Harvesting Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442344 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Harvesting Equipment Market Size

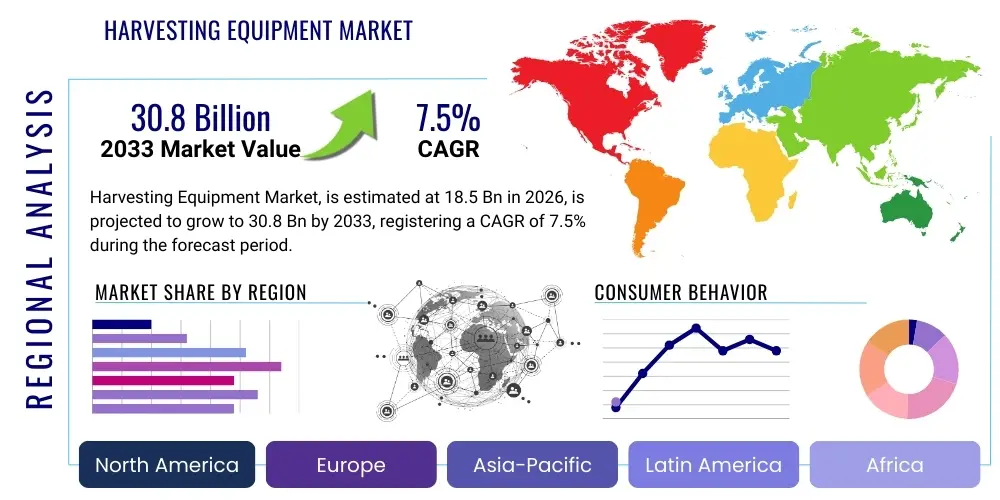

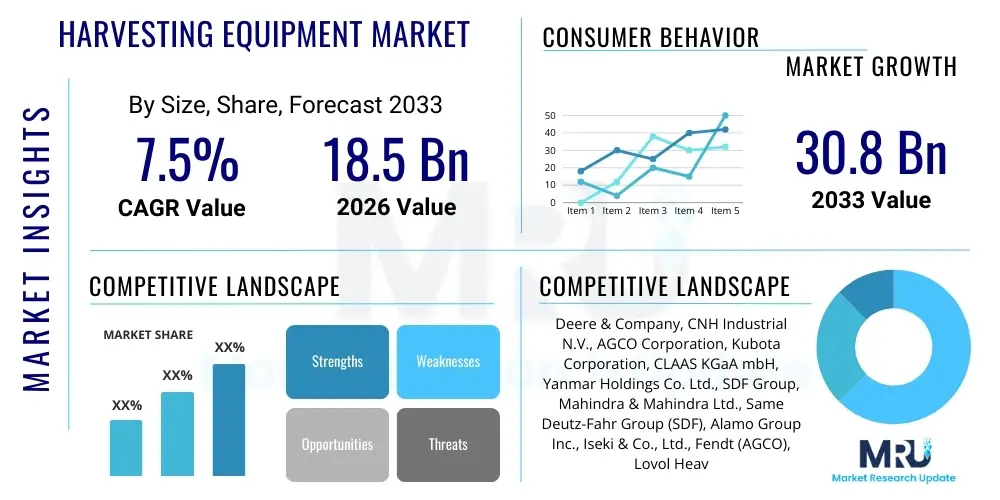

The Harvesting Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 30.8 Billion by the end of the forecast period in 2033.

Harvesting Equipment Market introduction

The Harvesting Equipment Market encompasses a broad range of specialized machinery designed to facilitate the efficient and timely collection of agricultural crops, ranging from staple grains and oilseeds to fruits, vegetables, and specialty crops. This equipment, which includes combines, harvesters, pickers, and associated implements, is fundamental to modern commercial agriculture, directly influencing farm productivity, operational efficiency, and overall global food supply chain stability. The rapid advancements in agricultural technology, particularly precision agriculture and automation, are transforming this market, leading to the development of high-capacity, smart, and environmentally sustainable machinery capable of optimized field performance and reduced post-harvest losses. The product descriptions within this sector emphasize ruggedness, fuel efficiency, ergonomic design, and increasingly, integration with advanced telemetry and GPS systems.

Major applications of harvesting equipment span diverse agricultural segments. Combine harvesters remain the core machinery for large-scale cereal and oilseed operations (wheat, corn, soybean, rice), offering multifunctionality by reaping, threshing, and cleaning the crop in a single pass. Specialized equipment is crucial for crops requiring delicate handling, such as vineyard harvesters, cotton pickers, and potato diggers, ensuring minimal damage and maintaining crop quality. The shift toward vertical integration in large farming operations and contract farming services is expanding the demand for versatile and durable equipment that can handle various crop types across different geographical terrains and climate conditions efficiently, thereby maximizing the return on investment for agricultural producers.

The primary benefits of utilizing modern harvesting equipment include significant reduction in labor dependency, accelerated harvest times crucial for mitigating weather risks, and substantial improvement in yield quality and quantity through optimized cutting and separation processes. Key driving factors fueling market expansion are the rising global population demanding higher food production, the decreasing availability of skilled agricultural labor, supportive government policies promoting farm mechanization in developing economies, and the necessity for sustainable farming practices that require precision tools. Furthermore, continuous technological innovation focusing on enhancing operational performance, predictive maintenance capabilities, and minimizing environmental footprint reinforces the long-term growth trajectory of this essential agricultural sector.

Harvesting Equipment Market Executive Summary

The Harvesting Equipment Market is experiencing robust expansion, driven primarily by globalization of agricultural trade and the imperative for large-scale producers to maximize efficiency and mitigate production risks. Key business trends include consolidation among major equipment manufacturers seeking economies of scale and technological synergy, and a notable surge in the adoption of leasing and rental models, particularly in emerging economies, lowering the initial capital expenditure barrier for smaller farming enterprises. Furthermore, manufacturers are focusing heavily on developing equipment compatible with alternative fuels and regenerative agriculture practices, responding to growing stakeholder and regulatory pressures for environmental sustainability. The shift toward digitized farming ecosystems necessitates that new machinery possesses advanced connectivity and data processing capabilities, positioning software services and after-sales support as crucial revenue streams.

Regional trends indicate that Asia Pacific (APAC) is emerging as the fastest-growing market, propelled by massive government initiatives in countries like India and China to boost farm mechanization and address food security concerns stemming from high population density. North America and Europe, while mature, lead in the adoption of high-precision, large-capacity, autonomous, and specialized harvesting solutions, capitalizing on high average farm sizes and advanced technological infrastructures. Latin America, particularly Brazil and Argentina, shows strong demand, fueled by expansion in soybean and sugarcane cultivation, driving the need for durable, high-horsepower machinery suited to demanding tropical and sub-tropical environments. Political stability, favorable agricultural commodity prices, and infrastructure development are critical factors determining the pace and type of adoption across these regions.

Segment trends reveal that the Combine Harvester category dominates the market share due to its versatility and indispensable role in cereal production globally. However, the market for specialized equipment, such as forage harvesters (driven by livestock feed demand) and potato and sugar beet harvesters, is exhibiting accelerated growth rates due to increasing diversification of global agriculture and shifting consumer dietary preferences. In terms of propulsion, the segment for high-power (above 250 HP) equipment is expanding rapidly, reflecting the trend toward larger farm operations and the demand for increased speed and efficiency per hour of operation. Furthermore, the integration of sensors, GPS, and advanced telematics is becoming standard across all equipment types, enabling farmers to monitor performance, optimize routing, and manage assets remotely, fundamentally redefining equipment capability and profitability metrics.

AI Impact Analysis on Harvesting Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Harvesting Equipment Market frequently revolve around practical implementations such as autonomous operation, predictive maintenance, and optimizing harvest quality. Key user concerns focus on the reliability and cybersecurity of fully autonomous systems, the cost-benefit analysis of integrating expensive AI components, and the ethical implications of data ownership derived from smart machinery operation. Users are primarily seeking to understand how AI can minimize labor costs, improve yield mapping accuracy, and perform real-time adjustment of harvesting parameters (like cutting height or cleaning fan speed) based on complex field conditions. There is a high expectation that AI will transition harvesting from reactive operational adjustments to proactive, precision-driven execution, ultimately leading to greater resource efficiency and reduced post-harvest losses across diverse cropping systems.

AI's most profound immediate impact lies in enhancing the precision capabilities of existing harvesting platforms. Through computer vision systems integrated with sophisticated machine learning algorithms, modern harvesters can distinguish between crop and weed, assess ripeness levels, and automatically adjust internal mechanics to optimize separation efficiency and grain quality. This capability is critical for specialty crops where uniformity and minimal physical damage are paramount. For staple crops, AI-driven yield monitoring provides hyper-granular data on field variability, which informs subsequent planting, irrigation, and fertilization decisions, thereby closing the loop in the precision agriculture cycle and increasing overall farm profitability.

Furthermore, AI is instrumental in transforming equipment maintenance and fleet management. Predictive maintenance systems use sensor data and historical performance metrics to forecast potential component failures, scheduling maintenance precisely when needed, thereby dramatically reducing unexpected downtime during critical harvest windows. This enhances operational uptime and reduces the total cost of ownership (TCO). The integration of fully autonomous navigation systems, leveraging AI for path planning, obstacle avoidance, and real-time environmental adaptation, suggests a future where harvesting tasks are executed 24/7 without human intervention, contingent upon regulatory advancements and robust cybersecurity frameworks.

- Autonomous Operation: AI-driven path planning, obstacle detection, and automated execution of entire harvest cycles, enabling 24/7 field work.

- Precision Sorting and Quality Control: Real-time visual recognition systems to grade crop quality and adjust cleaning parameters dynamically.

- Predictive Maintenance: Machine learning models analyzing sensor data to anticipate equipment failures, minimizing critical operational downtime.

- Yield Optimization: AI synthesis of yield maps, soil data, and weather patterns to adjust harvesting speed and settings for maximum efficiency per zone.

- Enhanced Safety Protocols: AI monitoring of operational parameters and environmental factors to ensure safer working conditions and adherence to regulatory limits.

- Reduced Labor Dependency: Automation enabled by AI addresses the persistent global shortage of skilled agricultural labor.

DRO & Impact Forces Of Harvesting Equipment Market

The dynamics of the Harvesting Equipment Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The core driver is the escalating global necessity for increased food production to meet the demands of a growing population, coupled with diminishing arable land and water resources, mandating higher efficiency per unit area. This necessitates the adoption of high-capacity, precision machinery. Opportunities primarily reside in the untapped markets of developing economies where farm mechanization rates are low, and in the continued development of sustainable farming solutions, particularly equipment designed for specialty crops and urban agriculture. However, the market faces significant restraints, including the high initial capital investment required for technologically advanced machinery, which can deter small and medium-sized farmers, and the inherent volatility of agricultural commodity prices which directly impacts farm profitability and subsequent equipment purchasing decisions.

Drivers: A primary catalyst is the substantial shortage of farm labor in both developed and rapidly industrializing economies, pushing farmers towards highly automated and efficient machinery that can perform the work of multiple manual laborers. Furthermore, supportive governmental policies, such as subsidies and loan schemes aimed at increasing farm income and productivity, particularly in major agricultural producers across Asia and South America, substantially accelerate equipment purchases. The ongoing advancement and adoption of precision agriculture techniques, requiring specialized equipment with GPS, IoT connectivity, and sensors for variable rate application and yield monitoring, inherently drive demand for modern, smart harvesting platforms capable of integrating into digitized farm management systems.

Restraints: The significant financial outlay associated with procuring cutting-edge harvesters represents a major barrier, especially for smallholder farmers who lack access to easy credit or large capital reserves. Beyond capital costs, the specialized nature of repair and maintenance, requiring trained technicians and proprietary software, increases operational expenditure (OpEx) and dependence on Original Equipment Manufacturers (OEMs). Moreover, the cyclical nature of agricultural production, which is heavily reliant on unpredictable weather patterns and fluctuating global market prices for key commodities (e.g., corn, wheat), creates market uncertainty, often leading to postponed equipment upgrade cycles during periods of low profitability. Regulatory complexity concerning emissions standards (Tier 4/Stage V) also places cost pressures on manufacturers, which are eventually passed on to the end-users.

Opportunities & Impact Forces: The most impactful opportunities stem from the rise of rental and leasing markets, offering flexible financing solutions that make expensive machinery accessible to a wider pool of farmers, thus mitigating the restraint posed by high upfront cost. The burgeoning interest in sustainable and specialized farming—such as organic farming, vertical farming, and precision viticulture—creates niches for highly customized, smaller-scale, and electric harvesting equipment. Furthermore, the development of robust telematics and data services provides a new revenue stream for OEMs and significantly enhances customer value through predictive maintenance and optimized operational advice. The impact forces driving the market are technological disruption (automation), climate change adaptation (need for faster harvest), and geopolitical stability (affecting commodity prices and trade routes).

- Drivers: Labor scarcity, government mechanization subsidies, increasing demand for food, adoption of precision agriculture technologies.

- Restraints: High initial investment cost, dependency on agricultural commodity price volatility, skilled technical labor shortage for maintenance, stringent emission regulations.

- Opportunities: Expansion of equipment rental and leasing services, development of electric and specialized equipment for niche crops, untapped markets in emerging economies, growth in data analytics and telematics services.

- Impact Forces: Technological innovation (automation), climate variability affecting harvest windows, global supply chain disruptions, shifts in consumer diet preferences (e.g., rise of plant-based foods affecting crop focus).

Segmentation Analysis

The Harvesting Equipment Market is comprehensively segmented based on three critical parameters: the type of equipment, which dictates the crop processed; the capacity or power output of the machinery, reflecting operational scale; and the geographic region, highlighting distinct adoption rates and technological requirements. This segmentation provides a granular view of market dynamics, revealing where capital investment is concentrated and which technological innovations are garnering the highest demand. Understanding these segments is vital for manufacturers to tailor their product offerings, distribution strategies, and pricing models to specific agricultural ecosystems and farm sizes globally. The dominance of large, high-capacity machinery in developed markets contrasts sharply with the growing demand for smaller, affordable equipment in segments focused on smallholder farming in Asia and Africa.

The core segments underline the diverse needs of modern agriculture. The Equipment Type segment is dominated by multi-functional combines but also features robust growth in specialized segments such as foragers and pickers. The Power Output segment is witnessing a pronounced shift towards higher horsepower (>250 HP) machines, reflecting the consolidation of farm sizes and the necessity for faster fieldwork completion. Geographically, market maturity varies significantly; while North America and Europe emphasize replacement cycles and advanced technology adoption, the APAC region drives volume growth through initial mechanization efforts and the continuous expansion of cultivable land under intensive farming practices.

- By Equipment Type:

- Combine Harvesters (Axial Flow, Rotary, Conventional)

- Forage Harvesters

- Cotton Harvesters (Pickers, Strippers)

- Root Crop Harvesters (Potato, Sugar Beet)

- Grape Harvesters (Vineyard Equipment)

- Others (Sugarcane Harvesters, Vegetable Harvesters)

- By Power Output:

- Below 100 HP

- 100 HP – 250 HP

- Above 250 HP

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Harvesting Equipment Market

The Value Chain for the Harvesting Equipment Market is complex, beginning with upstream raw material suppliers and culminating in the end-user farmer. The upstream segment involves the procurement of high-grade steel, advanced composite materials, engine components, hydraulics, and sophisticated electronic control units. Key activities include component design, specialized material sourcing, and ensuring compliance with stringent quality and durability standards required for heavy agricultural use. Manufacturers maintain critical relationships with engine producers (e.g., Cummins, John Deere Power Systems) and electronics providers to integrate the latest efficiency and connectivity technologies, making supply chain resilience and cost management at this stage highly critical to profitability and final product quality.

The midstream process focuses on manufacturing, assembly, and quality assurance. This stage is characterized by high capital intensity, involving precision engineering, robotics for welding and assembly, and advanced painting processes to ensure longevity against harsh field environments. Distribution channels are highly structured, relying predominantly on a robust network of authorized dealerships. Direct distribution is typically reserved for large-scale corporate farming operations or specialized tenders, while the vast majority of equipment flows through independent or captive dealer networks. These dealerships are critical for stocking inventory, offering demonstration units, providing localized financing options, and, most importantly, delivering crucial after-sales support, including parts supply and technical maintenance services.

Downstream activities center on sales, maintenance, and remarketing. Dealers act as primary interface points for farmers, providing expert consultation on equipment selection tailored to specific crop rotations and soil types. The indirect channel, primarily via dealers, dominates because agricultural machinery requires intensive service and parts availability, making proximity and trust essential. The emergence of online platforms and digital configurators aids the initial purchasing decision, but the physical delivery, commissioning, and long-term service relationships cement the indirect channel’s dominance. The value chain concludes with remarketing—the trade-in and resale of used equipment, which contributes significantly to the financial viability and accessibility of the market by providing a depreciation recovery mechanism for farmers.

Harvesting Equipment Market Potential Customers

The primary customers for harvesting equipment are large-scale commercial farming enterprises, often referred to as industrial farms, which operate expansive tracts of land dedicated to staple crops such as corn, wheat, soybean, and rice. These customers prioritize equipment with maximum throughput, high horsepower, advanced automation features (e.g., telematics, auto-guidance), and fuel efficiency, as their operational success hinges on completing harvests rapidly across vast areas. Their purchasing decisions are driven by the Total Cost of Ownership (TCO), expected operational lifespan, and the OEM's ability to provide extensive and rapid parts and service support, minimizing the financial impact of unexpected downtime during critical seasons.

A secondary, yet rapidly expanding, customer segment includes contract farming service providers and machinery rental companies. These entities invest heavily in diverse fleets of harvesting equipment which they lease or operate on behalf of smaller farmers or farms that do not possess the capital or labor for ownership. This segment demands versatility and robust, durable machines that can withstand high utilization rates across multiple different farm environments and crop types within a season. For this group, financing flexibility and the manufacturer's ability to provide high-utilization fleet management software are key deciding factors, allowing them to optimize scheduling and asset deployment efficiently across their client base.

Furthermore, small and medium-sized farmers, particularly those in rapidly mechanizing regions like Southeast Asia, represent a significant volume opportunity, albeit requiring different product specifications. This segment typically seeks durable, smaller-capacity, and more affordable machinery, often prioritizing straightforward mechanical reliability over complex electronics. Government subsidies and micro-financing schemes often dictate the purchasing timeline and preferred models for this group. Specialized agricultural operations, such as vineyards, orchards, and vegetable farms, constitute a crucial niche, requiring highly specialized, often purpose-built harvesters that must balance gentle handling of high-value crops with operational efficiency, making crop damage prevention the utmost purchasing criterion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 30.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, CNH Industrial N.V., AGCO Corporation, Kubota Corporation, CLAAS KGaA mbH, Yanmar Holdings Co. Ltd., SDF Group, Mahindra & Mahindra Ltd., Same Deutz-Fahr Group (SDF), Alamo Group Inc., Iseki & Co., Ltd., Fendt (AGCO), Lovol Heavy Industry Co., Ltd., Rostselmash, Zetor Tractors a.s., Sonalika International Tractors Ltd., Sampo Rosenlew Ltd., Ploeger Machines B.V., OXBO International Corporation, Versatile (Buhler Industries Inc.) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Harvesting Equipment Market Key Technology Landscape

The technology landscape in the Harvesting Equipment Market is undergoing a rapid evolution, primarily driven by the principles of Precision Agriculture and the integration of digital technologies. Central to this transformation is the pervasive adoption of sophisticated telematics and Internet of Things (IoT) systems, which enable real-time monitoring of equipment performance, fuel consumption, and operational efficiency metrics. These systems facilitate remote diagnostics and predictive maintenance, allowing OEMs and farmers to proactively address potential mechanical issues before they lead to costly failures during critical harvest times. Furthermore, advanced sensor technology, including hyperspectral imaging and LiDAR, is increasingly used to assess crop conditions (moisture, protein content, ripeness) on the fly, allowing harvesters to instantly adjust internal settings for optimal yield quality and separation efficiency, significantly reducing grain loss.

Another dominant technological trend is the drive toward complete autonomy and enhanced guidance systems. GPS-based auto-guidance systems (RTK/GNSS), once a premium feature, are becoming standard, enabling harvesters to navigate fields with centimeter-level accuracy, minimizing overlap, reducing fuel consumption, and maximizing the use of field space. Building upon this foundation, manufacturers are actively investing in Level 3 and Level 4 autonomous technologies, integrating complex AI algorithms, computer vision, and sophisticated collision avoidance systems. This not only addresses the labor shortage but also ensures highly consistent operational execution, irrespective of operator fatigue or experience. These autonomous systems require robust cybersecurity measures and reliable connectivity infrastructure, presenting an opportunity for collaboration between equipment manufacturers and telecom providers in rural areas.

Sustainability and operational efficiency are heavily impacting equipment design, leading to advancements in engine technology and alternative power solutions. Tier 4 Final/Stage V compliant engines, utilizing complex exhaust gas recirculation and selective catalytic reduction systems, are standardizing low-emission operations across major markets. Simultaneously, significant research and development efforts are focused on electrifying smaller harvesting equipment, particularly for specialized and protected environment crops (e.g., vineyards, indoor farms), aiming to reduce local carbon footprints and noise pollution. The integration of lighter, stronger composite materials is also enhancing equipment durability while reducing overall weight, leading to improved soil health by minimizing compaction, thereby making the harvesting process more environmentally friendly and sustainable in the long term.

Regional Highlights

Regional dynamics heavily influence the demand for specific types of harvesting equipment, driven by local crop mix, farm structure, labor costs, and governmental support for agriculture. North America and Europe represent the mature market segments, characterized by high adoption rates of large-capacity, high-horsepower combine harvesters and advanced specialized equipment (e.g., precision foragers). These regions prioritize replacement cycles, focusing on equipment incorporating the latest digital features such as AI integration, full telematics, and near-perfect autonomy capabilities, justified by high labor costs and the need for peak efficiency in large-scale agribusinesses. Furthermore, stringent environmental regulations in Europe drive demand for fuel-efficient and low-emission machinery.

The Asia Pacific (APAC) region is poised for the highest growth, fueled by government initiatives promoting farm mechanization and rising farm incomes, particularly in countries like China, India, and Southeast Asian nations. The demand here is highly diversified, ranging from small-scale, affordable power tillers and mini-harvesters suitable for small plots in countries like Vietnam and Thailand, to medium-to-large capacity combines in the massive grain production regions of China and India. The rapid adoption of rice and wheat harvesters, often subsidized by local governments, is a key market mover. Labor migration to urban centers is accelerating the mechanization curve dramatically across this region.

Latin America (LATAM), dominated by agricultural giants like Brazil and Argentina, focuses on high-capacity machinery suited for large-scale soybean, corn, and sugarcane cultivation. The region exhibits strong demand for robust, durable equipment capable of handling challenging terrains and intensive operational use. The Middle East and Africa (MEA) remains a nascent market, primarily driven by government investments in large-scale agricultural projects designed to bolster food security. Adoption is currently slower but shows potential, especially in areas benefiting from donor-funded agricultural development programs, which prioritize basic, reliable mechanization solutions.

- North America: Leader in autonomous technology adoption, high demand for precision large-scale combine harvesters, focusing on efficiency and yield optimization in wheat and corn production.

- Europe: Strong focus on specialized harvesters (root crops, grapes), stringent environmental standards driving electric and low-emission equipment demand, high adoption of telematics.

- Asia Pacific (APAC): Fastest growth market driven by mechanization subsidies, high volume demand for small and medium-capacity equipment, particularly rice and wheat harvesters in China and India.

- Latin America (LATAM): High demand for powerful, robust machinery for extensive soybean, sugarcane, and corn operations, strong growth tied to global commodity prices.

- Middle East and Africa (MEA): Market growth tied to government food security initiatives and development aid, primary focus on basic mechanization tools and grain production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Harvesting Equipment Market.- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Kubota Corporation

- CLAAS KGaA mbH

- Yanmar Holdings Co. Ltd.

- SDF Group

- Mahindra & Mahindra Ltd.

- Alamo Group Inc.

- Iseki & Co., Ltd.

- Fendt (AGCO)

- Lovol Heavy Industry Co., Ltd.

- Rostselmash

- Zetor Tractors a.s.

- Sonalika International Tractors Ltd.

- Sampo Rosenlew Ltd.

- Ploeger Machines B.V.

- OXBO International Corporation

- Versatile (Buhler Industries Inc.)

- Tractor Supply Co.

Frequently Asked Questions

Analyze common user questions about the Harvesting Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate for the Harvesting Equipment Market?

The Harvesting Equipment Market is projected to experience robust expansion, growing at a Compound Annual Growth Rate (CAGR) of 7.5% through the forecast period spanning 2026 to 2033, driven largely by global mechanization trends and technological integration.

Which region currently dominates the adoption of high-tech harvesting equipment?

North America and Europe currently lead the adoption of high-tech and autonomous harvesting equipment, characterized by a market preference for large, high-horsepower machinery integrated with advanced AI and telematics systems to maximize efficiency and mitigate high labor costs.

How is Artificial Intelligence (AI) specifically impacting modern harvesters?

AI is transforming harvesters by enabling fully autonomous operation, facilitating real-time precision adjustment of harvesting parameters based on crop conditions, and providing advanced predictive maintenance capabilities, significantly boosting operational uptime and yield quality.

What is the primary restraint affecting the rapid growth of the harvesting equipment market?

The primary restraint is the significantly high initial capital investment required for technologically advanced harvesting equipment, which poses a substantial financial barrier, particularly for small and medium-sized farming operations globally.

What is the role of rental services in the future of the harvesting equipment sector?

Rental and leasing services play a crucial role by mitigating the high upfront cost restraint, allowing smaller farmers and contract providers access to advanced machinery, thus acting as a major growth opportunity by increasing market accessibility and equipment utilization rates.

What distinguishes Combine Harvesters from Forage Harvesters?

Combine harvesters are designed for grain crops (e.g., wheat, corn), performing reaping, threshing, and cleaning in one operation. Forage harvesters, conversely, are specialized for chopping and processing feed crops like corn silage or hay into feed for livestock, requiring a distinct cutting and processing mechanism.

Which market segment by power output is experiencing the fastest growth?

The power output segment classified as "Above 250 HP" is experiencing the fastest growth. This trend reflects the ongoing consolidation of agricultural land, requiring farmers to utilize larger, faster, and higher-capacity machinery to cover vast acreage efficiently during narrow harvest windows.

How do emission standards affect the manufacturing of new harvesting equipment?

Stringent emission standards (like Tier 4 Final/Stage V) necessitate that manufacturers invest heavily in complex engine technologies, such as exhaust aftertreatment systems. These requirements increase manufacturing complexity and product cost, driving the market toward more fuel-efficient and sustainable engine designs.

What role does telematics play in the maintenance of harvesting equipment?

Telematics enables manufacturers and farmers to monitor equipment performance remotely in real-time. This data feeds into predictive maintenance systems, allowing for the anticipation of component failure, scheduling maintenance precisely when needed, and minimizing costly, unscheduled operational downtime.

Is there significant demand for electric harvesting equipment currently?

Demand for fully electric harvesting equipment is still emerging but is growing rapidly, primarily concentrated in specialized agricultural niches such as vineyards, protected agriculture (greenhouses), and specific root crop harvesting where reduced noise pollution and zero local emissions offer significant operational advantages.

What is the primary benefit of GPS auto-guidance systems in harvesting operations?

GPS auto-guidance systems (using RTK accuracy) ensure precise field coverage, minimizing overlap between passes. This directly reduces fuel consumption, labor time, and stress on the machinery, leading to enhanced overall field efficiency and lower operational costs per acre harvested.

Which geographical region represents the largest volume opportunity for new market entrants?

The Asia Pacific (APAC) region represents the largest volume opportunity for new market entrants due to the region's massive push towards initial farm mechanization, driven by supportive government policies and the sheer number of small and medium-sized farms requiring efficient, entry-level machinery.

How does climate change influence the demand for advanced harvesting equipment?

Climate variability, leading to increasingly unpredictable weather, necessitates faster and more efficient harvesting capabilities. Farmers require equipment that can maximize productivity during shorter, critical harvest windows, driving demand for high-capacity, durable, and reliable modern machines.

Who are the major upstream suppliers in the harvesting equipment value chain?

Major upstream suppliers include providers of specialized engine systems, advanced hydraulic components, electronic control units, and high-strength, lightweight steel and composite materials essential for the construction and durability of heavy agricultural machinery.

How do political factors affect equipment purchasing decisions in Latin America?

In Latin America, purchasing decisions are highly sensitive to political stability and trade agreements that affect commodity export prices (especially soybeans and corn). Favorable commodity prices and stable government policies encourage capital expenditure on new, large-scale harvesting machinery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager