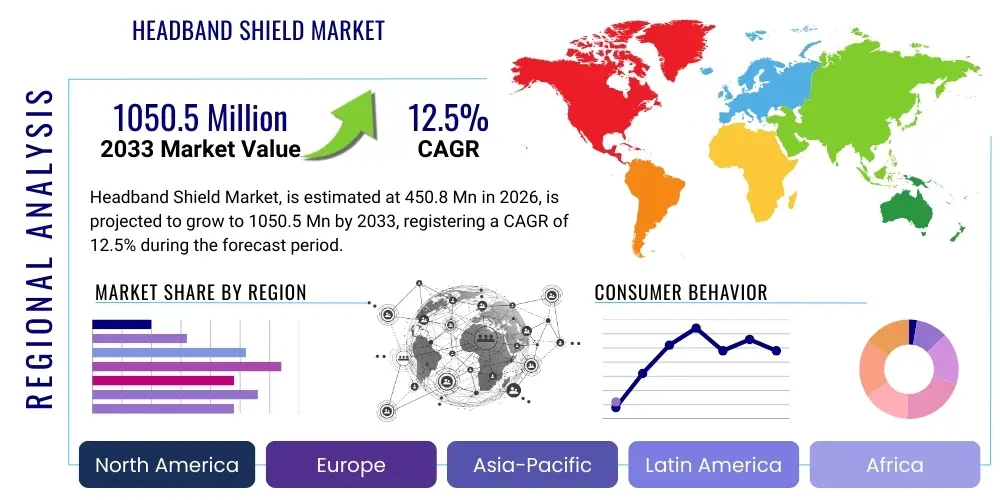

Headband Shield Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441055 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Headband Shield Market Size

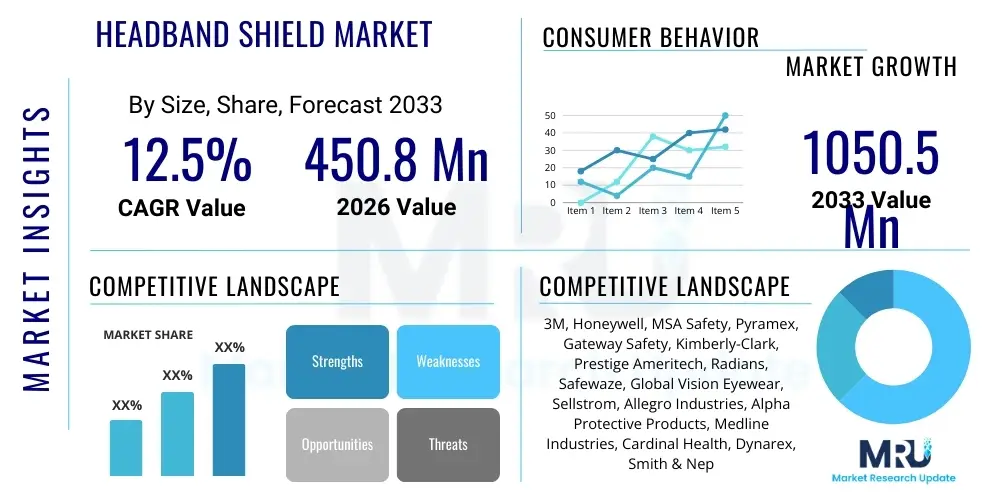

The Headband Shield Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 450.8 Million in 2026 and is projected to reach USD 1050.5 Million by the end of the forecast period in 2033. This robust growth trajectory is underpinned by persistent global concerns regarding occupational safety standards, particularly within healthcare settings and industrial environments requiring protection against aerosols, splash hazards, and flying debris. Regulatory mandates across key economies are increasingly stringent, compelling organizations to adopt higher quality and more frequent usage of personal protective equipment (PPE), of which the headband shield is a crucial component.

The valuation reflects significant investment in product innovation aimed at enhancing wearer comfort, durability, and optical clarity, features essential for prolonged usage compliance. Furthermore, the expansion of manufacturing capabilities in emerging economies, coupled with sophisticated supply chain management, is contributing to increased market accessibility and competitive pricing. The sheer volume required during periods of heightened health crises, as observed historically, establishes a fundamental baseline demand that continues to stabilize and expand the market structure moving forward.

Headband Shield Market introduction

The Headband Shield Market encompasses the global production, distribution, and consumption of transparent protective barriers affixed to an adjustable head fixture, designed primarily to protect the facial area from various occupational and biological hazards. These devices, often utilized as supplementary protection over masks and goggles, serve critical functions in preventing exposure to liquids, sprays, bloodborne pathogens, and light-to-moderate physical impact hazards typical in laboratory, construction, dental, and medical settings. The core product description involves a robust, optically clear visor—typically made from materials like polycarbonate or polyethylene terephthalate (PET)—attached to an ergonomic, reusable or disposable headband system engineered for secure, comfortable fit over long periods.

Major applications of headband shields span across diverse sectors, fundamentally rooted in safety and hygiene protocols. In healthcare, they are indispensable during surgeries, patient care procedures, and infectious disease management, acting as a crucial line of defense against infectious bodily fluids and aerosols. Within industrial safety, applications include welding assistance, grinding, light machining, and chemical handling, where protection from sparks, debris, and chemical splashes is paramount. Key benefits driving adoption include superior full-face protection compared to eyewear alone, reduced risk of cross-contamination, and enhanced user compliance due to designs that minimize fogging and pressure points. The versatility and ease of disinfection further solidify their market position across professional domains.

Driving factors for sustained market growth include escalating global health security concerns, leading to sustained demand for medical PPE stockpiling by governments and private entities, and stricter enforcement of workplace safety regulations (such as OSHA standards in the US and equivalent directives in the EU and APAC). Technological advancements focusing on bio-compatibility, anti-fog coatings, and sustainable manufacturing practices (e.g., biodegradable plastics for disposable components) are also key accelerators. The continuous expansion of manufacturing, dental, and laboratory research activities worldwide further broadens the addressable user base, maintaining a positive growth momentum for the headband shield sector.

Headband Shield Market Executive Summary

The Headband Shield Market is characterized by robust growth, driven primarily by sustained global focus on healthcare infrastructure resilience and occupational safety mandates across industrial and service sectors. Business trends reveal a shift towards highly ergonomic and customizable designs, favoring reusable components with replaceable shields to enhance sustainability and cost-effectiveness for major institutional buyers. Key market players are intensifying R&D in material science, integrating advanced anti-scratch and anti-glare technologies to improve user experience, while simultaneously optimizing supply chain efficiencies to meet sporadic, high-volume demands effectively. Furthermore, strategic partnerships between PPE manufacturers and large hospital systems or industrial conglomerates are becoming prevalent to ensure reliable supply flows and standardization of safety equipment protocols, indicating a move towards long-term contractual stability over transient procurement cycles.

Regional trends demonstrate North America and Europe retaining dominant market shares due to high healthcare expenditure, stringent regulatory frameworks (e.g., NIOSH, CE markings), and high penetration rates of sophisticated safety protocols in manufacturing. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by rapidly expanding healthcare capacity, increasing industrialization, and growing awareness regarding workplace hazards in populous nations like China and India. Government initiatives in these regions focusing on public health protection and domestic PPE production are significant tailwinds, attracting substantial foreign and domestic investment into localized manufacturing hubs.

Segmentation trends highlight the dominance of polycarbonate material due to its superior impact resistance and clarity, although PET and bio-based polymers are gaining traction, especially in single-use scenarios where disposal is a major consideration. The End-User segment remains heavily weighted towards Healthcare and Medical applications, which serve as the primary volume driver. Nonetheless, specialized industrial applications requiring high heat or chemical resistance are fueling innovation in niche material segments. Distribution channel analysis shows a strong reliance on established industrial safety distributors and specialized medical supply chains, although e-commerce platforms have permanently increased their relevance for smaller enterprises and individual consumer purchases, particularly since 2020, requiring manufacturers to implement comprehensive omnichannel strategies.

AI Impact Analysis on Headband Shield Market

User inquiries concerning AI's influence on the Headband Shield Market frequently center on themes of manufacturing efficiency, predictive demand forecasting, and ergonomic design optimization. Key questions often address whether AI can reduce production costs through automated quality control, how machine learning might predict spikes in global demand (like future pandemics or localized industrial safety crises) better than traditional models, and if generative design tools can create lighter, more comfortable shields that maximize protection while minimizing visual obstruction and pressure points. There is a keen interest in utilizing AI to analyze real-world usage data—collected via smart PPE—to continuously refine the product lifecycle, especially concerning common pain points such as fogging and strap durability. The primary expectation is that AI will transform the manufacturing supply chain from a reactive system into a highly responsive, predictive mechanism capable of scaling production quickly and maintaining consistent quality standards across global operations.

The implementation of Artificial Intelligence in the Headband Shield manufacturing process primarily targets optimizing throughput and material utilization. AI-driven vision systems are increasingly being deployed on assembly lines for immediate, non-destructive testing of optical clarity, ensuring that shields meet stringent regulatory standards (e.g., ANSI Z87.1). This not only improves quality consistency but significantly reduces material waste by identifying flaws earlier in the process. Furthermore, AI models are being utilized in logistics and inventory management to analyze geopolitical health reports, climate patterns, and industrial activity metrics, generating highly accurate forecasts that allow manufacturers to maintain optimal stock levels of raw materials (like high-grade polymer sheets) and finished goods, thereby mitigating risks associated with sudden supply chain shocks.

Beyond manufacturing, AI-powered design tools (Generative Design) are revolutionizing the headband component itself. By inputting physical constraints—such as average head size measurements, required pressure distribution points for comfort, and material strength requirements—AI algorithms can propose novel geometries that are significantly lighter, stronger, and more ergonomic than traditional designs. This iterative design optimization reduces development cycles and enhances user satisfaction, a critical factor for compliance. As the market moves towards smart PPE integration (e.g., shields with embedded sensors for environmental monitoring), AI will become essential for processing this complex data, translating raw input into actionable insights for both the user (via alerts) and the manufacturer (via product refinement).

- AI-Enhanced Quality Control: Automated optical inspection and defect detection on production lines for superior clarity and compliance.

- Predictive Demand Forecasting: Machine learning models analyzing global epidemiological and industrial data to optimize inventory and production scale-up.

- Generative Ergonomics: Utilizing AI for designing optimal headband geometry, improving comfort, weight distribution, and reducing user fatigue.

- Supply Chain Optimization: Intelligent routing and risk assessment for raw material sourcing and finished goods distribution.

- Smart PPE Integration: Processing sensor data from next-generation shields to provide real-time user feedback and aid in continuous product improvement.

DRO & Impact Forces Of Headband Shield Market

The dynamics of the Headband Shield Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the core Impact Forces. Key drivers include stringent governmental safety regulations across industries, mandatory usage protocols in healthcare settings, and the sustained global increase in awareness regarding infectious disease transmission pathways, necessitating robust barrier protection. However, growth is tempered by significant restraints such as the volatility in raw material (polymer) pricing, the environmental impact of disposable shield waste, and persistent supply chain bottlenecks during peak demand periods. Opportunities abound in developing sustainable, biodegradable materials and integrating advanced features like embedded sensors and sophisticated anti-fog technologies. The primary impact forces are regulatory pressure (pushing adoption), material cost fluctuations (restraining margins), and technological innovation (opening new application niches and user segments).

The dominant driver remains the regulatory environment. Health and safety organizations worldwide continuously update standards, requiring higher levels of protection and specific certifications (e.g., high-velocity impact resistance). This regulatory push guarantees a constant replacement cycle and mandates initial adoption in newly established industrial facilities or renovated healthcare units. The COVID-19 pandemic served as a massive, sustained external driver, permanently elevating public and institutional consciousness regarding airborne and splash protection. This has created a "new normal" where face shields, once optional accessories, are now frequently integrated into standard operating procedures in non-traditional settings like retail services, hospitality, and education, thereby expanding the addressable market significantly beyond traditional industrial and clinical borders.

Crucial restraints include cost pressures and environmental concerns. While the unit cost of a face shield is relatively low, high-volume purchasers (governments, large hospitals) prioritize cost-effectiveness, leading to intense pricing competition that compresses manufacturer margins, especially for standardized disposable products. Furthermore, the sheer volume of plastic waste generated by disposable shields poses a severe environmental challenge, driving R&D toward sustainable alternatives, which often carry a higher immediate production cost. Opportunities, therefore, lie in mastering bio-based polymer manufacturing and establishing robust recycling programs specific to industrial and medical PPE waste. Secondary opportunities exist in penetrating underserved markets in developing regions through localized production and affordable product offerings, leveraging the foundational health protection needs in those areas.

Segmentation Analysis

The Headband Shield Market is meticulously segmented based on Material Type, End-User Industry, Product Type, and Distribution Channel, reflecting the diverse application requirements and user profiles across the global market. This granular segmentation aids manufacturers in tailoring product specifications—such as optical grade, impact resistance, and sterilization capabilities—to meet specific compliance requirements inherent in various sectors, ranging from sterile operating rooms to heavy construction sites. Understanding these segments is crucial for strategic market positioning, allowing companies to focus their production and marketing efforts on high-growth or high-margin niches, such as specialized anti-glare shields for ophthalmic surgery or robust, chemical-resistant shields for laboratory work. The structural integrity and clarity requirements mandated by certifications (e.g., EN 166 or ANSI standards) often dictate the choice of material, forming the fundamental basis of segmentation analysis.

- Material Type: Polycarbonate, Polyethylene Terephthalate (PET), Cellulose Acetate, Others (e.g., Acrylic, Bio-Plastics).

- End-User Industry: Healthcare/Medical (Hospitals, Clinics, Dental, Laboratories), Industrial Safety (Construction, Manufacturing, Welding, Mining), Retail/Consumer, Government & Public Safety.

- Product Type: Reusable (Headband Frame), Disposable (Replaceable Shields), Combination/Hybrid.

- Distribution Channel: Online Retail, Offline Retail (Safety Supply Stores, Pharmacies), Institutional Sales (Direct Contracts, Government Tenders).

Value Chain Analysis For Headband Shield Market

The value chain for the Headband Shield Market begins with the upstream sourcing of raw materials, primarily high-grade optical polymers such as polycarbonate, PET, and various plastics for the headband structure. This stage involves significant reliance on the petrochemical industry, making the value chain susceptible to global oil price fluctuations and complex feedstock availability. Key upstream activities include polymerization, sheet extrusion, and specialized coating applications (anti-fog, anti-scratch). Efficiency at this stage is dictated by relationships with large chemical suppliers and the ability to negotiate favorable long-term contracts for bulk material purchasing. The quality and cost of these raw polymers fundamentally determine the final product characteristics, margin potential, and regulatory compliance status of the finished shield.

The midstream phase focuses on manufacturing and assembly. This involves precision cutting, molding (for headbands), shield attachment, and final assembly, often requiring ISO-certified cleanroom environments, particularly for medical-grade products. High automation levels are common in cutting and molding to maintain low unit costs and high consistency. Downstream analysis focuses heavily on distribution channels. Due to the critical nature of PPE, the distribution network is bifurcated: institutional distribution relies on specialized medical and industrial safety distributors capable of handling large tenders and ensuring regulatory tracking, while direct-to-consumer and small business sales leverage e-commerce platforms and traditional offline safety supply stores. The increasing complexity of global logistics and regulatory hurdles necessitates sophisticated inventory management and traceability systems.

The direct and indirect distribution channels play distinct roles. Direct sales often involve large-volume contracts negotiated directly between major manufacturers and healthcare systems, defense agencies, or multinational industrial companies, offering predictability and stability. Indirect channels, which utilize wholesalers, retailers, and e-commerce aggregators, provide wider market reach and are crucial for servicing smaller businesses and fluctuating consumer demand. The effectiveness of the value chain is increasingly measured by its resilience—its ability to rapidly scale production and distribution in response to unforeseen events, requiring seamless integration and communication between upstream polymer producers and downstream logistical partners.

Headband Shield Market Potential Customers

Potential customers for Headband Shields are diverse, encompassing any entity or individual requiring facial barrier protection against physical, chemical, or biological hazards, categorized broadly into institutional and professional end-users. The primary and highest volume customer base resides within the Healthcare and Medical sector, including acute care hospitals, dental clinics, specialized surgical centers, outpatient laboratories, and emergency medical services (EMS). These buyers prioritize sterilization capability, optical clarity, reliable anti-fog coatings, and adherence to specific medical device standards (e.g., FDA clearance, European MDR compliance). Procurement decisions here are often centralized, contract-based, and highly sensitive to regulatory compliance and confirmed certification.

The second major segment comprises the Industrial Safety market, encompassing sectors such as heavy manufacturing, construction, oil and gas, mining, and specialized chemical processing. These customers prioritize impact resistance (ANSI Z87.1 high-impact rating), heat resistance, and long-term durability suitable for harsh environments. Safety managers in these organizations are the key buyers, focusing on total cost of ownership (favoring reusable models where appropriate) and conformity with Occupational Safety and Health Administration (OSHA) standards or local equivalents. The purchasing cycles here are often predictable, tied to capital expenditures and mandatory safety equipment refreshment schedules, but can spike dramatically following safety incidents or regulatory crackdowns.

A rapidly growing segment includes Government, Public Safety, and Service Industries. This group includes police, fire departments, educational institutions (teachers and laboratory staff), food service workers (in specific high-risk food preparation environments), and general consumers seeking enhanced personal protection. While consumer purchasing is highly fluid and price-sensitive, institutional buying within government and education is driven by large-scale tenders and budget allocations focused on public preparedness and ensuring safe operational environments for public servants and students. These segments represent significant opportunity for manufacturers willing to offer cost-effective, high-volume products optimized for generalized usage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.8 Million |

| Market Forecast in 2033 | USD 1050.5 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, Honeywell, MSA Safety, Pyramex, Gateway Safety, Kimberly-Clark, Prestige Ameritech, Radians, Safewaze, Global Vision Eyewear, Sellstrom, Allegro Industries, Alpha Protective Products, Medline Industries, Cardinal Health, Dynarex, Smith & Nephew, Becton Dickinson, Ansell, Moldex-Metric |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Headband Shield Market Key Technology Landscape

The technology landscape of the Headband Shield Market is focused primarily on material science innovation, coating techniques, and ergonomic design precision to enhance safety and user compliance. The material segment is continuously evolving, moving beyond standard PET and polycarbonate towards specialized polymers offering enhanced durability, lighter weight, and improved optical properties, minimizing visual distortion and glare. A critical technological push involves developing superior anti-fog and anti-scratch coatings. Traditional anti-fog treatments often rely on surfactants that degrade over time or after cleaning; newer technologies are exploring hydrophilic nanocoatings that chemically prevent condensation build-up, ensuring sustained clarity even in high-humidity or high-temperature operational environments typical of industrial and medical settings. These advancements are key differentiators, justifying premium pricing and driving preference among professional users.

Furthermore, manufacturing technology plays a vital role, particularly in optimizing the headband component. Precision injection molding techniques are utilized to create complex, lightweight structures that distribute pressure evenly across the forehead, often incorporating elastomeric materials for superior grip and comfort without sacrificing structural integrity. The integration of modular design is also a technological trend, allowing end-users to easily replace only the shield component while retaining the robust headband frame, significantly reducing waste and long-term costs. This modularity requires precise engineering to ensure secure, rapid attachment mechanisms that prevent the shield from detaching under stress while remaining easy to sterilize.

Looking ahead, the market is witnessing nascent integration of smart technologies, signaling the shift towards "Smart PPE." This includes experimental shields incorporating minimal flexible electronics, such as embedded ambient light sensors to dynamically adjust tinting (relevant in welding or high-UV environments) or micro-ventilation systems powered by small, lightweight batteries to actively manage air flow and completely eliminate fogging. While these technologies are currently niche and expensive, their development points towards a future where face shields offer active protection and user monitoring capabilities. Biocompatibility testing and certification processes also remain a key technological requirement, especially as companies introduce new additives or coatings that contact the skin, ensuring compliance with global health standards.

Regional Highlights

- North America: Dominant market share attributed to stringent safety regulations (OSHA, FDA), high healthcare spending, and a large concentration of advanced manufacturing and research facilities. The U.S. acts as the primary consumption hub, characterized by a preference for high-quality, certified products and a robust local supply chain capable of rapid scale-up.

- Europe: High adoption rates driven by strict EU directives (e.g., MDR and PPE Regulation (EU) 2016/425) requiring CE marking and rigorous standards compliance. Germany, the UK, and France are key markets, focusing heavily on sustainability initiatives, leading to increased demand for reusable, long-lasting headband shields and responsible waste management solutions.

- Asia Pacific (APAC): Fastest-growing region, fueled by rapid industrialization in China, India, and Southeast Asian nations, coupled with massive government investments in expanding public health infrastructure. Localized manufacturing capabilities are increasing rapidly, making the region a major global production center, although quality control standards remain a competitive differentiator.

- Latin America (LATAM): Market characterized by price sensitivity and a focus on essential, cost-effective solutions. Brazil and Mexico are primary consumers due to active industrial sectors. Growth is often linked to governmental procurement cycles for public hospitals and disaster preparedness efforts, often relying on imported goods or local assembly of foreign components.

- Middle East and Africa (MEA): Growth driven by large construction and oil & gas projects requiring high-level industrial safety PPE, particularly in the GCC states. Healthcare market expansion, funded by government initiatives to modernize facilities, provides a steady, high-quality demand base, although overall market maturity lags behind Europe and North America.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Headband Shield Market.- 3M

- Honeywell

- MSA Safety

- Pyramex

- Gateway Safety

- Kimberly-Clark

- Prestige Ameritech

- Radians

- Safewaze

- Global Vision Eyewear

- Sellstrom

- Allegro Industries

- Alpha Protective Products

- Medline Industries

- Cardinal Health

- Dynarex

- Smith & Nephew

- Becton Dickinson

- Ansell

- Moldex-Metric

Frequently Asked Questions

Analyze common user questions about the Headband Shield market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between medical-grade and industrial headband shields?

Medical-grade shields prioritize fluid resistance, anti-fog performance, and sterilization compatibility (often disposable or easily disinfectable), adhering to standards like ASTM F2100. Industrial shields prioritize high-impact resistance, conforming to rigorous standards such as ANSI Z87.1, designed to protect against flying debris and chemical splashes in harsh environments.

Which materials offer the best combination of optical clarity and impact resistance for face shields?

Polycarbonate is generally regarded as the industry standard, offering superior impact resistance and high optical clarity, making it ideal for both high-risk medical procedures and heavy industrial tasks. PET is often used for disposable, cost-effective shields where impact resistance is secondary to splash protection.

How is the market addressing the environmental concerns associated with disposable face shields?

Manufacturers are focusing on two main strategies: increasing the use of reusable headband frames coupled with replaceable, thin shields, and investing heavily in developing biodegradable or bio-based polymers for the disposable components to minimize petrochemical waste and improve end-of-life disposal options.

What regulatory standards govern the sale and use of headband shields internationally?

Key international standards include ANSI Z87.1 in the United States (primarily for industrial safety), the European Union’s EN 166 (CE Marking), and specific local health ministry approvals (e.g., FDA in the US, TGA in Australia) which are mandatory for medical applications. Compliance with these standards assures adequate protection levels and market access.

What technological innovations are currently impacting the comfort and compliance of headband shields?

Recent innovations focus on advanced anti-fog nanocoatings, ergonomic design optimization through generative AI, and the use of soft, adjustable elastomeric headbands to reduce pressure points and improve fit, directly addressing user fatigue and enhancing long-term compliance rates.

The Headband Shield Market, while seemingly mature, is undergoing continuous refinement driven by heightened regulatory scrutiny and sophisticated material science breakthroughs. The demand landscape is permanently shifted following global health events, embedding the need for high-quality facial protection across societal sectors far beyond traditional clinical and heavy industrial domains. This transformation necessitates manufacturers to maintain flexible, high-capacity production facilities, robust supply chains, and a relentless focus on product innovation aimed at combining maximum protection with superior ergonomic comfort.

The segmentation analysis confirms that the Healthcare sector remains the financial backbone of the market, driven by non-negotiable safety protocols and infectious disease preparedness. However, the fastest growth is observed in emerging markets, propelled by industrial infrastructure expansion and improving economic conditions that allow for greater investment in workplace safety. The integration of technology, particularly AI in manufacturing and advanced coatings, signals a move towards premiumization in certain segments, ensuring that the market remains dynamic and capable of adapting to future challenges, including environmental sustainability pressures. Success in this market hinges on rapid adaptability, cost-efficiency, and unwavering commitment to global safety standards.

Future market trajectory is heavily reliant on regulatory consistency and global health stability. Should regulatory bodies continue to increase safety requirements, the demand for certified, high-performance shields will strengthen, potentially favoring premium polycarbonate and advanced polymer solutions. Conversely, economic downturns could intensify price competition, particularly in the high-volume disposable PET segment, forcing manufacturers to focus acutely on operational efficiencies and minimizing production costs. Ultimately, the market for Headband Shields is positioned for sustained, above-average growth throughout the forecast period, reflecting its essential role in modern personal protection strategy globally. The strategic imperative for market players is to leverage digital transformation tools, especially AI, to better navigate demand volatility and enhance product lifecycle management from raw material sourcing to final user disposal.

The structural transformation includes a significant effort to localize production capacities, especially within the APAC region, mitigating risks associated with long-distance global logistics observed during periods of peak crisis. This regionalization trend is beneficial for local economies and also ensures quicker responsiveness to localized infectious outbreaks or industrial accidents. Moreover, the long-term trend favors reusable systems, prompting innovation in sterilization protocols and material durability to maximize the lifespan of the headband component. This shift is crucial for institutional buyers seeking long-term cost savings and adherence to corporate social responsibility mandates. The complexity of material selection—balancing cost, clarity, protection rating, and environmental impact—will continue to define competitive advantages among leading market participants.

The evolution towards smart shields, although embryonic, represents the highest value creation opportunity. Integrating biosensors or environmental monitors could transform the shield from a passive barrier into an active safety device, capable of alerting workers to dangerous airborne particulates or excessive heat exposure. Companies investing in R&D partnerships with technology firms to develop these integrated solutions are poised to capture premium market share within specialized, high-risk operational environments, such as advanced chemical laboratories or military applications. This move underscores the market’s pivot from simple plastic barriers to sophisticated engineered safety systems, reflecting a broader trend in the PPE industry towards highly functional, data-enabled gear.

Finally, the distribution landscape is being redefined by the prominence of e-commerce, which has drastically shortened the supply chain for small and medium enterprises (SMEs) and individual consumers. While institutional sales through large distributors remain crucial for bulk medical and government procurement, digital channels offer manufacturers unprecedented direct access to market intelligence and quicker feedback loops for product optimization. Manufacturers must therefore maintain robust digital platforms that offer detailed product specifications, compliance documentation, and efficient logistics management, ensuring seamless delivery across all geographic zones and meeting diverse purchasing preferences, from small retail orders to massive governmental tenders.

The market faces inherent challenges related to the cyclical nature of demand, often spiking unpredictably during health crises. Managing excess inventory during stable periods without compromising the ability to scale up rapidly remains a logistical tightrope walk for key players. This necessitates flexible manufacturing operations that can quickly pivot resources. Furthermore, the persistent threat of counterfeiting and the proliferation of non-compliant, low-quality products—especially in rapidly developing markets—poses a reputational risk to certified manufacturers and undermines mandatory safety standards. Regulatory enforcement and consumer education campaigns are vital mitigating strategies against this grey market activity, ensuring that professional and institutional buyers receive guaranteed protection levels. The future viability of the Headband Shield Market is intrinsically linked to its ability to balance economic efficiency with rigorous quality control and ethical sourcing practices.

The investment in advanced manufacturing techniques, such as additive manufacturing (3D printing) for custom headband components, allows for rapid prototyping and mass customization, catering to niche applications requiring specialized fits or features. While full 3D printing of the shield itself is not yet economically viable for mass market optical requirements, its application in molds and complex headband geometries provides an important technological edge in rapid product iteration. This agility is becoming a non-negotiable requirement in a market segment that must be prepared for immediate, unpredictable global safety events. Moreover, standardization efforts across multinational corporations seek to simplify procurement by limiting the number of approved models, favoring suppliers capable of consistent global delivery and regulatory compliance across varied jurisdictions, thereby consolidating market power among the top-tier, vertically integrated manufacturers.

The analysis concludes that while the Headband Shield Market matured rapidly during the early 2020s, its long-term stability is secured by permanent regulatory requirements and institutional awareness. Market penetration rates remain high in developed nations, driving focus toward replacement cycles, quality upgrades, and ergonomic innovation. In contrast, emerging markets offer vast untapped potential for initial adoption. The competitive environment will intensify, rewarding firms that successfully merge cost-effective mass production with superior, certified product features and demonstrable commitments to environmental stewardship. The trajectory suggests a resilient market segment crucial to global occupational and public health preparedness.

Specific material science advancements are pivotal. Research into polymer blends that inherently resist scratching without relying solely on external coatings promises shields with longer effective lifespans, reducing replacement frequency and total lifecycle cost for end-users. Additionally, developments in flexible shield materials that can conform better to the face, minimizing gaps without sacrificing airflow, are critical for enhancing protection against micro-aerosols. These technological refinements directly influence user perception and compliance, which is arguably the single most important non-cost factor in sustained usage. Manufacturers who demonstrate clear, quantifiable improvements in user comfort and protection efficacy will solidify their market leadership in the coming years.

The regulatory convergence across major trading blocs (North America, EU) towards stricter enforcement of traceability and supply chain transparency also impacts market structure. Buyers are increasingly demanding evidence of ethical sourcing and transparent manufacturing processes, particularly in the wake of previous global shortages where supply chains were compromised. Companies that can provide auditable proof of quality control, from raw polymer feedstock to the final sterile packaging, will gain a significant competitive advantage in securing high-value government and institutional contracts. This emphasis on governance and transparency further integrates the supply chain, requiring closer collaboration and data sharing among suppliers, manufacturers, and distributors, reinforcing the robustness of the overall value network.

Finally, the socio-economic impact of the Headband Shield Market is profound, directly contributing to reduced absenteeism, fewer workplace injuries, and the containment of infectious diseases. The economic value extends far beyond the direct sales figures, encompassing the societal benefits derived from maintaining a healthier and safer workforce. This broader societal relevance provides a stable foundation for demand, ensuring that investment in high-quality, certified protective equipment is viewed not merely as an expense but as a critical capital investment in human safety and operational continuity. This perspective underpins the long-term forecast of steady growth for the Headband Shield market segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager