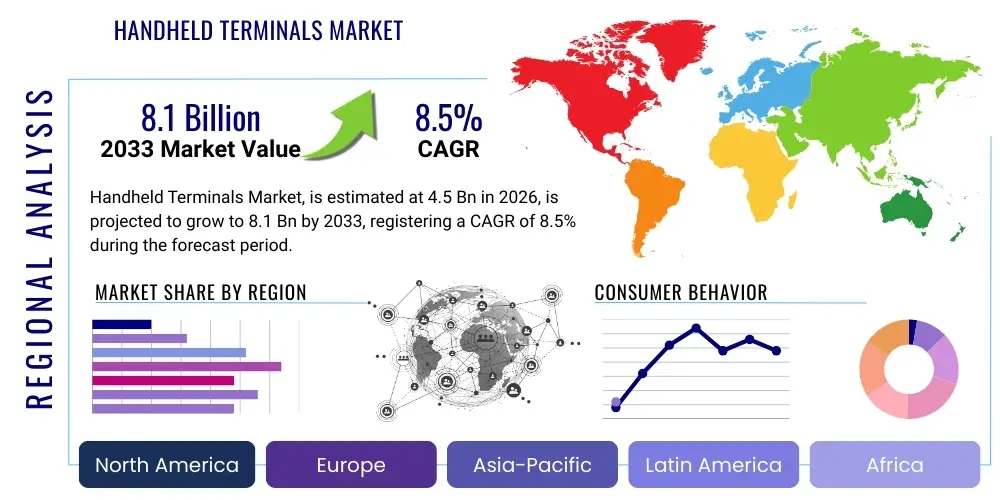

Handheld Terminals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442260 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Handheld Terminals Market Size

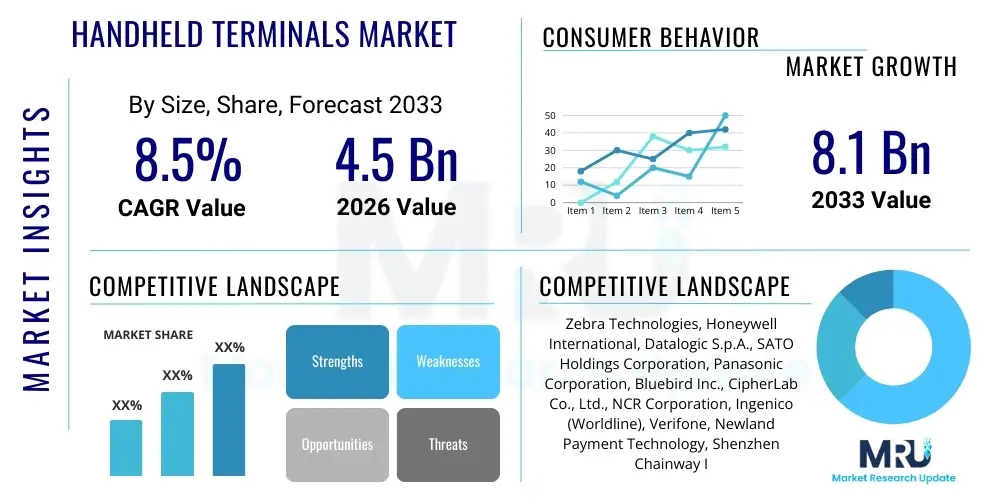

The Handheld Terminals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Handheld Terminals Market introduction

The Handheld Terminals Market encompasses a wide array of portable computing and data capture devices designed for efficiency and mobility across various industry verticals. These devices, which include ruggedized mobile computers, industrial PDAs, advanced barcode scanners, and mobile point-of-sale (mPOS) terminals, are crucial tools for modern operations requiring real-time data input, processing, and transmission in environments ranging from harsh logistics warehouses to bustling retail floors. The core function of these terminals is to streamline processes such as inventory management, asset tracking, field service automation, and supply chain visibility, significantly reducing manual errors and accelerating operational throughput. Furthermore, the shift from proprietary operating systems to open-source platforms like Android has catalyzed the development of more intuitive, user-friendly applications, driving broader adoption globally.

Product descriptions vary significantly based on intended use. For instance, rugged handheld terminals are characterized by their durable construction, capable of withstanding drops, extreme temperatures, and moisture, making them indispensable in manufacturing and transportation sectors. Conversely, payment-focused handhelds prioritize secure transaction processing and connectivity. Major applications span inventory control in retail and e-commerce, patient identification and tracking in healthcare, route optimization and delivery confirmation in logistics, and quality assurance in manufacturing facilities. The primary benefits derived from integrating these systems include enhanced workforce productivity, superior data accuracy, reduced operational bottlenecks, and improved customer experience through faster service delivery and accurate stock information.

Driving factors underpinning the market growth include the explosive proliferation of e-commerce, necessitating sophisticated warehouse and last-mile delivery solutions, and the increasing global emphasis on supply chain optimization and traceability. Businesses are prioritizing digital transformation initiatives that require real-time data connectivity between the field and enterprise resource planning (ERP) systems, positioning handheld terminals as essential data conduits. Additionally, the replacement cycle of legacy Windows CE/Mobile devices with modern, Android-based rugged terminals contributes substantially to market momentum, offering businesses superior performance, enhanced security features, and access to a wider ecosystem of professional applications. These technological migrations are fundamental to sustaining competitive advantage in fast-paced industries.

Handheld Terminals Market Executive Summary

The global Handheld Terminals Market is experiencing robust growth driven primarily by escalating demand for automation solutions across retail, logistics, and manufacturing sectors. Key business trends indicate a strong migration toward integrated mobile solutions that combine data capture (barcoding, RFID), communication (5G/LTE), and payment functionalities within a single device, catering to the convergent needs of modern enterprises. Strategic shifts among leading vendors focus heavily on developing highly ruggedized devices featuring enhanced processing power, larger high-resolution touchscreens, and extended battery life to maximize uptime and worker efficiency. Furthermore, the rise of specialized vertical applications leveraging machine learning capabilities for tasks like predictive inventory analysis and dynamic route planning is shaping product development trajectories, making terminals smarter and more integral to daily operations. Partnerships between hardware manufacturers and independent software vendors (ISVs) are crucial for delivering complete, sector-specific solutions, thus accelerating market penetration and adoption rates.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive infrastructure development in logistics and warehousing, coupled with rapid retail expansion in emerging economies like China and India. North America and Europe maintain dominance in terms of technological maturity and early adoption of high-end specialized devices, particularly within highly regulated sectors such as healthcare and defense. The increasing penetration of advanced mobile payment solutions in Latin America and the rapid industrialization efforts in the Middle East and Africa (MEA) are contributing to sustained, albeit moderate, growth in these regions. Regulatory environments requiring greater product traceability and security, such as those impacting pharmaceutical and food supply chains, also provide significant regional impetus for sophisticated handheld terminal deployment.

Segment trends confirm the ascendance of Android-based terminals, which offer developers flexibility and familiarity, significantly outpacing legacy operating systems. In terms of device type, mobile computers (rugged PDAs) are commanding the largest market share due to their versatility and multifunctionality, serving both basic data capture and complex enterprise application needs. The retail and logistics segments remain the primary revenue drivers, although the healthcare sector is demonstrating rapid growth through the increased use of terminals for medication administration verification and electronic health record (EHR) access at the point of care. The growing adoption of RFID technology, particularly in high-value asset tracking and apparel inventory management, is a notable segment trend, demanding terminals with integrated RFID read capabilities to improve read range and speed.

AI Impact Analysis on Handheld Terminals Market

User queries regarding the impact of Artificial Intelligence (AI) on handheld terminals typically revolve around how AI enhances data processing capabilities, improves decision-making in real-time logistics scenarios, and automates mundane tasks like visual inspection and asset identification. Users frequently ask if AI-powered computer vision will replace traditional barcode scanning entirely, or how Edge AI processing affects battery life and device performance. The key themes emerging from user concerns involve the security implications of processing sensitive data locally on the device (Edge AI), the cost justification for implementing AI-enhanced terminals, and the potential for AI to optimize worker workflow by providing predictive insights directly through the terminal interface. Users expect AI to transform handheld terminals from mere data collection tools into intelligent, proactive assistants capable of identifying inventory discrepancies, optimizing picking routes on the fly, and performing complex quality checks without cloud dependency.

AI's influence is pivoting the handheld terminals market toward 'smart' device functionality. Edge AI enables localized data processing, significantly reducing latency critical for fast-paced environments like automated warehouses. For instance, AI algorithms embedded in the terminal can process images captured by the device’s camera to instantly verify product quality, detect foreign objects, or ensure compliance with packaging standards, all without needing to send high-resolution images to the cloud. This capability drastically improves efficiency in manufacturing and quality control applications. Furthermore, AI contributes to enhanced device management; predictive maintenance algorithms can monitor device health, battery performance, and software stability, alerting IT administrators to potential failures before they impact operational continuity, thereby optimizing the total cost of ownership (TCO).

In logistics and retail, AI integrated into handheld terminals facilitates sophisticated task management. Machine learning models utilize historical performance data and real-time environmental factors (e.g., traffic conditions, stock levels) to generate dynamic work instructions, prioritizing tasks for mobile workers to ensure maximum productivity and adherence to service level agreements (SLAs). This transforms basic work order lists into dynamically optimized workflows. For instance, in a large distribution center, an AI-enabled terminal can adjust a picker's route mid-task based on sudden stock-outs detected elsewhere or priority rush orders, minimizing walking distance and maximizing fulfillment speed. This shift towards prescriptive guidance powered by AI fundamentally alters how workers interact with their handheld devices, making them central to real-time operational intelligence.

- AI-driven computer vision enhances asset identification and quality control tasks.

- Edge AI facilitates real-time data processing and decision-making on the device, reducing cloud dependence and latency.

- Predictive maintenance algorithms improve device uptime and optimize IT resource allocation.

- AI models dynamically optimize routing and task assignment for mobile workers in logistics and field service.

- Natural Language Processing (NLP) integration improves voice-guided picking and hands-free operations.

DRO & Impact Forces Of Handheld Terminals Market

The Handheld Terminals Market is propelled by robust Drivers (D), constrained by certain Restraints (R), and offers significant Opportunities (O), all shaped by distinct Impact Forces (I). Key drivers include the acceleration of global e-commerce and the associated boom in logistics and warehouse management, necessitating tools for high-speed, accurate inventory handling and tracking. The pervasive trend of digital transformation across all industries, pushing enterprises to abandon paper-based processes in favor of real-time digital data capture, is also a fundamental market impetus. The continuous innovation in device capabilities, such as longer battery life, integrated 5G connectivity, and enhanced ruggedness, further encourages device upgrade cycles and new deployments. However, the market faces restraints such as the relatively high initial capital investment required for deploying large fleets of rugged terminals, especially for small and medium-sized enterprises (SMEs). Furthermore, data security concerns regarding sensitive enterprise and customer information processed on mobile devices pose a challenge, requiring continuous investment in secure operating systems and device management software.

Significant opportunities lie in the expansion of niche applications and geographic markets. The healthcare sector presents a high-growth opportunity, with increasing utilization of handheld terminals for bedside verification, inventory management of medical supplies, and mobile clinical documentation, particularly post-pandemic driving tele-health adoption requiring robust mobile data connectivity. The transition from traditional 2D barcode scanning to advanced RFID and Near Field Communication (NFC) technologies is opening new revenue streams, especially in apparel retail and high-value manufacturing asset tracking, where instantaneous bulk reading is essential. Furthermore, the growing demand for mobile Point-of-Sale (mPOS) solutions, driven by pop-up stores, event-based commerce, and the need for seamless checkout experiences, provides a fertile ground for multifunctional handheld terminals integrating payment capabilities.

The primary impact forces shaping this competitive landscape include technological pressure from consumer-grade devices and the competitive dynamics among major hardware manufacturers. While ruggedized terminals offer superior durability, consumer smartphones and tablets are increasingly being adapted for light industrial use, pressuring the low-end rugged market segment. Manufacturers are responding by focusing heavily on highly specialized, ultra-rugged, and technologically advanced devices that offer functionalities consumer devices cannot match, such as integrated enterprise scanning engines and enhanced thermal management. Regulatory compliance, specifically concerning data privacy (like GDPR) and traceability mandates, acts as a crucial external impact force, mandating the adoption of certified and secure handheld solutions. Finally, the supply chain resilience post-2020 dictates the availability and pricing of critical electronic components, influencing production capacity and delivery timelines for vendors.

Segmentation Analysis

The Handheld Terminals Market is comprehensively segmented based on Type, Operating System, Technology, and End-User Industry, reflecting the diversity of functional requirements across different operational environments. This segmentation is crucial for understanding specific market dynamics, as device requirements vary drastically between, for instance, a cold storage logistics facility and a boutique retail store. The analysis highlights that multifunctional devices, categorized primarily as Mobile Computers, dominate the revenue share due to their flexibility in handling complex tasks beyond simple data capture. Furthermore, the industry is increasingly moving towards unified platforms, with the operating system segment heavily dominated by Android, reflecting the industry's desire for an open ecosystem, reduced training time, and seamless integration with existing enterprise mobile applications.

The market’s functional segmentation by Technology emphasizes the ongoing shift from purely 1D barcode reliance to integrating 2D imaging, RFID, and advanced biometric identification methods. While traditional barcode scanners remain foundational, the growing need for real-time item-level visibility, mandated by modern supply chain complexity, accelerates the adoption of RFID readers, especially in asset management and high-volume retail inventory. Geographically, segmentation reveals distinct preferences in ruggedization levels; for example, North America prioritizes integrated solutions for field service automation, while APAC drives volume demand for logistics and manufacturing terminals due to high density of warehousing operations and factory floors.

End-User segmentation provides the clearest insight into demand drivers. The Logistics and Transportation sector, encompassing warehousing, distribution, and last-mile delivery, remains the largest consumer, driven by intense competitive pressure to minimize fulfillment times. The Retail and E-commerce segment is experiencing rapid transformation, necessitating mPOS terminals and inventory terminals for omni-channel fulfillment strategies. Healthcare, although a smaller segment currently, is projected to exhibit the highest growth rate as hospitals and clinics seek to digitize patient records, manage pharmaceutical inventory, and improve staff efficiency through mobile clinical workflow solutions, cementing the importance of specialized antimicrobial and disinfectant-ready devices.

- By Type:

- Industrial PDAs/Mobile Computers

- Barcode Scanners (1D/2D Imagers)

- RFID Readers

- Payment Terminals (mPOS/Pin Pad)

- Wearable Terminals

- By Operating System:

- Android

- Windows Embedded/IoT

- Proprietary OS (e.g., specific payment terminals)

- By Technology:

- Barcode Scanning (Laser, Imager)

- RFID (HF, UHF)

- NFC

- Biometrics

- By End-User Industry:

- Logistics & Transportation

- Retail & E-commerce

- Manufacturing

- Healthcare

- Government & Public Sector (incl. Field Service)

Value Chain Analysis For Handheld Terminals Market

The value chain for the Handheld Terminals Market is characterized by highly specialized stages, beginning with upstream component manufacturing, extending through complex assembly, and concluding with sophisticated distribution and service provision. Upstream analysis focuses on the sourcing of critical components, including high-performance processors (often supplied by companies like Qualcomm or Intel tailored for mobile enterprise devices), specialized scanning engines (e.g., from Honeywell or Zebra sub-units), ruggedized screen displays (Gorilla Glass equivalents), and robust battery systems. Component providers, particularly those supplying semiconductors and optical readers, exert significant influence over production costs and innovation cycles. Stability in the supply of these components is paramount, especially given the recent global constraints on semiconductor availability, which directly impacts the lead times and final pricing of terminals.

Midstream activities involve the design, assembly, and integration of hardware and software. Leading Original Equipment Manufacturers (OEMs) like Zebra, Honeywell, and Datalogic invest heavily in R&D to enhance device ruggedness (IP ratings), ergonomics, and software integration capabilities. Crucially, the integration of enterprise mobility management (EMM) software and proprietary developer tools is a key value-add at this stage, facilitating seamless deployment and management for large corporate clients. Customization services, such as pre-loading specialized applications or configuring specific hardware modules (e.g., dedicated UHF RFID antennas), are also performed here to meet the precise requirements of target end-user sectors, enhancing the terminal's suitability for specific vertical workflows.

Downstream analysis centers on distribution channels, which are predominantly indirect but include significant direct sales to large enterprise customers. The indirect channel relies heavily on Value-Added Resellers (VARs) and system integrators who bundle the handheld terminals with essential complementary services, such as enterprise software, implementation support, worker training, and ongoing maintenance contracts. These partners are vital for providing local support and domain expertise in complex sectors like healthcare and field services. Direct sales channels, typically managed by the OEMs themselves, focus on major global accounts seeking standardized deployments and centralized procurement. Aftermarket services, including repair, maintenance, and software updates (crucial for maintaining security and compliance), form a significant and growing part of the downstream value proposition, ensuring device longevity and maximizing customer return on investment.

Handheld Terminals Market Potential Customers

Potential customers for handheld terminals span nearly every industry that involves physical inventory, asset tracking, mobile workforce deployment, or transaction processing away from a fixed workstation. The largest group of buyers resides within the global Logistics and Transportation sector, including third-party logistics (3PL) providers, express delivery companies, and large-scale warehousing operations. These entities rely on terminals for crucial activities like receiving, put-away, cycle counting, picking, and proof-of-delivery (PoD), requiring devices with superior scanning speed, long-range wireless connectivity, and extreme durability to withstand daily impacts and environmental variances found in distribution centers and delivery vehicles. Efficiency gains in this sector directly translate to competitive advantages, making them continuous investors in terminal technology upgrades.

The second major group comprises large-scale retailers and e-commerce giants. These customers utilize terminals for inventory accuracy across brick-and-mortar stores and fulfillment centers, enabling omni-channel strategies such as "Buy Online, Pick Up In Store" (BOPIS) and ensuring real-time stock visibility. Retail customers often seek devices that are ergonomic and aesthetically pleasing for use on the sales floor (e.g., mobile POS and price check devices), alongside rugged devices for back-of-house operations. The shift toward mobile checkouts and personalized shopping experiences further broadens the demand profile, requiring terminals capable of secure payment processing (PCI compliance) and loyalty program integration.

Finally, the Healthcare and Manufacturing sectors represent critical high-value customer bases. Hospitals, clinics, and pharmaceutical distributors use handhelds for positive patient identification, electronic medication administration records (eMAR), and accurate tracking of temperature-sensitive assets, prioritizing devices that can be easily sanitized (antimicrobial casings). Manufacturing facilities, particularly automotive and aerospace, use terminals for work-in-process (WIP) tracking, quality control checks, and tool crib management, requiring highly ruggedized devices that can operate reliably in noisy, dusty, or high-temperature factory environments. Government agencies and utility providers also form a stable customer segment, utilizing terminals for field inspections, meter reading, and public safety applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zebra Technologies, Honeywell International, Datalogic S.p.A., SATO Holdings Corporation, Panasonic Corporation, Bluebird Inc., CipherLab Co., Ltd., NCR Corporation, Ingenico (Worldline), Verifone, Newland Payment Technology, Shenzhen Chainway Information Technology Co., Ltd., BIXOLON Co., Ltd., Handheld Group, Advantech Co., Ltd., Getac Corporation, Wasp Barcode Technologies, Unitech Electronics Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Handheld Terminals Market Key Technology Landscape

The technology landscape for handheld terminals is defined by a rapid convergence of data capture methodologies, advanced wireless connectivity, and enhanced computational capabilities designed for Edge processing. Central to modern terminals is the adoption of powerful System-on-Chips (SoCs) optimized for enterprise mobility, capable of handling complex applications, high-definition display output, and efficient power management to support extended shift work. The shift from 1D laser scanners to 2D imagers is nearly complete, driven by the need to read complex codes (QR codes, Data Matrix) and capture images, while the integration of Ultra High Frequency (UHF) RFID technology is gaining prominence, enabling simultaneous reading of hundreds of tagged items over several meters, fundamentally altering inventory count processes in large distribution environments and apparel retail.

Connectivity standards are crucial, with the market rapidly moving towards 5G compatibility to ensure ultra-low latency and high data throughput necessary for real-time cloud interactions and massive data uploads (e.g., full inventory snapshots or high-resolution video streams). Alongside cellular connectivity, robust Wi-Fi 6 (802.11ax) implementation ensures reliable performance within dense warehouse environments where interference is common. Furthermore, the development of modular and future-proof architectures allows businesses to upgrade specific components, such as scanning engines or battery packs, without replacing the entire terminal, thus extending the device lifecycle and improving the long-term TCO. Advanced display technologies, including sunlight-readable screens and glove-compatible capacitive touchscreens, are standard features addressing varied working conditions.

Security and operating system developments form another critical facet of the technology landscape. The dominance of Android, particularly enterprise-optimized versions managed through programs like Android Enterprise Recommended (AER), ensures long-term security patching and compatibility. Dedicated enterprise mobility management (EMM) software suites are essential technological overlays, enabling centralized provisioning, remote diagnostics, and policy enforcement to secure devices deployed across geographically dispersed locations. Lastly, technologies enhancing durability, such as specialized ruggedization techniques (e.g., dual-shot molding, reinforced chassis design) and high Ingress Protection (IP) ratings (e.g., IP67 and IP68), remain foundational requirements for devices deployed in challenging manufacturing or outdoor field service environments, protecting the sophisticated internal technology from dust, water, and repeated impact stresses.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive investments in modernizing supply chains, booming e-commerce markets in China, India, and Southeast Asia, and aggressive manufacturing expansion. The high population density and corresponding logistical complexity necessitate widespread adoption of automated data capture solutions. Government initiatives supporting digitalization and smart city development further accelerate demand for handheld terminals in public sector services and infrastructure projects.

- North America: North America holds a substantial market share, characterized by high technology maturity and early adoption of advanced, integrated solutions, particularly in field service automation, high-end healthcare, and specialized logistics. Demand is driven by the replacement cycle of legacy devices and the continuous need for complex inventory management solutions required by major retail chains and distribution hubs, emphasizing robust security features and seamless integration with existing ERP systems.

- Europe: Europe represents a mature market with steady growth, significantly influenced by strict labor regulations emphasizing worker safety and productivity, and rigorous traceability requirements (e.g., F&B, Pharmaceuticals). Countries like Germany and the UK lead in advanced manufacturing (Industry 4.0) adoption, necessitating high-performance, real-time data terminals. The focus is often on high-quality, long-lifecycle devices that align with sustainability goals and support multilingual user interfaces.

- Latin America (LATAM): Growth in LATAM is driven by the formalization of retail, the increasing penetration of mobile banking and mPOS terminals, and the need for improved inventory visibility in growing economies like Brazil and Mexico. Price sensitivity remains a factor, driving demand for cost-effective, yet reliable, rugged solutions suitable for both large-scale agriculture and urban distribution networks.

- Middle East and Africa (MEA): The MEA region is witnessing accelerated growth, underpinned by large-scale infrastructure projects, expansion of logistics hubs (especially around the GCC states), and rapid urbanization. Investments in digital transformation and the burgeoning e-commerce sector in countries like the UAE and Saudi Arabia are primary demand generators, requiring terminals for port operations, warehousing, and emerging retail concepts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Handheld Terminals Market.- Zebra Technologies

- Honeywell International

- Datalogic S.p.A.

- SATO Holdings Corporation

- Panasonic Corporation

- Bluebird Inc.

- CipherLab Co., Ltd.

- NCR Corporation

- Ingenico (Worldline)

- Verifone

- Newland Payment Technology

- Shenzhen Chainway Information Technology Co., Ltd.

- BIXOLON Co., Ltd.

- Handheld Group

- Advantech Co., Ltd.

- Getac Corporation

- Wasp Barcode Technologies

- Unitech Electronics Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Handheld Terminals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Handheld Terminals Market?

The dominant growth factor is the global expansion of e-commerce and the associated digitalization of logistics and warehouse management, requiring real-time inventory tracking and optimization solutions to meet demanding fulfillment schedules.

Which operating system dominates the new handheld terminal deployments?

Android currently dominates new deployments, largely replacing legacy Windows Mobile systems, due to its user-friendly interface, vast app ecosystem, superior security management features, and integration ease with enterprise software.

How is AI specifically impacting the functionality of handheld terminals?

AI is transforming terminals by enabling Edge computing for real-time visual inspection, quality control, and dynamic workflow optimization directly on the device, reducing latency and reliance on continuous cloud connectivity.

What is the difference between a Handheld Terminal and a standard consumer smartphone in an enterprise setting?

Handheld terminals are purpose-built rugged devices featuring specialized enterprise-grade scanning engines, superior durability (high IP ratings), extended battery life, and secure, managed operating systems optimized for industrial environments, unlike consumer smartphones.

Which industry segment represents the highest potential for future market growth?

While Logistics remains the largest segment, the Healthcare sector is anticipated to show the highest growth rate, driven by the increasing need for mobile solutions for bedside patient verification, medication administration, and clinical documentation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager